Professional Documents

Culture Documents

Ucits Kiid Blackrock Ics Euro Government Liquidity Fund Premier Acc t0 Eur GB Ie00b41n0724 en

Uploaded by

ja1220087Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ucits Kiid Blackrock Ics Euro Government Liquidity Fund Premier Acc t0 Eur GB Ie00b41n0724 en

Uploaded by

ja1220087Copyright:

Available Formats

KEY INVESTOR INFORMATION

This document provides you with key investor information about this Fund. It is not marketing material. The

information is required by law to help you understand the nature and risks of investing in this Fund. You are advised

to read it so you can make an informed decision about whether to invest.

Class Premier Accumulating T0 EUR

BlackRock ICS Euro Government Liquidity

ISIN: IE00B41N0724

Fund Manager: BlackRock Asset Management Ireland Limited

A sub-fund of Institutional Cash Series plc

Objectives and Investment Policy

The Fund aims to generate a moderate level of income on your investment consistent with maintaining capital and ensuring that it's underlying assets can easily be

bought or sold in the market (in normal market conditions). Money invested in the Fund is not protected or guaranteed.

The Fund invests in a broad range of government fixed income securities (such as bonds) and money market instruments (MMIs) (i.e. debt securities with short term

maturities) reverse repurchase agreements and in cash.

The Fund is a “Short Term Public Debt Constant Net Asset Value Money Market Fund” as defined by the EU Money Market Funds Regulations. Details of the current

credit ratings (if any) attributed to the Fund are available from www.blackrock.com/cash.

The Fund is actively managed. The investment manager has discretion to select the Fund’s investments and is not constrained by any benchmark in this process. The

Euro Short-Term Rate (ESTR) should be used by investors to compare the performance of the Fund.

At least 99.5% of the Fund’s assets will be securities, instruments or obligations issued or guaranteed by the governments of countries which have adopted the Euro at

the time of purchase and reverse repurchase agreements referencing such assets and in cash. These assets shall always be denominated in Euro.

The Fund will limit its investment to assets which have 397 days or less remaining until the full principal must be repaid. The weighted average maturity (i.e. the

average length of time to the date when the principal of the asset is to be repaid in full (or, in respect of interest rate notes, the average length of time to the next

interest rate reset to a money market rate) of all of the Fund’s assets will be up to 60 days. The weighted average life (i.e. the average length of time to the date when

the principal of the assets is to be repaid in full) of all of the Fund’s assets will be up to 120 days. To calculate these averages, figures are adjusted to reflect the

relative holdings of each of the Fund’s assets.

The Fund may also enter into reverse repurchase agreements on a short term basis. Through these, the Fund agrees to purchase government securities from certain

eligible third parties for cash and that the seller can buy these back at an agreed time and price.

The investments of the Fund are valued using the amortised cost method. The net asset value (NAV) may be rounded for dealing purposes. A comparative NAV is also

calculated using either the mark-to-market (i.e. a valuation based on current market prices) or mark-to-model (i.e. a valuation based on a financial model) methods, to

four decimal places daily.

Recommendation: This Fund may not be suitable for investors who seek long-term capital growth.

Your shares will be accumulating shares (i.e. dividend income will be included in their value).

Your shares will be denominated in Euro, the Fund's base currency.

You can buy and sell your shares daily. The minimum initial investment for this share class is €500,000,000.

For more information on the Fund, share/unit classes, valuation methodology, risks and charges, please see the Fund's prospectus, available on the product pages at

www.blackrock.com.

Risk and Reward Profile

Lower risk Higher risk - Short Term Money Market Funds do not generally experience extreme price

Typically lower rewards Typically higher rewards variations. Changes in interest rates will impact the Fund.

- On any day where the net return (i.e. return less costs and expenses) of the

Fund is negative an Accumulating Share Class of the fund will see a decrease

in the NAV per Share.

This indicator is based on historical data and may not be a reliable indication of Particular risks not adequately captured by the risk indicator include:

the future risk profile of the Fund. - Counterparty Risk: The insolvency of any institutions providing services such

The risk category shown is not guaranteed and may change over time. as safekeeping of assets or acting as counterparty to derivatives or other

The lowest category does not mean risk free. instruments, may expose the Fund to financial loss.

The Fund is rated one due to the nature of its investments which include the - Credit Risk: The issuer of a financial asset held within the Fund may not pay

risks listed below. These factors may impact the value of the Fund’s investments income or repay capital to the Fund when due.

or expose the Fund to losses.

Charges

The charges are used to pay the costs of running the Fund, including the costs of One-off charges taken before or after you invest

marketing and distributing it. These charges reduce the potential growth of your

Entry Charge None

investment.

Exit Charge None

The entry and exit charges shown are maximum figures. In some cases you might

pay less. Please refer to your financial advisor or the distributor for the actual entry This is the maximum that might be taken out of your money before it is invested or

before proceeds of your investments are paid out.

and exit charges.

Charges taken from the Fund over each year

The ongoing charge figure shown here is estimated and based on the expected

annualised charges. This figure may vary from year to year. It excludes portfolio trade Ongoing Charges 0.10%

-related costs and any entry/exit charge paid to an underlying collective investment Charges taken from the Fund under certain conditions

scheme (if any). Performance Fee None

Past Performance

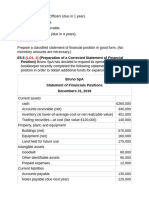

Past performance is not a guide to future Historic performance to 31 December 2023

performance.

The chart shows the Fund's annual performance in

EUR for each full calendar year over the period

displayed in the chart. It is expressed as a

percentage change of the Fund's net asset value at

each year-end. The Fund was launched in 2008. The

share class was launched in 2010.

Performance is shown after deduction of ongoing

charges. Any entry/exit charges are excluded from

the calculation.

†¹Overnight ESTR (EUR)

Prior to 26.11.2021, the Fund used a different 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023

benchmark which is reflected in the benchmark data. Fund 0.0 -0.2 -0.6 -0.7 -0.7 -0.6 -0.7 -0.7 -0.2 3.1

Comparator †¹ 0.1 -0.2 -0.4 -0.5 -0.5 -0.5 -0.6 -0.6 0.0 3.3

During this period performance was achieved under circumstances that no longer apply.

Practical Information

The depositary of the Fund is J.P. Morgan SE – Dublin Branch.

Further information about the Fund can be obtained from the latest annual and half-yearly reports of the Institutional Cash Series plc (ICS). These documents are

available free of charge in English and certain other languages. These can be found, along with other information, such as share prices, on the BlackRock website at

www.blackrock.com/cash or by calling the International Investor Servicing team on + 353 1612 3393.

Investors should note that the tax legislation that applies to the Fund may have an impact on the personal tax position of your investment in the Fund.

The Fund is a sub-fund of ICS, an umbrella structure comprising different sub-funds. This document is specific to the Fund and share class stated at the beginning of

this document. However, the prospectus, annual and half-yearly reports are prepared for the umbrella.

ICS may be held liable solely on the basis of any statement contained in this document that is misleading, inaccurate or inconsistent with the relevant parts of the

Fund's Prospectus.

Under Irish law, ICS has segregated liability between its sub-funds (i.e. the Fund’s assets will not be used to discharge the liabilities of other sub-funds within ICS). In

addition, the Fund’s assets are held separately from the assets of other sub-funds.

Investors may switch their shares in the Fund for shares in another sub-fund within ICS, subject to the restrictions and conditions set out in the Fund’s prospectus.

The Remuneration Policy of the Management Company, which describes how remuneration and benefits are determined and awarded, and the associated governance

arrangements, is available at www.blackrock.com/Remunerationpolicy or on request from the registered office of the Management Company.

This Fund and its manager, BlackRock Asset Management Ireland Limited, are authorised in Ireland and regulated by the Central Bank of Ireland.

This Key Investor Information is accurate as at 09 February 2024

You might also like

- Long Term FinancingDocument5 pagesLong Term Financingjayaditya joshiNo ratings yet

- Quiz - Overview of Government AccountingDocument5 pagesQuiz - Overview of Government AccountingPaula Bautista80% (5)

- The ABCs of MoneyDocument254 pagesThe ABCs of Moneyalice michira100% (1)

- Complete Mcqs For Oblicon Complete Mcqs For ObliconDocument41 pagesComplete Mcqs For Oblicon Complete Mcqs For ObliconMama AnjongNo ratings yet

- Kiid Ishares Dow Jones Global Sustainability Screened Ucits Etf Usd Acc GB Ie00b57x3v84 enDocument2 pagesKiid Ishares Dow Jones Global Sustainability Screened Ucits Etf Usd Acc GB Ie00b57x3v84 enxacaxaNo ratings yet

- Kiid Ishares Core Global Aggregate Bond Ucits Etf Usd Hedged Acc GB Ie00bz043r46 enDocument2 pagesKiid Ishares Core Global Aggregate Bond Ucits Etf Usd Hedged Acc GB Ie00bz043r46 enAl BoscoNo ratings yet

- HLMM US Fund KIID Class A Acc 0922 1Document2 pagesHLMM US Fund KIID Class A Acc 0922 1bhupstaNo ratings yet

- Kiid Ishares Core Msci em Imi Ucits Etf Usd Acc GB Ie00bkm4gz66 enDocument2 pagesKiid Ishares Core Msci em Imi Ucits Etf Usd Acc GB Ie00bkm4gz66 endasadsNo ratings yet

- Kiid Ishares Agribusiness Ucits Etf Usd Acc GB Ie00b6r52143 enDocument2 pagesKiid Ishares Agribusiness Ucits Etf Usd Acc GB Ie00b6r52143 enfraknoNo ratings yet

- Ishares J.P. Morgan $ em Corp Bond Ucits Etf: Objectives and Investment PolicyDocument2 pagesIshares J.P. Morgan $ em Corp Bond Ucits Etf: Objectives and Investment PolicyIulian Claudiu PascalNo ratings yet

- Ishares Core Msci World Ucits Etf: Objectives and Investment PolicyDocument2 pagesIshares Core Msci World Ucits Etf: Objectives and Investment PolicyxacaxaNo ratings yet

- Key Investor Information: Credit Suisse (Lux) Fixed Maturity Bond Fund 2021 S-IIDocument2 pagesKey Investor Information: Credit Suisse (Lux) Fixed Maturity Bond Fund 2021 S-IIanushreerNo ratings yet

- 1up1 - IShares - SandP500Document2 pages1up1 - IShares - SandP500Antonio MaticNo ratings yet

- Wisdomtree Cloud Computing Ucits Etf-Usd Acc: Key Investor InformationDocument2 pagesWisdomtree Cloud Computing Ucits Etf-Usd Acc: Key Investor Informationduc anhNo ratings yet

- Key Investor Information: Vanguard S&P 500 UCITS ETF (The "Fund")Document2 pagesKey Investor Information: Vanguard S&P 500 UCITS ETF (The "Fund")sinwha321No ratings yet

- Non-UCITS Retail Scheme Key Investor Information: Objectives and Investment PolicyDocument2 pagesNon-UCITS Retail Scheme Key Investor Information: Objectives and Investment Policysinwha321No ratings yet

- Eu Priips Blackrock Ics Euro Government Liquidity Fund Premier Acc t0 Eur Ie00b41n0724 enDocument3 pagesEu Priips Blackrock Ics Euro Government Liquidity Fund Premier Acc t0 Eur Ie00b41n0724 enAllanNo ratings yet

- Kiidoc 2020 02 24 en Lu 2020 02 24 Lu1744468221 YcapfundDocument2 pagesKiidoc 2020 02 24 en Lu 2020 02 24 Lu1744468221 Ycapfundmatthieu massieNo ratings yet

- Key Investor Information:, A Sub-Fund of Ssga SPDR Etfs Europe I PLC (A Ucits Compliant Exchange Traded Fund)Document2 pagesKey Investor Information:, A Sub-Fund of Ssga SPDR Etfs Europe I PLC (A Ucits Compliant Exchange Traded Fund)xacaxaNo ratings yet

- SP Ishares Short Maturity Bond Etf 10 31Document16 pagesSP Ishares Short Maturity Bond Etf 10 31adrienneduckett9No ratings yet

- Fsuu - Ebi GBP Cash Margin Fund (Eng)Document2 pagesFsuu - Ebi GBP Cash Margin Fund (Eng)Gangi Reddy UbbaraNo ratings yet

- 2002 - Blackrock - Ishares Msci Usa Momentum Factor Esg Ucits Etf Usd AccDocument2 pages2002 - Blackrock - Ishares Msci Usa Momentum Factor Esg Ucits Etf Usd Accmarc mennellNo ratings yet

- Kiid Emqq IE00BFYN8Y92 en GBDocument2 pagesKiid Emqq IE00BFYN8Y92 en GBMónica CletoNo ratings yet

- Factsheet March2022 1649167929Document5 pagesFactsheet March2022 1649167929BISWAJITNo ratings yet

- Docrep O00000908 00000039 0001 2022 02 18 Ki en 0000Document2 pagesDocrep O00000908 00000039 0001 2022 02 18 Ki en 0000Geeta RawatNo ratings yet

- Ishares Msci World Esg Screened Ucits Etf: Objectives and Investment PolicyDocument2 pagesIshares Msci World Esg Screened Ucits Etf: Objectives and Investment PolicyxacaxaNo ratings yet

- Key Investor Information: Objectives and Investment PolicyDocument2 pagesKey Investor Information: Objectives and Investment PolicyGeorgio RomaniNo ratings yet

- Key Investor Information: Vanguard FTSE Emerging Markets UCITS ETF (The "Fund")Document2 pagesKey Investor Information: Vanguard FTSE Emerging Markets UCITS ETF (The "Fund")sinwha321No ratings yet

- Key Investor Information: Objectives and Investment PolicyDocument2 pagesKey Investor Information: Objectives and Investment Policysinwha321No ratings yet

- Kiidoc 2020 07 20 en CH 2020 07 30 Lu0794389287Document2 pagesKiidoc 2020 07 20 en CH 2020 07 30 Lu0794389287Isabelle ChapuysNo ratings yet

- Vanguard Core Bond Fund Summary Prospectus: January 26, 2018Document8 pagesVanguard Core Bond Fund Summary Prospectus: January 26, 201876132No ratings yet

- Key Investor Information: Vanguard S&P 500 UCITS ETF (The "Fund")Document2 pagesKey Investor Information: Vanguard S&P 500 UCITS ETF (The "Fund")Antonio Rodríguez de la TorreNo ratings yet

- Vanguard California Municipal Money Market Fund Summary ProspectusDocument8 pagesVanguard California Municipal Money Market Fund Summary Prospectus76132No ratings yet

- Ishares Barclays 20+ Year Treasury Bond Fund (TLT) FS 13-10-10Document3 pagesIshares Barclays 20+ Year Treasury Bond Fund (TLT) FS 13-10-10João Silva TavaresNo ratings yet

- The Cohen & Steers Equity Dividend & Income Closed-End Portfolio 2019-3Document2 pagesThe Cohen & Steers Equity Dividend & Income Closed-End Portfolio 2019-3A RNo ratings yet

- Kiidoc 2020 07 20 en CH 2020 07 30 Lu0650751489Document2 pagesKiidoc 2020 07 20 en CH 2020 07 30 Lu0650751489Isabelle ChapuysNo ratings yet

- Kiidoc 2020 07 20 en CH 2020 07 30 Lu0929190568Document2 pagesKiidoc 2020 07 20 en CH 2020 07 30 Lu0929190568Isabelle ChapuysNo ratings yet

- Key Investor Information: JPM Global Research Enhanced Index Equity (ESG) UCITS ETF - USD (Acc)Document2 pagesKey Investor Information: JPM Global Research Enhanced Index Equity (ESG) UCITS ETF - USD (Acc)sinwha321No ratings yet

- Kiid Xact Bull 2 (Etf) 0p0000mh7cDocument2 pagesKiid Xact Bull 2 (Etf) 0p0000mh7cAntonio Rodríguez de la TorreNo ratings yet

- Glosory InvestmentDocument5 pagesGlosory InvestmentGantulga NamdaldagvaNo ratings yet

- Kiidoc 2020 07 20 en CH 2020 07 30 Lu0337271356Document2 pagesKiidoc 2020 07 20 en CH 2020 07 30 Lu0337271356Isabelle ChapuysNo ratings yet

- Lyxor MSCI South Africa UCITS ETF - Acc (The "Fund") : Objectives and Investment PolicyDocument2 pagesLyxor MSCI South Africa UCITS ETF - Acc (The "Fund") : Objectives and Investment PolicysigurddemizarNo ratings yet

- Ie00b5bmr087 - 01 01 2023Document3 pagesIe00b5bmr087 - 01 01 2023Tanasa AlinNo ratings yet

- US Equity Index FundDocument2 pagesUS Equity Index FundRocketNo ratings yet

- Key Investor Information: HL Select Global Growth SharesDocument2 pagesKey Investor Information: HL Select Global Growth SharesMerabharat BharatNo ratings yet

- Factsheet For The 6 Schemes Under Winding Up As On August 31, 2021Document17 pagesFactsheet For The 6 Schemes Under Winding Up As On August 31, 2021Ankur SarafNo ratings yet

- Supplement To The Prospectuses and Summary ProspectusesDocument9 pagesSupplement To The Prospectuses and Summary Prospectuses76132No ratings yet

- ATRAM GLOBAL ALLOCATION FEEDER FUND KIIDS (USD) - Oct 2021Document5 pagesATRAM GLOBAL ALLOCATION FEEDER FUND KIIDS (USD) - Oct 2021Glenda ReyesNo ratings yet

- SP Ishares Core Msci Total International Stock Etf 7 31Document16 pagesSP Ishares Core Msci Total International Stock Etf 7 31colt williamsNo ratings yet

- Stable Value Strategy HSPDocument2 pagesStable Value Strategy HSPLoganBohannonNo ratings yet

- Amundi Funds Pioneer Flexible Opportunities - I Usd A Sub-Fund of The Sicav Amundi FundsDocument2 pagesAmundi Funds Pioneer Flexible Opportunities - I Usd A Sub-Fund of The Sicav Amundi FundsFlamain HugoNo ratings yet

- T Class Shares in Fundsmith Equity Fund: Key Investor InformationDocument2 pagesT Class Shares in Fundsmith Equity Fund: Key Investor InformationJohn SmithNo ratings yet

- Kiidoc 2020 07 22 en CH 2020 07 30 Lu1516025506Document2 pagesKiidoc 2020 07 22 en CH 2020 07 30 Lu1516025506Isabelle ChapuysNo ratings yet

- Key Information and Investment Disclosure Statement: Metro World Equity Feeder FundDocument3 pagesKey Information and Investment Disclosure Statement: Metro World Equity Feeder FundMartin MartelNo ratings yet

- Fundsmith Equity Fund I Class KIID (For Institutional Investors)Document2 pagesFundsmith Equity Fund I Class KIID (For Institutional Investors)John SmithNo ratings yet

- Kiidoc 2020 07 22 en CH 2020 07 30 Lu1516025415Document2 pagesKiidoc 2020 07 22 en CH 2020 07 30 Lu1516025415Isabelle ChapuysNo ratings yet

- Key Investor Information: Objectives and Investment PolicyDocument2 pagesKey Investor Information: Objectives and Investment Policyduc anhNo ratings yet

- Fidelity South-East Asia Fund, A Sub-Fund of Fidelity Investment Funds, A Accumulation Shares (ISIN: GB0003879185)Document2 pagesFidelity South-East Asia Fund, A Sub-Fund of Fidelity Investment Funds, A Accumulation Shares (ISIN: GB0003879185)Nais BNo ratings yet

- The Cohen & Steers Equity Dividend & Income Closed-End Portfolio 2019-2Document2 pagesThe Cohen & Steers Equity Dividend & Income Closed-End Portfolio 2019-2A RNo ratings yet

- MTFDocument2 pagesMTFchiragNo ratings yet

- 富達環球科技基金 說明Document7 pages富達環球科技基金 說明Terence LamNo ratings yet

- 02 - Ishares Barclays Credit Bond FundDocument0 pages02 - Ishares Barclays Credit Bond FundRoberto PerezNo ratings yet

- Solution Manual For Investments An Introduction 10th Edition by MayoDocument13 pagesSolution Manual For Investments An Introduction 10th Edition by MayoChristianLeonardqgsm100% (38)

- Vadilal ValuationDocument77 pagesVadilal Valuationsid lahoriNo ratings yet

- Test Bank Chapter 16Document23 pagesTest Bank Chapter 16rolathaer1996No ratings yet

- Computerized Accounting Using Tally - ERP 9 - Activity BookDocument18 pagesComputerized Accounting Using Tally - ERP 9 - Activity Bookshruti0% (1)

- Unit A 1Document12 pagesUnit A 1Karl Lincoln TemporosaNo ratings yet

- MODULE 3 SecuritiesAndStockMarketDocument7 pagesMODULE 3 SecuritiesAndStockMarketLeslie Joy OrenNo ratings yet

- Joint Parliamentary Committee Report, 2016Document20 pagesJoint Parliamentary Committee Report, 2016puspitaNo ratings yet

- Object ObjectDocument4 pagesObject ObjectSean LeeNo ratings yet

- A Study To Analyze Impact of Insolvency and BankruDocument17 pagesA Study To Analyze Impact of Insolvency and Bankruravenraven0000No ratings yet

- Accounting For Managerial DecisionDocument10 pagesAccounting For Managerial DecisionVishal MehtaNo ratings yet

- Payment of ACCA Subscription by Direct Debit: SECTION A - Your DetailsDocument1 pagePayment of ACCA Subscription by Direct Debit: SECTION A - Your DetailsVishnu VasudevanNo ratings yet

- Analysis of Credit Management System of Jamuna Bank Limited (JBL)Document38 pagesAnalysis of Credit Management System of Jamuna Bank Limited (JBL)Sayed Farrukh AhmedNo ratings yet

- Exercise Chap 5Document9 pagesExercise Chap 5JF FNo ratings yet

- Summer Internship (304) RDM PROJECT MBA 3rd SEMESTERDocument87 pagesSummer Internship (304) RDM PROJECT MBA 3rd SEMESTERPawan DheraNo ratings yet

- Fca PBLDocument21 pagesFca PBLttanishataNo ratings yet

- Quiz 4 Unit IIIDocument6 pagesQuiz 4 Unit IIILeslie Mae Vargas ZafeNo ratings yet

- Contract LawDocument15 pagesContract Lawnatasha anandNo ratings yet

- Off Balance SheetDocument15 pagesOff Balance SheetHussain khawajaNo ratings yet

- Chapter4 IA Midterm BuenaventuraDocument10 pagesChapter4 IA Midterm BuenaventuraAnonnNo ratings yet

- Chapter 4. Review of AccountingDocument49 pagesChapter 4. Review of AccountingMichenNo ratings yet

- RND CREDIT APPLICATION FORM Fillable (2)Document1 pageRND CREDIT APPLICATION FORM Fillable (2)Atlas SNo ratings yet

- Chapter 3. The Accounting EquationDocument2 pagesChapter 3. The Accounting EquationKarysse Arielle Noel JalaoNo ratings yet

- 2017-Herd Behavior in The French Stock MarketDocument20 pages2017-Herd Behavior in The French Stock MarketAhmed El-GayarNo ratings yet

- Financial LibabilitiesDocument15 pagesFinancial LibabilitiesHatdogNo ratings yet

- Draft SciDocument5 pagesDraft SciMariella Antonio-NarsicoNo ratings yet

- Acct 1201 Final ReviewDocument2 pagesAcct 1201 Final ReviewJacob HarrisNo ratings yet

- Chapter-4: ConsiderationDocument18 pagesChapter-4: ConsiderationMd. Shadman Sakib 1610973630No ratings yet