Professional Documents

Culture Documents

27 (B3 and B4) .IFP (8,9, 10) - 19.06.2023

Uploaded by

jopah81118Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

27 (B3 and B4) .IFP (8,9, 10) - 19.06.2023

Uploaded by

jopah81118Copyright:

Available Formats

From the desk of : Rizwan Manai

Tax Practices (B3 and B4) : 27th Lecture dated June 19, 2023

IFP (8)

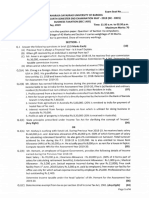

Joint Ownership of a Property

Mrs. Arsalan purchased a plot of land in Tax Year 2021, out of her savings from

salary income. Mr. Arsalan financed the construction on the plot of land, which was

completed in Tax Year 2022. The building given on rent in Tax Year 2023 and

fetched monthly rent of Rs. 500,000 commenced from 1st July 2022. Tenant being

an individual paid 2 years’ rent in advance and refundable security deposit of Rs. 1

million. The fair market rent of the location is Rs. 600,000 per month.

Required

Discuss the relevant assessee of the income and computation of taxable income for

the Tax Year 2023.

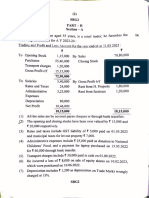

IFP (9)

Renting out of Agriculture Land

Mr. Arjumand owns an Agriculture Land in Hyderabad, Pakistan. On 1 August 2022

rented out the land for poultry farming at monthly rent of Rs.250,000 whereas FMR

is Rs. 280,000 per month. Tenant has also paid non-adjustable and refundable

deposit of Rs.1,000,000.

Mr. Arjumand has incurred the following expenses in this regard;

1) Ground levelling expenses Rs.80,000;

2) Property tax; Rs.120,000;

3) Provincial Agriculture tax Rs.80,000;

4) Interest on mortgage loan Rs.100,000;

5) Rent collection charges Rs.360,000;

6) Insurance premium against risk of water logging Rs.50,000.

Required

Computation taxable income for the Tax Year 2023.

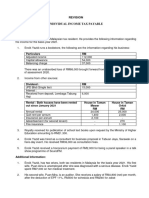

IFP (10)

Inter head adjustment of Salary and Property

Mrs. Shaheen has provided you the following data, for the tax year 2023;

Income Amount

(Rupees)

Income from salary 4,800,000

Income from property (120,000)

Prize on prize bonds 2,000,000

Required

Computation taxable income and tax payable for the Tax Year 2023.

Page 1 of 1

You might also like

- SVKM'S Nmims Anil Surendra Modi School of Commerce Sybcom Sem Iii (2019-22) Subject Name: Direct Taxation No. of Hours: 2 Hours InstructionsDocument20 pagesSVKM'S Nmims Anil Surendra Modi School of Commerce Sybcom Sem Iii (2019-22) Subject Name: Direct Taxation No. of Hours: 2 Hours InstructionsMadhuram SharmaNo ratings yet

- Semester III 52414304 Income Tax Law and Practice-CORE Set Ii Duration: 3 Hours Attempt Any Four Questions. All Questions Carry Equal MarksDocument3 pagesSemester III 52414304 Income Tax Law and Practice-CORE Set Ii Duration: 3 Hours Attempt Any Four Questions. All Questions Carry Equal MarksAnshu kumarNo ratings yet

- Practice Questions: Question # 1 (A)Document4 pagesPractice Questions: Question # 1 (A)Hamid Rana khanNo ratings yet

- Taxation Paper EMBA 16042022Document4 pagesTaxation Paper EMBA 16042022Rohit B .S. Prabhu Verlekar100% (1)

- Question Test Paper 2 - NOV 2023Document2 pagesQuestion Test Paper 2 - NOV 2023ABCXYZNo ratings yet

- Assessment 1Document4 pagesAssessment 1lalshahbaz57No ratings yet

- 029 Practice Test 08 Taxation Test Solution Subjective Udesh RegularDocument8 pages029 Practice Test 08 Taxation Test Solution Subjective Udesh Regulardeathp006No ratings yet

- CAF 2 TAX Autumn 2020Document6 pagesCAF 2 TAX Autumn 2020duocarecoNo ratings yet

- 1686044906DTS-2 Taxation CA InteranswerDocument11 pages1686044906DTS-2 Taxation CA InteranswerViraj SharmaNo ratings yet

- Questions 34nosDocument21 pagesQuestions 34nosAshish TomsNo ratings yet

- Caf 2 Tax Autumn 2021Document6 pagesCaf 2 Tax Autumn 2021Mueez NaseerNo ratings yet

- IncomeTax-2Document6 pagesIncomeTax-2Aditya .cNo ratings yet

- CAF 2 TAX Spring 2022Document6 pagesCAF 2 TAX Spring 2022Sumair IqbalNo ratings yet

- Vol 1 31032019 PDFDocument9 pagesVol 1 31032019 PDFPradeep KattimaniNo ratings yet

- 1 Business TaxationDocument4 pages1 Business TaxationchouhanjainilNo ratings yet

- CAF 2 TAX Autumn 2019Document5 pagesCAF 2 TAX Autumn 2019duocarecoNo ratings yet

- Caf Pac Mock With Solutions Compiled by Saboor AhmadDocument124 pagesCaf Pac Mock With Solutions Compiled by Saboor AhmadkamrankhanlagharisahabNo ratings yet

- Adobe Scan 09 Nov 2023Document11 pagesAdobe Scan 09 Nov 2023Sanskruti BarikNo ratings yet

- IncomeTax-IIDocument7 pagesIncomeTax-IIAditya .cNo ratings yet

- STT Mock Test S-24 Question PaperDocument8 pagesSTT Mock Test S-24 Question PaperabdullahNo ratings yet

- 18222rtp PCC May10 Paper5Document37 pages18222rtp PCC May10 Paper5Kamesh IyerNo ratings yet

- Tax Laws Letures (13-07-2021 To 17-07-2021)Document28 pagesTax Laws Letures (13-07-2021 To 17-07-2021)shanmukvardhanNo ratings yet

- Computation of Total Income & TaxDocument3 pagesComputation of Total Income & TaxkhushhalibajajNo ratings yet

- CAF 2 TAX Autumn 2023Document6 pagesCAF 2 TAX Autumn 2023duocarecoNo ratings yet

- TAXATION (Preps)Document5 pagesTAXATION (Preps)Navya GulatiNo ratings yet

- Mock Test - 2-2Document10 pagesMock Test - 2-2Deepsikha maitiNo ratings yet

- House Propery QuestionsDocument6 pagesHouse Propery QuestionsTauseef AzharNo ratings yet

- CAF 2 - Energizer - Day 1 - March 2023Document14 pagesCAF 2 - Energizer - Day 1 - March 2023Muhammad Ahsan RiazNo ratings yet

- CAF 2 TAX Spring 2020Document5 pagesCAF 2 TAX Spring 2020duocarecoNo ratings yet

- HPDocument15 pagesHPkhanpattanNo ratings yet

- Past Paper Tax PDFDocument102 pagesPast Paper Tax PDFUmar AkhtarNo ratings yet

- TAX Mock September 2023Document64 pagesTAX Mock September 2023Saqib IqbalNo ratings yet

- Assignment MBA III: Business Taxation: TH THDocument4 pagesAssignment MBA III: Business Taxation: TH THShubham NamdevNo ratings yet

- CA Inter N22 - Tax Model QPDocument14 pagesCA Inter N22 - Tax Model QPNAVEEN SURYA MNo ratings yet

- Unit 3 Important Questions: BBA 3 Year 5 Semester Subject: Income Tax Law & Accounting Subject Code: BBA N 503Document5 pagesUnit 3 Important Questions: BBA 3 Year 5 Semester Subject: Income Tax Law & Accounting Subject Code: BBA N 503jyoti.singh100% (1)

- Examples & Practice Questions For Income From PropertyDocument8 pagesExamples & Practice Questions For Income From PropertyAbdulAzeemNo ratings yet

- CAF 2 TAX Spring 2021Document6 pagesCAF 2 TAX Spring 2021duocarecoNo ratings yet

- Direct Tax-IDocument21 pagesDirect Tax-Ivivek rajakNo ratings yet

- TAXQDocument7 pagesTAXQcashubhamkelaNo ratings yet

- CA Inter Taxation Mock Test - 02.08.2018 - Only QuestionDocument7 pagesCA Inter Taxation Mock Test - 02.08.2018 - Only QuestionKaustubhNo ratings yet

- Income Tax S5 Set IDocument5 pagesIncome Tax S5 Set ITitus ClementNo ratings yet

- MTP 19 50 Questions 1712317445Document13 pagesMTP 19 50 Questions 1712317445Nitin KumarNo ratings yet

- Test Series: March, 2021 Mock Test Paper 1 Intermediate (New) Course Paper - 4: Taxation Time Allowed - 3 Hours Maximum Marks - 100 Section - A: Income Tax Law (60 Marks)Document11 pagesTest Series: March, 2021 Mock Test Paper 1 Intermediate (New) Course Paper - 4: Taxation Time Allowed - 3 Hours Maximum Marks - 100 Section - A: Income Tax Law (60 Marks)M100% (1)

- IFOSDocument2 pagesIFOSJimmy ShergillNo ratings yet

- I.TAx 302Document4 pagesI.TAx 302tadepalli patanjaliNo ratings yet

- Test Series: October, 2014 Mock Test Paper - 2 Intermediate (Ipc) : Group - I Paper - 4: Taxation Time Allowed - 3 Hours Maximum Marks - 100Document8 pagesTest Series: October, 2014 Mock Test Paper - 2 Intermediate (Ipc) : Group - I Paper - 4: Taxation Time Allowed - 3 Hours Maximum Marks - 100TejTejuNo ratings yet

- CAF 2 TAX Autumn 2022Document6 pagesCAF 2 TAX Autumn 2022QasimNo ratings yet

- Aa 498 AssignmentDocument2 pagesAa 498 AssignmentMeena SinghNo ratings yet

- Mba 3 Sem Tax Planning and Management Jan 2019Document3 pagesMba 3 Sem Tax Planning and Management Jan 2019Er Aftab ShaikhNo ratings yet

- RTP June 2018 QnsDocument14 pagesRTP June 2018 QnsbinuNo ratings yet

- 2 - House Property Problems 22-23Document5 pages2 - House Property Problems 22-2320-UCO-517 AJAY KELVIN ANo ratings yet

- Income From PropertyDocument2 pagesIncome From Propertyumar farooqNo ratings yet

- Revision 1Document4 pagesRevision 1carazamanNo ratings yet

- CA FINAL Class Test Paper MAY/NOV-22 Exams Topics: Basics, Capital Gain & IFOSDocument8 pagesCA FINAL Class Test Paper MAY/NOV-22 Exams Topics: Basics, Capital Gain & IFOSMayank GoyalNo ratings yet

- DT BB TestDocument5 pagesDT BB TestMayank GoyalNo ratings yet

- Bíñüäpü Báár A®Üì¿Á Gçýé Ë Ýwüwüúwæ Eñü Äôä. Pýâç Püáâçæàoã E Üáãàwüpær A®Üáêüá C ÆDocument8 pagesBíñüäpü Báár A®Üì¿Á Gçýé Ë Ýwüwüúwæ Eñü Äôä. Pýâç Püáâçæàoã E Üáãàwüpær A®Üáêüá C ÆSudhir SoudagarNo ratings yet

- Tax Nov 22 RTPDocument28 pagesTax Nov 22 RTPShailjaNo ratings yet

- Bos 59265Document46 pagesBos 59265oproducts96No ratings yet

- Caf 6 Tax Spring 2019Document5 pagesCaf 6 Tax Spring 2019Raza Ali SoomroNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet