Professional Documents

Culture Documents

Working Capital Financing

Working Capital Financing

Uploaded by

Nandini jagdish Raula0 ratings0% found this document useful (0 votes)

2 views2 pagesGives information about the working capital finance

Original Title

working capital financing

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentGives information about the working capital finance

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views2 pagesWorking Capital Financing

Working Capital Financing

Uploaded by

Nandini jagdish RaulaGives information about the working capital finance

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

MPB

Pointsto Remember

also meant as circulating

capital.

capitalis with the acquisition of raw material for

Working cycle begins

capital receivables. cash and ends

(1) Workingcollection

2) of

withthe importarnttypes of working capital are groSs working capital,,net

Some ofthe

(3) working capital, negative working capital,

capital, positivecapital, etc. worktinagl,

initial working capi

regularworking working capital requirements are - nature of

Factors determining and time

(4) business unit, cost

circulating capital, inflation, etc.

involved in

manufacturing

process, businturnover

ess, size ofof

(5)

Working capital has to be financed trom short term sources of funds

Reserve Bank of India (RBI) is the Central Bank of India.

(6) RBI

requlates the entire banking system through its monetary policy.

(8) RBI frames policies relating to priority sector lending.

(9) RRL decides on concessional interest rates for lending finance to

strategic importance.

certain cen.

(10) RBI indirectly through its chain of commercial banks helps in

activities. corporate finance

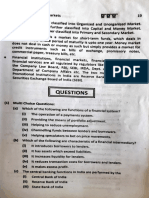

Questions for Self-Practice

OBJECTIVE QUESTIONS

() Fillin the blanks:

(1) Working Capital is also called as capital.

(2) management involves managing the

payables and cash. inventory, receivables,

(3) In case of inadequate working capital situation, the firm

runs the risk of

(4) Current assets have a life span and are quickly transformed into

other asset forms.

(5) indicates the length of time between a company's purchasing

materials, entering into stock and receiving the cash from sales of finished

goods.

[Ans.: (1) Net Current Assets; (2) Working Capital; (3) Insolvency: (49) Short

(5) Working Capital Cycle]

(I) State whether the following statements are True or False:

(1) When the processing time is not given, calculation of stock of work-in-progfess

should be ignored. month then

(2) If wages are paid at the beginning of every month for the previous

the period of lag in payment of wages is one month.

Debtors may be valued at cost of the goods sold on credit or at selling price.

(3)

(4) In the absence of specific instructions while calculating work-in-progress it is

assumed that labour and overheads OcCur evenly.

always.

(5) Provision for contingencies is to be taken at 10% of working capital

working capital during

(6) Seasonal industries like Sugar and Oil require more

season and less working capital during slack seasons.

(7) Adequate working capital ensures credit standing of the firm.

(8) Working capital is estimated for the previous financial year. Materials,

(9) Work-in-progress in working capital includes Average Stock of Raw

Labour and Overheads.

Assets then working

(10) If Liability decreases more than decrease in Current

capital also decreases.

(11) Working capital requirement is high when supply of Raw Material is low.

(12) Under the Gross WorkingCapital Concept, Working Capital = Current Assets.

(13) Gross workingcapital = Current Assets - Current Liabilities,

(14) High Bank overdraft means high working capital.

(15) Temporary working capital is also known as core working capital.

(16) Term loan iSan advance given by bank to its customers. (April 19)

(17) Depreciation is an external source of finance. (April 19)

(18) In case of inadequate working capital situation, the firm runs the risk of

insolvency. (Oct. 19)

(19) A firm using labour oriented technology will require more working capital to pay

labour wages regularly. (Oct. 19)

of

(20) Marketable Securities are temporary short term investments made out

surplus cash balance. (Oct. 19)

liabilities are

(21) Zero working capital is when both current assets and current

equal. (0ct. 19)

True;

[Ans.: (1) True; (2) False; (3) True; (4) True; (5) False; (6) True; (7) False;

(8) False; (9) True; (10) False; (11) True; (12)True; True; (13) False; (14)

(15) False; (16) False; (17) False; (18) True; (19) (20) True; (21) True]

(I) Match the column: Column 'B'

Column A'

(1) Gross Working Capital () Not Considered in calculation of working capital

(2) Net Working Capital (iü) Short Term Funds

(3) Depreciation (ii) ldle Funds

(4) Working Capital Need (iv) Current Assets

(5) Large Working Capital (v) Term Loan

(vi) CA minus CL

[Ans.: (1 - iv); (2- vi); (3 - i); (4- i); (5 - ii)]

(M) Multiple choice questions: years. (April 19)

(0) Public deposits are accepted for a maximum of

(a) 1 (b) 2

(c) 3 (d) 5

guidelines issued by

(<) In India, Commercial Papers are issued as per the

(April 19)

(a) SEBI (b) RBI

(c) Forward Market Commission (d) None of the Above

19)

(3

is the most liquid item of current assets. (Oct.

(a) Cash (b) Stock

(c) Debtors

19)

(9) High tax rates demands amount of Working Capital. (Oct.

(a) less (b) more

(c) none of these

Ans.: (1 -c); (2- b): (3-a); (4 -

b)]

You might also like

- Accounting 2019 v2.0: IA2 High-Level Annotated Sample ResponseDocument9 pagesAccounting 2019 v2.0: IA2 High-Level Annotated Sample ResponseOliverNo ratings yet

- Test Bank Partnership Accounting and Reporting Multiple Choice 1. Topic: Partnership Characteristics LO1Document44 pagesTest Bank Partnership Accounting and Reporting Multiple Choice 1. Topic: Partnership Characteristics LO1Wendelyn Tutor100% (1)

- A Roadmap To Accounting For Equity Method Investments and Joint Ventures - November 2020Document253 pagesA Roadmap To Accounting For Equity Method Investments and Joint Ventures - November 2020pravinreddyNo ratings yet

- Income From Business-ProblemsDocument20 pagesIncome From Business-Problems24.7upskill Lakshmi V100% (1)

- Financial Management (FM) Question Pack: S. No ACCA Exam Paper Topics CoveredDocument34 pagesFinancial Management (FM) Question Pack: S. No ACCA Exam Paper Topics CoveredKoketso Mogwe100% (1)

- Academy of Finance - PTP, Otc, RTR - Londonsam Polska 2019 PDFDocument9 pagesAcademy of Finance - PTP, Otc, RTR - Londonsam Polska 2019 PDFJinore GomaceNo ratings yet

- Kamal Kant Sharma MBA 02313703920 FMDocument22 pagesKamal Kant Sharma MBA 02313703920 FMKANISHKA SHARMANo ratings yet

- 2020 Summer Maharashtra State Baord STD 12 Commerce Past Exam Question Papers Downlaod SPDocument2 pages2020 Summer Maharashtra State Baord STD 12 Commerce Past Exam Question Papers Downlaod SPAshwini NaleNo ratings yet

- Secretarial Practical March 2020 STD 12th Commerce HSC Maharashtra Board Question PaperDocument2 pagesSecretarial Practical March 2020 STD 12th Commerce HSC Maharashtra Board Question PaperShubham ParmarNo ratings yet

- Secretarial Practical March 2020 STD 12th Commerce HSC Maharashtra Board Question PaperDocument2 pagesSecretarial Practical March 2020 STD 12th Commerce HSC Maharashtra Board Question PaperShubham ParmarNo ratings yet

- Management Accounting Chapter 4Document17 pagesManagement Accounting Chapter 4Sonia BhavnaniNo ratings yet

- OCM July 2022Document2 pagesOCM July 2022harshu harshuNo ratings yet

- Working Capital ManagementDocument20 pagesWorking Capital ManagementHarshita ChoudharyNo ratings yet

- Project Management Project ManagementDocument11 pagesProject Management Project ManagementSwapnil PatilNo ratings yet

- Figures: Time: Three Hours MarginDocument7 pagesFigures: Time: Three Hours MarginNABAJYOTI KUMARNo ratings yet

- SP Sept '21Document4 pagesSP Sept '21gauriwani0209No ratings yet

- Preboard 3 EcoDocument8 pagesPreboard 3 EcoSuganthi VNo ratings yet

- SP PaperDocument11 pagesSP Paper9137373282abcdNo ratings yet

- Paper 13 Operations and Project Management & Control June 2004Document5 pagesPaper 13 Operations and Project Management & Control June 2004api-19931402No ratings yet

- Managementof Working CapitalDocument31 pagesManagementof Working CapitalSuperintending Engineer Quality Assurance UnitNo ratings yet

- Ded 2012Document4 pagesDed 2012SVS ShanthaNo ratings yet

- Chapter (1) Elementary Accounting Equation: Lcci Level I & IiDocument4 pagesChapter (1) Elementary Accounting Equation: Lcci Level I & IiJames MilzerNo ratings yet

- 17 ImeDocument6 pages17 ImeRegg ParkerNo ratings yet

- Working Capital ManagementDocument62 pagesWorking Capital ManagementAditya B raghavNo ratings yet

- FM - Working Capital Mgmt. (Cir.24.3.2020)Document80 pagesFM - Working Capital Mgmt. (Cir.24.3.2020)Owais KadiriNo ratings yet

- Key Words: Multiple Choice QuestionsDocument7 pagesKey Words: Multiple Choice QuestionsMOHAMMED AMIN SHAIKHNo ratings yet

- PTP PP OS v0.2Document27 pagesPTP PP OS v0.2sanketpavi21No ratings yet

- SP March 2022Document3 pagesSP March 2022Niranjan JadhavNo ratings yet

- The Title of KingdomDocument6 pagesThe Title of KingdomKailash RNo ratings yet

- P5 PDFDocument20 pagesP5 PDFTeddy BearNo ratings yet

- Paper-5: Financial Accounting: Answer To PTP - Intermediate - Syllabus 2008 - Jun 2014 - Set 3Document21 pagesPaper-5: Financial Accounting: Answer To PTP - Intermediate - Syllabus 2008 - Jun 2014 - Set 3Joseph VarshaNo ratings yet

- Banking PaperDocument11 pagesBanking Paperrekha sainiNo ratings yet

- Secretarial Practical March 2019 STD 12th Commerce HSC Maharashtra Board Question Paper PDFDocument2 pagesSecretarial Practical March 2019 STD 12th Commerce HSC Maharashtra Board Question Paper PDFPratik TekawadeNo ratings yet

- Secretarial Practical March 2019 STD 12th Commerce HSC Maharashtra Board Question PaperDocument2 pagesSecretarial Practical March 2019 STD 12th Commerce HSC Maharashtra Board Question PaperPratik TekawadeNo ratings yet

- Securities Laws and Regulation of Financial MarketsDocument4 pagesSecurities Laws and Regulation of Financial MarketsAtul PatelNo ratings yet

- Form 4 - Statement Relating To The Accounts of A Holder of A Capital Markets Services Licence - Supplementary Information (Ver 8 Oct 2018)Document3 pagesForm 4 - Statement Relating To The Accounts of A Holder of A Capital Markets Services Licence - Supplementary Information (Ver 8 Oct 2018)Cheong KokYungNo ratings yet

- BK - July Board 2023Document11 pagesBK - July Board 2023akshaydevendra09No ratings yet

- Accounting Principle & Assumption - DPPDocument2 pagesAccounting Principle & Assumption - DPPRounak PanjaNo ratings yet

- Accounting Round 1 Ans KeyDocument21 pagesAccounting Round 1 Ans KeyMalhar ShahNo ratings yet

- Objectives, Case Based Que of TS GrewalDocument42 pagesObjectives, Case Based Que of TS Grewalmamta.bdvrrmaNo ratings yet

- QR Code Collage of Objectives TypeDocument29 pagesQR Code Collage of Objectives Typejaychhugani594No ratings yet

- Worksheet 02Document2 pagesWorksheet 02LuckyNo ratings yet

- Paper5 Set1Document6 pagesPaper5 Set1TarunNo ratings yet

- Board Question Paper: March 2014: Std. XII: CommerceDocument2 pagesBoard Question Paper: March 2014: Std. XII: CommerceRaj MishraNo ratings yet

- UntitledDocument9 pagesUntitledLincoln SoetzenbergNo ratings yet

- Ev 2Document9 pagesEv 2minita sharmaNo ratings yet

- Chapter 1,2&3 Back ExcerciseDocument15 pagesChapter 1,2&3 Back ExcerciseParth GargNo ratings yet

- Worksheet 03Document4 pagesWorksheet 03LuckyNo ratings yet

- XII Economics Guess Paper - 1Document5 pagesXII Economics Guess Paper - 1kawaljeetsingh121666No ratings yet

- Practice Test 01 - Accountancy Test Solution - (Aarambh 2.0 2024)Document5 pagesPractice Test 01 - Accountancy Test Solution - (Aarambh 2.0 2024)Kanishk SawaliyaNo ratings yet

- Overview of Working Capital Management (WCM)Document30 pagesOverview of Working Capital Management (WCM)NameNo ratings yet

- ACCOUNTANCY CLASS XI QUESTION PAPER 2023-24 FinalDocument2 pagesACCOUNTANCY CLASS XI QUESTION PAPER 2023-24 Finalashmitamor10No ratings yet

- Collage of Objectives TypeDocument32 pagesCollage of Objectives TypeAnadi AgarwalNo ratings yet

- Cbse Class 12 Economics Sample Paper Set 3 QuestionsDocument6 pagesCbse Class 12 Economics Sample Paper Set 3 QuestionsPhototronixNo ratings yet

- Roll No Time Allowed: 3 Hours Maximum Marks: 100 Total Number of Questions: 8 Total Number of Printed Pages: 7Document7 pagesRoll No Time Allowed: 3 Hours Maximum Marks: 100 Total Number of Questions: 8 Total Number of Printed Pages: 7sheena2saNo ratings yet

- Paper5 Set1 SolDocument16 pagesPaper5 Set1 SolmvsvvksNo ratings yet

- Chapter 3 - IAS 23Document5 pagesChapter 3 - IAS 23Chandan SamalNo ratings yet

- MA 2.1-Financial StatementDocument57 pagesMA 2.1-Financial Statementvini2710100% (1)

- Chapter 1 - Intro To CFDocument2 pagesChapter 1 - Intro To CFParth GargNo ratings yet

- Examination: Subject CA1 Core Applications Concepts Paper 1 (Assets)Document3 pagesExamination: Subject CA1 Core Applications Concepts Paper 1 (Assets)Saad MalikNo ratings yet

- EC Sample Paper 20 UnsolvedDocument8 pagesEC Sample Paper 20 Unsolvedmanjotsingh.000941No ratings yet

- CBSE Class 12 Acc Notes Financial Statements of A CompanyDocument16 pagesCBSE Class 12 Acc Notes Financial Statements of A CompanyDevanshi Agarwal100% (1)

- RKG Guess Paper 1Document7 pagesRKG Guess Paper 1krishnabagla373No ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- (Score For Question 1: - of 5 Points) : Math - Graded Assignment - Unit Test, Part 2 - IncomeDocument2 pages(Score For Question 1: - of 5 Points) : Math - Graded Assignment - Unit Test, Part 2 - IncomeGracie CroneNo ratings yet

- Legal Reasearch CaseDocument5 pagesLegal Reasearch Casewenny capplemanNo ratings yet

- Credit Tran PNB Vs Producer's WarehouseDocument9 pagesCredit Tran PNB Vs Producer's WarehouseNilsaNo ratings yet

- Coblaw 2Document3 pagesCoblaw 2Eana RanilloNo ratings yet

- LAWDocument11 pagesLAWGlance Piscasio CruzNo ratings yet

- MemorandumDocument11 pagesMemorandumSteve ArakaNo ratings yet

- (9781589061620 - International Monetary Fund Annual Report 2002) International Monetary Fund Annual Report 2002Document233 pages(9781589061620 - International Monetary Fund Annual Report 2002) International Monetary Fund Annual Report 2002Juasadf IesafNo ratings yet

- Chapter 2 Accounting ElementsDocument40 pagesChapter 2 Accounting ElementsVivek GargNo ratings yet

- Financial and Managerial Accounting 13th Edition Warren Solutions Manual DownloadDocument47 pagesFinancial and Managerial Accounting 13th Edition Warren Solutions Manual DownloadElizabethLewisixmt100% (45)

- 5459Document68 pages5459alicewilliams83nNo ratings yet

- Tutorial 2 Business Entities #1Document3 pagesTutorial 2 Business Entities #1Shannan RichardsNo ratings yet

- 02-People of The Philippines-V. ConcepcionDocument2 pages02-People of The Philippines-V. ConcepcionBibi JumpolNo ratings yet

- Forms of Business Organisation: Chapter - 2Document34 pagesForms of Business Organisation: Chapter - 2Tanmay AroraNo ratings yet

- What Are The Modes of Winding Up of The CompaniesDocument3 pagesWhat Are The Modes of Winding Up of The CompaniesMahesh SNo ratings yet

- Lebanon's Economy An Analysis and Some Recommendations: Esther Baroudy & Hady Farah 20 January 2020Document17 pagesLebanon's Economy An Analysis and Some Recommendations: Esther Baroudy & Hady Farah 20 January 2020terryhadyNo ratings yet

- Test 1 Maf653 April 2018 Latest-SolutionDocument9 pagesTest 1 Maf653 April 2018 Latest-SolutionFakhrul Haziq Md FarisNo ratings yet

- Bounced Cheques in The UAEDocument16 pagesBounced Cheques in The UAEfortune xiuNo ratings yet

- Respondent 17th Surana & Surana National Corporate Law Moot Court-2019Document26 pagesRespondent 17th Surana & Surana National Corporate Law Moot Court-2019AyushNo ratings yet

- Midterm Quiz 1 (Basic Concepts and Principles On Extinguishment of Obligations) SubmissionsDocument3 pagesMidterm Quiz 1 (Basic Concepts and Principles On Extinguishment of Obligations) SubmissionsJinky ValdezNo ratings yet

- Financial Statements and RatiosDocument27 pagesFinancial Statements and RatiosIoana MariucaNo ratings yet

- 2023 BCT Diploma (Specialising in Software Development & Programming) - PC Support and Networking Year 1Document2 pages2023 BCT Diploma (Specialising in Software Development & Programming) - PC Support and Networking Year 1sibekothabani7No ratings yet

- DLP Fs Analysis Concepts and FormatDocument14 pagesDLP Fs Analysis Concepts and FormatDia Did L. RadNo ratings yet

- 1/Ct & Re (A2) 04-Jan-2010: Government of Tamilnadu Treasury Bill For Salary (Employee)Document3 pages1/Ct & Re (A2) 04-Jan-2010: Government of Tamilnadu Treasury Bill For Salary (Employee)PRAVEENKUMAR MNo ratings yet

- Harrison Chapter 5 Student 6 CeDocument46 pagesHarrison Chapter 5 Student 6 CeAliyan AmjadNo ratings yet

- Fin430 - Dec2019Document6 pagesFin430 - Dec2019nurinsabyhahNo ratings yet