Professional Documents

Culture Documents

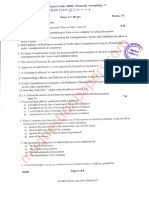

FA-5 University Test Paper

FA-5 University Test Paper

Uploaded by

katejagruti30 ratings0% found this document useful (0 votes)

7 views26 pagesOriginal Title

FA-5 University test paper

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views26 pagesFA-5 University Test Paper

FA-5 University Test Paper

Uploaded by

katejagruti3Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 26

433

tank

: OCTOBER 2015 t

ETE Eee

amalgamation includes ____ reconstruction.

resolution is to be passed by shareholders for the approval of scheme of internal

reconstruction.

Underwriting commission cannot exceed

Bills Payable are given in list.

Buy back of shares is for Class of shares.

Preliminary expenses are transferred to shareholders’ account.

The difference in revaluation of asset is transferred to account.

FacurTas aaeconia t© subsciiie thal shareaiin the aiiaiee'|h Gace under subscription is

% of debenture.

known as :

Secured debentures are given in____jist,

—— Paid up shares cannot be bought back,

ES NATIT

Directors can authorise 15% buy-back of capital,

Directors are required to submit stater

Total shares for which guarantee are

"Ment of affairs on liquidation.

given by each underwriter indivi

Accounting in external and internal reconstruction is identical,

only sick companies undertake capital reduction,

Sub-division of shares results in gain for a company.

The class of shares subjected to buy back cannot be issued immediately,

as NOVEMBER | 2016)

MULTIPLE CHOICE QUESTIONS,

ithe XYZ Ltd. and PQR Ltd. are taken over bi

{@) tis called absorption

(¢)Itis called intemal reconstruction

Amalgamation adjustment reserve is opened i

(a) The assets of the transferor company

(b) The liabilities of the transferor company

(¢) The statutory reserves of the transferor company

(6) None of the above

Balance in Capital Reduction A/c is generally transferred to

(@) General Reserve (b) Profit and Loss A/c

() Capital Reserve (d) None of the above

For Capital Reduction under internal reccnstruction, authorisation/approval is required from

(2) Shareholders (b) Articles of Association

© Court (d) All the above

y a New company GST Ltd.

(b) It is called external reconstruction

(d) It is called amalgamation

in the books of transferee company to incorporate

a Financial Accounting « vepyy 7

5, Unmarkod applications rotor to

(a) Firm underwriting

(0) Applications bearing the stamp of underwriter

(c) Applications issued by the company

{@) Applications from the public received directly without bearing any stamp oy

6. B Ltd, issued shares of € 1000 each at £950 the underwriting commission wi yr!™tey

(ay%50 (b) % 1,950 be pala ot

(c) & 1,000 (a) 950

7. List C in Statement of affairs gives the list of

(a) Preferential creditors

(c) Debentureholders

8. Acompany can buy back

(a) Equity shares

(b) Secured creditors

(d) Shareholders

(b) Preference shares

(d) None of the above

(b) General Reserve

(a) Profit and Loss A/c

(d) Dividend Equalisation Reserve

(c) Revaluation Reserve

STATE WHETHER TRUE OR FALSE

idation and one formation,

1. Under external reconstruction, there is one

2. AS-14 does not distinguish between the amalgamation and absorption.

3, Only sick companies undertake Internal Reconstruction.

4. The cost of re-organisation of the share capital is to be charged from capital reduction ace

5. Under firm underwriting, the underwriters do not agree to purchase any shares. =

6. The underwriting commission is payable in cash.

7. Only insolvent companies can be liquidated.

8. Local Taxes are an examples of secured creditors.

9. Capital redemption reserve account can be utilised for issuing partly paid bonus shares,

40. Buy back of shares decreases the earning per share (EPS) of the company.

Persie s sae

A. (1) external (2) Special (3) 2.50 (4) E (5) Equity (6) Equity (7) Capital Reduction (8)

(9) B (10) Partly luction (8) Underwrite

B. True: 1,3, 4,5, 6,8; False: 2,7,9

Dawsons

A.

1. @) 2. (©) 3. (©) 4. (d) 5. Chana 7 (0)

8 (a) 2 © (@) (d) (b)

B. Tru

.4; False: 2, 3,5, 6,7, 8,9, 10,

Paper Solutions (UPS)

M35

UNIVERSITY PAPER SOLUTIONS (UPS)

COG roe

NOVEMBER ~- 2018

9

otal Marks : 75

Time : 2% Hours

a.t (A): Rewrite sentence after selecting correct altemative

4. The underwriter is entitled to claim remuneration on

(a) The issue price of shares underwritten

(b) The face value of shares actually purchased

(c) The face value of shares not purchased by him

(d) None of the above

2. Accounting for amalgamation is governed by

(a) Accounting Standard 1

(c) Accounting Standard 14

3. Intemal Reconstruction ___

(a) No company is liquidated

(c) Two or more companies are liquidated

4, Amount of calls in advance is treated as

(a) Secured creditor

(c) Preferential creditor

5. Interest on debenture and unsecured loan is

(a) if the company is solvent

(b) if the company is insolvent

(c) whether the company is solvent or insolvent

(d) none of the above

6. Marked applications refer to.

{a) Applications bearing the stamp of the underwriters

(b) Applications carrying the signature of public who applied for shares

(c) Applications carrying the stamp of company which offered the shares

(d) None of the above

7. Buyback must be completed within

{any eight) ; (8)

(b) Accounting Standard 13

(d) Accounting Standard 11

(b) Only one company goes into liquidation

(d) One or more companies go into liquidation

(b) Asset not specifically pledged

(4) Unsecured creditor

Payable upto the date of actual payment

from the date of passing the resolution.

(a) 12 months (b) 3 months

(©) 6 months (d) 2 months

8, The asset which is not taken under the Net Assets Method of calculating purchase consideration

is -

(a) Loose Tools (b) Bills Receivables

(©) Machinery (@) Share Issue Expenses

9. Capital Redemption Reserve can be utilised only for

(a) Issue of fully paid bonus shares to the members

(b) Issue of partly paid bonus shares to the members

(c) Writing off losses

10. See aieiaTnaer intemal reconstruction, authorisation/approvalis required from ——-

(a) Shareholders (b) Articles of Association

(c) Tribunal (d) Allof the above

ru)

Q.1 (B) : State whether given statements are True or False (any aw 5

1. The company is allowed to convert fully paid shares into stock. be

2. The balance is security premium account cannot be transferred to capi

za

punting VTYWAR : SP

Financial Ae fv,

436

3, Buyback of security Is qovornod by section 68 of Companios Act

4. Cancollation of contingont Hability is troated as profit to the company.

5. Equity shares can bo bought back out of frosh issue of shares only.

6. Undorwrting may be done by individuals, partnorship firms or joint stock companics,

7. Matked applications are also known as diract applications

8. Local Taxes aro an oxamplo of secured croditors.

In the case of amalgamation there are two or more liquidations and one formation.

10.1 the company is insolvent, interest on debentures is payable upto the date of actual paymar,

Q.2 : A Ltd. and B Ltd. wore carrying on the business of manufacturing of auto components. Bor,

the companies decided toamalgamate and a new company AB Ltd. is formed with an Authorised

Capital of ¥ 10,00,000 divided into 1,00,000 Equity Shares of ¥ 10 each. The Balance Sheet of th,

companies as on 31-3-2018 were as under (15)

Balance Sheet as at 31-3-2018

Particulars Alia (O[B Lia &

1. EQUITY AND LIABILITIES

1. Shareholders Funds

a. Share Capital

b. Reserves and Surplus

Profit and Loss A/c

ES 1,40,000] 2,50,000

30,000] 35,009

General Reserve . -| 1,20,000

2. Non-Current Liabilities

8% Secured Debentures 1,10,000 -

3. Current Liabilities

Trade Payables

Total

I. ASSETS

1. Non-Current Assets

Property, Plant and Equipment

- Building

- Plant and Machinery

- Furniture and Fixture

54,000] 1,40,000

p— 50.000,

3,34,000| 5,45,000

14,00,000| 1,90,000

-| 80,000

ss 25,000] 25,000

2. Current Assets

a. Inventories 1,35,000] 50,000

b. Trade Receivables 44,000 | 1,42,000

¢. Cash at Bank 30,000} 58,000

Total 3,34,000| 5,45,000

The assets and liabilities of the existing companies are to be transferred at book value with the

exception of some items detailed below

1. Goodwill of A Ltd. was worth % 50,000 and B Ltd. worth & 1,50,000.

2. Fumiture and Fixture of B Ltd. was valued at = 35,000.

3. The debentures of A Ltd. are to be discharged by issue of 8% 11,000 debentures of AB Ltd. at

premium of 10%.

You are required to :

1. Compute Purchase consideration.

2. Pass opening entries in the books of AB Ltd. and draw a Balance Sheet of AB Ltd. as per

Purchase Method.

oR

Q.2 : The following is the Summary Balance Sheet of Teena Ltd. : (15)

Liabilities ante Assets [eee

issued and Paid-up : Intangible Assets 50,000

Equity Share Capital of 10 each 5,00,000] Fixed Assets 4,20,000

Statutory Reserve (to be maintained Current Assets 4,10,000

for 3 more years) 10,000] Profit and Loss A/c 80,000

[pobonti

“Guoullors, “

8.005

_———

[oon Ltd. noo to ae

1 Moone Lt. agrpd

Tho ari

ai

MT)

hihi,

On” 6 A HK,

() Loug Hons

OF Monona La

ho following is the

#19 ha Balance Ghoet ot x27 14g YC 0 es Haney og

__ Balance Shoot as 4 N40 sees!

Liabiiitios Rel

Share Capital: s a

1,000, 6% Protoronce Share ey,

, CO Sharos of “os ,

2100 each, fully ne a a

2,000 Equity Shinow ott 100 ach | aoyigna| BAS Oo ee

caon | $0000) i PO

a Share of 2 100 ongh, | 200.000 Pro 41 ae

ae : Olt and Lows, hoc 3,00, “4

Loan from Bank (on eocurity of stocky) 1129000 on

00

9,00,000

following amounts

aid out of cash

The assets realised the

amounting to & 5,000 p;

Fixed Assets

TDI

} lallor all costs of realication nag in

hin hand 2 ao salanoe She

idators

100 38 per B, ye

cornrtiesion

ene lanes Shes)

Stock 21,10,000

Book Debts 2 2,30.000

Calls on partly paid shares wero mado bot the

inecoverable.

amount dus on 200

Prepare the Liquidators’ Final Statement of Account,

‘hie

was found to be

oR

‘anasonic Ltd, as on 31%

3: Following is the Balance Sheet of p ot March, 2018,

(15)

Balance Sheet

Liabilities | Assois 7

6,000 8% Preference Shares Goodwih 6,000

of 8 100 each 6,00,000) Patents 40,000

$0,000 Equity Shares of & 10 each | 5,00,000| Building 6,900,009

5% Debenture of @ 100 each 3,00,000| Furniture 1.90,000

Outstanding Debenture Interest 50,000} Stock +0900

Sundry Creditors 1,80,000| Sundry Debtors eae

Bank ;

Profit and Loss Alc 5,320,000

Ta30 000 30,000

16,30,000 16.30,

Note : Preference dividend is in arrears for three years.

Th

* following scheme of reconstruction is approved by Court - barren ran thy

" The Preference shares shall be converted into aval number 0

®2ch and the Equity shares shall be reduced to % 3 each.

Financial Accounting -V(TYBAF : 5p uy

woes tT 7S each. The ceterture taiters agrees

ot

O% Of ther cams and te accent Eats stares tor? ig,

2 Oh,

os Ciidend which is 2

{SC mein

(c) Stock - # 7,00.000

(8) Sundry Debtors - z _

g. intangible end fieutious assets ere to be writen oH

jen nd prepare Cente!

70.009

Ld.

0.4: Following is the

Liabilities

Shares € 10)

Security Premium

General Reserve

Profit and Loss A/c

10% Debentures

Bank Loans

Sundry Creditors

The company decided to buy back fs ey!

steps:

4. Issued 3,000, 8% Pre’

2. Issued 2,000, 10% Debentures of € 100 each at 2 premiu:

3. Sold 70% of investments at 2 prot of 107.

Ascenzin:

(2) Maximum Ni tty shares that cen be bought bacic

(0) Maximum price it can offer for buy back

igs in the books of t

(¢) Pass Journal

Q4: Spine Ld. i

of €5 per share. The entire issue we

2 20% and 20% res;

7,000 and 1,000 shares respectiv

pemnitted by law.

The company received applications for 70.000 shares from public o:

19,000; 10,000; 21,000 end 8,000 shares were marked in favour of P,

Calculate the liability of each of the underwriters when firm underwriti

marked and unmarked applications.

Q.5 (a): State the conditions for amalgemation in the nature of merger. @)

Q5 (b) : What do you mean by Liquidation of a company ? Describe the ditterent modes of wincing

@)

up.

OR

Q.5 : Write any three short notes :

{a) Overriding Commission

(b) Purchase Consideration

(c) Preferential Creditors

(d) Need of intemal Reconstruction

(e) Buy-back of Equity Shares

ersity Paper Solutions (UPS)

m9

tution 1 (a):

Tho underwriter is entitlod t

| Accounting for amalgama

internal Reconstruction No company ie liquidated,

© Amount of calls in

© claim tomunoration on the isaue prico of shares undervritton,

na, Governed by Accounting Standard 14,

‘alculating purchase consideration

i's Share Issue Expenses. |

jenecemption Reserve can be utilised only for Issue of fully paid bonu:

members,

'S Shares to the

).For capital reduction under intemal r

reconstruction, authorisation/approval ig Fequired from

Shareholders, Articles of Association and Tribunal,

olution 1 (b) :

The company is allowed to convert fully paid shares into stock. « True

The balance Count cannot be transferred to ca;

False

pital reduction account, -

. Underwriting may be done by indivi

. Marked applications are also know

of shares only. - False

iduals, partnership firms or joint stock companies, -

True

"as direct applications, - False

~ Local Taxes are an example of secured creditors, - False

In the case of amalgamation there are two or more liquidations and one formation, - Tre

Oui the company is insolvent, interest on debentures 'S Payable upto the date of actual payment.

- False

olution 2 =

Calculation of Purchase Consideration

‘articulars Alta. (7B Lia.

\. Assets taken over :

Goodwill 50,000] 1,50,000

Building 1,00,000] 1/90,000

Plant and Machinery -| 80,000

Furniture 25,000] 38,000

laventories

Trade Receivables

Cash at Bank

Total

Less : Liabilities :

% Debentures

Trade Payables

Total

1,35,000] 50,000

44,000} 1,42,000

30,000} 58,000

7,05,000

1,21,000 :

os 54,000] 1,40,000

1,75,000| 1,40,000

5,65,000

Net Assets taken over - Purchase Consideration scan | 2108;000 £5,000

No.of Shares issued as Purchase Consideration 10 each) X

Financial Accounting = V(TYRAp.

440

Journal Entries in the Books of A Ltd.

i Particulars r

7. | Business Purchase A/c Dr. | 7,74,000

To Liquidator of A Ltd. Ale

To Liquidator of B Ltd. A/c

2. | Goodwill A/c Dr. | 2,00,000

Building A/c Dr. | 2:90:00

Plant and Machinery A/c Dr. | 'g0‘000

Furniture Ale Dr. | 60,000

Inventories A/c Dr. | 1,85,000

Trade Receivables A/c Dr. | 1,86,000

Cash at Bank A/c Dr. | 88,000

To 8% Debentures A/c 1.21.09

To Trade Payables Alc 1194009

To Business Purchase A/c 774000

3. | Liquidator of A Ltd. Alc Dr. | 2,09,000

Liquidator of B Ltd. A/c Dr. | 5,65,000

To Equity Share Capital A/c 7.74.00

4. | 8% Debentures Alc (A Ltd.) Dr. | 1,21,000

To 8% Debentures A/c (AB Ltd.) 1,10,000

To Securities Premium A/c 11,000

AB Ltd.

Balance Sheet as at 1-4-2018

Particulars Note =

1. EQUITY AND LIABILITIES

1. Shareholders’ Funds

a. Share Capital 1 | 7,74,000

b. Reserves and Surplus 2 11000

2. Non-Current Liabilities

Long-term Borrowings 3° | 4,10,000

3. Current Liabilities

Trade Payables (54,000 + 1,40,000) 1,94,000

Total 10,89,000

i, ASSETS

1. Non-current Assets

Property, Plant and Equipment

Tangible 4 | 4,30,000

= Intangible 5 | 2,00,000

2. Current Assets

a. Inventories (1,35,000 + 50,000) 1,85,000

b. Trade Receivables (44,000 + 1,42,000) 1,86,000

©. Cash at Bank (30,000 + 58,000) 88,000

Total [10,89,000

Notes to Accounts #

1. Share Capital

Equity Share Capital

Authorised Capital

1,00,000 Shares of 10 each ee 10,00,000

Issued and Subscribed :

77,400 Shares of 2 10 each uo on 7,74,000

2. Reserves and Surplus : “

Security Premium 11,000

3. Long Term Borrowings mnee

8% Debentures 1,10,000

0

30

0

0

0

© 0°

1910

i paper stations (UPS)

unil

ial assole

11 a0" 1,00,000 + 1.90,000)

+ guild Machinery

Mit 85 (25,000 + 35,000)

woe

12! pte Assets

intrivill

es

as

i iua of Assets

Fao ates taken over

LoS5,pditors

entre

jar consideration

pul Cc

| purshasy /4 x 3,50,000)

nash Gls X8.60.000)

ia

‘onsideration discharged :

res 10 be 19SU0d 10 the vendor :

uw

200th

205th

Lith

200800

os cane

Purchase Consideration

z

| TEST

9.0%

1.06.06)

No. — ipe paid is shares = % 2,62,500

“Aout ces = 262,500 / 12 = € 21,875 shares

i.

N In the Books of Teena Ltd,

& Realisation Account c

ies | Panicutars T

intangible Assets 80,000] By Debentures |

io arp esets 4,20,000| By Creditors |

oF at Assets 1,10,000| By Meena Lr,

“eearetexpenses) 300) By Equity Shareholders (Loss)

| 160,300

ra Equity Shareholders Account

emia %_| Pariculars

Ee ealsation Alc 80,300 | By Equity Share Capital

fo ewitand Loss Alc 80,000] By Statutory Reserve

i y

‘aa 87,200

Jo Shares in Meena Ltd. 2,62,500

10,000

Meena Ltd, Account

or.

| Panicuars @_ | Panticutars jane

“To Realisation Alc 3,50,000| By Bank Alc 7.500

| By Shares in Meena Ltd. 2,62,500

' 350,000, 350,000

Ac Bank Account cr.

Particulars | @ | Particulars

ToMeena Lid. 87,500| By Realisation Ale

By Equity Shareholders

87,500

Hinanclal Accounting

“VOVHAL,

Kquity Sharos in Moona Ltd. Account

Sena >————_—_—___

Particulara ORTON

By Equity Shareholders

62,500

In tho Books of Meona Ltd,

Journal Entrlos,

No. Particulars ele z

1 | Businoss Purchase Ave Dr.

To Liquidators of Toona Lid. Ale

2. | Fixed Assots Ale Dr. | 4,20,000

Curront Aasots A/c Dr. | 1,10,000

To Tado Croditors Ale

To Debentures Ale

sorve Ale

si Purchaso Ale

3. | Liquidators of Toona Ltd. Ale Dr. | 3,50,000

To Equity Share Capital Alc

To Socuuitios Promium Alc

To Bank Ale

4, | Amalgamation Adjustment Ale Dr. | 10,000

‘To Statutory Reserve Ale

8. | Debentures in Teona Ale Dr. | 1,00,000

To Bank A/c

3,50,000 |--———

HM,

3,50,009

50,009

1,00,009

30,000

350,000

2,18,759

43.750

87.500

10,000

Tutorial Note : Students should provide narration for Journal Entries as an exercise.

Solution 3 : Refer Chapter 5, Illustration 18,

oR

Solution 3 :

Journal Entries of Panasonic Ltd.

1,00,000

No. Particulars One [ore

1. | 8% Preference Share Capital Alc Dr. | 6,00,000

‘To 9% Preference Share Capital A/c 3,00,000

To Capital Reduction A/c 3,00,000

2. | Equity Share Capital Ale © 10) Dr. | 5,00,000

To Equity Share Capital A/c (@ 3) 1,50,000

To Capital Reduction A/c 3,50,000

3. | 5% Debentures Ale @ 100) Dr. | 3,00,000

To 5% Debentures A/c (® 75) 2,25,000

To Capital Reduction A/c 75,000

Debentures Interest A/c Dr. | 25,000

To Capital Reduction A/c 25,000

5. | Capital Reduction (Preference Dividend) Ale Dr. | 48,000

To Bank Alc 48,000

6. | Creditors Ale Dr. | 84,000

To Equity Share Capital A/o 30,000

To Capital Reduction A/c 54,000

7. | Buildings Ave Dr. | 60,000

To Capital Reduction A/c 60,000

perce

= paper Sotuttons (OPS)

wer eduction A/c

yt anit ia and 1.056 Ale Ms

| © Goodwill Ale Or 1 816.000

patont AC S200)

° rurniture Ve 000

qo siock Ae Mth)

| fo Hopiors Nc 200

7 Capital Reserve Ale AO

7 Students should provide nan £000

“a :si © Rarration for Journal Entries a 1

“i Capital Reduetion ore"

of z ~ Cr.

flats. Particulars

BE gana oss Ne 5:30,000] By 6% Prete f

Pr duill 60,000] BY Eph 'forence Share Capital | 3.00.000

Go 40.000) By city Share Capital 5

& pat pret. OM) 48,000 ey 5% Debentures eee

nk Ce ’ Interest on Di =

0 te 20,000| By Creditors eae ee on

1 cock 50,000| By Building 54,000

SFO serve 5,000! 60,000

‘0 Dthal Reser 1.11,000

i

8,64,000

0 TSS z

urces

1 Beperal Reserve

2 aero oss Ale - . | 20,00,000

Profit an

p. ities Premium 25,00,000

f Securite E0000

g,_ Reserves and Surplus 50,00,000

{2} 25% of Own Funds

2, Reserves and Surplus 50,00,000

|p. Equity Capital 50,00,000

¢, Own Funds 1,00,00,000

4, 25% of Own Funds fos po onl

[5] Minimum Own Funds

‘a. Own Funds 4,00,00,000

B Less : 50% of Debt (40,00,000 + 10,00,000) '25,00,000

Minimum Own Funds 75,00,000

||] Maximum Possible Amount of Buy-Back ee 25,00,000

| [5] 25% of Paid-up Equity os 12,50,000

Maximum No. of Shares 4,25,000

[6] Maximum Possible Offer Price

[Maximum Buy-Back / Maximum No. of Shares]

_ 28,00,000 ; g

1,25,000 &

Least Amountof1,2and3__

Max. No, of Equity Shares asin 4

Conclusion : Thus, Keeping in view all legal conditions, Satya 1d. can uy back 1,25,000 equity

shares ata price of € 20 each including premium of < 10 Pet share.

Naximum No. of shares that can be bought back = 25% of 50,00,000/ 10

‘Maximum Price = 25,00,000 / 1,25,000 = € 20 per share

= 1,25,000.

|

Financial Ac

444 anclal Accounting ~ V(TYRAL ;

Journal of Satya Ltd, 1 SEM.y,

Particulars

7. | Bank Ave

To Investment Alc

To Profit and Loss A/C

2. | Bank Ac =

Ty a% Preference Share Capital Alc

Jo Securities Premium A/c

3. | Bank A/c oe

To 10% Debenture A/c ‘

To Securities Premium A/c

4. | Equity Capital A/c De

Premium on Buy Back A/c Dr

‘To Equity Shareholders Alc .

5. | Securities Premium A/c De

Dr.

General Reserve Alc

To Premium on Buyback A/c

Dr.

Equity Shareholders A/c

To Bank A/c

Dr.

6.

9,50,000

7. | General Reserve A/c :

To Capital Redemption Reserve Alc

Tutorial Note : Students ‘should provide narration for Journal Entries a

OR

1s an exercise.

Solution 4 : Refer Chapter 4, Mustration 32.

Solution 5 :

(a) CONDITIONS

Refer Chapter 3, Pal

NOFA COMPANY AND Tl

Para 1, 2 and 3.

FOR AMALGAMATION IN THE NATURE OF MERGER :

ra 3.3.

HE DIFFERENT MODES OF WINDING UP:

(b) LIQUIDATIO!

Refer Chapter 5,

oR

Solution 5 =

(a) OVERRIDING COMMISSION :

ON : Refer Chapter 3,

Refer Chapter 5, Para 9g

(b) PURCHASE CONSIDERATI! Para 4.

ITORS : Refer Chapter 5, Para 7.

(c) PREFERENTIAL CRED!

NAL RECONSTRUCTION : Refer Chapter 4, Para 1.1.

(d) NEED OF INTER

K OF EQUITY SHARES : Refer Chapter 2, Para 1

(e) BUY-BAC

pasion O09

pill )

Ter

“

ye

oe

Tre: Th tones

”

6-20 wanrsgon

10th

got

‘rate 2

Ne gt

ee ae

Warehesters ty Eysty Chaser eiters bie

6 by ore creegany tn er

a urmany in

nee tenreeeuttr i vere,

fp alone 10 OTHER ts fly gain sare

1 eng of Shao and debentures 6 ret en

UP agation of compan

tag steven

Lr eteesir,

te tee.

OLE 25 Pe

Me Weleteren tacnines on

ity tlio head toh eens 1-2

y .or00e® the correct option from the ogtion provises ards

wer py wack shall be Carpeted witin a yaress

J e date Othe si

ent ee pang sa veten

(gmat from the dete of BEA eh

so IVIL

gat from the date of

vat from the date of o

‘company purchases

ers be transferred to Capital Rede

(a) equal to the amount paid to the

ip) equal to paid-up capital o

fe) equal to the nominal valus of shares

(gj none of the above

4, The payment of commission to underurt

(a) he board of directors

{g) the memorandum of assaciation

4, Amerchant banker can act as 2 und

(@) Government of India

(© SEBI OF

5, Acompany after the completion of a buyback of ts

{@) cannot issue same kind of shares within one y

ory

(imo

winere

sah resnhsion

Ot oh free reser

(0) cannot issue same Kind of shares within 6 months

(6) can issue same kind of shares within 6 mor

(4) cannot issue bonus shares

6. Capital reduction scheme is worth considering

(a) f the company is small (0) # the company has recovery prospects

(c) if the company has no prospects (@) if the company is less capitalized

7. The company must apply for an order confirming the reduction

{@) to the Supreme Court (b) to the High Court

; (6) to the Tribunal (6) to the Ligui

Liquidation of Companies the payment schedule is 25

i Liquidator expenses, Outsider Lisbities, Prefers

a oe Liabilties, Preferential Liabiit

ne onpenses, Preferential Liabilities, Outs

iquidator expenses, Outsider Liabilities, Owners, Pref

jites, Owners

Labi

jes, Liquidator expenses, Owners

jer Liabi Owners

nal Liabilities

i

“6 Hinancial Accountiays- VANBAP : SEM,

9. Invostmont Allowance Rosorve Is

(a) Capital Ronorve

(c) Revenue Reserve.

10. For calculating Purchase Gonsidoration undor AS-14

(a) only paymont to equity sharoholdors are to bo tikon into consideration

(b) only payment to shareholders aro takon Into consideration

(6) only paymont to sharoholdors as woll as dabenture holders are takon Into consideration

(d) paymont to All stakeholdors Is taken into consideration

(b) Statutory Rosarvo,

(dl) Allof tho abovo

Q.2 : [SPAT India Ltd, « company which deals in ton and stool has suffarad heavy 109508 ‘nd took,

‘your advice as to how the balance shoot can be rostructiras,

Mn A to restructure it ot. It sel

Moss and how tho restructured balance shoot can bo made? (15)

ag From tho below information aro provided : z

ye 5,000, 0% Proteronco Sharos of @ 10 oach, € 8 palk-up 4,00,005

i 1,50,000 Equity Sharos of € 10 each 15,00,009

ia f 10% Debentures: 5,00,009

a4 Bank Loan 5,00,000

‘quit Creditors 15,00,009

‘not Cash Crodits 2,50,000

AA Goodwill 1,00,009

fost Land 2,00,000

fost Plant and Machinery 12,00,000

The Receivables :

req + Good 5,00,000

oy = Doubtful 30,000

§ Inventories 6,00,000

iolt Preliminary Expenses 70,000

; The scheme of restructure was put in place as :

1. Allthe partly paid shares were called up and paid by all the shareholders.

2. Preference shares were reduced by % 40 per share and Equity shares were reduced to @ 4 per

share.

Equity shares were split to ¥ 1 per share post the above reduction.

Debentureholders agreed to reduce their claim by 40% if the the interest on debentures was

raised to 11%.

. Land was appreciated to % 6,00,000 whereas Plant and Machinery was depreciated by 40%,

The market value of Inventories was ¥ 4,50,000 and it was brought to that level.

All the fictitious, Intangible, doubtful and losses were to be written off.

There was a claim against the company to the tune of ¥ 1,50,000 recorded under the Creditors

” which was settled by paying one-third of the amount due.

9. An unrecorded liability of & 1,50,000 came to light of the company on verification and it was

settled by paying off € 50,000.

10. The Directors of the company decided to sell 4,00,000 Equity shares of the company at ¥ 1 per

share at par for the working capital needs of the company.

Allthe point put above were accepted. You are required to pass Journal Entries and prepare Revised

3.

4,

Balance Sheet.

oR

he :IRCTC Ltd. a government company who files DRHP for its Initial Public Offer of 80,00,000

shares of ¥ 10 each at % 250 per share, appoints SBI Capital, Citi Bank Financial Services, JM

Financial Services and Morgan Stanley as its lead manager for the IPO in the ratio of 4:3: 2:1.

The lead manager agreed to the ratio and also took the following shares for themselves (Firm

underwriting). (15)

SBI Capital 2,00,000 shares

CITI Bank Financial 1,00,000 shares

JM Financial 1,00,000 shares

Morgan Stanley 1,00,000 shares

asters acm m 800 >I]

Prog

ions (UPS)

30,00,000 sharos

20,00,000 sharos

10,00,000 shares

5,00,000 shares

aot Underwiting of Shares and also ca

nest “one oro paid @ 5% On Issue price ofthe shares

eT rentios in context to the underwriters,

Sp LIABILITIES

Za jee Funds

» ya

Se oni surplus

1 Reve8 Sod against Share Warrants

i foe) Frain Money received Pening Allotment

5 a Bent Liaplities

» porrowings

en Ar iabilities

ou ‘Borrowings

* grote ables

1 a Goren Labs

» ome

7

10 stamp of Yond manago

.g tho stamp of fond managor (oxctuding the shares taken ty than) mas

ring no stamp of the lead manager was 6,00,000 shares,

iculate the Not Liability of Undorartars

y jane balance sheet of M/s Sharp Lg, as on st March, 2019: (15)

ae valance sheet of Ws Component Linited as at att March, 2019

Note z

1 | 25,00,000

2 | 37,50,000

3 | 57,50,000

13,00,000

40,00,000

10,00,000

1,53,00,000

wl 3

L ss arent Assets

i ns

d Asset

1 Fire agile Assets 4 | 93,00,000

won curent Investments

» Gurrent Assets

* Curent Investments ae

* fqvertoies a

» Frade Receivables 10,00,000

{cash and Cash Equivalents tenn

Se 1,53,00,000

‘Wes of Accounts —

i. Share Capital

Authorised Capital :

3,00,000 Equity Shares of € 10 each

Issued, Subscribed and Paid-up Capital :

2,50,000 Equity Shares of % 10 each fully paid

. Reserve and Surplus

1. Revenue Reserve

Security Premium,

Profit & Loss A/c

Total

' Long Term Borrowings

Secured Loans

~ 12% Debentures

~ Unsecured Loans

Total

30,00,000

25,00,000

30,00,000

5,00,000

2,50,000

37,50,000

37 50,000

20,00,000

57,50,000

V(TYBAF: SEM)

Financial Accounting

53,00,000

30.00.00

10,00,009

10.00.0009

93,00,000

4. Fixed Assets - Tangible Assets

a. Land and Bi

b. Plant and Machinery

Furniture and Fittings

Total

ach on 18t APH 2019 at € 20 poy

ry rosolution passed by the

e mado by the Company oUt of

The company wants to buy b:

share. Buy back of shares is duly authorised bY

company towards this. The payment for buy’ Dé

sufficient bank balance available

Comment with your calculations, whether buy

Companies Act, 2013. It yes, pass necessary journal

a Balance sheet after a buyback of share!

its articles and nec

ck of shares will b

pany is within provisions of the

Jack of sharas by com s

back of er rowards May back of ShAFOS ANd proparg

OR

Q3 : The following is the Balance Sheet of Suman Lt

a which is in the hand of liquidator, (18)

Balance Sheet as at 31-12-2019

Liabilities TT [Assets ‘ £

Share Capital = Fixed ASsots 7 00)

500 6% Preference Shares of € 100 Stock 1.20:000

each, tully paid 50,000] Book Debts SS oeae

1,000 Equity Shares of € 100 each, Gash 1.50.00

fully paid 4,00,000} Profit and Loss Beh

3,000 Equity Shares of £ 50 each.

25 paid 75,000

Loan from Bank (on Security of stock)} 50,000

Trade Creditors 1,75,000

¥50,000

The assets realized the following amounts (atter all costs of re:

(000 as per Balance Sheet) :

amounting to 3,000 paid out of cash in hand ¢ 20,

Fixed Assets 84,000

Stock 55,000

Book Debts 1,15,000

Prepare the Liquidators Final Statement of Account.

mmarised Balance Sheets of A Lid. and B Ltd. as at 1st April, 2019 are as follows : (15)

Q.4: The Sul

Balance Sheets of A Ltd. and B Ltd.

A Ltd, (2) [B Lid. (2)

Particulars 3

1. EQUITY AND LIABILITIES

4. Shareholders’ Funds

a. Share Capital

— Equity Shares of € 10 each fully paid

= 11% Preference Shares of = 10 each fully paid

6,00,000 | 5,00,000

-| 3,00,000

b. Reserves and Surplus

= Profit and Loss A/c 2,00,000 :

— Reserves 2,40,000 :

2. Share Application Money received Pending Allotment

3. Non-Current Liabilities

Long-term Borrowings

= 12% Debentures ,00,000 2,00,000

4, Current Liabilities =

Trade Payables

= Sundry Creditors 60,000 | 1,00,000

}12,00,000 [11,00,000

Total

splutions (UPS) oy

int papers ators ( wy

7,00,000 | #,00,000

2,000) 00,000

ors

rd Oe Equivalents 2,50,000| 1,40,000

50,000] 1,00,000

112,00,000 |12,00,000 .

6 agree to amalgamate and form a new company AB Ltd. on the following

ab very 5 equity shares, 6 shares of AB Ltd. of 8 10 each will be issued at premium of 50%.

weir nolders wil be issued 12% debentures of AB Ld, of samo amount and denomination.

41% Preference shares will be

oe rine I aares hat alloted 4, 13% Preference shares of & 10 each of

Od '5 equity shares 6 shares of AB Ltd. of % 10 each will be issued at promium of 50%.

2, For even oiders willbe issued 12% debentures of AB Ltd. of same amount and denomination.

eben woth 10,000 inthe balance shect of A Lid. ao fom the goods purchased by Bud.

em _eauited 10 SHO |

are Fgulation of Purchase Consideration

cents in the Books of AB Ltd, under Purchase Method

7

1 Th

2 Spening Balance Sheet of AB Ltd,

yo

oR

g is the summarised balance sheet of Hexza Ltd. as at 31st March, 2019 + (15)

a: Fotowin

Balance Sheet as at 31st March, 2019

Padua. z

1, equity AND LIABILITIES

{, shareholders’ Funds

a, Share Capital 60,00,000

& reserves and Surplus

"General Reserve eer

Profit and Loss Alc 415,20,000

= Workmen Profit Sharing Fund cecure

», sare Application Money received Pending Allotment .. -

3, Non-Current Liabilities a 7

4 Current Liabilities

Trade Payables

= Creditors es 0,00,000

eal 7,01,20,000

ll. ASSETS Err

1, Non-Current Assets

Fixed Assets

- Tangible Assets

Building a 14,00,000

Plant and Machinery 26,00,000

~ Intangible Assets

Good 16,00,000

2. Current Assets

& Inventories 14,00,000 .

b. Trade Receivables

~ Sundry Debtors 18,00,000

FMAM TE”

a

Onal an Gant Equivalent 14.00,000

101,20,005

anh at Hanh

YON HEHE TAG p6O10 Hany

Jat Apa #

PM nerd ab © 2A00,000 HEE PUKE sins

total

yoae of Haezi Ltd Ob

ya hie

ig whieh wae

fenta Lidl decided te whoa Ab

OO e TT Un Iie aqeegt beiiit

values af anpete and tite Halil

HMivotinery at © 20,00,000

Pirahnine conatinration van payables 46 filo ne

tion Fagannon © 10,000

oe 10 enol filly 8

2A poor Equity shivite 10 646

won © 1,00,000

Hexen Lid, wine the ane

(208%, On Bale

rare Hipor share for every Equity shinre OA Norry

sl

nore due 10 Pen td

I alook purchase (01

1. Payriont of Liquid!

Po Ianie of Pquily Bhai:

Hid nnd a payment of

4. Gundy Croditons of Hegzi Hd

4. Inventorios worth © 1,20,000 6F

which The company oharges prof Ol

Catonials the Purohiine considorntion, show the necessat

Hicand opening Jonna! Paios in the books of Ponte Lit

Pont 11d, on

y innigor anctunt nthe books of Hora

sonaidoration ar calculated: ts)

0.6 (a) : Give the methods under whieh Purchase C ont!

0.5 (bh): Give the conditions: laid down for Buy Back of Equly Sharon under Companions ACL, aoe

on

6: Write short notes on : (Any 3) (15)

(a) Capital eduction Alc

(b) Firm Undorwiting

(c) Liquidation of Companies

(a) Undorwritors Commission undor Undorwriting of Sharon and Debentures

(0) Typos of Amalgamation

Solution 1 (a) :

a now company is called absorption. - False

ties are taken at book

1. Two or more companies combining to form

2. Undor purchase mothod of accounting for amalgamation, a

valuos. - False

Dobit balance of realisation account Is profit which is transferred to Equity Shareholders Ale

under amalgamation of companies. - False

Purchase consideration means tho amount paid by one company to another company in

consideration for the assets and liabilities taken. - True

‘of external reconstruction and internal reconstruction is same.

Stakeholders is not required for Internal reconstruction. - False

‘allowed to convert its fully paid shares into stock. - True

pulsory as per the Companies Act, 2013. -

ssets and liabi

3.

>

False

The nature

Approval of

A company is

Underwriting of shares and debentures is not comy

exoo

False

9. Under liquidation of companies, the preference shareholders are paid last after payment to all

the other stakeholders. - False

10. Post buy back debt-equity ratio should not exceed 1 : 2. - False

Solution 1 (c}:

4. Every buy back shall be completed within a period of 7 year from the date of passing of the

special resolution.

2. Where a company purchases its own shares out of free re:

serve or securities premium, a sum

should be transferred to Capital Redemption Reserve which should be equal to the nominal

value of shares so purchased.

3. The payment of commission to underwriter(s) is to be authorised by the articles of association.

pe setae TINY

yy

nt Hi

nl at a HHO ; oem aa

tia 1 HANNON lanite oaine Kad Of shares

Fe trig wn tin be Ye Cai

an iy AE AE far an an

manny

on

HEL Me gH

Hy ea arent He AL RE Med

PPT oo

yall

in :

Lntevs ston send

Oe

WAY ae Imanvary prospacte

hichion to Me Fltunal

Nel Hiquidato

i Mulator oxponses, Owtatdtor Ltabititios,

wn il

weal Aiwa HAGOI I MALY Ho

A

pace alter atte da

V4 ANy payment ta shareholders are taken

Halanen Bhaat (Hota Heconstuction)

S ———— eats

we BhAHHe

Gan

Ch 1,090,000

t 200,000

12,090,000

6,600,000, von

OEE 10 ba0h

Houlatul oo000

#,00,000) Pratininary £ FNONSES, 70,000

Profit and Loss (al, Fig.) 19,50,000

4i,60,000

_ }46,50,000,

WW the Hooks of SPAT India Lid,

Journal Entrlas

ee

o FLITE SS OPA I PW

Is ank Aa (8,000 20)

saan / Han

1 eee ateranoe Share Capital Alo De Foo 000

> Prratoranoe Bhan Capital Ale (6,000 x 100) De | 6,04 "

“ fo Pafaroniee Sluts Capital A/e (5,000 x 60) | 600,000) a0

fo Capital Hodtetion Afi (6,000 4 A0) 2.00/00

Tapaity Sle Capital Ale (150,000 5 10) Dr |15,00,000

; To Equity Share Capital Ale (150,000 4) " 6,00,000

|__ to Gap Hrocuction Ae (1450.00.09) 9,00,000

a, [Eanaly Stare Ale (@ 10) (1,60,000 « 4) Dr. | 6,00,000

‘fo Equity Sharon Ale & 1) (6,00,000 x 1) 6,00,000

5, | 10% Dobonturon Ale Dr. | 5,00,000

To 11% Dobontures A/c (60%) 3,00,000

fo Cupital Reduction Alc (40%) 210,000

6. | Land We Dr. | 4,00,000

To Capital Reduction Ale 4,00,000

7. | Capital Reduction Alc

Dr. |27,80,000

To Plant and Machinory A/c (12,00,000 x 40%)

4,80,000

To Stock A/c (6,00,000 ~ 4,50,000) 1,50,000

To Goodwill Alc. 1,00,000

To Roceivablos A/c (Doutlul)

30,000

To Prolit and Loss A/c (BS) 19,50,000

To Proliminary Expenses Alc 70,000

8. | Croditors A/c Dr. | 1,50,000

To Cash / Bank Alc (1/3) 50,000

‘To Capital Reduction A/c (2/3) 1,00,000

9. | Capital Reduction A/c Dr. | 50,000

‘To Gash / Bank A/c (Unrecorded Liabilities) 50,000

id Vinanelat Accounting VTYBAE : SEM,

42

Pr | 4,00,000

10. | Cann / Bank No (4 00,000 1) 4,00,000

To Equity Sharon A/o raha assets

1. [ Goodwit At rs 10,20,000

Note : Studonts should provide narrations for Journal Entries as an exorcise,

Dr. Capital Reduction Account

Particulars © __| Particulars

To Plant and Machinory 4,60,000| By Proference Share

To Stock 1,50,000| By Equity Share Capital

To Goodwill 1,00,000] By 10% Debentures

To Receivables (Doubttul) 30,000] By Land

To Profit and Loss 19,50,000] By Creditors

To Cash / Bank 50,000] By Goodwill (Bal. Fig.)

28,30,000

ISPAT India Ltd.

Balance Sheet (After Reconstruction)

Particulars Note v

1. EQUITY AND LIABILITIES

1. Shareholders’ Funds

a! Share Capital 1 |13,00,000

b. Reserves and Surplus 2 -

2. Non-Current Liabilities

Long-term Borrowings 3 | 8,00,000

3. Current Liabilities

a. Short-term Borrowings 2,50,000

b. Trade Payables e 13,50,000

Total ae [37,00,000

Il. ASSETS

1. Non-current Assets

Property, Plant and Equipment

- Tangible 13,20,000

—. Intangible 4 10,30,000

2. Current Assets

a. Inventories 4,50,000

b. Trade Receivables 5,00,000

¢. Cash and Cash Equivalents 4,00,000

Total 37,00,000

Notes to Accounts is

1. Share Capital

@. 10,00,000 Equity Shares of € 1 each 10,00,000

5. 5,000 Preference Shares of % 100 each & 60 paid 3,00,000

Total 13,00,000

2. Reserves and Surplus [

Profit and Loss A/c (Balance b/f) (19,50,000)

Less : W/o on Capital Reduction /19,50,000

Total ir

3. Long Term Borrowings

2. 11% Debentures 3,00,000

y oan Loan 5,00,000

. | $:00,000_

1. Intangible Assets [£00,000

Goodwill

[1e.30,000.

454

LIABI

ILITY OF UNDERWRITERS (No. of s

= = - Of Securition)

u JM Morgan Total

Financial Stanto;

32,00.000] aa 7 Ze

¢ SS Marked Actuan 00,000 16,00,000 8.00,000 80,00,000

Leseations | Actual — |(30,00,099

é potest ci a = {20.00.000) |(10,00,000)| ¢s 00,000) |(65,00,000)

«. |B aned . 4.00,000]"6,00,0001 3,00,000 15,00,000

s | 4:3:2:4] (2400

D- | application: ( i (1,80,000) (1.20,000)| (60,000) (6,00,000)

‘ galance 00)) 2.20,000 4,80,000] 2,40,000| 9,00,000

| Less?

f underwriting 40,000 20,000 13,333 6,667 ms

g. {B27 “| 2:00.00] “4,66,667] 2,33,23| ~9.00,000

* | Less: Fier

H undemriting (2,00,000) (1,00,000) (4,00,000) (1,00,000) (5,00,000)

L ae i [G-H) (2,00,000)|7,00,000 3,66,667| 1,33,333| 4,00,000

i, | Less:

+ | agjusted 2,00,000 | (100,000) (86,667) (33,333) -

x. | Balance tJ) SI ~| 3:00,000] 4,00,000]” 4,00,000

| add : Firm

oo Underwriting 2,00,000 1,00,000 1,00,000 1,00,000| . 5,00,000

my. | Net Liability} (K +L} 2,00,000) 1,00,000| 4,00,000 2,00,000| 9,00,000

n. | Issue Price 250 250 250 250 250

5,00,00,000 2,50,00,000 '0,00,00,000 | 5,00,00,000 22,50,00,000

©. Commission (32,00,000 x (24,00,000 x|(4,60,000 x (8,00,000 x }10,00,00,000

: 9 250 x 5%) | (250 x 5%)| 250 x 5%)| 250 x 5%)

|4,00,00,000 {3,00,00,000 |2,00,00,000 |1,00,00,000

PB. 11,00,00,000. |(50,00,000) |8,00,00,000 \4,00,00,000

“ Receivable Payable | Receivable | Receivable

in the Books of IRCTC Ltd.

Journal Entries

7 Particulars = =

Dr. | 5,00,00,000

| Sera Dr. | 250,00,000

M. Dr. }10,00,00,000

ee Dr. | 5,00,00,000

Morgan Stanley Alc * """ \99.50,00,000

To Equity Share Capital Alc arene

ae 5 ),00,00,000

2. | Underwriting Commission A/c Dr. {10.00.01 4,00,00,000

To SBI A/c 3,00,00,000

To Citi A/c 2,00,00,000

To JM Financial A/c 1,00,00,000

Stanley A/c .

To Morgan Stanley. Dr. |13,00,00,000

3. | Cash/ Bank Ale 1,00,00;000

To SBI Alc 8,00,00,000

To JM Financial A/c 4,00,00,000:

ley A/c

To Morgan Stanley oF 50,00,000

4. | Citi Ale

To Cash / Bank A/c

50,00,000

Note : Students should provide narrations for Journal Entries as an exercise.

Financial Accounting; - V TYBAF

454

Suen ss Ascertain Maximum Buy-Back Amound)

-BACK (Asc:

|. CONDITIONS FOR BUY-BACK ( >

‘Step_ Condition

(1) Sources °9,00,000

a. Revenue Reserve 50,000

b. Profit and Loss A/c 5,00,000

© Security Premium 37,50,000

a. Reserves and Surplus pS

[2] 25% of Own Funds 25,00,000

a. Paid up Capital 87,50,000

b. Free Reserves 62.50.00

©. Own Funds 15.62.509

a. 25% of Own Funds pS

[3] Excess of Equity Over Debt 162,50,000

a. Equity

b. Debt (Secured Loans + Unsecured Loans) / 2 t28.75,c00

(87,50,000 + 20,00,000) / 2 : 53.750

E 10

Maximum amount of Buy back 1, 2 and 3 whichever is less = © cee

I. MAXIMUM NO. OF EQUITY SHARES TO BE BOUGHT-BACI ee

25% of Equity Share Capital = 6,25,000 / 10 = 62,500 Equity Shares

Since company has to buy-back 50,000 Equity shares which is lesser than maximum no, of

‘shares which can be bought back 80 it is allowed to buy-back shares.

In the Books of M/s Sharp Ltd.

Journal Entries

No. Particulars fa z

1. | Revenue Reserve Ac Dr. | 5,00,000

To CRR A/c 5,00,000

2. | Equity Share Capital Ave Dr. | 5,00,000

Premium on Buy-back A/é : Dr. | 5,00,000

To Equity Shareholders A/c 10,00,000

3. | Equity Shareholders Ave Dr. ]10,00,000

To Cash/ Bank A/c 10,00,000

4. | Security Premium Af Dr. | 5,00,000

To Premium on Buy-back A/c

vy 5,00,000

Note : Students should provide narrations for Journal Ent

S as an exercise,

Balance Sheet (After Buy-back)

Particulars Note e

1. Equity AND LIABILITIES

1 Shareholders’ Funds

a. Share Capital

,000

b. Reserves and Surplus 2 32.80.00

2. Non-Current Liabilities ms

Long-term Borrowings

3. Current Liabilities 3 57,50,000

2: Short-term Borrowings

b. Trade Payablos 10100,000

©. Other Current Liabilities 10/00000,

Total ["743,00,000

1,43,00,000

gr SOMMMOUS (CUES)

18

stTS a assots.

+ Nome pant ‘and Equipmont

m

nae ots

Gate iqvostimonts

% cation

8 we ocoivables

v. Yad hg Cash Equivalents

Gast

é

‘ott

jp mecounls

93,00,000

10,90,000

10,09,000

10,00,090

20,900,000

1,43,00,000,

(ee Capital

i. Stay Share Capital

Eat orised Capital :

Autres Equily Shares of € 10 each

3,000? subscribed and Paid-up Capital

lsste%G9 Equity Shares of € 10 each fully paid

269Siyes and Surplus

, Reser Reserve

ever’ Redemption Reserve

r

Crert and Loss Alc

ro Term Borrowings

Secured Loans

2% Debentures

Unsecured Loans

Total

Tangible Assets

Land and Building

Plant and Machinery

Furniture and Fittings

Total

oR

Solution 3 :

[30,00,000

[20,00,000

Liquidator’s Final Statement of Account

{25,00,000

5,00,000

2,50,000

[92,50,000

'37,50,000

120,00,000

[57,50,000

153,00,000

130,00,000

10,00,000

\93,00,000

Receipts =

Payments

To Assets =

+ Cash in Hand

+ Trade Debtors

= Fixed Assets

To Surplus from Securities

- Assets Realised

Less : Bank Loan

To Proceeds of Call

~ Receipts from Call on.

Contributories =

Equity Shares (WN)

20,000

4,15,000

84,000

55,000

(50,000

5,000

By Liquidation Expenses

By Unsecured Creditors

By Returns to Contributories

~ Preference Share Capital

By Retums to Equity Shareholders

~~ Equity Share Capital

2,56,400

|

Working Notes :

(1) Amount Required :

Preference Share Capital

Equity Share fully paid

=

3,000

1,75,000

50,000

28,400

2,56,400

z

50,000

4,00,000

on Financial Accounting VOVIAE SIM Vy

Equity Share partly paid a ie oe

Lose Available Gash [20,000 + 1,18,000 + 4,000 + 6,000 ~ (9,000 4 1,75,000)) an ney,

(2) Denictency 1,79,000

Total Deficiency = 1.78.00

(2) Thovetare nah oF sono {a 80 76.00) vl bo mado on 9,000 Baran = & ary,

2 and 9

rotum of £28.40 (100.00 ~ 71.60) will be made on 1,000 shares = 7 26,400,

Solution 4:

Purchase Consideration

Particulars Te ; i

Ald. _

Equity Shareholders of A Ltd. (72,000 x 15) semen 0.80.06

B Ltda,

ity Shareholders of B Ltd. (60,000 x 15) “

Preference Shareholders of B Ltd. (24,000 x 10)

9.00.05

2.40.00,

In the Books of AB Ltd.

Journal Entries

No. Particulars As z

1. | Business Purchase Ale Dr. [22.20,000

To Liquidator of A A/c 10,20,009

To Liquidator of B A/c 11,40,009,

2. | Plant and Machinery Alc Or. [18,00,000

Inventories Alc Dr. | 2,60,000

Debtors A/c Dr. | 3,90,000

Cash / Bank A/c Or. | 1,50,000

Goodwill A/c Dr. | 3,80,000

To 12% Debentures Alc 3,00,000

To Security Premium A/c 1,60,000

To Business Purchase A/c [22.20.00

3. | Liquidator of A A/c Dr. |10,80,000

Liquidator of B A/c Dr. |11,40,000

To Equity Share Capital A/c 13,20,000,

To Security Premium A/c 6,60,000

To Preference Share Capital A/c 2.401009

4, | 12% Debentures A/c Dr. | 3,00,000

To 12% Debentures A/c 3;00,000

5. | Creditors Ale Dr. | 10,000

To Debtors A/c 10,000

Note : Students should provide narrations for Journal Entries as an exercise.

Balance Sheet of AB Ltd.

Particulars Note z

|. EQUITY AND LIABILITIES

1. Shareholders’ Funds

a. Share Capital 1 [15,560,000

b. Reserves and Surplus 2 | 6,60,000

2. Non-Current Liabilities

Long-term Borrowings . 3 | 3,00,000

3. Current Liabilities

Trade Payables

Total

yr

Paper Solutions (UPS)

pavers” 487

18

AsseTrront Assets

{none plant and Equipment

Prof sngible .

= tangible 5 |15,00,000

Syren Assets 6 3,80,000

2, Cup ntories

we ivables 2,60,000

a. tg Recel

Bie ish Equivalents 7 | 380,000

gestae co 8 |_1\50,000

total |26,70,000

Sesto teow =

share capital

+ Bruty Shares of & 10 each fully paid ae

‘fa, Preference Shares of 10 each fully paid eon

Total

p, poserves and Surplus [15:60,000"

‘ourity Premium

4, tong Term Borrowings | 6:60.00.

* 42% Debentures AO

4, Trade Payables a

Sundry Creditors noon

5, Tangible Assets eer

Plant and Machinery 15,00,000

6. Intangible Assets EEE

Goodwill

17, Trade Receivables | 3:80.00.

Sundry Debtors ies 3,80,000

8. Cash and Cash Equivalents . |_3,80,000_

Cash and Bank i 1,50,000

Ee

OR

Solution 4:

Purchase Consideration

Particulars =

Equity Shareholders of Hexza Ltd.

6,00,000 x 11 66,00,000

6,00,000 x 4

In the Books of Penta Ltd, =

Journal Entries .

No. Particulars z =

1. | Business Purchase A/c Dr. |90,00,000

To Liquidator of Hexza A/c 190,00,000

2. | Building A/c Dr. |24,00,000

Plant and Machinery A/c Dr. 20,00,000

Inventories A/c Dr. |14,00,000

Sundry Debtors A/c Dr. |18,00,000

Cash / Bank A/c Dr. [13,20,000

Goodwill Alc Dr. |14,80,000

To Workmen Profit Sharing Fund A/c 6,00,000

To Trade Creditors A/c 8,00,000

To Business Purchase A/c |90,00,000

oo,

Financial Accounting - V (TYBAF : SEM-V)

Dr. [90,00,000

Uquidator of Hoxza Alc 160,00,000

To Eauity ital Alc [24,00,000

To Sesh Ave 6,00,000

a. beat Promium Ale Deel coo

To Dobtors Alc oo, 000

8. [ Goodwil Ale Dr | 24.000 aa

To Inventories Ale 5 7 009

8: | Goodwill Alc (Liquidation Expenses) " oo

To Cash Ale 10,000

Note : Students should provide narrations for Journal Entries as an exercise.

Or. Equity Shareholders Account Cr,

Particulars @_| Particulars = es

To Equity Shares in Penta Ltd. 166,00,000] By Equity Share Capital 160,00,000

To Cash 24,00,000| By General Reserve H12,00,000

By Profit / Loss A/c 15,20,000

By Realisation 2,80,000

lsoa0000 190,00,000

eo Penta Ltd. Account cr.

Particulars & | Particutars fe

To Realisation 190,00,000] By Equity Shares in Penta Ltd. _|66,00,000

By Cash 124,00,000

{90,00,000

Dr. Equity Shares in Penta Ltd. Account Cr.

Particulars & | Pantculars jExte:

To Penta Ltd. [66,00,000| By Equity Shareholders 166,00,000

: [66,00,000 __|66,00,000

Dr. . Realisation Account cr.

Particulars = Particulars =

To Sundry Assets : By Workmen Profit Sharing Fund] 6,00,000

-_ Building 14,00,000] By Creditors 8,00,000

-" Plant and Machinery 26,00,000| By Penta Ltd. 90,00,000

= Goodwill 16,00,000

To Inventories 14,00,000

To Sundry Debtors 18,00,000

To Cash 13,20,000

To Equity Shareholders 2,80,000 | -

: 1,14,00,000 : 7,14,00,000

Solution 5 :

(a) THE METHODS UNDER WHICH PI

Chapter 3, Para 4.1 44.2

(b) THE CONDITIONS LAID DOWN

FOR BUY BACK OF Et

ACT, 2018 : Refer Chapter 2,

Paras

oR

Solution 5 :

(a) CAPITAL REDUCTION AVC : Re:

(©) FIRM UNDERWRITING : Refer Chapter 1, Para 4 (2)

(c) LIQUIDATION OF COMPANIES : Refer Chapter 5, Para 1

(d) UNDERWRITERS COMMISSION

Refer Chapter 1, Para 2

(©) TYPES OF AMALGAMATION : Refer Chapter 3, Para 1.1

fer Chapter 4, Para 5.3

URCHASE CONSIDERATION ARE CALCULATED : Refer

‘QUITY SHARES UNDER COMPANIES

UNDER UNDERWRITING OF SHARES AND DEBENTURES:

You might also like

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Tybaf Sem5 Fa-V Nov19Document8 pagesTybaf Sem5 Fa-V Nov19katejagruti3No ratings yet

- Insurance Company-1Document13 pagesInsurance Company-1katejagruti3No ratings yet

- Blue Book ShreyyyDocument9 pagesBlue Book Shreyyykatejagruti3No ratings yet

- Tybaf Project Guidance 1Document10 pagesTybaf Project Guidance 1katejagruti3No ratings yet

- GST ManinIndiaDocument8 pagesGST ManinIndiakatejagruti3No ratings yet