Professional Documents

Culture Documents

Babasab Patil: Debt Equity Ratio

Uploaded by

SUGAR MERCHANTOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Babasab Patil: Debt Equity Ratio

Uploaded by

SUGAR MERCHANTCopyright:

Available Formats

Ratio Analysis at NSL

II. Leverage Ratios

Leverage ratios are also known as capital structure ratio. These ratios indicate

mix of funds provided by owners & lenders. As a general rule these should be appropriate

mix debt & owners equity in financing the firm’s assets.

Leverage ratios are calculated to judge the long long-term financial position of

the company. Some of the popular leverage ratios are:

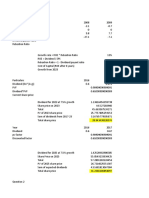

a. Debt-Equity Ratio

Debt-Equity ratio shows the relative contribution of creditors and owners. Debt-

Equity also known as External-Internal equity ratio. It is calculated to measure the

relative claims of outsiders against firm assets.

Debt-Equity Ratio = Total Debt

Net Worth

TABLE-2.1 Debt Equity Ratio

Year Total Debt Net Worth Ratio

2004-05 554110249 43052429 0.61

2005-06 499246293 63171947 0.62

2006-07 547168647 568828076 0.52

2007-08 565092766 570188858 0.82

2008-09 627397167 571266087 0.93

DEBT EQUITY RATIO

1

0.9

0.8

0.7

0.6

RATIO

0.5 0.93 Ratio

0.4 0.82

0.3 0.61 0.62

0.52

0.2

0.1

0

2004-05 2005-06 2006-07 2007-08 2008-09

YEAR

BABASAB PATIL 52

You might also like

- Graph of SailDocument12 pagesGraph of SailKshipra GoyalNo ratings yet

- CAMEL Analysis For Indian BanksDocument6 pagesCAMEL Analysis For Indian BanksRohit VargheseNo ratings yet

- Current Assets To Proprieors FundsDocument8 pagesCurrent Assets To Proprieors FundsindramuniNo ratings yet

- Godrej Agrovet LTD (GOAGRO In) - AyushDocument11 pagesGodrej Agrovet LTD (GOAGRO In) - AyushPraksh chandra Rajeek kumarNo ratings yet

- Current Ratio: Cash and Bank Balance To Current Assets RatioDocument6 pagesCurrent Ratio: Cash and Bank Balance To Current Assets RatioSocialist GopalNo ratings yet

- CAMEL Analysis For Indian BanksDocument10 pagesCAMEL Analysis For Indian BanksAbhishek Anand75% (4)

- Project ValuesDocument30 pagesProject ValueshariharanpNo ratings yet

- Summer Project: Comparative Study: Financial Analysis of Edelweiss Capital LTD - With Its CompetitorsDocument41 pagesSummer Project: Comparative Study: Financial Analysis of Edelweiss Capital LTD - With Its CompetitorsManisha SoniNo ratings yet

- Working Capital Analysis Of: Supraneet AryaDocument21 pagesWorking Capital Analysis Of: Supraneet Aryadeepak_chamaylNo ratings yet

- Working Capital Analysis Of: Supraneet AryaDocument20 pagesWorking Capital Analysis Of: Supraneet AryaSupraneet AryaNo ratings yet

- IndusDocument2 pagesIndusp229135.ictNo ratings yet

- Table 1 Summary StatisticsDocument2 pagesTable 1 Summary StatisticsLuz Marina ArboledaNo ratings yet

- Financial Ratio AnalysisDocument17 pagesFinancial Ratio Analysissarmad_bakhtNo ratings yet

- FM ReportDocument12 pagesFM ReportANKITA M SHARMANo ratings yet

- GraphDocument8 pagesGraphKumar AmitNo ratings yet

- Ratios For SugarDocument4 pagesRatios For SugaromairNo ratings yet

- Ambee Pharma Square Pharma Aci Beacon IBNSINA Marico Pharm Aid Orion Infusion Beximc o Pharma GSKDocument2 pagesAmbee Pharma Square Pharma Aci Beacon IBNSINA Marico Pharm Aid Orion Infusion Beximc o Pharma GSKRiazboniNo ratings yet

- Pakistan State Oil Company Limited (Pso)Document6 pagesPakistan State Oil Company Limited (Pso)Maaz HanifNo ratings yet

- Fundamental Analysis of Fertilizer SectorDocument13 pagesFundamental Analysis of Fertilizer SectorAmit SinghNo ratings yet

- Prob 0.05 Stock 1 Stock 2 Weights Mean Critical Value Mean 10 Mean 5 0 - 1.644854 SD 5 SD 2 SD Correlation - 0.3 1Document4 pagesProb 0.05 Stock 1 Stock 2 Weights Mean Critical Value Mean 10 Mean 5 0 - 1.644854 SD 5 SD 2 SD Correlation - 0.3 1Aditi BhiteNo ratings yet

- Calculation of Z ScoreDocument2 pagesCalculation of Z ScoreSk Jannatun Naeim Begum ChyNo ratings yet

- A Global Organisation: An Analysis of Marriott InternationalDocument22 pagesA Global Organisation: An Analysis of Marriott InternationalTulshi NaikNo ratings yet

- Interpretation R FinalDocument42 pagesInterpretation R FinalrifatbudhwaniNo ratings yet

- Dividend Policy Analysis HotelsDocument3 pagesDividend Policy Analysis Hotelsvineet383No ratings yet

- Data p3 Rskke FixDocument13 pagesData p3 Rskke FixpietzdeoNo ratings yet

- Financial Analysis: Pakistan Telecommunication LimitedDocument28 pagesFinancial Analysis: Pakistan Telecommunication LimitedSadiqa VahidNo ratings yet

- FSB - 01 - Reeby SportsDocument3 pagesFSB - 01 - Reeby SportsDhagash SanghaviNo ratings yet

- Historical and Industry Average Ratios For Sterling Company Ratio Actual 2004 Actual 2005 Actual 2006 Industry Average Time Series Cross SectionalDocument1 pageHistorical and Industry Average Ratios For Sterling Company Ratio Actual 2004 Actual 2005 Actual 2006 Industry Average Time Series Cross SectionalArslan MukhtarNo ratings yet

- Grow Well 1Document12 pagesGrow Well 1ShivamKumar DubeyNo ratings yet

- Hola Kola Case SolutionDocument5 pagesHola Kola Case SolutionMary Meza RivasNo ratings yet

- Campbell SoupsDocument2 pagesCampbell SoupsBhavesh MotwaniNo ratings yet

- Campbell Soups Company: Year 11 Year 10 Year 9 Net Sales Costs and ExpensesDocument2 pagesCampbell Soups Company: Year 11 Year 10 Year 9 Net Sales Costs and ExpensesBhavesh MotwaniNo ratings yet

- Comparison of All Mutual Funds: Anish Vyas Roll No: 2Document12 pagesComparison of All Mutual Funds: Anish Vyas Roll No: 2Anish VyasNo ratings yet

- Diatom 24Document191 pagesDiatom 24handikajati kusumaNo ratings yet

- AVG SD (-1) SD (+1) SD (+2SD) 1.04 (-2SD) 0.97 Male Female AVG 1.01 ### SD 0.02 0.04 Ttest 0.8642160062 P 0.05, Accept Null HypDocument4 pagesAVG SD (-1) SD (+1) SD (+2SD) 1.04 (-2SD) 0.97 Male Female AVG 1.01 ### SD 0.02 0.04 Ttest 0.8642160062 P 0.05, Accept Null HypSarah TseungNo ratings yet

- Research-Report - NMS ResourcesDocument5 pagesResearch-Report - NMS Resourcesvanshikaverma1704No ratings yet

- Beyond The Crisis Building For The Future: Michael Geoghegan, Group Chief ExecutiveDocument20 pagesBeyond The Crisis Building For The Future: Michael Geoghegan, Group Chief ExecutiveAbhilash SharmaNo ratings yet

- Financial Statements and Industry Structure, 2007: DescriptionDocument4 pagesFinancial Statements and Industry Structure, 2007: DescriptionFebriyani Tampubolon0% (1)

- Frpa Project FileDocument12 pagesFrpa Project FileSivapathi NANo ratings yet

- Analysis and Discussion 6.1 Current RatioDocument86 pagesAnalysis and Discussion 6.1 Current RatioMAYUGAMNo ratings yet

- Ride Price Calculation Sheet Inputs: Ride of Same Type in Park?Document7 pagesRide Price Calculation Sheet Inputs: Ride of Same Type in Park?Jhon IngNo ratings yet

- Data For Dabur IndiaDocument4 pagesData For Dabur IndiaKarma MaharjanNo ratings yet

- Ratio 3Document42 pagesRatio 3Komal KapilNo ratings yet

- UT-512 SCAN REPORT OUTLET Pump 2'' LP&HP V - 1401&V-1601Document4 pagesUT-512 SCAN REPORT OUTLET Pump 2'' LP&HP V - 1401&V-1601Zouhair BenmabroukNo ratings yet

- Group 07 22657 Sandeep S SDocument21 pagesGroup 07 22657 Sandeep S SSandeep ShirasangiNo ratings yet

- Ratio Analysis ProjectDocument53 pagesRatio Analysis ProjectSrinivas Reddy DondeletiNo ratings yet

- Toshiba Fraud CaseDocument23 pagesToshiba Fraud CaseShashank Varma100% (1)

- Performance Analysis of R. N. Spinning Mills Limited.Document10 pagesPerformance Analysis of R. N. Spinning Mills Limited.Axis StyleNo ratings yet

- Raj Packaging Industries: PrintDocument2 pagesRaj Packaging Industries: PrintRAKESH VARMANo ratings yet

- Company Info - Print FinancialsDocument2 pagesCompany Info - Print FinancialsKavitha prabhakaranNo ratings yet

- Financial and Stock MarketDocument12 pagesFinancial and Stock MarketYogyata MishraNo ratings yet

- SAMPLE Financial RatiosDocument26 pagesSAMPLE Financial RatiosJeryl RautrautNo ratings yet

- Case-2 Airline Profitability AnalysisDocument4 pagesCase-2 Airline Profitability AnalysisHaseeb Razzaq MinhasNo ratings yet

- 04 Chapter-4Document50 pages04 Chapter-4Khushi LakhaniNo ratings yet

- Padmavati Palace RA03Document11 pagesPadmavati Palace RA03Abhishek PandeyNo ratings yet

- Awikwok 1Document9 pagesAwikwok 1Durriyah AmiiNo ratings yet

- Maryam Finance Project-1-11Document1 pageMaryam Finance Project-1-11Tutii FarutiNo ratings yet

- Capital Structure: Presented by Group 10 Abhishek Modi Amit Agarwal Archanaa .K Ayush Agarwal Sadaf Ali KhanDocument21 pagesCapital Structure: Presented by Group 10 Abhishek Modi Amit Agarwal Archanaa .K Ayush Agarwal Sadaf Ali KhanAlisha Ashish100% (1)

- Math Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesFrom EverandMath Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesRating: 5 out of 5 stars5/5 (3)

- Credit Securitisations and Derivatives: Challenges for the Global MarketsFrom EverandCredit Securitisations and Derivatives: Challenges for the Global MarketsNo ratings yet