Professional Documents

Culture Documents

1bba FOA Prep QP

Uploaded by

Suhail AhmedCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1bba FOA Prep QP

Uploaded by

Suhail AhmedCopyright:

Available Formats

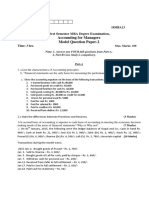

Noble Group of Institutions

JP Nagar, Opp. To Rajashekar Hospital, Bangalore–78

CLASS: I SEM BBA PREPARATORY EXAMINATION JANUARY – 2024 SUB: Fundamentals of Accounting

TIME: 2.5 HOURS ( as part of Noble initiative to save nature we attempt to reduce & reuse paper) TOTAL MARKS: 60

SECTION – A

I. Answer any 5 questions, each carries 2 marks each. (5X2=10)

1. a. State any 2 limitations of accounting?

b. Mention any 4 subsidiary books

c. What is trading account?

d. What is Bank reconciliation statement?

e. What do you mean by narration?

f. What is trade discount?

g. What is computerised accounting?

SECTION – B

II Answer any four questions of the following (4x5=20)

2. Explain the features of Tally Accounting software.

3. Prepare Trial Balance in the books of Mr. Ashok from the following ledger balances:

Rs. Rs

Capital 3,12,000 Debtors 20,000

Creditors 50,000 Sales 2,00,000

Purchases 2,50,000 Closing stock 60,000

Outstanding exp 15,000 Building 2,00,000

Establishment exp 12,000 Prepaid exp 5,000

4. Prepare a trading account of Mr Prajwal for the year ending 31 March 2021

Particulars Amount (Rs)

Purchase of materials 5,00,000

Carriage on purchases 12,000

Wages 1,40,000

Stock of goods on 1-4-2020 7,20,000

Stock of goods on 1-4-2021 7,60,000

Sales 13,00,000

Sales returns 1,60,000

Purchase returns 60,000

Duty and cleaning charges 1,40,000

Factory rent and lighting charges 60,000

Factory salaries 40,000

5. Journalize the following transactions in the books of Mr. Raghu.

2021

Jan. 1: Commenced business with cash Rs.50,000

Jan. 3: Purchased furniture for Rs.60,000

Jan. 5: Bought goods on credit from Vijay for Rs.70,000.

Jan. 8: Purchased goods for cash Rs.50,000

Jan.11: Returned goods to Vijay Rs.10,000

Jan. 14: Sold goods to Rajesh for Rs.50,000.

6. From the following particulars prepare bank reconciliation statement as on 31.3.2018.

a) Bank Balance as per pass book on 31-3-2018 Rs.12,000.

b) Cheque issued but not presented for payment Rs.1,000.

c) Bank charges debited Rs.500.

d) Cheque of Rs6,000 deposited to bank but not credited in the pass book.

e) Cheque of Rs.300 was recorded as deposit in cash book instead of recording it as payment.

f) A cheque drawn for Rs.50 has been incorrectly entered in-the cash book

as Rs 500

SECTION – C

III Answer any TWO questions of the following (2x12=24)

7. Enter the following transactions in a three column cash book.

April 1 Cash at office Rs.4,500 and Bank Overdraft Rs 1,250

April 2 Purchased goods for Rs 5,000 and paid by cheque less 10% discount

April 5 Settled Charan account of Rs 4,500 by cheque for Rs 4,325

April 6 Kumar settled his account of Rs 7,500 by cheque. This is Banked immediately.

April 8 Received from Sudheer a crossed cheque for Rs 12,875in settlement of his account Rs 13,050

April 10 Sold furniture for Rs 750

April 12 Cash Sales Rs 4,000 of which Rs 3,200 was Banked

April 15 Cashed a Cheque Rs 1,250

April 18 Bank charges as per passbook Rs 150

April 20 Paid by Salaries Rs 2,200 Rent Rs 1,500

April 25 Withdrew from Bank for office use Rs 2,000 and for personal use Rs1,500

8. Enter the following transactions in the subsidiary books of M/S Udayasree for the month of January 2022.

2022

Jan 1 Purchased from Pathi Silk house, 100 silk sarees at Rs. 2,500 each.

Jan 5 Purchased from Nagendra & Co. 200 Kanchi silk sarees at Rs. 10,000 each.

Jan 7 Sold to kumari on account 50 printed sarees at Rs. 3,000 each, 100 kanchi sarees at Rs. 12,000 each.

Jan 8 Claimed for damages from Pathi silks Rs. 500.

Jan 9 Returned damaged goods to Nagendra & Co. 5 Kanchi Sarees.

Jan 12 Purchased from sudharshan silks 150 Mysore silk sarees at Rs. 2500 each, 100 Handloom sarees at Rs. 7,500 each, less trade

discount at 10%

Jan 15 Sold to Kala on account 20 printed sarees at Rs. 3,000 each, 25 Kanchi sarees at Rs. 13,000 each, 20 mysore silk sarees at Rs.

3,000 each.

Jan 20 Sold to kusum sarees 40 Handloom sarees at Rs.10,000 each.

Jan 21 Kumari returned, 10 printed sarees and 20 kanchi sarees.

Jan 25 Returned to Sudharshan's silk, 25 Mysore silk sarees.

Jan 27 Returned from Kusum Sarees, 10 Handloom sarees.

Jan 30 Purchased from Nandi silks, 400 Nandi brand sarees at Rs. 5,000 each.

9. From the following Trial Balance extracted from the books of Mr.Narayan, prepare Trading and P & L A/c for the year ending 31st

March 2019 and Balance Sheet as on that date.

Particulars Debit Credit

Capitals - 81,000

Drawing 10,000 -

Plant and machinery 60,000 -

Debtors 40,000 -

Creditors - 45,000

Purchase and sales 80,000 1,40,000

Returns 4,000 5,000

Wages 15,000 -

Cash in hand 1,000 -

Cash at bank 6,000 -

Salaries 10,000 -

Repair 4,000 -

Rent 4,500 -

Stock 20,000 -

Manufacturing exp 5,000 -

Bills 10,000 -

Bad debts 1,000 -

Provision for bad debts - 1,500

carriages 2,000 -

2,72,500 2,72,500

Adjustments :

a) Rent paid in advance Rs 500

b) Depreciate plant and machinery at10% p.a.

c) Allow interest on capital at 5% p.a.

d) Closing stock was Rs. 30,000.

SECTION – D

IV Answer any one of the following (1x6=6)

10. Prepare a bank reconciliation statement with imaginary figures

11. Prepare simple petty cash book with imaginary figures.

You might also like

- Nava Bharath National School Annur Annual Examination - 2021 AccountancyDocument5 pagesNava Bharath National School Annur Annual Examination - 2021 AccountancypranavNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Financial Accounting - IA QPDocument2 pagesFinancial Accounting - IA QPShreeniwas BhawnaniNo ratings yet

- Commerce First YearDocument7 pagesCommerce First Yearravulapallysona93No ratings yet

- Let's Practise: Maths Workbook Coursebook 6From EverandLet's Practise: Maths Workbook Coursebook 6No ratings yet

- Karnataka Ist PUC Accountcancy Sample Question Paper 4 PDFDocument4 pagesKarnataka Ist PUC Accountcancy Sample Question Paper 4 PDFNeha BaligaNo ratings yet

- BCA DEGREE EXAM ACCOUNTING EXAMDocument11 pagesBCA DEGREE EXAM ACCOUNTING EXAMStudents Xerox ChidambaramNo ratings yet

- Fundamentals of Accounting 2020Document4 pagesFundamentals of Accounting 2020sreehari dineshNo ratings yet

- 11 AccDocument6 pages11 AccPushpinder KumarNo ratings yet

- XI AccountancyDocument5 pagesXI Accountancytechnical hackerNo ratings yet

- 0438Document9 pages0438Ahmed BilalNo ratings yet

- Class 11 Accounts SP 1Document6 pagesClass 11 Accounts SP 1UdyamGNo ratings yet

- 11 Accountancy SP 2Document17 pages11 Accountancy SP 2Vikas Chandra BalodhiNo ratings yet

- Fundamentals of Accounting 2019Document4 pagesFundamentals of Accounting 2019sreehari dineshNo ratings yet

- Accountancy Question Bank for Class XIDocument9 pagesAccountancy Question Bank for Class XIlasyaNo ratings yet

- 1 Accounting Equation UniqueDocument3 pages1 Accounting Equation UniqueSohan AgrawalNo ratings yet

- LHU8Q Olopr DaisyAcountXIDocument35 pagesLHU8Q Olopr DaisyAcountXIDido MuczNo ratings yet

- MBA I Semester Supplementary Examinations December/January 2018/19Document2 pagesMBA I Semester Supplementary Examinations December/January 2018/19Chandra SekharNo ratings yet

- Nov - 19 - Question and AnswersDocument15 pagesNov - 19 - Question and AnswersVidhi AgrawalNo ratings yet

- Sample Paper For See Acc Xi - 1Document6 pagesSample Paper For See Acc Xi - 1Piyush JNo ratings yet

- Xi Accountancy 80 Marks General InstructionsDocument5 pagesXi Accountancy 80 Marks General InstructionsJash ShahNo ratings yet

- BM102TDocument25 pagesBM102TMariamma KuriakoseNo ratings yet

- Practice Question Paper - Financial AccountingDocument6 pagesPractice Question Paper - Financial AccountingNaomi SaldanhaNo ratings yet

- Class Xi SP 1Document17 pagesClass Xi SP 1Priya NasaNo ratings yet

- 11 QP Final (2021-22)Document4 pages11 QP Final (2021-22)Flick OPNo ratings yet

- 11th BK Final Exam Quesiton Paper March 2021Document5 pages11th BK Final Exam Quesiton Paper March 2021Harendra Prajapati100% (1)

- Faculty of Commerce: Code No. 10001Document4 pagesFaculty of Commerce: Code No. 10001Madasu BalnarsimhaNo ratings yet

- BCA & BSC (CS) Bussines Accounting I Internal QuestionDocument3 pagesBCA & BSC (CS) Bussines Accounting I Internal QuestionVignesh GopalNo ratings yet

- AFH Important questionDocument6 pagesAFH Important questionmanassadashiv013No ratings yet

- Accounts and Financial ManagementDocument2 pagesAccounts and Financial ManagementAmeen ZahidNo ratings yet

- Ugmbcc04 - Business AccountingDocument4 pagesUgmbcc04 - Business AccountingShreya MitraNo ratings yet

- A. Objective Type Question: 10 MarksDocument5 pagesA. Objective Type Question: 10 MarksHem BhattNo ratings yet

- AC PaperDocument2 pagesAC Paperpiyush kumarNo ratings yet

- MQP - MBA - Sem1 - Financial and Management Accounting (DMBA104)Document5 pagesMQP - MBA - Sem1 - Financial and Management Accounting (DMBA104)Rohit SoodNo ratings yet

- Accounts Prelim Paper 28-11-23Document4 pagesAccounts Prelim Paper 28-11-23roshanchoudhary4350No ratings yet

- Accountancy 17Document12 pagesAccountancy 17Manav GargNo ratings yet

- XI ACCOUNTING SET 4Document8 pagesXI ACCOUNTING SET 4aashirwad2076No ratings yet

- 0438Document7 pages0438murtaza5500No ratings yet

- 4 MarksDocument4 pages4 MarksEswari GkNo ratings yet

- B. Com I All PapersnDocument14 pagesB. Com I All Papersnrahim Abbas aliNo ratings yet

- Hsslive Xi Acc Prvs QN Ans 4 Recording of Transaction IIDocument27 pagesHsslive Xi Acc Prvs QN Ans 4 Recording of Transaction IIMuhammed Rasil NaseerNo ratings yet

- Accountin 2 (6 Files Merged)Document8 pagesAccountin 2 (6 Files Merged)Arshad KhanNo ratings yet

- Accounting For Managers Model Question Paper-2: First Semester MBA Degree ExaminationDocument5 pagesAccounting For Managers Model Question Paper-2: First Semester MBA Degree ExaminationRohan Chaugule0% (1)

- Class 11 AccountsDocument3 pagesClass 11 Accountssamarthj.9390No ratings yet

- Problems On Journal, Ledger and Accounting EquationDocument11 pagesProblems On Journal, Ledger and Accounting EquationGopiNo ratings yet

- Topic Wise Test Accounting From Incomplete RecordsDocument4 pagesTopic Wise Test Accounting From Incomplete RecordsChinmay GokhaleNo ratings yet

- SAMPLE PAPER - (Solved) : For Examination March 2018 Accountancy Class - XIDocument14 pagesSAMPLE PAPER - (Solved) : For Examination March 2018 Accountancy Class - XISaksham AroraNo ratings yet

- June, 2004 Q.P JRDocument4 pagesJune, 2004 Q.P JRM JEEVARATHNAM NAIDUNo ratings yet

- MTP 2Document5 pagesMTP 2Arpit GuptaNo ratings yet

- XI Acc 3Document4 pagesXI Acc 3Bhumika ShaldarNo ratings yet

- MB0025 Financial and Management AccountingDocument4 pagesMB0025 Financial and Management AccountingsanthoshaliasNo ratings yet

- Modle Paper 1Document7 pagesModle Paper 1Yaseen MaalikNo ratings yet

- Government Boys Degree College Accounting Paper 1Document4 pagesGovernment Boys Degree College Accounting Paper 1Arshad KhanNo ratings yet

- Inter May, 2008Document4 pagesInter May, 2008M JEEVARATHNAM NAIDUNo ratings yet

- Test Papers AccountsDocument16 pagesTest Papers Accountsmamta.bdvrrmaNo ratings yet

- FA Work BookDocument59 pagesFA Work BookUnais AhmedNo ratings yet

- Marisole Jamarion Bank StatementDocument2 pagesMarisole Jamarion Bank StatementhartNo ratings yet

- CHAP - 3 - Consumer Loans, Credit Cards and Real Estate LendingDocument98 pagesCHAP - 3 - Consumer Loans, Credit Cards and Real Estate LendingNgọc Minh VũNo ratings yet

- Positive Pay System For CTSDocument2 pagesPositive Pay System For CTSOK BHaiNo ratings yet

- Statements 3612 2Document4 pagesStatements 3612 2Aditya Pangestu ArdanaNo ratings yet

- Chapter-3 1Document5 pagesChapter-3 1Gabrielle Joshebed AbaricoNo ratings yet

- Promo BRI X RemboelanDocument20 pagesPromo BRI X RemboelanNaga TanahNo ratings yet

- 76 Going To The Bank CanDocument14 pages76 Going To The Bank CanOlga Amy100% (1)

- Ebill 100081672407Document7 pagesEbill 100081672407Awie daudNo ratings yet

- ch08 PDFDocument4 pagesch08 PDFRabie HarounNo ratings yet

- Can A Debit Card From A Different Bank Be Used at Another BankDocument5 pagesCan A Debit Card From A Different Bank Be Used at Another BankHabtamu AssefaNo ratings yet

- Chapter 2 - Purchasing - 2022Document46 pagesChapter 2 - Purchasing - 2022Ten LeeNo ratings yet

- Use Your ADCB Credit or Debit Card With Apple Pay or Samsung Pay For 3 Transactions and Get AED 50 Cashback (The "Offer")Document2 pagesUse Your ADCB Credit or Debit Card With Apple Pay or Samsung Pay For 3 Transactions and Get AED 50 Cashback (The "Offer")RohitNo ratings yet

- Your TM Bill: Page 1 of 4 Level 51, Menara TM, 50672 Kuala Lumpur ST ID: W10-1808-31001554Document4 pagesYour TM Bill: Page 1 of 4 Level 51, Menara TM, 50672 Kuala Lumpur ST ID: W10-1808-31001554Geetha. SNo ratings yet

- Electricity Account Tax Invoice SummaryDocument2 pagesElectricity Account Tax Invoice SummaryHamza HanifNo ratings yet

- Issuer Mastercard and Debit Test Cases - ManualDocument808 pagesIssuer Mastercard and Debit Test Cases - ManualFernando NiscaNo ratings yet

- Receipt for Roblox Gift Card Purchase from BitrefillDocument2 pagesReceipt for Roblox Gift Card Purchase from BitrefillCristhian SalazarNo ratings yet

- Germany - Domestic Interchange FeesDocument3 pagesGermany - Domestic Interchange FeesjohnNo ratings yet

- What's in your bag vocabularyDocument3 pagesWhat's in your bag vocabularyKaren QuirozNo ratings yet

- Grade 8 Accounting BookletDocument24 pagesGrade 8 Accounting BookletLisandra SantosNo ratings yet

- Banking Products and ServicesDocument30 pagesBanking Products and ServicesAryan AroraNo ratings yet

- Persoanl Account Opening Form English A1edbfb2bdDocument8 pagesPersoanl Account Opening Form English A1edbfb2bdsubhsarki4No ratings yet

- Cisi Application Form For Initial Certificate of ProfessionalismDocument5 pagesCisi Application Form For Initial Certificate of ProfessionalismrajNo ratings yet

- 11 BST Businessservices tp01Document6 pages11 BST Businessservices tp01RajatNo ratings yet

- 15 Budgeting TipsDocument13 pages15 Budgeting TipsWhel DeLima ConsueloNo ratings yet

- Coursebook Chapter 16 AnswersDocument3 pagesCoursebook Chapter 16 AnswersAhmed Zeeshan80% (5)

- Double Entry Exercises Set DDocument1 pageDouble Entry Exercises Set DNayaz EmamaulleeNo ratings yet

- Trends and Outlook For BNPLDocument47 pagesTrends and Outlook For BNPLBetsy Alexandra TaypeNo ratings yet

- Citibank vs. Gatchalian (G.R. No.111222; January 18, 1995Document3 pagesCitibank vs. Gatchalian (G.R. No.111222; January 18, 1995Rochelle Othin Odsinada MarquesesNo ratings yet

- Notice: Accessing Student Financing ServicesDocument1 pageNotice: Accessing Student Financing ServicesLamar TaylorNo ratings yet

- ACCY901 Accounting Foundations For Professionals: Topic 5 ReceivablesDocument30 pagesACCY901 Accounting Foundations For Professionals: Topic 5 Receivablesvenkatachalam radhakrishnan100% (1)