Professional Documents

Culture Documents

Boundaryless Organisation

Uploaded by

Sivil JainOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Boundaryless Organisation

Uploaded by

Sivil JainCopyright:

Available Formats

MARKET REPORT

SURVEY

IP SERVICES MATRIX

DIRECTORY

STP + automation

The boundaryless organisation

The true information revolution is only just emerging as technology strips away traditional product silos to provide a more integrated view.

When Peter Drucker wrote in October 1999, The truly

Allen Brown, The Open Group

organizational structures. In order to achieve that and to enable the information age to realize its full potential, we need to allow for what The Open Group calls Boundaryless Information Flow- a continuous secure stream of information seamlessly flowing within and among enterprises, across permeable boundaries.

revolutionary impact of the information revolution is just beginning to be felt,

he recognized that its real impact was not in terms of information at all. Just as the Industrial Revolution in its first half-century merely mechanized the process of producing goods that had been there all along, so the Information Revolution, since the introduction of the first computers, has only improved processes that already existed. The organization of enterprises into departments and divisions that engage in end-to-end processes, which is a consequence of the Industrial Revolution, has not substantially changed. The main impact of information technology so far has been enhancing existing processes, with tremendous savings in time and cost and similarly tremendous improvements in consistency and quality. But the underlying processes have not really changed at all. Jack Welch of General Electric (GE) coined the phrase The Boundaryless Organisation. He believed, and has been proven correct, that GE would be much more effective if the cultural, geographical and organizational barriers that separated the employees become more permeable. He put emphasis on the boundaries ability to enable business, rather than get in its way. In the next era of the information age, we will expect to have information from multiple parts of the enterprise at our fingertips, all integrated to suit our specific needs, instantly available, across geographies, time zones and

NO BOUNDARIES

To achieve Boundaryless Information Flow, an organisation needs to put in place infrastructure services that bring data sources together and provide that information to those users and applications that need it. Creating the environment for integrated information has been a challenge. What were once regarded as necessary boundaries between the different stages in operational processes designed to achieve the benefits of specialisation, now represent silos delivering outmoded solutions, which do not allow for the sharing of information. Barriers at the business and technical levels must be broken down. If we look at the application of the Boundaryless Information Flow concept at industry level, we can see some very encouraging signs: for example, supply chain management in the manufacturing industry, customer relationship management (CRM) in the services industry, or straight through processing (STP) in the financial services industry. STP automates end-to-end processing of financial transactions from start to finish. It eliminates many of the boundaries that currently exist, leads to real risk mitigation and significant cost savings. By including applications, standards and best practices in its implementation, STP is moving the concept of Boundaryless Information Flow into the mainstream of finance.

This article was first published in the December 2003 issue of financial-

www.financial-i.com financial1

CONTENTS

NEWS PEOPLE LOG-IN GUEST

PEOPLE

STP can be divided into two distinct parts: firstly, enterprise application integration or internal STP, which focuses on integrating internal processes within the enterprise, and secondly, business-to-business application integration or external STP, which focuses on seamlessly connecting all external partners in the trading and settlement process. Many financial enterprises also use another STP component, business process management, to automate and integrate their varied corporate business processes.

suited for leveraging investment in existing legacy systems. Since they utilize open standards, they enable easy integration and implementation of different applications and allow them to communicate securely across the internet. Web Services surpass the flexibility offered by todays middleware. Where are we now? Although the financial industry has made some strides towards reducing processing time and streamlining back office activities, there is still a lot to be accomplished.

What were once regarded as necessary boundaries between the different stages in operational processes designed to achieve the benefits of specialisation, now represent silos delivering outmoded solutions.

OPEN ARCHITECTURE

STP reflects the industrys growing need for higher accuracy with less human intervention, reduced trade cycle and access to trade information in real time; reduced operating costs based on elimination of redundant processes and manual activities; and the need for better connectivity among different entities of the trading cycle. The key prerequisite for achieving this is standards-based integration of applications. In order to implement and achieve a truly seamless solution, financial enterprises need to start with an open architectural framework foundation capable of providing flexible support for open standards, on which the application architecture can be built. There are several technologies implementing open standards that could be used for integrating STP applications one of the most promising approaches is based on Web Services. Web Services not only support the development of new applications with value added capabilities, but also are well

ALL-ENCOMPASSING

Full adoption of STP and standardized application integration such as Web Services represents significant progress in making Boundaryless Information Flow a reality in the financial services industry. This will help break down boundaries and liberate the information from the legacy systems that hold it so closely today, reducing operational costs and increasing overall effectiveness. It is not the whole story, however. We still face challenges. For example, how to manage this information flow the information we extract represents a huge amount of data. There is also the challenge of expanding information flow across different industries and partners who face very different issues and challenges. But this should not be a deterrent. No one solution is perfect and all encompassing. We just need to set the right expectations, roll-up our sleeves, and work together to identify and develop the right set of standards. //

financial-

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Manual Samsung Galaxy S Duos GT-S7562Document151 pagesManual Samsung Galaxy S Duos GT-S7562montesjjNo ratings yet

- Part Time Civil SyllabusDocument67 pagesPart Time Civil SyllabusEr Govind Singh ChauhanNo ratings yet

- Applied Physics (PHY-102) Course OutlineDocument3 pagesApplied Physics (PHY-102) Course OutlineMuhammad RafayNo ratings yet

- Morse Potential CurveDocument9 pagesMorse Potential Curvejagabandhu_patraNo ratings yet

- Process Strategy: Powerpoint Slides by Jeff HeylDocument13 pagesProcess Strategy: Powerpoint Slides by Jeff HeylMuizzNo ratings yet

- Intervensi Terapi Pada Sepsis PDFDocument28 pagesIntervensi Terapi Pada Sepsis PDFifan zulfantriNo ratings yet

- 01 - A Note On Introduction To E-Commerce - 9march2011Document12 pages01 - A Note On Introduction To E-Commerce - 9march2011engr_amirNo ratings yet

- 2a Unani Medicine in India - An OverviewDocument123 pages2a Unani Medicine in India - An OverviewGautam NatrajanNo ratings yet

- 3rd Page 5Document1 page3rd Page 5api-282737728No ratings yet

- Mitsubishi FanDocument2 pagesMitsubishi FanKyaw ZawNo ratings yet

- Project Manager PMP PMO in Houston TX Resume Nicolaas JanssenDocument4 pagesProject Manager PMP PMO in Houston TX Resume Nicolaas JanssenNicolaasJanssenNo ratings yet

- IG Deck Seal PumpDocument3 pagesIG Deck Seal PumpSergei KurpishNo ratings yet

- Model TB-16Document20 pagesModel TB-16xuanphuong2710No ratings yet

- Holiday AssignmentDocument18 pagesHoliday AssignmentAadhitya PranavNo ratings yet

- Participant Observation: Qualitative Research Methods: A Data Collector's Field GuideDocument17 pagesParticipant Observation: Qualitative Research Methods: A Data Collector's Field GuideMarta CabreraNo ratings yet

- Power System Planning and OperationDocument2 pagesPower System Planning and OperationDrGopikrishna Pasam100% (4)

- Bushcraft Knife AnatomyDocument2 pagesBushcraft Knife AnatomyCristian BotozisNo ratings yet

- 200150, 200155 & 200157 Accelerometers: DescriptionDocument16 pages200150, 200155 & 200157 Accelerometers: DescriptionJOSE MARIA DANIEL CANALESNo ratings yet

- Mode of Action of Vancomycin: L D D D D DDocument8 pagesMode of Action of Vancomycin: L D D D D DNolanNo ratings yet

- List of Phrasal Verbs 1 ColumnDocument12 pagesList of Phrasal Verbs 1 ColumnmoiibdNo ratings yet

- Revit 2023 Architecture FudamentalDocument52 pagesRevit 2023 Architecture FudamentalTrung Kiên TrầnNo ratings yet

- Optimal Dispatch of Generation: Prepared To Dr. Emaad SedeekDocument7 pagesOptimal Dispatch of Generation: Prepared To Dr. Emaad SedeekAhmedRaafatNo ratings yet

- Progress Report 1Document3 pagesProgress Report 1api-302815786No ratings yet

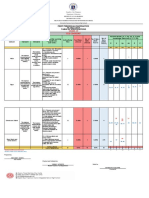

- Revised Final Quarter 1 Tos-Rbt-Sy-2022-2023 Tle-Cookery 10Document6 pagesRevised Final Quarter 1 Tos-Rbt-Sy-2022-2023 Tle-Cookery 10May Ann GuintoNo ratings yet

- Resume NetezaDocument5 pagesResume Netezahi4149No ratings yet

- TRICARE Behavioral Health Care ServicesDocument4 pagesTRICARE Behavioral Health Care ServicesMatthew X. HauserNo ratings yet

- Geometry and IntuitionDocument9 pagesGeometry and IntuitionHollyNo ratings yet

- Daikin FUW Cabinet Fan Coil UnitDocument29 pagesDaikin FUW Cabinet Fan Coil UnitPaul Mendoza100% (1)

- Ginger Final Report FIGTF 02Document80 pagesGinger Final Report FIGTF 02Nihmathullah Kalanther Lebbe100% (2)

- Why File A Ucc1Document10 pagesWhy File A Ucc1kbarn389100% (4)