Professional Documents

Culture Documents

6 CHP 13 14 15 Solution

Uploaded by

Bijay AgrawalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

6 CHP 13 14 15 Solution

Uploaded by

Bijay AgrawalCopyright:

Available Formats

lOMoARcPSD|4964459

6-Chp 13 & 14 & 15-Solution

Financial Analysis & Valuation (University of Southern California)

StuDocu is not sponsored or endorsed by any college or university

Downloaded by bijay agrawal (bijayagrawal@yahoo.com)

lOMoARcPSD|4964459

Chapter 13 & 14 & 15 (Choosing the Right Model-Dividend Model /FCFE

model/ FCFF Models)

Scenario 1: Ameritech Corporation paid dividends per share of $3.56 in 1992, and dividends are

expected to grow 5.5% a year forever. The stock has a beta of 0.90, and the treasury bond rate is

6.25% and the equity risk premium is 5.5%.

1) Use Scenario 1: What is the value per share, using the Gordon Growth Model?

A) $78.55

B) $72.80

C) $65.89

D) $60.80

E) $55.47

Solution: C

Cost of Equity = 6.25% + 0.90 * 5.5% = 11.20%

Value Per Share = $3.56 * 1.055/(0.1120 - 0.055) = $65.89

2) Use Scenario 1: The stock is trading for $80 per share. What would the growth rate in

dividends have to be to justify this price?

A) 3.65%

B) 6.46%

C) 5.84%

D) 4.86%

E) 5.19%

Solution: B

$3.56 (1 + g)/(.1120 - g) = $80

Solving for g,

g = (80 * .112 - 3.56)/(80 + 3.56) = 6.46%

3) Church & Dwight, a large producer of sodium bicarbonate, reported earnings per share of

$1.50 in 1993 and paid dividends per share of $0.42. In 1993, the firm also reported the

following:

Net Income = $30 million

Interest Expense = $0.8 million

Book Value of Debt = $7.6 million

Book Value of Equity = $160 million

The firm faced a corporate tax rate of 38.5%. The market value debt-to -equity ratio is 5%. The

Treasury bond rate is 7%. The equity risk premium is 5.5%.

The firm expects to maintain these financial fundamentals from 1994 to 1998, at which time it is

expected to become a stable firm, with an earnings growth rate of 6%. The firm's financial

characteristics will approach industry averages after 1998. The industry averages are as follows:

1

Downloaded by bijay agrawal (bijayagrawal@yahoo.com)

lOMoARcPSD|4964459

Return on Assets = 12.5%

Debt/Equity Ratio = 25%

Interest Rate on Debt = 7%

Church & Dwight had a beta of 0.85 in 1993, and the unlevered beta is not expected to change

over time. What is the value of the stock in year 1993, using the two-stage dividend discount

model?

A) $14.62

B) $17.50

C) $16.74

D) $15.59

E) $18.47

Solution: E

Current (year 1993):

Retention Ratio = 1 - Payout Ratio = 1-(Dividend per share/EPS) = 1 - 0.42/1.50 = 72%

ROE = NI/Equity = 30/160 = 0.1875 = 18.75%

Given: Beta in 1993 = 0.85; MV Debt / MV Equity = 5%; and tax rate = 38.5% and rf =7%

and Equity risk premium = 5.5%

Unlevered Beta = 0.85/(1 + (1 - 0.385) * 0.05) = 0.8246

High growth period (between 1994-1998):

Since firm is expected to maintain the fundamentals from 1994 to 1998, we can assume the

below.

Expected retention ratio = Current retention ratio = 72%

Expected payout ratio = 1-0.72= 28%

Expected ROE = current ROE = 18.75%

Expected Growth Rate = expected Retention ratio * expected ROE = 0.72 * .1875 = 13.5%

Given beta is constant from the current year, we can assume beta = 0.85.

Cost of Equity in 1999 = 7% + 0.85 * 5.5% = 11.68%

Stable growth period (in 1999 and after):

Given: g = 6% and unlevered beta is constant from prior years.

Given: ROC =12.5 ; D/E = 25%; rd = 7%; and tax rate = 38.5%. These are at the industry

averages.

𝒈 𝒈

𝑬𝒙𝒑𝒆𝒄𝒕𝒆𝒅 𝒑𝒂𝒚𝒐𝒖𝒕 𝒓𝒂𝒕𝒊𝒐 = 𝟏 − 𝒓𝒆𝒕𝒆𝒏𝒕𝒊𝒐𝒏 𝒓𝒂𝒕𝒊𝒐 = 𝟏 − =𝟏−

𝑹𝑶𝑬 𝑫

[𝑹𝑶𝑪 + 𝑬 (𝑹𝑶𝑪 − 𝒊(𝟏 − 𝒕))]

𝟎. 𝟎𝟔

𝑬𝒙𝒑𝒆𝒄𝒕𝒆𝒅 𝒑𝒂𝒚𝒐𝒖𝒕 𝒓𝒂𝒕𝒊𝒐 = 𝟏 − = 𝟓𝟖. 𝟕𝟔%

[𝟎. 𝟏𝟐𝟓 + 𝟎. 𝟐𝟓(𝟎. 𝟏𝟐𝟓 − 𝟎. 𝟎𝟕(𝟏 − 𝟎. 𝟑𝟖𝟓))]

Beta = 0.8246 * (1 + (1 - 0.385) * 0.25) = 0.95

Cost of Equity = 7% + 0.95 * 5.5% = 12.23%

Downloaded by bijay agrawal (bijayagrawal@yahoo.com)

lOMoARcPSD|4964459

PV of Cash Flows:

𝑫𝒊𝒗𝒊𝒅𝒆𝒏𝒅𝟏𝟗𝟗𝟗

𝑻𝑽𝟏𝟗𝟗𝟖 =

𝒄𝒐𝒔𝒕 𝒐𝒇 𝒆𝒒𝒖𝒊𝒕𝒚𝒔𝒕𝒂𝒃𝒍𝒆 − 𝒈𝒓𝒐𝒘𝒕𝒉 𝒓𝒂𝒕𝒆𝒔𝒕𝒂𝒃𝒍𝒆

𝑬𝑷𝑺𝟏𝟗𝟗𝟗 ∗ 𝑷𝒂𝒚𝒐𝒖𝒕 𝒓𝒂𝒕𝒊𝒐𝒔𝒕𝒂𝒃𝒍𝒆

=

𝒄𝒐𝒔𝒕 𝒐𝒇 𝒆𝒒𝒖𝒊𝒕𝒚𝒔𝒕𝒂𝒃𝒍𝒆 − 𝒈𝒓𝒐𝒘𝒕𝒉 𝒓𝒂𝒕𝒆𝒔𝒕𝒂𝒃𝒍𝒆

(𝟏. 𝟓𝟎 ∗ 𝟏. 𝟏𝟑𝟓𝟓 ∗ 𝟏. 𝟎𝟔) ∗ 𝟎. 𝟓𝟖𝟕𝟔

𝑻𝑽𝟏𝟗𝟗𝟖 = = $𝟐𝟖. 𝟐𝟓

𝟎. 𝟏𝟐𝟐𝟑 − 𝟎. 𝟎𝟔

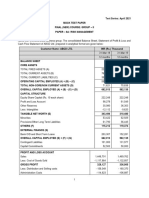

YEAR EPS DPS

Current $1.50

1994 $1.70 $1.50*1.135 $0.48 $1.70*0.28

1995 $1.93 $1.70*1.135 $0.54 $1.93*0.28

1996 $2.19 $1.93*1.135 $0.61 $2.19*0.28

1997 $2.49 $2.19*1.135 $0.70 $2.49*0.28

1998 $2.83 $2.49*1.135 $0.79 $2.83*0.28 TV = $28.25

We will discount all the cash flows using high growth period cost of equity 11.68%.

CF0=0 CF1 =0.48 CF2=0.54 CF3=0.61 CF4=0.70 CF5=0.79+28.25=29.04 I/Y = 11.68

COMPUTE NPV=? = $18.47 = PV in 1993

OR you can use growing annuity formula to compute the PV.

(𝟏 + 𝒈𝒉 )𝒏

(𝟏 − )

(𝟏 + 𝒄𝒐𝒔𝒕 𝒐𝒇 𝒆𝒒𝒖𝒊𝒕𝒚)𝒏

𝑷𝑽𝟎 𝒈𝒓𝒐𝒘𝒊𝒏𝒈 𝒂𝒏𝒏𝒖𝒊𝒕𝒚 = 𝑪𝑭𝟏

𝒄𝒐𝒔𝒕 𝒐𝒇 𝒆𝒒𝒖𝒊𝒕𝒚 − 𝒈𝒉

𝟏. 𝟏𝟑𝟓𝟓

(𝟏 −)

𝟏. 𝟏𝟏𝟔𝟖𝟓

𝑷𝑽 𝒐𝒇 𝒈𝒓𝒐𝒘𝒊𝒏𝒈 𝒂𝒏𝒏𝒖𝒊𝒕𝒚 = 𝟎. 𝟒𝟖 = $𝟐. 𝟐𝟐𝟎𝟐

𝟎. 𝟏𝟏𝟔𝟖 − 𝟎. 𝟏𝟑𝟓

PV of terminal value = 28.25/(1.1168^5) = 16.2608

PV = 2.2202 + 16.2608 = $18.48

4) Medtronic Inc., the world's largest manufacturer of implantable biomedical devices, reported

earnings per share in 1993 of $3.95 and paid dividends per share of $0.68. Its earnings are

expected to grow 16% from 1994 to 1998, but the growth rate is expected to decline each year

after that to a stable growth rate of 6% in 2003. The payout ratio is expected to remain

unchanged from 1994 to 1998, after which it will increase each year to reach 60% in steady state.

The stock is expected to have a beta of 1.25 from 1994 to 1998, after which the beta will decline

each year to reach 1.00 by the time the firm becomes stable (the Treasury bond rate is 6.25%).

Assuming that the growth rate and beta declines linearly (and the payout ratio increases linearly)

from 1999 to 2003, estimate the value per share in 1993, using the three-stage dividend discount

model. Assume the equity risk premium is 5.5%.

A) $147.55

B) $155.80

C) $133.62

Downloaded by bijay agrawal (bijayagrawal@yahoo.com)

lOMoARcPSD|4964459

D) $120.00

E) $115.53

Solution: A

High growth period (years 1 (1994) through 5 (1998)):

Growth in EPS = 16%

Payout ratio = Dividend per share / Earnings per share = 0.68 / 3.95 = 17.22%

Beta = 1.25

Cost of equity = 0.0625 + (1.25) (0.055) = 13.13%

Stable Period (after year 10 (2003)):

Growth rate = 6%

Payout ratio = 60%

Beta =1

Cost of equity = 0.0625 + (1) (0.055) = 11.75%

Transition Phase (years 1999 through 2003):

Linear decline per year for growth rate = (16 – 6) /5 =2%

Linear increase per year for payout ratio = (60 – 17.22) /5 =8.556%

Linear decline per year for beta = (1.25 - 1)/5=0.05

DPS = Cumulative

payout Cost of

Year EPS g (EPS*payout Beta discount PV

ratio equity

ratio) rates

Current $3.95 $0.68 17.2%

1994 $4.58 16% $0.79 17.2% 1.25 13.13% 1.13 $0.70

1995 $5.32 16% $0.92 17.2% 1.25 13.13% 1.28 $0.72

1996 $6.17 16% $1.06 17.2% 1.25 13.13% 1.45 $0.73

1997 $7.15 16% $1.23 17.2% 1.25 13.13% 1.64 $0.75

1998 $8.30 16% $1.43 17.2% 1.25 13.13% 1.85 $0.77

1999 $9.46 14% $2.44 25.8% 1.20 12.85% 2.09 $1.17

2000 $10.59 12% $3.64 34.3% 1.15 12.58% 2.35 $1.55

2001 $11.65 10% $5.00 42.9% 1.10 12.30% 2.64 $1.89

2002 $12.58 8% $6.47 51.4% 1.05 12.03% 2.96 $2.19

2003 $13.34 6% $8.00 60.0% 1.00 11.75% 3.31 $2.42

2003 TV $147.55 11.75% 3.31 $44.59

SUM $57.47

Year How did we calculate Cumulative Discount rate?

Current

1994 (1.1313)^1

1995 (1.1313)^2

Downloaded by bijay agrawal (bijayagrawal@yahoo.com)

lOMoARcPSD|4964459

1996 (1.1313)^3

1997 (1.1313)^4

1998 (1.1313)^5

1999 (1.1313)^5 * (1.1285)

2000 (1.1313)^5 * (1.1285)*(1.1258)

2001 (1.1313)^5 * (1.1285)*(1.1258)*(1.1230)

2002 (1.1313)^5 * (1.1285)*(1.1258)*(1.1230)*(1.1203)

2003 (1.1313)^5 * (1.1285)*(1.1258)*(1.1230)*(1.1203)*(1.1175)

TV2003 = EPS2003 * (1+growth stable period) *(payout ratio stable period)/ (cost of capital stable period –

growth stable period) = ($13.34 * 1.06 * 0.60)/(.1175 - .06) = $147.55

5) Yuletide Inc. is a manufacturer of Christmas ornaments. The firm earned $100 million last

year and paid out 20% of its earnings as dividends. The firm has also bought back $180 million

of stock over the past 4 years in varying amounts in each year. The firm is in stable growth,

expects to grow 5% a year in perpetuity, and has a cost of equity of 12%. If the dividend payout

ratio is modified to include stock buybacks, what is the value of equity (stock price)? Use

dividend discount model.

A) $790 million

B) $847 million

C) $1250 million

D) $998 million

E) $975 million

Solution: E

Dividends = $ 20 million

Average annual stock buyback = 180/4 = $ 45 million

Modified dividends = $20 million + $45 million = $ 65 million

Value of equity = 65 (1.05)/(.12-.05) = $ 975 million

6) Newell Corporation, a manufacturer of do-it-yourself hardware and housewares, reported

earnings per share of $2.10 in 1993, on which it paid dividends per share of $0.69. The current

return on equity is 22.34%. The return on equity and dividend payout ratio is expected to remain

unchanged from 1994 to 1998. After 1998, the earnings growth rate is expected to drop to a

stable 6%, and the ROE is expected to drop to 3.64%. The firm has a beta of 1.40 currently, and

it is expected to have a beta of 1.10 after 1998. The Treasury bond rate is 6.25% and the equity

risk premium is 5.5%. What is the value of the stock in 1993, using the two-stage dividend

discount model?

A) $55.00

B) $18.35

C) $46.68

D) $27.59

E) $35.47

Solution: D

Downloaded by bijay agrawal (bijayagrawal@yahoo.com)

lOMoARcPSD|4964459

CURRENT:

Given: beta= 1.40, rf= 6.25%, ERP=5.5%, EPS= 2.10; DPS=0.69; ROE= 22.34% (expected

to stay constant over the high growth period), payout ratio is expected to stay constant over

the high growth period

Current Payout ratio = DPS/EPS= 0.69/2.10= 32.86%

Current Retention ratio= 1- payout ratio= 1-0.3286= 0.6714 =67.14%

HIGH GROWTH:

Expected retention ratio= current retention ratio= 67.14%

Expected ROE = current ROE 22.34%

Expected growth rate= expected ROE*expected retention ratio= 0.2234*0.6714 = 0.15 =

15%

Beta= 1.40 same as current beta

Cost of equity= rf+ (beta) (ERP)= 6.25% + (1.40)*(5.5%)= 13.95%

STABLE PERIOD GROWTH:

Given: Growth rate= 6% ; ROE declines to 3.64%, beta= 1.10

Payout ratio= 1- g/ROE = 1- (0.06/0.0364)= 0.65 = 65%

Cost of equity = 6.25% + (1.10)*(5.5%)= 12.30%

𝑫𝒊𝒗𝒊𝒅𝒆𝒏𝒅𝟏𝟗𝟗𝟗 𝑬𝑷𝑺𝟏𝟗𝟗𝟗 ∗ 𝑷𝒂𝒚𝒐𝒖𝒕 𝒓𝒂𝒕𝒊𝒐𝒔𝒕𝒂𝒃𝒍𝒆

𝑻𝑽𝟏𝟗𝟗𝟖 = =

𝒄𝒐𝒔𝒕 𝒐𝒇 𝒆𝒒𝒖𝒊𝒕𝒚𝒔𝒕𝒂𝒃𝒍𝒆 − 𝒈𝒓𝒐𝒘𝒕𝒉 𝒓𝒂𝒕𝒆𝒔𝒕𝒂𝒃𝒍𝒆 𝒄𝒐𝒔𝒕 𝒐𝒇 𝒆𝒒𝒖𝒊𝒕𝒚𝒔𝒕𝒂𝒃𝒍𝒆 − 𝒈𝒓𝒐𝒘𝒕𝒉 𝒓𝒂𝒕𝒆𝒔𝒕𝒂𝒃𝒍𝒆

(𝟐. 𝟏𝟎 ∗ 𝟏. 𝟏𝟓𝟓 ∗ 𝟏. 𝟎𝟔) ∗ 𝟎. 𝟔𝟓

𝑻𝑽𝟏𝟗𝟗𝟖 = = $𝟒𝟔. 𝟏𝟗

𝟎. 𝟏𝟐𝟑𝟎 − 𝟎. 𝟎𝟔

growth in

YEAR EPS EPS DPS payout

Current $2.10 $0.69 $2.10*0.3286

1994 $2.42 $2.10*1.15 $0.79 $2.42*0.3286

1995 $2.78 $2.42*1.15 $0.91 $2.78*0.3286

1996 $3.19 $2.78*1.15 $1.05 $3.19*0.3286

1997 $3.67 $3.19*1.15 $1.21 $3.67*0.3286

1998 $4.22 $3.67*1.15 $1.39 $4.22*0.3286 TV = $46.19

We will discount all the cash flows using high growth period cost of equity 13.95%.

CF0=0 CF1 =0.79 CF2=0.91 CF3=1.05 CF4=1.21 CF5=1.39+46.19= I/Y = 13.95 COMPUTE

NPV=? = $27.59 = PV in year 1993

Downloaded by bijay agrawal (bijayagrawal@yahoo.com)

lOMoARcPSD|4964459

(𝟏 + 𝒈𝒉 )𝒏

(𝟏 − )

(𝟏 + 𝒄𝒐𝒔𝒕 𝒐𝒇 𝒆𝒒𝒖𝒊𝒕𝒚)𝒏

𝑷𝑽𝟎 𝒈𝒓𝒐𝒘𝒊𝒏𝒈 𝒂𝒏𝒏𝒖𝒊𝒕𝒚 = 𝑪𝑭𝟎 (𝟏 + 𝒈𝒉 )

𝒄𝒐𝒔𝒕 𝒐𝒇 𝒆𝒒𝒖𝒊𝒕𝒚 − 𝒈𝒉

𝟏. 𝟏𝟓𝟓

) (𝟏 −

𝟏. 𝟏𝟑𝟗𝟓𝟓

𝑷𝑽 𝒐𝒇 𝒈𝒓𝒐𝒘𝒊𝒏𝒈 𝒂𝒏𝒏𝒖𝒊𝒕𝒚 = 𝟎. 𝟔𝟗(𝟏 + 𝟎. 𝟏𝟓) = $𝟑. 𝟓𝟓

𝟎. 𝟏𝟑𝟗𝟓 − 𝟎. 𝟏𝟓

PV of terminal value = 46.19/(1.1395^5) = 24.04

PV = 3.55 + 24.04 = $27.59

Scenario 2: Kimberly-Clark, a household product manufacturer, reported earnings per share of

$3.20 in 1993 and paid dividends per share of $1.70 in that year. The firm reported depreciation

of $315 million in 1993, and capital expenditures of $475 million (there were 160 million shares

outstanding, trading at $51 per share). This ratio of capital expenditures to depreciation is

expected to be maintained in the long term. The working capital needs are negligible. Kimberly-

Clark had debt outstanding of $1.6 billion and intends to maintain its current financing mix (of

debt and equity) to finance future investment needs. The firm is in a steady state, and earnings

are expected to grow 7% a year. The stock had a beta of 1.05, the Treasury bond rate is 6.25%,

and the equity risk premium is 5.5%.

7) Use Scenario 2: What is the value per share, using the Dividend Discount Model?

A) $36.20

B) $42.40

C) $48.95

D) $52.36

E) $65.90

Solution: A

Cost of Equity = 6.25% + 1.05 * 5.50% = 12.03%

Value Per Share = $1.70 * 1.07/(.1203 - .07) = $36.20

8) Use Scenario 2: Estimate the value per share, using the FCFE Model.

A) $17.50

B) $23.69

C) $50.20

D) $45.67

E) $34.00

Solution: C

MV of Equity = 160 million * $51 = $8160 million

Debt ratio = Debt / (Debt + Equity) = $1600 million / ($1600 million + $8160 million) =

16.39%

Downloaded by bijay agrawal (bijayagrawal@yahoo.com)

lOMoARcPSD|4964459

Net Capex per share = (Capital Spending – Depreciation) / # of shares = ($475 mio - $315

mio)/160 mio = $1

The below values are based on per share.

Current Earnings per share = $3.20

- (1 – Debt ratio) * (Capital Spending - Depreciation) = 83.61%* $1.00 =$0.84

- (1 – Debt ratio) * Working Capital = 83.61% * $0.00 = $0.00

Free Cash Flow to Equity = $2.36

Cost of Equity = 6.25% + 1.05 * 5.5% = 12.03%

Value Per Share = $2.36 * 1.07/(.1203 - .07) = $50.20

Assumption: By growing the FCFE, we are assuming that current ratio of capital

expenditures to depreciation is maintained in perpetuity. Otherwise, FCFE does not

necessarily need to increase by 7% even though EPS is increasing by 7%.

9) Use Scenario 2: How would you explain the difference between the two models, and which

one would you use as your benchmark for comparison to the market price?

Solution: The FCFE is greater than the dividends paid. The higher value from the model

reflects the additional value from the cash accumulated in the firm. The FCFE value is

more likely to reflect the true value.

10) Ecolab Inc. sells chemicals and systems for cleaning, sanitizing, and maintenance. It

reported earnings per share of $2.35 in 1993 and expected earnings growth of 15.5% a year from

1994 to 1998, and 6% a year after that. The capital expenditure per share was $2.25, and

depreciation was $1.125 per share in 1993. Both capital expenditure and depreciation are

expected to grow at the same rate as earnings from 1994 to 1998. However, the capital

expenditures continue to be 200% of depreciation after year 1998 (during the stable period).

Working capital is expected to remain at 5% of revenues, and revenues, which were $1,000

billion in 1993, were expected to increase 6% a year from 1994 to 1998 and a 4% a year after

that. The firm currently has a debt ratio [D/(D+E)] of 5% but plans to finance future investment

needs (including working capital investments) using a debt ratio of 20%. The stock is expected to

have a beta of 1.00 for the period of the analysis, and the Treasury bond rate is 6.50% and the

equity risk premium is 5.5%. There are 63 million shares outstanding. Estimate the value per

share in 1993 using the two stage FCFE approach.

A) $26.65

B) $47.38

C) $42.00

D) $37.41

E) $33.30

Solution: D

Downloaded by bijay agrawal (bijayagrawal@yahoo.com)

lOMoARcPSD|4964459

Total

Growth Change in Change in Change in

Revenue

Year Time rate in Revenue (in WC (in mio) WC (per

(in mio)

Revenues mio) = (Change share)

in Rev*5%)

1993 Current $1,000 n/a n/a

1994 1 6% $1,060 $60 $3.00 $0.0476

1995 2 6% $1,124 $64 $3.18 $0.0505

1996 3 6% $1,191 $67 $3.37 $0.0535

1997 4 6% $1,262 $71 $3.57 $0.0567

1998 5 6% $1,338 $76 $3.79 $0.0601

1999 6 4% $1,392 $54 $2.68 $0.0425

2000 7 4% $1,447 $56 $2.78 $0.0442

Growth Capital Change in FCFE

Depreciation

Year Time rate in EPS Expenditure WC per per

per share

EPS per share share share

1993 Current $2.35 $2.25 $1.13 n/a n/a

1994 1 15.50% $2.71 $2.60 $1.30 $0.0476 $1.64

1995 2 15.50% $3.13 $3.00 $1.50 $0.0505 $1.89

1996 3 15.50% $3.62 $3.47 $1.73 $0.0535 $2.19

1997 4 15.50% $4.18 $4.00 $2.00 $0.0567 $2.54

1998 5 15.50% $4.83 $4.62 $2.31 $0.0601 $2.93

1999 6 6% $5.12 $4.90 $2.45 $0.0425 $3.13

2000 7 6% $5.43 $5.20 $2.60 $0.0442 $3.31

Note: The capex continues to be 200% of depreciation in the stable period.

FCFE = NI – (1-DR)*(Capex – Depreciation) – (1-DR)*(Change in WC)

Since the data is given as per share, we adjust the FCFE equation to per share basis.

Example: FCFE = $2.71 – ((1 - 0.20)* ($2.60 - $1.30)) – ((1 - 0.20) * $0.0476) = $1.64

Cost of Equity = 6.5% + 1 * 5.5% = 12%

Growth in earnings in stable period = 6% (also the growth in FCFE keeps up with this

growth rate in earnings)

Terminal Value Per Share in year 1998 = $3.13/(0.12 - 0.06) = $52.17

𝟏. 𝟔𝟒 𝟏. 𝟖𝟗 𝟐. 𝟏𝟗 𝟐. 𝟓𝟒 𝟐. 𝟗𝟑 + 𝟓𝟐. 𝟏𝟕

𝑷𝑽 𝒑𝒆𝒓 𝒔𝒉𝒂𝒓𝒆 𝒊𝒏 𝒚𝒆𝒂𝒓 𝟏𝟗𝟗𝟑 = 𝟏

+ 𝟐

+ 𝟑

+ + = $𝟑𝟕. 𝟐𝟏

𝟏. 𝟏𝟐 𝟏. 𝟏𝟐 𝟏. 𝟏𝟐 𝟏. 𝟏𝟐𝟒 𝟏. 𝟏𝟐𝟓

Or

CF0=0 CF1= 1.64 CF2=1.89 CF3=2.19 CF4=2.54 CF5=2.93+52.17=55.10 I/Y=12% compute

NPV = ? = $37.41

11) Dionex Corporation, a leader in the development and manufacture of ion chromography

systems (used to identify contaminants in electronic devices), reported net income of $14.14

Downloaded by bijay agrawal (bijayagrawal@yahoo.com)

lOMoARcPSD|4964459

million in 1993 and paid no dividends. These earnings are expected to grow 14% a year for five

years (1994 to 1998) and 7% a year after that. The firm reported depreciation of $2 million in

1993 and capital spending of $4.20 million and had 7 million shares outstanding. Both the

depreciation and the capital expenditure are expected to grow at the same rate as earnings.

However, in the stable period (in 1999 and afterwards), the capital expenditures are 150% of

depreciation. The working capital is expected to remain at 50% of revenues, which were $106

million in 1993, and revenues are expected to grow 6% a year from 1994 to 1998 and 4% a year

after that. In 1999 and after, firm is expected to maintain working capital at 25% of revenues,

consistent with industry. The firm is expected to finance 10% of its capital expenditures and

working capital needs with debt. Dionex had a beta of 1.20 in 1993, and this beta is expected to

drop to 1.10 after 1998. The Treasury bond rate is 7% and the equity risk premium is 5.5%.

Estimate the value per share today (1993), based upon the two stage FCFE model.

A) $28.54

B) $39.65

C) $37.53

D) $33.25

E) $30.65

Solution: B

Total

Growth Change in

Revenue % of Change in

Year Time in Revenue (in

(in mio) Revenues WC (in

revenues mio)

mio)

1993 Current $106 n/a n/a

1994 1 6% $112.36 $6.36 50% $3.18

1995 2 6% $119.10 $6.74 50% $3.37

1996 3 6% $126.25 $7.15 50% $3.57

1997 4 6% $133.82 $7.57 50% $3.79

1998 5 6% $141.85 $8.03 50% $4.01

1999 6 4% $147.53 $5.67 25% $1.42

2000 7 4% $153.43 $5.90 25% $1.48

Capital Change in FCFE

Growth NI in Depreciation

Year Time Expenditure WC (in (in

in NI million in million

in million million) million)

1993 Current $14.14 $4.20 $2 n/a

1994 1 14% $16.12 $4.79 $2.28 $3.18 $11.00

1995 2 14% $18.38 $5.46 $2.60 $3.37 $12.77

1996 3 14% $20.95 $6.22 $2.96 $3.57 $14.80

1997 4 14% $23.88 $7.09 $3.38 $3.79 $17.13

1998 5 14% $27.23 $8.09 $3.85 $4.01 $19.80

1999 6 7% $29.13 $6.18 $4.12 $1.42 $26.00

2000 7 7% $31.17 $6.61 $4.41 $1.48 $27.86

10

Downloaded by bijay agrawal (bijayagrawal@yahoo.com)

lOMoARcPSD|4964459

Note: The capex continues to be 150% of depreciation in the stable period.

FCFE = NI – (1-DR)*(Capex – Depreciation) – (1-DR)*(Change in WC)

Example: FCFE = $16.12 mio – ((1 - 0.10)* ($4.79 mio - $2.28 mio)) – ((1 - 0.10) * $3.18

mio) = $11 mio

Cost of Equity in high growth period = 7% + 1.20 * 5.5% = 13.60%

Cost of equity in stable period = 7%+1.10*5.5%=13.05%

Growth in earnings in stable period =7% (also the growth in FCFE keeps up with this

growth rate in earnings)

Terminal Value1998 = $26 million/(0.1305 - 0.07) = $429.752 million

𝟏𝟏 𝒎𝒊𝒐 𝟏𝟐. 𝟕𝟕𝒎𝒊𝒐 𝟏𝟒. 𝟖𝟎𝒎𝒊𝒐 𝟏𝟕. 𝟏𝟑𝒎𝒊𝒐 𝟏𝟗. 𝟖𝟎𝒎𝒊𝒐 + 𝟒𝟐𝟗. 𝟕𝟓𝟐𝒎𝒊𝒐

𝑷𝑽 𝒑𝒆𝒓 𝒔𝒉𝒂𝒓𝒆 𝟏𝟗𝟗𝟑 = + + + +

𝟏. 𝟏𝟑𝟔𝟎𝟏 𝟏. 𝟏𝟑𝟔𝟎𝟐 𝟏. 𝟏𝟑𝟔𝟎𝟑 𝟏. 𝟏𝟑𝟔𝟎𝟒 𝟏. 𝟏𝟑𝟔𝟎𝟓

= $𝟐𝟕𝟕. 𝟓𝟖𝒎𝒊𝒐

Or

CF0=0 CF1= 11 CF2=12.77 CF3=14.80 CF4=17.13 CF5=19.80+429.752=449.552

I/Y=13.60% compute NPV = ? = $277.58 mio

#of shares outstanding = 7 mio

Price per share = 277.58 mio /7 mio = $39.65 per share

12) Luminos Corporation, a manufacturer of lightbulbs, is a firm in stable growth. The firm

reported net income of $100 million on a book value of equity of $1 billion. However, the firm

also had a cash balance of $200 million on which it earned after tax interest income of $10

million last year (this interest income is included in the net income, and the cash is part of the

BV of equity). The cost of equity for the firm is 9%. If you expect the cash flows from the

operating assets of Luminos to increase 3% a year in perpetuity, estimate the value of equity at

Luminos using the FCFE approach.

A) $1333 million

B) $1444 million

C) $1133 million

D) $1222 million

E) $1022 million

Solution: A

𝑵𝑰 𝒇𝒓𝒐𝒎 𝒏𝒐𝒏𝒄𝒂𝒔𝒉 𝒂𝒔𝒔𝒆𝒕𝒔

𝑵𝒐𝒏𝒄𝒂𝒔𝒉 𝑹𝑶𝑬 =

𝑩𝑽 𝒐𝒇 𝒆𝒒𝒖𝒊𝒕𝒚 − 𝑪𝒂𝒔𝒉

𝑵𝑰 − (𝑰𝒏𝒕𝒆𝒓𝒆𝒔𝒕 𝒇𝒓𝒐𝒎 𝒄𝒂𝒔𝒉 &𝒎𝒂𝒓𝒌𝒕. 𝒔𝒆𝒄. (𝟏 − 𝒕))

=

𝑩𝑽 𝒐𝒇 𝒆𝒒𝒖𝒊𝒕𝒚 − 𝑪𝒂𝒔𝒉

𝟏𝟎𝟎𝒎𝒊𝒐 − (𝟏𝟎𝒎𝒊𝒐) 𝟗𝟎𝒎𝒊𝒐

𝑵𝒐𝒏𝒄𝒂𝒔𝒉 𝑹𝑶𝑬 = = = 𝟏𝟏. 𝟐𝟓%

𝟏𝟎𝟎𝟎𝒎𝒊𝒐 − 𝟐𝟎𝟎𝒎𝒊𝒐 𝟖𝟎𝟎𝒎𝒊𝒐

Equity reinvestment rate = g / ROE = 3% / 11.25% = 26.67%

11

Downloaded by bijay agrawal (bijayagrawal@yahoo.com)

lOMoARcPSD|4964459

𝑵𝑰𝒕+𝟏 (𝟏 − 𝒆𝒒𝒖𝒊𝒕𝒚 𝒓𝒆𝒊𝒏𝒗𝒆𝒔𝒕𝒎𝒆𝒏𝒕)

𝑷𝑽𝒕 =

𝑪𝒐𝒔𝒕 𝒐𝒇 𝒆𝒒𝒖𝒊𝒕𝒚 − 𝒈

𝟗𝟎 ∗ 𝟏. 𝟎𝟑 ∗ (𝟏 − 𝟎. 𝟐𝟔𝟔𝟕)

𝑷𝑽𝒕 =

𝟎. 𝟎𝟗 − 𝟎. 𝟎𝟑

= $𝟏, 𝟏𝟑𝟑 𝒎𝒊𝒍𝒍𝒊𝒐𝒏 𝒃𝒖𝒕 𝒕𝒉𝒊𝒔 𝒊𝒔 𝒗𝒂𝒍𝒖𝒆 𝒐𝒇 𝒏𝒐𝒏𝒄𝒂𝒔𝒉 𝒆𝒒𝒖𝒊𝒕𝒚

Value of equity = $1,133 million + $ 200 million = $1,333 million

(the PV of cash is added separately to the value of the non-cash equity).

13) Which of the following statements is true?

A) FCFE can never be negative.

B) FCFE will always be higher than net income.

C) For a firm that pays out more in dividends than potential dividends, the dividend discount

model will overstate the value of the firm compared to FCFE approach.

D) For a firm that pays out less in dividends than potential dividends, the dividend discount

model will yield the same value as the FCFE approach.

E) All of the statements are true.

Solution: C

14) Biomet Inc., designs, manufactures and markets reconstructive and trauma devices, and

reported earnings per share of $0.56 in 1993, on which it paid no dividends. (It had revenues per

share in 1993 of $2.91). It had capital expenditures of $0.13 per share in 1993 and depreciation

in the same year of $0.08 per share. The working capital was 60% of revenues in 1993 and will

remain at that level from 1994 to 1998, while earnings and revenues are expected to grow 17% a

year. The earnings and revenue growth rate is expected to decline linearly over the following five

years to a rate of 5% in 2003 and afterwards. During the high growth, transition, and stable

periods, capital spending and depreciation are expected to grow at the same rate as earnings.

Working capital is expected to drop linearly from 60% of revenues during the 1994-1998 period

to 30% of revenues in 2003 and afterwards. The firm has no debt currently, but plans to finance

10% of its net capital investment and working capital requirements with debt.

The stock is expected to have a beta of 1.45 for the high growth period (1994-1998), and it is

expected to decline linearly to 1.10 by the time the firm goes into steady state (in 2003). The

Treasury bond rate is 7% and the equity risk premium is 5.5%. Estimate the value per share,

using the three stage FCFE model.

A) $5.50

B) $6.10

C) $7.20

D) $9.25

E) $8.30

Solution: D

12

Downloaded by bijay agrawal (bijayagrawal@yahoo.com)

lOMoARcPSD|4964459

Linear decline in EPS, Capex. Depr and Revenues. (17% - 5%)/5% = 12% / 5 = 2.4%

decline per year

Linear decline in WC /Revenue = (60%-30%)/5 = 6% per year

Stable period growth rate in earnings = 5% (also growth in FCFE keeps up with the 5%

growth in earnings)

Beta in high growth = 1.45

Beta in stable period = 1.10

Beta in transition declined by (1.45-1.10)/5 =0.07% per year

Cost of equity in high growth = 7% + (1.45)*(5.5%) = 14.98%

Cost of equity in stable period = 7% +(1.10)*(5.5%) = 13.05%

Cost of equity in transition period is provided in the below table.

Growth Revenu Change in Change in

Working

Year Time rate in e (per Revenue (per WC (per

Capital/Revenue

Revenue share) share) share)

Curren

1993 t $2.91 n/a

1994 1 17% $3.40 $0.49 60% $0.30

1995 2 17% $3.98 $0.58 60% $0.35

1996 3 17% $4.66 $0.68 60% $0.41

1997 4 17% $5.45 $0.79 60% $0.48

1998 5 17% $6.38 $0.93 60% $0.56

1999 6 14.6% $7.31 $0.93 54% $0.50

2000 7 12.2% $8.20 $0.89 48% $0.43

2001 8 9.8% $9.01 $0.80 42% $0.34

2002 9 7.4% $9.67 $0.67 36% $0.24

2003 10 5.0% $10.16 $0.48 30% $0.15

2004 11 5% $10.67 $0.51 30% $0.15

growth

rate in Capital Change in FCFE Cumulative

Depreciation Cost of

Year Time EPS, EPS Expenditure WC per per beta Discount

per share equity

Capex, per share share share rate

Depr

1993 Current $0.56 $0.13 $0.08 n/a n/a n/a n/a n/a

1994 1 17% $0.66 $0.15 $0.09 $0.30 $0.34 1.45 14.98% 1.1498

1995 2 17% $0.77 $0.18 $0.11 $0.35 $0.39 1.45 14.98% 1.3219

1996 3 17% $0.90 $0.21 $0.13 $0.41 $0.46 1.45 14.98% 1.5199

1997 4 17% $1.05 $0.24 $0.15 $0.48 $0.54 1.45 14.98% 1.7475

1998 5 17% $1.23 $0.29 $0.18 $0.56 $0.63 1.45 14.98% 2.0092

1999 6 14.6% $1.41 $0.33 $0.20 $0.50 $0.84 1.38 14.59% 2.3023

2000 7 12.2% $1.58 $0.37 $0.23 $0.43 $1.07 1.31 14.21% 2.6294

2001 8 9.8% $1.73 $0.40 $0.25 $0.34 $1.29 1.24 13.82% 2.9927

2002 9 7.4% $1.86 $0.43 $0.27 $0.24 $1.50 1.17 13.44% 3.3948

2003 10 5.0% $1.95 $0.45 $0.28 $0.15 $1.67 1.10 13.05% 3.8378

13

Downloaded by bijay agrawal (bijayagrawal@yahoo.com)

lOMoARcPSD|4964459

2004 11 5.0% $2.05 $0.48 $0.29 $0.15 $1.75 1.10 13.05% 4.3387

TV2002 = FCFE2003 / (cost of equity stable – growth stable) = $1.67 /(0.1305 – 0.05) = $20.71

𝟎. 𝟑𝟒 𝟎. 𝟑𝟗 𝟎. 𝟒𝟔 𝟎. 𝟓𝟒 𝟎. 𝟔𝟑 𝟎. 𝟖𝟒 𝟏. 𝟎𝟕 𝟏. 𝟐𝟗 𝟏. 𝟓𝟎 + 𝟐𝟎. 𝟕𝟏

𝑷𝒓𝒊𝒄𝒆𝟏𝟗𝟗𝟑 = + + + + + + + + = $𝟗. 𝟐𝟓

𝟏. 𝟏𝟒𝟗𝟖 𝟏. 𝟑𝟐𝟏𝟗 𝟏. 𝟓𝟏𝟗𝟗 𝟏. 𝟕𝟕𝟕𝟓 𝟐. 𝟎𝟎𝟗𝟐 𝟐. 𝟑𝟎𝟐𝟑 𝟐. 𝟔𝟐𝟗𝟒 𝟐. 𝟗𝟗𝟐𝟕 𝟑. 𝟑𝟗𝟒𝟖

15) You have been asked to value Oneida steel, a midsize steel company. The firm reported $80

million in net income, $50 million in capital expenditures, and $20 million in depreciation in the

just-completed financial year. The firm reported that its noncash working capital increased by

$20 million during the year and that total debt outstanding increased by $10 million during the

year. The book value of equity at Oneida Steel at the beginning of last financial year was $400

million. The cost of equity is 10%. You can assume that the firm will continue to maintain the

same debt ratio that it used last year to finance its reinvestment needs.

Estimate the expected growth rate using the above fundamentals. If this growth rate is expected

to last five years and then drop to a 4% stable growth rate after that and the return on equity after

year 5 is expected to be 12%, estimate the value of equity today, using the two stage FCFE

approach.

A) $1600

B) $1124

C) $1328

D) $1078

E) $1467

Solution: B

Net Income Net income

- (capex - Depreciation) - (capex-depr)

- Changes in noncash WC - changes in noncash WC

- (Principal Repayments - New Debt Issues) +net debt issue

FCFE FCFE

Equity Reinvestment rate= (Cap Ex – Deprec’n + Chg in WC- Net Debt Issued)/ Net

Income = (50 –20 + 20 - 10)/ 80 = 50%

Return on Equity = Net Income/ Book value of equity = 80/ 400 = 20%

High growth period:

Expected equity reinvestment rate= current equity reinvestment rate=50%

Expected ROE= current ROE= 20%

Expected growth rate in net income = ROE * Equity Reinv. Rate = 20% * 0.5 = 10%

Cost of equity= 10%

Stable growth period:

Given: g= 4%, ROE=12%

Equity reinvestment rate after year 5 = g/ ROE = 4/12 = 33.33%

Cost of equity = 10%

14

Downloaded by bijay agrawal (bijayagrawal@yahoo.com)

lOMoARcPSD|4964459

equity

Growth reinvestment

YEAR in NI Net income rate FCFE

Current n/a 80 n/a n/a

1 10% 88.00 50% 44.00

2 10% 96.80 50% 48.40

3 10% 106.48 50% 53.24

4 10% 117.13 50% 58.56

5 10% 128.84 50% 64.42

6 4% 133.99 33.33% 89.33

7 4% 139.35 33.33% 92.91

FCFE 6 = NI 6 (1- equity reinvestment rate 6)

TV5 = FCFE 6 / (cost of equity stable – growth rate stable) = 89.33 / (0.10 -0.04) = $1,488.83

In stable period, since equity reinvestment rate is constant and NI grows at 4%, FCFE also

grows by 4%.

𝟒𝟒 𝟒𝟖. 𝟒𝟎 𝟓𝟑. 𝟐𝟒 𝟓𝟖. 𝟓𝟔 𝟔𝟒. 𝟒𝟐 + 𝟏𝟒𝟖𝟖. 𝟖𝟑

𝑷𝑽 𝒑𝒆𝒓 𝒔𝒉𝒂𝒓𝒆 𝟎 = + + + + = $𝟏𝟏𝟐𝟒. 𝟒𝟒

𝟏. 𝟏𝟎𝟏 𝟏. 𝟏𝟎𝟐 𝟏. 𝟏𝟎𝟑 𝟏. 𝟏𝟎𝟒 𝟏. 𝟏𝟎𝟓

Or

CF0=0 CF1= 44 CF2=48.40 CF3=53.24 CF4=58.56 CF5=64.42+1488.83=1553.25 I/Y=10%

compute NPV = ? = $1124.44 mio

16) Union Pacific Railroad reported EBIT of $1523 million and net income of $770 million in

1993. The corporate tax rate was 36%. It reported depreciation of $960 million in that year, and

capital spending was $1.2 billion. Union Pacific paid 40% of its earnings as dividends and

working capital requirements are negligible.

The firm also had $4 billion in debt outstanding on the books, rated AA (carrying a yield to

maturity of 8%), trading at par (up from $3.8 billion at the end of 1992). The beta of the stock is

1.05, and there were 200 million shares outstanding (trading at $60 per share), with a book value

of $5 billion. The treasury bond rate is 7% and equity risk premium is 5.5%. What is the value of

the firm at the end of 1993, using the FCFF approach.

A) $9,920 million

B) $9,050 million

C) $9,210 million

D) $9,530 million

E) $9,780 million

Solution: C

Reinvestment rate = (Netcapex + Changes in noncash WC)/ EBIT (1-t) = (1,200 mio -960

mio + 0)/ (974.72 mio) = 24.62%

15

Downloaded by bijay agrawal (bijayagrawal@yahoo.com)

lOMoARcPSD|4964459

Return on Capital = EBIT (1-t)/ (BV of Debt + BV of Equity) =

974.72mio/(4,000+5,000)mio = 10.83%

Growth = Reinvestment rate *ROC= 0.2462 * 10.83% = 2.67%

Cost of Equity = 7% + 1.05 * 5.5% = 12.775%

Before tax cost of debt = YTM = 8%

MV debt = BV debt = $4000 million since it trades at par.

MV equity = 200 million * $60 = $12000 million

Wd = MV debt/MV (D+E) = 4,000 mio/ (4,000 mio+12,000 mio) = 25%

We = MV equity / MV (D+E) = 12,000 mio / (4,000 mio + 12,000 mio) = 75%

Cost of capital =WACC = wd rd (1-t) + we re

Cost of Capital = 8% (1 - 0.36) (0.25) + (12.775%) (0.75) = 10.86%

Value of the Firm 1993 = EBIT(1-T) 1993 (1+g) (1- reinvestment rate) /(WACC-g)

= 974.72 * (1+0.0267) (1-0.2462) /(0.1086 - 0.0267) = $9,210 millions

Extra: If you would like to find the Value of Equity

Value of equity= Value of Firm - Market Value of Debt

= $9,210 million - $4,000 million = $5,210 millions

Value Per Share = $5,210 million/200 million = $26.05

17) Santa Fe Pacific, a major rail operator with diversified operations, had earnings before

interest, taxes and depreciation, of $637 million in 1993, with depreciation amounting to $235

million (offset by capital expenditure of an equivalent amount). The firm is in steady state and

earnings before interest and taxes are expected to grow 3% a year in perpetuity. Santa Fe Pacific

had a beta of 1.25 in 1993 and debt outstanding of $1.34 billion. The stock price was $18.25 at

the end of 1993, and there were 183.1 million shares outstanding. The expected ratings and the

costs of debt at different levels of debt for Santa Fe are shown in the following table The tax rate

is 40%, the Treasury bond rate is 7% and equity risk premium is 5.5%. Estimate the value of the

firm using the FCFF approach. Hint: Find the debt ratio for the firm and based on the below

rating table, find the cost of debt for the firm.

Cost of Debt

D/(D+E) Rating

(Pre-tax)

0% AAA 6.23%

10% AAA 6.23%

20% A+ 6.93%

30% A- 7.43%

40% BB 8.43%

50% B+ 8.93%

60% B- 10.93%

70% CCC 11.93%

80% CCC 11.93%

90% CC 13.43%

16

Downloaded by bijay agrawal (bijayagrawal@yahoo.com)

lOMoARcPSD|4964459

A) $3,989 million

B) $3,714 million

C) $3,563 million

D) $3,326 million

E) $3,037 million

Solution: E

MV equity = $18.25 * 183.1 million = $3,342 million

Current Debt Ratio (wd) = D/ (D+E) = $1,340 million/($1,340 million + $3,342 million) =

28.63%

we = E/ (D+E) = $3,342 million / ($1,342 million + $3,342 million) = 71.37%

Cost of Equity = 7% + 1.25 * 5.5% = 13.88%

In the above table, the cost of debt for a debt ratio of 28.63% (around 30%) is 7.43%.

Cost of Capital = 13.88% (0.7137) + 7.43% (1 - 0.4) (0.2863) = 11.18%

Remember that EBIT = EBITDA-Depreciation

EBIT(1-t) = (637-235) (1-0.4)= 241.2 million

Reinvestment rate = ((Capital Expenditures –Depreciation) + Working Capital)/ EBIT

(1-t)

Reinvestment rate= 0 since depreciation is offset by capital expenditure, and there is no

change in WC

Value of the Firm 1993= EBIT(1-t)1993 (1+g) (1-reinvestment rate) / (WACC –g) = 241.2 mio*

1.03* (1-0) /(0.1118-0.03) = $3,037.11 million

Scenario 3: You have been asked to estimate the value of Cavanaugh Motels, a motel chain. The

firm reported earnings of $200 million before interest and taxes in the most recent year and paid

40% of its taxable income in taxes. The book value of capital at the firm is $1.2 billion, and the

firm expects to grow 4% a year in perpetuity. The firm has a beta of 1.2, a pretax cost of debt of

6%, equity with a market value of $1 billion, and debt with a market value of $500 million. (The

risk-free rate is 5%, and the market risk premium is 5.5%.) The probability of default at this firm

at its current debt level is 10% and that the cost of bankruptcy is 25% of unlevered firm value.

18) Use Scenario 3: Estimate the value of the firm, using the FCFF (cost of capital) approach.

A) $1,519 million

B) $1,392 million

C) $1,765 million

D) $1,841 million

E) $1,967 million

Solution: A

Cost of equity = 5% + 1.2 (5.5%) = 11.6%

Pre-tax cost of debt = 6%

17

Downloaded by bijay agrawal (bijayagrawal@yahoo.com)

lOMoARcPSD|4964459

Cost of capital =WACC= wd rd (1-t) + we re

Cost of capital = (500/1500) (6%) (1-.4) + (1000/1500) (11.6%) = 8.93%

Return on capital = EBIT (1-t) /Invested capital = 200 (1 - 0.4)/ 1200 = 10%

Growth in perpetuity = 4%

Reinvestment rate = g/ ROC = 4%/10% = 40%

Value of firm = EBIT (1-t) (1- Reinvestment rate) (1+g)/ (Cost of capital – g)

= 200 (1-0.4) (1-0.4)(1.04)/ (0.0893 -0.04) = $1,519 million

19) Use Scenario 3: Estimate the value of the firm using the adjusted present value approach.

A) $1,591 million

B) $1,401 million

C) $1,471 million

D) $1,531 million

E) $1,571 million

Solution: B

Levered beta = Unlevered beta (1+ (1-t) D/E)) and solve for unlevered beta as below:

Unlevered beta = 1.20/ (1 + (1-.4)(500/1000)) = 0.9231

Use the unlevered beta to derive the unlevered cost of equity = 5% + 0.9231 (5.5%) =

10.08%

Value of firm = EBIT (1-t) (1- Reinvestment rate) (1+g)/ (Cost of capital – g)

When the firm has zero debt and all the capital is financed through equity, the cost of

capital equals to the cost of equity

Cost of capital =WACC= wd rd (1-t) + we re = 0 + (1) re = re

Unlevered firm value = 200 (1-0.4) (1-0.4)(1.04)/ (0.1008 - 0.04) = $1,232 million. We used

cost of equity to discount.

PV of tax benefits from debt = Tax rate * Debt= 0.40 * 500 = $ 200 million

Expected bankruptcy costs = Probability of bankruptcy * Unlevered firm value * Cost

of bankruptcy = 0.10 * 1232 * 0.25 = $30.8 million

Firm Value through APV method:

Firm Value = Unlevered firm value + PV of tax benefits from debt– Expected bankruptcy

cost

APV value of firm = $ 1,232 million + $200 million – $30.8 million= $ 1,401.2 million

20) In the face of disappointing earnings results and increasingly assertive institutional

stockholders, Eastman Kodak was considering a major restructuring in 1993. As part of this

restructuring, it was considering the sale of its health division, which earned $560 million in

earnings before interest and taxes in 1993, on revenues of $5.285 billion. The expected growth in

earnings was expected to moderate to 6% between 1994 and 1998, and to 4% after that. Capital

expenditures in the health division amounted to $420 million in 1993, while depreciation was

18

Downloaded by bijay agrawal (bijayagrawal@yahoo.com)

lOMoARcPSD|4964459

$350 million. Both were expected to grow 4% a year in the long term. Working capital

requirements were negligible.

The average beta of firms competing with Eastman Kodak’s health division was 1.15. While

Eastman Kodak had a debt ratio [D/(D + E)] of 50%, the health division could sustain a debt

ratio [D/(D + E)] of only 20%, which was similar to the average debt ratio of firms competing in

the health sector. At this level of debt, the health division could expect to pay 7.5% on its debt,

before taxes. The tax rate is 40%, the Treasury bond rate is 7%, and the risk premium is 5.5%.

What is the value of the division? Use the two stage FCFF method.

A) $3,550 million

B) $3,610 million

C) $4,060 million

D) $4,150 million

E) $3,870 million

Solution: C

Growth in

Growth

EBIT Capital Capital Change

in EBIT Depreciation FCFF

(1-t) Expend & Expenditure in WC

earnings

Depreciation

1993 6% $560 $336 4% $420 $350 $0 $266

1994 6% $594 $356 4% $437 $364 $0 $283

1995 6% $629 $378 4% $454 $379 $0 $302

1996 6% $667 $400 4% $472 $394 $0 $321

1997 6% $707 $424 4% $491 $409 $0 $342

1998 6% $749 $450 4% $511 $426 $0 $364

1999 4% $779 $468 4% $531 $443 $0 $379

In both stages (high growth and stable growth periods),

Beta for the Health Division = 1.15

Cost of Equity = 7% + 1.15 * 5.5% = 13.33%

Before tax cost of debt = 7.5%

Debt/(D+E) = 20%

E/(D+E) = 80%

Cost of Capital for the division= 0.80 * 13.33% + 0.2 * (7.5% * (1-0.40)) = 11.56%

Growth rate in stable period = 4%

TV 1998 = FCFF1999 / (WACC-g) = 379 / (0.1156 – 0.04) = $5,013 million

Value of the Division in 1993 = 283 mio/1.1156 + 302 mio/(1.1156)2 + 321 mio/(1.1156)3 +

342 mio/(1.1156)4 + (364 mio+ 5,013 mio)/(1.1156)5 = $4,060 millions

OR

CF0 = 0 CF1=283 mio CF2= 302 mio CF3=321 mio CF4= 342 mio CF5 = 5377 mio

i/y = 11.56 Compute NPV=?= 4,060 million

19

Downloaded by bijay agrawal (bijayagrawal@yahoo.com)

lOMoARcPSD|4964459

20

Downloaded by bijay agrawal (bijayagrawal@yahoo.com)

You might also like

- Business Finance Assignment 2Document8 pagesBusiness Finance Assignment 2Akshat100% (1)

- Fundamentals of Investments Valuation and Management 7th Edition by Jordan ISBN Solution ManualDocument9 pagesFundamentals of Investments Valuation and Management 7th Edition by Jordan ISBN Solution Manualbarbara0% (1)

- Answer The Short Answer Questions in A Separate Word Document and Clearly Show All Your WorkDocument4 pagesAnswer The Short Answer Questions in A Separate Word Document and Clearly Show All Your WorkTalhaa MaqsoodNo ratings yet

- Stock SolutionDocument9 pagesStock Solution신동호No ratings yet

- Peachtree Securities (B)Document26 pagesPeachtree Securities (B)Rufino Gerard MorenoNo ratings yet

- Neptune Model CompleteDocument23 pagesNeptune Model CompleteChar_TonyNo ratings yet

- (Anand, Arun, Chris, Nirupama, Priyanka, Samhita, Sharat) : Assessment 2 - Business FinanceDocument5 pages(Anand, Arun, Chris, Nirupama, Priyanka, Samhita, Sharat) : Assessment 2 - Business Financearun gopalakrishnanNo ratings yet

- 1 - TVM Student TemplatesDocument16 pages1 - TVM Student Templatesaazad3201No ratings yet

- FAFD ICAI Indentity Theft Investigation ReportDocument9 pagesFAFD ICAI Indentity Theft Investigation ReportArvind KumarNo ratings yet

- Forensic Report 2 - Gopal Jewellers LimitedDocument24 pagesForensic Report 2 - Gopal Jewellers LimitedMeena BhagatNo ratings yet

- AFAR2 - Sales Agency, H.O., & Branch AccountingDocument18 pagesAFAR2 - Sales Agency, H.O., & Branch AccountingVon Andrei MedinaNo ratings yet

- Sees Candy SchroederDocument15 pagesSees Candy SchroederAAOI2No ratings yet

- Panera Bread SWOT Analysis and Financial PerformanceDocument18 pagesPanera Bread SWOT Analysis and Financial PerformanceAvnchick100% (1)

- Apple's Internal Environment AnalysisDocument5 pagesApple's Internal Environment AnalysisVinabie PunoNo ratings yet

- Name: Nishant AdhikariDocument3 pagesName: Nishant AdhikariMarketing HyundaiNo ratings yet

- Damodaran On Valuation Lect5Document7 pagesDamodaran On Valuation Lect5Keshav KhannaNo ratings yet

- Business Analysis and Valuation - IntroductionDocument109 pagesBusiness Analysis and Valuation - IntroductioncapassoaNo ratings yet

- A Brief History of Risk and Return: Concept QuestionsDocument6 pagesA Brief History of Risk and Return: Concept QuestionsChaituNo ratings yet

- FM Assignment 3 - Group 4Document7 pagesFM Assignment 3 - Group 4Puspita RamadhaniaNo ratings yet

- Handouts 3-4 - Review Exercises With SolutionsDocument7 pagesHandouts 3-4 - Review Exercises With Solutions6kb4nm24vjNo ratings yet

- Dividend Re-Investment Plans: Andre J. TrottierDocument65 pagesDividend Re-Investment Plans: Andre J. Trottierghata kunaNo ratings yet

- Fmi Assignment #8: Ind - Ps - Ps - A1 McqsDocument4 pagesFmi Assignment #8: Ind - Ps - Ps - A1 McqsAditi RawatNo ratings yet

- Brooks 3e IM 07!Document10 pagesBrooks 3e IM 07!Aai NurrNo ratings yet

- Risk & Return AnalysisDocument90 pagesRisk & Return AnalysisRashi MehtaNo ratings yet

- Mid Test IB1708 SE161403 Nguyễn Trọng BằngDocument14 pagesMid Test IB1708 SE161403 Nguyễn Trọng BằngNguyen Trong Bang (K16HCM)No ratings yet

- Corporate Finance - Exercises Session 1 - SolutionsDocument5 pagesCorporate Finance - Exercises Session 1 - SolutionsLouisRemNo ratings yet

- W1 - Implied Equity PremiumDocument7 pagesW1 - Implied Equity PremiumChip choiNo ratings yet

- I. Income StatementDocument27 pagesI. Income StatementNidhi KaushikNo ratings yet

- Assignment 4 (Revised) (Answers)Document3 pagesAssignment 4 (Revised) (Answers)kaankNo ratings yet

- American Vanguard Corporation (Security AnaylisisDocument18 pagesAmerican Vanguard Corporation (Security AnaylisisMehmet SahinNo ratings yet

- CFIN 5th Edition Besley Solutions Manual 1Document7 pagesCFIN 5th Edition Besley Solutions Manual 1billy100% (31)

- Cfin 5Th Edition Besley Solutions Manual Full Chapter PDFDocument28 pagesCfin 5Th Edition Besley Solutions Manual Full Chapter PDFcarolyn.leung589100% (12)

- Ch5. VALUATIONpdfDocument5 pagesCh5. VALUATIONpdfLovely CabardoNo ratings yet

- Stock ValuationDocument5 pagesStock ValuationDiana SaidNo ratings yet

- CH05Document6 pagesCH05Sumeet DesaiNo ratings yet

- ASSIGNMENT-2 MathematicsDocument14 pagesASSIGNMENT-2 MathematicsHiteshNo ratings yet

- Fintech Chapter 7: Time Value of Money: Interest, Bonds, Money Market FundsDocument17 pagesFintech Chapter 7: Time Value of Money: Interest, Bonds, Money Market FundsAllen Uhomist AuNo ratings yet

- Ch24sol PDFDocument5 pagesCh24sol PDFSandeep MishraNo ratings yet

- Revenue Multiples and Sector-Specific Multiples: Problem 1Document5 pagesRevenue Multiples and Sector-Specific Multiples: Problem 1Silviu TrebuianNo ratings yet

- Rights IssueDocument18 pagesRights Issuemuthum44499335No ratings yet

- Chap 18Document16 pagesChap 18n_kurniatiNo ratings yet

- Chapter 10Document14 pagesChapter 10Beatrice ReynanciaNo ratings yet

- Fin 4600 Practice Mid Term Exam 1 Robert UptegraffDocument12 pagesFin 4600 Practice Mid Term Exam 1 Robert UptegraffNguyễn Thanh TùngNo ratings yet

- Công TH CDocument9 pagesCông TH CLê Hồng ThuỷNo ratings yet

- MTP Soln 1Document14 pagesMTP Soln 1Anonymous 8wg4eowIdzNo ratings yet

- CHAPTER 4: Practice Questions (Page 82)Document4 pagesCHAPTER 4: Practice Questions (Page 82)ALLtyNo ratings yet

- Bsc. Sem-Corporate Finance Retake Exam - Solution Guide: August 5, 2016 2 HoursDocument6 pagesBsc. Sem-Corporate Finance Retake Exam - Solution Guide: August 5, 2016 2 HoursDerek LowNo ratings yet

- Tugas 3 CH 7 Dan 8 Up Date1Document5 pagesTugas 3 CH 7 Dan 8 Up Date1Bayu SilvatikaNo ratings yet

- Week 6 Tutorial SolutionsDocument8 pagesWeek 6 Tutorial SolutionsManoaNo ratings yet

- Solutions Manual: Ross, Westerfield, and Jaffe Asia Global EditionDocument14 pagesSolutions Manual: Ross, Westerfield, and Jaffe Asia Global EditionRia FitriyanaNo ratings yet

- Finance 33Document16 pagesFinance 33iris100% (1)

- Self Study Practice Questions Topic 3 Part 2 AnswersDocument6 pagesSelf Study Practice Questions Topic 3 Part 2 AnswersTriet NguyenNo ratings yet

- Current Financial Analysis and ValuationDocument30 pagesCurrent Financial Analysis and ValuationAbhinav PandeyNo ratings yet

- XLS EngDocument21 pagesXLS EngRudra BarotNo ratings yet

- Ch10 Solutions 6thedDocument14 pagesCh10 Solutions 6thedMrinmay kunduNo ratings yet

- Lab4 FahmiGilangMadani 120110170024 Jumat10.30 KakAlissaDocument7 pagesLab4 FahmiGilangMadani 120110170024 Jumat10.30 KakAlissaFahmi GilangNo ratings yet

- Problems & Solutions On Fundamental AnalysisDocument8 pagesProblems & Solutions On Fundamental AnalysisAnonymous sTsnRsYlnkNo ratings yet

- Fundamentals of Investments 6th Edition Jordan Solutions ManualDocument17 pagesFundamentals of Investments 6th Edition Jordan Solutions ManualIsaiahHahnaszxk100% (13)

- MM 5009 Financial Management Yeats Valves and Control Inc.: Group 10Document11 pagesMM 5009 Financial Management Yeats Valves and Control Inc.: Group 10ppNo ratings yet

- Solutions to Chapter 10 Risk and Return QuestionsDocument41 pagesSolutions to Chapter 10 Risk and Return QuestionsAimen AyubNo ratings yet

- EFM2e, CH 03, SlidesDocument36 pagesEFM2e, CH 03, SlidesEricLiangtoNo ratings yet

- CHAPTER 10 - Questions and ProblemsDocument12 pagesCHAPTER 10 - Questions and ProblemsMrinmay kunduNo ratings yet

- UntitledDocument6 pagesUntitledShuHao ShiNo ratings yet

- FM Practice Questions KeyDocument7 pagesFM Practice Questions KeykeshavNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- AFM JUNE 2003 QT ANSDocument25 pagesAFM JUNE 2003 QT ANSBijay AgrawalNo ratings yet

- AFM JUNE 2005 QT ANSDocument25 pagesAFM JUNE 2005 QT ANSBijay AgrawalNo ratings yet

- Yes BankDocument12 pagesYes BankBijay AgrawalNo ratings yet

- 5. SwapsDocument119 pages5. SwapsBijay AgrawalNo ratings yet

- AFM JUNE 2010 QT ANSDocument21 pagesAFM JUNE 2010 QT ANSBijay AgrawalNo ratings yet

- CHAPTER 14 INTEREST RATE AND CURRENCY SWAPS SUGGESTED ANSWERS AND SOLUTIONS TO END-OF-CHAPTER QUESTIONS AND PROBLEMSDocument15 pagesCHAPTER 14 INTEREST RATE AND CURRENCY SWAPS SUGGESTED ANSWERS AND SOLUTIONS TO END-OF-CHAPTER QUESTIONS AND PROBLEMSBijay AgrawalNo ratings yet

- CA Final (New) - Risk Management - Mock Test Paper - Apr 2023 - AnswersDocument8 pagesCA Final (New) - Risk Management - Mock Test Paper - Apr 2023 - AnswersBijay AgrawalNo ratings yet

- QT MAY 2018Document24 pagesQT MAY 2018Bijay AgrawalNo ratings yet

- VODAFONE IDEADocument4 pagesVODAFONE IDEABijay AgrawalNo ratings yet

- 6A MTP OCT 2020Document13 pages6A MTP OCT 2020Bijay AgrawalNo ratings yet

- QT MAY 2019Document20 pagesQT MAY 2019Bijay AgrawalNo ratings yet

- AFMDocument27 pagesAFMBijay AgrawalNo ratings yet

- Strategic-Cost-mngt.-May-18Document33 pagesStrategic-Cost-mngt.-May-18Bijay AgrawalNo ratings yet

- QT JAN 2021Document24 pagesQT JAN 2021Bijay AgrawalNo ratings yet

- The Question Paper Comprises Five Case Study Questions. The Candidates Are Required To Answer Any Four Case Study Questions Out of FiveDocument12 pagesThe Question Paper Comprises Five Case Study Questions. The Candidates Are Required To Answer Any Four Case Study Questions Out of FiveMallesh ArjaNo ratings yet

- RM May 2020 MTP SDocument10 pagesRM May 2020 MTP SdsdsNo ratings yet

- CA Final (New) - Risk Management - Mock Test Paper - Apr 2021 - Question PaperDocument10 pagesCA Final (New) - Risk Management - Mock Test Paper - Apr 2021 - Question PaperBijay AgrawalNo ratings yet

- Private credit & private equity Decision drivers for today’s marketsDocument5 pagesPrivate credit & private equity Decision drivers for today’s marketsBijay AgrawalNo ratings yet

- f9 2006 Dec PPQDocument17 pagesf9 2006 Dec PPQMuhammad Kamran KhanNo ratings yet

- Vassili Joannidès de Lautour - Strategic Management Accounting, Volume I - Aligning Strategy, Operations and Finance-Springer (2018)Document320 pagesVassili Joannidès de Lautour - Strategic Management Accounting, Volume I - Aligning Strategy, Operations and Finance-Springer (2018)muhamad.ichwaniNo ratings yet

- AUDIT NOTES CA BOSDocument30 pagesAUDIT NOTES CA BOSBijay AgrawalNo ratings yet

- Strategic Management Accounting, Volume III Aligning Ethics, Social Performance and Governance (Vassili Joannidès de Lautour) (Z-Library)Document245 pagesStrategic Management Accounting, Volume III Aligning Ethics, Social Performance and Governance (Vassili Joannidès de Lautour) (Z-Library)Bijay AgrawalNo ratings yet

- 71467-exam57501-p3-nilDocument20 pages71467-exam57501-p3-nilBijay AgrawalNo ratings yet

- NMC GOLD FINANCE LIMITED - Forensic Report 1Document11 pagesNMC GOLD FINANCE LIMITED - Forensic Report 1Anand KhotNo ratings yet

- A2.2 Strategic Performance Management (QP)Document10 pagesA2.2 Strategic Performance Management (QP)Bijay AgrawalNo ratings yet

- AUDIT KAMAL GARGDocument54 pagesAUDIT KAMAL GARGBijay AgrawalNo ratings yet

- CA_Intermediate_PAPER_–_5_AUDITING_AND_ETHICS_MTP_Series_2_QuestionDocument13 pagesCA_Intermediate_PAPER_–_5_AUDITING_AND_ETHICS_MTP_Series_2_QuestionBijay AgrawalNo ratings yet

- Answerstohomework 5 Summer 2013Document21 pagesAnswerstohomework 5 Summer 2013GoodnessNo ratings yet

- Planning Audit Risk AssessmentDocument8 pagesPlanning Audit Risk AssessmentCiel ArvenNo ratings yet

- CVP Analysis and Incremental Decision MakingDocument19 pagesCVP Analysis and Incremental Decision MakingRobert DomingoNo ratings yet

- Himani Fast Relief: - Arkaprava Ghosh-Emami LimitedDocument68 pagesHimani Fast Relief: - Arkaprava Ghosh-Emami Limitedarkaprava ghoshNo ratings yet

- Ae Week 5 6 PDFDocument26 pagesAe Week 5 6 PDFmary jane garcinesNo ratings yet

- Purchasing-Related 120,000 Set-Up-Related 210,000 Total Overhead Cost P 440,000Document6 pagesPurchasing-Related 120,000 Set-Up-Related 210,000 Total Overhead Cost P 440,000Pamela Galang100% (3)

- FEC ContractsDocument2 pagesFEC ContractssatyambhanduNo ratings yet

- AdxDocument3 pagesAdxSameer ShindeNo ratings yet

- Operating Segment Reporting Key Financial DataDocument19 pagesOperating Segment Reporting Key Financial DataRainNo ratings yet

- Logistics Management Appunti 1 20Document71 pagesLogistics Management Appunti 1 20Parbatty ArjuneNo ratings yet

- AmirDocument5 pagesAmirОксана ГриневичNo ratings yet

- Homework Practice CH 6 25th EdDocument4 pagesHomework Practice CH 6 25th EdThomas TermoteNo ratings yet

- Global Business Management: COMSATS University Islamabad (Lahore Campus)Document4 pagesGlobal Business Management: COMSATS University Islamabad (Lahore Campus)HUMNANo ratings yet

- 3.03 Key TermsDocument95 pages3.03 Key Termsapi-262218593No ratings yet

- Cambridge International AS & A Level: BUSINESS 9609/23Document4 pagesCambridge International AS & A Level: BUSINESS 9609/23ayanda muteyiwaNo ratings yet

- Future of Advertising Lies in Differentiating Consumers and Integrating RequirementsDocument14 pagesFuture of Advertising Lies in Differentiating Consumers and Integrating RequirementsmdjfldmNo ratings yet

- Business Plan of Pasa-Buy DeluxeDocument30 pagesBusiness Plan of Pasa-Buy DeluxeExynos NemeaNo ratings yet

- Intimation Regarding Investors Meetings of The Company and Submission of Presentation To Be Made To The Investors (Company Update)Document37 pagesIntimation Regarding Investors Meetings of The Company and Submission of Presentation To Be Made To The Investors (Company Update)Shyam SunderNo ratings yet

- Consumer Behavior Case StudyDocument13 pagesConsumer Behavior Case StudySheel GautamNo ratings yet

- SummaryDocument41 pagesSummarynasim.amiri88No ratings yet

- 1Document45 pages1VishakhaNo ratings yet

- Case9 Columbia SportswearDocument18 pagesCase9 Columbia Sportswearqian12150% (2)

- Rem 5Document17 pagesRem 5Sandeep ArikilaNo ratings yet

- Partnership Liquidation Do It YourselfDocument3 pagesPartnership Liquidation Do It YourselfBC qpLAN CrOwNo ratings yet

- Advanced Accounting: Chapter 4: Consolidated Financial Statements After AcquisitionDocument24 pagesAdvanced Accounting: Chapter 4: Consolidated Financial Statements After AcquisitionuseptrianiNo ratings yet

- Financial Research Report Fin 534Document15 pagesFinancial Research Report Fin 534Angelo Logan75% (4)