Professional Documents

Culture Documents

14.development of Interest

Uploaded by

Wana MaliOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

14.development of Interest

Uploaded by

Wana MaliCopyright:

Available Formats

Durham Islamic Finance Autumn School

2011 in Istanbul

DEVELOPMENT OF INTEREST-‐FREE BANKING

AND CAPITAL MARKETS

IN TURKEY

Mustafa

Büyükabacı

Industrial

Eng.

MSc

Birler

Investment,

Istanbul

Presented

at

the

Durham

Islamic

Finance

Autumn

School

2011

jointly

organised

by

Durham

Centre

for

Islamic

Economics

and

Finance

and

ISAR-‐Istanbul

FoundaBon

for

Research

and

EducaBon

Istanbul

Commerce

University,

Istanbul

19th-‐22nd

September

2011

Outline

• Interest-‐free

banking,

Turkish

experience

– Brief

history,

– Figures-‐Market

Share-‐Growth

Rate,

– Mechanism,

• Capital

markets,

Turkish

experience

– Fixed

Income

and

Equity

Markets,

– Compliance

Rules

for

Islamic

fund

management,

– Islamic

Market

Index,

– Funds

Under

Management

• Furthermore:

what

are

next

steps,

instruments,

applica=ons

?

Mustafa Büyükabacı, Developments in

Islamic Banking and Capital Markets in

Turkey 1

Durham Islamic Finance Autumn School

2011 in Istanbul

Interest-‐Free

Banking-‐History

• 1985

–

Founding

the

basis

of

Special

Finance

Houses

(SFH),

ini[ally

ALBARAKA

and

FAISAL

started

to

operate.

• 1985-‐2000

–

Rapid

growth,

reaching

the

market

share

of

2%

in

terms

of

assets.

• 2000-‐2002

–

Economic

Crisis,

Bankruptcy

of

banks.

Acquisi[on

of

Faisal

SFH

by

Mr.Sabri

Ülker.

• 2006-‐

SFH’s

became

Par[cipa[on

Bank,

new

Banking

Act.

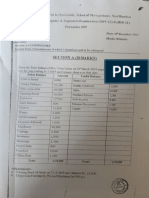

Interest-‐Free Banking-‐Figures

Par=cipa=on Banks as of 2010 year end

Assets 43.423.000.000 TL

Allocated Funds 32.096.000.000 TL

Shareholders' Equity 5.457.000.000 TL

Market Share (in terms of Assets) 4,31%

No of banks 4

No of branches 607

No of Staff 12.694

Source : Par[cipa[on Banks Associa[on

Mustafa Büyükabacı, Developments in

Islamic Banking and Capital Markets in

Turkey 2

Durham Islamic Finance Autumn School

2011 in Istanbul

Interest-‐Free Banking-‐Figures

ASSETS in million TL

Par[cipa[on

Banking

Year

Banks

System

Market

Share

2001

2.365

218.873

1,08%

2010

43.423

1.007.031

4,31%

AGR 38,18% 18,48%

Source : Par[cipa[on Banks Associa[on

Interest-‐Free

Banking-‐Figures

Allocated

Funds

in

million

TL

Par[cipa[on

Banking

Year

Banks

System

Market

Share

2001

1.072

58.413

1,84%

2010

32.096

537.315

5,97%

AGR 45,89% 27,96%

Source : Par[cipa[on Banks Associa[on

Mustafa Büyükabacı, Developments in

Islamic Banking and Capital Markets in

Turkey 3

Durham Islamic Finance Autumn School

2011 in Istanbul

Interest-‐Free Banking-‐Figures

Allocated/Total Assets

Year Par[cipa[on Banks Banking System

2001 45,33% 26,69%

2010 73,91% 53,36%

Interest-‐Free Banking-‐Figures

Shareholder's Equity in million TL

Par[cipa[on

Banking

Year

Banks

System

Market

Share

2001

203

19.003

1,07%

2010

5.457

134.549

4,06%

AGR 44,15% 24,29%

Source : Par[cipa[on Banks Associa[on

Mustafa Büyükabacı, Developments in

Islamic Banking and Capital Markets in

Turkey 4

Durham Islamic Finance Autumn School

2011 in Istanbul

Interest-‐Free

Banking-‐Mechanism

Main

considera[ons

:

-‐

to

comply

with

islamic

business

ethic

principles

-‐

to

avoid

transac[ons

related

with

non-‐

compliant

sectors

-‐

to

avoid

interest

in

any

transac[on

To

maintain

that

-‐

make

necessary

analysis

and

audit

according

to

these

considera[ons.

-‐

make

all

the

funding

based

on

an

invoice,

to

be

sure

that

the

transac[on

is

real.

Interest-‐Free

Banking-‐Mechanism

SUPPLY

DEMAND

Depositor / Ul=mate Debtor / Ul=mate

Creditor PARTICIPATION BANK PARTICIPATION BANK Alloca=on

Capital Owner

Capital Owner (on behalf of

(par[cipa[on accounts) Mudaraba Mudarib Depositor) Mudaraba Mudarib

Partner Musharaka Partner Partner Musharaka Partner

Intermediary

Trader

Creditor

(on

behalf

of

Murabaha

(mostly

syndica[ons)

Murabaha

Intermediary

trader

Depositor)

and

others

Debtor

(in

most

cases)

Creditor

(on

behalf

of

Syndica[on

bank

Depositor)

Tavarruk

+trader

Mustafa Büyükabacı, Developments in

Islamic Banking and Capital Markets in

Turkey 5

Durham Islamic Finance Autumn School

2011 in Istanbul

Interest-‐Free Banking-‐Mechanism

• Par[cipa[on Banks are inves[ng or lending in

real transac[ons through invoice. High asset

quality by defini[on.

• No interest risk for Par[cipa[on Banks. PBs

collect the deposit without any interest promised

Interest-‐Free

Banking-‐Mechanism

Transac=on

methods

applied

in

Turkey

• Murabaha -‐ buy in cash sell installments

• Mudaraba -‐ partnership of capital owner and the one having the

exper[se

• Musharaka – Shareholding

• Ijara – Leasing

• Is[sna – prefinancing of an industrial produc[on during the

produc[on period

• Sukuk – Asset-‐backed Securi[sa[on

• Takaful -‐ Insurance

• Tavarruk – Special Murabaha method via Commodity Markets

Mustafa Büyükabacı, Developments in

Islamic Banking and Capital Markets in

Turkey 6

Durham Islamic Finance Autumn School

2011 in Istanbul

Interest-‐Free

Banking-‐Bank

Banking

Opera=ons

by

PARTICIPATION

BANK

Lejer

of

Guarantee

Lejer

of

Credit

Foreign

Trade

opera[ons

Money

Transfers

Sukuk

Opera[ons

Credit

Cards

POS

Machines

Re[rement

Insurance

Plan

Dow

Jones

Islamic

Market

Index

Par[cipa[on

Index

Equity

Funds

Gold

ETF

Capital Markets-‐Basics

Capital

Markets

Fixed

Income

Equity

Limited, Low Risk High Risk

Limited Return Expected Higher Return

Pretedermined Cash Flow Expected Cash Flow

Mustafa Büyükabacı, Developments in

Islamic Banking and Capital Markets in

Turkey 7

Durham Islamic Finance Autumn School

2011 in Istanbul

Capital Markets-‐ISE Figures

Number of companies ISE Market Capitalisa[on

Year traded in ISE (billion TL)

2000 195 38

2001 196 57

2002 201 45

2003 203 81

2004 216 108

2005 227 171

2006 248 172

2007 259 273

2008 262 148

2009 267 284

2010 285 375

2011 321 412

Capital Markets-‐Compliance Rules

Criteria for Compliance

• Islamic business Ethics

• Sector Screening, avoid transac[on of any goods

and services which are not compliant.

• Avoid interest in any case

-‐see the parameters in summary table below-‐

• Evalua[on of dividend from the income compliancy

point of view.

Mustafa Büyükabacı, Developments in

Islamic Banking and Capital Markets in

Turkey 8

Durham Islamic Finance Autumn School

2011 in Istanbul

Capital Markets-‐Equity Funds

in 2003

• BMD Equity Fund,

• BMD Construc[on Sector Fund, another ac[vely

managed fund,

• Funds marke[ng made by (Faisal SFH)Türkiye

Finans

Capital Markets-‐Dow Jones Islamic

in

2004

• Dow

Jones

Islamic

Market

Turkey

Index

(DJIMTR)

launched

by

Dow

Jones

USA.

• DJIMTR

was

the

first

islamic

country

index

launched

in

a

Muslim

Country.

• Turkiye

Finans

and

BMD

securi[es

set

up

an

ETF

tracking

DJIMTR

index.

• DJIMTR

ETF

was

the

first

ETF

launched

based

on

an

Islamic

Index

in

the

world.

Mustafa Büyükabacı, Developments in

Islamic Banking and Capital Markets in

Turkey 9

Durham Islamic Finance Autumn School

2011 in Istanbul

Capital Markets-‐Par[cipa[on Index

in

2010

• A

new

index

launched

by

Par[cipa[on

Banks

Associa[on.

• Second

compliant

index

in

Turkey.

• ISE

licence

and

coopera[on.

• BMD

securi[es

is

the

index

calculator.

• Not

a

Fund

or

ETF

launched

on

the

index

yet.

Capital Markets-‐Compliance Rules

Avioding Interest Criteria for Islamic Equity Index currently applied in Turkey

Parameters and upper limits DJ Indexes Par[cipa[on Index

DJ Islamic Market KATLM

Total debt /

33% 30%

Total Assets (*)

Cash + Interest Bearing Securi[es /

33% 30%

Total Assets (*)

Account Receivables /

33% -‐

Total Assets (*)

Incompliant Revenues (**) 5% 5%

* DJ and BMD u[lize market cap instead of assets

** implicitly applied by Dow Jones

Source : BMD Securi[es

Mustafa Büyükabacı, Developments in

Islamic Banking and Capital Markets in

Turkey 10

Durham Islamic Finance Autumn School

2011 in Istanbul

Capital Markets-‐Islamic Index

PB Index lis=ngs and market share

Number of Market Value

companies (billion TL)

Par[cipa[on Index compliant all companies 153 124

Par[cipa[on Index List 30 101

DJIMTR compliant all companies (*) 160 130

DJIMTR Index list 36 103

ISE-‐All companies 321 412

ISE-‐100 index list 100 324

(*) Rough es[ma[on

Source: BMD Securi[es

Capital Markets-‐Islamic Index

Indexes, Represen=ng the market (full list)

Number of Market

companies Value

Representa[on% of Par[cipa[on Index 47,66% 30,10%

Representa[on% of DJIMTR 49,84% 31,55%

Representa[on% of ISE-‐100 31,15% 78,64%

Mustafa Büyükabacı, Developments in

Islamic Banking and Capital Markets in

Turkey 11

Durham Islamic Finance Autumn School

2011 in Istanbul

Capital Markets-‐Gold ETF

in

2010

• As

a

good

approach

to

market

expecta[ons,

Kuveyt

Turk

launched

another

ETF

based

on

physiscal

Gold.

• BMD

is

the

manager

of

the

ETF.

• The

first

ETF

on

commodity

launched

in

Turkey.

____

The

system

has

seen

the

use

and

benefit

of

ETF

as

a

secure,

liquid,

comlementary

alterna[ve

vehicle

for

interest-‐free

investment.

Capital Markets-‐Islamic Funds

All these funds showed that these type of

investment vehicles are not compe[tor to the

deposits of interest-‐free banking system.

Every instrument has its own risk and return

projec[on.

And every investor has its own risk and return

ape[te.

Mustafa Büyükabacı, Developments in

Islamic Banking and Capital Markets in

Turkey 12

Durham Islamic Finance Autumn School

2011 in Istanbul

Furthermore

a. The system’s own and unique re[rement insurance plan

-‐ Fund management

-‐ Insurance company

-‐ Strong Secondary Sukuk market

b. Securi[sa[on of asset-‐backed securi[es which the system has in

leasing form assets mostly.

-‐ Secondary corporate Sukuk market

c. Securi[sa[on of murabaha accounts (possibility, limita[ons)

d. Use of Commodity Markets (limita[ons should be clarified),

e. Commodity ETFs for diversifica[on and for secure investment

(considering foreign tavarruk opera[ons, others?)

f. Funds and ETF for Par[cipa[on Index

Thank

you

Mustafa

Büyükabacı

mustafa@buyukabaci.com

Mustafa Büyükabacı, Developments in

Islamic Banking and Capital Markets in

Turkey 13

You might also like

- Development and Future of Islamic Banking in Turkey: Abdullah Çelik CEO, Bank AsyaDocument19 pagesDevelopment and Future of Islamic Banking in Turkey: Abdullah Çelik CEO, Bank AsyaAshraf KhanNo ratings yet

- Chapter-1 Introduction To Report: Internship Report On NBP, Karak BranchDocument36 pagesChapter-1 Introduction To Report: Internship Report On NBP, Karak BranchwaqarNo ratings yet

- The Analysis of Bank Deposits Through Spatial Modelling by ProvincesDocument11 pagesThe Analysis of Bank Deposits Through Spatial Modelling by ProvincesBinod SharmaNo ratings yet

- Financial Sector Reforms in India: February 2014Document50 pagesFinancial Sector Reforms in India: February 2014Ashutosh YadavNo ratings yet

- KazakhstanDocument13 pagesKazakhstanЛяззат НуртайNo ratings yet

- Determinants of Profitability of Banks: Evidence From Islamic Banks of BangladeshDocument14 pagesDeterminants of Profitability of Banks: Evidence From Islamic Banks of BangladeshRashel MahmudNo ratings yet

- Islamic Banking Murat ÇETİNKAYA Kuveyt TürkDocument40 pagesIslamic Banking Murat ÇETİNKAYA Kuveyt TürkrameshNo ratings yet

- Determinants of Bank Technical Efficiency Evidence From Commercial Banks in EthiopiaDocument13 pagesDeterminants of Bank Technical Efficiency Evidence From Commercial Banks in EthiopiaGetnet ZemeneNo ratings yet

- Islamic Banking Regulator and Supervisory of NigeriaDocument14 pagesIslamic Banking Regulator and Supervisory of Nigeriaafieq tensaiNo ratings yet

- Turkish - Banking - Sectors - Profitability - Factors Acaravci and Calim 2013Document16 pagesTurkish - Banking - Sectors - Profitability - Factors Acaravci and Calim 2013carltondurrantNo ratings yet

- The Effect of Capital Adequacy On Performance of State Bank of India, CoimbatoreDocument38 pagesThe Effect of Capital Adequacy On Performance of State Bank of India, Coimbatorewasim musthaqNo ratings yet

- Trust in Investment Banking". I Am Thankful To The Organizers ForDocument4 pagesTrust in Investment Banking". I Am Thankful To The Organizers ForkarimteliNo ratings yet

- Capital Adequency Ratio (CAR) and Determinants Case Study Islamic Banking in IndonesiaDocument10 pagesCapital Adequency Ratio (CAR) and Determinants Case Study Islamic Banking in IndonesiaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Factors Affecting Liquidity of Banks: Empirical Evidence From The Banking Sector of PakistanDocument18 pagesFactors Affecting Liquidity of Banks: Empirical Evidence From The Banking Sector of PakistanMuhammad RaafayNo ratings yet

- Capital Structureand Profitabilityof Deposit Money BanksDocument13 pagesCapital Structureand Profitabilityof Deposit Money BanksRaja RehanNo ratings yet

- BIMB Vs BSN PDFDocument10 pagesBIMB Vs BSN PDFIelts TutorNo ratings yet

- Topic 1. Financial System in Malaysia - STDocument12 pagesTopic 1. Financial System in Malaysia - STgs69466No ratings yet

- Swot AnalysisDocument7 pagesSwot AnalysisSikandar AkramNo ratings yet

- The Factors Affecting Mudharabah DepositDocument11 pagesThe Factors Affecting Mudharabah DepositNhã ThiiNo ratings yet

- Tahir ASRB ProposalDocument11 pagesTahir ASRB ProposalTahir Ullah MohmandNo ratings yet

- Islamic Banking Murat ÇETİNKAYA Kuveyt TürkDocument40 pagesIslamic Banking Murat ÇETİNKAYA Kuveyt TürkFatima Ezzahra BouchhaNo ratings yet

- Factors Affecting The Efficiency of Islamic and Conventional Banks in TurkeyDocument3 pagesFactors Affecting The Efficiency of Islamic and Conventional Banks in TurkeyAmna NawazNo ratings yet

- SUKUK An Introduction To Islamic Capital MarketDocument32 pagesSUKUK An Introduction To Islamic Capital MarketWana MaliNo ratings yet

- Risk-Sharing and Financial InclusionDocument13 pagesRisk-Sharing and Financial InclusionWana MaliNo ratings yet

- Norhidayu Saad Nbf3d 2019859936 Assignment 2Document11 pagesNorhidayu Saad Nbf3d 2019859936 Assignment 2hidayu saadNo ratings yet

- 1 s2.0 S2214845016300011 Main PDFDocument9 pages1 s2.0 S2214845016300011 Main PDFAyman WaelNo ratings yet

- 1 PB - 2Document10 pages1 PB - 2Biruk FikreselamNo ratings yet

- Article1380550430 - Büyüksalvarci and AbdiogluDocument11 pagesArticle1380550430 - Büyüksalvarci and AbdiogluAlma ZildžićNo ratings yet

- 18 KoksalDocument10 pages18 Koksalcongdoanh06No ratings yet

- Isik Et Al-2002-Financial ReviewDocument23 pagesIsik Et Al-2002-Financial ReviewzahideNo ratings yet

- 2002 JBF Isik - Technical, Scale and Allocative Efficiencies of Turkish Banking IndustryDocument48 pages2002 JBF Isik - Technical, Scale and Allocative Efficiencies of Turkish Banking IndustryWahyutri IndonesiaNo ratings yet

- The Role of Banks in Capital Formation and Economic Growth: The Case of NigeriaDocument2 pagesThe Role of Banks in Capital Formation and Economic Growth: The Case of NigeriaLx Rajveer RajNo ratings yet

- Determinants of Capital Adequacy Ratio of Commercial Banks in NepalDocument15 pagesDeterminants of Capital Adequacy Ratio of Commercial Banks in NepalSabinaNo ratings yet

- Mikias PaperDocument60 pagesMikias PaperMeadot MikiasNo ratings yet

- Fi MMMMMMDocument13 pagesFi MMMMMMPrabin ChaudharyNo ratings yet

- Comparative Study On Performance of Islamic Banks and Conventional Banks: Evidence From OmanDocument7 pagesComparative Study On Performance of Islamic Banks and Conventional Banks: Evidence From OmanAbdullah SiddiqNo ratings yet

- FIN536 Chapter 1c (Islamic Banking)Document18 pagesFIN536 Chapter 1c (Islamic Banking)shndh nadeerahNo ratings yet

- Cash Flow Statement Analysis Between Commercial BaDocument9 pagesCash Flow Statement Analysis Between Commercial Baशिवम कर्णNo ratings yet

- The Impact of Monetary Policy On Bank Lending Rate in South AfricaDocument7 pagesThe Impact of Monetary Policy On Bank Lending Rate in South AfricaNokuthulaNo ratings yet

- Chapter 1 History and Development of Banking System in MalaysiaDocument18 pagesChapter 1 History and Development of Banking System in MalaysiaMadihah JamianNo ratings yet

- MBA Final AssignmentDocument106 pagesMBA Final AssignmentMuhammad AzeemNo ratings yet

- Proposal BinodDocument16 pagesProposal BinodbinuNo ratings yet

- Presentation1 PDFDocument27 pagesPresentation1 PDFAyesha NaseemNo ratings yet

- My Second PublicationDocument12 pagesMy Second PublicationYeabkal BelegeNo ratings yet

- Financial Analysis OF State Bank of IndiaDocument59 pagesFinancial Analysis OF State Bank of IndiaPratik KansaraNo ratings yet

- Factors EthiopiaDocument10 pagesFactors EthiopiaAbey BerhaneNo ratings yet

- Profitability of Interest-Free Vs Interest-Based BDocument29 pagesProfitability of Interest-Free Vs Interest-Based BCarnoto EmiradLogisticsNo ratings yet

- Canara Bank Priority Sector AnalysisDocument59 pagesCanara Bank Priority Sector AnalysisSoujanya NagarajaNo ratings yet

- Chapt 1 Bank Banking BusinessDocument3 pagesChapt 1 Bank Banking BusinessMuhammad SyanizamNo ratings yet

- Mission of IBBLDocument19 pagesMission of IBBLTayyaba AkramNo ratings yet

- Investment Performance of Al-Arafah Islami BankDocument64 pagesInvestment Performance of Al-Arafah Islami BankSharifMahmud100% (2)

- Artikel Focus On Cause Kelas 9 - MEI - 2023Document19 pagesArtikel Focus On Cause Kelas 9 - MEI - 2023Mohamad Soleh NurzamanNo ratings yet

- Jitendra Kr. Yadav ProposalDocument13 pagesJitendra Kr. Yadav ProposalSarina ThapaNo ratings yet

- Ific BankDocument99 pagesIfic BankNoor Ibne SalehinNo ratings yet

- 5 Evaluation of The FinancialDocument15 pages5 Evaluation of The FinancialAsniNo ratings yet

- Understanding of Islamic Bank Balance Sheet PDFDocument50 pagesUnderstanding of Islamic Bank Balance Sheet PDFeakubmdNo ratings yet

- Executive Summary: State Bank of IndiaDocument56 pagesExecutive Summary: State Bank of Indiavinu_ckdNo ratings yet

- Ijibec: Interest Free Banking in Ethiopia: Customer Awareness, Satisfaction and Its Role On Economic DevelopmentDocument11 pagesIjibec: Interest Free Banking in Ethiopia: Customer Awareness, Satisfaction and Its Role On Economic DevelopmentBekele Guta GemeneNo ratings yet

- S.No Particular NO: Customer Awareness About Sbi Mutual FundDocument63 pagesS.No Particular NO: Customer Awareness About Sbi Mutual FundRishabh MitraNo ratings yet

- Weathering the Global Crisis: Can the Traits of Islamic Banking System Make a Difference?From EverandWeathering the Global Crisis: Can the Traits of Islamic Banking System Make a Difference?No ratings yet

- GN-6 GN On LRM (April 2015) - FinalDocument68 pagesGN-6 GN On LRM (April 2015) - FinalWana MaliNo ratings yet

- Islamic Finance Pakistan Issue 1 Volume 2 - JAN 2011Document12 pagesIslamic Finance Pakistan Issue 1 Volume 2 - JAN 2011Wana MaliNo ratings yet

- 56.islamic Finance in Practice Relative Significance of Profitloss - Sharing and Mark-Up in Islamic BankingDocument38 pages56.islamic Finance in Practice Relative Significance of Profitloss - Sharing and Mark-Up in Islamic BankingWana MaliNo ratings yet

- Credit Agricole-Market Focus-Egypt's Uncretain Political Future TH Economy and The Army-2011-02-04Document7 pagesCredit Agricole-Market Focus-Egypt's Uncretain Political Future TH Economy and The Army-2011-02-04Wana MaliNo ratings yet

- 55.the Journal of Strategic Thinking in Islamic FinanceDocument29 pages55.the Journal of Strategic Thinking in Islamic FinanceWana MaliNo ratings yet

- Bourkhis and Nabi-Islamic and Conventional Banks' Soundness During 2007-2008 Financial Crisis-Rfe-2013Document10 pagesBourkhis and Nabi-Islamic and Conventional Banks' Soundness During 2007-2008 Financial Crisis-Rfe-2013Wana MaliNo ratings yet

- 54.sir John Vicker's Speech On Banking Reform in FullDocument9 pages54.sir John Vicker's Speech On Banking Reform in FullWana MaliNo ratings yet

- 57.islamic Finance in Theory Evolution and Economics of Mark-Up (Financial MurabahahDocument26 pages57.islamic Finance in Theory Evolution and Economics of Mark-Up (Financial MurabahahWana MaliNo ratings yet

- Asset & Liability ManagementDocument23 pagesAsset & Liability ManagementWana MaliNo ratings yet

- Shariah Governance in Financial InstitutionDocument13 pagesShariah Governance in Financial InstitutionWana MaliNo ratings yet

- Risk-Sharing and Financial InclusionDocument13 pagesRisk-Sharing and Financial InclusionWana MaliNo ratings yet

- Islamic Economic DevelopmentDocument27 pagesIslamic Economic DevelopmentWana MaliNo ratings yet

- The Internationalisation and Evolving Paradigm of Islamic Finance Concept, Performance, Developments and TrendsDocument37 pagesThe Internationalisation and Evolving Paradigm of Islamic Finance Concept, Performance, Developments and TrendsWana MaliNo ratings yet

- IcaapDocument2 pagesIcaapWana MaliNo ratings yet

- Ril Financing DecisionDocument2 pagesRil Financing DecisionPravin Sagar ThapaNo ratings yet

- R K Tubes CorporationDocument2 pagesR K Tubes Corporationshravanienterprises108No ratings yet

- Mankind Pharma Limited RHPDocument588 pagesMankind Pharma Limited RHPArmeet ChhatwalNo ratings yet

- A Study On Risk and Return Analysis With Special References To Reliance CapitalDocument15 pagesA Study On Risk and Return Analysis With Special References To Reliance CapitalManoj MondalNo ratings yet

- Nasr City Cons 12 2020EDocument48 pagesNasr City Cons 12 2020EAly A. SamyNo ratings yet

- Problem: Echon - Dizon - TuazonDocument12 pagesProblem: Echon - Dizon - TuazonChela Nicole EchonNo ratings yet

- Annex UreDocument1 pageAnnex UreBalineni Giridhar NaiduNo ratings yet

- Ho2 SciDocument2 pagesHo2 SciAbdullah JulkanainNo ratings yet

- On ICAI Valuation Standards 2018Document109 pagesOn ICAI Valuation Standards 2018pramodmurkya13No ratings yet

- MSR 40000 Gid 20009265 403 20220627 1 008Document5 pagesMSR 40000 Gid 20009265 403 20220627 1 008Burn4 YouNo ratings yet

- Accounts Xerox Wala Question Paper 08-Jan-2022Document16 pagesAccounts Xerox Wala Question Paper 08-Jan-2022Aquila GodaboleNo ratings yet

- Cash Management (Finance)Document63 pagesCash Management (Finance)Rahul NishadNo ratings yet

- CFA Level 1 SyllabusDocument3 pagesCFA Level 1 Syllabusjohn ramboNo ratings yet

- The Mpassbook Statement Is Generated For Selected Date Range Between 16-01-2023 TO 16-04-2023Document17 pagesThe Mpassbook Statement Is Generated For Selected Date Range Between 16-01-2023 TO 16-04-2023RSS GROUP OF ROYAL (RAHUL CHAURASIYA)No ratings yet

- Excel Assignment 1 FABMDocument3 pagesExcel Assignment 1 FABMG Vidamo Charisma Kizmeth B.No ratings yet

- Alasseel Financial ResultsDocument17 pagesAlasseel Financial ResultsmohamedNo ratings yet

- IFRS 3 Business Combinations Etc Inc Associates and JADocument41 pagesIFRS 3 Business Combinations Etc Inc Associates and JASahilPatelNo ratings yet

- Duration Gap ModelDocument29 pagesDuration Gap ModelSachit KCNo ratings yet

- NBF Industry - Report 2022 01 04T06 - 50 - 56 05 - 00Document7 pagesNBF Industry - Report 2022 01 04T06 - 50 - 56 05 - 00robNo ratings yet

- Temp Statement RFBX 7836 Akun DemoDocument2 pagesTemp Statement RFBX 7836 Akun DemoFebbyNo ratings yet

- ICICI Bank - Consolidated Profit & Loss Account Banks - Private Sector Consolidated Profit & Loss Account of ICICI Bank - BSE: 532174, NSE: ICICIBANKDocument2 pagesICICI Bank - Consolidated Profit & Loss Account Banks - Private Sector Consolidated Profit & Loss Account of ICICI Bank - BSE: 532174, NSE: ICICIBANKr79qwkxcfjNo ratings yet

- Final Assignment VJDocument91 pagesFinal Assignment VJb3316730No ratings yet

- A2 Accounting p3 Booklet (2023 - 24)Document208 pagesA2 Accounting p3 Booklet (2023 - 24)Saif UllahNo ratings yet

- Entrepreneurial Mind (Reviewer)Document3 pagesEntrepreneurial Mind (Reviewer)gonzales.trisha10No ratings yet

- New Bank BR CodesDocument58 pagesNew Bank BR CodesakilamadushankeNo ratings yet

- List of Accounts SAP Hel-ExportDocument216 pagesList of Accounts SAP Hel-ExportEnrique MarquezNo ratings yet

- NISM VA Chapter Wise QuestionsDocument45 pagesNISM VA Chapter Wise QuestionsAvinash JainNo ratings yet

- Financial Reporting Thesis PDFDocument6 pagesFinancial Reporting Thesis PDFUK100% (2)

- MindChamps - Annual ReportDocument15 pagesMindChamps - Annual ReportChristian?97No ratings yet

- BP Ch3Document24 pagesBP Ch3isma farizNo ratings yet