Professional Documents

Culture Documents

CARO

Uploaded by

Niket SharmaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CARO

Uploaded by

Niket SharmaCopyright:

Available Formats

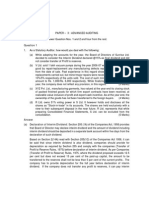

CA Final – Advanced Auditing & Professional Ethics Additional Questions for Practice (Chapter 8)

08

Chapter CARO 2016

Q.1 In the course of audit of MM Ltd. for the financial year ended 31st March, 2020, your audit

team has identified the following matter:

All amount of ₹ 4 Lakh per month for the marketing services rendered is paid to M/s. MG

Associates, a partnership firm in which Director of MM Ltd. is also a managing partner, with

a profit sharing ratio of 30%. Based on an independent assessment, the consideration paid

is higher than the arm's length pricing by ₹ 1.50 Lakh per month. Whilst the transaction was

accounted in the financial statements based on the amounts paid, no separate disclosure

has been made in the notes forming part of the accounts.

Give your comments for reporting under CARO 2016. [Nov. 20 – New Syllabus (4Marks)]

Ans.: Reporting of Related Party Transactions under CARO:

Clause (xiii) of Para 3 of CARO, 2016, requires the auditor to report whether all

transactions with the related parties are in compliance with sections 177 and 188 of

Companies Act, 2013 where applicable and the details have been disclosed in the

Financial Statements etc., as required by the applicable accounting standards.

Therefore the duty of the auditor, under this clause is to report

(i) Whether all transactions with the related parties are in compliance with section 177

and 188 of the Companies Act,2013:

(ii) Whether related party disclosures as required by relevant Accounting Standards (AS

18, as may be applicable) are disclosed in the financial statements.

In the given case, MG Associates is a related party and also rendering marketing services

to MM Ltd. in return of Consideration of ₹ 4 Lakhs which is related party transaction. No

separate disclosure has been made in the notes to accounts in this context, which was

required to be made.

In view of above, Auditor shall report as under:

1. Nature of the related party relationship and the underlying transaction: MG Associates is

a partnership firm in which Director of MM Ltd is also a managing partner, with a profit

sharing ratio of 30 %. Payment of ₹ 4 Lakhs to MG Associates is a related party

transaction.

2. Amount involved is consideration for the Marketing services rendered by MG Associates

(₹ 4 Lakhs p.m.) is higher than the arm’s length pricing by ₹ 1.50 Lakh p.m. (₹ 18 Lakhs

p.a.)

Q.2 As an auditor, how will you report under CARO in each of the following situation?

(i) Since more than seven months, payment of electricity bills to company established

under statue is outstanding.

(ii) The company had imported goods 5 years back and were placed in bonded warehouse

till the end of financial year under Audit. The company has not paid import duty as

goods have not been removed from such warehouse. The company has also not paid

rent and interest expenditure payable on the amount of custom duty.

©CA. Pankaj Garg www.altclasses.in Page1

CA Final – Advanced Auditing & Professional Ethics Additional Questions for Practice (Chapter 8)

(iii) The company has received income tax assessment order along with demand notice

from Assessing officer. The company has not paid dues payable as the same is not

acceptable to the company. The company has neither preferred appeal against the

order nor an application for rectification of mistake has been made. The company has

just merely represented to the Assessing Officer.

(iv) The company in view of voluminous pay-roll data consistently follows the method of

making lump sum deposit of estimated amount of ESI collections and adjust the excess

or deficit against next following months’ deposit and the difference of the said amount

always remains insignificant. [Jan. 21 – Old Syllabus (5 Marks)]

Ans.: Reporting under CARO:

Clause (vii)(a) of Para 3 of CARO, 2016 requires the auditor to state in his report whether

the company is regular in depositing undisputed statutory dues including provident fund,

employees' state insurance, income-tax, sales-tax, services tax, duty of customs, duty of

excise, value added tax, cess and any other statutory dues to the appropriate authorities and

if not, the extent of the arrears of outstanding statutory dues as on the last day of the

financial year concerned for a period of more than 6 months from the date they became

payable, shall be indicated;

It is important to mention that any sum, which is to be regularly paid to an appropriate

authority under a statute (whether Central, State or Local or Foreign) applicable to the

company, should be considered as a “statutory due” for the purpose of this clause. In other

words, obligation to pay a statutory due is created or arises out of a statute, rather than

being based on an independent contractual or legal relationship.

Conclusion: Based on the above stated provisions, following conclusions may be drawn:

(i) Any sum payable to an electricity company as electricity bill would not constitute a

statutory due as dues has arisen on account of contract of supply of goods or services

between the parties. Thus, reporting under CARO is not required for electricity dues.

(ii) In case of imported goods placed in a bonded warehouse, the payment of import duty is

to be made when the goods are removed from the bonded warehouse. However, till the

time the importer opts to remove the goods from the warehouse, the importer is

required to incur the rent and interest expenditure on the amount of customs duty

payable. Since the payment of the custom duty is not due in the current case, the

question of regularity does not arise in respect of custom duty.

Interest and rent that are required to be incurred u/s 61 of the Customs Act, 1962

would come under other statutory dues and the auditor would have to examine and

comment upon the regularity of the company in depositing such interest and rent.

(iii) In relation to income tax assessment order received by the company along with demand

notice, the auditor is required to check whether time limit for filing the appeal or

application for rectification of mistake has expired or not. In case such time limit has

expired, disputed amount will become undisputed statutory due (as mere

representation to the concerned Department shall not be treated as a dispute).

Auditor is also required to ascertain whether such dues are outstanding for a period of

more than 6 months from the date they became payable. Accordingly, after ensuring the

above, if the statutory dues are outstanding for more than 6 months the auditor is

required to report the same under clause (vii)(a) of CARO.

©CA. Pankaj Garg www.altclasses.in Page2

CA Final – Advanced Auditing & Professional Ethics Additional Questions for Practice (Chapter 8)

However, in case the statutory dues are not outstanding for a period of more than 6

months from the date they became payable the auditor is not required to report the

same under CARO.

(iv) If the method as stated in the question is consistently followed and the difference

between the total dues and the lump-sum deposit is not significant, it need not be

considered that dues have not been regularly deposited and no unfavorable comment is

necessary. Thus, no reporting is required for the same under CARO.

© All rights reserved

Law stated in this publication is upto 31.10.2020 and is relevant for May 2021 Exams and onwards.

Disclaimer:

Every effort has been made to avoid errors or omissions in this publication. In spite of this, errors may creep in.

Any mistake, error or discrepancy noted may be brought to our notice which shall be taken care of in the next

edition. No part of this publica

For academic updates and related contents:

Join telegram channel: https://t.me/altclasses

Visit knowledge portal of www.altclasses.in

For books/class related queries:

E-mail: info@altclasses.in

Ph.: 9319805511

For academic doubts:

E-mail: cacs.gargpankaj@gmail.com

For Online purchase of books/classes:

Visit our web portal: www.altclasses.in

©CA. Pankaj Garg www.altclasses.in Page3

You might also like

- Caro PresentationDocument33 pagesCaro PresentationVIJAY GARGNo ratings yet

- CA IPCC Company Audit IIDocument50 pagesCA IPCC Company Audit IIanon_672065362No ratings yet

- 2.caro For Company AuditDocument43 pages2.caro For Company AuditchariNo ratings yet

- Corporate Financial Accounting Project Roll No KSPMCAA012 Dev Shah Mcom Part 2 Sem 4 2022-2023 CARO 2016Document5 pagesCorporate Financial Accounting Project Roll No KSPMCAA012 Dev Shah Mcom Part 2 Sem 4 2022-2023 CARO 2016Dev ShahNo ratings yet

- Caro 2016Document6 pagesCaro 2016Priya AshokNo ratings yet

- Adv Aud Final May08Document16 pagesAdv Aud Final May08Fazi HaiderNo ratings yet

- PCC - Auditing - RTP - June 2009Document18 pagesPCC - Auditing - RTP - June 2009Omnia HassanNo ratings yet

- Group-IV Paper-16: Advanced Financial Accounting & Reporting Dec 2011Document71 pagesGroup-IV Paper-16: Advanced Financial Accounting & Reporting Dec 2011pkaul1No ratings yet

- CSM - CHP 12 - Accounting For Income TaxDocument4 pagesCSM - CHP 12 - Accounting For Income TaxaseppahrudinNo ratings yet

- Bossugansnov 18 Finalp 3Document21 pagesBossugansnov 18 Finalp 3Rhx GangblogNo ratings yet

- Note On Schedule III AmendmentsDocument2 pagesNote On Schedule III AmendmentsJainam ShahNo ratings yet

- CIT v. HCL Technologies Limited (2018) 404 ITR 719 (SC) : Judicial UpdateDocument17 pagesCIT v. HCL Technologies Limited (2018) 404 ITR 719 (SC) : Judicial UpdateHemanthNo ratings yet

- Financial Year 2015-2016Document28 pagesFinancial Year 2015-2016Vinothini MuruganNo ratings yet

- Checklist for Revised Schedule III of Companies ActDocument6 pagesChecklist for Revised Schedule III of Companies ActTony VargheseNo ratings yet

- Ind As ImplementationDocument5 pagesInd As ImplementationrohitNo ratings yet

- DT PDFDocument8 pagesDT PDFKanha KarwaNo ratings yet

- Economic Update 17th May-1Document2 pagesEconomic Update 17th May-1mNo ratings yet

- Revisionary Test Paper: Group IvDocument107 pagesRevisionary Test Paper: Group IvRama AnandNo ratings yet

- Test Series: August, 2018 Mock Test Paper - 1 Final (New) Course: Group - I Paper - 3: Advanced Auditing and Professional EthicsDocument5 pagesTest Series: August, 2018 Mock Test Paper - 1 Final (New) Course: Group - I Paper - 3: Advanced Auditing and Professional EthicsRobinxyNo ratings yet

- Accounting StandardDocument128 pagesAccounting StandardIndu GuptaNo ratings yet

- Master of Business Administration - MBA Semester 3 Subject Code - MF0012 Subject Name - Taxation Management 4 Credits (Book ID: B1210) Assignment Set-1 (60 Marks)Document10 pagesMaster of Business Administration - MBA Semester 3 Subject Code - MF0012 Subject Name - Taxation Management 4 Credits (Book ID: B1210) Assignment Set-1 (60 Marks)balakalasNo ratings yet

- Budget 2018 Highlights Direct Tax ChangesDocument5 pagesBudget 2018 Highlights Direct Tax ChangesSrushti BhattNo ratings yet

- As 26 - Intangible Assets: ApplicabilityDocument4 pagesAs 26 - Intangible Assets: ApplicabilityJignesh RathodNo ratings yet

- Changes in CARO2020Document5 pagesChanges in CARO2020Sheet RavalNo ratings yet

- Tax Bulletin - Issue 2Document26 pagesTax Bulletin - Issue 2Sindura KuloNo ratings yet

- FAQ Annual ReturnsDocument10 pagesFAQ Annual ReturnsWendell de RidderNo ratings yet

- Nov 18 PaperDocument21 pagesNov 18 Paperritz meshNo ratings yet

- CA Final Audit AmendmentDocument8 pagesCA Final Audit AmendmentSandesh LaddhaNo ratings yet

- AAA Question PracticeDocument8 pagesAAA Question PracticenishantsayshiNo ratings yet

- Webel Technology Limited - 188202395048947Document8 pagesWebel Technology Limited - 188202395048947shafaquesameen2001No ratings yet

- Revenue Ifrs 15Document24 pagesRevenue Ifrs 15kimuli FreddieNo ratings yet

- XC 4 MXxu XDocument57 pagesXC 4 MXxu XSunil ShahNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument14 pages© The Institute of Chartered Accountants of IndiaRobinxyNo ratings yet

- Caro For Chartered AccountantsDocument4 pagesCaro For Chartered AccountantsaakashagarwalNo ratings yet

- Day 13 - Insurance - SADocument3 pagesDay 13 - Insurance - SAVarun JoshiNo ratings yet

- The Company Audit - II: © The Institute of Chartered Accountants of IndiaDocument35 pagesThe Company Audit - II: © The Institute of Chartered Accountants of IndiaHarikrishnaNo ratings yet

- (Micro, Small and Medium Enterprises Development (MSMED) Act, 2006)Document2 pages(Micro, Small and Medium Enterprises Development (MSMED) Act, 2006)Mahiti RathNo ratings yet

- Disclosure in Financial StatementsDocument8 pagesDisclosure in Financial StatementsAnkur ShahNo ratings yet

- Revenue Accounting Transition ExampleDocument8 pagesRevenue Accounting Transition ExampleJignesh Vasa100% (1)

- Companies (Auditor's Report) Order, 2020: Companies Specifically Excluded From Its PurviewDocument4 pagesCompanies (Auditor's Report) Order, 2020: Companies Specifically Excluded From Its PurviewABINASHNo ratings yet

- Final Internal Audit Report 12-ICSIL-Ver-DraftDocument29 pagesFinal Internal Audit Report 12-ICSIL-Ver-DraftRamesh ChandraNo ratings yet

- Chennai Metro Rail Limited: Terms of Reference For Outsourcing of Internal AuditDocument15 pagesChennai Metro Rail Limited: Terms of Reference For Outsourcing of Internal Auditpvraju1040No ratings yet

- ActDocument436 pagesActRoshan KaharNo ratings yet

- Tax Reforms in India: Static DimensionsDocument11 pagesTax Reforms in India: Static DimensionsLeela LazarNo ratings yet

- CompiledDocument17 pagesCompiledMeghna SinghNo ratings yet

- 9 Framework For Preparation - Presentation of Financial StatementsDocument13 pages9 Framework For Preparation - Presentation of Financial StatementssmartshivenduNo ratings yet

- Ind-AS 115-Revenue From Contract With Customers: C.A. Hemant WaniDocument42 pagesInd-AS 115-Revenue From Contract With Customers: C.A. Hemant WaniBijay ShresthaNo ratings yet

- LawDocument5 pagesLawHR AssigmnetsNo ratings yet

- The Pitfalls of Interest Deduction Claims by Corporate Taxpayers - ACCA GlobalDocument9 pagesThe Pitfalls of Interest Deduction Claims by Corporate Taxpayers - ACCA GlobalhfdghdhNo ratings yet

- Odisha Hydro Power Corporation EOIDocument12 pagesOdisha Hydro Power Corporation EOISoumyaranjan SinghNo ratings yet

- Amendment PArveen Sharma NotesDocument59 pagesAmendment PArveen Sharma NotesSuhag Patel0% (1)

- Companies (Auditor’s Report) Order, 2020 highlightsDocument17 pagesCompanies (Auditor’s Report) Order, 2020 highlightsRohit BajajNo ratings yet

- CARO, 2016: J.K.Shah Classes I.P.C.C. - AUDITDocument4 pagesCARO, 2016: J.K.Shah Classes I.P.C.C. - AUDITRaviNo ratings yet

- Akwa Ibom ProjectDocument1 pageAkwa Ibom ProjectAdy IbikunleNo ratings yet

- Check List For The AuditDocument14 pagesCheck List For The AuditushaNo ratings yet

- Partnership Firm TaxationDocument4 pagesPartnership Firm TaxationAvishek PathakNo ratings yet

- 1.2. Conceptual Framework - Practice - ENDocument6 pages1.2. Conceptual Framework - Practice - ENBích Trâm100% (1)

- CARODocument9 pagesCAROSai Lakshmi PNo ratings yet

- Transportation & Logistics Transportation & Logistics: Impacts of The Annual Improvements ProjectDocument6 pagesTransportation & Logistics Transportation & Logistics: Impacts of The Annual Improvements ProjectSo LokNo ratings yet

- Gigabyte 8simlh - Rev 3.02Document32 pagesGigabyte 8simlh - Rev 3.02Denis MartinsNo ratings yet

- AFPRP Final Group 25Document19 pagesAFPRP Final Group 25Pranay NitnawareNo ratings yet

- Top Answers to Mahout Interview QuestionsDocument6 pagesTop Answers to Mahout Interview QuestionsPappu KhanNo ratings yet

- Semiconductor Optical AmplifierDocument40 pagesSemiconductor Optical AmplifierVikas ThakurNo ratings yet

- The Historical Foundations of Law. Harold BermanDocument13 pagesThe Historical Foundations of Law. Harold BermanespinasdorsalesNo ratings yet

- Agile Spotify - Team - HomeworkDocument8 pagesAgile Spotify - Team - Homeworksp76rjm7dhNo ratings yet

- Developing Website Information ArchitectureDocument39 pagesDeveloping Website Information ArchitectureBizuNo ratings yet

- Nursing Care Plans for ChildrenDocument4 pagesNursing Care Plans for ChildrenAlexander Rodriguez OlipasNo ratings yet

- Oral Communication Skills Assessment Republic of the PhilippinesDocument3 pagesOral Communication Skills Assessment Republic of the PhilippinesMarissa UrnosNo ratings yet

- MPMC All Questions and AnswerDocument6 pagesMPMC All Questions and AnswerMODERN TELUGAMMAYINo ratings yet

- The Secret Science of Shaktipat - Guide To Initiation 13 September 2020Document77 pagesThe Secret Science of Shaktipat - Guide To Initiation 13 September 2020Patrick JenksNo ratings yet

- Critical Buckling Load of Pile in Liquefied SoilDocument8 pagesCritical Buckling Load of Pile in Liquefied SoilKefas JanuarNo ratings yet

- Holy Week Labyrinth GuideDocument4 pagesHoly Week Labyrinth GuideEileen Campbell-Reed100% (1)

- ĐỀ THI HSGDocument13 pagesĐỀ THI HSGahmad amdaNo ratings yet

- Combining Singing and PsycologyDocument6 pagesCombining Singing and PsycologyAna luciaNo ratings yet

- Enscape Tutorial GuideDocument27 pagesEnscape Tutorial GuideDoroty CastroNo ratings yet

- Bomba de Vacio Part ListDocument2 pagesBomba de Vacio Part ListNayeli Zarate MNo ratings yet

- Group ActDocument3 pagesGroup ActRey Visitacion MolinaNo ratings yet

- How To Critique A Photograph - Facebook PDFDocument1 pageHow To Critique A Photograph - Facebook PDFpeterNo ratings yet

- F2 IS Exam 1 (15-16)Document10 pagesF2 IS Exam 1 (15-16)羅天佑No ratings yet

- 2006fileaveo MTDocument63 pages2006fileaveo MTeurospeed2100% (1)

- Mobile Assisted Language Learning (MALL) Describes An Approach To Language LearningDocument7 pagesMobile Assisted Language Learning (MALL) Describes An Approach To Language Learninggusria ningsihNo ratings yet

- 02.casebook - BLDG Repairs & Maint - Chapter 1 - 2011 (Water Seepage)Document13 pages02.casebook - BLDG Repairs & Maint - Chapter 1 - 2011 (Water Seepage)Hang kong TseNo ratings yet

- Slide Detail For SCADADocument20 pagesSlide Detail For SCADAhakimNo ratings yet

- Timetable 1Document1 pageTimetable 1sunilbijlaniNo ratings yet

- Knowledge Paper XDocument28 pagesKnowledge Paper XLaurențiu Cătălin NeagoeNo ratings yet

- Electric Charges and Fields Bank of Board QuestionsDocument11 pagesElectric Charges and Fields Bank of Board QuestionsNishy GeorgeNo ratings yet

- Rotorvane Tea OrthodoxDocument9 pagesRotorvane Tea OrthodoxyurinaNo ratings yet

- A Daily Morning PrayerDocument8 pagesA Daily Morning Prayerjhustine05100% (1)

- Integrated Marketing Communication PlanDocument5 pagesIntegrated Marketing Communication Planprojectwork185No ratings yet

- Business Process Mapping: Improving Customer SatisfactionFrom EverandBusiness Process Mapping: Improving Customer SatisfactionRating: 5 out of 5 stars5/5 (1)

- A Step By Step Guide: How to Perform Risk Based Internal Auditing for Internal Audit BeginnersFrom EverandA Step By Step Guide: How to Perform Risk Based Internal Auditing for Internal Audit BeginnersRating: 4.5 out of 5 stars4.5/5 (11)

- (ISC)2 CISSP Certified Information Systems Security Professional Official Study GuideFrom Everand(ISC)2 CISSP Certified Information Systems Security Professional Official Study GuideRating: 2.5 out of 5 stars2.5/5 (2)

- GDPR-standard data protection staff training: What employees & associates need to know by Dr Paweł MielniczekFrom EverandGDPR-standard data protection staff training: What employees & associates need to know by Dr Paweł MielniczekNo ratings yet

- The Layman's Guide GDPR Compliance for Small Medium BusinessFrom EverandThe Layman's Guide GDPR Compliance for Small Medium BusinessRating: 5 out of 5 stars5/5 (1)

- Audit. Review. Compilation. What's the Difference?From EverandAudit. Review. Compilation. What's the Difference?Rating: 5 out of 5 stars5/5 (1)

- Financial Statement Fraud Casebook: Baking the Ledgers and Cooking the BooksFrom EverandFinancial Statement Fraud Casebook: Baking the Ledgers and Cooking the BooksRating: 4 out of 5 stars4/5 (1)

- Electronic Health Records: An Audit and Internal Control GuideFrom EverandElectronic Health Records: An Audit and Internal Control GuideNo ratings yet

- A Pocket Guide to Risk Mathematics: Key Concepts Every Auditor Should KnowFrom EverandA Pocket Guide to Risk Mathematics: Key Concepts Every Auditor Should KnowNo ratings yet

- GDPR for DevOp(Sec) - The laws, Controls and solutionsFrom EverandGDPR for DevOp(Sec) - The laws, Controls and solutionsRating: 5 out of 5 stars5/5 (1)

- Audit and Assurance Essentials: For Professional Accountancy ExamsFrom EverandAudit and Assurance Essentials: For Professional Accountancy ExamsNo ratings yet

- Executive Roadmap to Fraud Prevention and Internal Control: Creating a Culture of ComplianceFrom EverandExecutive Roadmap to Fraud Prevention and Internal Control: Creating a Culture of ComplianceRating: 4 out of 5 stars4/5 (1)