Professional Documents

Culture Documents

Rupal Jain: Encl: As Above

Uploaded by

organic.machliOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Rupal Jain: Encl: As Above

Uploaded by

organic.machliCopyright:

Available Formats

March 06, 2024

The Manager, The Manager,

Listing Department, Listing Department,

BSE Limited, The National Stock Exchange of India Ltd.,

Phiroze Jeejeebhoy Towers, Exchange Plaza, 5th Floor, Plot C/1, G Block,

Dalal Street, Bandra - Kurla Complex, Bandra (E),

Mumbai 400 001. Mumbai 400 051.

BSE Scrip Code: 532636 NSE Symbol: IIFL

Subject: Fairfax India Agrees to Invest up to US$200 Million Liquidity Support to IIFL Finance.

Dear Sir/Madam,

Pursuant to Regulation 30 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations,

2015, we are enclosing herewith the Press Release stating that Fairfax India agrees to invest upto

US$200 million liquidity support to IIFL Finance Limited.

The same has also been made available on the website of the Company, i.e. www.iifl.com.

Kindly take above on record and oblige.

Thanking You,

For IIFL Finance Limited

RUPAL Digitally signed

by RUPAL JAIN

JAIN Date: 2024.03.06

11:16:50 +05'30'

Rupal Jain

Company Secretary & Compliance Officer

Email Id: csteam@iifl.com

Place: Mumbai

Encl: as above

IIFL Finance Limited

CIN No.: L67100MH1995PLC093797

Corporate Office – 802, 8th Floor, Hub Town Solaris, N.S. Phadke Marg, Vijay Nagar, Andheri East, Mumbai 400069

Tel: (91-22) 6788 1000 .Fax: (91-22) 6788 1010

Regd. Office – IIFL House, Sun Infotech Park, Road No. 16V, Plot No. B-23, MIDC, Thane Industrial Area, Wagle Estate, Thane – 400604

Tel: (91-22) 41035000. Fax: (91-22) 25806654 E-mail: csteam@iifl.com Website: www.iifl.com

IIFL Finance Limited

Press Release

For immediate publication

Mumbai, India

March 6, 2024

Contact: Sourav Mishra, Head of Communications, IIFL Finance, +91 99202 85887

Headline: Fairfax India Agrees to Invest up to US$200 Million Liquidity Support to IIFL Finance

[Mumbai- March 6, 2024]—Fairfax India Holdings Corporation (Fairfax India; TSX: FIH.U), a long-

standing investor in IIFL Finance Limited (the company), has announced its commitment to provide

liquidity support amidst the recent Reserve Bank of India (RBI) embargo effective March 5, 2024, on

the company's gold loan disbursements.

The RBI's embargo has raised liquidity concerns amongst the company’s investors and lenders. In

response to these concerns, Fairfax India has agreed to invest up to US$200 million of liquidity support

on terms to be mutually agreed and subject to applicable laws, including regulatory approvals (if any).

"We have been long-term investors in the IIFL group of companies and have full trust and confidence

in the company's strong management team led by Nirmal Jain and R Venkataraman. We are confident

that Nirmal and Venkat will take corrective actions to meet and exceed RBI's compliance standards,”

said Prem Watsa, Chairman of Fairfax India.

Nirmal Jain, Managing Director and Founder of IIFL Finance commented, “At this crucial juncture,

Fairfax India’s and Prem’s generous offer to provide liquidity support is very timely and motivating.

We are committed to complying fully with RBI’s directives and growing the business under the

regulator’s guidance on the strong foundation of compliance, risk management, and fair practices.”

About IIFL Finance:

IIFL Finance is one of the leading RBI-regulated NBFCs engaged in retail credit. Along with its

subsidiaries, IIFL is a key player in small ticket gold, home, and business loans, with loan assets of

about Rs. 78,000 crores, net-worth of over Rs. 10,000 crores, serviced by 4,681 branches and about

40,000 employees. It has garnered acclaim for its steadfast commitment to excellence and innovation.

The company's rich heritage spanning decades has built its impeccable credibility and reputation for

integrity, transparency, and pioneering financial solutions. Guided by a visionary leadership team and

fueled by a passion for empowering dreams, IIFL Finance continues to redefine the contours of success

in the ever-evolving financial ecosystem.

About Fairfax India:

Fairfax India is an investment holding company whose objective is to achieve long-term capital

appreciation, while preserving capital, by investing in public and private equity securities and debt

instruments in India and Indian businesses or other businesses with customers, suppliers or business

primarily conducted in, or dependent on, India.

You might also like

- Intimation Under SEBI ( (Listing Obligations and Disclosure Requirements) Regulations 2015Document3 pagesIntimation Under SEBI ( (Listing Obligations and Disclosure Requirements) Regulations 2015companysecretaryathulNo ratings yet

- Navin Fluorine International LTD 532504 March 2018Document218 pagesNavin Fluorine International LTD 532504 March 2018dwivedishantanuNo ratings yet

- Navin Fluorine International LTD 532504 March 2019Document217 pagesNavin Fluorine International LTD 532504 March 2019dwivedishantanuNo ratings yet

- Appointment of CTO and CRO - 11.11.2021Document4 pagesAppointment of CTO and CRO - 11.11.2021Ashok GNo ratings yet

- Dayeeta Shrinivas GokhaleDocument1 pageDayeeta Shrinivas GokhalerahulraotigerNo ratings yet

- TML Rights Issue LofDocument445 pagesTML Rights Issue LofPriya SumanNo ratings yet

- Im - Infra Series IVDocument89 pagesIm - Infra Series IVdroy21No ratings yet

- REliance Growth FundsDocument60 pagesREliance Growth FundsBhushan KelaNo ratings yet

- 1000 2000 Full Company Update 20230227Document55 pages1000 2000 Full Company Update 20230227Contra Value BetsNo ratings yet

- Deepika Srivasta VA: TH THDocument21 pagesDeepika Srivasta VA: TH THSandy SandyNo ratings yet

- RajDocument376 pagesRajrojabommalaNo ratings yet

- Reliance A Debt Free CompanyDocument13 pagesReliance A Debt Free Companypulimi manojNo ratings yet

- Intimation of Schedule of Analyst Meet 05 02 2020Document4 pagesIntimation of Schedule of Analyst Meet 05 02 2020vishalmehandirattaNo ratings yet

- Scrip Code: 500325 / 890147 Trading Symbol: RELIANCE / RelianceppDocument3 pagesScrip Code: 500325 / 890147 Trading Symbol: RELIANCE / Relianceppmallesh kNo ratings yet

- Nippon India Asset Management Annual Report 2019-20Document182 pagesNippon India Asset Management Annual Report 2019-20vvpvarunNo ratings yet

- BurgerKing 20220221Document3 pagesBurgerKing 20220221siva sumanthNo ratings yet

- Scrip Code: 500325 / 890147 Trading Symbol: RELIANCE / RELIANCEPPDocument4 pagesScrip Code: 500325 / 890147 Trading Symbol: RELIANCE / RELIANCEPPskandamsNo ratings yet

- Category) On The Board of The Bank, With Effect From April 11, 2024, Who Shall Hold Office As AnDocument3 pagesCategory) On The Board of The Bank, With Effect From April 11, 2024, Who Shall Hold Office As AnBrojo Gopal GhoshNo ratings yet

- Chapter 2Document6 pagesChapter 2ExampleNo ratings yet

- Mirae Asset Annual Report 2016-17 (Abridged)Document40 pagesMirae Asset Annual Report 2016-17 (Abridged)Sachidananda SubudhyNo ratings yet

- Twentieth AR IIFL 20150703Document164 pagesTwentieth AR IIFL 20150703Sri ReddyNo ratings yet

- InbDocument187 pagesInbPk AroraNo ratings yet

- ANGELONE 05042024135458 April052024Intimationofpressrelease QIPDocument3 pagesANGELONE 05042024135458 April052024Intimationofpressrelease QIPanirudhNo ratings yet

- Shelf ProspectusDocument583 pagesShelf ProspectussohamNo ratings yet

- Shreya Project Copy - 97 WordDocument129 pagesShreya Project Copy - 97 WordArshdeep SaroyaNo ratings yet

- N DE Pment F ED: HOU CorporationDocument1 pageN DE Pment F ED: HOU Corporationhayat muratNo ratings yet

- Letter of Debenture Trustee Pursuant To Regulation 525Document2 pagesLetter of Debenture Trustee Pursuant To Regulation 525krishna salesNo ratings yet

- Hous NG Development Finance Corporation LimitedDocument3 pagesHous NG Development Finance Corporation LimitedManu SarathNo ratings yet

- Venture Capital: Presented ByDocument14 pagesVenture Capital: Presented BysandeshNo ratings yet

- Reliance Centre Tel: +91 22 4303 1000 Santa Cruz (E) Fax: +91 22 4303 8662 Mumbai 400055 CIN: L75100MH1929PLC001530Document2 pagesReliance Centre Tel: +91 22 4303 1000 Santa Cruz (E) Fax: +91 22 4303 8662 Mumbai 400055 CIN: L75100MH1929PLC001530SaiKumar RachalaNo ratings yet

- Intimation 30th AGM Record Date 15th June2018Document126 pagesIntimation 30th AGM Record Date 15th June2018Naina TuuNo ratings yet

- FraudsDocument49 pagesFraudsGarima ChauhanNo ratings yet

- Moot Proposition - AJIIBM 2023 (Final)Document22 pagesMoot Proposition - AJIIBM 2023 (Final)sourabh rajpurohitNo ratings yet

- Reliance Eqity FundDocument27 pagesReliance Eqity FundMohamed SharifNo ratings yet

- National Stock Exchange of India Limited BSE Limited: LimiteDocument1 pageNational Stock Exchange of India Limited BSE Limited: LimiteTrust 1010No ratings yet

- Clarifies On News Item (Company Update)Document1 pageClarifies On News Item (Company Update)Shyam SunderNo ratings yet

- IDFCFIRSTB InvestorPresentation 31122018Document43 pagesIDFCFIRSTB InvestorPresentation 31122018Rashid MashoodNo ratings yet

- IFM CIA3bDocument18 pagesIFM CIA3bSAURAV KUMAR KALITA 2227652No ratings yet

- Moot Proposition - AJIIBMC 2023Document20 pagesMoot Proposition - AJIIBMC 2023Kritika JoshiNo ratings yet

- Equity Advisory Under India Infoline LTD.: A Summer Internship ProjectDocument45 pagesEquity Advisory Under India Infoline LTD.: A Summer Internship ProjectRohit KewlaniNo ratings yet

- Abridged Annual Report 2017-18Document40 pagesAbridged Annual Report 2017-18garvikaRNo ratings yet

- IREDA 08022024222301 SEintimationgiftcityDocument2 pagesIREDA 08022024222301 SEintimationgiftcityfreak mailNo ratings yet

- What's The Wrap?: 2nd SlideDocument6 pagesWhat's The Wrap?: 2nd SlideManish SatapathyNo ratings yet

- Federalbankanoncementsep 142021Document2 pagesFederalbankanoncementsep 142021Ganesan MNo ratings yet

- Care d19prDocument27 pagesCare d19prmanunair13No ratings yet

- 2023-10-18-IIFS - NS-Refinitiv StreetEven-IIFS - NS - Event Transcript of IIFL Securities LTD Conference... - 104459586Document12 pages2023-10-18-IIFS - NS-Refinitiv StreetEven-IIFS - NS - Event Transcript of IIFL Securities LTD Conference... - 104459586Vinod TPNo ratings yet

- Vision: Investment PhilosophyDocument9 pagesVision: Investment PhilosophyMaddy BabaNo ratings yet

- 163 Investors Policy 2022Document7 pages163 Investors Policy 2022Sumit KalelkarNo ratings yet

- Abhfl NCD Im 29112022Document88 pagesAbhfl NCD Im 29112022tonkkumawatNo ratings yet

- Annual Report 2020 21Document174 pagesAnnual Report 2020 21Namrata KumariNo ratings yet

- Intergrated Assignment: By: Suhail JoshuaDocument24 pagesIntergrated Assignment: By: Suhail JoshuaSuhail Alpheus JoshuaNo ratings yet

- Industry ProfileDocument6 pagesIndustry ProfileDavid SandersNo ratings yet

- Mahindra and Mahindra Financial Services Limited Letter of Offer For ResidentsDocument399 pagesMahindra and Mahindra Financial Services Limited Letter of Offer For ResidentsAkash AggarwalNo ratings yet

- For Our BIG PROFIT Calls and LATEST Reports, SUBSCRIBE To Our Premium Reports. Click Here .Document8 pagesFor Our BIG PROFIT Calls and LATEST Reports, SUBSCRIBE To Our Premium Reports. Click Here .MLastTryNo ratings yet

- MD - Jan 27'22Document22 pagesMD - Jan 27'22Vaishnavi SomaniNo ratings yet

- Nventure: Date: 8 September 2021 National Stock Exchange of India LTDDocument191 pagesNventure: Date: 8 September 2021 National Stock Exchange of India LTDSaikumar SawantNo ratings yet

- Jitendra WordDocument59 pagesJitendra WordDEEPU JHANo ratings yet

- Summary of Saurabh Mukherjea, Rakshit Ranjan & Salil Desai's Diamonds in the DustFrom EverandSummary of Saurabh Mukherjea, Rakshit Ranjan & Salil Desai's Diamonds in the DustNo ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2021: Volume I—Country and Regional ReviewsFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2021: Volume I—Country and Regional ReviewsNo ratings yet

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- Q Paper May 2010Document266 pagesQ Paper May 2010bharticNo ratings yet

- iNDIA Auto FinanceDocument34 pagesiNDIA Auto FinanceRavindra PathariaNo ratings yet

- KR GXGW MYcgdq 0 V1 FDocument2 pagesKR GXGW MYcgdq 0 V1 FRakshit KandpalNo ratings yet

- Rbi Committee On Housing Finance SecuritisationDocument91 pagesRbi Committee On Housing Finance SecuritisationmeenaldutiaNo ratings yet

- IcicibankDocument247 pagesIcicibankR Madhusudhan GoudNo ratings yet

- One Liner Updates Banking Awareness SBI Clerk Mains1Document19 pagesOne Liner Updates Banking Awareness SBI Clerk Mains1Neradabilli EswarNo ratings yet

- Allahabad Bank - Settlement-Deceased-DepositorsDocument20 pagesAllahabad Bank - Settlement-Deceased-DepositorsNobodyNo ratings yet

- Bolt Jun 201598705281117 PDFDocument113 pagesBolt Jun 201598705281117 PDFaaryangargNo ratings yet

- Fundamental Analysis of Public and Private Banks in IndiaDocument91 pagesFundamental Analysis of Public and Private Banks in IndiaNISHANT0% (1)

- JAIIB Exam June 2022 52 Days - 52 Class Very Important Question Class 25Document14 pagesJAIIB Exam June 2022 52 Days - 52 Class Very Important Question Class 25Sudhir DehariyaNo ratings yet

- OnlyIas Important Committee Their Recommendations Marks BoosterDocument42 pagesOnlyIas Important Committee Their Recommendations Marks Boosterprakash patelNo ratings yet

- RBI Releases Financial Literacy Material: Guide Diary 16 PostersDocument1 pageRBI Releases Financial Literacy Material: Guide Diary 16 PostersShrishailamalikarjunNo ratings yet

- Working Capital Management of HDFC BankDocument77 pagesWorking Capital Management of HDFC BankSuraj Dubey100% (1)

- Original Prospectus of L&T Financial Holdings IPODocument547 pagesOriginal Prospectus of L&T Financial Holdings IPO1106531No ratings yet

- X-Social ScienceDocument81 pagesX-Social Scienceshanzathekkoth7No ratings yet

- Electronic Clearing ServiceDocument41 pagesElectronic Clearing Servicejsdhilip0% (1)

- 24 Public Sector Banks Finance To MsmeDocument7 pages24 Public Sector Banks Finance To MsmePARAMASIVAN CHELLIAHNo ratings yet

- Overseas Direct Investment PDFDocument4 pagesOverseas Direct Investment PDFSHREYA GNo ratings yet

- 04.technology in Banking - Unit Iii Part Ii - Prof. Dr. Rajesh MankaniDocument14 pages04.technology in Banking - Unit Iii Part Ii - Prof. Dr. Rajesh MankaniGame ProfileNo ratings yet

- Banking Ombudsman 58Document4 pagesBanking Ombudsman 58Sahil GauravNo ratings yet

- RBI May Deploy LTRR To Mop-Up Liqudity With BanksDocument1 pageRBI May Deploy LTRR To Mop-Up Liqudity With Banksshriya rajanNo ratings yet

- ProjectDocument39 pagesProjectSoham HanamgharNo ratings yet

- SBI PO Mains CA Exam PDF 1Document209 pagesSBI PO Mains CA Exam PDF 1Wasim AkramNo ratings yet

- Kotak Mahindra Bank Limited Standalone Financials FY18Document72 pagesKotak Mahindra Bank Limited Standalone Financials FY18Shankar ShridharNo ratings yet

- Banking Industry Report BhavinDocument43 pagesBanking Industry Report BhavinBhavin VadhadiyaNo ratings yet

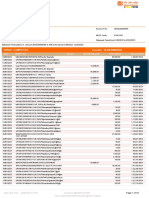

- OpTransactionHistoryUX502 02 2023Document18 pagesOpTransactionHistoryUX502 02 2023Aniket BhalekarNo ratings yet

- Credit Recovery ManagementDocument79 pagesCredit Recovery ManagementSudeep ChinnabathiniNo ratings yet

- RBI Monetary Policy FinalDocument28 pagesRBI Monetary Policy FinaltejassuraNo ratings yet

- PESTEL AnalysisDocument2 pagesPESTEL AnalysispoisonboxNo ratings yet

- FEMADocument41 pagesFEMApuneet.sharma1493No ratings yet