Professional Documents

Culture Documents

Customer Information Sheet NEW INDIA ASHA KIRAN POLICY 18.12

Uploaded by

bipinchauhan87Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Customer Information Sheet NEW INDIA ASHA KIRAN POLICY 18.12

Uploaded by

bipinchauhan87Copyright:

Available Formats

(LEGAL DISCLAIMER) NOTE: The information must be read in conjunction with the Prospectus and Policy

Document. In case of any conflict between the CIS and the Policy Document the terms and conditions

mentioned in the Policy Document shall prevail.

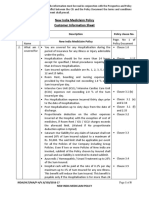

CUSTOMER INFORMATION SHEET/KNOW YOUR POLICY

SI Title Description Policy

No Clause

Number

1 Name of the PAGE1

NEW INDIA ASHA KIRAN POLICY

Insurance

Product/Policy

2 Policy Number

3 Type of Insurance Policy

Product/Policy clause

Indemnity + Benefit

Section

3 and 3.5

4 Sum Insured Basis Floater Sum insured. Prospect

Sum insured available are 2, 3, 5, 8, 10, 12 and 15 lakhs. us Point

2 & 19.

5 Policy Coverage Expense in respect of:

(What Policy

Covers?) Admission in hospital beyond 24 hours Policy

clause

2.18

Pre-hospitalisation (treatment prior to admission in hospital) of Policy

30 days clause

2.36 and

3.1(e)

Post-Hospitalisation (treatment after discharge from Hospital) Policy

within 60 days from date of discharge clause

2.37 &

3.1(f)

Specified / Listed procedures requiring less than 24 hours of Annexur

hospitalization (day care) e 1: List

1 of Day

List of 226 Day care procedure in policy clause. Care

Procedur

e

UIN: NIAHLIP24123V032324 Page 1 of 15

NEW INDIA ASHA KIRAN POLICY

(LEGAL DISCLAIMER) NOTE: The information must be read in conjunction with the Prospectus and Policy

Document. In case of any conflict between the CIS and the Policy Document the terms and conditions

mentioned in the Policy Document shall prevail.

Proportionate Deduction is applicable on the Associate Medical Policy

Expenses, if the Insured Person opts for a higher Room than his Clause

eligible category. It shall be effected in the same proportion as 3.1(g)

the eligible rate per day bears to the actual rate per day of Room

Rent. However, it is not applicable on

Cost of Pharmacy and consumables.

Cost of Implants and Medical Devices

Cost of Diagnostics.

Proportionate Deduction shall also not be applied in respect of

Hospitals which do not follow differential billing or for those

expenses in which differential billing is not adopted based on

the room category, as evidenced by the Hospital’s schedule of

charges / tariff.

Cataract: Our liability for any claim of Cataract shall not Policy

exceed 10% of Sum Insured subject to a maximum of Rs. Clause

50,000. 3.2

Our liability for expenses incurred for Policy

Ayurvedic/Homeopathic/Unani treatments shall not exceed Clause

25% of the Sum Insured in respect of all such treatments 3.3

admitted during the Period of Insurance, provided the

treatment for Illness or Injury, is taken in any AYUSH Hospital.

We will pay Hospital Cash at the rate of 0.1% of the Sum Policy

Insured, for each day of Hospitalisation, admissible under the Clause

Policy. The payment under this Clause for Any One Illness 3.4

shall not exceed 1% of the Sum Insured. The payment under

this Clause is applicable only where the period of

Hospitalization exceeds twenty-four hours.

CRITICAL CARE BENEFIT Policy

Clause

If during the Period of Insurance any Insured Person discovers 3.5

that he or she is suffering from any Critical Illnesses as defined

under 2.8, which results in a claim admissible under this Policy,

10% of the Sum Insured would be paid as Critical Care Benefit

along with the admissible claim amount.

Critical Care Benefit is payable only once in the life time of each

Insured Person and is not applicable to any Insured Persons for

whom it is a Pre- Existing Condition/Disease.

Any payment under this Clause would be in addition to the Sum

Insured and shall not deplete the Sum Insured.

UIN: NIAHLIP24123V032324 Page 2 of 15

NEW INDIA ASHA KIRAN POLICY

(LEGAL DISCLAIMER) NOTE: The information must be read in conjunction with the Prospectus and Policy

Document. In case of any conflict between the CIS and the Policy Document the terms and conditions

mentioned in the Policy Document shall prevail.

PAYMENT OF AMBULANCE CHARGES

We will pay You the charges for Ambulance services not Policy

exceeding 1% of the Sum Insured per Insured event, Medically Clause

Necessarily incurred for shifting any Insured Person to Hospital 3.6

for admission in Emergency Ward or ICU, or from one Hospital

to another Hospital for better medical facilities.

Optional Cover I: NO PROPORTIONATE DEDUCTION Policy

Clause

On payment of additional Premium as mentioned in Schedule, it 3.9

is hereby agreed and declared that Clause 3.1(g) stands deleted

for the members covered in the Policy as stated in the Schedule.

You shall continue to bear the differential between actual and

eligible Room Rent.

Optional Cover II: Maternity Expenses- Policy

Clause

On the payment of additional Premium as mentioned in 3.10

Schedule, it is hereby agreed and declared that Clause 4.4.15

stands deleted for Insured Person as mentioned in the Schedule.

Our liability for claim admitted for Maternity shall not exceed 10%

of the average Sum Insured of the Insured Person in the

preceding three years. This Optional Cover is available for Sum

Insured 5 L & above.

For more details Please refer policy documents.

Optional Cover III: Revision in cataract Limit- Policy

Clause

This benefit is applicable only if the Sum Insured of the Insured 3.11

person is more than or equal to Rs. 8 lakhs. On payment of

additional premium, additional limit shall be as follows:

Sum Insured Revised Cataract Limit

Rs. 8,00,000 Rs. 80,000

Rs. 10,00,000 Rs. 1,00,000

Rs. 12,00,000 Rs. 1,20,000

Rs. 15,00,000 Rs. 1,50,000

Note: Benefit of this cover will be available after the expiry of

thirty-six months from the date of opting this cover

UIN: NIAHLIP24123V032324 Page 3 of 15

NEW INDIA ASHA KIRAN POLICY

(LEGAL DISCLAIMER) NOTE: The information must be read in conjunction with the Prospectus and Policy

Document. In case of any conflict between the CIS and the Policy Document the terms and conditions

mentioned in the Policy Document shall prevail.

Optional Cover IV: Non-Medical Items (Consumables) – Policy

Clause

On payment of additional Premium items listed in Annexure II 3.12

(List 1) of the policy clause shall become payable up to Rs.

15,000/- in a policy period. This Optional Cover is available for

Sum Insured of 8 L & above. Once this optional cover is opted

and a claim has been admitted under the policy, You cannot opt

out of this optional cover.

Congenital Internal Disease or Defects or anomalies shall Policy

be covered after twenty-four months of Continuous Clause

Coverage. If it was unknown to You or to the Insured 3.8

Person at the commencement of such Continuous

Coverage. Exclusion for Congenital Internal Disease or

Defects or Anomalies would not apply to a New Born Baby

during the year of Birth and also subsequent renewals, if

Premium is paid for such New Born Baby and the renewals

are effected before or within thirty days of expiry of the

Policy.

Congenital External Disease or Defects or anomalies shall Policy

be covered after forty-eight months of Continuous Clause

Coverage, but such cover for Congenital External Disease 3.8

or Defects or anomalies shall be limited to 10% of the

average Sum Insured in the preceding four years.

SPECIFIC COVERAGES Clauses

3.13(a) to

1- Artificial life maintenance 3.13(e)

2- Puberty and Menopause related Disorders

3- Age Related Macular Degeneration (ARMD)

4- Genetic diseases or disorders

5- Treatment of Mental Illness.

COVERAGE FOR MODERN TREATMENTS or Clauses

PROCEDURES – 3.14.1 to

3.14.12

12 Treatments as per clause no 3.14.1 to 3.14.12

Please refer policy documents for more details.

UIN: NIAHLIP24123V032324 Page 4 of 15

NEW INDIA ASHA KIRAN POLICY

(LEGAL DISCLAIMER) NOTE: The information must be read in conjunction with the Prospectus and Policy

Document. In case of any conflict between the CIS and the Policy Document the terms and conditions

mentioned in the Policy Document shall prevail.

CO-PAYMENT FOR CHANGE IN ZONE: Policy

Clause

Where the Insured Person is treated in a Hospital situated 3.15

outside the Area of Coverage as stated in the Schedule, our

liability will be:

80% of the admissible claim amount, (or)

Sum Insured.

Whichever is less.

PERSONAL ACCIDENT (APPLICABLE TO PROPOSER AND Policy

SPOUSE). Clause

3.16

If the Proposer and/or Spouse shall sustain any bodily Injury

resulting solely and directly from Accident then,we shall pay to

dependent daughter(s) as specified in the schedule, the sum

hereinafter set forth that is to say:

If such Injury shall within twelve calendar months of its

occurrence be the sole and direct cause of

S. No Coverage Compensation

3.16.1 Death of Proposer or

100% of Sum Insured

Spouse

Proposer and

200% of Sum Insured

Spouse

3.16.2 Permanent Proposer or

100% of Sum Insured

Total Spouse

Disablement of Proposer and

200% of Sum Insured

Spouse

3.16.3 Loss of both Proposer or

100% of Sum Insured

eyes / Loss of Spouse

both limbs /

Proposer and

Loss of one limb 200% of Sum Insured

Spouse

and one eye of

3.16.4 Loss of one limb Proposer or

100% of Sum Insured

/ one eye of Spouse

Proposer and

200% of Sum Insured

Spouse

Note: In the event of unfortunate death of all the Insured

Persons specified in the policy, no such benefits shall be

payable under this Section.

Any payment under this Clause would be in addition to the Sum

Insured and shall not deplete the Sum Insured

UIN: NIAHLIP24123V032324 Page 5 of 15

NEW INDIA ASHA KIRAN POLICY

(LEGAL DISCLAIMER) NOTE: The information must be read in conjunction with the Prospectus and Policy

Document. In case of any conflict between the CIS and the Policy Document the terms and conditions

mentioned in the Policy Document shall prevail.

6 Exclusion Standard Exclusions Policy

(What Policy does clause

not cover) INVESTIGATION & EVALUATION (Code- Excl04) 4.4.1 to

a. Expenses related to any admission primarily for 4.4.15

diagnostics and evaluation purposes.

b. Any diagnostic expenses which are not related or not

incidental to the current diagnosis and treatment

REST CURE, REHABILITATION AND RESPITE CARE

(Code- Excl05) Expenses related to any admission

primarily for enforced bed rest and not for receiving

treatment. This also includes:

a. Custodial care either at home or in a nursing facility for

personal care such as help with activities of daily living

such as bathing, dressing, moving around either by

skilled nurses or assistant or non-skilled persons.

b. Any services for people who are terminally ill to

address physical, social, emotional and spiritual

needs.

OBESITY/ WEIGHT CONTROL (Code- Excl06)

Expenses related to the surgical treatment of obesity that

does not fulfil all the below conditions:

a. Surgery to be conducted is upon the advice of the

Doctor

b. The surgery/Procedure conducted should be

supported by clinical protocols

c. The member has to be 18 years of age or older and

d. Body Mass Index (BMI);

1. greater than or equal to 40 or

2. greater than or equal to 35 in conjunction with any

of the following severe co-morbidities following

failure of less invasive methods of weight loss:

i. Obesity-related cardiomyopathy

ii. Coronary heart disease

iii. Severe Sleep Apnea

iv. Uncontrolled Type2 Diabetes

UIN: NIAHLIP24123V032324 Page 6 of 15

NEW INDIA ASHA KIRAN POLICY

(LEGAL DISCLAIMER) NOTE: The information must be read in conjunction with the Prospectus and Policy

Document. In case of any conflict between the CIS and the Policy Document the terms and conditions

mentioned in the Policy Document shall prevail.

CHANGE-OF-GENDER TREATMENTS (Code- Excl07):

Expenses related to any treatment, including surgical

management, to change characteristics of the body to

those of the opposite sex.

COSMETIC OR PLASTIC SURGERY (Code- Excl08):

Expenses for cosmetic or plastic surgery or any treatment

to change appearance unless for reconstruction following

an Accident, Burn(s) or Cancer or as part of medically

necessary treatment to remove a direct and immediate

health risk to the insured. For this to be considered a

medical necessity, it must be certified by the attending

Medical Practitioner

HAZARDOUS OR ADVENTURE SPORTS (Code-

Excl09): Expenses related to any treatment necessitated

due to participation as a professional in hazardous or

adventure sports, including but not limited to, para-

jumping, rock climbing, mountaineering, rafting, motor

racing, horse racing or scuba diving, hand gliding, sky

diving, deep-sea diving.

BREACH OF LAW (Code- Excl10): Expenses for

treatment directly arising from or consequent upon any

Insured Person committing or attempting to commit a

breach of law with criminal intent.

EXCLUDED PROVIDERS (Code-Excl11): Expenses

incurred towards treatment in any hospital or by any

Medical Practitioner or any other provider specifically

excluded by the Insurer and disclosed in its website /

notified to the policyholders are not admissible. However,

in case of life-threatening situations or following an

accident, expenses up to the stage of stabilization are

payable but not the complete claim.

Treatment for, Alcoholism, drug or substance abuse or

any addictive condition and consequences thereof.

(Code- Excl12)

Treatments received in health hydros, nature cure clinics,

spas or similar establishments or private beds registered

as a nursing home attached to such establishments or

where admission is arranged wholly or partly for domestic

reasons. (Code- Excl13)

UIN: NIAHLIP24123V032324 Page 7 of 15

NEW INDIA ASHA KIRAN POLICY

(LEGAL DISCLAIMER) NOTE: The information must be read in conjunction with the Prospectus and Policy

Document. In case of any conflict between the CIS and the Policy Document the terms and conditions

mentioned in the Policy Document shall prevail.

Dietary supplements and substances that can be

purchased without prescription, including but not limited to

Vitamins, minerals and organic substances unless

prescribed by a medical practitioner as part of

hospitalization claim or day care procedure. (Code-

Excl14)

REFRACTIVE ERROR (Code- Excl15): Expenses

related to the treatment for correction of eye sight due to

refractive error less than 7.5 dioptres.

UNPROVEN TREATMENTS (Code- Excl16): Expenses

related to any unproven treatment, services and supplies

for or in connection with any treatment. Unproven

treatments are treatments, procedures or supplies that

lack significant medical documentation to support their

effectiveness.

STERILITY AND INFERTILITY (Code- Excl17)

Expenses related to sterility and infertility. This includes:

a. Any type of contraception, sterilization

b. Assisted Reproduction services including artificial

insemination and advanced reproductive technologies

such as IVF, ZIFT, GIFT, ICSI

c. Gestational Surrogacy

d. Reversal of sterilization

MATERNITY EXPENSES (Code - Excl18)

a. Medical treatment expenses traceable to childbirth

(including complicated deliveries and caesarean

sections incurred during hospitalization) except ectopic

pregnancy;

b. Expenses towards miscarriage (unless due to an

accident) and lawful medical termination of pregnancy

during the policy period.

Specific Exclusions Policy

clause

Acupressure, acupuncture, magnetic therapies.

4.4.16 to

Any expenses incurred on Domiciliary Hospitalization. 4.4.33

Service charges, Surcharges, Luxury Tax, Admission fees,

Registration fees, Record Charges and Telephone Charges

levied by the Hospital.

Bodily Injury or Illness due to willful or deliberate exposure

UIN: NIAHLIP24123V032324 Page 8 of 15

NEW INDIA ASHA KIRAN POLICY

(LEGAL DISCLAIMER) NOTE: The information must be read in conjunction with the Prospectus and Policy

Document. In case of any conflict between the CIS and the Policy Document the terms and conditions

mentioned in the Policy Document shall prevail.

to danger (except in an attempt to save human life),

intentional self-inflicted Injury and attempted suicide.

Circumcision unless Medically Necessary or as may be

necessitated due to an Accident.

Convalescence and General debility.

Cost of braces, equipment or external prosthetic devices,

eyeglasses, Cost of spectacles and contact lenses, hearing

aids including cochlear implants.

External Medical / Non-medical equipment used for

diagnosis and/or treatment including CPAP/BIPAP, Oxygen

Concentrator, Infusion pump , Ambulatory devices (walker,

crutches, Collars, Caps, Splints, Elasto crepe bandages,

external orthopaedic pads) and sub cutaneous insulin

pump, Diabetic foot wear, Glucometer / Thermometer and

equipment, which is subsequently used at home and

outlives the use and life of the Insured Person.

Naturopathy and Siddha Treatments.

Nuclear, chemical or biological attack or weapons,

contributed to, caused by, resulting from or from any other

cause or event contributing concurrently or in any other

sequence to the loss, claim or expense. For the purpose of

this exclusion:

Nuclear attack or weapons means the use of any nuclear

weapon or device or waste or combustion of nuclear fuel or

the emission, discharge, dispersal, release or escape of

fissile/ fusion material emitting a level of radioactivity

capable of causing any Illness, incapacitating disablement

or death.

Chemical attack or weapons means the emission,

discharge, dispersal, release or escape of any solid, liquid

or gaseous chemical compound which, when suitably

distributed, is capable of causing any Illness, incapacitating

disablement or death.

Biological attack or weapons means the emission,

discharge, dispersal, release or escape of any pathogenic

(disease producing) micro-organisms and/or biologically

produced toxins (including genetically modified organisms

and chemically synthesized toxins) which are capable of

causing any Illness, incapacitating disablement or death.

UIN: NIAHLIP24123V032324 Page 9 of 15

NEW INDIA ASHA KIRAN POLICY

(LEGAL DISCLAIMER) NOTE: The information must be read in conjunction with the Prospectus and Policy

Document. In case of any conflict between the CIS and the Policy Document the terms and conditions

mentioned in the Policy Document shall prevail.

Stem cell implantation/Surgery for other than those

treatments mentioned in clause 3.20.12

Expenses incurred for Rotational Field Quantum Magnetic

Resonance (RFQMR), External Counter Pulsation (ECP),

Enhanced External Counter Pulsation (EECP), Hyperbaric

Oxygen Therapy.

Treatment and/or services taken outside the geographical

limits of India

Vaccination and/or inoculation

War (whether declared or not) and war like occurrence or

invasion, acts of foreign enemies, hostilities, civil war,

rebellion, revolutions, insurrections, mutiny, military or

usurped power, seizure, capture, arrest, restraints and

detainment of all kinds

Payment or compensation in respect of death, Injury or

disablements directly or indirectly arising out of or

contributed to or traceable to any disability already existing

on the date of commencement of this policy.

Procedures / treatments usually done in outpatient

department are not payable under the Policy even if

converted as an in-patient in the Hospital for more than

twenty-four consecutive hours.

Change of treatment from one system to another unless

recommended by the consultant/ Hospital under which the

treatment is taken

7 Waiting period Initial Waiting period: First 30 days of all illness (not Policy

applicable in case of continuous renewal or accidents) clause

4.3

UIN: NIAHLIP24123V032324 Page 10 of 15

NEW INDIA ASHA KIRAN POLICY

(LEGAL DISCLAIMER) NOTE: The information must be read in conjunction with the Prospectus and Policy

Document. In case of any conflict between the CIS and the Policy Document the terms and conditions

mentioned in the Policy Document shall prevail.

PRE-EXISTING DISEASES (Code- Excl01) Policy

a. Expenses related to the treatment of a pre-existing Disease Clause

(PED) and its direct complications shall be excluded until the 4.1

expiry of 48 months of continuous coverage after the date of

inception of the first policy with us.

b. In case of enhancement of Sum Insured the exclusion shall

apply afresh to the extent of Sum Insured increase.

c. If the Insured Person is continuously covered without any

break as defined under the portability norms of the extant IRDAI

(Health Insurance) Regulations then waiting period for the same

would be reduced to the extent of prior coverage.

d. Coverage under the policy after the expiry of 48 months for

any pre-existing disease is subject to the same being declared at

the time of application and accepted by us.

SPECIFIC WAITING PERIOD (Code- Excl02) Clause

4.2

90 Days Waiting Period

1. Diabetes Mellitus

2. Hypertension

3. Cardiac Conditions

24 Months waiting period

1. All internal and external benign tumours, cysts,

polyps of any kind, including benign breast lumps

2. Benign ear, nose, throat disorders

3. Benign prostate hypertrophy

4. Cataract and age related eye ailments

5. Gastric/ Duodenal Ulcer

6. Gout and Rheumatism

7. Hernia of all types

8. Hydrocele

9. Non Infective Arthritis

10. Piles, Fissures and Fistula in anus

11. Pilonidal sinus, Sinusitis and related disorders

12. Prolapse inter Vertebral Disc and Spinal Diseases

unless arising from accident

13. Skin Disorders

14. Stone in Gall Bladder and Bile duct, excluding

malignancy

15. Stones in Urinary system

16. Treatment for Menorrhagia/Fibromyoma, Myoma and

Prolapsed uterus

17. Varicose Veins and Varicose Ulcers

18. Puberty and Menopause related Disorders

UIN: NIAHLIP24123V032324 Page 11 of 15

NEW INDIA ASHA KIRAN POLICY

(LEGAL DISCLAIMER) NOTE: The information must be read in conjunction with the Prospectus and Policy

Document. In case of any conflict between the CIS and the Policy Document the terms and conditions

mentioned in the Policy Document shall prevail.

19. Internal Congenital Diseases

48 Months waiting period

1. Joint Replacement due to Degenerative Condition

2. Age-related Osteoarthritis & Osteoporosis

3. Treatment of Mental Illness

4. Age Related Macular Degeneration (ARMD)

5. Genetic diseases or disorders

6. External Congenital disease.

8 Financial Limit of The Policy will pay only up to the limits specified hereunder for

Coverage the following disease/procedures:

i. Sub-limit Room Rent, boarding and nursing expenses as provided by Clause

the Hospital not exceeding 1.0 % of the Sum Insured (without 3.1(a)

Cumulative Bonus) per day.

Intensive Care Unit (ICU) / Intensive Cardiac Care Unit (ICCU) Policy

expenses not exceeding 2.0 % of the Sum Insured (without clause

Cumulative Bonus) per day. 3.1. (b)

LIMIT ON PAYMENT FOR CATARACT Policy

clause

Our liability for payment of any claim within the Period of 3.2

Insurance, relating to Cataract for each eye shall not exceed

10% of the Sum Insured or Rs. 50,000, whichever is less.

Coverage for Modern Treatment Policy

clause

Coverage for 12 listed modern treatment will be payable as per 3.14

the sublimit mentioned in the policy clause.

Please refer policy document for more details.

ii. Co-Payment Where the Insured Person is treated in a Hospital situated Policy

outside the Area of Coverage (Zone) as stated in the Schedule, clause

our liability will be: 3.15

80% of the admissible claim amount,

Sum Insured.

Whichever is less.

UIN: NIAHLIP24123V032324 Page 12 of 15

NEW INDIA ASHA KIRAN POLICY

(LEGAL DISCLAIMER) NOTE: The information must be read in conjunction with the Prospectus and Policy

Document. In case of any conflict between the CIS and the Policy Document the terms and conditions

mentioned in the Policy Document shall prevail.

iii. Deductible Not applicable

iv. Any Other limit No

as applicable

9 Claims/Claim Details of procedure to be followed for cashless service as well

Procedure as for reimbursement of claims including pre and post

hospitalisation.

Provide the details/ Web link of the following

i. Network hospital details-

https://www.newindia.co.in/portal/readMore/HospitalsList

ii. Helpline number: 1800-209-1415

iii. Hospitals which are blacklisted or from where no claims

will be accepted by the insurer- Not applicable

iv. Downloading the claim form-

https://www.newindia.co.in/cms/24b38b03-6b17-42e8-

b047-43c7784c6528/Claim_Form.pdf?guest=true

v. Pre-authorisation approval/rejections:

Within 2 hours from the time of admission.

Within 1 hour of receipt of request for enhancement.

Within 1 hour of receipt of final bill for discharge.

Within 1 hour from the receipt of response to queries.

Within 24 hours if confirmation of policy is required.

No pre-authorisation will be done in the absence of beneficiary

photo ID and other valid ID proof as defined

10 Policy Servicing Call center number of the insurer- 1800-209-1415

Details of the Company Officials https://www.newindia.co.in/

UIN: NIAHLIP24123V032324 Page 13 of 15

NEW INDIA ASHA KIRAN POLICY

(LEGAL DISCLAIMER) NOTE: The information must be read in conjunction with the Prospectus and Policy

Document. In case of any conflict between the CIS and the Policy Document the terms and conditions

mentioned in the Policy Document shall prevail.

Policy Issuing Office: -

11 Grievances/Compla Grievance redressal officer of the company:

ints

https://www.newindia.co.in/portal/readMore/Grievances

Insurance company grievance portal/department: Not

applicable

Senior Citizens may write to -

seniorcitizencare.ho@newindia.co.in

IRDAI Integrated Grievance Management System–

https://igms.irda.gov.in/

Ombudsman’s: Annexure III of the policy clause

12 Things to Free look cancellation: You may cancel the insurance policy, if Policy

Remember you do not want it, within 15 days from the beginning of the clause

policy. 5.6

Policy Renewal: Except on grounds of fraud, moral hazard or Policy

misrepresentation or non-cooperation, renewal of your policy clause

shall not be denied, provided the policy is not withdrawn. 5.11

Migration and Portability: This policy is subject to portability Policy

guidelines issued by IRDA and as amended from time to time. clause

5.15

Please refer policy document for more detail.

Moratorium period: Policy

After completion of eight continuous years under this policy no clause

look back would be applied. This period of eight years is called 5.8

as moratorium period. The moratorium would be applicable for

the Sums Insured of the first policy and subsequently completion

of eight continuous years would be applicable from date of

enhancement of Sums Insured only on the enhanced limits. After

the expiry of Moratorium Period no claim under this policy shall

be contestable except for proven fraud and permanent

exclusions specified in the policy contract. The policies would

however be subject to all limits, sub limits, co-payments as per

the policy.

UIN: NIAHLIP24123V032324 Page 14 of 15

NEW INDIA ASHA KIRAN POLICY

(LEGAL DISCLAIMER) NOTE: The information must be read in conjunction with the Prospectus and Policy

Document. In case of any conflict between the CIS and the Policy Document the terms and conditions

mentioned in the Policy Document shall prevail.

13 Your Obligation Please disclose all pre-existing disease/s or conditions before Policy

buying a policy. Non-disclosure may affect the claim settlement. clause

5.4

The policy shall be void and all premium paid thereon shall be

forfeited to the Company in the event of misrepresentation, mis

description or non-disclosure of any material fact by the

policyholder. (Explanation: "Material facts" for the purpose of this

policy shall mean all relevant information sought by the company

in the proposal form and other connected documents to enable it

to take informed decision in the context of underwriting the risk).

Declaration by the Policy Holder;

I have read the above and confirm having noted the details.

Place

Date: (Signature of the Policy Holder)

Note:

i. Web-link where the product related documents including the Customer information

sheet are available on https://www.newindia.co.in/health/all-products.

ii. In case of any conflict, the terms and condition mentioned in the policy document

shall prevail.

UIN: NIAHLIP24123V032324 Page 15 of 15

NEW INDIA ASHA KIRAN POLICY

You might also like

- C Is New India Floater Medi Claim PolicyDocument12 pagesC Is New India Floater Medi Claim PolicyDeepan ManojNo ratings yet

- Customer Information Sheet New India Mediclaim PolicyDocument8 pagesCustomer Information Sheet New India Mediclaim PolicyABHIJEETNo ratings yet

- PolicyUsageGuide UPTO 40 LAKHS PDFDocument3 pagesPolicyUsageGuide UPTO 40 LAKHS PDFpizza nmorevikNo ratings yet

- Senior Citizen Policy WordingsDocument6 pagesSenior Citizen Policy WordingsBINAY KUMAR YADAVNo ratings yet

- Star Cancer Care Platinum One PagerDocument2 pagesStar Cancer Care Platinum One Pagerricky aliaNo ratings yet

- CIS Health Suraksha Policy WordingDocument7 pagesCIS Health Suraksha Policy WordinganandmvyasNo ratings yet

- Cis DocumentDocument23 pagesCis Documentatadu1No ratings yet

- ICAI HS360 WithoutDuductibleDocument52 pagesICAI HS360 WithoutDuductiblepadiNo ratings yet

- Care Advantage-Policy WordingDocument61 pagesCare Advantage-Policy Wordingmilind.v.patilNo ratings yet

- Goodhealth Group Mediclaim Policy: The New India Assurance Company LimitedDocument24 pagesGoodhealth Group Mediclaim Policy: The New India Assurance Company LimitedTanmoy Pal ChowdhuryNo ratings yet

- Customer Information Sheet: Title Description Refer To Policy Clause Number Product Name Tata Aig Medicare Plus Top-UpDocument4 pagesCustomer Information Sheet: Title Description Refer To Policy Clause Number Product Name Tata Aig Medicare Plus Top-UpSankyBoy06No ratings yet

- Prospectus New India Floater Mediclaim 21012020 - 1Document20 pagesProspectus New India Floater Mediclaim 21012020 - 1mail2sranjanNo ratings yet

- Star Cancer Care Platinum One Pager Version 1.2 September 2021Document1 pageStar Cancer Care Platinum One Pager Version 1.2 September 2021DHIRAJ SHETTY100% (1)

- Health Insurance 360 BaseDocument2 pagesHealth Insurance 360 BasepadiNo ratings yet

- SBI General Insurance Company Limited: (Description Is Illustrative and Not Exhaustive)Document45 pagesSBI General Insurance Company Limited: (Description Is Illustrative and Not Exhaustive)adnaanrashid7No ratings yet

- Insurance Research.Document19 pagesInsurance Research.Partha BatabyalNo ratings yet

- Title Description: UIN: RHLHLIP19097V011819Document45 pagesTitle Description: UIN: RHLHLIP19097V011819Touch MidasNo ratings yet

- VARISTHA Mediclaim For Senior Citizens Policy PDFDocument15 pagesVARISTHA Mediclaim For Senior Citizens Policy PDFSudhirNo ratings yet

- Customer Guide Cover: Policy RulesDocument19 pagesCustomer Guide Cover: Policy RulesBertrandNo ratings yet

- Health RechaDocument39 pagesHealth RechaKasibhatta SuryaNo ratings yet

- ICICI GMC Quote - Baroda Decorators Revised 02.04.2024Document6 pagesICICI GMC Quote - Baroda Decorators Revised 02.04.2024silvershield.generalNo ratings yet

- Health Add OnsDocument6 pagesHealth Add OnssureshNo ratings yet

- D098330816 12289438838710598 ScheduleDocument6 pagesD098330816 12289438838710598 ScheduleSAMRAT BAJAJNo ratings yet

- Prospectus New India Floater Mediclaim Wef 01 04 2021Document26 pagesProspectus New India Floater Mediclaim Wef 01 04 2021SnehaAnilSurveNo ratings yet

- Wef 01 04 2021Document26 pagesWef 01 04 2021M.KATHIRESANNo ratings yet

- Final PSL Healthpolicy Wording PERSISTANT 2021-22Document38 pagesFinal PSL Healthpolicy Wording PERSISTANT 2021-22AsifNo ratings yet

- Prospectus: The New India Assurance Co. LTDDocument26 pagesProspectus: The New India Assurance Co. LTDShittyNo ratings yet

- Every DETAIL Matters To Your HEALTH.: Policy ContractDocument38 pagesEvery DETAIL Matters To Your HEALTH.: Policy Contractmaakabhawan26No ratings yet

- Arogya Sanjeevani Policy CIS - 2Document3 pagesArogya Sanjeevani Policy CIS - 2PrasanthNo ratings yet

- Future Aarogy Bima Policy WordingsDocument27 pagesFuture Aarogy Bima Policy Wordingsvikash kumarNo ratings yet

- Hospitalization PlansDocument64 pagesHospitalization PlansSurya PrakasamNo ratings yet

- Health Premier Insurance Policy BrochureDocument14 pagesHealth Premier Insurance Policy BrochureMUKUL JANGIDNo ratings yet

- Healthsurance Product BrochureDocument6 pagesHealthsurance Product Brochuregauravjuyal1988No ratings yet

- Equicover Health Cis PWDocument27 pagesEquicover Health Cis PWLogeshParthasarathyNo ratings yet

- Arogya Premier Policy WordingDocument30 pagesArogya Premier Policy WordingSyed AbudhakirNo ratings yet

- HDFC Ergo Policy ScheduleDocument3 pagesHDFC Ergo Policy ScheduleReshma GuptaNo ratings yet

- Tere MDF MadDocument19 pagesTere MDF MadJitendra BhatewaraNo ratings yet

- (Description Is Illustrative and Not Exhaustive) : Customer Information SheetDocument29 pages(Description Is Illustrative and Not Exhaustive) : Customer Information SheetUtkarsh ShahNo ratings yet

- Kotak Health Premier Claim Form Part BDocument32 pagesKotak Health Premier Claim Form Part BRKNo ratings yet

- STU Policy WordingsDocument35 pagesSTU Policy WordingsSandeep NRNo ratings yet

- Mediclaim Insurance SchemeDocument7 pagesMediclaim Insurance SchemeYogesh TiwariNo ratings yet

- Reliance Healthwise Policy ScheduleDocument2 pagesReliance Healthwise Policy ScheduleueraviNo ratings yet

- Tata AIG Medi Care Plus E8a0cf5358Document16 pagesTata AIG Medi Care Plus E8a0cf5358Sameer DesaiNo ratings yet

- Nan To SeeDocument5 pagesNan To SeeSam FernandeNo ratings yet

- VTC Premier PolicyDocument17 pagesVTC Premier PolicyaaaNo ratings yet

- Corona Kavach Policy, Max Bupa Health Insurance Co. Ltd. - Policy Schedule Policy ScheduleDocument17 pagesCorona Kavach Policy, Max Bupa Health Insurance Co. Ltd. - Policy Schedule Policy ScheduleGlobal College of Engineering TechnologyNo ratings yet

- Lifeline 2.0 Policy WordingDocument33 pagesLifeline 2.0 Policy WordingVijay Singh RathourNo ratings yet

- Energy Policy WordingsDocument14 pagesEnergy Policy WordingsGopal PenjarlaNo ratings yet

- Arogya Sanjeevani-IFFCO-Tokio ProspectusDocument18 pagesArogya Sanjeevani-IFFCO-Tokio ProspectusLakshya SaxenaNo ratings yet

- CIS-Arogya Sanjeevani - ITGIDocument2 pagesCIS-Arogya Sanjeevani - ITGIvikrantNo ratings yet

- 05 Standard Group Mediclaim 2007 PolicyDocument31 pages05 Standard Group Mediclaim 2007 PolicyAkash JangidNo ratings yet

- Prudent Religare Employee Benefit ManualDocument24 pagesPrudent Religare Employee Benefit ManualSheikh AtifNo ratings yet

- Icimi LombardDocument55 pagesIcimi Lombardranjeetsingh2908No ratings yet

- Niahlgp21282v022021 2020-2021Document27 pagesNiahlgp21282v022021 2020-2021Rupayan DuttaNo ratings yet

- Optima Restore, Customer Information Sheet: HDFC ERGO Health Insurance LimitedDocument17 pagesOptima Restore, Customer Information Sheet: HDFC ERGO Health Insurance LimitedHemant KhanNo ratings yet

- Prospectus Yuva Bharat Health PolicyDocument28 pagesProspectus Yuva Bharat Health PolicyS PNo ratings yet

- Schedule INDM202200111963 0.HomeLiteDocument51 pagesSchedule INDM202200111963 0.HomeLiteZeeshan HasanNo ratings yet

- Newman's Billing and Coding Technicians Study GuideFrom EverandNewman's Billing and Coding Technicians Study GuideRating: 4.5 out of 5 stars4.5/5 (2)

- Final Prelim Module Educ 11Document33 pagesFinal Prelim Module Educ 11Maden betoNo ratings yet

- Prenatal Aneuploidy ScreeningDocument80 pagesPrenatal Aneuploidy ScreeningBharti Pant GahtoriNo ratings yet

- Congenital Heart DefectsDocument16 pagesCongenital Heart DefectsLara TomašićNo ratings yet

- Rania Nasir 22667 Human Development Assignment 1Document2 pagesRania Nasir 22667 Human Development Assignment 1Rania NasirNo ratings yet

- 2014 Editorial June 2014Document20 pages2014 Editorial June 2014panniyin selvanNo ratings yet

- MedBack MyelomeningoceleDocument3 pagesMedBack MyelomeningoceleJulia Rei Eroles IlaganNo ratings yet

- Psychology NotesDocument92 pagesPsychology NotesCatherine Wong100% (1)

- A Multiparity Woman With Pregnancy of Recurrent Anencephaly A Rare Case ReportDocument2 pagesA Multiparity Woman With Pregnancy of Recurrent Anencephaly A Rare Case ReportInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- MSDS - Minium (Red Lead)Document9 pagesMSDS - Minium (Red Lead)billfrindall7261No ratings yet

- PBL 2 KLP 9aDocument40 pagesPBL 2 KLP 9aPutri ReniNo ratings yet

- Hydrocephalus: Cebu City Medical Center-College of NursingDocument7 pagesHydrocephalus: Cebu City Medical Center-College of NursingALL DAY PISO PRINT 2022No ratings yet

- Folic AcidDocument4 pagesFolic AcidRuturaj MokashiNo ratings yet

- Neonatal ConvulsionDocument49 pagesNeonatal ConvulsionAhmad IhsanNo ratings yet

- Assessment of High Risk PregnancyDocument8 pagesAssessment of High Risk PregnancyJessica Carmela Casuga100% (1)

- Rajiv Gandhi University Thesis Topics in PsychiatryDocument6 pagesRajiv Gandhi University Thesis Topics in Psychiatrygbvhhgpj100% (1)

- Gastroschisis Final PresentationDocument43 pagesGastroschisis Final PresentationlhedavenNo ratings yet

- Compilation and Comparison of Medical Camp Data in The Endosulfan Affected Area in KasaragodDocument4 pagesCompilation and Comparison of Medical Camp Data in The Endosulfan Affected Area in KasaragodDr KMSreekumarNo ratings yet

- Sindrome de DownDocument9 pagesSindrome de DownNube AzulNo ratings yet

- Psychotropic Medications During PregnancyDocument20 pagesPsychotropic Medications During PregnancyMaria Von ShaftNo ratings yet

- Aicardi SydnromeDocument2 pagesAicardi SydnromeDennyNo ratings yet

- PNDT ActDocument25 pagesPNDT ActSurinder PalNo ratings yet

- Diabetes Mellitus in PregnancyDocument5 pagesDiabetes Mellitus in PregnancyRockyNo ratings yet

- 01 Cir 16 5 736Document14 pages01 Cir 16 5 736Surya GunawanNo ratings yet

- Jan Mar 2019Document92 pagesJan Mar 2019DrNishanthNo ratings yet

- Case Report - Ectopia CordisDocument10 pagesCase Report - Ectopia CordisAnne Reichel MinasNo ratings yet

- Medical and Surgical Complication in PregnancyDocument29 pagesMedical and Surgical Complication in PregnancyVictor-Gabriel Rugina0% (1)

- The Association of Torch Infection and Congenital Malformations: A Prospective Study in ChinaDocument36 pagesThe Association of Torch Infection and Congenital Malformations: A Prospective Study in ChinaAisyah MajidNo ratings yet

- 29 Surgical Emergencies in PediatricDocument42 pages29 Surgical Emergencies in PediatricDavid HartantoNo ratings yet

- Clinical Genetics and Genomics Oxford University b8h DR NotesDocument935 pagesClinical Genetics and Genomics Oxford University b8h DR NotesZay Yar WinNo ratings yet

- Chola MS General Insurance Co. LTDDocument21 pagesChola MS General Insurance Co. LTDSrikanthNo ratings yet