Professional Documents

Culture Documents

Quiz Time Value of Money

Quiz Time Value of Money

Uploaded by

rizzamaybacarra.birOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Quiz Time Value of Money

Quiz Time Value of Money

Uploaded by

rizzamaybacarra.birCopyright:

Available Formats

FINANCIAL MANAGEMENT

TIME VALUE OF MONEY

QUIZ #1

1. Suppose you put P250 at the beginning of every month in a savings account that credits

interest at the annual rate of 6%, but compounds it monthly. Find the amount in this account

after 25 years.

2. You have decided to put P130 in a savings account at the end of each month. The savings

account credits interest monthly, at the annual rate of 6%. How much money is in your

account after 6 years?

3. Fred Abbott has just opened an IRA in which he plans to deposit P150 at the end of every

month. The account will compound interest monthly at the annual rate of 9%. How much

money will Fred have after 25 years in this account?

4. You have started a job with an annual salary of P48,000. You will get the paycheck at the end

of each month, and your deductions for taxes will be 34%. Using a discount rate of 0.8% per

month, find the present value of the take home pay for the whole year.

5. Suppose you want to accumulate P10,000 for a down payment for a house. You will deposit

P400 at the beginning of every month in an account that credits interest monthly at the rate of

0.6% per month. How long will it take you to achieve your goal?

6. James Earl has decided to save a million pesos by depositing P50,000 at the beginning of

each year in an account that pays interest at the rate of 10%, compounded annually. How

long will it take him to reach his objective?

7. Suppose you are a property owner and you are collecting rent for an apartment. The tenant

has signed a one-year lease with P600 a month rent, payable in advance. Find the present

value of the lease contract if the discount rate is 12% per year.

8. West Bank gives consumer loans at the annual interest rate of 8.25%. Suppose you take out a

P5,200 loan for 36 months, what will your monthly payment be?

9. Bennington Company has borrowed a certain amount from the bank that it will repay in 24

monthly installments. The bank charges 6% interest annually on this loan and the monthly

payment is P6000. Find the amount of loan.

10. On January 1, 2019, an entity acquired an equipment for P1,000,000. The entity paid

P100,000 down and signed a noninterest bearing note for the balance which is due after three

years on January 1, 2021. There was no established cash price for the equipment. The

prevailing interest rate for this type of note is 10%. Determine at what amount should the

equipment be recorded by the entity?

You might also like

- Financial Markets InstitutionsDocument28 pagesFinancial Markets Institutionskean leigh felicano50% (4)

- ANNUITIES CompleteDocument26 pagesANNUITIES CompleteWex Senin Alcantara60% (5)

- Sources and Uses of Short Term and Long Term FundsDocument13 pagesSources and Uses of Short Term and Long Term FundsPia Bueno75% (4)

- Problem Set Time Value of MoneyDocument5 pagesProblem Set Time Value of MoneyRohit SharmaNo ratings yet

- Exercises - Corporate Finance 1Document12 pagesExercises - Corporate Finance 1Hông HoaNo ratings yet

- Problem SolvingDocument7 pagesProblem SolvingSantos, Kimberly R.No ratings yet

- Econ Project FinalDocument9 pagesEcon Project FinalMharco Colipapa0% (2)

- Simple, Compound Interest and Annuity Problems For Special ClassDocument2 pagesSimple, Compound Interest and Annuity Problems For Special ClassPaolo PerezNo ratings yet

- Bank Treasury Operations Competency MatrixDocument4 pagesBank Treasury Operations Competency MatrixAmber AJNo ratings yet

- 2nd QTR ModuleDocument3 pages2nd QTR ModuleL Alcosaba100% (1)

- Gen - MathDocument4 pagesGen - MathJudith DelRosario De RoxasNo ratings yet

- Consumer MathDocument28 pagesConsumer MathMylene Magalong De GuzmanNo ratings yet

- ES 301 SeatWork 1Document2 pagesES 301 SeatWork 1trixie marie jamoraNo ratings yet

- Quiz Number 1Document1 pageQuiz Number 1Cortez, Christan M.No ratings yet

- Solved ProblemsDocument44 pagesSolved ProblemsGlyzel Dizon0% (1)

- Busana 1 Pe FinalsDocument3 pagesBusana 1 Pe FinalsKim TNo ratings yet

- Activity 2Document1 pageActivity 2Brixter AdvientoNo ratings yet

- Exercises 1Document4 pagesExercises 1Dilina De SilvaNo ratings yet

- Compound Interest Example ProblemsDocument2 pagesCompound Interest Example ProblemsMicah Aila MallariNo ratings yet

- Tutorial TVM - S1 - 2020.21Document4 pagesTutorial TVM - S1 - 2020.21Bảo NhiNo ratings yet

- Chapter 2 Time Value of MoneyDocument2 pagesChapter 2 Time Value of MoneyPik Amornrat SNo ratings yet

- Fundamentals of Engineering EconomyDocument3 pagesFundamentals of Engineering EconomySean Matthew L. OcampoNo ratings yet

- Chapter 2 ANNUITIESDocument21 pagesChapter 2 ANNUITIESCarl Omar GobangcoNo ratings yet

- Interest and Money Time Relationship Problem Set (Extra Problems)Document1 pageInterest and Money Time Relationship Problem Set (Extra Problems)Alvaro Laureano100% (1)

- Time Value of Money Problems:: 8. You Invest $10,000. During The First Year The Investment Earned 20%Document3 pagesTime Value of Money Problems:: 8. You Invest $10,000. During The First Year The Investment Earned 20%UmerMajeedNo ratings yet

- Midterm MoiDocument2 pagesMidterm MoiSHENo ratings yet

- Tutorial TVM - S1 - 2020.21Document4 pagesTutorial TVM - S1 - 2020.21anon_355962815No ratings yet

- Discount, Denoted by D Which Is A Measure of Interest Where The Interest IsDocument3 pagesDiscount, Denoted by D Which Is A Measure of Interest Where The Interest IsNguyễn Quang TrườngNo ratings yet

- Compilation For Final Exam 1 Converted 1Document7 pagesCompilation For Final Exam 1 Converted 1Trending News and TechnologyNo ratings yet

- Gen Math Rev. PrefDocument1 pageGen Math Rev. PrefAshley GonzalesNo ratings yet

- Sample Problems Engineeri G EconomyDocument2 pagesSample Problems Engineeri G Economysaleh gaziNo ratings yet

- PROBLEM - SET (3) - EconomyDocument3 pagesPROBLEM - SET (3) - EconomytuaNo ratings yet

- Unit ACTIVITY 3Document2 pagesUnit ACTIVITY 3Alliyah NicolasNo ratings yet

- Problem Set 3Document1 pageProblem Set 3JLNo ratings yet

- Econ AS1Document1 pageEcon AS1charmaine fosNo ratings yet

- BT Chap 5Document4 pagesBT Chap 5Hang NguyenNo ratings yet

- PV Examples S10Document6 pagesPV Examples S10Paul Christian Lopez FiedacanNo ratings yet

- Tutorial TVMDocument5 pagesTutorial TVMMi ThưNo ratings yet

- 2017 Seminar2Document1 page2017 Seminar2LizzyNo ratings yet

- Simple Interest ProblemsDocument1 pageSimple Interest ProblemsLiNo ratings yet

- Time Value of MoneyDocument9 pagesTime Value of Moneyelarabel abellareNo ratings yet

- TUTORIAL TVM Feb17Document5 pagesTUTORIAL TVM Feb17Thu Uyên Trần ThiNo ratings yet

- All Eco Problems OTDocument3 pagesAll Eco Problems OTdave0% (1)

- Seatwork Activity: Engineering EconomyDocument12 pagesSeatwork Activity: Engineering EconomyMark Ian HernandezNo ratings yet

- Seatwork Activity: Engineering EconomyDocument12 pagesSeatwork Activity: Engineering EconomyMark Ian HernandezNo ratings yet

- EconomicsDocument6 pagesEconomicsJamia Nathalie CatimbangNo ratings yet

- Chapter 4 - Time Value of MoneyDocument4 pagesChapter 4 - Time Value of MoneyTruc Khanh Pham NgocNo ratings yet

- Quarter 2 Simply AnnuityDocument36 pagesQuarter 2 Simply Annuitycatherine saldeviaNo ratings yet

- BF 3220 CH 5 Recitation ReviewDocument1 pageBF 3220 CH 5 Recitation ReviewDuke BallardNo ratings yet

- Money Time LowDocument41 pagesMoney Time LowChristian Sunga0% (2)

- Engecon ReviewerDocument2 pagesEngecon Reviewerdaday el machoNo ratings yet

- Simulated Exam - Questions - General MathematicsDocument2 pagesSimulated Exam - Questions - General MathematicsWesly Paul Salazar CortezNo ratings yet

- Sec - C - TVM 2019 - PW, FW, AW, GR, Nom-EffDocument4 pagesSec - C - TVM 2019 - PW, FW, AW, GR, Nom-EffNaveen KumarNo ratings yet

- Simple and Compound InterestDocument1 pageSimple and Compound InterestJennifer MagangoNo ratings yet

- Compound InterestDocument3 pagesCompound InterestmirkazimNo ratings yet

- MODULE 4 - Consumer MathDocument10 pagesMODULE 4 - Consumer MathALMIRA LOUISE PALOMARIANo ratings yet

- Busana1 Pe 1 PDFDocument2 pagesBusana1 Pe 1 PDFWu YueyangNo ratings yet

- Activity 1 ManEDocument1 pageActivity 1 ManECherri Amistoso cheNo ratings yet

- Seatwork Busana1Document1 pageSeatwork Busana1Julian VitugNo ratings yet

- Becoming a Millionaire Using Your Employee Salary: The Formula to Wealth.From EverandBecoming a Millionaire Using Your Employee Salary: The Formula to Wealth.No ratings yet

- Real Estate Investing Strategies: The Secret to Financial Independence with Real Estate: Real Estate Investing, #1From EverandReal Estate Investing Strategies: The Secret to Financial Independence with Real Estate: Real Estate Investing, #1No ratings yet

- Reserve Bank of IndiaDocument14 pagesReserve Bank of Indiaswati_rathourNo ratings yet

- HND 2 Accounting For Banking SyllabusDocument4 pagesHND 2 Accounting For Banking Syllabusserge folegweNo ratings yet

- 2016 Indian Banknote DemonetisationDocument19 pages2016 Indian Banknote DemonetisationAnshuman Tiwari Saryuparin100% (1)

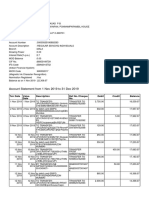

- Account Statement From 1 Jan 2019 To 18 Apr 2019: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument8 pagesAccount Statement From 1 Jan 2019 To 18 Apr 2019: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceManoj PrabhakarNo ratings yet

- Cash DepartmentDocument3 pagesCash DepartmentKiran ReddyNo ratings yet

- English File Intermediate 15 17Document3 pagesEnglish File Intermediate 15 17Sandra Navarro100% (1)

- Chapter 2 - Multiple Compounding PeriodsDocument7 pagesChapter 2 - Multiple Compounding PeriodsSatyendraKumarNo ratings yet

- Post PurchaseDocument25 pagesPost PurchaseArpit PandeyNo ratings yet

- T-Bills: Abhishek Sinha (CSM 1001) Anand Sachdeva (CSM 1002) Pramod Singh (CSM 1013) Saurabh Shukla (CSM 1019)Document14 pagesT-Bills: Abhishek Sinha (CSM 1001) Anand Sachdeva (CSM 1002) Pramod Singh (CSM 1013) Saurabh Shukla (CSM 1019)anandsachsNo ratings yet

- Account Statement From 1 Nov 2019 To 31 Dec 2019: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument3 pagesAccount Statement From 1 Nov 2019 To 31 Dec 2019: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceSyamprasad P BNo ratings yet

- Account Statement 08-04-2023T14 30 46Document2 pagesAccount Statement 08-04-2023T14 30 46Haanain AliNo ratings yet

- Time Value of MoneyDocument7 pagesTime Value of MoneyNida KhanNo ratings yet

- Notice: Now You Can Pay Your Bill Online. For Online Payment Please Visit HTTPS://GMDWSB - Assam.gov - in orDocument1 pageNotice: Now You Can Pay Your Bill Online. For Online Payment Please Visit HTTPS://GMDWSB - Assam.gov - in orGaryNo ratings yet

- Invoice: Thank You For Your BusinessDocument1 pageInvoice: Thank You For Your BusinessAakash ThakurNo ratings yet

- Financial Management AssignmentDocument4 pagesFinancial Management AssignmentTwaha R. KabandikaNo ratings yet

- Lenovo Cashback Offer T&CsDocument3 pagesLenovo Cashback Offer T&CsSarthak KakkarNo ratings yet

- Installments in Compound InterestDocument12 pagesInstallments in Compound InterestRitwikNo ratings yet

- Session 2 - Unit and Branch BankingDocument20 pagesSession 2 - Unit and Branch BankingMohamed AhmedNo ratings yet

- Receivable & Payable Management PDFDocument7 pagesReceivable & Payable Management PDFa0mittal7No ratings yet

- This Is A System-Generated Statement. Hence, It Does Not Require Any SignatureDocument9 pagesThis Is A System-Generated Statement. Hence, It Does Not Require Any SignatureLalayadav LalayadavNo ratings yet

- Cash Cash Equivalents Reviewer2Document9 pagesCash Cash Equivalents Reviewer2anor.aquino.upNo ratings yet

- Entrepreneurship Chapter 11 - Sources of CapitalDocument3 pagesEntrepreneurship Chapter 11 - Sources of CapitalSoledad Perez100% (6)

- Statement of Account: L036G SBI Contra Fund - Regular Plan - Growth NAV As On 28/09/2021: 194.6193Document4 pagesStatement of Account: L036G SBI Contra Fund - Regular Plan - Growth NAV As On 28/09/2021: 194.6193Soumya Ranjan Mohanty PupunNo ratings yet

- MTDC BookingDocument1 pageMTDC BookingnrmstarNo ratings yet

- Schedule of Charges PDFDocument3 pagesSchedule of Charges PDFSrinivas MadyalaNo ratings yet

- The Bangko Sentral NG Pilipinas (BSP)Document21 pagesThe Bangko Sentral NG Pilipinas (BSP)nicole martin100% (1)

- Account Statement PDFDocument12 pagesAccount Statement PDFShalini SinghNo ratings yet