Professional Documents

Culture Documents

Reading Comprehension

Uploaded by

Cecilia AlancayOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Reading Comprehension

Uploaded by

Cecilia AlancayCopyright:

Available Formats

STEP 1 - Read the following article

The struggling Spanish economy

Spain's borrowing costs shot up at a bond auction on Thursday, after economic data confirmed

the country is back in recession and reports of an outflow of deposits from nationalized Bankia

hammered its share price.

The Spanish Treasury had to pay around 5 percent to attract buyers of three- and four-year

bonds. The longer-dated paper sold with a yield of 5.106 percent, way above the 3.374 percent

the last time it was auctioned.

"This ... fits the pattern of recent sales, with the Spanish treasury successfully getting its supply

away but at ever-higher yields," said Richard McGuire, rate strategist at Rabobank in London.

"This unfavorable trend looks set to remain firmly in place ... Ultimately, this ratcheting up of

yields will likely require some form of outside intervention," McGuire said.

Spanish Prime Minister Mariano Rajoy said on Wednesday his government, struggling to reduce

its budget deficit, could soon find it difficult to fund itself affordably on the bond market unless

the pressure eases.

His finance minister, Cristobal Montoro, meets heads of finance of all 17 regions later to review

their budget plans which are a crucial plank of the drive to lower public debt.

The European Commission warned last week that stubbornly high debts in the regions and the

welfare system would prevent Spain meeting its deficit goal of 5.3 percent of GDP this year.

Spain's 10-year yields have spiked back above 6 percent, which investors view as a pivot point

that could accelerate a climb to 7 percent, a cost of borrowing widely seen as unsustainable

even though Madrid has sold well over half its debt needs for the year.

(c) AFP 05/09/2012

STEP 2 - Answer these questions (choose the best answer):

1. How much higher was this past bond yield compared to the previous one?

over 1.5% higher

0.5 % higher

It wasn't higher. It was lower.

2. What happened to Bankia shares on the market?

They plunged.

They rose by about 1.5%.

They remained steady.

3. According to the article, how high can Spain's 10 year yields go?

7%

6%

5%

4. Is the Spanish government unable to sell bonds?

No, it's the high yields that are the problem.

Yes, they can't even sell half of the bonds.

No, the biggest problem is corruption.

5. According to the article, what's the biggest hurdle to Spain meeting its deficit goal this year?

Debts in the regions and the welfare system

The drop in value of Bankia shares

The inability of the government to successfully sell bonds

You might also like

- Traduccion Articulo 4Document2 pagesTraduccion Articulo 4Guerrero AgeNo ratings yet

- The Struggling Spanish Economy: Guide Words Possible Source Main IdeaDocument4 pagesThe Struggling Spanish Economy: Guide Words Possible Source Main IdeaMayeNo ratings yet

- Gmo Quarterly Letter Q4 2018Document17 pagesGmo Quarterly Letter Q4 2018Stirling AdelhelmNo ratings yet

- 2015: Outlook for Stocks, Bonds, Commodities, Currencies and Real EstateFrom Everand2015: Outlook for Stocks, Bonds, Commodities, Currencies and Real EstateNo ratings yet

- Market Commentary 2019 JuneDocument4 pagesMarket Commentary 2019 JuneDavid BriggsNo ratings yet

- Bnpparibas Eds Derivatives Lens 20 Oct 2011 EuroDocument4 pagesBnpparibas Eds Derivatives Lens 20 Oct 2011 Eurobaburavula4756No ratings yet

- Spain's Financial CrisisDocument15 pagesSpain's Financial CrisisPurnendu SinghNo ratings yet

- JUL 07 Wells Fargo Eco OutlookDocument6 pagesJUL 07 Wells Fargo Eco OutlookMiir ViirNo ratings yet

- Title: The Tide Is Turning For Greece-And The Euro Zone Author: Simon Nixon Date: April 13, 2014 Source: The Wall Street JournalDocument5 pagesTitle: The Tide Is Turning For Greece-And The Euro Zone Author: Simon Nixon Date: April 13, 2014 Source: The Wall Street JournalKimberly FieldsNo ratings yet

- Dow Closes Above 11,000 This Rally Has Ignored Fundamentals, and Will Be Corrected Painfully, Hussman SaysDocument10 pagesDow Closes Above 11,000 This Rally Has Ignored Fundamentals, and Will Be Corrected Painfully, Hussman SaysAlbert L. PeiaNo ratings yet

- Dow Closes Above 11,000 This Rally Has Ignored Fundamentals, and Will Be Corrected Painfully, Hussman SaysDocument10 pagesDow Closes Above 11,000 This Rally Has Ignored Fundamentals, and Will Be Corrected Painfully, Hussman SaysAlbert L. PeiaNo ratings yet

- Hedgfx 07-07-12Document9 pagesHedgfx 07-07-12HedgfxNo ratings yet

- RMF March2012updateDocument5 pagesRMF March2012updatejep9547No ratings yet

- Weekly Market Commentary 6-12-2012Document3 pagesWeekly Market Commentary 6-12-2012monarchadvisorygroupNo ratings yet

- GI Report May 2012Document3 pagesGI Report May 2012Bill HallmanNo ratings yet

- The Road To PerditionDocument3 pagesThe Road To PerditionBrian BarkerNo ratings yet

- Abstract: The Article After The Sugar Rush Appeared in The Online Edition of TheDocument3 pagesAbstract: The Article After The Sugar Rush Appeared in The Online Edition of TheAndreea DurlaNo ratings yet

- Macro Analysis PhilippinesDocument9 pagesMacro Analysis PhilippinesAnthony AlferesNo ratings yet

- Moment - of - Truth - Martn WolfDocument3 pagesMoment - of - Truth - Martn Wolf3bandhuNo ratings yet

- 2016-04 Wrestling With Negative Interest RatesDocument3 pages2016-04 Wrestling With Negative Interest RatesMichael BenzingerNo ratings yet

- ECO3933 Study GuideDocument7 pagesECO3933 Study GuidekmeloNo ratings yet

- Fasanara Capital Investment Outlook - May 3rd 2016Document17 pagesFasanara Capital Investment Outlook - May 3rd 2016Zerohedge100% (1)

- Japan's Lessons For A World of Balance-Sheet Deflation: by Martin Wolf, Financial Times, February 17 2009Document3 pagesJapan's Lessons For A World of Balance-Sheet Deflation: by Martin Wolf, Financial Times, February 17 2009vedran1980No ratings yet

- Stimulating DebateDocument2 pagesStimulating DebatetbwsmNo ratings yet

- James FournierDocument1 pageJames Fournierapi-100874888No ratings yet

- Do Budget Deficits Raise Long-Term Interest Rates?, Cato Tax & Budget BulletinDocument2 pagesDo Budget Deficits Raise Long-Term Interest Rates?, Cato Tax & Budget BulletinCato InstituteNo ratings yet

- Spain - Can The House Resist The StormDocument4 pagesSpain - Can The House Resist The StormJojo JavierNo ratings yet

- Warnings To Be Ignored: DAY 8: Progressive Test 1Document10 pagesWarnings To Be Ignored: DAY 8: Progressive Test 1thanh truc bùiNo ratings yet

- Market Leader Intermediate Reading Homework - Unit 6Document4 pagesMarket Leader Intermediate Reading Homework - Unit 6HafiniNo ratings yet

- Breakfast With Dave: David A. RosenbergDocument11 pagesBreakfast With Dave: David A. RosenbergwardavisNo ratings yet

- Open Letter To Chancellor MerkelDocument5 pagesOpen Letter To Chancellor MerkelXavier SoutoNo ratings yet

- Open Europe BriefingDocument11 pagesOpen Europe BriefingZerohedgeNo ratings yet

- FT - How To Find An Income in A High-Inflation Market (17 Sept 11)Document2 pagesFT - How To Find An Income in A High-Inflation Market (17 Sept 11)Björn Brynjúlfur BjörnssonNo ratings yet

- Week Ending Friday, August 3, 2018: Exchange Yoy MomDocument13 pagesWeek Ending Friday, August 3, 2018: Exchange Yoy MomsirdquantsNo ratings yet

- Why Spain's Economy Is in Horrific Shape But Bond Markets Think The Crisis Is Over - QuartzDocument8 pagesWhy Spain's Economy Is in Horrific Shape But Bond Markets Think The Crisis Is Over - QuartzGiovanna SandrelliNo ratings yet

- GX Fsi Dcfs 2019 Banking Cap Markets Outlook PDFDocument40 pagesGX Fsi Dcfs 2019 Banking Cap Markets Outlook PDFJyoti KumawatNo ratings yet

- When Will Japan's Debt Crisis ImplodeDocument11 pagesWhen Will Japan's Debt Crisis Implodeyoutube watcherNo ratings yet

- Hide and Seek: U.S. Economy UncertainDocument12 pagesHide and Seek: U.S. Economy UncertainCanadianValueNo ratings yet

- Government Austerity Measures Next StepDocument10 pagesGovernment Austerity Measures Next StepkakeroteNo ratings yet

- GI Report January 2012Document3 pagesGI Report January 2012Bill HallmanNo ratings yet

- Dave Rosenberg 2018 Economic OutlookDocument9 pagesDave Rosenberg 2018 Economic OutlooksandipktNo ratings yet

- Renaissance: European Retail Banking An Opportunity For ADocument22 pagesRenaissance: European Retail Banking An Opportunity For AataktosNo ratings yet

- Stock Market Investing for Beginners: And Intermediate. Learn to Generate Passive Income with Investing, Stock Trading, Day Trading Stock. Useful for Cryptocurrency. Great to Listen in a Car!From EverandStock Market Investing for Beginners: And Intermediate. Learn to Generate Passive Income with Investing, Stock Trading, Day Trading Stock. Useful for Cryptocurrency. Great to Listen in a Car!No ratings yet

- Stocks Have Rallied and Will Now Return Less. Hip Hip Hooray! But Now What?Document5 pagesStocks Have Rallied and Will Now Return Less. Hip Hip Hooray! But Now What?saif_shakeelNo ratings yet

- Global Credit CrisisDocument8 pagesGlobal Credit CrisisNLD1888No ratings yet

- Angola Woes Risk Sharpening Focus On Africa's DebtDocument3 pagesAngola Woes Risk Sharpening Focus On Africa's DebtNixon de AlmeidaNo ratings yet

- Commodities Current Rally Is Likely To Be Limited Business Standard March 23, 2016Document1 pageCommodities Current Rally Is Likely To Be Limited Business Standard March 23, 2016Dr Vidya S SharmaNo ratings yet

- Sub Prime LendingDocument4 pagesSub Prime Lendinggagan585No ratings yet

- Triangle Financial 2010 4th QTR NewsletterDocument10 pagesTriangle Financial 2010 4th QTR NewsletterTriangleFinancialNo ratings yet

- Act ch03 l01 EnglishDocument3 pagesAct ch03 l01 EnglishLinds RiveraNo ratings yet

- Pictet Report 3 May 2010 EnglishDocument36 pagesPictet Report 3 May 2010 EnglishmarcosvillaruelNo ratings yet

- Power Off The Money Printer America's Economy Needs Tighter Monetary PolicyDocument3 pagesPower Off The Money Printer America's Economy Needs Tighter Monetary PolicyZiyad YahmadNo ratings yet

- Economist (2005) - Saving by Companies. The Corporate Savings GlutDocument3 pagesEconomist (2005) - Saving by Companies. The Corporate Savings GlutalbirezNo ratings yet

- The Pensford Letter - 10.1.12Document4 pagesThe Pensford Letter - 10.1.12Pensford FinancialNo ratings yet

- Sharing Wisdom (21 Feb 2012)Document2 pagesSharing Wisdom (21 Feb 2012)Winston Wisdom KohNo ratings yet

- Fitch Ratings Downgraded Spain's Long Term ForeignDocument14 pagesFitch Ratings Downgraded Spain's Long Term ForeignmelvineNo ratings yet

- Current Edition Contains: 1: A Couple of Notes On EuropeDocument11 pagesCurrent Edition Contains: 1: A Couple of Notes On EuropeJan KaskaNo ratings yet

- Global 4Document89 pagesGlobal 4MiltonThitswaloNo ratings yet

- Cultural AdvancedDocument3 pagesCultural AdvancedCecilia AlancayNo ratings yet

- Paper Olimpic GamesDocument2 pagesPaper Olimpic GamesCecilia AlancayNo ratings yet

- Elementary LevelDocument2 pagesElementary LevelCecilia AlancayNo ratings yet

- Work PaperDocument1 pageWork PaperCecilia AlancayNo ratings yet

- TensesDocument1 pageTensesCecilia AlancayNo ratings yet

- WH QuestionDocument1 pageWH QuestionCecilia AlancayNo ratings yet

- Work PaperDocument2 pagesWork PaperCecilia AlancayNo ratings yet

- WORK PAPER Days, Months and SeasonsDocument2 pagesWORK PAPER Days, Months and SeasonsCecilia AlancayNo ratings yet

- I Will SurviveDocument1 pageI Will SurviveCecilia AlancayNo ratings yet

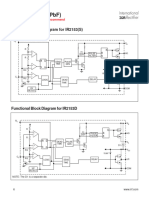

- IR2153 Parte6Document1 pageIR2153 Parte6FRANK NIELE DE OLIVEIRANo ratings yet

- Praise and Worship Songs Volume 2 PDFDocument92 pagesPraise and Worship Songs Volume 2 PDFDaniel AnayaNo ratings yet

- LP32HS User Manual v1Document52 pagesLP32HS User Manual v1tonizx7rrNo ratings yet

- Quality Control of Rigid Pavements 1Document58 pagesQuality Control of Rigid Pavements 1pranjpatil100% (1)

- How Chargers WorkDocument21 pagesHow Chargers WorkMuhammad Irfan RiazNo ratings yet

- Li JinglinDocument3 pagesLi JinglincorneliuskooNo ratings yet

- Yetta Company ProfileDocument6 pagesYetta Company ProfileAfizi GhazaliNo ratings yet

- The Ovation E-Amp: A 180 W High-Fidelity Audio Power AmplifierDocument61 pagesThe Ovation E-Amp: A 180 W High-Fidelity Audio Power AmplifierNini Farribas100% (1)

- Lacey Robertson Resume 3-6-20Document1 pageLacey Robertson Resume 3-6-20api-410771996No ratings yet

- Module 6 Metal Properties and Destructive TestingDocument46 pagesModule 6 Metal Properties and Destructive TestingMiki Jaksic100% (6)

- 4.2.4.5 Packet Tracer - Connecting A Wired and Wireless LAN InstructionsDocument5 pages4.2.4.5 Packet Tracer - Connecting A Wired and Wireless LAN InstructionsAhmadHijaziNo ratings yet

- Active Hospital Network List For Vidal Health Insurance Tpa PVT LTD As On 01 Feb 2023Document119 pagesActive Hospital Network List For Vidal Health Insurance Tpa PVT LTD As On 01 Feb 2023jagdeepchkNo ratings yet

- Sample REVISION QUESTION BANK. ACCA Paper F5 PERFORMANCE MANAGEMENTDocument43 pagesSample REVISION QUESTION BANK. ACCA Paper F5 PERFORMANCE MANAGEMENTAbayneh Assefa75% (4)

- Literature Review Template DownloadDocument4 pagesLiterature Review Template Downloadaflsigfek100% (1)

- Philodendron Plants CareDocument4 pagesPhilodendron Plants CareSabre FortNo ratings yet

- APA Vs Harvard Referencing - PDFDocument4 pagesAPA Vs Harvard Referencing - PDFTalo Contajazz Chileshe50% (2)

- Subject OrientationDocument15 pagesSubject OrientationPearl OgayonNo ratings yet

- Ultracold Atoms SlidesDocument49 pagesUltracold Atoms SlideslaubbaumNo ratings yet

- Precursor Effects of Citric Acid and Citrates On Zno Crystal FormationDocument7 pagesPrecursor Effects of Citric Acid and Citrates On Zno Crystal FormationAlv R GraciaNo ratings yet

- DIR-819 A1 Manual v1.02WW PDFDocument172 pagesDIR-819 A1 Manual v1.02WW PDFSerginho Jaafa ReggaeNo ratings yet

- DCS800ServiceManual RevADocument96 pagesDCS800ServiceManual RevAElinplastNo ratings yet

- ABARI-Volunteer Guide BookDocument10 pagesABARI-Volunteer Guide BookEla Mercado0% (1)

- Perdarahan Uterus AbnormalDocument15 pagesPerdarahan Uterus Abnormalarfiah100% (1)

- Unit 1 Module 3 Rep in PlantsDocument26 pagesUnit 1 Module 3 Rep in Plantstamesh jodhanNo ratings yet

- 444323735-Chem-Matters-Workbook-2E-Teacher-s-Edn-pdf 16-16Document1 page444323735-Chem-Matters-Workbook-2E-Teacher-s-Edn-pdf 16-16whatisNo ratings yet

- Enlightened ExperimentationDocument8 pagesEnlightened ExperimentationRaeed HassanNo ratings yet

- Chapter 13 CarbohydratesDocument15 pagesChapter 13 CarbohydratesShanna Sophia PelicanoNo ratings yet

- Virtual WorkDocument12 pagesVirtual Workdkgupta28No ratings yet

- Existentialism in CinemaDocument25 pagesExistentialism in CinemanormatthewNo ratings yet

- 2500 Valve BrochureDocument12 pages2500 Valve BrochureJurie_sk3608No ratings yet