Professional Documents

Culture Documents

Pan Card Application Form

Pan Card Application Form

Uploaded by

peeyush dwivediCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pan Card Application Form

Pan Card Application Form

Uploaded by

peeyush dwivediCopyright:

Available Formats

INSTRUCTIONS FOR FILLING FORM 49A

(a) (b) (c) (d) (e) (f) (g) (h) Form to be filled legibly in BLOCK LETTERS and in BLACK INK only. Each box, wherever provided, should contain only one character (alphabet/number/punctuation sign) leaving a blank box after each word. 'Individual' applicants should affix a recent colour photograph (size 3.5 cm x 2.5 cm) in the space provided on the form. The photograph should not be stapled or clipped to the form. (The clarity of image on PAN card will depend on the quality and clarity of photograph affixed on the form.) Signature /Left thumb impression should only be within the box provided in the form. The signature should not be on the photograph. If there is any mark on the photograph such that it hinders the clear visibility of the face of the applicant, the application will not be accepted. Thumb impression, if used, should be attested by a Magistrate or a Notary Public or a Gazetted Officer, under official seal and stamp. Applicants are required to provide their Ward/Circle, Range and Commissioner details in the application. These details can be obtained from the Income Tax Office. Area Code, AO Type, Range Code and AO Number must be filled up by the applicant. If the applicant is unable to determine the details, TIN Facilitation Centre (TIN-FC) may assist it in doing so. Applicant can also search for its AO details on http://tin.nsdl.com

Guidelines for filling the form Individuals must state full expanded name. Do not use abbreviations and initials. Single and two characters in Last Name and First Name except OM, DE, UR, UL and AL are treated as initials. For example Jasjit Singh Anand should be written as: Last Name/Surname First Name Middle Name ANAND JASJIT SINGH Applicants other than 'Individuals' i.e. Non-Individuals, must ignore above instructions. Non-Individuals will write their full name starting from the first block of Last Name/Surname. If the name is longer than the space provided for the last name, it can be continued in the space provided for First and Middle Name. For example: Last Name/Surname First Name Middle Name NATIONAL SECURITIES DEPOSITORY LIMITED HUFs will mention (HUF) within brackets after their full name. For example: Last Name/Surname First Name Middle Name JASJIT SINGH ANAND (HUF) In case of Company, the name should be provided without any abbreviations. For example, different variations of 'Private Limited' viz. Pvt Ltd, Private Ltd, Pvt Limited, P Ltd, P. Ltd., P. Ltd are not allowed. It should be 'Private Limited' only. In case of sole proprietorship concern, the sole proprietor should use/apply PAN in his/her personal name. Name should not be prefixed with titles such as Shri, Smt, Kumari, Dr., Major, M/s etc. Individual applicants are allowed to provide abbreviated 'name to be printed on the card'. The abbreviated name should necessarily contain the expanded last name. For example Last Name/Surname First Name Middle Name RAVAL RUTVIJ ATULBHAI can be written as, RUTVIJ ATULBHAI RAVAL R. A. RAVAL RUTVIJ A. RAVAL 'Name to be printed on the card' for individuals should contain maximum 25 characters. 'Name to be printed on the card' for Non- Individual applicants should be same as last name field in Item No.1 above. If applicant selects 'Yes', then it is mandatory to provide details of the other name. Instructions in Item No.1 with respect to name apply here. Applicable to Individuals only. Instructions in Item No.1 with respect to name apply here. Married women applicants should give only father's name and not husband's name. R - Residential Address: Out of first four fields, applicant must fill up at least two fields. Further, Town/City/District, State/Union Territory and PIN are mandatory. Applicants other than Individuals/HUF will leave this field (Residential address) blank. O - Office Address: (1) In case of Individuals/HUF, if Item No.6 (Address for Communication) is selected as "O" then Office Address is mandatory. (2) Name of Office and address to be mentioned in case of individuals having source of income as salary [Item No.13 (a)]. (3) In case of other applicants, name of office and address is mandatory. (4) For all category of applicants out of first four fields, at least two fields are mandatory (5) Town/City/District, State/Union Territory and PIN are mandatory. 'R' means Residence and 'O' means Office. Individuals/HUFs may indicate either 'R' or 'O' and other applicants will necessarily indicate 'O' as the Address for Communication. All future communication will be sent at the address indicated in this field. (1) If Telephone Number is mentioned, STD Code is mandatory. (2) In case of mobile number, country code should be mentioned as STD Code STD Code Tel. No.

Item No. Item Details 1. Full Name

2.

Name you would like printed on the card

3. 4. 5.

Have you ever been known by any other name ? Fathers Name Address Residential and Office

6.

Address for Communication Telephone Number and e-mail ID

7.

8. 9. 10.

Sex Status of Applicant Date of Birth/ Incorporation/Agreement /Partnership or Trust Deed/Formation of Body of Individuals/ Association of Persons.

Where '91' is the country code of India. (3) It is suggested that applicants mention their telephone number so that they can be contacted in case of any discrepancy in the application form. (4) Applicants may provide their valid e-mail id for receiving PAN through email. This field is mandatory for Individuals Field should be left blank in case of other applicants. This field is mandatory for all categories of applicants. Date can not be a future date. Date: 2nd August 1975 should be written as

0 2 DD

0 8 MM

9 7 5 YYYY

Relevant date for different category of applicants is: Individual: Actual Date of Birth; Company: Date of Incorporation; Association of Persons: Date of Formation/Creation; Association of Persons (Trusts): Date of Creation of Trust Deed; Partnership Firms: Date of Partnership Deed; HUFs: Date of Creation of HUF and for ancestral HUF date can be 01010001 where the date of creation is not available.

V. 1.0

11. 12. 13 (b) 13 (c) 14.

Registration Number Citizen of India Nature and Code of Business/Profession Others Name and address of Representative Assessee Proof of Identity and Address

Not applicable to Individuals and HUFs. Mandatory for 'Company'. Company should mention registration number issued by the Registrar of Companies. Other applicants may mention registration number issued by any State or Central Government Authority. This field is mandatory for all categories of applicants. In case of salaried employee this is a mandatory field and Name of Organiation should be mentioned. This field should be specified if applicant is not covered under 13 (a) or 13 (c). Corresponding Business/Profession Code should be mentioned from the list given in Point No. (e) below (General Information for PAN Applicants). Applicants not covered by column 13(a) and 13(b) must mention any one or combination of (i) income from house property (ii) income from capital gains (iii) income from other sources, as their source of income. Section 160 of Income Tax Act, 1961 provides that any assessee can be represented through Representative Assessee. Representative Assessee can be an individual only. This column will contain particulars of such Representative Assessee. Column 1 to 13 will contain details of assessee on whose behalf this application is submitted. It is mandatory to attach proof of identity and address with PAN application. List of documents which will serve as proof of identity and address for each category of applicant is given in point (f) below (General Information for PAN Applicants).

13. (a) Salaried Employee

15.

GENERAL INFORMATION FOR PAN APPLICANTS

(a) (b) (c) Applicants can obtain the application form for PAN (Form 49A) in the format prescribed by Income Tax Department from TIN-Facilitation Centres (TIN-FCs), any other stationery vendors providing such forms or freely download from the NSDL website (http://tin.nsdl.com). In case applicants obtain forms from TIN-FCs, TIN-FCs may charge a maximum of Rs. 5/- per form. The fee for processing of PAN application to be paid to TIN-FCs is Rs. 60/- (plus service tax, as applicable). Those already allotted a ten digit alphanumeric PAN shall not apply again as having or using more than one PAN is illegal. However, request for a new PAN card with the same PAN or/and changes or correction in PAN data can be made by filling up 'Request for New PAN Card or/and Changes or Correction in PAN Data' form available from any source mentioned in (a) above. The cost of application and processing fee is same as in the case of Form 49A. Applicants will receive an acknowledgment containing a 15 digit unique number from the TIN-FC on submission of Form 49A. This acknowledgment number can be used by the applicant for tracking the status of his/her application on http://tin.nsdl.com List of Business Professions along with codes (Column 13(b) of Form 49A). Business/Profession Medical Profession and Business Engineering Architecture Chartered Accountant/Accountancy Interior Decoration Technical Consultancy Company Secretary Legal Practitioner and Solicitors Government Contractors Insurance Agency Category Individual Code 11 12 13 14 15 16 17 18 19 20 Business/Profession Films, TV and such other entertainment Information Technology Builders and Developers Members of Stock Exchange, Share Brokers and Sub-Brokers Performing Arts and Yatra Operation of Ships, Hovercraft, Aircrafts or Helicopters Plying Taxis, Lorries, Trucks, Buses or other Commercial Vehicles Ownership of Horses or Jockeys Cinema Halls and Other Theatres Others 01 02 03 04 05 06 07 08 09 10 (f)

(d) (e)

Code

Documents to be submitted alongwith application for PAN (column 15 of Form 49A) Documents Required For Proof of Identity (Copy of any one of the following): 1. School leaving certificate 2. Matriculation certificate 3. Degree of a recognised educational institution 4. Depository account 5. Credit card 6. Bank account 7. Water bill 8. Ration card 9. Property tax assessment order 10. Passport 11. Voter's Identity Card 12. Driving License 13. Certificate of identity signed by a Member of Parliament or Member of Legislative Assembly or Municipal Councilor or a Gazetted Officer. For Proof of Address (Copy of any one of the following): 1. Electricity bill 2. Telephone bill 3. Depository account 4. Credit card 5. Bank account 6. Ration card 7. Employer certificate 8. Passport 9. Voter's Identity card 10. Property tax assessment order 11. Driving License 12. Rent Receipt 13. Certificate of address signed by a Member of Parliament or Member of Legislative Assembly or Municipal Councilor or a Gazetted Officer. In case of a minor, any of the above documents of any of the parents or guardian of such minor shall be deemed to be the proof of identity and address. For proof of identity and address, any document prescribed in the case of individuals in respect of Karta of the HUF. Copy of Certificate of Registration issued by Registrar of Companies Copy of Certificate of Registration issued by Registrar of Firms or Copy of Partnership Deed Copy of Trust Deed or Copy of Certificate of Registration Number issued by Charity Commissioners. Copy of Agreement or Copy of Certificate of Registration Number issued by Charity Commissioner or Registrar of Co-operative Society or any other Competent Authority or any other document originating from any Central or State Government Department establishing identity and address of such person.

HUF Company Firms AOP (Trusts) AOP/BOI/Local Authority/Artificial Juridical Person (g)

V. 1.0

For more information Visit us at http://tin.nsdl.com Call TIN Support Desk at 022-2499 4650 e-mail us at tininfo@nsdl.co.in Write to: National Securities Depository Limited, A Wing, 3rd Floor, Trade World, Kamala Mills Compound, Senapati Bapat Marg, Lower Parel (W), Mumbai - 400 013.

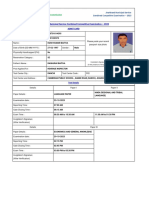

Form No. 49A

Application for Allotment of Permanent Account Number

Under Section 139A of the Income Tax Act, 1961 (To avoid mistake(s), please follow the accompanying instructions and examples carefully before filling up the form)

Form No. ITS 49A

To

The Assessing Officer Ward / Circle Range Commissioner

Area Code

AO Type

Range Code

AO No.

Only Individuals to affix recent photograph (3.5 cm 2.5 cm)

Sir, I/We hereby request that a permanent account number be allotted to me/us. I/We give below necessary particulars : 1. Full Name (Full expanded name : initials are not permitted) Please Tick ! as applicable Shri Last Name / Surname Middle Name Smt. Kumari M/s First Name

Signature/Left Thumb Impression

2. Name you would like printed on the card 3. Have you ever been known by any other name ? If yes, please give that other name (Full expanded name : initials are not permitted) Last Name / Surname Middle Name 4. Fathers Name (Only Individual applicants : Even married women should give fathers name only) Last Name / Surname Middle Name 5. Address R. Residential Address Flat/Door/Block No. Name of Premises / Building / Village Road / Street / Lane / Post Office Area / Locality / Taluka / Sub - Division Town / City / District O. Office Address (Name of Office) Flat/Door/Block No. Name of Premises / Building / Village Road / Street / Lane / Post Office Area / Locality / Taluka / Sub - Division Town / City / District State / Union Territory Pin (Indicating PIN is mandatory) 6. Address for communication Please Tick ! as applicable R or O

V. 1.0

Please Tick ! Shri Smt.

as applicable Kumari M/s

Yes

No

First Name

First Name

State / Union Territory

Pin (Indicating PIN is mandatory)

STD Code 7. Tel. No. email ID

Tel. No.

8. Sex (For Individual Applicants only) Please Tick ! as applicable 9. Status of the Applicant Individual P Hindu Undivided Family H Company C Please Tick ! as applicable Firm F Association of Persons A Association of Persons (Trusts) T

Male

Female

Body of Individuals B Local Authority L Artificial Juridical Person J

10. Date of Birth / Incorporation / Agreement / Partnership or Trust Deed / Formation of Body of Individuals / Association of Persons

D D

M M

Y Y

11. Registration Number (In case of Firms, Companies etc.)

12. Whether citizen of India

Please Tick !

as applicable Others

Yes

No

13. (a) Are you a salaried employee? If yes, indicate Government Name of the Organisation where working

(b) If you are engaged in a business / profession, indicate nature of business or profession and fill the relevant code (c) If you are not covered by (a) or (b) above, indicate sources of income, if any 14. Full name, address of the Representative Assessee, who is assessable under the Income Tax Act in respect of the person, whose particulars have been given in column 1 to 13. Full Name (Full expanded name : initials are not permitted) Please tick ! as applicable Last Name / Surname Middle Name Address Flat/Door/Block No. Name of Premises / Building / Village Road / Street / Lane / Post Office Area / Locality / Taluka / Sub - Division Town / City / District State / Union Territory Pin (Indicating PIN is mandatory) 15. I/We have enclosed proof of address. as proof of identity and as Shri Smt. First Name Kumari M/s

I/We what is stated above is true to the best of my / our information and belief.

, the applicant, do hereby declare that

Verified today, the D D M M Y Y Y Y Signature / Left Thumb Impression of Applicant (inside the box)

V. 1.0

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5807)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Certificate of IncorporationDocument1 pageCertificate of IncorporationPriya ShindeNo ratings yet

- Vendor RegistrationDocument3 pagesVendor RegistrationvijaymandiNo ratings yet

- Ponna Sudheer Kumar - 7397888-1-2Document2 pagesPonna Sudheer Kumar - 7397888-1-2ponna sudheerNo ratings yet

- Suhail Khan Offer - Letter - For - HCLDocument2 pagesSuhail Khan Offer - Letter - For - HCLSuhail KhanNo ratings yet

- Kempegowda Institute of Medical SciencesDocument3 pagesKempegowda Institute of Medical SciencesalishNo ratings yet

- TDS Presentation Taxguru - inDocument35 pagesTDS Presentation Taxguru - inBj Thivagar0% (2)

- Current Affairs Q&A PDF December 2 2022 by Affairscloud 1Document18 pagesCurrent Affairs Q&A PDF December 2 2022 by Affairscloud 1Krishna AKř ŘaĶiNo ratings yet

- Rajguru Nagar PalikaDocument26 pagesRajguru Nagar PalikaDevesh YadavNo ratings yet

- Tata Group - HR InvitationDocument2 pagesTata Group - HR InvitationMariaNo ratings yet

- Pan-Card Tampering Using Computer VisionDocument16 pagesPan-Card Tampering Using Computer VisionSriram R MNo ratings yet

- HSBC BankDocument40 pagesHSBC BankPrasanjeet PoddarNo ratings yet

- JSSC - Admit CardDocument2 pagesJSSC - Admit Cardkushkumarbaitha0162No ratings yet

- Uttarakhand Transport Corporation E-Ticket: Fare DetailDocument1 pageUttarakhand Transport Corporation E-Ticket: Fare DetailTarun KumarNo ratings yet

- GHMC - Plumbing Contractor LicenceDocument27 pagesGHMC - Plumbing Contractor LicenceVVRAONo ratings yet

- Bid Doc TricycleDocument23 pagesBid Doc Tricyclenarasimma8313No ratings yet

- Star Health and Allied Insurance Company Limited: Proposal FormDocument2 pagesStar Health and Allied Insurance Company Limited: Proposal FormBhaktha SinghNo ratings yet

- DocumentsRequirementGuidelines FinalDocument13 pagesDocumentsRequirementGuidelines Finalsumit4up6rNo ratings yet

- NRI Account Opening FormDocument6 pagesNRI Account Opening FormAnkush JainNo ratings yet

- Gold Loan Online Apply For Loan Against Gold in IndiaDocument10 pagesGold Loan Online Apply For Loan Against Gold in IndiaDavid SmithNo ratings yet

- Industrial Training Registration (Form 104)Document13 pagesIndustrial Training Registration (Form 104)pkpallb mNo ratings yet

- BP040 Current Process ModelDocument1 pageBP040 Current Process Modelsastrylanka1980No ratings yet

- Constitutional Validy of Aadhar CardDocument47 pagesConstitutional Validy of Aadhar CardSuresjNo ratings yet

- Project 2Document66 pagesProject 2Richa MittalNo ratings yet

- Kyc Update Form: Customer Details (Mandatory)Document2 pagesKyc Update Form: Customer Details (Mandatory)vikram122No ratings yet

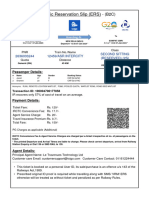

- Electronic Reservation Slip (ERS) Electronic Reservation Slip (ERS) - (B2B)Document2 pagesElectronic Reservation Slip (ERS) Electronic Reservation Slip (ERS) - (B2B)MUNNA SKNo ratings yet

- Electronic Reservation Slip (ERS) : 6529288499 15909/avadh Assam Exp Ac 3 Tier Sleeper (3A)Document3 pagesElectronic Reservation Slip (ERS) : 6529288499 15909/avadh Assam Exp Ac 3 Tier Sleeper (3A)Ą JohnNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)ANSHU KAPOORNo ratings yet

- About PKYKV Skill IndiaDocument28 pagesAbout PKYKV Skill Indiapr1041No ratings yet

- ITR 4 Sugam Form For Assessment Year 2018 19Document9 pagesITR 4 Sugam Form For Assessment Year 2018 19sureshstipl sureshNo ratings yet

- Electronic Reservation Slip (ERS) : 2636033244 12459/asr Intercity Second Sitting (RESERVED) (2S)Document3 pagesElectronic Reservation Slip (ERS) : 2636033244 12459/asr Intercity Second Sitting (RESERVED) (2S)foreverbayan786No ratings yet