Professional Documents

Culture Documents

4 - CIR v. CA, G.R. No. 125355, March 30, 2000

Uploaded by

Rizchelle Sampang-ManaogOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

4 - CIR v. CA, G.R. No. 125355, March 30, 2000

Uploaded by

Rizchelle Sampang-ManaogCopyright:

Available Formats

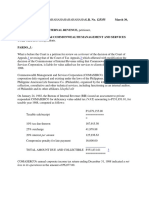

CIR v. CA, G.R. No.

125355, March 30, 2000

Doctrine: Performance of all kinds of services for others for a fee, remuneration, or consideration is considered a sale of

services subject to value-added tax (VAT). The term "in the course of trade or business" requires the regular conduct or

pursuit of a commercial or economic activity, regardless of whether the entity is profit-oriented. As long as an entity

provides services for a fee, remuneration, or consideration, the service rendered is subject to VAT. Additionally, any

exemption from the payment of tax must be clearly stated in the language of the law and cannot be merely implied.

Facts:Commonwealth Management and Services Corporation (COMASERCO) is a corporation affiliated with

Philippine American Life Insurance Co. (Philamlife), organized to perform collection, consultative, and other

technical services, including functioning as an internal auditor, for Philamlife and its affiliates.

The Bureau of Internal Revenue (BIR) issued an assessment to COMASERCO for deficiency value-added tax

(VAT) amounting to P351,851.01 for taxable year 1988. COMASERCO contested the assessment, claiming it

was not engaged in the business of providing services and was operating on a "no-profit, reimbursement-of-

cost-only" basis.

The Court of Tax Appeals ruled in favor of the Commissioner of Internal Revenue, but the Court of Appeals

reversed this decision, citing a previous case involving the same parties where COMASERCO was held not

liable for fixed and contractor's tax. The Commissioner of Internal Revenue appealed to the Supreme Court.

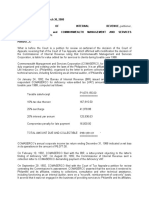

Issue:Whether or not COMASERCO is liable for VAT on the services it rendered to Philamlife and its affiliates.

Ruling:Yes, the Supreme Court held that COMASERCO is liable for VAT on the services it rendered.

The Court clarified that the term "in the course of trade or business" includes any activity conducted

regularly, regardless of profit motive. Even a non-stock, non-profit organization or government entity is liable

to pay VAT on the sale of goods or services.

The Court also emphasized that VAT is imposed on transactions, including the performance of services, even

in the absence of profit. As long as an entity provides services for a fee, remuneration, or consideration, the

service rendered is subject to VAT. The Court upheld the decision of the Court of Tax Appeals and reversed

the decision of the Court of Appeals, reinstating the assessment of deficiency VAT against COMASERCO.

The petition is granted, and the decision of the Court of Appeals is reversed. The decision of the Court of Tax

Appeals is reinstated.

You might also like

- VatDocument4 pagesVatColeenNo ratings yet

- Commissioner of Internal Revenue, Petitioner, Vs - Court of Appeals and Commonwealth Management and Services Corporation, Respondents.Document2 pagesCommissioner of Internal Revenue, Petitioner, Vs - Court of Appeals and Commonwealth Management and Services Corporation, Respondents.Jennilyn Gulfan YaseNo ratings yet

- Cir V CA ComasercoDocument2 pagesCir V CA ComasercoJoel G. AyonNo ratings yet

- VAT Liability of Corporation Providing Services to AffiliatesDocument2 pagesVAT Liability of Corporation Providing Services to AffiliatesChristine Gel MadrilejoNo ratings yet

- CIR vs CA on VAT liability of non-profit service providerDocument2 pagesCIR vs CA on VAT liability of non-profit service providerEllen Glae DaquipilNo ratings yet

- Commissioner of Internal Revenue vs. Comaserco DigestDocument3 pagesCommissioner of Internal Revenue vs. Comaserco DigestClavel Tuason0% (1)

- CIR v. Commonwealth Management & Services CorporationDocument9 pagesCIR v. Commonwealth Management & Services CorporationHazel SegoviaNo ratings yet

- Cir V. Ca/ComasercoDocument2 pagesCir V. Ca/ComasercoEdward Kenneth KungNo ratings yet

- Petitioner Vs Vs Respondents The Solicitor General Benilda V. Quevedo-Santos and Anita A. Diomalanta-ArcinueDocument7 pagesPetitioner Vs Vs Respondents The Solicitor General Benilda V. Quevedo-Santos and Anita A. Diomalanta-ArcinueKing ForondaNo ratings yet

- (CASE DIGEST) CIR v. CA and COMASERCO (G.R. No. 125355) : March 30, 2000Document3 pages(CASE DIGEST) CIR v. CA and COMASERCO (G.R. No. 125355) : March 30, 2000j guevarraNo ratings yet

- Revenue Memorandum Circular No. 065-12 Clarifying The Taxability of Association DuesDocument3 pagesRevenue Memorandum Circular No. 065-12 Clarifying The Taxability of Association DuesMary Cris O. ServinasNo ratings yet

- CIR Vs CADocument1 pageCIR Vs CAJazem AnsamaNo ratings yet

- COMMISSIONER OF INTERNAL REVENUE Vs CommonwealthDocument52 pagesCOMMISSIONER OF INTERNAL REVENUE Vs CommonwealthM Azeneth JJNo ratings yet

- (11 Sections) : 3 Types of Activities: Sale of Goods and PropertiesDocument12 pages(11 Sections) : 3 Types of Activities: Sale of Goods and PropertiesInna Marie CaylaoNo ratings yet

- CIR Vs Commonwealth ManagementDocument3 pagesCIR Vs Commonwealth ManagementGoody100% (1)

- Condo dues tax circular summaryDocument3 pagesCondo dues tax circular summarySpecforcNo ratings yet

- CIR vs. CA and Commonwealth 125355Document1 pageCIR vs. CA and Commonwealth 125355magenNo ratings yet

- CIR Vs CADocument7 pagesCIR Vs CAChrissyNo ratings yet

- CIR v. COMASERCO - DigestDocument2 pagesCIR v. COMASERCO - DigestMark Genesis RojasNo ratings yet

- VAT CasesDocument97 pagesVAT CasesTiff AtendidoNo ratings yet

- CIR v. COMASERCO - Persons Liable for VAT on ServicesDocument3 pagesCIR v. COMASERCO - Persons Liable for VAT on Serviceskaira marie carlosNo ratings yet

- 2 Digested Cir Vs CA and Commonwealth Management and Services CorporationDocument1 page2 Digested Cir Vs CA and Commonwealth Management and Services CorporationRoli Sitjar ArangoteNo ratings yet

- Commissioner of Internal Revenue vs. Court of AppealsDocument3 pagesCommissioner of Internal Revenue vs. Court of AppealsFrancise Mae Montilla MordenoNo ratings yet

- Compiled Digest Set 2Document50 pagesCompiled Digest Set 2RTC-OCC Olongapo CityNo ratings yet

- 2000 Commissioner of Internal Revenue, Petitioner, Court of Appeals and Commonwealth Management and Services CORPORATION, Respondents. Pardo, J.Document5 pages2000 Commissioner of Internal Revenue, Petitioner, Court of Appeals and Commonwealth Management and Services CORPORATION, Respondents. Pardo, J.Fely DesembranaNo ratings yet

- Commissioner of Internal Revenue vs. Court of AppealsDocument7 pagesCommissioner of Internal Revenue vs. Court of Appealsvince005No ratings yet

- Tax 2Document99 pagesTax 2Francis PunoNo ratings yet

- VAT 5 - CIR vs. Commonwealth MGTDocument1 pageVAT 5 - CIR vs. Commonwealth MGTFrances CruzNo ratings yet

- Cases VatDocument137 pagesCases VatStephen CabalteraNo ratings yet

- CIR Vs CA GR 125355Document6 pagesCIR Vs CA GR 125355Melo Ponce de LeonNo ratings yet

- Commissioner of Internal Revenue, Petitioner, vs. Court of Appeals and Commonwealth Management and Services CORPORATION, RespondentsDocument6 pagesCommissioner of Internal Revenue, Petitioner, vs. Court of Appeals and Commonwealth Management and Services CORPORATION, RespondentsMary Joy NavajaNo ratings yet

- Intelligentia Et Scientia Semper Mea: Tax 2 PinedapcgrnmanDocument35 pagesIntelligentia Et Scientia Semper Mea: Tax 2 PinedapcgrnmanPaul Christopher PinedaNo ratings yet

- Cir Vs Comaserco Case DigestDocument1 pageCir Vs Comaserco Case DigestjovifactorNo ratings yet

- First Division G.R. No. 125355, March 30, 2000: Supreme Court of The PhilippinesDocument5 pagesFirst Division G.R. No. 125355, March 30, 2000: Supreme Court of The PhilippinesMarian Dominique AuroraNo ratings yet

- Case Digests CIR Vs CA and Commonwealth Toshiba Vs CIR - Part 2 PDFDocument15 pagesCase Digests CIR Vs CA and Commonwealth Toshiba Vs CIR - Part 2 PDFSamantha RoxasNo ratings yet

- Basic ElementsDocument82 pagesBasic Elementskristel jane caldozaNo ratings yet

- Commonwealth Management and Services Corp. v. CIRDocument5 pagesCommonwealth Management and Services Corp. v. CIRJoyceNo ratings yet

- RMC No 65-2012 PDFDocument3 pagesRMC No 65-2012 PDFGhreighz GalinatoNo ratings yet

- CIR V CA and COMASERCODocument2 pagesCIR V CA and COMASERCOVel JuneNo ratings yet

- BIR V First E-Bank-fullDocument17 pagesBIR V First E-Bank-fullLucky JavellanaNo ratings yet

- CIR Vs CA, GR 125355Document4 pagesCIR Vs CA, GR 125355JanMarkMontedeRamosWongNo ratings yet

- 05 CIR V Commonwealth Management and Services CorporationDocument2 pages05 CIR V Commonwealth Management and Services CorporationChelle BelenzoNo ratings yet

- Tax CasesDocument67 pagesTax CasesRichardEnriquezNo ratings yet

- VatDocument274 pagesVatzaneNo ratings yet

- Vat Cases (Chel)Document16 pagesVat Cases (Chel)FCNo ratings yet

- Understanding VAT TaxationDocument23 pagesUnderstanding VAT Taxationtherezzzz0% (1)

- Taxation IIDocument3 pagesTaxation IIAnonymous BNrz1arNo ratings yet

- T2-1819 (78) Waterfront Philippines Inc. v. CIR - VILLANUEVADocument1 pageT2-1819 (78) Waterfront Philippines Inc. v. CIR - VILLANUEVACJVNo ratings yet

- LGM212Written Exam VerdilloDocument3 pagesLGM212Written Exam VerdilloFrancis VerdilloNo ratings yet

- Case DigestsDocument158 pagesCase DigestsJustin Imadhay100% (4)

- Contex Corp vs CIRDocument2 pagesContex Corp vs CIRAudrey Deguzman67% (3)

- VAT - Module 1 - General Principles To Zero-RatedDocument57 pagesVAT - Module 1 - General Principles To Zero-RatedReyan RohNo ratings yet

- CIR v. Toshiba Tax Credit RefundDocument12 pagesCIR v. Toshiba Tax Credit RefundAnna AbadNo ratings yet

- Case Digests in Taxation II: (G.R. No.151135, July 2, 2004)Document1 pageCase Digests in Taxation II: (G.R. No.151135, July 2, 2004)Bettina TiongcoNo ratings yet

- Tax CasesDocument8 pagesTax CasesLaUnion ProvincialHeadquarters Bfp RegionOneNo ratings yet

- OtesvatDocument18 pagesOtesvatRichelle Joy Reyes BenitoNo ratings yet

- VAT Tax CasesDocument12 pagesVAT Tax CasesAnna AbadNo ratings yet

- VAT Tax Digest on Key CasesDocument25 pagesVAT Tax Digest on Key CasesJohn Roel S. VillaruzNo ratings yet

- Value-Added Tax: Secs. 105 To 115Document71 pagesValue-Added Tax: Secs. 105 To 115louise carinoNo ratings yet

- CIR v. Hong Kong Shanghai Banking Corporation LimitedDocument1 pageCIR v. Hong Kong Shanghai Banking Corporation LimitedRizchelle Sampang-Manaog100% (1)

- Saint Wealth LTD., Et Al. v. Bureau of Internal RevenueDocument3 pagesSaint Wealth LTD., Et Al. v. Bureau of Internal RevenueRizchelle Sampang-Manaog67% (3)

- Ignacia Balicas vs. Fact-Finding and Intelligence Bureau G.R. No. 145972, March 23, 2004Document2 pagesIgnacia Balicas vs. Fact-Finding and Intelligence Bureau G.R. No. 145972, March 23, 2004Rizchelle Sampang-ManaogNo ratings yet

- COURAGE v. BIR, G.R. No. 213446, July 3, 2018Document2 pagesCOURAGE v. BIR, G.R. No. 213446, July 3, 2018Rizchelle Sampang-ManaogNo ratings yet

- CIR v. BOAC G.R. No. L-65773, April 30, 1987Document1 pageCIR v. BOAC G.R. No. L-65773, April 30, 1987Rizchelle Sampang-ManaogNo ratings yet

- Maria Elena Malaga vs. Manuel R. Penachos G.R. No. 86695 September 3, 1992Document2 pagesMaria Elena Malaga vs. Manuel R. Penachos G.R. No. 86695 September 3, 1992Rizchelle Sampang-ManaogNo ratings yet

- Banez v. CA, G.R. No. L-30351, September 11, 1974Document2 pagesBanez v. CA, G.R. No. L-30351, September 11, 1974Rizchelle Sampang-ManaogNo ratings yet

- Rana v. Lee Wong, G.R. No. 192861 & G.R. No. 192862, June 30, 2014Document3 pagesRana v. Lee Wong, G.R. No. 192861 & G.R. No. 192862, June 30, 2014Rizchelle Sampang-ManaogNo ratings yet

- Antonio v. Mecano vs. Commission On Audit GR No. 103982 December 11, 1992Document2 pagesAntonio v. Mecano vs. Commission On Audit GR No. 103982 December 11, 1992Rizchelle Sampang-ManaogNo ratings yet

- Manila Lodge No. 761, vs. Court of Appeals, 73 SCRA 162, September 30, 1976Document2 pagesManila Lodge No. 761, vs. Court of Appeals, 73 SCRA 162, September 30, 1976Rizchelle Sampang-ManaogNo ratings yet

- Iron and Steel Authority vs. Court of Appeals G.R. No. 102976, October 25, 1995Document2 pagesIron and Steel Authority vs. Court of Appeals G.R. No. 102976, October 25, 1995Rizchelle Sampang-Manaog100% (1)

- Primitivo Leveriza vs. Intermediate Appllate Court G.R. No. L-66614, January 25, 1988Document3 pagesPrimitivo Leveriza vs. Intermediate Appllate Court G.R. No. L-66614, January 25, 1988Rizchelle Sampang-ManaogNo ratings yet

- Robles v. CA, G.R No. 123509, March 14, 2000Document2 pagesRobles v. CA, G.R No. 123509, March 14, 2000Rizchelle Sampang-ManaogNo ratings yet

- Arangote v. Spouses Maglunob, G.R. No. 178906, February 18, 2009Document3 pagesArangote v. Spouses Maglunob, G.R. No. 178906, February 18, 2009Rizchelle Sampang-ManaogNo ratings yet

- Santiago vs. Northbay Knitting, Inc., 842 SCRA 502, October 11, 2017Document1 pageSantiago vs. Northbay Knitting, Inc., 842 SCRA 502, October 11, 2017Rizchelle Sampang-ManaogNo ratings yet

- Quimen v. CA, G.R. No. 112331, May 29, 1996Document2 pagesQuimen v. CA, G.R. No. 112331, May 29, 1996Rizchelle Sampang-ManaogNo ratings yet

- Republic v. Diaz, G.R. No. L - 36486, August 6, 1979Document3 pagesRepublic v. Diaz, G.R. No. L - 36486, August 6, 1979Rizchelle Sampang-ManaogNo ratings yet

- Republic v. Baltazar-Ramirez G.R. No. 148103, July 27, 2006Document2 pagesRepublic v. Baltazar-Ramirez G.R. No. 148103, July 27, 2006Rizchelle Sampang-ManaogNo ratings yet

- Andamo vs. Intermediate Appellate Court, 191 SCRA 195, November 06, 1990Document1 pageAndamo vs. Intermediate Appellate Court, 191 SCRA 195, November 06, 1990Rizchelle Sampang-ManaogNo ratings yet

- Basa vs. Loy Vda. de Senly Loy, 864 SCRA 96, June 04, 2018Document2 pagesBasa vs. Loy Vda. de Senly Loy, 864 SCRA 96, June 04, 2018Rizchelle Sampang-ManaogNo ratings yet

- Benedicto v. CA, G.R. No. L-22733, September 25, 1968Document2 pagesBenedicto v. CA, G.R. No. L-22733, September 25, 1968Rizchelle Sampang-ManaogNo ratings yet

- Alfredo J. Non v. Office of The Ombudsman, G.R. No. 251177, September 8, 2020Document3 pagesAlfredo J. Non v. Office of The Ombudsman, G.R. No. 251177, September 8, 2020Rizchelle Sampang-Manaog100% (1)

- Pardell v. BartolomeDocument3 pagesPardell v. BartolomeRizchelle Sampang-ManaogNo ratings yet

- Philippine National Bank vs. Court of Appeals, 256 SCRA 491, April 25, 1996Document2 pagesPhilippine National Bank vs. Court of Appeals, 256 SCRA 491, April 25, 1996Rizchelle Sampang-ManaogNo ratings yet

- Lopez vs. Orosa, JR., and Plaza Theatre, Inc., 103 Phil. 98, February 28, 1958Document1 pageLopez vs. Orosa, JR., and Plaza Theatre, Inc., 103 Phil. 98, February 28, 1958Rizchelle Sampang-ManaogNo ratings yet

- Palanca vs. La Mancomunidad de Filipinas, 69 Phil. 449, January 29, 1940Document1 pagePalanca vs. La Mancomunidad de Filipinas, 69 Phil. 449, January 29, 1940Rizchelle Sampang-ManaogNo ratings yet

- Vicente R. de Ocampo & Company vs. GatchalianDocument2 pagesVicente R. de Ocampo & Company vs. GatchalianRizchelle Sampang-ManaogNo ratings yet

- Great Asian Sales v. CA, G.R. No. 105774, 2002Document2 pagesGreat Asian Sales v. CA, G.R. No. 105774, 2002Rizchelle Sampang-ManaogNo ratings yet

- Far East Bank v. Gold Palace, G.R. No. 168274, 2008Document2 pagesFar East Bank v. Gold Palace, G.R. No. 168274, 2008Rizchelle Sampang-ManaogNo ratings yet

- Consolidated Plywood Industries, Inc. vs. IFC Leasing and Acceptance CorporationDocument2 pagesConsolidated Plywood Industries, Inc. vs. IFC Leasing and Acceptance CorporationRizchelle Sampang-ManaogNo ratings yet

- Philippine Deposit Insurance Corporation, Petitioner, vs. Bureau of Internal Revenue, RespondentDocument16 pagesPhilippine Deposit Insurance Corporation, Petitioner, vs. Bureau of Internal Revenue, RespondentLuelle PacquingNo ratings yet

- Boac v. CadapanDocument24 pagesBoac v. CadapanRose Ann LascuñaNo ratings yet

- MARILYN C. PASCUA v. CADocument15 pagesMARILYN C. PASCUA v. CAMicah CandelarioNo ratings yet

- PCAB V Manila WaterDocument14 pagesPCAB V Manila WaterJake MacTavishNo ratings yet

- Sample Motion For Reconsideration Under Code of Civil Procedure Section 1008 (A) in CaliforniaDocument3 pagesSample Motion For Reconsideration Under Code of Civil Procedure Section 1008 (A) in CaliforniaStan Burman80% (35)

- The Anti-Money Laundering ActDocument115 pagesThe Anti-Money Laundering ActShieryl-Joy Postrero Porras100% (1)

- Convergences - Law Literature and FeminismDocument45 pagesConvergences - Law Literature and FeminismPaulaNo ratings yet

- Maaz GDocument13 pagesMaaz GGautamkumar ModanwalNo ratings yet

- Consumer Protection Quiz InsightsDocument37 pagesConsumer Protection Quiz InsightsAditya BakshiNo ratings yet

- Res Ipsa LoquiturDocument7 pagesRes Ipsa LoquiturmonekaNo ratings yet

- Supreme Court limits suspension of govt employees to 3 months without charge sheetDocument6 pagesSupreme Court limits suspension of govt employees to 3 months without charge sheetBadap Swer100% (1)

- Tokio Marine Malayan Insurance Company Incorporated vs. ValdezDocument10 pagesTokio Marine Malayan Insurance Company Incorporated vs. ValdezjoanaarilyncastroNo ratings yet

- 538 Supreme Court Reports Annotated: Mandarin Villa, Inc. vs. Court of AppealsDocument11 pages538 Supreme Court Reports Annotated: Mandarin Villa, Inc. vs. Court of AppealsGioNo ratings yet

- History and Nature of Conflict of LawsDocument7 pagesHistory and Nature of Conflict of LawsMarvin TumwesigyeNo ratings yet

- VI. Best Evidence RuleDocument146 pagesVI. Best Evidence RuleAngeli Pauline JimenezNo ratings yet

- G.R. No. 195580 - Narra Nickel Mining & Development Corp. v. Redmont Consolidated Mines Corp - PDFDocument13 pagesG.R. No. 195580 - Narra Nickel Mining & Development Corp. v. Redmont Consolidated Mines Corp - PDFRACHEL MEGAN AGLAUANo ratings yet

- Aquino Vs CasabarDocument10 pagesAquino Vs CasabarJohnde MartinezNo ratings yet

- Negligence - Duty of Care - Liability For Injury Caused by Obvious Defect Where Lessor Contracted To RepairDocument4 pagesNegligence - Duty of Care - Liability For Injury Caused by Obvious Defect Where Lessor Contracted To RepairValan ANo ratings yet

- Court of Appeals: Petitioners,, JJDocument18 pagesCourt of Appeals: Petitioners,, JJBrian del MundoNo ratings yet

- SACE-2: SECTION 309-According To Section 309 of The Indian Penal Code (IPC) "Whoever AttemptsDocument6 pagesSACE-2: SECTION 309-According To Section 309 of The Indian Penal Code (IPC) "Whoever AttemptsSankalp PariharNo ratings yet

- Coram: Tumwesigye, Kisaakye, Mwangusya, Opio-Aweri, &Tibatemwa-Ekirikubinza, Jj.S.C.Document20 pagesCoram: Tumwesigye, Kisaakye, Mwangusya, Opio-Aweri, &Tibatemwa-Ekirikubinza, Jj.S.C.Musiime Katumbire HillaryNo ratings yet

- Hemedes vs. CAp10Document1 pageHemedes vs. CAp10Anonymous nYvtSgoQNo ratings yet

- Validity of Contract of Barter UpheldDocument1 pageValidity of Contract of Barter UpheldKling KingNo ratings yet

- Law of Damages in IndiaDocument49 pagesLaw of Damages in IndiaAarush ChaturvediNo ratings yet

- Norberto A. Vitangcol, Petitioner, vs. People of The PHILIPPINES, RespondentDocument14 pagesNorberto A. Vitangcol, Petitioner, vs. People of The PHILIPPINES, RespondentAmicah Frances AntonioNo ratings yet

- CASIANO U. LAPUT, Petitioner, vs. ATTY. FRANCISCO E.F. REMOTIGUE and ATTY. FORTUNATO P. PATALINGHUG, Respondents.Document1 pageCASIANO U. LAPUT, Petitioner, vs. ATTY. FRANCISCO E.F. REMOTIGUE and ATTY. FORTUNATO P. PATALINGHUG, Respondents.Charles Roger RayaNo ratings yet

- Oklahomas Statute of Repose Limiting The Liability of ArchitectsDocument25 pagesOklahomas Statute of Repose Limiting The Liability of ArchitectsCutter PritchettNo ratings yet

- REMCIVPRO 2018 (GR No. 185484, Francisco Chavez v. Imelda Marcos)Document2 pagesREMCIVPRO 2018 (GR No. 185484, Francisco Chavez v. Imelda Marcos)Michael Parreño VillagraciaNo ratings yet

- S.14Case Status - Search by Case NumberDocument1 pageS.14Case Status - Search by Case NumberUdit MehtaNo ratings yet

- 4 Ramos V PangilinanDocument9 pages4 Ramos V PangilinanElden Claire DevilleresNo ratings yet