Professional Documents

Culture Documents

Ethiopia 1

Uploaded by

biruk shiferawOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ethiopia 1

Uploaded by

biruk shiferawCopyright:

Available Formats

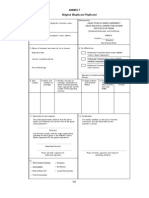

1. Goods consigned from (exporter's business name, Certificate No.

●●●/●●/●●/●●●

address,country)

●●●●●●● ●●●●●●● GENERALIZED SYSTEM OF PREFERENCES

ADDIS ABABA ●●●●● ●●●-●● CERTIFICATE OF ORIGIN

Ethiopia (Combined declaration and certificate)

FORM A

2. Goods consigned to (consignee's business name,

address, country)

●●●●● CO., LTD Issued in Ethiopia

●●●●●●●●●● Japan (Country)

See notes overleaf

3. Means of transport and route (as far as known) 4. For official use

Departure Date: ●/●/2021

Vessel/Flight/Train/Vehicle No.: ●●●●●

Port of loading: ●●●●●

Port of discharge: ●●●●●

5. HS 6. Marks and 7. Number and kind of packages; 8. Origin criterion 9. Gross weight or 10. Number and

code numbers of packages description of goods (see notes overleaf) other quantity date of invoices

●●●●● ●●●●● ●/●

●●●●●● ●● ●●●●●

●/●/2021

11. Certificate 12. Declaration by the exporter

It is hereby certified, on the basls of control carried The undersigned hereby declares that the above detalls

out, that the declaration by the exporter is correct and statements are correct; that all the goods were

produced in Ethiopia

(Country)

and that they comply with the origin requirements specified

●●●●●●●●●● for those goods in DFTP Scheme for LDCs.

Japan

●/●/2021 (Importing Country)

●●●●●●●●●●

Ethiopian Customs Commission

●/●/2021

Place, Date and name of approver of certifying authority Place, Date and name of the authorised signatory

Ethiopian Customs Commission Page 1 of 2 LPCO ID : ●●●●●●●●●●

Ethiopia Electronic Single Window

Visit http://esw.et/esw-cbra/ for online verification

Information => LPCO outsider => LPCO ID

NOTES (2007)

I. Countries which accepts Form A for the purpose of the generalized system of preferences (GSP):

Australia*

Belarus

United States of America****

Canada

Russian Federation

Japan

New Zealand** United Kingdom

Full details of the conditions covering admission to the GSP in these countries are obtainable from the designated authorities

in the exporting preference-receiving countries or from the customs authorities of the preference giving countries listed above.

An information note is also obtainable from the UNCTAD secretariat.

II. General Conditions

To qualify for preference, products must:

(a) fall within a description of products eligible for preference in the country of destination. The description entered on the

form must be sufficiently detailed to enable the products to be identified by the customs officer examining them;

(b) comply with the rules of origin of the country of destination. Each article in a consignment must qualify separately in its

own right; and,

(c) comply with consignment conditions specified by the country of destination. In general, Products must be consigned direct

from the country of exportation to the country of destination but most preference-giving countries accept passage through

intermediate countries subject to certain conditions. (for Australia, direct consignment is not necessary).

III. Entries to be made in Box 8

Preference products must either be wholly obtained in accordance with the rules of the country of destination or sufficiently

worked or processed to fulfill the requirements of that country's origin rules.

(a) Products wholly obtained: for export to all countries listed in Section I, enter the letter "p" in Box 8 (for Australia and

New Zealand Box 8 may be left blank).

(b) Products sufficiently worked or processed: for export to the countries specified below, the entry in Box 8 should be as

followed:

(1) United States of America: for single country shipments, enter the letter "Y" in Box 8, for shipments from recognized

associations of countries, enter the letter "Z" followed by the sum of the cost or value of the domes tic materials and

the direct cost of processing, expressed as a percentage of the ex-factory price of the export ed products: (example

"Y" 3 5% or "Z" 3 5%).

(2) Canada: for products which meet origin criteria from working or processing in more than one eligible least developed

country, enter letter “G” in Box 8, otherwise “F”.

(3) Japan: enter the letter "W" in Box 8 followed by the Harmonized ommodity Description and coding system

(Harmonized system) heading at the 4-digit level of the exported products (Example "W" 96.18).

(4) Russian Federation: for products which include value added in the exporting preference-receiving country, enter the letter "Y"

in Box 8 followed by the value of imported materials and components expressed as a percentage of the fob price of the

exported products (examples "Y" 45%); for products obtained in a prefer ence-receiving country and worked or processed in

one or more other such countries, enter “PK.

(5) Australia and New Zealand:completion of Box 8 is not required. It is sufficient that a declaration be properly

made in Box 12.

* For Australia, the main requirement is the exporter's declaration on the normal commercial invoice. Form A, accompa

nied by the normal commercial invoice, is an acceptable alternative, but official certification is not required.

** Official certification is not required.

*** The principality of Liechtenstein forms, pursuant to the Treaty of 29 March 1923, a customs union with Switzerland.

**** The United States does not require GSP Form A. A declaration setting forth all pertinent detailed information concerning

the production or manufacture of the merchandise is considered sufficient only if requested by the district collector of

customs.

You might also like

- Outboard Motorboats World Summary: Market Sector Values & Financials by CountryFrom EverandOutboard Motorboats World Summary: Market Sector Values & Financials by CountryNo ratings yet

- Marine Machinery, Equipment & Supplies Wholesale Revenues World Summary: Market Values & Financials by CountryFrom EverandMarine Machinery, Equipment & Supplies Wholesale Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Certificate of Origin: INDIA .Document2 pagesCertificate of Origin: INDIA .Moges TolchaNo ratings yet

- Chapter 2 SVDocument43 pagesChapter 2 SVTM PhụngNo ratings yet

- Anexa 2 - 412Document2 pagesAnexa 2 - 412Anonymous 3OwL0xuzbcNo ratings yet

- Certificatul de Origine Forma ADocument9 pagesCertificatul de Origine Forma ASorinBologaNo ratings yet

- DGFT - Status Holder Certificate User Help FileDocument18 pagesDGFT - Status Holder Certificate User Help Filepratyush1200No ratings yet

- Form E From VietnamDocument6 pagesForm E From Vietnambomcon123456No ratings yet

- Form ADocument2 pagesForm AgeorgevoommenNo ratings yet

- ANF5ADocument9 pagesANF5ACharles JacobNo ratings yet

- Customs Clearance Training - (Export Import) 1Document76 pagesCustoms Clearance Training - (Export Import) 1Ravindran100% (3)

- Operational Procedures For Imports Under The Asean-India Free Trade Area (Aifta) Trade in Goods (Tig) AgreementDocument4 pagesOperational Procedures For Imports Under The Asean-India Free Trade Area (Aifta) Trade in Goods (Tig) AgreementDio MaulanaNo ratings yet

- Anf 1BDocument11 pagesAnf 1Bdkhatri01No ratings yet

- ANF-2D Application Format For Seeking Policy/Procedure Relaxation in Terms of para 2.58 of FTPDocument4 pagesANF-2D Application Format For Seeking Policy/Procedure Relaxation in Terms of para 2.58 of FTPUtkarsh KhandelwalNo ratings yet

- Combined Certificate of Value and of Origin For Goods Exported To The Federation of NigeriaDocument3 pagesCombined Certificate of Value and of Origin For Goods Exported To The Federation of Nigeriaecho yangNo ratings yet

- Form AIDocument8 pagesForm AITrịnh Huyền LinhNo ratings yet

- Anf 5A Application Form For Epcg Authorisation IssueDocument6 pagesAnf 5A Application Form For Epcg Authorisation IssueBaljeet SinghNo ratings yet

- Exchange Control Software Export Declaration (Softex) FormDocument4 pagesExchange Control Software Export Declaration (Softex) FormRixinayNo ratings yet

- Softex FormDocument4 pagesSoftex Formrajkumarjain10No ratings yet

- 5 2 1 2 - enDocument4 pages5 2 1 2 - enDimple EstacioNo ratings yet

- Tratados y Convenios Sistema Generalizado de Preferencias SGP .Normas de Origen.20.06.2008Document3 pagesTratados y Convenios Sistema Generalizado de Preferencias SGP .Normas de Origen.20.06.2008Wendy Milagros Villacorta GutierrezNo ratings yet

- Car Importation RequirementsDocument6 pagesCar Importation Requirementsbfac2024No ratings yet

- Form AANZDocument6 pagesForm AANZkatacumiNo ratings yet

- Sub Section VIDocument9 pagesSub Section VIdvnambNo ratings yet

- Form AJDocument6 pagesForm AJkatacumiNo ratings yet

- Anf 5BDocument3 pagesAnf 5BAkash KediaNo ratings yet

- EouDocument12 pagesEouRuby SinghNo ratings yet

- Air Export CustomsDocument7 pagesAir Export CustomsDivyabhan SinghNo ratings yet

- Exports Documentation/procedures BasicsDocument23 pagesExports Documentation/procedures Basicskrishna mohanNo ratings yet

- TD DG Account Approval Request Form V20Document3 pagesTD DG Account Approval Request Form V20jecaceres12No ratings yet

- K EtaDocument14 pagesK EtaJosue Teni BeltetonNo ratings yet

- ASEAN India OCP PDFDocument2 pagesASEAN India OCP PDFCha CahNo ratings yet

- Export: Do You Want To To The EU?Document6 pagesExport: Do You Want To To The EU?Vaibhav AgarwalNo ratings yet

- Slip 2 (AD/MA 1/1999) Exchange Control Software Export Declaration (Softex) FormDocument4 pagesSlip 2 (AD/MA 1/1999) Exchange Control Software Export Declaration (Softex) FormRixinayNo ratings yet

- Generalized System of Preferences For Goods Under Duty Free/ Quota Free For Least Developed Countries Certificate of Origin (Form DFQF)Document2 pagesGeneralized System of Preferences For Goods Under Duty Free/ Quota Free For Least Developed Countries Certificate of Origin (Form DFQF)Moges TolchaNo ratings yet

- Phytosanitary CertificateDocument2 pagesPhytosanitary Certificatesasibreeze0% (1)

- Revised Form EDocument3 pagesRevised Form EazkaNo ratings yet

- Application Form For Export of SCOMET ItemsDocument4 pagesApplication Form For Export of SCOMET Itemsakashaggarwal88No ratings yet

- Irsd112 (E) - Stamping Request - Agreement / AssignmentDocument6 pagesIrsd112 (E) - Stamping Request - Agreement / AssignmentlauandnganllpNo ratings yet

- Certificate of OriginDocument3 pagesCertificate of OriginUmair BukhariNo ratings yet

- Unit V: Export IncentivesDocument37 pagesUnit V: Export IncentivesthensureshNo ratings yet

- Angola Cotecna DatasheetDocument10 pagesAngola Cotecna DatasheetIssa NshaiwatNo ratings yet

- CO Form D AtigaDocument2 pagesCO Form D AtigaDustin SangNo ratings yet

- Exports Framework Policy, Schemes AND ProceduresDocument59 pagesExports Framework Policy, Schemes AND ProceduresthensureshNo ratings yet

- Aa15 Evidencia 8Document10 pagesAa15 Evidencia 8Asesor Japomotos OcañaNo ratings yet

- Evidencia 6 Video Steps To ExportDocument6 pagesEvidencia 6 Video Steps To ExportJorge NiñoNo ratings yet

- Ley de Nigeria PDFDocument12 pagesLey de Nigeria PDFElena RSNo ratings yet

- UgandaDocument2 pagesUgandaKelz YouknowmynameNo ratings yet

- Evidencia 8 Presentation Steps To ExportDocument10 pagesEvidencia 8 Presentation Steps To ExportCarlos RuizNo ratings yet

- XML File SpecDocument311 pagesXML File SpecjackscloseoutsNo ratings yet

- Export: Do You Want To To The EU?Document6 pagesExport: Do You Want To To The EU?Anonymous Rg89p3qNo ratings yet

- Certificate of OriginDocument2 pagesCertificate of OriginRaja PaluruNo ratings yet

- Supporting Documents Required Forimportgoods BangladeshDocument1 pageSupporting Documents Required Forimportgoods BangladeshAli AnsarNo ratings yet

- eBRC Manual 28.12.2023Document23 pageseBRC Manual 28.12.2023Ilesh GhevariyaNo ratings yet

- Egypt ACI Shipper GuideDocument9 pagesEgypt ACI Shipper GuideShaymaa RachidNo ratings yet

- FMS, FPS, MLFPS Schemes & Documents Reqd.Document7 pagesFMS, FPS, MLFPS Schemes & Documents Reqd.bibhas1No ratings yet

- Export: Do You Want To To The EU?Document6 pagesExport: Do You Want To To The EU?Dan LakesNo ratings yet

- ANF 5B LIC - NoDocument5 pagesANF 5B LIC - Nosuman_gourh100% (2)

- Agricultural Trade in the Global South: An Overview of Trends in Performance, Vulnerabilities, and Policy FrameworksFrom EverandAgricultural Trade in the Global South: An Overview of Trends in Performance, Vulnerabilities, and Policy FrameworksNo ratings yet

- INV N287-OO MergedDocument26 pagesINV N287-OO Mergedshanusingh98806No ratings yet

- Looking Back Vietnam'S Exports To Korea After 5 Years of Implementation of VkftaDocument8 pagesLooking Back Vietnam'S Exports To Korea After 5 Years of Implementation of VkftaKhanh KimNo ratings yet

- Bilateral Agreements: Aanzfta & Aifta: Members: Izon, DonabelleDocument21 pagesBilateral Agreements: Aanzfta & Aifta: Members: Izon, DonabelleMirajane StraussNo ratings yet

- Full Text UkvftaDocument176 pagesFull Text UkvftaHeena GuptaNo ratings yet

- HSN Codes PDFDocument35 pagesHSN Codes PDFSundeep RajNo ratings yet

- Miranda, Madeleigne CA7-B1: Pjepa Ph-Efta FtaDocument7 pagesMiranda, Madeleigne CA7-B1: Pjepa Ph-Efta FtaSeashell LoafingNo ratings yet

- Notes On SAPTADocument13 pagesNotes On SAPTAashishNo ratings yet

- WCO News 93 October 2020Document96 pagesWCO News 93 October 2020Bishop TNo ratings yet

- AWP No. 98Document77 pagesAWP No. 98chhetribharat08No ratings yet

- Iii. Trade Policies and Practices by Measure (1) O: Trinidad and Tobago WT/TPR/S/151Document48 pagesIii. Trade Policies and Practices by Measure (1) O: Trinidad and Tobago WT/TPR/S/151hinbox7No ratings yet

- 2 - CPTPP Viet Nam's Commitments in Some Key Areas - EN - 0001Document26 pages2 - CPTPP Viet Nam's Commitments in Some Key Areas - EN - 0001MTCB BlogNo ratings yet

- CM102Document7 pagesCM102Jasper VincentNo ratings yet

- Iii. Trade Policies and Practices by Measure (1) I: Singapore WT/TPR/S/202Document39 pagesIii. Trade Policies and Practices by Measure (1) I: Singapore WT/TPR/S/202metabealNo ratings yet

- Group Presentation For The Shivam ShuklaDocument7 pagesGroup Presentation For The Shivam ShuklaShivam ShuklaNo ratings yet

- A Guide To Vietnam's Supply Chains: From Dezan Shira & AssociatesDocument12 pagesA Guide To Vietnam's Supply Chains: From Dezan Shira & AssociatesVân ĂnggNo ratings yet

- EVFTA's Effect on Vietnam Textile Industry-đã Chuyển ĐổiDocument26 pagesEVFTA's Effect on Vietnam Textile Industry-đã Chuyển ĐổiHữu Phúc ĐỗNo ratings yet

- 04 - Guidelines On Infrastructure For Tariff - Valuation and Origin-ENDocument46 pages04 - Guidelines On Infrastructure For Tariff - Valuation and Origin-ENDio MaulanaNo ratings yet

- III Legal Regimes and Custom Regimes 2021Document103 pagesIII Legal Regimes and Custom Regimes 2021Anna Alcove MartiNo ratings yet

- Form I Rules of OriginDocument5 pagesForm I Rules of OriginHannah OlivarNo ratings yet

- 12-01087 - Mai Nguyen Hoang Nam - ECO 601 - Final AssignmentDocument19 pages12-01087 - Mai Nguyen Hoang Nam - ECO 601 - Final AssignmentnamNo ratings yet

- CBP Form 0434 - 15363Document3 pagesCBP Form 0434 - 15363richardNo ratings yet

- NTRC 2014Document192 pagesNTRC 2014Marc MendozaNo ratings yet

- Дэлхийн Галийн БайгууллагаDocument39 pagesДэлхийн Галийн БайгууллагаХүрэлцоож АмарзоригтNo ratings yet

- The Role of The Private Sector in Regional Economic Integration: A View From The PhilippinesDocument28 pagesThe Role of The Private Sector in Regional Economic Integration: A View From The PhilippinesjhaymanlodNo ratings yet

- ASEAN India OCP PDFDocument2 pagesASEAN India OCP PDFCha CahNo ratings yet

- GTCJ - 9-10 - Interviewed by Eugenia Costanza LaurenzaDocument5 pagesGTCJ - 9-10 - Interviewed by Eugenia Costanza LaurenzaberniverNo ratings yet

- Form AANZDocument6 pagesForm AANZkatacumiNo ratings yet

- Introduction To Preferential To Certificate of Origin - UPDATEDDocument68 pagesIntroduction To Preferential To Certificate of Origin - UPDATEDtamil vaanan100% (1)

- Torq Aifta 070 IssuedDocument11 pagesTorq Aifta 070 IssuedSuraj KapseNo ratings yet

- Carotar Brochure 07102020Document15 pagesCarotar Brochure 07102020bhalchandra2290876No ratings yet