0% found this document useful (0 votes)

55 views6 pagesFinance Essentials for Business Success

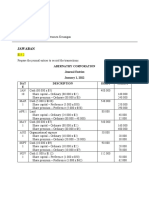

This document outlines a module to teach students about the role of finance in business and financial statement analysis. The module contains three sessions that introduce key finance concepts, the three primary financial statements, and how to analyze these statements. Students participate in activities like case studies, financial statement analysis, and a final case study presentation. The goal is for students to understand how finance supports business goals and decision-making and be able to evaluate a company's financial health through statement analysis.

Uploaded by

bernadette pacalaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

55 views6 pagesFinance Essentials for Business Success

This document outlines a module to teach students about the role of finance in business and financial statement analysis. The module contains three sessions that introduce key finance concepts, the three primary financial statements, and how to analyze these statements. Students participate in activities like case studies, financial statement analysis, and a final case study presentation. The goal is for students to understand how finance supports business goals and decision-making and be able to evaluate a company's financial health through statement analysis.

Uploaded by

bernadette pacalaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd