Professional Documents

Culture Documents

Three Lines of Defence March 2015

Uploaded by

Joshua JonesOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Three Lines of Defence March 2015

Uploaded by

Joshua JonesCopyright:

Available Formats

IIA Policy Paper

Internal audit, risk and corporate governance – the Three

Lines of Defence Model

Main message

The Three Lines of Defence Model is a valuable framework that outlines internal

audit’s role in assuring the effective management of risk, and the importance for

delivering this of its position and function in the corporate governance structure.

Applying the three lines of defence model in an organisation is not a silver bullet for

achieving effective internal audit. Much also depends for example on the standing,

scope and resourcing of the internal audit function. However if the positioning and

governance structure for internal audit are wrong, its ability to support the board or

audit committee in their challenging of management can be fatally undermined.

Different parts and levels of an organisation play different roles in risk management,

and the interplay between them determines how effective the organisation as a whole

is in dealing with risk.

Internal audit’s unique role is to provide assurance to the board that is objective and

independent of management about the controls in place to manage risk. Blurring

internal audit’s role can undermine effectiveness. The independence and objectivity

of internal audit are vital in its support of the board and audit committee.

Regular and ongoing dialogue by internal audit with the first and second lines of

defence is needed so that the function has a more timely perspective of business

direction and business issues. Internal audit can therefore play a valuable advisory

role to help the executive improve the second line of defence processes with advice,

facilitation and training. Internal audit can also identify where there are gaps in the

first two lines of defence and advise on how they can be plugged.

Internal audit can also play a valuable role in helping the board ensure that

governance structures are effective in identifying and managing wider strategic as

well as internal risks.

What do we want?

Changes to governance codes, standards, guidance or regulation should promote

internal audit’s role as a core part of the third line of defence and must avoid

undermining its unique position in monitoring and providing assurance on the

management of risk. Demarcation between the third line of defence and the first two

lines must be preserved to enable internal audit to provide an objective overview to

the Board, independent of management, on the effectiveness of all risk management

and assurance processes in the organisation.

In some organisations the role of internal audit is combined with elements from the

first two lines of defence. For example some internal audit functions are asked to play

a part in facilitating risk management or managing the internal whistleblowing

arrangements. Where that happens, boards need to be aware of potential conflicts of

interest and ensure they take measures to safeguard the objectivity of internal audit.

(See

www.iia.org.uk/policy/policy-position-papers/risk-management-and-internal-audit/ and

https://www.iia.org.uk/media/565182/iia_whistleblowing_briefing3.3.2014final.pdf)

Background

1. The first line of defence (functions that own and manage risks)

is formed by managers and staff who are responsible for identifying and

managing risk as part of their accountability for achieving objectives.

Collectively, they should have the necessary knowledge, skills, information,

and authority to operate the relevant policies and procedures of risk control.

This requires an understanding of the company, its objectives, the

environment in which it operates, and the risks it faces.

2. The second line of defence (functions that oversee or who specialise in

compliance or the management of risk)

provides the policies, frameworks, tools, techniques and support to enable

risk and compliance to be managed in the first line, conducts monitoring to

judge how effectively they are doing it, and helps ensure consistency of

definitions and measurement of risk.

3. The third line of defence (functions that provide independent assurance)

is provided by internal audit. Sitting outside the risk management processes

of the first two lines of defence, its main roles are to ensure that the first two

lines of are operating effectively and advise how they could be improved.

Tasked by, and reporting to the board / audit committee, it provides an

evaluation, through a risk-based approach, on the effectiveness of

governance, risk management, and internal control to the organization’s

governing body and senior management. It can also give assurance to sector

regulators and external auditors that appropriate controls and processes are

in place and are operating effectively.

For a more detailed analysis of the three lines of defence and how to

coordinate their activities, please see

https://global.theiia.org/standards-

guidance/Public%20Documents/ippf%20pp%20the%20three%20lines%20of

%20defense%20in%20effective%20risk%20management%20and%20control.

pdf

© Chartered Institute of Internal Auditors, March2015

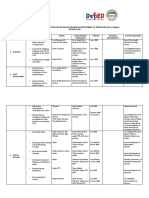

Board / Audit Committee

Senior Management

First Line of Defence Second Line of Defence Third Line of Defence

Financial Control

Application of Controls

Management of Risk

Risk Management

Internal Audit

Day-to-day

Quality

Inspection

Compliance

You might also like

- VC AndrewsDocument3 pagesVC AndrewsLesa O'Leary100% (1)

- Comptronix Case FinalDocument9 pagesComptronix Case FinalMarina KushilovskayaNo ratings yet

- GTAG3 Audit KontinyuDocument37 pagesGTAG3 Audit KontinyujonisupriadiNo ratings yet

- Ey Control and Testing Transformation PDFDocument12 pagesEy Control and Testing Transformation PDFPavan VasudevanNo ratings yet

- Intelligent Assurance Smart Controls PDFDocument31 pagesIntelligent Assurance Smart Controls PDFChristen CastilloNo ratings yet

- The Three Lines of Defence: Audit Committee InstituteDocument4 pagesThe Three Lines of Defence: Audit Committee InstituteDigong SmazNo ratings yet

- Scrum Handbook: Scrum Training Institute PressDocument66 pagesScrum Handbook: Scrum Training Institute PressFranky RiveroNo ratings yet

- Internal Audit Training - 011948Document170 pagesInternal Audit Training - 011948aassweNo ratings yet

- Nyambe African Adventures An Introduction To African AdventuresDocument5 pagesNyambe African Adventures An Introduction To African AdventuresKaren LeongNo ratings yet

- Three Lines of DefenceDocument8 pagesThree Lines of Defencemladenoviczoran8No ratings yet

- GTAG 3 Continuous Auditing 2nd EditionDocument30 pagesGTAG 3 Continuous Auditing 2nd EditionDede AndriNo ratings yet

- Ericka Feyne R. Barañao Mindanao State University BS Accountancy ACT 140 Assignment No. 2Document2 pagesEricka Feyne R. Barañao Mindanao State University BS Accountancy ACT 140 Assignment No. 2PATATASNo ratings yet

- Governance of Risk - Three Lines of DefenceDocument3 pagesGovernance of Risk - Three Lines of DefenceStephanus Kukuh DewantoNo ratings yet

- Otago 701770Document19 pagesOtago 701770Nda-jiya SuberuNo ratings yet

- SSRN Id3409423Document13 pagesSSRN Id3409423TehakelewTeferaNo ratings yet

- Three Lines of DefenceDocument4 pagesThree Lines of DefenceedaariedaNo ratings yet

- TOPIC 8 Internal Control Frameworks (E.g., COSO, COBIT)Document8 pagesTOPIC 8 Internal Control Frameworks (E.g., COSO, COBIT)kenl69784No ratings yet

- Draft - V3 - Compliance AwarenessDocument15 pagesDraft - V3 - Compliance AwarenessSYED MURTAZANo ratings yet

- Role of Internal Auditor: (Type Text)Document6 pagesRole of Internal Auditor: (Type Text)Rio RegalaNo ratings yet

- Recommendation For An Effective Continuous Audit Process ..1Document11 pagesRecommendation For An Effective Continuous Audit Process ..1jamballNo ratings yet

- C 2Document16 pagesC 2Mboh MelvisNo ratings yet

- Lines of Defense Model For Financial Institutions.), This Article Has Provided An Understanding OnDocument15 pagesLines of Defense Model For Financial Institutions.), This Article Has Provided An Understanding OnaliyaNo ratings yet

- Chapter 1 - BAGOBUSXDocument11 pagesChapter 1 - BAGOBUSXClaire Joy CadornaNo ratings yet

- Quality Assurance MappingDocument1 pageQuality Assurance MappingArtoToroNo ratings yet

- Beyond The Three Lines of Defense - The Five Lines of Defense Model For Financial Institutions - ACRNDocument16 pagesBeyond The Three Lines of Defense - The Five Lines of Defense Model For Financial Institutions - ACRNGeorgios VousinasNo ratings yet

- Audting II AnsDocument12 pagesAudting II Ansfikremaryam hiwiNo ratings yet

- Chapter 5 AuditDocument62 pagesChapter 5 Auditmaryumarshad2No ratings yet

- Risk AssessmentDocument9 pagesRisk AssessmentAshley Levy San PedroNo ratings yet

- Audit RisksDocument4 pagesAudit RisksAliAwaisNo ratings yet

- Manalastas, Jimbo P. Activity Module 6Document4 pagesManalastas, Jimbo P. Activity Module 6Jimbo ManalastasNo ratings yet

- Internal Control and RiskDocument9 pagesInternal Control and RiskdominicNo ratings yet

- Control: Chartered Institute of Internal AuditorsDocument5 pagesControl: Chartered Institute of Internal AuditorsGNo ratings yet

- Assurance Mapping Example SemangatDocument2 pagesAssurance Mapping Example SemangatRiyoHussainMNo ratings yet

- Risk Based Internal Auditing: Chartered Institute of Internal AuditorsDocument3 pagesRisk Based Internal Auditing: Chartered Institute of Internal AuditorsPujito KusworoNo ratings yet

- 2022 WEAR AGIA Webinar Presmat Part 2 Day 1Document36 pages2022 WEAR AGIA Webinar Presmat Part 2 Day 1Britt John BallentesNo ratings yet

- C3A Internal Control Inter AuditDocument9 pagesC3A Internal Control Inter Auditbroabhi143No ratings yet

- FAQ - Assurance EngagementsDocument3 pagesFAQ - Assurance EngagementsmubarakhusseinNo ratings yet

- Chapter 3 Risk Assement & Internal ControlDocument54 pagesChapter 3 Risk Assement & Internal ControlRohit Kumar SantukaNo ratings yet

- Internal Audit Roles IIDocument13 pagesInternal Audit Roles IIAsif KhanNo ratings yet

- 10683-Article Text-30653-1-10-20180330Document24 pages10683-Article Text-30653-1-10-20180330Ahamed AliNo ratings yet

- What Is The Importance of Having Internal Controls in Business Organizations?Document3 pagesWhat Is The Importance of Having Internal Controls in Business Organizations?lena cpaNo ratings yet

- CHAPTER 1 N 2Document16 pagesCHAPTER 1 N 2Maria Erika GarcesNo ratings yet

- ACCA SBL Chapter 12 Internal ControlDocument15 pagesACCA SBL Chapter 12 Internal ControlSeng Cheong KhorNo ratings yet

- Almendralejo Chap8 DiscussionDocument16 pagesAlmendralejo Chap8 DiscussionRhywen Fronda GilleNo ratings yet

- Chapter 3Document14 pagesChapter 3Donald HollistNo ratings yet

- Name: Divine Grace H. Domingo Year & Section: BSBA 3ADocument1 pageName: Divine Grace H. Domingo Year & Section: BSBA 3ADivine DomingoNo ratings yet

- Presentasi Evaluasi Manajemen Risiko - YLYDocument16 pagesPresentasi Evaluasi Manajemen Risiko - YLYOPERASIONALNo ratings yet

- Spencer Masuku Corporate GovernanceDocument7 pagesSpencer Masuku Corporate GovernanceSPENCER MXOLISINo ratings yet

- GTAG 3 Continuous Auditing Implications For Assurance Monitoring and Risk AssessmentDocument41 pagesGTAG 3 Continuous Auditing Implications For Assurance Monitoring and Risk AssessmentGurcan KarayelNo ratings yet

- 15864348723, Reviewing and Enhancing A Risk Management Framework PDFDocument12 pages15864348723, Reviewing and Enhancing A Risk Management Framework PDFmariasamariaNo ratings yet

- Auditor Independence in Times of Crisis1Document9 pagesAuditor Independence in Times of Crisis1Maria M Ñañez RNo ratings yet

- Accounting 412 Chapter 6 Homework SolutionsDocument5 pagesAccounting 412 Chapter 6 Homework SolutionsxxxjungxzNo ratings yet

- Module 1. Internal AuditingDocument8 pagesModule 1. Internal AuditingIvy Claire SemenianoNo ratings yet

- Sistem Pengendalian InternalDocument18 pagesSistem Pengendalian InternalElizabeth PutriNo ratings yet

- Internal Audit Good Practice Guide For BrokersDocument9 pagesInternal Audit Good Practice Guide For BrokersmomairarfeenNo ratings yet

- Unit 8 - Int. ContDocument36 pagesUnit 8 - Int. ContKeshav SoomarahNo ratings yet

- Ententendiendo Los Controles InternosDocument21 pagesEntentendiendo Los Controles InternosMario SierraNo ratings yet

- Ais Chapter SixDocument6 pagesAis Chapter Sixtarekegn gezahegnNo ratings yet

- TO: Belverd E. Needles, JR., PH.D., CPA, CMA From: Melanie Patton Date: May 9, 2013 SUBJECT: Evaluation of Comptronix CorporationDocument6 pagesTO: Belverd E. Needles, JR., PH.D., CPA, CMA From: Melanie Patton Date: May 9, 2013 SUBJECT: Evaluation of Comptronix CorporationjasminekalraNo ratings yet

- Books 3Document9 pagesBooks 3Nagesh BabuNo ratings yet

- III. Internal Control: According To AICPA Statement On Auditing Standards (SAS)Document11 pagesIII. Internal Control: According To AICPA Statement On Auditing Standards (SAS)ohmyme sungjaeNo ratings yet

- 02 Handout 1Document15 pages02 Handout 1Zednem JhenggNo ratings yet

- Fire Extinguishers - Uae FC 2018Document5 pagesFire Extinguishers - Uae FC 2018Joshua JonesNo ratings yet

- Fire Extinguisher Placement Guide - NFPADocument6 pagesFire Extinguisher Placement Guide - NFPAJoshua JonesNo ratings yet

- UL 1564 SUN Rev 8 25 2020 ED 8 25 2022Document3 pagesUL 1564 SUN Rev 8 25 2020 ED 8 25 2022Joshua JonesNo ratings yet

- Car Part Xi On Aerodrome Emergency Services, Facilities and Equipment - Issue 04Document80 pagesCar Part Xi On Aerodrome Emergency Services, Facilities and Equipment - Issue 04Joshua JonesNo ratings yet

- FDD Spindle Motor Driver: BA6477FSDocument12 pagesFDD Spindle Motor Driver: BA6477FSismyorulmazNo ratings yet

- Business Plan: Muzammil Deshmukh, MMS From Kohinoor College, MumbaiDocument6 pagesBusiness Plan: Muzammil Deshmukh, MMS From Kohinoor College, MumbaiMuzammil DeshmukhNo ratings yet

- SahanaDocument1 pageSahanamurthyarun1993No ratings yet

- Thermodynamic c106Document120 pagesThermodynamic c106Драгослав БјелицаNo ratings yet

- C++ Program To Create A Student Database - My Computer ScienceDocument10 pagesC++ Program To Create A Student Database - My Computer ScienceSareeya ShreNo ratings yet

- For ClosureDocument18 pagesFor Closuremau_cajipeNo ratings yet

- XU-CSG Cabinet Minutes of Meeting - April 4Document5 pagesXU-CSG Cabinet Minutes of Meeting - April 4Harold John LaborteNo ratings yet

- Chapter 1 4Document76 pagesChapter 1 4Sean Suing100% (1)

- 2.1 DRH Literary Translation-An IntroductionDocument21 pages2.1 DRH Literary Translation-An IntroductionHassane DarirNo ratings yet

- Annex To ED Decision 2013-015-RDocument18 pagesAnnex To ED Decision 2013-015-RBurse LeeNo ratings yet

- Uts Cmo Module 5Document31 pagesUts Cmo Module 5Ceelinah EsparazNo ratings yet

- MiddleWare Technology - Lab Manual JWFILESDocument171 pagesMiddleWare Technology - Lab Manual JWFILESSangeetha BajanthriNo ratings yet

- Electromagnetism WorksheetDocument3 pagesElectromagnetism WorksheetGuan Jie KhooNo ratings yet

- HPCL CSR Social Audit ReportDocument56 pagesHPCL CSR Social Audit Reportllr_ka_happaNo ratings yet

- 6 Uec ProgramDocument21 pages6 Uec Programsubramanyam62No ratings yet

- Participatory EvaluationDocument4 pagesParticipatory EvaluationEvaluación Participativa100% (1)

- Epistemology and OntologyDocument6 pagesEpistemology and OntologyPriyankaNo ratings yet

- FKTDocument32 pagesFKTNeeraj SharmaNo ratings yet

- ProspDocument146 pagesProspRajdeep BharatiNo ratings yet

- The Beauty of Laplace's Equation, Mathematical Key To Everything - WIRED PDFDocument9 pagesThe Beauty of Laplace's Equation, Mathematical Key To Everything - WIRED PDFYan XiongNo ratings yet

- BA 4722 Marketing Strategy SyllabusDocument6 pagesBA 4722 Marketing Strategy SyllabusSri GunawanNo ratings yet

- Advanced Java SlidesDocument134 pagesAdvanced Java SlidesDeepa SubramanyamNo ratings yet

- Research Methods in Developmental PsychologyDocument9 pagesResearch Methods in Developmental PsychologyHugoNo ratings yet

- Pontevedra 1 Ok Action PlanDocument5 pagesPontevedra 1 Ok Action PlanGemma Carnecer Mongcal50% (2)

- 2 - Sample Kids Can Read and Write 2 and 3 Letter Words - Step 2 Final Downloadable Version For Website PDFDocument18 pages2 - Sample Kids Can Read and Write 2 and 3 Letter Words - Step 2 Final Downloadable Version For Website PDFsantoshiNo ratings yet

- Medabots-Rokusho Version (European) - Medal Codes (Part 1) (GBA Cheats) - CodeTwink ForumsDocument5 pagesMedabots-Rokusho Version (European) - Medal Codes (Part 1) (GBA Cheats) - CodeTwink Forumsdegraded 4resterNo ratings yet

- Case No. Class Action Complaint Jury Trial DemandedDocument43 pagesCase No. Class Action Complaint Jury Trial DemandedPolygondotcom50% (2)