Professional Documents

Culture Documents

Retairement in Accounting

Uploaded by

poornapavan0 ratings0% found this document useful (0 votes)

2 views1 pageCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views1 pageRetairement in Accounting

Uploaded by

poornapavanCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

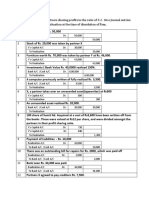

RETAIRMENT:

When we are removing the asset from the company the retainment will be happen, in

this case you make a profit or loss

The journal entry for profit on sale of fixed asset?

Bank A/c Dr

Accumulated Depreciation A/c Dr

To Fixed Asset A/c

To Gain on Sale of Fixed Asset A/c

Ex1: corporate wala.in sold fixed assets (original cost of $ 60000) for $ 65000.

Accumulated Depreciation till date was $10000, prepare JE:

Bank A/C Dr. $65000

Accumulated Depreciation A/C Dr. $10000

To Fixed Assets A/c $60000

To Profit on sale of Fixed Assets A/C $15000

The journal entry for Loss on sale of fixed asset?

Bank A/C Dr.

Accumulated Depreciation A/C Dr.

Loss on sale of Fixed Assets A/C Dr.

To Fixed Assets A/c

Ex1: corporate wala.in sold fixed assets (original cost of $60000) for $35000.

Accumulated Depreciation till date was $10000, prepare JE:

Bank A/C Dr. $35000

Accumulated Depreciation A/C Dr. $10000

Loss on sale of Fixed Assets A/C Dr.$15000

To Fixed Assets A/c $60000

You might also like

- JDocument13 pagesJpalash khannaNo ratings yet

- Chapter 2 - Double Entry Book Keeping - PPTMDocument84 pagesChapter 2 - Double Entry Book Keeping - PPTMMahdia Binta KabirNo ratings yet

- Chapter 13Document12 pagesChapter 13palash khannaNo ratings yet

- CAT Review Qs PDFDocument4 pagesCAT Review Qs PDFSuy YanghearNo ratings yet

- H077 Chp. 8 AssignmentDocument10 pagesH077 Chp. 8 AssignmentIsha KatiyarNo ratings yet

- Note For ExamDocument58 pagesNote For ExamMichael Al100% (1)

- Mid TermDocument13 pagesMid TermMya B. Walker100% (4)

- Chap 03 Double EntryDocument6 pagesChap 03 Double Entry465jgbgcvfNo ratings yet

- Accounting Exercises - Balance Sheet and Income StatementDocument29 pagesAccounting Exercises - Balance Sheet and Income Statementtestmaster12345No ratings yet

- Sample QSDocument12 pagesSample QSIsha KatiyarNo ratings yet

- 6001q1specimen PaperDocument12 pages6001q1specimen Paperckjoshua819100% (1)

- A-Levels Accounting RandalDocument36 pagesA-Levels Accounting RandalchauromweaNo ratings yet

- Class Work Chp. 8Document13 pagesClass Work Chp. 8Isha KatiyarNo ratings yet

- Change in PSR NotesDocument10 pagesChange in PSR Noteskapilbishnoi.10a.svnNo ratings yet

- Class Work Chp. 8 H077 A&B Co. Ltd.Document3 pagesClass Work Chp. 8 H077 A&B Co. Ltd.Isha KatiyarNo ratings yet

- H077 Chp.5 Q.2Document10 pagesH077 Chp.5 Q.2Isha KatiyarNo ratings yet

- 15 Joint VentureDocument11 pages15 Joint VentureJanani PriyaNo ratings yet

- AccountsDocument13 pagesAccountspalash khannaNo ratings yet

- Accounting For StockDocument3 pagesAccounting For Stockkevin phillipsNo ratings yet

- Issue of SharesDocument24 pagesIssue of SharesManasNo ratings yet

- H077 Chp. 8 Q.6 PQR Co. Ltd.Document3 pagesH077 Chp. 8 Q.6 PQR Co. Ltd.Isha KatiyarNo ratings yet

- In The Books of A & B Co. LTD.: Journal Entries Date Sr. No. Particulars L.FDocument2 pagesIn The Books of A & B Co. LTD.: Journal Entries Date Sr. No. Particulars L.FIsha KatiyarNo ratings yet

- Solved Garth Company Sold Goods On Account To Kyle Enterprises WithDocument1 pageSolved Garth Company Sold Goods On Account To Kyle Enterprises WithAnbu jaromiaNo ratings yet

- Accounting and Transaction Processing Assignment ADocument6 pagesAccounting and Transaction Processing Assignment AShubha KoiralaNo ratings yet

- CH 3 Exhibit 4, 5Document5 pagesCH 3 Exhibit 4, 5ЭниЭ.No ratings yet

- Seminar Week 7 (Lecture Slides Correcting-Adjusting-Reversing Entries)Document45 pagesSeminar Week 7 (Lecture Slides Correcting-Adjusting-Reversing Entries)palekingyeNo ratings yet

- Zq2.Change in Profit Sharing Ratio of The ExistingDocument20 pagesZq2.Change in Profit Sharing Ratio of The ExistingAaditya SaratheNo ratings yet

- Assignment 5Document2 pagesAssignment 5Phuong DungNo ratings yet

- Class Work Chp. 8Document12 pagesClass Work Chp. 8Isha KatiyarNo ratings yet

- Home Work One - MBADocument2 pagesHome Work One - MBAIslam SamirNo ratings yet

- 11 Redemption of Preference SharesDocument6 pages11 Redemption of Preference SharesRohith KumarNo ratings yet

- Financial Accounting & AnalysisDocument4 pagesFinancial Accounting & AnalysisAakash agrawalNo ratings yet

- NotesDocument14 pagesNotesEll EssNo ratings yet

- Corporate Accounting NotesDocument78 pagesCorporate Accounting NotesdivyanshuNo ratings yet

- Dissolution With Journal Entries For Winter CampDocument10 pagesDissolution With Journal Entries For Winter CampDev RathiNo ratings yet

- Exercise 5: Double Entry Book-KeepingDocument2 pagesExercise 5: Double Entry Book-KeepingLerry AnnNo ratings yet

- AccountsDocument43 pagesAccountsgogunikhilNo ratings yet

- Correction of Errors2020Document14 pagesCorrection of Errors2020Parvatee RamessurNo ratings yet

- Practical 1Document31 pagesPractical 1Rohit ReddyNo ratings yet

- Test Bank2 - Version1Document14 pagesTest Bank2 - Version1Ahmed Khaled MansourNo ratings yet

- Financial Accounting Chapter 12 Test 2 FinalDocument4 pagesFinancial Accounting Chapter 12 Test 2 Finalronny nyagakaNo ratings yet

- MCQ - EquityDocument6 pagesMCQ - EquityEshaNo ratings yet

- ACC1701 Revision Session SlidesDocument38 pagesACC1701 Revision Session SlidesshermaineNo ratings yet

- Additional Illustrations-13Document9 pagesAdditional Illustrations-13Gulneer LambaNo ratings yet

- Accounts and RulesDocument2 pagesAccounts and RulesKishore MurugananthamNo ratings yet

- Journal Entry For AccountingDocument12 pagesJournal Entry For AccountingpoornapavanNo ratings yet

- H077 Full Sum Q5 Accounts Assignment Chp. 3Document13 pagesH077 Full Sum Q5 Accounts Assignment Chp. 3Isha KatiyarNo ratings yet

- Exercise 6: Double Entry Bookkeeping (Level Advanced)Document2 pagesExercise 6: Double Entry Bookkeeping (Level Advanced)Lerry AnnNo ratings yet

- Class 11 Accounts SP 2 Answer KeyDocument18 pagesClass 11 Accounts SP 2 Answer KeyUdyamGNo ratings yet

- SE10210Document3 pagesSE10210syed rahmanNo ratings yet

- FA Assistant Class Notes (Jan-13)Document9 pagesFA Assistant Class Notes (Jan-13)raj shahNo ratings yet

- IFM Module 6 ProblemsDocument7 pagesIFM Module 6 ProblemsAlissa BarnesNo ratings yet

- Redemption of Preference SharesDocument15 pagesRedemption of Preference SharesVasu JainNo ratings yet

- Treatmentofgoodwill 180504105837Document26 pagesTreatmentofgoodwill 180504105837PresanaNo ratings yet

- CH 10 IIDocument15 pagesCH 10 IIYing LiuNo ratings yet

- General Journal, General Ledger and Trial Balance TemplateDocument14 pagesGeneral Journal, General Ledger and Trial Balance TemplateAnoop VgNo ratings yet

- Joint VentureDocument32 pagesJoint VentureKaren SomcioNo ratings yet

- Full Throttle: How to Build a Fully Funded Emergency Fund: Financial Freedom, #201From EverandFull Throttle: How to Build a Fully Funded Emergency Fund: Financial Freedom, #201No ratings yet

- Depriciation in AccountingDocument3 pagesDepriciation in AccountingpoornapavanNo ratings yet

- Disposal AccountDocument2 pagesDisposal AccountpoornapavanNo ratings yet

- Accont PayableDocument1 pageAccont PayablepoornapavanNo ratings yet

- Sundry Creditors & DebtorsDocument1 pageSundry Creditors & DebtorspoornapavanNo ratings yet

- 2.accounting PrinciplesDocument2 pages2.accounting PrinciplespoornapavanNo ratings yet

- 1 AccountingDocument2 pages1 AccountingpoornapavanNo ratings yet

- All Basic Terms of AccountingDocument20 pagesAll Basic Terms of AccountingpoornapavanNo ratings yet

- R2R CodesDocument2 pagesR2R CodespoornapavanNo ratings yet

- Journal Entry For AccountingDocument12 pagesJournal Entry For AccountingpoornapavanNo ratings yet