Professional Documents

Culture Documents

Sro 898

Sro 898

Uploaded by

MuhammadIjazAslam0 ratings0% found this document useful (0 votes)

5 views1 pageOriginal Title

20131041410271258 Sro 898

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views1 pageSro 898

Sro 898

Uploaded by

MuhammadIjazAslamCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 1

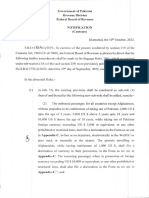

GOVERNMENT OF PAKISTAN

MINISTRY OF FINANCE, ECONOMIC A FPAIRS,

STATISTICS AND REVENUE

VENUE DIVISION:

EVIE ESION ith

Islamabad, the October, 2013

NOTIFICATION

(SALES TAX)

S.R.O. 398 (0/2013 In exercise of the Powers conferred by clause (c) of section 4 read

with clause (b) of. sub-section (2) and sub-section (6) of section 3, clause (b), of sub-section (1) of

section 8 and section 71 of the Sales Tax Act, 1990, the Federal Govemment is pleased to direct

‘that the following further amendments shall be made in its Notification No. S.R. 0, 1125(1/2011

dated the 31" December, 2011, namely:~

In the aforesaid Notification,—

@ after condi (iD. the folowing nev condition shall be inserted, namely:

“(viia) notwithstanding anything contained in any other condition of this

Notification, import and supplies of fabric shall be ‘charged t0 sales tax at the rate

Of three per cent and value addition tax at the rate of two er cent shall be

chargeable on commercial imports of fabrics,”; and

in condition (x), for the proviso, the following shall be substituted, namely:-

“Provided that refund against local supplies, if any, shall be admissible

only subjest to pre-efind audit and in case of value addition of less than ten

Pervent Subject to the condition that the registered persons furnishes a revolving

bank guarantee valid for at least ninety days issued by a scheduled bank to the

satisfaction of the Commissioner, Inland Revenue having jurisdiction, of an

Amount net less than the average monthly refund claim during last twelve months:

Inland Revenue having jurisdiction,”,

iC. No. 1/56-8TB/2013)

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Sro 1864Document2 pagesSro 1864MuhammadIjazAslamNo ratings yet

- Dev 2022-23.docxDocument7 pagesDev 2022-23.docxMuhammadIjazAslamNo ratings yet

- EXpress LHR 25octDocument12 pagesEXpress LHR 25octMuhammadIjazAslamNo ratings yet

- DerivativesDocument7 pagesDerivativesMuhammadIjazAslamNo ratings yet

- Express Multan 29 DecDocument12 pagesExpress Multan 29 DecMuhammadIjazAslamNo ratings yet

- No. HR-Manager Admin-11274-80 Dated 2021-07-06Document1 pageNo. HR-Manager Admin-11274-80 Dated 2021-07-06MuhammadIjazAslamNo ratings yet

- Express Multan 01 JanDocument14 pagesExpress Multan 01 JanMuhammadIjazAslamNo ratings yet

- Administrative Officer, NPSL, Plot# 16, Sector H-9, Islamabad 051-9265163Document1 pageAdministrative Officer, NPSL, Plot# 16, Sector H-9, Islamabad 051-9265163MuhammadIjazAslamNo ratings yet

- No. HR-Manager-Admin-11024-31 Dated 2021-07-02Document1 pageNo. HR-Manager-Admin-11024-31 Dated 2021-07-02MuhammadIjazAslamNo ratings yet

- Psda Act 2019Document7 pagesPsda Act 2019MuhammadIjazAslamNo ratings yet

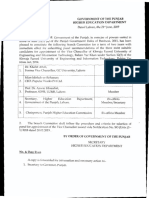

- Government of The Punjab Higher Education Department: No. DateDocument11 pagesGovernment of The Punjab Higher Education Department: No. DateMuhammadIjazAslamNo ratings yet

- In The Lahore High Court Lahore Judicial Department: Judgment SheetDocument27 pagesIn The Lahore High Court Lahore Judicial Department: Judgment SheetMuhammadIjazAslamNo ratings yet