Professional Documents

Culture Documents

Lecture 03 - Partnership Formation With Business

Lecture 03 - Partnership Formation With Business

Uploaded by

olavidezkarylOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lecture 03 - Partnership Formation With Business

Lecture 03 - Partnership Formation With Business

Uploaded by

olavidezkarylCopyright:

Available Formats

Sir Win – Accounting Lectures

Tagalog

Jokes

Legit Professor

Stories

Life Lessons

-------------------------------------------------------------------------------------

-------------------------

Lecture 03: Partnership Formation

(Two or more sole proprietors form a partnership)

-------------------------------------------------------------------------------------

-------------------------

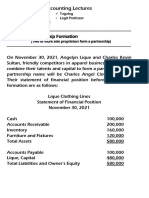

On November 30, 2021, Angelyn Lique and Charles Kevin Sultan,

friendly competitors in apparel business, decided to combine their

talents and capital to form a partnership. The partnership name will be

Charles Angel Clothing Circles. Their statement of financial position

before partnership formation are as follows:

Lique Clothing Lines

Statement of Financial Position

November 30, 2021

Cash 100,000

Accounts Receivable 200,000

Inventory 160,000

Furniture and Fixtures 120,000

Total Assets 580,000

Accounts Payable 100,000

Lique, Capital 480,000

Total Liabilities and Owner’s Equity 580,000

Sir Win – Accounting Lectures

Tagalog

Jokes

Legit Professor

Stories

Life Lessons

Sultan Clothing Curves

Statement of Financial Position

November 30, 2021

Cash 100,000

Accounts Receivable 160,000

Inventory 200,000

Machineries 180,000

Total Assets 640,000

Accounts Payable 250,000

Sultan, Capital 390,000

Total Liabilities and Owner’s Equity 640,000

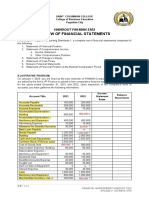

The conditions and adjustments agreed upon by the partners for

purposes of determining their interests in the partnership are:

a. Establishment of a 15% allowance for uncollectible accounts in

each book.

b. The inventory of Lique is to be increased by 20,000 while the

inventory of Sultan is to be decreased to 185,000.

c. The furniture and fixtures of Lique are to be depreciated by

15,000. The machineries of Sultan are to be depreciated by 10%.

Required:

1. Journal entries to record the partnership formation

2. Statement of financial position after partnership formation.

You might also like

- May 2017Document7 pagesMay 2017Patrick Arazo0% (1)

- Accounting Principles Chapter 8 SolutionDocument111 pagesAccounting Principles Chapter 8 SolutionKitchen Useless100% (1)

- Application 1 (Basic Steps in Accounting)Document2 pagesApplication 1 (Basic Steps in Accounting)Maria Nezka Advincula86% (7)

- Jun Zen Ralph V. Yap 3 Year - BSA Let's CheckDocument4 pagesJun Zen Ralph V. Yap 3 Year - BSA Let's CheckJunzen Ralph YapNo ratings yet

- Chapter 2 #2Document2 pagesChapter 2 #2spp75% (4)

- Ratios AS - Topical A Level Accounting Past PaperDocument27 pagesRatios AS - Topical A Level Accounting Past PaperVersha 2021100% (1)

- Chapter 10 - Problem 9Document13 pagesChapter 10 - Problem 9Christy HabelNo ratings yet

- Unit 1 - QuestionsDocument4 pagesUnit 1 - QuestionsMohanNo ratings yet

- 8 Lec 03 - Partnership Formation With BusinessDocument2 pages8 Lec 03 - Partnership Formation With BusinessNathalie GetinoNo ratings yet

- Lecture 03 - Partnership Formation With BusinessDocument4 pagesLecture 03 - Partnership Formation With BusinessDave LopezNo ratings yet

- 7 Lec 03 - Partnership Formation With One With BuDocument2 pages7 Lec 03 - Partnership Formation With One With BuNathalie GetinoNo ratings yet

- PacoaDocument12 pagesPacoaSassy GirlNo ratings yet

- Chapter 2 - Review On Financial StatementsDocument6 pagesChapter 2 - Review On Financial StatementsLorraine Millama PurayNo ratings yet

- PARCOR Exercises PFormationDocument4 pagesPARCOR Exercises PFormationangelovilladoresNo ratings yet

- Catherine Manufacturing Balance Sheet As of December 31, 2015 Assets Current AssetsDocument2 pagesCatherine Manufacturing Balance Sheet As of December 31, 2015 Assets Current AssetsNica CabradillaNo ratings yet

- Adjusting EntriesDocument5 pagesAdjusting EntriesM Hassan BrohiNo ratings yet

- Partnership ActivityDocument12 pagesPartnership ActivityTeresa Pantallano DivinagraciaNo ratings yet

- JayathDocument5 pagesJayathJayaprakash JayathNo ratings yet

- Loyola College (Autonomous), Chennai - 600 034: Degree Examination - CommerceDocument4 pagesLoyola College (Autonomous), Chennai - 600 034: Degree Examination - CommerceHarish KapoorNo ratings yet

- Fsa Prac Ex PDFDocument3 pagesFsa Prac Ex PDFAngel Alejo AcobaNo ratings yet

- Cash Flow (Exercise)Document5 pagesCash Flow (Exercise)abhishekvora7598752100% (1)

- Accounting - Partnership Formation (Answer)Document4 pagesAccounting - Partnership Formation (Answer)mdgomez2021No ratings yet

- Review Test FarDocument10 pagesReview Test FarEli PinesNo ratings yet

- Unit 3 - Business Finance - AppendixDocument5 pagesUnit 3 - Business Finance - Appendixmhmir9.95No ratings yet

- Case 3 BudgetingDocument13 pagesCase 3 BudgetingPatrick SalvadorNo ratings yet

- Suggested Answer CAP II Dec 2011Document98 pagesSuggested Answer CAP II Dec 2011Sankalpa NeupaneNo ratings yet

- Vertical Financial StatementDocument4 pagesVertical Financial StatementForam VasaniNo ratings yet

- Problem 2.3.Document4 pagesProblem 2.3.ArtisanNo ratings yet

- Problem #1: Adjusting EntriesDocument5 pagesProblem #1: Adjusting EntriesShahzad AsifNo ratings yet

- Acc hw2Document5 pagesAcc hw2pujaadiNo ratings yet

- ACC203 - AssignmentDocument2 pagesACC203 - AssignmentHailsey WinterNo ratings yet

- Accounting For Special Transactions: Adrian T. NovalDocument32 pagesAccounting For Special Transactions: Adrian T. Novalkwyncle100% (5)

- TT10 QuestionDocument1 pageTT10 QuestionUyển Nhi TrầnNo ratings yet

- Handout Fin Man 2302Document2 pagesHandout Fin Man 2302Ranz Nikko N PaetNo ratings yet

- Illustrations YR4 DocumentDocument3 pagesIllustrations YR4 DocumentmosezkamandezNo ratings yet

- ACCT1002 Assignment 3B 2nd S 2021-2022Document16 pagesACCT1002 Assignment 3B 2nd S 2021-2022Zenika PetersNo ratings yet

- Test 1 - 2022 08 17Document3 pagesTest 1 - 2022 08 17MiclczeeNo ratings yet

- Exercise 7.3 (2023)Document1 pageExercise 7.3 (2023)Clarisha fritzNo ratings yet

- Cash Flow Statement Numericals QDocument3 pagesCash Flow Statement Numericals QDheeraj BholaNo ratings yet

- Midterm Problems ABCDDocument2 pagesMidterm Problems ABCDCastleclash CastleclashNo ratings yet

- Integrated Accounting Review - AFAR T1, AY 2023-2024Document40 pagesIntegrated Accounting Review - AFAR T1, AY 2023-2024Conteza EliasNo ratings yet

- SOFP-mcq ProblemsDocument4 pagesSOFP-mcq Problemschey dabest100% (1)

- Unit IIIDocument9 pagesUnit IIIkuselvNo ratings yet

- References: Enabling ActivityDocument3 pagesReferences: Enabling ActivityKazia PerinoNo ratings yet

- BUSINESS COMBI (Activity On Goodwill Computation) - PALLERDocument5 pagesBUSINESS COMBI (Activity On Goodwill Computation) - PALLERGlayca PallerNo ratings yet

- AFM-CFS ProblemsDocument10 pagesAFM-CFS ProblemskanikaNo ratings yet

- Seatwork Partnership Formation - SEATWORK - PARTNERSHIP - FORMATIONDocument8 pagesSeatwork Partnership Formation - SEATWORK - PARTNERSHIP - FORMATIONshe kioraNo ratings yet

- Module 7 ActDocument3 pagesModule 7 ActairamaecsibbalucaNo ratings yet

- LEC09A - BSA 2201 - 022021-Single Entry Accounting (P)Document2 pagesLEC09A - BSA 2201 - 022021-Single Entry Accounting (P)Kim FloresNo ratings yet

- Asynchronous Statement of Financial Position XYZ CompanyDocument5 pagesAsynchronous Statement of Financial Position XYZ CompanyDiana Fernandez MagnoNo ratings yet

- Financial Statement AnalysisDocument4 pagesFinancial Statement AnalysisAsad RehmanNo ratings yet

- Acctg Special TransDocument24 pagesAcctg Special TransMina JjangNo ratings yet

- CH 3 In-Class ExercisesDocument2 pagesCH 3 In-Class ExercisesAbdullah alhamaadNo ratings yet

- FABM1 11 Quarter 4 Week 2 Las 2Document1 pageFABM1 11 Quarter 4 Week 2 Las 2Janna PleteNo ratings yet

- Financial Statement Analysis Probs On Funds Flow Analysis PDFDocument15 pagesFinancial Statement Analysis Probs On Funds Flow Analysis PDFSAITEJA ANUGULANo ratings yet

- FFS - NumericalsDocument5 pagesFFS - NumericalsFunny ManNo ratings yet

- BINI General Merchandise Answer Key 2Document19 pagesBINI General Merchandise Answer Key 2workwithericajaneNo ratings yet

- 05 Corporate LiquidationDocument4 pages05 Corporate LiquidationEric CauilanNo ratings yet

- GPV & SCF (Assignment)Document16 pagesGPV & SCF (Assignment)Mica Moreen GuillermoNo ratings yet

- Accounting for Real Estate Transactions: A Guide For Public Accountants and Corporate Financial ProfessionalsFrom EverandAccounting for Real Estate Transactions: A Guide For Public Accountants and Corporate Financial ProfessionalsNo ratings yet

- On September 1 2011 The Account Balances of Rand Equipment PDFDocument1 pageOn September 1 2011 The Account Balances of Rand Equipment PDFM Bilal SaleemNo ratings yet

- Ch03 6th Ed Narayanaswamy Financial AccountingDocument13 pagesCh03 6th Ed Narayanaswamy Financial AccountingRam Kishore100% (2)

- Advanced Financial Accounting 11th Edition Christensen Solutions ManualDocument43 pagesAdvanced Financial Accounting 11th Edition Christensen Solutions Manualtiffanywilliamsenyqjfskcx100% (22)

- Far Reviewer - Bale (Millan)Document27 pagesFar Reviewer - Bale (Millan)Chiee Takahashi100% (1)

- Knowledge Check - Chap 15-17Document4 pagesKnowledge Check - Chap 15-17Ella Angel BriguezNo ratings yet

- Higher Secondary AccountancyDocument8 pagesHigher Secondary Accountancysgangwar2005sgNo ratings yet

- Cost of CapitalDocument4 pagesCost of CapitalNusratJahanHeabaNo ratings yet

- Local Voice Summer/Fall 2018Document32 pagesLocal Voice Summer/Fall 2018MoveUP, the Movement of United ProfessionalsNo ratings yet

- Practice Perf CompDocument28 pagesPractice Perf CompsooguyNo ratings yet

- Opening Day Balance SheetDocument1 pageOpening Day Balance SheetCoTrios Health ChainsNo ratings yet

- Week 4 Practice Questions 1Document17 pagesWeek 4 Practice Questions 1Gabriel Abdillah100% (1)

- Akm 2 Week 11Document3 pagesAkm 2 Week 11Ahsan FirdausNo ratings yet

- Orchid Business Group Balance Sheet As at December 31 Assets 2012 2011Document9 pagesOrchid Business Group Balance Sheet As at December 31 Assets 2012 2011Amanuel DemekeNo ratings yet

- Lesson 2 Statement of Comprehensive IncomeDocument24 pagesLesson 2 Statement of Comprehensive IncomeMylene Santiago100% (2)

- Assets User GuideDocument36 pagesAssets User GuidemohdbilalmaqsoodNo ratings yet

- John Bala Maps Worksheet December 31, 2015 Account Title Unadjusted Trial Balance Adjustments Debit Credit Debit CreditDocument3 pagesJohn Bala Maps Worksheet December 31, 2015 Account Title Unadjusted Trial Balance Adjustments Debit Credit Debit CreditJessie ForpublicuseNo ratings yet

- BA 99.1 DiagnosticDocument1 pageBA 99.1 Diagnostictikki0219No ratings yet

- Valmeth AssDocument20 pagesValmeth AssMark Andrei TalastasNo ratings yet

- 3 - Introduction To Fixed Income Valuation-UnlockedDocument53 pages3 - Introduction To Fixed Income Valuation-UnlockedAditya NugrohoNo ratings yet

- CH 11 Exam PracticeDocument20 pagesCH 11 Exam PracticeSvetlanaNo ratings yet

- CH 4 SolutionDocument14 pagesCH 4 SolutionRody El KhalilNo ratings yet

- Paper 4 Financial ManagementDocument321 pagesPaper 4 Financial ManagementExcel Champ0% (2)

- Correction of Errors - UEC 2016 and 2020Document2 pagesCorrection of Errors - UEC 2016 and 2020Zhong HanNo ratings yet

- Deegan5e SM Ch08Document18 pagesDeegan5e SM Ch08Rachel TannerNo ratings yet

- Assignment 1 ACT502Document6 pagesAssignment 1 ACT502Mahdi KhanNo ratings yet

- Topic 1 - Ch01&2 - The Role of Accounting and Financial Statments For Decision MakingDocument44 pagesTopic 1 - Ch01&2 - The Role of Accounting and Financial Statments For Decision MakingNhân HuỳnhNo ratings yet

- MRF PNL BalanaceDocument2 pagesMRF PNL BalanaceRupesh DhindeNo ratings yet

- FIN201 Term Paper 1Document34 pagesFIN201 Term Paper 1Mahbub Rahman NionNo ratings yet