Professional Documents

Culture Documents

10 of 2014

Uploaded by

FelicianFernandopulle0 ratings0% found this document useful (0 votes)

1 views7 pagesOriginal Title

10of2014

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

1 views7 pages10 of 2014

Uploaded by

FelicianFernandopulleCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 7

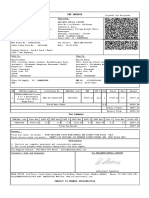

PARLIAMENT OF THE DEMOCRATIC

SOCIALIST REPUBLIC OF

SRI LANKA

NATION BUILDING TAX (AMENDMENT)

ACT, No. 10 OF 2014

[Certified on 24th April, 2014]

Printed on the Order of Government

Published as a Supplement to Part II of the Gazette of the Democratic

Socialist Republic of Sri Lanka of April 25, 2014

PRINTED AT THE DEPARTMENT OF GOVERNMENT PRINTING, SRI LANKA

TO BE PURCHASED AT THE GOVERNMENT PUBLICATIONS BUREAU, COLOMBO 5

Price : Rs. 12.00 Postage : Rs. 5.00

Nation Building Tax (Amendment) 1

Act, No. 10 of 2014

[Certified on 24th April, 2014]

L. D.—O. 6/2014.

AN ACT TO AMEND THE NATION BUILDING TAX ACT, NO. 9 OF 2009

BE it enacted by the Parliament of the Democratic Socialist

Republic of Sri Lanka as follows :—

1. This Act may be cited as the Nation Building Tax Short title and

(Amendment) Act, No. 10 of 2014 and shall be deemed to date of

operation.

have come into operation from January 1, 2014.

2. Section 3 of the Nation Building Tax Act, No. 9 of Amendment of

2009 as last amended by Act, No. 11 of 2013 (hereinafter section 3 of Act,

No. 9 of 2009.

referred to as the “principal enactment”) is hereby further

amended in subsection (2) of that section as follows :—

(1) by the substitution in paragraph (iii) thereof, for the

words, “other than any excepted service referred to in

the First Schedule to this Act,” of the following words

and figures:—

“other than any excepted service referred to in the

First Schedule to this Act:

Provided that, the liable turnover from the

supply of any financial service in Sri Lanka, by any

person carrying on the business of banking or

finance shall, notwithstanding anything contrary

in any other provision of this Act, be the value

addition attributable to such financial service,

calculated for the purposes of applying the

attributable method referred to in subsection (4) of

section 25C of the Value Added Tax Act, No. 14 of

2002, for the payment of Value Added Tax on the

supply of finanical services :

Provided further, that in calculating the value

addition attributable to such financial service, where

2—PL 008069—2900 (03/2014)

2 Nation Building Tax (Amendment)

Act, No. 10 of 2014

the amount of profits for each relevant quarter cannot

be accurately ascertained, such amount may be

estimated on the basis of available information. The

estimated amount shall be adjusted to reflect the

actual amount with the audited statement of

accounts on yearly basis and such adjustment shall

be submitted within six months after the closing

date of the relevant accounting period.”;

(2) in paragraph (iv) –

(i) by the substitution for subparagraph (2) thereof

of the following subparagraph:—

“(2) (a) sugar, dhal, potatoes, onions, dried

fish, milk powder or chilies under the

provisions of the Special Commodity

Levy Act, No. 48 of 2007, where such

article is sold on or before December

31, 2013, by the importer of such

article; or

(b) any article which is subject to the

Special Commodity Levy under the

provisions of the Special Commodity

Levy Act, No. 48 of 2007, where such

article is sold on or after January 1,

2014, by the importer of such article

without any processing except for

adaption for sale;”;

(ii) by the substitution in subparagraph (7) thereof

for the words “producer thereof; and” of the

words “producer thereof;”;

(iii) by the substitution in subparagraph (8) thereof

for the words “in a filling station.” of the words

“in a filling station;”;

Nation Building Tax (Amendment) 3

Act, No. 10 of 2014

(iv) by the addition immediately after subparagraph

(8) of that paragraph, of the following

subparagraphs:—

“(9) retail sale of any article at duty free

shops for payment in foreign currency;

and

(10) distribution of LP Gas.”.

3. The First Schedule to the principal enactment as last Amendment of

First Schedule of

amended by Act, No. 11 of 2013 ,is hereby further amended

the principal

as follows:— enactment.

(1) In PART I of that Schedule:—

(a) by the substitution for item (xiii) thereof, of the

following item:—

“(xiii) pharmaceuticals identified under

the Harmonized of Commodity

Descripion and Coding Numbers for

Custom purposes;”;

(b) by the substitution for item (xix) thereof, of the

following item:—

“(xix) locally manufactured tractors at the

point of sale;”;

(c) by the substitution in item (XLIV) for the words

“project implementation period; and” of the

words “project implementation period;”;

(d) by the substitution in item (XLV) for the words

“approved by the Minister of Finance.” of the

words “approved by the Minister of Finance;

and”;

4 Nation Building Tax (Amendment)

Act, No. 10 of 2014

(e) by the insertion immediatly after item (XLV)

thereof the following new item:—

“(XLVI)locally manufactured coconut oil at the

point of sale by the manufacturer, for

a period of three years commencing

from January 1, 2014;”and;

(2) In PART II of that schedule :—

(a) by the substitution for item (i) thereof of the

following item:—

“(i) the business of Banking or Finance

for any period ended on or before

December 31, 2013;

(b) by the substitution for item (vi) thereof of the

following item:—

“(vi) the provision of finance leasing

facilities in respect of any movable

property;”;

(c) by the substitution for item (xxvi) thereof of

the following item:—

“(xxvi) services provided to or within any

port or airport in relation to

international transportation;”;

(d) by the substitution for item (xxviii) thereof of

the following item:—

“(xxviii) telecommunication services, in

respect of which the

telecommunication levy has been

paid under the Telecommunication

Levy Act, No. 21 of 2011;”;

Nation Building Tax (Amendment) 5

Act, No. 10 of 2014

(e) by the substitution in item (xxxv) for the words

“Monetary Law Act (Chapter 422); and” of the

words “Monetary Law Act (Chapter 422);”;

(f) by the substitution in item (xxxvi) for the words

“on behalf of the Government.” of the words

“on behalf of the Government; and”;

(g) by the insertion immediately after the item

(xxxvi), of the following new item:—

“(xxxvii) the services provided by any relocted

international headquaters or regional

head office of any institution in the

international network, prescribed for

the purpose of Inland Revenue Act,

for payment in foreign currency.”.

4. Where the Commissioner-General of Inland Revenue Validation.

or the Director-General of Customs as the case may be,

collects under the provisions of section 4 or section 5

respectively of the principal enactment, the tax calculated

considering the provisions of this Act, during the period

commencing from January 1, 2014 and ending on the date

on which the cerificate of the Speaker is endorsed in respect

of this Act from a person to whom the provisions of this Act

applies, such collection shall be deemed for all purposes to

have been, and to be validly made:

Provided that the aforesaid provisions of this section shall

not affect any decision or order made by any Court or any

proceedings pending in any Court in respect of any tax

collected during the aforesaid period.

5. In the event of any inconsistency between the Sinhala Sinhala text to

and Tamil texts of this Act, the Sinhala text shall prevail. prevail in case of

an inconsistency.

6 Nation Building Tax (Amendment)

Act, No. 10 of 2014

Annual subscription of English Bills and Acts of the Parliament Rs. 885 (Local), Rs. 1,180

(Foreign), Payable to the SUPERINTENDENT, GOVERNMENT PUBLICATIONS BUREAU, DEPARTMENT OF

GOVERNMENT INFORMATION, NO. 163, KIRULAPONA MAWATHA, POLHENGODA, COLOMBO 05 before 15th

December each year in respect of the year following.

You might also like

- VATActNo9 (E) 2011Document23 pagesVATActNo9 (E) 2011jing qiangNo ratings yet

- Vatactno7 (E) 2012Document20 pagesVatactno7 (E) 2012jing qiangNo ratings yet

- VATActNo13 (E) 2004Document32 pagesVATActNo13 (E) 2004jing qiangNo ratings yet

- Act No 28dt 24-9-08Document7 pagesAct No 28dt 24-9-08Balu Mahendra SusarlaNo ratings yet

- Parliament of The Democratic Socialist Republic of Sri LankaDocument6 pagesParliament of The Democratic Socialist Republic of Sri LankaAudithya KahawattaNo ratings yet

- Vatactno7 (E) 2003Document19 pagesVatactno7 (E) 2003jing qiangNo ratings yet

- Finance (Supplementary) Act, 2023Document9 pagesFinance (Supplementary) Act, 2023Umair NeoronNo ratings yet

- (B18-2019) (Taxation Laws)Document56 pages(B18-2019) (Taxation Laws)Khayakazi NtondiniNo ratings yet

- 10 of 2007Document58 pages10 of 2007FelicianFernandopulleNo ratings yet

- Parliament of The Democratic Socialist Republic of Sri LankaDocument6 pagesParliament of The Democratic Socialist Republic of Sri LankaLasitha VijayakumarNo ratings yet

- The Central Goods and Services Tax (Amendment) BILL, 2018Document26 pagesThe Central Goods and Services Tax (Amendment) BILL, 2018Mystic MysteryNo ratings yet

- Sec 54 amendment allows purchase of two homesDocument7 pagesSec 54 amendment allows purchase of two homesSuchitaNo ratings yet

- Act of HydDocument24 pagesAct of HydNOOR SHAMSI KHANNo ratings yet

- Parliament of The Democratic Socialist Republic of Sri LankaDocument7 pagesParliament of The Democratic Socialist Republic of Sri LankaanushkaNo ratings yet

- Value Added Tax (Amendment) Bill, 2023Document10 pagesValue Added Tax (Amendment) Bill, 2023Frank WadidiNo ratings yet

- 07 of 2014Document12 pages07 of 2014FelicianFernandopulleNo ratings yet

- Khyber Pakhtunkhwa Land Revenue Act amendmentsDocument4 pagesKhyber Pakhtunkhwa Land Revenue Act amendmentsm.osman riazNo ratings yet

- VATActNo15 (E) 2008Document12 pagesVATActNo15 (E) 2008jing qiangNo ratings yet

- 2002 PDFDocument111 pages2002 PDFAsmi MohamedNo ratings yet

- Public Procurement and Disposal of Public Assets (Amendment) ActDocument28 pagesPublic Procurement and Disposal of Public Assets (Amendment) Actiam ianneNo ratings yet

- Housing Consumers Protection Measures Amendment Bill: Republic of South AfricaDocument8 pagesHousing Consumers Protection Measures Amendment Bill: Republic of South AfricarondgaaNo ratings yet

- Finance Act 2022Document43 pagesFinance Act 2022Mark GechureNo ratings yet

- Amendments in The Sindh Sales Tax On Services Rules 2011Document8 pagesAmendments in The Sindh Sales Tax On Services Rules 2011Ali AkberNo ratings yet

- CGST Amendment Act 2018Document9 pagesCGST Amendment Act 2018sridharanNo ratings yet

- Amendment 2Document12 pagesAmendment 2Netanja BrinkNo ratings yet

- in Section 2 of The Income-Tax Act, With Effect From The 1st Day of April, 2014Document20 pagesin Section 2 of The Income-Tax Act, With Effect From The 1st Day of April, 2014vickytatkareNo ratings yet

- VATActNo8 (E) 2006Document29 pagesVATActNo8 (E) 2006jing qiangNo ratings yet

- Registration Act Amendments to Facilitate E-RecordsDocument21 pagesRegistration Act Amendments to Facilitate E-Recordsrkjayakumar7639No ratings yet

- Factoring Regulation Bill, 2020Document9 pagesFactoring Regulation Bill, 2020Ritwik MehtaNo ratings yet

- Act No. 25 The Customs and Excise Act, (Amendment) 2022Document12 pagesAct No. 25 The Customs and Excise Act, (Amendment) 2022kasongo.mwensoNo ratings yet

- A1286-2007 Street Drainage Building AmendmentDocument12 pagesA1286-2007 Street Drainage Building AmendmentJulie Tan100% (1)

- Value Added Tax Act AmendmentsDocument42 pagesValue Added Tax Act AmendmentsJamie ReyesNo ratings yet

- Vatactno6 (E) 2005Document16 pagesVatactno6 (E) 2005jing qiangNo ratings yet

- The Sindh Government GazetteDocument8 pagesThe Sindh Government GazettepakistanhrfNo ratings yet

- Act 39 of 2021Document9 pagesAct 39 of 2021Kriti KumarNo ratings yet

- THE (Khyber Pakhtunkhwa) FINANCE ACT, 1997. ( (Khyber Pakhtunkhwa) Act No. Iii of 1997)Document11 pagesTHE (Khyber Pakhtunkhwa) FINANCE ACT, 1997. ( (Khyber Pakhtunkhwa) Act No. Iii of 1997)livegsmNo ratings yet

- Patents (Amendment) Act 2022 (Act A1649)Document44 pagesPatents (Amendment) Act 2022 (Act A1649)AHMAD FADHIL BIN ABD RASHID STUDENTNo ratings yet

- Finance ActDocument53 pagesFinance Actshahid farooq100% (1)

- PPDA (AMENDMENT) ACT, 2020 AssentDocument28 pagesPPDA (AMENDMENT) ACT, 2020 AssentNyakuni NobertNo ratings yet

- Tax 4Document3 pagesTax 4JK Lights TradingNo ratings yet

- Municipalities Amendment No. 2 Bill 2014Document18 pagesMunicipalities Amendment No. 2 Bill 2014Patricia bNo ratings yet

- Amendment To Negotiable Instruments ActDocument5 pagesAmendment To Negotiable Instruments ActRamanujarInstitutionalLearningNo ratings yet

- Bill b29b 2023Document16 pagesBill b29b 2023Errol GawNo ratings yet

- Business Laws Amendment Act 2021Document15 pagesBusiness Laws Amendment Act 2021Cyrus KNo ratings yet

- 38dthe Foreign Trade (Development and Regulation) Amendment Act, 2010Document12 pages38dthe Foreign Trade (Development and Regulation) Amendment Act, 2010Pranav PrashantNo ratings yet

- Foreign TradeDocument12 pagesForeign TradeSoumyajit Das MahapatraNo ratings yet

- Finance BillDocument128 pagesFinance BillonepakistancomNo ratings yet

- VLK/KKJ.K HKKX (K.M Izkf/Kdkj Ls Izdkf'Kr Lañ Ubz Fnyyh) Lkseokj) VXLR 25) 2014@ HKKNZ 3) 1936 'KD BL HKKX Esa Fhkuu I'"B La ( K NH TKRH Gs Ftlls FD G Vyx Ladyu Ds:I Esa J (KK TK LdsaDocument17 pagesVLK/KKJ.K HKKX (K.M Izkf/Kdkj Ls Izdkf'Kr Lañ Ubz Fnyyh) Lkseokj) VXLR 25) 2014@ HKKNZ 3) 1936 'KD BL HKKX Esa Fhkuu I'"B La ( K NH TKRH Gs Ftlls FD G Vyx Ladyu Ds:I Esa J (KK TK LdsaAdityaSinghRathoreNo ratings yet

- IB Code Amendments Provide Relief for MSMEs and Real Estate ProjectsDocument5 pagesIB Code Amendments Provide Relief for MSMEs and Real Estate ProjectsAAKASH BATRANo ratings yet

- National Credit ActMARCH2015Document36 pagesNational Credit ActMARCH2015EtienneBothaNo ratings yet

- Housing Development Regulations Amendment 2015Document66 pagesHousing Development Regulations Amendment 2015Ezumi HarzaniNo ratings yet

- Kenya amends insolvency regulationsDocument34 pagesKenya amends insolvency regulationsJoy SitatiNo ratings yet

- Service Tax Rules AmendedDocument4 pagesService Tax Rules AmendedDipesh Chandra BaruaNo ratings yet

- Central Excise Notification No. 3/2011Document8 pagesCentral Excise Notification No. 3/2011sonia87No ratings yet

- Arbitration and Conciliation Bill, 2015Document28 pagesArbitration and Conciliation Bill, 2015Ravi ShankarNo ratings yet

- The Wakf (Amendment) Act, 2013.Document16 pagesThe Wakf (Amendment) Act, 2013.Radhika ReddyNo ratings yet

- Taxation Laws Amendment Act, 17 of 2009Document82 pagesTaxation Laws Amendment Act, 17 of 2009Sam JacksonNo ratings yet

- The Gazzat of PakistanDocument236 pagesThe Gazzat of PakistanFaheem UllahNo ratings yet

- 15 of 2014Document3 pages15 of 2014FelicianFernandopulleNo ratings yet

- Parliament of The Democratic Socialist Republic of Sri LankaDocument5 pagesParliament of The Democratic Socialist Republic of Sri LankaFelicianFernandopulleNo ratings yet

- Parliament of The Democratic Socialist Republic of Sri LankaDocument10 pagesParliament of The Democratic Socialist Republic of Sri LankaFelicianFernandopulleNo ratings yet

- 085 NLR NLR V 04 He Estate of Margaret WernhamDocument6 pages085 NLR NLR V 04 He Estate of Margaret WernhamFelicianFernandopulleNo ratings yet

- 20 of 2014Document12 pages20 of 2014FelicianFernandopulleNo ratings yet

- 17 of 2014Document8 pages17 of 2014FelicianFernandopulleNo ratings yet

- 29 of 2011Document6 pages29 of 2011FelicianFernandopulleNo ratings yet

- 7 of 2011Document10 pages7 of 2011FelicianFernandopulleNo ratings yet

- 18 of 2014Document3 pages18 of 2014FelicianFernandopulleNo ratings yet

- Parliament of The Democratic Socialist Republic of Sri LankaDocument10 pagesParliament of The Democratic Socialist Republic of Sri LankaFelicianFernandopulleNo ratings yet

- 12 of 2011Document3 pages12 of 2011FelicianFernandopulleNo ratings yet

- 04 of 2014Document11 pages04 of 2014FelicianFernandopulleNo ratings yet

- 16 of 2011Document3 pages16 of 2011FelicianFernandopulleNo ratings yet

- 25 of 2011Document9 pages25 of 2011FelicianFernandopulleNo ratings yet

- 12 of 2011Document3 pages12 of 2011FelicianFernandopulleNo ratings yet

- Parliament of The Democratic Socialist Republic of Sri LankaDocument8 pagesParliament of The Democratic Socialist Republic of Sri LankaFelicianFernandopulleNo ratings yet

- 03-2024 - S PoaDocument4 pages03-2024 - S PoaFelicianFernandopulleNo ratings yet

- 29 of 2011Document6 pages29 of 2011FelicianFernandopulleNo ratings yet

- 26 of 2007Document19 pages26 of 2007FelicianFernandopulleNo ratings yet

- 10 of 2007Document58 pages10 of 2007FelicianFernandopulleNo ratings yet

- 46 of 2007Document3 pages46 of 2007FelicianFernandopulleNo ratings yet

- 1 PHC Cpa 69 21 PDFDocument8 pages1 PHC Cpa 69 21 PDFFelicianFernandopulleNo ratings yet

- Parliament of The Democratic Socialist Republic of Sri LankaDocument7 pagesParliament of The Democratic Socialist Republic of Sri LankaFelicianFernandopulleNo ratings yet

- 2090-16 TTDocument6 pages2090-16 TTFelicianFernandopulleNo ratings yet

- SLLR 1978-79-80 v1 Palihawadana v. Attorney General and Two OthersDocument37 pagesSLLR 1978-79-80 v1 Palihawadana v. Attorney General and Two OthersFelicianFernandopulleNo ratings yet

- 28-2022 - S PoaDocument15 pages28-2022 - S PoaFelicianFernandopulleNo ratings yet

- 18 of 2007Document7 pages18 of 2007FelicianFernandopulleNo ratings yet

- 1 PHC Cpa 69 21 PDFDocument8 pages1 PHC Cpa 69 21 PDFFelicianFernandopulleNo ratings yet

- SLLR 1978 79 V2 Fernando v. Jinadasa and OthersDocument5 pagesSLLR 1978 79 V2 Fernando v. Jinadasa and OthersFelicianFernandopulleNo ratings yet

- SLLR-1978-79-80-V1-G. P. A. Silva and Others-V. Sadique and OthersDocument16 pagesSLLR-1978-79-80-V1-G. P. A. Silva and Others-V. Sadique and OthersFelicianFernandopulleNo ratings yet

- DEUTSCHEBANK - WHITE SCREEN Privat WHITEDocument2 pagesDEUTSCHEBANK - WHITE SCREEN Privat WHITESALLEXNo ratings yet

- Amex Statement - Aug 2019Document6 pagesAmex Statement - Aug 2019Afzal sayedNo ratings yet

- De Minimis BenefitsDocument3 pagesDe Minimis BenefitsanneNo ratings yet

- Income From House Property Solved Mcq's With PDF Download (Set-1)Document6 pagesIncome From House Property Solved Mcq's With PDF Download (Set-1)DevNo ratings yet

- Tax Invoice: S.No. Description SKU HSN Unit Price Qty Amount SGST CGST AmountDocument1 pageTax Invoice: S.No. Description SKU HSN Unit Price Qty Amount SGST CGST Amountpankaj kadulkarNo ratings yet

- PREMATABLE DEPOSIT RENEWALDocument1 pagePREMATABLE DEPOSIT RENEWALTanvi DhingraNo ratings yet

- ACE - 01.3.22 - To - 28.02.23Document59 pagesACE - 01.3.22 - To - 28.02.23PramodNo ratings yet

- PreviewDocument4 pagesPreviewandrealhepburnNo ratings yet

- Bir Ruling 047-2013Document8 pagesBir Ruling 047-2013Ar Yan SebNo ratings yet

- Tallentx Allen AcknowledgementDocument1 pageTallentx Allen AcknowledgementLakshya SinghalNo ratings yet

- Slides Ethiopian Tax System 1Document15 pagesSlides Ethiopian Tax System 1yebegashetNo ratings yet

- 71148bos57143 cp10Document56 pages71148bos57143 cp10Sibadatta KhuntiaNo ratings yet

- Yutivo Sons Hardware Vs CTADocument1 pageYutivo Sons Hardware Vs CTASuiNo ratings yet

- Tax InvoiceDocument1 pageTax InvoicevinaygaddamNo ratings yet

- Compliance RequirementsDocument27 pagesCompliance Requirementsedz_1pieceNo ratings yet

- Gain or Loss from Sale or ExchangeDocument7 pagesGain or Loss from Sale or Exchangejohn paulNo ratings yet

- Final Exam Tax Preparer 2017Document19 pagesFinal Exam Tax Preparer 2017nzabanita6417% (6)

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument64 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalancePDRK BABIUNo ratings yet

- Entrepreneurship - MGT602 Power Point Slides Lecture 29Document11 pagesEntrepreneurship - MGT602 Power Point Slides Lecture 29faizan.kareemNo ratings yet

- Buda-Fighter Card CloningDocument3 pagesBuda-Fighter Card Cloningגולדה מאיר100% (3)

- Chapter 27 HW FinalDocument4 pagesChapter 27 HW FinalGabriel Aaron DionneNo ratings yet

- Reliance Retail tax invoice for dining table and chairsDocument6 pagesReliance Retail tax invoice for dining table and chairsmanish kumarNo ratings yet

- VC Bill No 64Document2 pagesVC Bill No 64Mathewraj Dhanasekaran palanivelNo ratings yet

- Offer Letter: Globiva Services Private LimitedDocument2 pagesOffer Letter: Globiva Services Private LimitedNiteesh KumarNo ratings yet

- Fast Food Restaurant Business PlanDocument6 pagesFast Food Restaurant Business PlanChris MineNo ratings yet

- IFMIS Telangana Cheque Issued Report PDFDocument2 pagesIFMIS Telangana Cheque Issued Report PDFSomeshwar Lakavath100% (1)

- Journal Entries - Financial AccountingDocument3 pagesJournal Entries - Financial AccountingElham JabarkhailNo ratings yet

- 05 Hints MCQs Payment System and Fee Based ServicesDocument2 pages05 Hints MCQs Payment System and Fee Based ServicesVikashKumarNo ratings yet

- Ch. 02 Bank Reconciliation Intermediate Accounting Volume 1 2021 Edition ValixDocument7 pagesCh. 02 Bank Reconciliation Intermediate Accounting Volume 1 2021 Edition ValixNathalie GetinoNo ratings yet

- Course Fee Voucher 1646Document1 pageCourse Fee Voucher 1646Anonymous 3HqVgQrWNo ratings yet