Professional Documents

Culture Documents

The ICT New York Killzone

Uploaded by

huda EcharkaouiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The ICT New York Killzone

Uploaded by

huda EcharkaouiCopyright:

Available Formats

1

The ICT New York Killzone

ICT concepts used in this module

o Importance of time and price

o New York open

o New York session

o Important characteristics of the New York session

New York open

o Major pairs that are coupled with DXY or Dollar are ideal trading pair of the day

o New York open frequently sets up an optimal trade entry pattern that can offer 20 to 30 pips

as a scalp

o ICT New York kill zone = 7am to 9am New York time

o Dollar based Cross will give you a set up between 7 a.m. and 9 a.m. New York time

o it's the easiest time to trade because we have London and New York overlap

o every pair doesn't have a set up every New York open but every New York open has a set up

in one or more of the majors that are crossed with the dollar

New York Session

o The price action during the New York session sees a consistent round of economic news

releases

o New York trading session extends beyond 9am to 2:00 pm New York time

ICT MARKET MAKER PREMIER COURSE ADITYA SIDDHARTHA ROY

2

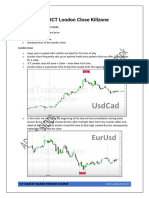

o In this both Eg, we can see power 3 formation

o we have a previous low; it rallies up & retrace back with OTE entry to previous day low to

session low = opportunity for long

New York session characteristics

o New York session typically has two potential scenarios continuation of London's move for a

complete reversal on the daily direction

o when the daily chart is in a clear one-sided momentum it is easiest to look with confirmation

of that direction in the London price action

for example, if London agrees with the daily chart being bullish that means we should be

seeing a low form in London we would anticipate a retracement lower into New York open

and

o in agreement with that daily bias so we would anticipate a New York low to post a

continuation setup or optimal trade entry by again reversals

ICT MARKET MAKER PREMIER COURSE ADITYA SIDDHARTHA ROY

You might also like

- The ICT London Close KillzoneDocument3 pagesThe ICT London Close Killzonehuda EcharkaouiNo ratings yet

- ICT London Kill ZoneDocument3 pagesICT London Kill Zoneazhar500100% (3)

- SMART MONEY CONCEPTS STRATEGY - The Prop TraderDocument20 pagesSMART MONEY CONCEPTS STRATEGY - The Prop Traderyoussner327No ratings yet

- ICT Forex - Trading The Key Swing PointsDocument4 pagesICT Forex - Trading The Key Swing Pointshuda EcharkaouiNo ratings yet

- Notes On - ICT Forex - Trading The Key SwingDocument8 pagesNotes On - ICT Forex - Trading The Key Swingsurendra Kumar100% (1)

- Best Times To Trade The Forex Markets - A GuideDocument14 pagesBest Times To Trade The Forex Markets - A GuidemohalidhNo ratings yet

- Notes On - ICT Forex - Trading The Key Swing PointsDocument10 pagesNotes On - ICT Forex - Trading The Key Swing Pointssaiful100% (1)

- London Forex Rush ManualDocument56 pagesLondon Forex Rush ManualBogdanC-tin100% (3)

- 7 Good Times To Enter ForexDocument15 pages7 Good Times To Enter Forexjayjonbeach100% (2)

- London For Ex RushDocument56 pagesLondon For Ex RushTengku Budiman100% (2)

- When To TradeDocument2 pagesWhen To Tradektlogesh48No ratings yet

- Summary On ForexDocument16 pagesSummary On ForexMworozi DicksonNo ratings yet

- London Forex RushDocument56 pagesLondon Forex RushM Syahrizal100% (1)

- 10% of The Account Is To High 5% of The Account Is Too HighDocument6 pages10% of The Account Is To High 5% of The Account Is Too HighAnder RomanNo ratings yet

- How To Use DTCC & Case StudiesDocument4 pagesHow To Use DTCC & Case StudiesJames PNo ratings yet

- Big Ben Trading StrategyDocument4 pagesBig Ben Trading StrategyMario CruzNo ratings yet

- The ICT Asian KillzoneDocument3 pagesThe ICT Asian Killzoneazhar500No ratings yet

- Forex SessionsDocument5 pagesForex SessionsKanickai DsouzaNo ratings yet

- Intraday Currency Market Volatility Turnover RBA 2007Document9 pagesIntraday Currency Market Volatility Turnover RBA 2007silvofNo ratings yet

- Simplified ICT by - GeminiDocument34 pagesSimplified ICT by - GeminiramolotsiwillieNo ratings yet

- Personal Dev..Document9 pagesPersonal Dev..Chris AsareNo ratings yet

- Essentials To ICT Market Structure1Document4 pagesEssentials To ICT Market Structure1huda EcharkaouiNo ratings yet

- Forex Hours Market SessionsDocument9 pagesForex Hours Market SessionsShamil Ps100% (3)

- MentoringDocument24 pagesMentoringVarun Vasurendran100% (1)

- Best Times To Trade ForexDocument23 pagesBest Times To Trade ForexInternational Business Times100% (2)

- Learnforexforex Trading SessionsDocument13 pagesLearnforexforex Trading Sessionslewgraves33No ratings yet

- ICT Forex Money Concept A Z Day Trading Practical Guide To ICT StrategyDocument43 pagesICT Forex Money Concept A Z Day Trading Practical Guide To ICT StrategyHarith Zar50% (2)

- Mentoring Session 4, Day 2: 25 May 2021 World Markets, VIX & Trading IdeasDocument18 pagesMentoring Session 4, Day 2: 25 May 2021 World Markets, VIX & Trading Ideaslakshmipathihsr64246No ratings yet

- ICT Forex - Implementing The Asian RangeDocument4 pagesICT Forex - Implementing The Asian Rangeazhar500No ratings yet

- Lesson 1Document21 pagesLesson 1Lone chanelNo ratings yet

- Time & Price TheoryDocument2 pagesTime & Price TheoryPlanet Travis0% (2)

- AcdDocument47 pagesAcdrandz8No ratings yet

- Basic Theory: The Forex Market Is Unique For The Following ReasonsDocument5 pagesBasic Theory: The Forex Market Is Unique For The Following ReasonsjuliethNo ratings yet

- PIPS30 Ultimate Forex GuideDocument76 pagesPIPS30 Ultimate Forex GuideadelowokanpelumijuliusNo ratings yet

- Learnforexcan Trade Forex Tokyo SessionDocument9 pagesLearnforexcan Trade Forex Tokyo Sessionlewgraves33No ratings yet

- Trading London TimeDocument9 pagesTrading London TimeOnique MilnaNo ratings yet

- ICT SauceDocument12 pagesICT SauceP E T A N100% (1)

- 7 The Normal and Other Continuous DistributionsDocument33 pages7 The Normal and Other Continuous Distributionsbullfinch2No ratings yet

- Characteristics of Forex MarketDocument12 pagesCharacteristics of Forex MarketANEESHNo ratings yet

- ICT Kill ZonesDocument9 pagesICT Kill ZonesArif Agustian100% (6)

- Lecture 3: The Foreign Exchange MarketDocument7 pagesLecture 3: The Foreign Exchange MarketEmil VoldNo ratings yet

- Introduction To Forex MarketsDocument26 pagesIntroduction To Forex MarketsRonald GacetaNo ratings yet

- NYAM Session Full GuideDocument7 pagesNYAM Session Full Guidedjstro15No ratings yet

- Time Element - Component Two - Unicorn Entry ModelDocument5 pagesTime Element - Component Two - Unicorn Entry ModelbacreatheNo ratings yet

- Scalping With Market Depth Lesson 2Document14 pagesScalping With Market Depth Lesson 2saied jaberNo ratings yet

- Best Times To Trade The Forex Market PDFDocument7 pagesBest Times To Trade The Forex Market PDFDarshana Shasthri NakandalaNo ratings yet

- D1 Trading Intro - Broker - Trading PlatformDocument36 pagesD1 Trading Intro - Broker - Trading Platformmbbs anthemNo ratings yet

- Summary of Al Brooks's Trading Price Action TrendsFrom EverandSummary of Al Brooks's Trading Price Action TrendsRating: 5 out of 5 stars5/5 (1)

- Bluemax IntroDocument35 pagesBluemax Intronazim100% (1)

- An easy approach to the forex trading: An introductory guide on the Forex Trading and the most effective strategies to work in the currency marketFrom EverandAn easy approach to the forex trading: An introductory guide on the Forex Trading and the most effective strategies to work in the currency marketRating: 5 out of 5 stars5/5 (2)

- Basic Concepts For The Currencies MarketDocument11 pagesBasic Concepts For The Currencies MarketRahul DevNo ratings yet

- Role of RBI in FOREX MarketDocument14 pagesRole of RBI in FOREX Marketcoolboy60375% (8)

- The Weekly BiasDocument2 pagesThe Weekly Biasazhar500No ratings yet

- Capital Management Academy: CopresentedDocument341 pagesCapital Management Academy: CopresentedAlqaab ArshadNo ratings yet

- Analysis of Intraday Trading of Index Option in Ko PDFDocument10 pagesAnalysis of Intraday Trading of Index Option in Ko PDFRakesh SinghaNo ratings yet

- Big Ben Breakout Strategy PDFDocument18 pagesBig Ben Breakout Strategy PDFegdejuanaNo ratings yet

- Learnforexnew York SessionDocument8 pagesLearnforexnew York Sessionlewgraves33No ratings yet

- 17 Currency MarketDocument26 pages17 Currency MarketGarv JainNo ratings yet

- Daily Trade Plan Development in Action (Step 5) : Key TakeawaysDocument3 pagesDaily Trade Plan Development in Action (Step 5) : Key TakeawaysJean Claude DavidNo ratings yet

- ICT Forex - Secrets To Swing TradingDocument3 pagesICT Forex - Secrets To Swing Tradinghuda EcharkaouiNo ratings yet

- ICT Forex - Higher Time Frame ConceptsDocument2 pagesICT Forex - Higher Time Frame Conceptshuda EcharkaouiNo ratings yet

- ICT Forex - The ICT Smart Money Technique or SMTDocument2 pagesICT Forex - The ICT Smart Money Technique or SMThuda EcharkaouiNo ratings yet

- ICT Forex - Understanding The ICT Judas SwingDocument2 pagesICT Forex - Understanding The ICT Judas Swinghuda EcharkaouiNo ratings yet