Professional Documents

Culture Documents

2 Money Market Instruments

Uploaded by

Muhammad Asad AliCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2 Money Market Instruments

Uploaded by

Muhammad Asad AliCopyright:

Available Formats

Money Market Instruments

1. What would be your annualized discount rate % and your annualized investment rate % on the

purchase of a 182-day Treasury bill for $4,925 that pays $5,000 at maturity?

2. What is the annualized discount rate % and your annualized investment rate % on a Treasury bill that

you purchase for $9,940 that will mature in 91 days for $10,000?

3. If you want to earn an annualized discount rate of 3.5%, what is the most you can pay for a 91-day

Treasury bill that pays $5,000 at maturity?

4. What is the annualized discount and investment rate % on a Treasury bill that you purchase for $9,900

that will mature in 91 days for $10,000?

5. The price of 182-day commercial paper is $7,840. If the annualized investment rate is 4.093%, what

will the paper pay at maturity?

6. How much would you pay for a Treasury bill that matures in 182 days and pays $10,000 if you require

a 1.8% discount rate?

7. The price of $8,000 face value commercial paper is $7,930. If the annualized discount rate is 4%, when

will the paper mature? If the annualized investment rate % is 4%, when will the paper mature?

8. How much would you pay for a Treasury bill that matures in one year and pays $10,000 if you require

a 3% discount rate?

9. The annualized discount rate on a particular money market instrument, is 3.75%. The face value is

$200,000, and it matures in 51 days. What is its price? What would be the price if it had 71 days to

maturity?

10. The annualized yield is 3% for 91-day commercial paper, and 3.5% for 182-day commercial paper.

What is the expected 91-day commercial paper rate 91 days from now?

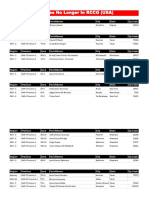

11. In a Treasury auction of $2.1 billion par value 91-day T-bills, the following bids were submitted:

Bidder Bid Amount Price

1 $500 million

$0.9940

2 $750 million

$0.9901

3 $1.5 billion

$0.9925

4 $1 billion

$0.9936

5 $600 million

$0.9939

If only these competitive bids are received, who will receive T-bills, in what quantity, and at what

price?

12. If the Treasury also received $750 million in non- competitive bids, who will receive T-bills, in what

quantity, and at what price? (Refer to the table under problem 11.)

You might also like

- Quiz 1-S2024Document1 pageQuiz 1-S2024Ngan Nguyen Ho KimNo ratings yet

- What are Stocks? Understanding the Stock Market - Finance Book for Kids | Children's Money & Saving ReferenceFrom EverandWhat are Stocks? Understanding the Stock Market - Finance Book for Kids | Children's Money & Saving ReferenceNo ratings yet

- Chapter 3 ExercisesDocument2 pagesChapter 3 ExercisesHình VậnNo ratings yet

- What Characteristics Define The Money Markets?Document8 pagesWhat Characteristics Define The Money Markets?habiba ahmedNo ratings yet

- Chapter 11 Summary and Questions PDFDocument2 pagesChapter 11 Summary and Questions PDFTedi Saleh100% (1)

- On The Purchase of 91-Day T-Bill, If The Face Value Is $3,000 and Purchase Price Is $2,900. (1QP)Document8 pagesOn The Purchase of 91-Day T-Bill, If The Face Value Is $3,000 and Purchase Price Is $2,900. (1QP)I IvaNo ratings yet

- Im 09Document7 pagesIm 09Ad QasimNo ratings yet

- Homework Assignment - Week 2Document5 pagesHomework Assignment - Week 2Kristine LaraNo ratings yet

- ExercisesDocument12 pagesExercisesTôn AnhNo ratings yet

- Chapter #9 "Money Markets": WORDS: 1212 - Date: 9th May 2021Document7 pagesChapter #9 "Money Markets": WORDS: 1212 - Date: 9th May 2021MųhåmmāđÄbęêřNo ratings yet

- Money Mrkts 2ndDocument3 pagesMoney Mrkts 2ndygolcuNo ratings yet

- L180030 - BBA Section B - Maham Fatima MirDocument7 pagesL180030 - BBA Section B - Maham Fatima MirMųhåmmāđÄbęêřNo ratings yet

- US Treasury and Repo Markt ExerciseDocument3 pagesUS Treasury and Repo Markt Exercisechuloh0% (1)

- Midterm-Exam IBS304 - World Financial MarketsDocument4 pagesMidterm-Exam IBS304 - World Financial MarketsThùy TrangNo ratings yet

- Money Market: Chapter 6 - GROUP 1 - PresentationDocument65 pagesMoney Market: Chapter 6 - GROUP 1 - PresentationThanh XuânNo ratings yet

- Asset Classes and Financial Instruments: Bodie, Kane and Marcus 9 Global EditionDocument48 pagesAsset Classes and Financial Instruments: Bodie, Kane and Marcus 9 Global EditionDyan Palupi WidowatiNo ratings yet

- Problem Set 1Document5 pagesProblem Set 1Kibet GibsonNo ratings yet

- The Money Markets: Quantitative ProblemsDocument4 pagesThe Money Markets: Quantitative ProblemsMai AnhNo ratings yet

- PSINDocument46 pagesPSINTaeyeon KimNo ratings yet

- Seminar Questions Set III CDocument3 pagesSeminar Questions Set III Cfanuel kijojiNo ratings yet

- Financial Markets Institutions and Money 3Rd Edition Kidwell Solutions Manual Full Chapter PDFDocument27 pagesFinancial Markets Institutions and Money 3Rd Edition Kidwell Solutions Manual Full Chapter PDFalicebellamyq3yj100% (12)

- Problem Set 4Document7 pagesProblem Set 4WristWork Entertainment100% (1)

- (FINA1303) (2012) (F) Quiz Dcyu6 41571Document3 pages(FINA1303) (2012) (F) Quiz Dcyu6 41571PortNo ratings yet

- A Private Investor's Guide To GiltsDocument36 pagesA Private Investor's Guide To GiltsFuzzy_Wood_PersonNo ratings yet

- 509 Chapter 05 SummaryDocument12 pages509 Chapter 05 Summarygenevieve_gnzlsNo ratings yet

- Chapter 8 SolutionsDocument9 pagesChapter 8 SolutionsEdmond ZNo ratings yet

- MarketshomeworkDocument2 pagesMarketshomeworkMae BawaganNo ratings yet

- Mid Term TestDocument4 pagesMid Term TestHarryNo ratings yet

- Interest Rates and Interest Rate DeterminationDocument46 pagesInterest Rates and Interest Rate DeterminationiluvoracleNo ratings yet

- Chapter Six: Bond MarketsDocument39 pagesChapter Six: Bond MarketsYash PiyushNo ratings yet

- 10 Golden Rules To Become RichDocument39 pages10 Golden Rules To Become RichAlmas K ShuvoNo ratings yet

- 1 What Is A Difference Between A Forward Contract and A Future ContractDocument6 pages1 What Is A Difference Between A Forward Contract and A Future ContractAlok SinghNo ratings yet

- AC 509. Business Finance True/False QuestionsDocument4 pagesAC 509. Business Finance True/False Questionstrevorsum123No ratings yet

- FNCE90047 - 2019 - S1 - W10 - Workshop - Question With Solution PDFDocument3 pagesFNCE90047 - 2019 - S1 - W10 - Workshop - Question With Solution PDFMia RenNo ratings yet

- Ebook GuideDocument30 pagesEbook GuideAthenogenes GastadorNo ratings yet

- My Notes (Eurodollar Master Notes From The Eurodollar Futures Book, by BurghardtDocument59 pagesMy Notes (Eurodollar Master Notes From The Eurodollar Futures Book, by Burghardtlaozi222No ratings yet

- Topic 6Document82 pagesTopic 6Narcisse ChanNo ratings yet

- Bond Features: TI Interest Rates and Bond ValuationDocument19 pagesBond Features: TI Interest Rates and Bond ValuationSissyboiNo ratings yet

- V1 - 20140410 FRM-2 - Questions PDFDocument30 pagesV1 - 20140410 FRM-2 - Questions PDFIon VasileNo ratings yet

- Corporate Finance 5E 2020-356-394Document39 pagesCorporate Finance 5E 2020-356-394Emanuele GennarelliNo ratings yet

- International Financial Management Finance 725 Phil Davies Answers To Recommended Questions and Problems QuestionsDocument18 pagesInternational Financial Management Finance 725 Phil Davies Answers To Recommended Questions and Problems QuestionsJalisa Massiah0% (1)

- Group 2 - IFI Week 6 AssignmentDocument4 pagesGroup 2 - IFI Week 6 AssignmentFadiah AliNo ratings yet

- CHAPTER 2 Mechanics of Futures MarketsDocument3 pagesCHAPTER 2 Mechanics of Futures MarketsAishwarya RajeshNo ratings yet

- FINS 3616 Tutorial Questions-Week 4Document6 pagesFINS 3616 Tutorial Questions-Week 4Alex WuNo ratings yet

- Chapter 1Document33 pagesChapter 1m.vakili.aNo ratings yet

- Definition of Money MarketsDocument21 pagesDefinition of Money Marketsnelle de leonNo ratings yet

- Amaranth Advisors: Burning Six Billion in Thirty DaysDocument24 pagesAmaranth Advisors: Burning Six Billion in Thirty DaysRosalina MaharanaNo ratings yet

- CH 8Document9 pagesCH 8realsimplemusicNo ratings yet

- BKM - Questions Week 1 in The Event of A Firm's BankruptcyDocument11 pagesBKM - Questions Week 1 in The Event of A Firm's BankruptcyElena WangNo ratings yet

- Practice Question of International ArbitrageDocument3 pagesPractice Question of International ArbitrageUSAMA KHALID UnknownNo ratings yet

- Debt MarketDocument25 pagesDebt MarketSuraj DasNo ratings yet

- BUU22550 Tutorial 1 Intro and TVMDocument2 pagesBUU22550 Tutorial 1 Intro and TVMmihsovyaNo ratings yet

- Risk Management Solution Chapters Seven-EightDocument9 pagesRisk Management Solution Chapters Seven-EightBombitaNo ratings yet

- Bodie Essentials of Investments 12e Chapter 02 PPT AccessibleDocument41 pagesBodie Essentials of Investments 12e Chapter 02 PPT AccessibleEdna DelantarNo ratings yet

- Chapter 4. Financial MarketsDocument41 pagesChapter 4. Financial MarketsNguyễn Lê KhánhNo ratings yet

- Solution Manual For Financial Markets and Institutions 7th Edition by MishkinDocument10 pagesSolution Manual For Financial Markets and Institutions 7th Edition by MishkinKennethOrrmsqiNo ratings yet

- Government Securities in India: Role in Risk Mitigation & TreasuryDocument54 pagesGovernment Securities in India: Role in Risk Mitigation & TreasurySaurab JainNo ratings yet

- Chapter 38Document31 pagesChapter 38kesianaNo ratings yet

- Entrenamiento 3412HTDocument1,092 pagesEntrenamiento 3412HTWuagner Montoya100% (5)

- 23 East 4Th Street NEW YORK, NY 10003 Orchard Enterprises Ny, IncDocument2 pages23 East 4Th Street NEW YORK, NY 10003 Orchard Enterprises Ny, IncPamelaNo ratings yet

- Sample Financial PlanDocument38 pagesSample Financial PlanPatrick IlaoNo ratings yet

- Ulangan Harian Lesson 4 Kls 6Document3 pagesUlangan Harian Lesson 4 Kls 6Megadevegaalgifari Minozholic Full100% (2)

- MPU Self Reflection Peer ReviewDocument3 pagesMPU Self Reflection Peer ReviewysaNo ratings yet

- Field Assignment On Feacal Sludge ManagementDocument10 pagesField Assignment On Feacal Sludge ManagementSarah NamyaloNo ratings yet

- Thomas Noochan Pokemon Review Final DraftDocument6 pagesThomas Noochan Pokemon Review Final Draftapi-608717016No ratings yet

- Gamboa Vs Chan 2012 Case DigestDocument2 pagesGamboa Vs Chan 2012 Case DigestKrissa Jennesca Tullo100% (2)

- Churches That Have Left RCCG 0722 PDFDocument2 pagesChurches That Have Left RCCG 0722 PDFKadiri JohnNo ratings yet

- 1634313583!Document24 pages1634313583!Joseph Sanchez TalusigNo ratings yet

- Psychology and Your Life With Power Learning 3Rd Edition Feldman Test Bank Full Chapter PDFDocument56 pagesPsychology and Your Life With Power Learning 3Rd Edition Feldman Test Bank Full Chapter PDFdiemdac39kgkw100% (9)

- Genomics - FAODocument184 pagesGenomics - FAODennis AdjeiNo ratings yet

- 2019 09 20 New Balance Harvard Business CaseDocument7 pages2019 09 20 New Balance Harvard Business CaseFrans AdamNo ratings yet

- Curriculum Vitae: Personal InformationDocument3 pagesCurriculum Vitae: Personal InformationMira ChenNo ratings yet

- 2024 01 31 StatementDocument4 pages2024 01 31 StatementAlex NeziNo ratings yet

- W 26728Document42 pagesW 26728Sebastián MoraNo ratings yet

- Proposed) Declaration of Factual Innocence Under Penal Code Section 851.8 and OrderDocument4 pagesProposed) Declaration of Factual Innocence Under Penal Code Section 851.8 and OrderBobby Dearfield100% (1)

- DLP No. 10 - Literary and Academic WritingDocument2 pagesDLP No. 10 - Literary and Academic WritingPam Lordan83% (12)

- Samsung LE26A457Document64 pagesSamsung LE26A457logik.huNo ratings yet

- 360-Degree FeedbackDocument24 pages360-Degree Feedbackanhquanpc100% (1)

- Government College of Engineering Jalgaon (M.S) : Examination Form (Approved)Document2 pagesGovernment College of Engineering Jalgaon (M.S) : Examination Form (Approved)Sachin Yadorao BisenNo ratings yet

- DHBVNDocument13 pagesDHBVNnitishNo ratings yet

- Magnetism 1Document4 pagesMagnetism 1krichenkyandex.ruNo ratings yet

- Atelierul Digital Pentru Programatori: Java (30 H)Document5 pagesAtelierul Digital Pentru Programatori: Java (30 H)Cristian DiblaruNo ratings yet

- Wwe SVR 2006 07 08 09 10 11 IdsDocument10 pagesWwe SVR 2006 07 08 09 10 11 IdsAXELL ENRIQUE CLAUDIO MENDIETANo ratings yet

- EMI - Module 1 Downloadable Packet - Fall 2021Document34 pagesEMI - Module 1 Downloadable Packet - Fall 2021Eucarlos MartinsNo ratings yet

- Name: Kartikeya Thadani Reg No.: 19bma0029Document4 pagesName: Kartikeya Thadani Reg No.: 19bma0029Kartikeya ThadaniNo ratings yet

- Steel and Timber Design: Arch 415Document35 pagesSteel and Timber Design: Arch 415Glennson BalacanaoNo ratings yet

- Scientific Errors in The QuranDocument32 pagesScientific Errors in The QuranjibranqqNo ratings yet

- Polymeric Nanoparticles - Recent Development in Synthesis and Application-2016Document19 pagesPolymeric Nanoparticles - Recent Development in Synthesis and Application-2016alex robayoNo ratings yet