Professional Documents

Culture Documents

Accounting Cycle

Uploaded by

poornapavanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting Cycle

Uploaded by

poornapavanCopyright:

Available Formats

ACCOUNTING CYCLE/FLOW/PROCESS:

The cycle starts with identify & analyse transactions &

Then, record transactions in a journal &

Then, post transactions to a appropriate general ledger &

Then, determine the unadjusted trial balance &

Then, Analyse the worksheet &

Then, Adjust Journal entries and fix any errors &

Finally, from trial balance financial statements are prepared from the

adjusted trial balance such as an income statement (P/L a/c), a trading

account, and a balance sheet. &

Then, Closing the books

Journal: It is a primary book of accounting or the book of original/first. It is a day-

day business Transactions in a chronological unit of accounting. The process is

called Journalising

Journalising: The process of recording Transactions in journal

Narration: A short explanation of every transaction is written under each entry.

Compound Journal Entry Compound Journal entry is an entry in which more than

two accounts are involved & hence more than one account is either debited or credited

Types of Journal entries: Opening entries, Transfer entries, closing entries, adjusting

entries, Compound entries, reversing entries.

Balance B/F (Brought Forward): Balance B/F are those opening balances at the

beginning of the month debit and credit balances are totalled brought forward to

previous page

Balance C/F (Carried Forward): Balance C/F are those closing balances at the end

of the month debit and credit balances are totalled carried forward to next page

General Journal: A general journal is a book of original entries in which all

transactions are recorded.

Special Journal: It collectively refers to all the subsidiary books namely sales book,

purchases book, sales return book, purchases return book, journal proper & cash book.

Different Types Of subsidiary books: Purchase book, Sales book, Purchase returns

book, Sales returns book, Bill receivable book, Bill payable book, Cash book, journal

proper, petty cash book.

Purchases book is for recording all credit purchases of goods.

Sales book is for recording all goods sold on credit.

Purchase returns book (return outwards) for recording all purchases returned to

creditors.

Sales returns book (return inwards) for recording all sales returned by customers.

Bill Receivable book to keep a record of bills received from customers.

Bills Payable book to keep a record of bills payable to creditors.

Cash Book: The book that keeps records of all transactions; cash receipts & cash

payments

Journal Proper: The journal proper is used for entering infrequent transactions. In

general, journal proper contains entries such as opening entries, closing entries,

rectification entries, transfer entries, adjustment entries, entries for bills dishonour,

miscellaneous entries

Petty cash book: petty cash is maintained by business to record petty cash expenses

of the business, such as postage, cartage stationary etc.,

Ledger: Ledger is the principal book of accounts or the book of final entry, where

in all accounts like personal, Real, Nominal accounts are maintained

Posting: Posting is the process of transferring information (debits & credits) from the

journal to a ledger.

If Dr. side > Cr. side is called debit balance, which is indicated as ‘By balance c/d’

If Cr. side > Dr. side is called credit balance which is indicated as ‘To balance c/d’.

Balance: The accounts are balanced at the end of each month or financial year. This

difference is called the balance,

Balance b/d is the Balance brought down as opening balance of a ledger pulled from

the previous accounting period

Balance c/d is the Balance carried down as closing balance of a ledger pushed to the

next accounting period

Debtors: Debtors are the persons to whom goods are sold

Creditors: Creditors are the persons or firm from whom we purchase the goods.

Trial balance: It is a statement which shows debit & credit balances of accounts.

Trading Account: The balance of this account will either be Gross profit or Gross

loss. If we get Gross Profit the amount should be transfer to P/L A/c of credit side. If

we get Gross Loss the amount should be transfer to P/L A/c of Debit side.

Profit & Loss Account (Income Statement): It is used to find out the net profit or a

net loss. If we get Net Profit we will add to capital. If we get Net Loss we will

subtract to capital. It shows Summarized company’s revenues & expenses

You might also like

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 5 out of 5 stars5/5 (1)

- Chapter: 1 Meaning, Objectives and Basic Accounting TermsDocument19 pagesChapter: 1 Meaning, Objectives and Basic Accounting TermsGudlipNo ratings yet

- Sources, Records and Books of Prime EntryDocument13 pagesSources, Records and Books of Prime EntryMuhammad Zubair Younas100% (2)

- Accounting BasicsDocument30 pagesAccounting BasicsAsciel Hizon MorcoNo ratings yet

- Tally Vol-1 - April #SKCreative2018Document34 pagesTally Vol-1 - April #SKCreative2018SK CreativeNo ratings yet

- 123Document16 pages123Arabella BolanteNo ratings yet

- Accounting Terms - Basic DefinitionsDocument7 pagesAccounting Terms - Basic DefinitionsSourav JaiswalNo ratings yet

- Trading and Profit Loss AccountDocument8 pagesTrading and Profit Loss AccountOrange Noida100% (1)

- Powerpoint Journal Ledger and Trial BalanceDocument40 pagesPowerpoint Journal Ledger and Trial BalanceChris Iero-Way100% (1)

- What Is A Journal Entry in AccountingDocument20 pagesWhat Is A Journal Entry in AccountingIc Abacan100% (1)

- eLearnMarkets OptionsBuying HindiDocument17 pageseLearnMarkets OptionsBuying Hindisrinivas20% (1)

- Review of The Accounting ProcessDocument18 pagesReview of The Accounting ProcessRoyceNo ratings yet

- Steps in Accounting CycleDocument34 pagesSteps in Accounting Cycleahmad100% (4)

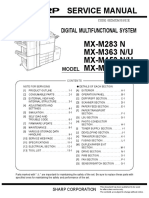

- Sharp MX M283 363 453 503 PDFDocument404 pagesSharp MX M283 363 453 503 PDFAlejandro Barraza100% (2)

- Accounting Books - Journal, Ledger and Trial BalanceDocument35 pagesAccounting Books - Journal, Ledger and Trial BalanceGhie Ragat100% (3)

- Tally Erp.9Document50 pagesTally Erp.9Jancy Sunish100% (1)

- Learning Tally Erp 9Document385 pagesLearning Tally Erp 9Samuel Zodingliana100% (2)

- Project On Finalization of Partnership FirmDocument38 pagesProject On Finalization of Partnership Firmvenkynaidu67% (3)

- Fundamentals of AccountancyDocument17 pagesFundamentals of AccountancyJeamie Sayoto100% (1)

- Financial Accounting Is The Process of Preparing Financial Statements For A BusinessDocument11 pagesFinancial Accounting Is The Process of Preparing Financial Statements For A Businesshemanth727100% (1)

- The Accounting CycleDocument17 pagesThe Accounting Cycleyuvita prasadNo ratings yet

- Explain Bank Reconciliation Statement. Why Is It PreparedDocument6 pagesExplain Bank Reconciliation Statement. Why Is It Preparedjoker.dutta100% (1)

- Define JournalDocument6 pagesDefine JournalOrbin SunnyNo ratings yet

- What Are The Different Types of Subsidiary Books Usually Maintained by A Firm?Document11 pagesWhat Are The Different Types of Subsidiary Books Usually Maintained by A Firm?sweet19girlNo ratings yet

- Al-Samnan Academy of Commerce and ScienceDocument7 pagesAl-Samnan Academy of Commerce and ScienceMian NajamNo ratings yet

- Accounting For Management: Mba 1 Semester Amity Global Business School Ms. Kavitha MenonDocument41 pagesAccounting For Management: Mba 1 Semester Amity Global Business School Ms. Kavitha Menongurudeep25100% (3)

- General-Journals and LedgersDocument13 pagesGeneral-Journals and LedgersRaviSankarNo ratings yet

- Chapter 3Document29 pagesChapter 3Sisira ChandranNo ratings yet

- Accounting BooksDocument30 pagesAccounting BooksAshley Keith CadizNo ratings yet

- Accounting CycleDocument4 pagesAccounting Cycleddoc.mimiNo ratings yet

- All Basic Terms of AccountingDocument20 pagesAll Basic Terms of AccountingpoornapavanNo ratings yet

- Suraj Singh Lodhi Accountancy Project 2023 24Document7 pagesSuraj Singh Lodhi Accountancy Project 2023 24www.friendlyaniket1992No ratings yet

- QuesDocument4 pagesQuesSreejith NairNo ratings yet

- Accounting Cambridge O LevelDocument6 pagesAccounting Cambridge O LevelAgha Saeed AhmedNo ratings yet

- Interview Question of AccountingDocument6 pagesInterview Question of AccountingSahana GNo ratings yet

- Accounting Calculations - Learning of FundamentalsDocument7 pagesAccounting Calculations - Learning of FundamentalsRobinHood TiwariNo ratings yet

- Accounts NotesDocument12 pagesAccounts NotesAkhil RaiNo ratings yet

- Accounting Manual On Double Entry System of AccountingDocument12 pagesAccounting Manual On Double Entry System of AccountingGaurav TrivediNo ratings yet

- Unit 3 Trading ConcernDocument13 pagesUnit 3 Trading ConcernBell BottleNo ratings yet

- Financial Accounting (Mgt-101) VUDocument311 pagesFinancial Accounting (Mgt-101) VUgoriNo ratings yet

- Mba Faaunit - IIDocument15 pagesMba Faaunit - IINaresh GuduruNo ratings yet

- Subsidiary BooksDocument7 pagesSubsidiary BooksRashmi PatelNo ratings yet

- Module 3 CFAS PDFDocument7 pagesModule 3 CFAS PDFErmelyn GayoNo ratings yet

- Accountancy Notes PDF Class 11 Chapter 3 and 4Document5 pagesAccountancy Notes PDF Class 11 Chapter 3 and 4Rishi ShibdatNo ratings yet

- Accounts PDFDocument46 pagesAccounts PDFArushi Singh100% (1)

- Accounting PresentationDocument68 pagesAccounting PresentationGibzy D100% (1)

- Chapter IVDocument13 pagesChapter IVMariel OroNo ratings yet

- Our Lady of Fatima University For Accounting For Sole Proprietorship For BS Accountancy DiscussionDocument8 pagesOur Lady of Fatima University For Accounting For Sole Proprietorship For BS Accountancy DiscussionJANNA RAZONNo ratings yet

- FAABM11 Final SummaryDocument18 pagesFAABM11 Final SummaryJeferson LincosananNo ratings yet

- Chapter 2Document10 pagesChapter 2mayhipolito01No ratings yet

- Chapter - 1 Basic Concepts (Accounting Process) : TransactionsDocument8 pagesChapter - 1 Basic Concepts (Accounting Process) : Transactionsgagan vermaNo ratings yet

- Accounting AssignmentDocument22 pagesAccounting AssignmentEveryday LearnNo ratings yet

- Accounting CycleDocument9 pagesAccounting Cyclerakshit konchadaNo ratings yet

- Unit-5 of Accounting For ManagerDocument70 pagesUnit-5 of Accounting For Managerklrahulprasad112No ratings yet

- Module 3: Completing The Accounting Cycles of A Service Business 3.1 Worksheet and The Financial StatementsDocument10 pagesModule 3: Completing The Accounting Cycles of A Service Business 3.1 Worksheet and The Financial StatementsWinoah HubaldeNo ratings yet

- Tally 9Document18 pagesTally 9Romendro ThokchomNo ratings yet

- Accounting Introduction p20Document14 pagesAccounting Introduction p20varadu1963No ratings yet

- Describe Merchandising Operations and Inventory SystemsDocument4 pagesDescribe Merchandising Operations and Inventory SystemsSadia RahmanNo ratings yet

- Glossary of Accounting TermsDocument8 pagesGlossary of Accounting TermsFauTahudAmparoNo ratings yet

- Accounting Equation and Business TransactionsDocument5 pagesAccounting Equation and Business TransactionsJoseph OndariNo ratings yet

- Depriciation in AccountingDocument3 pagesDepriciation in AccountingpoornapavanNo ratings yet

- Accont PayableDocument1 pageAccont PayablepoornapavanNo ratings yet

- Sundry Creditors & DebtorsDocument1 pageSundry Creditors & DebtorspoornapavanNo ratings yet

- Disposal AccountDocument2 pagesDisposal AccountpoornapavanNo ratings yet

- 1 AccountingDocument2 pages1 AccountingpoornapavanNo ratings yet

- 2.accounting PrinciplesDocument2 pages2.accounting PrinciplespoornapavanNo ratings yet

- R2R CodesDocument2 pagesR2R CodespoornapavanNo ratings yet

- All Basic Terms of AccountingDocument20 pagesAll Basic Terms of AccountingpoornapavanNo ratings yet

- Journal Entry For AccountingDocument12 pagesJournal Entry For AccountingpoornapavanNo ratings yet

- Spsi 622 Page Quattlebaum-Severecommunicationdisorders W Ecolog Inventory ExDocument25 pagesSpsi 622 Page Quattlebaum-Severecommunicationdisorders W Ecolog Inventory Exapi-270949898No ratings yet

- XeroxWC 5020DN Service Manual 03.02.2012 PDFDocument432 pagesXeroxWC 5020DN Service Manual 03.02.2012 PDFSergey100% (1)

- Retail ImageDocument76 pagesRetail ImageayushiNo ratings yet

- CREDEDocument10 pagesCREDEDaffodilsNo ratings yet

- Expt Lipid - Influence of Bile in The Action of LipaseDocument3 pagesExpt Lipid - Influence of Bile in The Action of LipaseAngela CaguitlaNo ratings yet

- ACS11Document3 pagesACS11Ebby OnyekweNo ratings yet

- Henry's Bench: Keyes Ky-040 Arduino Rotary Encoder User ManualDocument4 pagesHenry's Bench: Keyes Ky-040 Arduino Rotary Encoder User ManualIsrael ZavalaNo ratings yet

- Armenotech PCIDSS AOCDocument13 pagesArmenotech PCIDSS AOCHakob ArakelyanNo ratings yet

- IBEF Cement-February-2023Document26 pagesIBEF Cement-February-2023Gurnam SinghNo ratings yet

- QBM101Document37 pagesQBM101Shang BinNo ratings yet

- James Bruce, One of Russian Tsar Peter The Great's Key Advisors (1669-1735)Document2 pagesJames Bruce, One of Russian Tsar Peter The Great's Key Advisors (1669-1735)Johanna Granville100% (1)

- SN Quick Reference 2018Document6 pagesSN Quick Reference 2018pinakin4uNo ratings yet

- Music and Yoga Are Complementary To Each OtherDocument9 pagesMusic and Yoga Are Complementary To Each OthersatishNo ratings yet

- IQX Controller & I/O ModulesDocument12 pagesIQX Controller & I/O ModulesAnonymous XYAPaxjbYNo ratings yet

- Calydracomfort PiDocument16 pagesCalydracomfort PiionNo ratings yet

- 990XP Bandit ChipperDocument5 pages990XP Bandit ChipperFrancisco ConchaNo ratings yet

- Neonatal HypothermiaDocument8 pagesNeonatal Hypothermiamia liaNo ratings yet

- Sociology Internal AssessmentDocument21 pagesSociology Internal AssessmentjavoughnNo ratings yet

- ECON 211: Principles of Macroeconomics-901: Smhussain@vcu - EduDocument6 pagesECON 211: Principles of Macroeconomics-901: Smhussain@vcu - EdusshinnNo ratings yet

- Q1 WK 2 To 3 Las Fabm2 Kate DionisioDocument8 pagesQ1 WK 2 To 3 Las Fabm2 Kate DionisioFunji BuhatNo ratings yet

- RTI SpicesDocument226 pagesRTI SpicesvivebajajNo ratings yet

- Stat and Prob Q4 M2 DigitizedDocument38 pagesStat and Prob Q4 M2 Digitizedsecret secretNo ratings yet

- Chemistry Bridging Course Lecture NotesDocument3 pagesChemistry Bridging Course Lecture NotesNNo ratings yet

- REACH ArticlesDocument12 pagesREACH ArticlesChristian SugasttiNo ratings yet

- Inertia Physics: Defi Ni Ti OnDocument2 pagesInertia Physics: Defi Ni Ti OnSentoash NaiduNo ratings yet

- Unit Plan - Yr 9 Vis ArtDocument5 pagesUnit Plan - Yr 9 Vis Artapi-333348168No ratings yet

- Wooden Buildings: exposed to tiếp xúc với dramatic renewal sự làm mới đáng kểDocument6 pagesWooden Buildings: exposed to tiếp xúc với dramatic renewal sự làm mới đáng kểNguyễn Phạm Thảo NguyênNo ratings yet

- New Criticism Hills Like White Elephants FinalDocument4 pagesNew Criticism Hills Like White Elephants Finalapi-313631761No ratings yet