Professional Documents

Culture Documents

Concept of Pilllar 2A and Pillar 2B

Uploaded by

tamojit.cisoplatform0 ratings0% found this document useful (0 votes)

4 views2 pagesCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views2 pagesConcept of Pilllar 2A and Pillar 2B

Uploaded by

tamojit.cisoplatformCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

Concept of Pillar 2A and Pillar 2B

Required under requirements set out by CRD IV, which Prudential Regulation Authority (PRA) uses to

inform the setting of Pillar 2 capital.

Reason for creation – A firm’s capital requirements are defined in accordance with capital

requirements set under Pillar 1. However, PRA believes that, for certain asset classes Standardised

Approach (SA) of assigning risk weights (RW) underestimates the risk (e.g.- 0 risk weight to

sovereigns). Therefore, this is definitely applicable for firms using SA for Pillar 1 capital requirements.

For firms employing Internal Ratings Based (IRB) approach, this applies to exposures/ portfolios

where the firm applies SA in calculating the risk weight.

Two sections:

1. Pillar 2A- Created purposely to cover risk not covered by Pillar 1.

a. Credit concentration risk

b. Counterparty credit risk

c. Interest rate risk on Banking book

d. Pension obligation risk

e. Credit risk

f. Market risk

g. Operational risk.

For definitions, please refer the-pras-methodologies-for-setting-pillar-2a-capital-jan-2022. pdf

2. Pillar 2B – created to tackle weak governance towards risk management

Method of calculation of Pillar 2A in Standard Chartered for any year Yi:

a. IRBBB – (IRBBB for Y0/Total assets Y0)* Total assets Yi

b. CCR - (CCR for Y0/ Market RWA Y0)* Market RWA Yi

c. Market Risk - (Market Risk Y0/ Market RWA Y0)* Market RWA Yi

Method of calculation of Pillar 2B in Standard Chartered for any year Yi:

1. PRA buffer – 1.4% of (Cr RWA + Market RWA + Op RWA)

2. G-SII buffer – 1% of (Cr RWA + Market RWA + Op RWA)

3. Capital Conservation buffer – 2.5% of (Cr RWA + Market RWA + Op RWA)

4. Countercyclic buffer – 0.41 % of (Cr RWA + Market RWA + Op RWA)

You might also like

- Capital Adequacy and Market Discipline-New Capital Adequacy Framework (Ncaf) Basel IiDocument13 pagesCapital Adequacy and Market Discipline-New Capital Adequacy Framework (Ncaf) Basel IiBarun Kumar SinghNo ratings yet

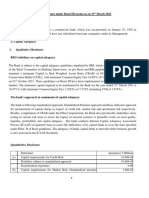

- Basel Disclosure DEC312018Document14 pagesBasel Disclosure DEC312018Archana HarishankarNo ratings yet

- Capital Adequacy and Market Discipline-New Capital Adequacy Framework (Ncaf) Basel IiDocument13 pagesCapital Adequacy and Market Discipline-New Capital Adequacy Framework (Ncaf) Basel IiaNILNo ratings yet

- Disclosure Under Basel III For 31st March 2021Document54 pagesDisclosure Under Basel III For 31st March 2021Nithin YadavNo ratings yet

- Basel IiDocument26 pagesBasel IipallavivyasNo ratings yet

- Risk Management: Presentation OnDocument41 pagesRisk Management: Presentation OnRohit AggarwalNo ratings yet

- CAR18 chpt1Document24 pagesCAR18 chpt1Charles HouedjissiNo ratings yet

- CitiGroup Collateral Risk Based Capital StandardsDocument38 pagesCitiGroup Collateral Risk Based Capital StandardsPropertywizzNo ratings yet

- Mahatma Education Society's Pillai College of Arts, Commerce and Science (Autonomous) New Panvel ISO 9001:2015 CertifiedDocument10 pagesMahatma Education Society's Pillai College of Arts, Commerce and Science (Autonomous) New Panvel ISO 9001:2015 CertifiedAbizer KachwalaNo ratings yet

- Glossary: Capital Earnings Funds and Investment Asset Securitisation Nds-Om Web HomeDocument16 pagesGlossary: Capital Earnings Funds and Investment Asset Securitisation Nds-Om Web HomeSanjeet MohantyNo ratings yet

- 3 RBCDocument43 pages3 RBCMonir HossenNo ratings yet

- The Summary of Risk Weights in Standardized Approach: Credit Risk Basel II Capital AdequacyDocument9 pagesThe Summary of Risk Weights in Standardized Approach: Credit Risk Basel II Capital AdequacyJuma KinenekejoNo ratings yet

- Basel III: Bank Regulation and StandardsDocument13 pagesBasel III: Bank Regulation and Standardskirtan patelNo ratings yet

- Refining The PRA's Pillar 2A Capital Framework: Consultation Paper - CP3/17Document26 pagesRefining The PRA's Pillar 2A Capital Framework: Consultation Paper - CP3/17Poon Long-SanNo ratings yet

- Risk Management and Basel II: Indian Institute of Banking and FinanceDocument31 pagesRisk Management and Basel II: Indian Institute of Banking and FinanceKaran AsraniNo ratings yet

- Capital Management and Profit PlanningDocument15 pagesCapital Management and Profit PlanningRahul SinghNo ratings yet

- 22 June 2012 Review On Risk Based Capital Framework For Insurers in Singapore RBC2 ReviewDocument33 pages22 June 2012 Review On Risk Based Capital Framework For Insurers in Singapore RBC2 ReviewKotchapornJirapadchayaropNo ratings yet

- Work Profile of Officers in Credit Risk Management Cell 1) Senior ManagerDocument4 pagesWork Profile of Officers in Credit Risk Management Cell 1) Senior ManagerMadhavasadasivan PothiyilNo ratings yet

- BFM-CH - 10 - Module BDocument20 pagesBFM-CH - 10 - Module BSantosh Saroj100% (1)

- BASEL - II Risk ManagementDocument32 pagesBASEL - II Risk ManagementLeen BarghoutNo ratings yet

- Standard Chartered p3 2010 Final PublishedDocument52 pagesStandard Chartered p3 2010 Final PublishedlmferlaNo ratings yet

- Capital Earnings Funds and Investment Asset Securitisation HomeDocument7 pagesCapital Earnings Funds and Investment Asset Securitisation HomeKumar PsnNo ratings yet

- Numl University of Moder Languages Islamabad: Department: Management SciencesDocument11 pagesNuml University of Moder Languages Islamabad: Department: Management SciencesAre EbaNo ratings yet

- Class Notes Financial Risk M: F PGDMDocument11 pagesClass Notes Financial Risk M: F PGDMprat05No ratings yet

- Basel II Norms: Sunday, March 02, 2014Document23 pagesBasel II Norms: Sunday, March 02, 2014Amit Kumar JhaNo ratings yet

- U 3: C A N: NIT Apital Dequacy OrmsDocument12 pagesU 3: C A N: NIT Apital Dequacy OrmsJaldeep MangawaNo ratings yet

- (Bank Policy) BASELDocument30 pages(Bank Policy) BASELprachiz1No ratings yet

- 1.RISK CompediumDocument95 pages1.RISK CompediumyogeshthakkerNo ratings yet

- Chapter 1 - Overview PDFDocument15 pagesChapter 1 - Overview PDFgopi_bobNo ratings yet

- Solvency IIDocument28 pagesSolvency IIamingwaniNo ratings yet

- Presentation On Basel IIDocument11 pagesPresentation On Basel IIAriful Haque SajibNo ratings yet

- D3S3Document17 pagesD3S3Dinesh BabuNo ratings yet

- Capital Capital FundsDocument10 pagesCapital Capital Fundsbhau_20No ratings yet

- BankingDocument43 pagesBankingAndrea La SerraNo ratings yet

- Caiib - Basel Iii Capital ReglulationsDocument25 pagesCaiib - Basel Iii Capital Reglulationsrosesunder1No ratings yet

- Banque Saudi Fransi: Pillar 3-Qualitative Disclosures 31 DECEMBER 2009Document11 pagesBanque Saudi Fransi: Pillar 3-Qualitative Disclosures 31 DECEMBER 2009Habib AntouryNo ratings yet

- Economics Glossary PDFDocument9 pagesEconomics Glossary PDFSK PNo ratings yet

- Capital Capital FundsDocument11 pagesCapital Capital FundsSantosh Kumar BarikNo ratings yet

- Cred Risk 1 GGGDocument33 pagesCred Risk 1 GGGAbhijeet PatilNo ratings yet

- What Is Basel IIDocument7 pagesWhat Is Basel IIyosefmekdiNo ratings yet

- A Presentation On: A Presentation On Basel Committee Norms As Regards To Financial Sector Reforms in IndiaDocument23 pagesA Presentation On: A Presentation On Basel Committee Norms As Regards To Financial Sector Reforms in Indiavidha_s23No ratings yet

- RBC20Document9 pagesRBC20Agdum BagdumNo ratings yet

- BASEL I, II, III-uDocument43 pagesBASEL I, II, III-uMomil FatimaNo ratings yet

- Risk Management: Presentation OnDocument41 pagesRisk Management: Presentation Onvandana005No ratings yet

- Risk Weights SimplifiedDocument18 pagesRisk Weights Simplifiedmail2ncNo ratings yet

- 2016 Pillar III DisclosureDocument13 pages2016 Pillar III Disclosureahsan habibNo ratings yet

- Basel II PillarDocument123 pagesBasel II Pillarperera_kushan7365No ratings yet

- Capital Capital FundsDocument12 pagesCapital Capital FundsDrKhalid A ChishtyNo ratings yet

- 2021 HSBC Bank Canada Regulatory Capital & Risk ManagementDocument9 pages2021 HSBC Bank Canada Regulatory Capital & Risk ManagementkwangzhenxingNo ratings yet

- Glossary PDFDocument8 pagesGlossary PDFkumarsanjeev.net9511No ratings yet

- B III I B S: Asel AND ITS Impact ON THE Ndian Anking EctorDocument24 pagesB III I B S: Asel AND ITS Impact ON THE Ndian Anking EctorMahesh Prasad PandeyNo ratings yet

- BaselDocument37 pagesBaselRohit BeheraNo ratings yet

- Basel 3Document3 pagesBasel 3NITIN PATHAKNo ratings yet

- Session 12-13 - Basel II - Credit RiskDocument18 pagesSession 12-13 - Basel II - Credit RiskArun KumarNo ratings yet

- Basel Norms Ii & Risk Management: Rasleen Kaur Sakshi Goenka Abhishek PassiDocument19 pagesBasel Norms Ii & Risk Management: Rasleen Kaur Sakshi Goenka Abhishek PassiTamanna KhemaniNo ratings yet

- Basel2 June2005 GoldmanSachsDocument100 pagesBasel2 June2005 GoldmanSachssilverletNo ratings yet

- Prudential Norms On Capital Adequacy - Basel I Framework PDFDocument106 pagesPrudential Norms On Capital Adequacy - Basel I Framework PDFKamalakar GudaNo ratings yet

- The Basel Ii "Use Test" - a Retail Credit Approach: Developing and Implementing Effective Retail Credit Risk Strategies Using Basel IiFrom EverandThe Basel Ii "Use Test" - a Retail Credit Approach: Developing and Implementing Effective Retail Credit Risk Strategies Using Basel IiNo ratings yet

- Economic Capital Allocation with Basel II: Cost, Benefit and Implementation ProceduresFrom EverandEconomic Capital Allocation with Basel II: Cost, Benefit and Implementation ProceduresNo ratings yet