Professional Documents

Culture Documents

Eufemia and Romel Almeda V.vbathala Marketing

Eufemia and Romel Almeda V.vbathala Marketing

Uploaded by

D. RamOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Eufemia and Romel Almeda V.vbathala Marketing

Eufemia and Romel Almeda V.vbathala Marketing

Uploaded by

D. RamCopyright:

Available Formats

EUFEMIA and ROMEL ALMEDA v.

vBATHALA MARKETING

G.R.No. 150806, January 28, 2008

FACTS

In May 1997, Bathala Marketng, renewed its Contract of Lease with Ponciano Almeda.

Under the contract, Ponciano agreed to lease a porton of Almeda Compound for a monthly

rental of P1,107,348.69 for four years. On January 26, 1998, petitioner informed respondent that

its monthly rental be increased by 73% pursuant to the condition No. 7 of the contract and

Article 1250. Respondent refused the demand and insisted that there was no extraordinary

inflation to warrant such application. Respondent refused to pay the VAT and adjusted rentals as

demanded by the petitioners but continually paid the stipulated amount. RTC ruled in favor of

the respondent and declared that plaintiff is not liable for the payment of VAT and the

adjustment rental, there being no extraordinary inflation or devaluation. CA affirmed the

decision deleting the amounts representing 10% VAT and rental adjustment.

ISSUE

Whether the amount of rentals due the petitioners should be adjusted by reason of

extraordinary inflation or devaluation

RULING

Petitioners are stopped from shifting to respondent the burden of paying the VAT. 6th

Condition states that respondent can only be held liable for new taxes imposed after the

effectivity of the contract of lease, after 1977, VAT cannot be considered a “new tax”. Neither

can petitioners legitimately demand rental adjustment because of extraordinary inflation or

devaluation. Absent an official pronouncement or declaration by competent authorities of its

existence, its effects are not to be applied.

Petition is denied. CA decision is affirmed.

You might also like

- Almeda vs. Bathala MarketingDocument3 pagesAlmeda vs. Bathala MarketingGia DimayugaNo ratings yet

- Almeda vs. Bathala Marketing DigestDocument1 pageAlmeda vs. Bathala Marketing DigestRein DyNo ratings yet

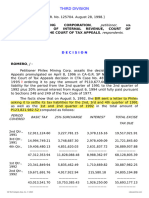

- Petitioners Vs Vs Respondent: Third DivisionDocument7 pagesPetitioners Vs Vs Respondent: Third DivisionErvin HiladoNo ratings yet

- Eufemia Almeda and Romel Almeda Vs Bathala MRKTG Industires IncDocument2 pagesEufemia Almeda and Romel Almeda Vs Bathala MRKTG Industires Incpiptipayb100% (1)

- Republic of The Philippines Supreme Court Manila: Third DivisionDocument10 pagesRepublic of The Philippines Supreme Court Manila: Third DivisionRonn PagcoNo ratings yet

- 03 Almeda Vs Bathala MarketingDocument1 page03 Almeda Vs Bathala MarketingFloyd MagoNo ratings yet

- Almeda Vs Bathala MarketingDocument8 pagesAlmeda Vs Bathala MarketingryuseiNo ratings yet

- Almeda vs. Bathala MarketingDocument5 pagesAlmeda vs. Bathala MarketingVince Llamazares LupangoNo ratings yet

- Philex Mining Corporation, Petitioner, Commissioner of Internal Revenue, Court of Appeals, and The Court of Tax Appeals, RespondentsDocument4 pagesPhilex Mining Corporation, Petitioner, Commissioner of Internal Revenue, Court of Appeals, and The Court of Tax Appeals, RespondentsVan CazNo ratings yet

- 136-Philex Mining Corp. v. CIR, August 28, 1988Document5 pages136-Philex Mining Corp. v. CIR, August 28, 1988Jopan SJNo ratings yet

- 1 BellDocument14 pages1 Belleinel dcNo ratings yet

- Tax Case DigestDocument11 pagesTax Case DigestPrincess Caroline Nichole IbarraNo ratings yet

- Sps. Silos vs. Philippine National Bank: Interest Rate of Escalation ClauseDocument2 pagesSps. Silos vs. Philippine National Bank: Interest Rate of Escalation ClauseJovz BumohyaNo ratings yet

- Philex Mining V CIRDocument7 pagesPhilex Mining V CIRJeunaj LardizabalNo ratings yet

- Asiatrust Vs TubleDocument5 pagesAsiatrust Vs Tubleecinue guirreisaNo ratings yet

- Philex Mining Corporation v. Commissioner of Internal Revenue, G.R. No. 125704, August 28, 1998Document6 pagesPhilex Mining Corporation v. Commissioner of Internal Revenue, G.R. No. 125704, August 28, 1998AkiNiHandiongNo ratings yet

- SPOUSES EDUARDO and LYDIA SILOS, Petitioners, vs. PHILIPPINE NATIONAL BANK, RespondentDocument3 pagesSPOUSES EDUARDO and LYDIA SILOS, Petitioners, vs. PHILIPPINE NATIONAL BANK, RespondentPam Ramos100% (3)

- Almeda vs. Bathala Marketing IndustriesDocument6 pagesAlmeda vs. Bathala Marketing IndustriesMarife Tubilag ManejaNo ratings yet

- 2 - Almeda Vs Bathala MarketingDocument6 pages2 - Almeda Vs Bathala Marketingdaniel angelNo ratings yet

- Cases For TaxDocument546 pagesCases For TaxChrysta FragataNo ratings yet

- Philex Mining Vs CIRDocument1 pagePhilex Mining Vs CIRSui GenerisNo ratings yet

- Philex Mining Vs CIRDocument6 pagesPhilex Mining Vs CIRArjay PuyotNo ratings yet

- Almeda Vs CaDocument5 pagesAlmeda Vs CaCamille GrandeNo ratings yet

- Credittrans Cases - 13-22Document37 pagesCredittrans Cases - 13-22Alessandra Mae SalvacionNo ratings yet

- Philex Mining Corporation vs. CIR, G.R. No. 125704 August 28, 1998Document2 pagesPhilex Mining Corporation vs. CIR, G.R. No. 125704 August 28, 1998piptipaybNo ratings yet

- 90 MIAA Vs AviaaDocument2 pages90 MIAA Vs AviaaCharles AtienzaNo ratings yet

- Jespajo Realty Corp. v. Court of AppealsDocument10 pagesJespajo Realty Corp. v. Court of AppealsLorebeth EspañaNo ratings yet

- Almeda v. Bathala Marketing IndustriesDocument3 pagesAlmeda v. Bathala Marketing IndustriesMac Burdeos CamposueloNo ratings yet

- Asia Trust V TubleDocument10 pagesAsia Trust V TubleSteph RubiNo ratings yet

- Miaa Vs AviaDocument5 pagesMiaa Vs AviaCherlene TanNo ratings yet

- Digested Case of The 5 Cases - 101309Document6 pagesDigested Case of The 5 Cases - 101309Melanie Graile TumaydanNo ratings yet

- 11 Sps Silos Vs PNBDocument7 pages11 Sps Silos Vs PNBNaomi InotNo ratings yet

- DOMESTIC PETROLEUM RETAILER CORPORATION v. MANILA INTERNATIONAL AIRPORT AUTHORITYDocument6 pagesDOMESTIC PETROLEUM RETAILER CORPORATION v. MANILA INTERNATIONAL AIRPORT AUTHORITYRizza Angela Mangalleno100% (3)

- Manila International Airport Authority vs. Avia Filipinas International, IncDocument2 pagesManila International Airport Authority vs. Avia Filipinas International, IncRachel Anne Baroja100% (1)

- Francel Realty Vs SycipDocument2 pagesFrancel Realty Vs SycipattyalanNo ratings yet

- Who Is An EmployeeDocument14 pagesWho Is An EmployeeJevi RuiizNo ratings yet

- Extraordinary InflationDocument13 pagesExtraordinary InflationThrees SeeNo ratings yet

- PNCC v. COURT OF APPEALSDocument4 pagesPNCC v. COURT OF APPEALSRose De JesusNo ratings yet

- G.R. No. 180168 February 27, 2012 MANILA INTERNATIONAL AIRPORT AUTHORITY, Petitioner, vs. AVIA FILIPINAS INTERNATIONAL, INC., Respondent.Document5 pagesG.R. No. 180168 February 27, 2012 MANILA INTERNATIONAL AIRPORT AUTHORITY, Petitioner, vs. AVIA FILIPINAS INTERNATIONAL, INC., Respondent.ANNAJANELLA LOZARESNo ratings yet

- G.R. No. 210641, March 27, 2019 Domestic Petroleum Retailer Corporation, v. Manila International Airport AuthorityDocument2 pagesG.R. No. 210641, March 27, 2019 Domestic Petroleum Retailer Corporation, v. Manila International Airport AuthorityCj GegareNo ratings yet

- Sony v. CIRDocument2 pagesSony v. CIRMaya Julieta Catacutan-EstabilloNo ratings yet

- G.R. No. 173425 September 4 2012Document21 pagesG.R. No. 173425 September 4 2012Romeo Boy-ag Jr.No ratings yet

- PNCC VS CaDocument1 pagePNCC VS Casamdelacruz1030No ratings yet

- ALMEDA Vs BATHALADocument1 pageALMEDA Vs BATHALARhenz ToldingNo ratings yet

- G.R. No. 160033Document3 pagesG.R. No. 160033Noel Christopher G. Belleza100% (1)

- 124676-1998-Philex Mining Corp. v. Commissioner Of20231218-12-Ln2n7gDocument8 pages124676-1998-Philex Mining Corp. v. Commissioner Of20231218-12-Ln2n7gJemuel LadabanNo ratings yet

- Philex Mining Corporation V. Cir, G.R. No. 125704, August 28, 1998 FactsDocument8 pagesPhilex Mining Corporation V. Cir, G.R. No. 125704, August 28, 1998 FactsBleizel TeodosioNo ratings yet

- Spouses Mahusay Vs San DiegoDocument3 pagesSpouses Mahusay Vs San DiegoErwin DacanayNo ratings yet

- Dokumen - Tips - Sps Silos V PNBDocument2 pagesDokumen - Tips - Sps Silos V PNBJonathan Carlo DancelNo ratings yet

- Silos vs. PNBDocument3 pagesSilos vs. PNBRad Isnani100% (1)

- Art 1182Document20 pagesArt 1182kaiNo ratings yet

- Tanguilig vs. CA, Et. Al. GR No. 117190Document1 pageTanguilig vs. CA, Et. Al. GR No. 117190Evander ArcenalNo ratings yet

- Estores V Spouses Supangan, G. R. No. 175139, April18, 2012Document4 pagesEstores V Spouses Supangan, G. R. No. 175139, April18, 2012CresteynTeyngNo ratings yet

- Mary Florence D. Yap - Tax DigestsDocument16 pagesMary Florence D. Yap - Tax Digestsowl2019No ratings yet

- Credit Transaction CasesDocument5 pagesCredit Transaction CasesKatharosJane0% (1)

- Tax Review CasesDocument20 pagesTax Review CasesNeri DelfinNo ratings yet

- Tax DigestsDocument9 pagesTax DigestsShigella MarieNo ratings yet

- Understanding Named, Automatic and Additional Insureds in the CGL PolicyFrom EverandUnderstanding Named, Automatic and Additional Insureds in the CGL PolicyNo ratings yet

- 8 - Re Letter of Tony Q. Valenciano, Holding of Religious Rituals at The Hall of JusticeDocument2 pages8 - Re Letter of Tony Q. Valenciano, Holding of Religious Rituals at The Hall of JusticeD. RamNo ratings yet

- Nuino Vs Delima Case DigestDocument1 pageNuino Vs Delima Case DigestD. RamNo ratings yet

- 16 - Pesigan Vs AngelesDocument2 pages16 - Pesigan Vs AngelesD. RamNo ratings yet

- 7 - Chavez V Gonzales GR 168338Document1 page7 - Chavez V Gonzales GR 168338D. RamNo ratings yet

- TSPI Corporation vs. TSPI Employees UnionDocument2 pagesTSPI Corporation vs. TSPI Employees UnionD. RamNo ratings yet

- 11 - Caunca vs. SalazarDocument1 page11 - Caunca vs. SalazarD. RamNo ratings yet

- PSBA vs. CADocument2 pagesPSBA vs. CAD. RamNo ratings yet

- 9 Garces Vs EstenzoDocument2 pages9 Garces Vs EstenzoD. RamNo ratings yet

- 6 Ramirez vs. CA G.R. No. 93833 September 28, 1995Document2 pages6 Ramirez vs. CA G.R. No. 93833 September 28, 1995D. RamNo ratings yet

- 10 - Pastor Dionisio Austria Vs NLRCDocument1 page10 - Pastor Dionisio Austria Vs NLRCD. RamNo ratings yet

- Bricktown Development vs. Amor Tierra DevelopmentDocument2 pagesBricktown Development vs. Amor Tierra DevelopmentD. RamNo ratings yet

- Sps. Guanio vs. Makati Shangri-La HotelDocument3 pagesSps. Guanio vs. Makati Shangri-La HotelD. RamNo ratings yet

- Leung Ben vs. O'BrienDocument2 pagesLeung Ben vs. O'BrienD. RamNo ratings yet

- Nikko Hotel Manila Garden vs. Roberto ReyesDocument2 pagesNikko Hotel Manila Garden vs. Roberto ReyesD. RamNo ratings yet