Professional Documents

Culture Documents

RPR 113320243336

Uploaded by

NKSOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

RPR 113320243336

Uploaded by

NKSCopyright:

Available Formats

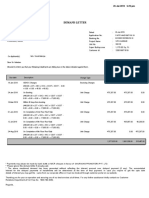

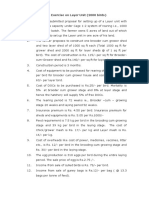

Tax Invoice

Mr Nayan kumar Satapathy

FLAT NO F M/15

NETAJI SUBHASH ENCLAVE

NEAR CENTRAL SCHOOL

Bhubaneswar 751017

Orissa

Contact no: 9432011733,9163405389

Your renewal premium receipt for Future Generali Assured Income Plan, policy Date : 10/03/2023

no.01499189

Receipt No.: 16738019 Policy Status: In Force

Dear Mr Nayan kumar Satapathy ,

Thank you for choosing Future Generali as your preferred life insurer. As a valued member of the Future Generali customer family, your continued

patronage is important to us.

Please find below the details of premiums which we have received.

Policy no. Plan name Date of Sum Assured Modal Premium Next Premium

commencement due date

01499189 Future Generali Assured 25th February 2019 6,200,000.00 200,000.00 25/02/2024

Income Plan

Particulars of Premium Received Premium ₹.

Premium Received 204,500.00

Goods and Services Tax 4,500.00

Total Amount Adjusted 204,500.00

Balance amount in excess (if any) 0.00

Taxable Value 25,000.00

CGST @9% 2,250.00

SGST/ UTGST @9% 2,250.00

IGST @18% 0.00

Following is the details of your FGLI branch :

State Name Orissa

State Code 21

FGLIC GSTIN 21AABCF0190Q1ZO

FG Address (Principal place of the business in the state) 1ST FLOOR, KALINGA COMPLEX, PLOT NO-B, UNIT I, RAJPATH

BHUBANESWAR-751009

Note:

· In case you have chosen ECS as premium payment mode, then you have the facility to withdraw ECS option within a period of 15 days prior to due date at no

charge

· The TDS u/s 194DA of Income Tax Act, 1961 is applicable if any amount paid/withdrawn under the policy, if the policy at time of payment falls within the

purview of section 194DA. Hence please visit the nearest branch to update your PAN details, to avoid higher rate of tax i.e. 20% u/s 206AA. If you wish to avail

benefit u/s 197A(1) , 197A(1A) & 197A(1C) of Income Tax Act, 1961 then please submit Form 15G & Form 15H

· Cheque/Autopay payments are subject to realisation and amount received in Company's account

· Premium payment(s) exclusive of Goods and Services Tax to Future Generali India Life Insurance Company Limited are eligible for tax benefit(s) u/s

80C/80CCC(1)/80D as applicable subject to satisfaction of the conditions specified under Income Tax Act, 1961

· Stamp Duty of Rs. 1/- is paid as provided under Article 53(A) of Indian Stamp Act, 1899 and included in Consolidated Stamp Duty Paid to the Government of

Maharashtra Treasury vide Order of Addl. Controller Of Stamps, Mumbai at General Stamp Office, Fort, Mumbai - 400001., vide this Order

No.(LOA/CSD/583/2023/Validity Period Dt.26/01/2023 To Dt.31/12/2025/337123 Date : 24/01/2023) applicable only if the receipt amount is equal to or greater

than Rs 5000

· The rate of the Goods and Services Tax is charged as per prevailing rate. Tax laws are subject to amendments from time to time.

· HSN/SAC- 997132 Life Insurance Services (excluding Reinsurance Services)

"We hereby declare that though our aggregate turnover in any preceding financial year from 2017-18 onwards is more than the aggregate turnover notified under

sub-rule (4) of rule 48 of the Central Goods and Services Tax Rules, 2017, we are not required to prepare an invoice in terms of the provisions of the said

sub-rule.”

You might also like

- PPCFinacial Year 2022Document2 pagesPPCFinacial Year 2022Subroto JenaNo ratings yet

- Ulipstatement 2Document2 pagesUlipstatement 2Shashwat DuggalNo ratings yet

- Date: February 19.2021: Premium Paid Certificate For The Financial Year 2020 - 2021Document2 pagesDate: February 19.2021: Premium Paid Certificate For The Financial Year 2020 - 2021Nihar Ranjan NikuNo ratings yet

- Duplicate Receipt Dear Sandip KamaniDocument2 pagesDuplicate Receipt Dear Sandip KamaniSandip PatelNo ratings yet

- Welcome Kit Term Plan-PS - PDF2Document34 pagesWelcome Kit Term Plan-PS - PDF2Abhishek Sengupta0% (1)

- ULIPRPR XXXXXXX8009 19022021 4680 UnlockedDocument1 pageULIPRPR XXXXXXX8009 19022021 4680 Unlockedmanish sharmaNo ratings yet

- 0088470515-Premium Deposit Acknowledgement PDFDocument1 page0088470515-Premium Deposit Acknowledgement PDFjayanandaNo ratings yet

- KTM rc200 Insurance - MA877865 - E - 1Document2 pagesKTM rc200 Insurance - MA877865 - E - 1smartguyxNo ratings yet

- Welcome Kit Term Plan-PS - PDFDocument35 pagesWelcome Kit Term Plan-PS - PDFAbhishek SenguptaNo ratings yet

- Medical Insurance Mother - Cleaned.cleanedDocument1 pageMedical Insurance Mother - Cleaned.cleanedAdil KhanNo ratings yet

- Zprmrnot 22891511 4720686 PDFDocument1 pageZprmrnot 22891511 4720686 PDFVishwambhara DasaNo ratings yet

- Zprmrnot 23614257 14778150Document1 pageZprmrnot 23614257 14778150c97rvkkyfrNo ratings yet

- Mamta RaniDocument2 pagesMamta RaniAjay AroraNo ratings yet

- Date: March 28.2022: Premium Paid Certificate For The Financial Year 2021 - 2022Document2 pagesDate: March 28.2022: Premium Paid Certificate For The Financial Year 2021 - 2022sandeep kumarNo ratings yet

- Life Insurance Premium Certificate: (Financial Year 2018-2019)Document1 pageLife Insurance Premium Certificate: (Financial Year 2018-2019)Sugar SugarNo ratings yet

- RelianceDocument2 pagesRelianceSachin PatilNo ratings yet

- Receipt OT037733302Document2 pagesReceipt OT037733302Gaurang MandalNo ratings yet

- Receipt OT012279515Document1 pageReceipt OT012279515amit kumarNo ratings yet

- Zprmrnot - 22303149 - 12926353 2Document1 pageZprmrnot - 22303149 - 12926353 2RKGUPTANo ratings yet

- ULIPRPR XXXXXXX8009 19022021 4680 UnlockedDocument1 pageULIPRPR XXXXXXX8009 19022021 4680 Unlockedmanish sharmaNo ratings yet

- Ulip StatementDocument2 pagesUlip StatementShashwat DuggalNo ratings yet

- Zprmrnot 21163309 8704721Document1 pageZprmrnot 21163309 8704721Arnav MishraNo ratings yet

- Consolidated Premium Paid STMT 2019-2020Document1 pageConsolidated Premium Paid STMT 2019-2020CHELLASWAMY RAMASWAMYNo ratings yet

- Renewal NoticeDocument1 pageRenewal NoticevishalmprojectNo ratings yet

- DGA Global - Union Budget Analysis - Income TaxDocument16 pagesDGA Global - Union Budget Analysis - Income TaxshwetaNo ratings yet

- 80C Relience InsuranceDocument1 page80C Relience Insuranceshailesh.kumarNo ratings yet

- Zprmrnot 20927762 24235025 231002 181434Document2 pagesZprmrnot 20927762 24235025 231002 181434aanandaman1098No ratings yet

- ABDocument1 pageABRohit SinghNo ratings yet

- Zprmrnot 23345535 17208239Document1 pageZprmrnot 23345535 17208239bharat4u04No ratings yet

- INSURBANCEDocument2 pagesINSURBANCE11rj.thakurNo ratings yet

- Input Tax CreditDocument21 pagesInput Tax CreditSUNIL PUJARINo ratings yet

- Premium Receipt: Personal DetailsDocument1 pagePremium Receipt: Personal Detailschethanchethanmn8No ratings yet

- Life Insurance Premium Receipt: Personal DetailsDocument1 pageLife Insurance Premium Receipt: Personal DetailsRanjith BNo ratings yet

- ABSLI 008108666 Renewal 16JAN2024 200000.00Document1 pageABSLI 008108666 Renewal 16JAN2024 200000.00jyotsanaNo ratings yet

- Aegon BillDocument1 pageAegon BillKSPNo ratings yet

- Cir 174 06 2022 CGSTDocument5 pagesCir 174 06 2022 CGSTNM JHANWAR & ASSOCIATESNo ratings yet

- Zprmrnot 23764103 16031216Document1 pageZprmrnot 23764103 16031216Kiran KumarNo ratings yet

- Zprmrnot - 22253699 - 17202314 2Document1 pageZprmrnot - 22253699 - 17202314 2Inder Raj GuptaNo ratings yet

- Dear Prakash Chandra Sharma,: Policy DetailsDocument5 pagesDear Prakash Chandra Sharma,: Policy DetailsShivam SharmaNo ratings yet

- G.R. No. 205955 University Physicians Services Inc.-Management, Inc PetitionerDocument12 pagesG.R. No. 205955 University Physicians Services Inc.-Management, Inc PetitionerKennethAnthonyMagdamitNo ratings yet

- Life Insurance Premium Receipt: Personal DetailsDocument1 pageLife Insurance Premium Receipt: Personal DetailsHarsh Gandhi0% (1)

- Your Renewal Premium Receipt (Provisional) : Receipt Number: OT007932427 Date: 02-03-2019Document2 pagesYour Renewal Premium Receipt (Provisional) : Receipt Number: OT007932427 Date: 02-03-2019Ritik Goyal100% (1)

- Ghulam Mohi U Din Tax CeDocument1 pageGhulam Mohi U Din Tax Cesinghgurmanan7No ratings yet

- RenewalReceipt 502-7066983 PolicyRenewalDocument2 pagesRenewalReceipt 502-7066983 PolicyRenewalSoumitra GuptaNo ratings yet

- 20875366Document1 page20875366tahamasoodiNo ratings yet

- Adobe Scan Nov 27, 2023-CompressedDocument7 pagesAdobe Scan Nov 27, 2023-Compressedswainsachidananda1950No ratings yet

- Endorsement For Policy Number: 5117904118 Vehicle Number: Fbb2261RDocument5 pagesEndorsement For Policy Number: 5117904118 Vehicle Number: Fbb2261RMohd IsaNo ratings yet

- Kishore Gym Snap FitnessDocument1 pageKishore Gym Snap Fitnesssathish ananthaneniNo ratings yet

- RPN 2H765220702 1294 PDFDocument1 pageRPN 2H765220702 1294 PDFManohar ByrisettiNo ratings yet

- eRRS 01962015 22092022162212 1Document2 pageseRRS 01962015 22092022162212 1Prakash GadadNo ratings yet

- Annual Premium Statement: Naresh KumarDocument1 pageAnnual Premium Statement: Naresh Kumarnaresh29122No ratings yet

- Demand LetterDocument2 pagesDemand LetterHimanshu RantiyaNo ratings yet

- Receipt OT010072550Document2 pagesReceipt OT010072550thetrilight2023No ratings yet

- Premium Certificate Financial Year 2019-2020 To Whomsoever It May ConcernDocument3 pagesPremium Certificate Financial Year 2019-2020 To Whomsoever It May ConcernVineet PahwaNo ratings yet

- DeliveryOrder 20220914171635Document1 pageDeliveryOrder 20220914171635sukhpreet singhNo ratings yet

- InsuranceDocument1 pageInsurancezabiulla mNo ratings yet

- MCLMDocument13 pagesMCLMcibil scoreNo ratings yet

- Car Insurance 2018Document7 pagesCar Insurance 2018Madhuchhanda BasuNo ratings yet

- 21 21 0593825 01 PDFDocument2 pages21 21 0593825 01 PDFtamil2oooNo ratings yet

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- MGMTDocument19 pagesMGMTMakrant MohanNo ratings yet

- ReferensiDocument4 pagesReferensiyusri polimengoNo ratings yet

- BRS PDFDocument14 pagesBRS PDFGautam KhanwaniNo ratings yet

- Starbucks Reconciliation Template & Instructions v20231 - tcm137-84960Document3 pagesStarbucks Reconciliation Template & Instructions v20231 - tcm137-84960spaljeni1411No ratings yet

- Region Iii - Central Luzon Padapada National High SchoolDocument2 pagesRegion Iii - Central Luzon Padapada National High SchoolRotipNo ratings yet

- Plasma Arc Machining (Pam) : Mechanical Engineering Department I.I.T Guwahati-781039 E-Mail: Manasdas@iitg - Ernet.inDocument15 pagesPlasma Arc Machining (Pam) : Mechanical Engineering Department I.I.T Guwahati-781039 E-Mail: Manasdas@iitg - Ernet.inSrinivasanNo ratings yet

- Case Exercise On Layer Unit (2000 Birds)Document2 pagesCase Exercise On Layer Unit (2000 Birds)Priya KalraNo ratings yet

- J. Bleger ArtDocument10 pagesJ. Bleger Artivancristina42No ratings yet

- DAMPNESSDocument21 pagesDAMPNESSChukwu SolomonNo ratings yet

- Celitron ISS 25L - Product Spec Sheet V 2.1 enDocument9 pagesCelitron ISS 25L - Product Spec Sheet V 2.1 enyogadwiprasetyo8_161No ratings yet

- Docu Ifps Users Manual LatestDocument488 pagesDocu Ifps Users Manual LatestLazar IvkovicNo ratings yet

- 2008 03 20 BDocument8 pages2008 03 20 BSouthern Maryland OnlineNo ratings yet

- Vocab PDFDocument29 pagesVocab PDFShahab SaqibNo ratings yet

- Martins Taylorb Os 10742 Final Opinion 2 11 2022 02898337xd2c78Document9 pagesMartins Taylorb Os 10742 Final Opinion 2 11 2022 02898337xd2c78Live 5 NewsNo ratings yet

- DDEV SPICES PVT LTD (Product List)Document1 pageDDEV SPICES PVT LTD (Product List)jaymin zalaNo ratings yet

- 1 A Finalexam FNH330 June 2015 Final Review QuestionsDocument6 pages1 A Finalexam FNH330 June 2015 Final Review QuestionsChinley HinacayNo ratings yet

- 3 14 Revision Guide Organic SynthesisDocument6 pages3 14 Revision Guide Organic SynthesisCin D NgNo ratings yet

- EBANX Beyond Borders 2020Document71 pagesEBANX Beyond Borders 2020Fernanda MelloNo ratings yet

- W4. Grade 10 Health - Q1 - M4 - v2Document22 pagesW4. Grade 10 Health - Q1 - M4 - v2Jesmael PantalunanNo ratings yet

- Plyometric Training: Sports Med 2Document9 pagesPlyometric Training: Sports Med 2Viren ManiyarNo ratings yet

- Laboratory Medicine Internship BookletDocument95 pagesLaboratory Medicine Internship BookletMuhammad Attique100% (1)

- LYON Conditions of Secondment 3500EUR enDocument4 pagesLYON Conditions of Secondment 3500EUR enabdu1lahNo ratings yet

- Starters Flash CardsDocument28 pagesStarters Flash CardsNara GarridoNo ratings yet

- Prepper MealsDocument22 pagesPrepper MealsmeineanmeldungenNo ratings yet

- Textbook of Dental Anatomy, Physiology and Occlusion, 1E (2014) (PDF) (UnitedVRG)Document382 pagesTextbook of Dental Anatomy, Physiology and Occlusion, 1E (2014) (PDF) (UnitedVRG)Konstantinos Ster90% (20)

- Cariprazine PDFDocument162 pagesCariprazine PDFige zaharaNo ratings yet

- Ancamine Teta UsDocument2 pagesAncamine Teta UssimphiweNo ratings yet

- CLSI Laboratory Documents Development and Control Approved Guideline NAT L COMM CLINICAL LAB STANDARDS 2006 PDFDocument100 pagesCLSI Laboratory Documents Development and Control Approved Guideline NAT L COMM CLINICAL LAB STANDARDS 2006 PDFErvin RodriguezNo ratings yet

- 1.8 SAK Conservations of Biodiversity EX-SITU in SITUDocument7 pages1.8 SAK Conservations of Biodiversity EX-SITU in SITUSandipNo ratings yet

- We Find The Way: Shipping InstructionsDocument10 pagesWe Find The Way: Shipping InstructionsLuke WangNo ratings yet