Professional Documents

Culture Documents

ABMG12-Business Ethics Lesson 1

Uploaded by

andrea0 ratings0% found this document useful (0 votes)

3 views24 pagesOriginal Title

ABMG12-Business Ethics Lesson 1 (2)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views24 pagesABMG12-Business Ethics Lesson 1

Uploaded by

andreaCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 24

You can classify this business structure as

either general or limited.

A business partnership can be

classified as general or limited, with

general partnerships allowing 100%

investment and no formal agreement,

while limited partnerships require

formal agreements.

An example of a partnership is a

business set up between two or more

family members, friends or colleagues

in an industry that supports their skill

sets. The partners of a business

typically divide the profits among

themselves.

all members are personally liable for

business-related debts and may be pursued in

a lawsuit.

Compared to other business structures,

partnerships require minimal paperwork and

legal documents to establish.

With more than one like-minded individual, there

are more opportunities to increase their

collaborative skillset.

People in partnerships commonly share

responsibilities so that one person doesn't have

to do all the work.

By having more than one person involved in

business decisions, partners may disagree on

some aspects of the operation.

Without a formal agreement that explicitly

states processes, a business may come to a halt

if partners disagree and choose to end their

partnership.

In a partnership, all members are personally

liable for business-related debts and may be

pursued in a lawsuit.

Is a business organization that acts as a

unique and separate entity from its

shareholders

A corporation is an entity in business

that functions independently of its

stockholders. A company does not

distribute dividends to shareholders

until after it has paid its own taxes. A C

corporation, a S corporation, and an

LLC, or limited liability company, are

the three primary types of

corporations.

Examples of corporations include a

business organization that possesses a

board of directors and a large company

that employs hundreds of people.

About half of all corporations have at

least 500 employees.

To raise additional funds for the business,

shareholders may sell shares

the shareholders of a corporation are not

liable for its debts. Instead, shareholders risk

their equity.

Corporations can deduct expenses related to

company benefits, including health insurance

premiums, wages, taxes, travel, equipment and

more.

To raise additional funds for the business,

shareholders may sell shares in the

corporation.

must pay income tax at the corporate rate before

profits transfer to the shareholders, who must

then pay taxes on an individual level.

With the exception of an S-corporation, the

corporate business structure involves a

substantial amount of paperwork.

there are several investors with no clear

majority interest, the management team may

direct business operations rather than the

owners.

This popular form of business structure is

the easiest to set up.

This popular form of business

structure is the easiest to set up. Sole

proprietorships have one owner who

makes all of the business decisions, and

there is no distinction between the

business and the owner.

Some typical examples of sole

proprietorships include the personal

businesses of freelancers, artists,

consultants and other self-employed

business owners who operate on a solo

basis.

You are personally responsible for all

business debts and company actions under this

business structure.

As the sole owner of your business, you have

full control of business decisions and spending

habits.

Sole proprietorships are not required to file

annual reports or other financial statements

with the state or federal government.

Owners don't need to file any special tax forms

with the IRS other than the Schedule C (Profit

or Loss from Business) form.

registering your business and obtain a business

occupancy permit in some places, the costs of

maintaining a sole proprietorship are much less

You are personally responsible for all business

debts and company actions under this business

structure.

Since you are not required to keep financial

statements, there is a risk of becoming too

relaxed when managing your money.

Investors typically favor corporations when

lending money because they know that those

businesses have strong financial records and

other forms of security.

Is a private business, organization or farm

that a group of individuals owns and runs to

meet a common goal.

is a private business, organization or

farm that a group of individuals owns

and runs to meet a common goal. These

owners work together to operate the

business, and they share the profits

and other benefits. Most of the time,

the members or part-owners of the

cooperative also work for the business

and use its services.

exist in the retail, service, production

and housing industries. Examples of

businesses operating as cooperatives

include credit unions, utility

cooperatives, housing cooperatives and

retail stores that sell food and

agricultural products.

Larger investors may choose to invest in

other business structures that allow them to

earn a larger share,

Cooperatives have access to government-

sponsored grant programs, like the USDA Rural

Development program, depending on the type of

cooperative.

Members of a cooperative follow the "one

member, one vote" philosophy, meaning that

everyone has a say, regardless of their

investment in the co-op.

Cooperatives allow members to join and leave

the business without disrupting its structure or

dissolving it.

Larger investors may choose to invest in other

business structures that allow them to earn a

larger share, as the cooperative structure

treats all investors the same, both large and

small.

Cooperatives are more relaxed in terms of

structure, so members who don't fully

participate or contribute to the business leave

others at a disadvantage and risk turning other

members away.

You might also like

- Forms of Business OrganizationsDocument6 pagesForms of Business OrganizationsBejay MandayaNo ratings yet

- NOTES Shipping BusinessDocument44 pagesNOTES Shipping BusinessSharon AmondiNo ratings yet

- Law in Enforcement Introduction To Financial ManagementDocument13 pagesLaw in Enforcement Introduction To Financial ManagementSamsuarPakasolangNo ratings yet

- What Is A Business StructureDocument7 pagesWhat Is A Business StructureHiroyo ChanNo ratings yet

- Common Types of Business OwnershipDocument18 pagesCommon Types of Business OwnershipsashimiNo ratings yet

- Financial Managment Assessment 1A - Paciones ChemaDocument9 pagesFinancial Managment Assessment 1A - Paciones ChemaChema PacionesNo ratings yet

- Types of BusinessesDocument3 pagesTypes of BusinessesBai Shalimar PantaranNo ratings yet

- Legal Structures Shape Your Journey As A BusinessDocument3 pagesLegal Structures Shape Your Journey As A BusinesszaraNo ratings yet

- TYPESOFBUSINESSFORMSDocument6 pagesTYPESOFBUSINESSFORMSMissy ArticaNo ratings yet

- EntrepreneurshipDocument11 pagesEntrepreneurshipappcode senseNo ratings yet

- How To Choose The Best Legal Structure For Your BusinessDocument4 pagesHow To Choose The Best Legal Structure For Your Businessmuhammad tayyab100% (3)

- A Sole TraderDocument5 pagesA Sole TraderGerÂld MuTaleNo ratings yet

- Business Finance HandoutsDocument21 pagesBusiness Finance HandoutsAli Akbar MalikNo ratings yet

- Company Structure: Post NavigationDocument6 pagesCompany Structure: Post NavigationHimal AcharyaNo ratings yet

- Activity 4 TUDLAS GRICHENDocument9 pagesActivity 4 TUDLAS GRICHENGrichen TudlasNo ratings yet

- AccountsDocument8 pagesAccountsAlveena UsmanNo ratings yet

- Business Ownerhsip - BoholDocument7 pagesBusiness Ownerhsip - BoholJohn Kenneth BoholNo ratings yet

- Forms of Business: Sole Proprietorship, Partnership, CorporationDocument4 pagesForms of Business: Sole Proprietorship, Partnership, CorporationLaurever CaloniaNo ratings yet

- Business Organizations: Types of Business Organizations 6 Forms of Business For IRS PurposesDocument21 pagesBusiness Organizations: Types of Business Organizations 6 Forms of Business For IRS PurposesganeahNo ratings yet

- The Advantages of Going From A Sole Proprietorship To A Limited PartnershipDocument5 pagesThe Advantages of Going From A Sole Proprietorship To A Limited PartnershipMaria Luz Clariza FonteloNo ratings yet

- Legal Docc 3Document4 pagesLegal Docc 3anukshalallchand13No ratings yet

- How To Write Your Own Business Plan Chapter One Business OwnershipDocument27 pagesHow To Write Your Own Business Plan Chapter One Business OwnershipjakirNo ratings yet

- Catibog, Marynissa M. (Assignment No. 1)Document2 pagesCatibog, Marynissa M. (Assignment No. 1)Marynissa CatibogNo ratings yet

- Chapter 4 Legal Issues 1Document24 pagesChapter 4 Legal Issues 1AjayNo ratings yet

- Partnerships: Advantages of A Sole ProprietorshipDocument3 pagesPartnerships: Advantages of A Sole ProprietorshipMinh TâmNo ratings yet

- Start Up LawDocument41 pagesStart Up LawMALKANI DISHA DEEPAKNo ratings yet

- UntitledDocument5 pagesUntitledAldrin ElamparoNo ratings yet

- Module 5 1Document6 pagesModule 5 1Manvendra Singh ShekhawatNo ratings yet

- Introduction - Forms of Business OrganizationDocument5 pagesIntroduction - Forms of Business OrganizationJanet Kent100% (1)

- Forms of Business Organization: Sole ProprietorshipDocument5 pagesForms of Business Organization: Sole ProprietorshipPauline ApiladoNo ratings yet

- Business StructuresDocument22 pagesBusiness StructuresDerrick Maatla MoadiNo ratings yet

- Q3L1 ETHICS Learning PacketDocument6 pagesQ3L1 ETHICS Learning PacketEowyn DianaNo ratings yet

- Types of Business OrganizationDocument8 pagesTypes of Business OrganizationMa Giselle Saporna Meneses100% (1)

- Fabm1 Module 1 Week 4Document6 pagesFabm1 Module 1 Week 4Alma A CernaNo ratings yet

- Week 2-AFDocument15 pagesWeek 2-AFZainab AshrafNo ratings yet

- Forms of Business OrganizationDocument13 pagesForms of Business OrganizationRaz Mahari67% (3)

- Guia de Estudio 1resumenDocument7 pagesGuia de Estudio 1resumenILIANA CABEZANo ratings yet

- Corporate FinanceDocument108 pagesCorporate FinanceKenneth AdokohNo ratings yet

- Commercial Law AssignmentDocument8 pagesCommercial Law AssignmentMemory ApiyoNo ratings yet

- Advantages and Disadvantages of Sole Proprietorship or Partnership Vs CorporationDocument2 pagesAdvantages and Disadvantages of Sole Proprietorship or Partnership Vs CorporationTharindu Dasun WeerasingheNo ratings yet

- Forms of Business OwnershipDocument17 pagesForms of Business OwnershipnatembeatalliaNo ratings yet

- What Are The Types of Business Organization? Differentiate EachDocument3 pagesWhat Are The Types of Business Organization? Differentiate EachCarmelle BahadeNo ratings yet

- Answer: Command Economies Should Be Applied To The Organization I Am WithDocument2 pagesAnswer: Command Economies Should Be Applied To The Organization I Am WithMa'am KC Lat PerezNo ratings yet

- Pro and Cons Sole Trader and PartnershipDocument3 pagesPro and Cons Sole Trader and PartnershipNaim100% (1)

- Man Project ParthDocument8 pagesMan Project ParthParth KshirsagarNo ratings yet

- Chapter One - Introduction To Corporate FinanceDocument25 pagesChapter One - Introduction To Corporate Financeonkarskulkarni100% (2)

- Forms of Business OrganizationDocument4 pagesForms of Business OrganizationMarissa ClementNo ratings yet

- Sole ProprietorshipDocument6 pagesSole ProprietorshipEron Roi Centina-gacutanNo ratings yet

- Lecture TwoDocument26 pagesLecture TwoAnsumanan FeikaNo ratings yet

- HW PavithraKrishnamurthy Sub1BDocument2 pagesHW PavithraKrishnamurthy Sub1BArun VermaNo ratings yet

- (WEEK 1) :: Forms of Business Ownership: Choosing The Right FitDocument41 pages(WEEK 1) :: Forms of Business Ownership: Choosing The Right FitAngelina ThomasNo ratings yet

- 1-Business StructureDocument9 pages1-Business StructureGen AbulkhairNo ratings yet

- Forms of Business OrganizationsDocument24 pagesForms of Business OrganizationsJessa TayoNo ratings yet

- Advantages of Being A Sole TraderDocument6 pagesAdvantages of Being A Sole TradercrthinkerNo ratings yet

- Sole Proprietorship ProsDocument10 pagesSole Proprietorship ProsCarlaGomezNo ratings yet

- Week 5 Quiz - EssayDocument3 pagesWeek 5 Quiz - EssayJohn Edwinson JaraNo ratings yet

- Business Definition: Business Definition Into Business Entity Definition and Business Activity DefinitionDocument10 pagesBusiness Definition: Business Definition Into Business Entity Definition and Business Activity Definitionmuhammad riazNo ratings yet

- Forms of Business OranizationsDocument6 pagesForms of Business Oranizationskremer.oscar2009No ratings yet

- Business Structure Sample PDFDocument5 pagesBusiness Structure Sample PDFAnujAggarwalNo ratings yet

- TaxationDocument2 pagesTaxationandreaNo ratings yet

- Blue Modern Business PresentationDocument42 pagesBlue Modern Business PresentationandreaNo ratings yet

- Finals PEDocument4 pagesFinals PEandreaNo ratings yet

- Obligations and Contracts - LectureDocument171 pagesObligations and Contracts - LectureandreaNo ratings yet

- Padayao, Leadership StyleDocument5 pagesPadayao, Leadership StyleandreaNo ratings yet

- JayveeDocument23 pagesJayveeandreaNo ratings yet

- Global EconomyDocument9 pagesGlobal EconomyandreaNo ratings yet

- Mary GraceDocument1 pageMary GraceandreaNo ratings yet

- Tray To Go 3Document117 pagesTray To Go 3andreaNo ratings yet

- Global EconomyDocument9 pagesGlobal EconomyandreaNo ratings yet

- Nestle Finance International LTD Fullyear Financial Report 2021 enDocument37 pagesNestle Finance International LTD Fullyear Financial Report 2021 enT.k.e.dNo ratings yet

- Comprehensive Financial Markets Topics Test BankDocument15 pagesComprehensive Financial Markets Topics Test BankMichelle V. LaurelNo ratings yet

- Macrs TableDocument3 pagesMacrs Tableeimg20041333No ratings yet

- Equalisation On Investment FundsDocument10 pagesEqualisation On Investment FundsWilling ZvirevoNo ratings yet

- Account Statement: Generated On Sunday, April 16, 2023 6:05:49 AMDocument1 pageAccount Statement: Generated On Sunday, April 16, 2023 6:05:49 AMPatience AkpanNo ratings yet

- GaugesDocument6 pagesGaugesJuan Felipe Garza GNo ratings yet

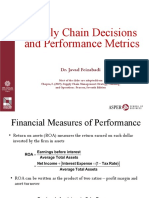

- 3-Supply Chain Decisions and Performance Metrics (A)Document21 pages3-Supply Chain Decisions and Performance Metrics (A)eeman kNo ratings yet

- Analysis of Financial StatementsDocument37 pagesAnalysis of Financial StatementsApollo Institute of Hospital Administration100% (5)

- Chapter 11. VatDocument56 pagesChapter 11. VatAmanda RuseirNo ratings yet

- List of the Most Important Financial Ratios: List of Financial Ratios (PDF), Key Financial Ratios: Formulas and Explanations, What are Financial Ratios (Explained Types), Common Financial Ratios: Formula, Importance of Best Financial Ratios: Analysis and Interpretation, Example of Financial Ratio, Formula, List of Profitability Ratios, Formula for Calculating ROIDocument5 pagesList of the Most Important Financial Ratios: List of Financial Ratios (PDF), Key Financial Ratios: Formulas and Explanations, What are Financial Ratios (Explained Types), Common Financial Ratios: Formula, Importance of Best Financial Ratios: Analysis and Interpretation, Example of Financial Ratio, Formula, List of Profitability Ratios, Formula for Calculating ROIThe KPI Examples Review100% (1)

- 12 TallyDocument4 pages12 TallyAtif RahmanNo ratings yet

- Perez Distributors PeriodicDocument28 pagesPerez Distributors PeriodicLalaineNo ratings yet

- Project FinancingDocument15 pagesProject FinancingAnkush RatnaparkheNo ratings yet

- Long Term Liabilities Part 1Document20 pagesLong Term Liabilities Part 1Umal MalikNo ratings yet

- Zensar Technologies: Turnaround To Take Four To Eight QuartersDocument4 pagesZensar Technologies: Turnaround To Take Four To Eight Quartersharsh jainNo ratings yet

- Deferred Tax LiabilityDocument2 pagesDeferred Tax LiabilityWiLliamLoquiroWencesLaoNo ratings yet

- Financial Management Midterm Quiz 407Document1 pageFinancial Management Midterm Quiz 407Agna AegeanNo ratings yet

- Business FinanceDocument10 pagesBusiness FinancenattoykoNo ratings yet

- P D T Reit: Ortfolio Iversification Hrough SDocument8 pagesP D T Reit: Ortfolio Iversification Hrough SsuperbuddyNo ratings yet

- Calcul Ating T He Co ST O F CapitalDocument50 pagesCalcul Ating T He Co ST O F CapitalSyrell NaborNo ratings yet

- Financial Statements and Cash Flow: Mcgraw-Hill/IrwinDocument38 pagesFinancial Statements and Cash Flow: Mcgraw-Hill/IrwinBennyKurniawanNo ratings yet

- Correction of Errors PDFDocument7 pagesCorrection of Errors PDFKylaSalvador0% (2)

- Bonds Payable 2023Document59 pagesBonds Payable 2023Kirstine SanchezNo ratings yet

- Accounting TermDocument7 pagesAccounting TermThangdong QuayNo ratings yet

- Apple Inc. Profit & Loss Statement: Operating ExpensesDocument4 pagesApple Inc. Profit & Loss Statement: Operating ExpensesDevanshu YadavNo ratings yet

- NESTLE Financial Report (218KB)Document64 pagesNESTLE Financial Report (218KB)Sivakumar NadarajaNo ratings yet

- AKD cpt03Document91 pagesAKD cpt03Anisha RosevitaNo ratings yet

- Economic Value Added: EVA Is An Estimate of A Firm's Economic Profit - BeingDocument7 pagesEconomic Value Added: EVA Is An Estimate of A Firm's Economic Profit - BeingSunil Kumar SahooNo ratings yet

- Chapter 1 New - FIN201Document12 pagesChapter 1 New - FIN201Shahinul KabirNo ratings yet

- Estmt - 2019 07 25Document8 pagesEstmt - 2019 07 25Sandra RíosNo ratings yet