Professional Documents

Culture Documents

Candidate Quesitons For Final-1213

Candidate Quesitons For Final-1213

Uploaded by

abduraimovbehruz870 ratings0% found this document useful (0 votes)

5 views5 pagesThe document outlines 10 questions that will appear on a final exam. The questions cover various topics in finance including short positions, riskless portfolios, arbitrage and equilibrium, capital market line, security market line, characteristic lines, agency problems, capital structure, and asset substitution. Students are asked to explain concepts, construct portfolios, derive lines, and analyze examples related to these finance topics.

Original Description:

Riskless

Original Title

candidate quesitons for final-1213

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document outlines 10 questions that will appear on a final exam. The questions cover various topics in finance including short positions, riskless portfolios, arbitrage and equilibrium, capital market line, security market line, characteristic lines, agency problems, capital structure, and asset substitution. Students are asked to explain concepts, construct portfolios, derive lines, and analyze examples related to these finance topics.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views5 pagesCandidate Quesitons For Final-1213

Candidate Quesitons For Final-1213

Uploaded by

abduraimovbehruz87The document outlines 10 questions that will appear on a final exam. The questions cover various topics in finance including short positions, riskless portfolios, arbitrage and equilibrium, capital market line, security market line, characteristic lines, agency problems, capital structure, and asset substitution. Students are asked to explain concepts, construct portfolios, derive lines, and analyze examples related to these finance topics.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 5

The Candidate questions for the final exam.

1. (5) Please explain ‘short position’ when you

construct your portfolio. (page 171)

2. (5) Please explain the figure 8.2. (p. 180)

3. (15) Please construct a riskless portfolio R using

the following information.

“Suppose that the rates of Securities U and V are

perfectly positively correlated. Let Xu and Xv be the

proportions in which an investor allocates funds

between these two securities to construct Portfolio

R. We shall now determine the values of Xu and Xv

that will make Portfolio R riskless.” (p. 194)

4. (10) Please explain arbitrage and equilibrium

when two risky securities have perfectly positively

correlated rate of return. (p.197)

5. (20) Please explain how to derive Capital Market

Line and interpret the meaning of the Line.

(p.220, p.210)

6. (20) Please explain how to derive Security Market

Line and interpret the meaning of the Line.

(p.223, p.229)

7. (5) Explain what the characteristic lines are and

how to estimate beta. (p.212)

8. (5) Explain a problem of agency by providing an

example of enforcing payouts of Free Cash Flows.

(section 13.5)

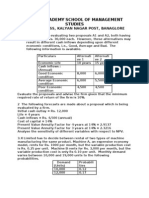

9. (20) Given the following information, please show

the capital structure of the two firms, and explain

why the high debt equity ratio help the firm to

reallocating resources when consumers’

preferences change. (p.324)

We assume that the discount rate of the bond and stock of Firm L is 0.11

and 0.14 respectively, and that of Firm H is 0.12 and 0.16 respectively.

Suppose that a shift in consumer preferences causes each firm’s net annual

earnings to decrease from $100,000 to $60,000. And suppose that if each

firm were to liquidate, the bondholders and the shareholders of that firm

could reinvest the capital in a new firm that would generate annual net

earnings of $90,000.

10. (20) Please fill out the vacancies in the table

below and explain the problem of agency with

asset substitution. (p.332)

You might also like

- FIN5203 GP2 Financial Analysis QuestionsDocument3 pagesFIN5203 GP2 Financial Analysis QuestionsNarasimhaBadri0% (1)

- MGMT 430-02 Practice Exam 1Document2 pagesMGMT 430-02 Practice Exam 1suruth242No ratings yet

- F 17 As 1Document3 pagesF 17 As 1Massimo FerranteNo ratings yet

- Portfolio Management Handout 1 - Questions PDFDocument6 pagesPortfolio Management Handout 1 - Questions PDFPriyankaNo ratings yet

- Chapter 7 QuestionsDocument6 pagesChapter 7 QuestionsArnav Pareek0% (2)

- Corporate Financial Distress, Restructuring, and Bankruptcy: Analyze Leveraged Finance, Distressed Debt, and BankruptcyFrom EverandCorporate Financial Distress, Restructuring, and Bankruptcy: Analyze Leveraged Finance, Distressed Debt, and BankruptcyNo ratings yet

- Новый документ-27Document9 pagesНовый документ-27abduraimovbehruz87No ratings yet

- Economics: Time Allowed: 3 Hours Maximum Marks: 100Document25 pagesEconomics: Time Allowed: 3 Hours Maximum Marks: 100Anonymous Ptxr6wl9DhNo ratings yet

- Iii Semester Endterm Examination October 2018 Subject: Security Analysis & Portfolio ManagementDocument2 pagesIii Semester Endterm Examination October 2018 Subject: Security Analysis & Portfolio ManagementGautam KumarNo ratings yet

- The FASB's Concepts Statement On Cash Flows and Present ValueDocument6 pagesThe FASB's Concepts Statement On Cash Flows and Present ValueYidersalNo ratings yet

- Capitulo 8 Comparative Financial StatementsDocument10 pagesCapitulo 8 Comparative Financial Statementskjsingh20118600No ratings yet

- Question Paper of FM (1) - 1637643755Document3 pagesQuestion Paper of FM (1) - 1637643755srijana pathakNo ratings yet

- Capital Structure and Arbitrage: Ke ShangDocument4 pagesCapital Structure and Arbitrage: Ke ShangSahil SharmaNo ratings yet

- Business Finance II: Exercise 1Document7 pagesBusiness Finance II: Exercise 1faisalNo ratings yet

- Economics Class - XII Time - 3 Hours. Maximum Marks - 100 Notes: 1. 2. 3. 4. 5. 6. 7Document12 pagesEconomics Class - XII Time - 3 Hours. Maximum Marks - 100 Notes: 1. 2. 3. 4. 5. 6. 7sahilNo ratings yet

- Financial ManagementDocument3 pagesFinancial Managementgundapola100% (2)

- Econ 132 Problems For Chapter 1-3, and 5Document5 pagesEcon 132 Problems For Chapter 1-3, and 5jononfireNo ratings yet

- Set-Iii Section - A: XII - EconomicsDocument4 pagesSet-Iii Section - A: XII - EconomicsSoniya Omir VijanNo ratings yet

- Microeconomics:: A 1 A 2 B 1 B 2 A 1 A 2 B 1 B 2Document12 pagesMicroeconomics:: A 1 A 2 B 1 B 2 A 1 A 2 B 1 B 225 sents zzNo ratings yet

- Class Xii Economics 2008 Delhi Outside DelhiDocument21 pagesClass Xii Economics 2008 Delhi Outside DelhiSoniya Omir VijanNo ratings yet

- BUS 365: Investments Practice Problems Risk and ReturnDocument4 pagesBUS 365: Investments Practice Problems Risk and ReturnAmeya RanadiveNo ratings yet

- FN3092 - Corporate Finance - 2008 Exam - Zone-ADocument5 pagesFN3092 - Corporate Finance - 2008 Exam - Zone-AAishwarya PotdarNo ratings yet

- Adfm Iii 2015-17Document3 pagesAdfm Iii 2015-17Nithyananda PatelNo ratings yet

- Act7 2Document4 pagesAct7 2Helen B. EvansNo ratings yet

- Managerial Economics Practice Set 1 2018Document9 pagesManagerial Economics Practice Set 1 2018Sir Jay265No ratings yet

- PS6Document4 pagesPS6KennethFuNo ratings yet

- Financial Management 14 JuneDocument3 pagesFinancial Management 14 JunerajNo ratings yet

- Problem 4Document7 pagesProblem 4billyNo ratings yet

- Iii Semester Endterm Examination November 2016Document3 pagesIii Semester Endterm Examination November 2016Gautam KumarNo ratings yet

- QUESTION BANK Engg - Eco.& CostingDocument12 pagesQUESTION BANK Engg - Eco.& CostingMamata swainNo ratings yet

- Solve The Below Questions and Submit Prior Final Exam.: ECO 502: Individual Assignment#2 For AllDocument1 pageSolve The Below Questions and Submit Prior Final Exam.: ECO 502: Individual Assignment#2 For AllDiptoDCastleNo ratings yet

- Paper 1 - Topic WiseDocument16 pagesPaper 1 - Topic WiseSushant SulabhNo ratings yet

- SAPMDocument10 pagesSAPMadisontakke_31792263No ratings yet

- TBChap 011Document12 pagesTBChap 011alaamabood6No ratings yet

- Maf5102 Accounting and Finance Virt MainDocument4 pagesMaf5102 Accounting and Finance Virt Mainshobasabria187No ratings yet

- Model Question Paper: EconomicsDocument3 pagesModel Question Paper: Economicssharathk916No ratings yet

- Word To PDF Converter - UnregisteredDocument4 pagesWord To PDF Converter - Unregisteredsharathk916No ratings yet

- Case Studies in F1 IAMDocument5 pagesCase Studies in F1 IAMChandru ChanduNo ratings yet

- TutorialsDocument28 pagesTutorialsmupiwamasimbaNo ratings yet

- Pre Board Eco Class 12Document3 pagesPre Board Eco Class 12Kusum VijaywargiyaNo ratings yet

- Chapter 6 Risk and Return, and The Capital Asset Pricing Model ANSWERS TO END-OF-CHAPTER QUESTIONSDocument10 pagesChapter 6 Risk and Return, and The Capital Asset Pricing Model ANSWERS TO END-OF-CHAPTER QUESTIONSSolutionz Manual50% (2)

- FE-Unit 1, 2 QuestionsDocument4 pagesFE-Unit 1, 2 Questionsarya.enactusdcacNo ratings yet

- Commerce Paper 4.4 (A) Security Analysis and Portfolio Management Accounting and FinanceDocument3 pagesCommerce Paper 4.4 (A) Security Analysis and Portfolio Management Accounting and FinanceSanaullah M SultanpurNo ratings yet

- MICROECONOMICS - Revison Notes 2013 S1 Ques Set 2Document6 pagesMICROECONOMICS - Revison Notes 2013 S1 Ques Set 2Imelda WongNo ratings yet

- Bangalore University Previous Year Question Paper AFM 2022Document4 pagesBangalore University Previous Year Question Paper AFM 2022Ramakrishna NagarajaNo ratings yet

- STD XII Economics: A. Answer Any 5 of The FollowingDocument3 pagesSTD XII Economics: A. Answer Any 5 of The FollowingDean WoodNo ratings yet

- FIN5203 Homework 5 FL22Document2 pagesFIN5203 Homework 5 FL22merly chermonNo ratings yet

- All Your Answers Should Be On An Excel Sheet. Show Your Calculation Process.Document6 pagesAll Your Answers Should Be On An Excel Sheet. Show Your Calculation Process.Adi SadiNo ratings yet

- Sums On Project AnalysisDocument26 pagesSums On Project AnalysisAlbert Thomas80% (5)

- Risk and ReturnDocument10 pagesRisk and ReturnAzrul KechikNo ratings yet

- Assignment 2Document3 pagesAssignment 2Gabriel PodolskyNo ratings yet

- Ch16 09Document5 pagesCh16 09Umer Shaikh50% (2)

- CBSE Class 11 Economics Sample Paper-07Document7 pagesCBSE Class 11 Economics Sample Paper-07cbsestudymaterialsNo ratings yet

- Bangalore University Previous Year Question Paper AFM 2020Document3 pagesBangalore University Previous Year Question Paper AFM 2020Ramakrishna NagarajaNo ratings yet

- Master of Commerce Term-End Examination December, 2OO8Document4 pagesMaster of Commerce Term-End Examination December, 2OO8Smriti SoniNo ratings yet

- Short Notes On:: IV-MBA (FM-422) - FDDocument3 pagesShort Notes On:: IV-MBA (FM-422) - FDJakki KhanNo ratings yet

- Assig 2Document7 pagesAssig 2Katie CookNo ratings yet

- This Paper Is Not To Be Removed From The Examination HallsDocument8 pagesThis Paper Is Not To Be Removed From The Examination HallsPaul DavisNo ratings yet

- FM11 CH 04 Mini CaseDocument6 pagesFM11 CH 04 Mini CaseAmjad IqbalNo ratings yet

- FIN 425 Global Financial Risk Management - Sample Exam IIDocument2 pagesFIN 425 Global Financial Risk Management - Sample Exam IIIbrahim KhatatbehNo ratings yet