0% found this document useful (0 votes)

157 views5 pagesLife Insurance Plan Details

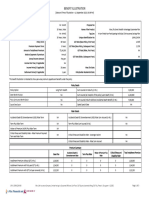

This document is a benefit illustration for a proposed Edelweiss Tokio Life Guaranteed Income STAR policy for ABC ABC aged 20. It shows that the annual premium would be Rs. 1,06,645 for a 36 year policy term with a 12 year premium paying term. It includes riders for accidental death and disability coverage. The sum assured on death is Rs. 10,00,000. It provides an annual guaranteed income of Rs. 33,820 starting at age 22 for 35 years, with death coverage of Rs. 10,00,000 throughout the policy term. It shows projected policy values and benefits for the first 7 years of the policy.

Uploaded by

Arvin DabasCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

157 views5 pagesLife Insurance Plan Details

This document is a benefit illustration for a proposed Edelweiss Tokio Life Guaranteed Income STAR policy for ABC ABC aged 20. It shows that the annual premium would be Rs. 1,06,645 for a 36 year policy term with a 12 year premium paying term. It includes riders for accidental death and disability coverage. The sum assured on death is Rs. 10,00,000. It provides an annual guaranteed income of Rs. 33,820 starting at age 22 for 35 years, with death coverage of Rs. 10,00,000 throughout the policy term. It shows projected policy values and benefits for the first 7 years of the policy.

Uploaded by

Arvin DabasCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd