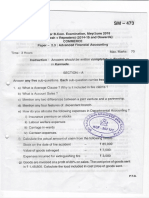

2020 X#Wut crl

Section A : Compulsory Question (60%)

Attempt ALL tlhe quesfions in thil secfion.

1. Foilowing were information adopted from Ai Kennot Trading that running business

of shirt printing as at 31 December 2019:

RM

Non-Current Assets 45,000

Net Profit 1,700

10% Bank Loan 12,000

Accounts Receivable 16,724

Accounts Payable 14880

Allowance for Doubtful Debts , 31 December 2019 1,672

,Bank Overdraft 300

Capital 35,888

Loan to YES 1,800

Closing Inventory, at cost 4,100

Drawings 500

Below were some errors that revealed after preparation of lncome Statement:

i) Drawings of goods cost RM 351 was credited to Bank Account.

ii) Market value of inventory as at 31 December 2019 was RM 3,750.

iii) Full year interest of loan was accrued. However, the double entry was made

based on 1o/o annual interest rate.

iv) RM 120 duty was paid for machine bought from oversea. The amount whs

recorded in credit side of both accounts concerned.

v) Bad debts of RM 800 was recorded in Accounts Receivable only. The amount

was entered as R MBO.

Note: Allowance for Doubfful Debts was 1 0o/o of the accounts receivable.

REQUIRED:

a) Make necessary correction journal entries for the above errors ; (13%)

(narrations are not required)

b) Prepare Statement of Financial Position as at 31 December 2019 (6%)

c) Briefly explain when Suspense Account would be created. (1Yo)

Z

�2. Bintulu Bhd has an authorised capital of RM 2,500,000 ordinary shares of RM 2 each. The

(issued sharre capiial\at 31 December 2019 wa{ RM 1 ,000,000)which was fully paid and had

'been issued at par. Th{bank balancQ as at 31 December 2019 wa{nU 1,000,000 )

On 1 Janu ary 2020, the directors decided to[incrgase the share capital)by offering the

balance of ordinary shares at a price o[nU 2.50 per share, payable as follow:

2A2A

Jan 15 RM 0.90 per share on application (including premium);

30 RM 0.60 per share on allotment;

Apr 1 RM 0.40 per share on first call;

Jun 1 Balance on second and final call.

Applications were received for RItl i|r530,O00'shares, and they were dealt with as follows:

Arrolications (shares) Allotments

100,000 Full allotment

450.000 To allot 1 share fro every 3 shares applied for

1,000,000 To allot 1 share fro every 2 shares applied for

2 No allotment and returned to applicants

The excess application monies were offset against the amount due on allotment. Any balance

remaining was then refunded on 1 February 2A20. The amount due on allotment were received

on 10 February 2420.

The monies due on the first call and the second and final callwere received on 7 April 2020

and 7 June 2020 respectively.

You are required to:

(a) calculate and fill in the table as given; (answer in the answer sheet provided) (7.5o/o)

Application mon Application and Alloment Application

Shares alloted received allotment monies monies monies

required receivable refunded

shares RM RM RM RM

{b) show the Journal entries( including cash items) to record the above transactions in the

books of Bintulu Bhd.( Narrations are not required.) (e.5%)

(c) show the appropriate seotions of Bintulu Bhd's Statement Of Financial Statement on

30 June 2020. (3%)

3

� profits and losses in the ratio of 3:1:1'

3. Anna, Aslrely anct Apple were partners, sharing

position of the partnership as at 31 July 2a2o:

The forowing is the siatement of financiar

TriPIe A

Statement Of Financial Position

As at 31 JulY 2020

RM RM RM

Aceumulated Carrying

Cost Amount

Depreciation

100,000 100,000

64,000 (38,000) 26,000

30,000

141,000

10,000

151,000

Current Assets

8,600

lnventory

Accounts Receivable

15,600

Less: Allowance For Doubtful Debts

Cash 176,400

Non^current Liabilities

10,000

Loan from RaYmond

25,000

Banl< Loan

21,000

Accounts PaYable

8,200

Banl< Overdnaft

200

Accrued lnterest On Bank Loan 112.000

Net Assets

45,000

30,000

30,000

12,44O

(16,000)

10,600

+

�On 1 August 2020, the partners agreed to selltheir business to Winner Partnership for

RM 45,C)00 by cheque.

The following was the Statement Of Financial Position of Winner Partnership:

RM RM

Machinery 100,000 Capital

Motor Vehlcles 50,000 -Willian 75,000

Fixtures,And Fittings 26,000 -Winne 85,000

lnv,entory 21,800 Accounts Payable 19,600

Accounts Fteceivable 20,244 Bank Loan 100,000

Bank 61.600

279,600 279.600

(i) Machinery were sold at 70a/o of net book value by cheque.

(iii) Half of otfice equipment was taken over by Apple at RM 5,000,

(iii) Accounts Fleceivable was taken over by Ashely RM 14,000, but a debtor

who owed RM 600 was unabte to paid his debt.

(iv) Anna paid bank loan RM 25,000 and accrued interest on bank loan RM 200 for

partnership and took over all inventory at RM 7,560.

(v) Buyer took over:

RM

Accounts Payable 9,800

Office Equipment 10,000

Premises 90,000

Loan fnom Raymond carrying value

(vi) Dissolution cost amounted RM 500 paid by cheque.

(vii) Final balances of the partners' capital accounts are settled by payment of

cheque, but Ashely could only clear 50% of his debit balance.

(viii) The remaining accounts payable were settled by the Triple A partnership at

RM 11,000.

You are required to prepare:

(a) Realisation Account and partners' capital account (columnar form) in the books of

Triple A; (15%)

(b) Journal entries of Winner Partnership to record the above business purchase .

(Narrations are not required) (5%)

J

�Section B : Elective Question (20%l

Attempt any ONE af the three questions in this section.

4. JackSon and Alvin entered into a joint venture to buy and sell vehicles- lt was agreed

th"t6;i; r."ir*rs should receive a commission ofi0%!n sales rn(b*arall

t losses

irort oro ctebts. j \

/ , ..\

Subject to this arrangement,[profits or losses were to b,e share eeuallV.J

Below was relevant joint venture transactions incurred in the month of December

2019:

Dec 1 Jackson purchased RM25,000 goods and delivered goods worth

RM18,000 to Alvin.

2 Alvin paid advertising fee amounted RM800-

I Jackson Alvin

- Cash sales : RM 8,500 - Cash Sales : RM 8,000

- Credit sales : RM 7,300 - Credit Sales : RM 8,000

14 Jackson collected RM 7,000 from the debtors while Alvin collected

FIM 7,500 for the debtors.

20 l-he remaining debtors owed to Alvin declared bankruptry, thus the debts

considered as bad.

2T Goods cost RM 3,000 stored at Jackson's warehouse was stolen. This

loss would be borne bY Jackson.

30 Both venturers decided to @ase the business. Remaining goods that cost

RM 5,000 stored at Alvin's warehouse were taken over by him. RM 3,000

of it was for business used, RM 500 of it was for personal used and the

remaining was for resale Purpose.

Cheque settlement was made between Jackson and Alvin.

REQUIRED:

a) Joint Venture accounts in both venfurers respective books ; (14o/o)

b) Memorandum Joint Venture Account (6%)

6

�5. Skylight Trading Company from Pasir Gudang dispatched 500 cases of goods, having a

total cost of RM 200,000 to their agent, Syarikat Ming in Penang, at a pro forma invoice

price of FIM 220,000 on 1 January 2A2A. They had paid Freight and lnsurance Expenses

amountinrg to RM 3,200 and 1% Export Duties on the same day.

On 7 January 202A the goods arrived at Penang, Syarikat Ming made the necessary

arrangements to clear the goods and paid for the fotlowing charges:

RM

Landing Charges 500

TransportationExpenses 1,000 bAA, {&i;*;irr!:ji-1,i i

Warehouse and lnsurance 1,800 E.pr" t s;1*ro5 JX }i\ i,* {lr, *,"a_

,"),." f;,

L)r'l{:t114

Syarikat Ming was entitled to deduct any expenses incurred and a commission of 5% on

the gross sales.

An Account Sales was rendered by Syarikat Ming as at 30 June 2A20 showing that 250

. of goods was sold at RM 850 per case on credit and a further 100 cases was sold out at

RM 1,000 per case on credit. Syarikat Ming had incurred a total amount of Carriage

Outwards RM 600 and Advertising Expenses RM 1,200.

S.yari(at Ming reported that 5 cases of goods had been stolen and the insurance company

egreeii to pay the total cost to Syarikat Ming in compensation.

\-- --

Up to 30 June 2A2O Syarikat Ming received all the amount due from consignment debtors

with the exception of a debt of RM2,000 which had been written off as bad.

On 30 June 2020, Syarikat Ming sent out a sight draft for the amount due to Skylight

Trading Company at that date.

You are nequired to write up the following accounts:

(a) In the books of Skylight Trading Company:

(i) Consignment; (7.5%)

(ii) Bank; (1.5%)

(iii) Consignee; (5.5%)

(b) Consignor account in the books of Syarikat Ming, (5.5%)

1

� The following inforrnation was taken

from the trial balance of Yoyo company'

6.

manufetcturer of toy on 30 June2A?A:

Dr.^- cr.

RM RM

lnventory, 1 January 2024:

20,600

- Raw Materia.[s

13,600

- UnfinishedGoods

28,560

- Finished Goods

Purchases

36,700

- Raw Materials

1,000

- Factory Lclose Tools '

29,560

- Finished Goods

Salaris

36,000

- Factory Manager

20,000

- Administration Staff

1,000

Bad Debts 6,000

Audit Fee

Returns 250

- Raw Materials 130

- Factory Loose Tools

330

- Finished Goods 189,000

Sales

lnsurance 1,900

- Plant And Machinery

Carriage lnwards 500

- Raw Materials 600

- Finished Goods 45,500

Production Wages 9,600

Rent 6,600

Water And EtectricitY 33,000

Plant A,nd Machinery

11,000

Office EquiPment 99,000 65,000

Accounts Receivable And Accounts Payable 8,600

Bank 2,000

Cash 500

Allowance For Doubtful Debts 6,700

Subcontract Cost 127,O7Q

CaPital, 1 Jantrary 2O2O 400.150 400,150

I

�Add itiorral I nformation :

(i) lnventory, 30 June ZA2A

- Raw Materials , RM 20,000

- Unfinished Goods RM 10,500

- Factory Loose Tools RM 700

- Finished Goods RM 59,000

(ii) 60% of water and electricity was paid

for factory.

(iii) All non-current assets were to be depreciate

d at2a% per annum on carrying

amount.

(iv) lnsurance of Plant Ahd Machinery was to be paid

at the end of each month,

June premium was not paid yet.

(v) Rent was received for a year from 1 January 202A.

(vi) Completed goods should be transfened to Trading

Account at RM 200,000.

You are required to prepare:

(ai Manufacturing Account;

(b) lncome Statement (Trading Account Section Only). {16%)

(4Yo)

Prepared by : Mr. Wong f.S. , Mr. Gary Choo W.K.

, Ms. Tsai p.C.