Professional Documents

Culture Documents

Bank Recon & Proof-Set B

Uploaded by

Jaypee BignoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bank Recon & Proof-Set B

Uploaded by

Jaypee BignoCopyright:

Available Formats

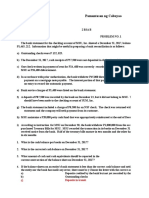

HOLY TRINITY COLLEGE OF GENERAL SANTOS CITY

COLLEGE OF BUSINESS MANAGEMENT & ACCOUNTANCY

APPLIED AUDITING QUIZ 2- SET B

General Instruction: Write your name on the

top of the test paper. Use only ballpen in Problem 2

writing your answer.

Consider the following data as of December 31,

I. Problem-Solving. Write your final answer on 2017:

the space provided after each question.

Strictly NO ERASURES. Answers with a) Total book credits in December,

erasures will be invalid. (3-0 point system) P500,000

b) November service charge taken in

December, P1,000

c) December service charge taken up in

Problem 1 January 2018, P1,500

d) November outstanding checks, P10,500

You obtained the following information on the e) December outstanding checks, P5,000

current account of Sinayang Company during

your examination of its financial statements for Solve for the bank debits.

the year ended December 31, 2017.

The bank statement on November 30, 2017

showed a balance of P306,000. Among the bank Problem 3

credits in November was customer’s note for

P100,000 collected for the account of the You were engaged to audit the accounts of

company which the company recognized in Pinabayaan Corporation for the year ended

December among its receipts. Included in the December 31, 2017. In your examination, you

bank debits were cost of checkbooks amounting determined that the Cash account represents

to P1,200 and a P40,000 check which was both cash on hand and cash in bank. You

charged by the bank in error against Sinayang further noted that the company’s internal

Co. account. Also in November you ascertained control over cash is very poor. You started the

that there were deposits in transit amounting to audit on January 15, 2007. Based on your cash

P80,000 and outstanding checks totaling count on this date, cash on hand amounted to

P170,000. The bank statement for the month of P19,200.

December showed total credits of P416,000 and

total charges of P204,000. The company’s books Examination of the cash book and other

for December showed total debits of P735,600, evidence of transactions disclosed

total credits of P407,200 and a balance of the following:

P485,600.

a) January collections per duplicate

Bank debit memos for December were: No. 121 receipts, P75,200.

for service charges, P1,600 and No. 122 on a b) Total duplicate deposit slips, all dated

customer’s returned check marked “Refer to January, P44,000. This amount

Drawer” for P24,000. On December 31, 2017 the includes a deposit

company placed with the bank a customer’s representing collections on December

promissory note with a face value of P120,000 31.

for collection. The company treated this note as c) Cash book balance at December 31,

part of its receipts although the 2017 amounted to P186,000,

bank was able to collect on the note only in representing both cash on hand and

January, 2007. A check for P3,960 was recorded cash in bank.

in the company cash payments books in d) Bank statement for December showed a

December as P39,600. balance of P170,400.

e) Outstanding checks at December 31:

QUESTIONS:

November checks December checks

Based on the application of the necessary audit No.280 P1,800 No.331 P2,400

procedures and appreciation of the above data, 290 6,600 339 1,600

you are to provide the answers to the following: 345 20,000

353 3,600

1. How much is the undeposited collections as of 364 10,000

December 31, 2017?

f) Undeposited collections at December 31,

2. How much is the adjusted cash balance as of 2017 amounted to P20,000.

November 30, 2017? g) An amount of P4,400 representing

proceeds of a clean draft on a customer

3. How much is the adjusted bank receipts for was credited by

December? bank, but is not yet taken up in the

company’s books.

4. How much is the adjusted book h) Bank service charges for December,

disbursements for December? P400.

5. How much is the adjusted cash balance as of The company cashier presented to you the

December 31, 2017? following reconciliation statement for December,

2017, which he has prepared:

APPLIED AUDITING QUIZ 2-SET B Page 1 of 2

HOLY TRINITY COLLEGE OF GENERAL SANTOS CITY

COLLEGE OF BUSINESS MANAGEMENT & ACCOUNTANCY

APPLIED AUDITING QUIZ 2- SET B

C. Simultaneous bank

Balance per books, December 31, 2017 P180,600 reconciliations

Add outstanding checks: D. Simultaneous surprise cash

No. 331 P2,400 count

339 1,600 2. When counting cash on hand, the

345 2,000 auditor must exercise control over all

353 3,600 cash and other negotiable assets to

364 1,000 10,600 prevent

Total 191,200 A. Theft

Bank service charge (400) B. Substitution

Undeposited collections (20,400) C. Irregular endorsement

Balance per bank, December 31, 2017 P170,400 D. Deposits-in-transit

QUESTIONS: 3. In testing controls over cash

disbursements, an auditor most likely

Based on the above and the result of your audit, would determine that the person who

answer the following: signs checks also:

A. Reviews the monthly bank

reconciliation.

1. How much is the adjusted cash balance as of

B. Returns the checks to accounts

December 31, 2017?

payable.

C. Is denied access to the

2. How much is the cash shortage as of supporting documents.

December 31, 2017? D. Is responsible for mailing the

checks.

Problem 4 4. Sound internal control dictates that,

immediately upon receiving checks from

Nawalan ng Pag-asa Inc., had the following bank customers by mail, a responsible

reconciliation at June 30, 2018: employee should:

A. Add the checks to the daily

Balance per book, June 30, 2018 P100,000 cash summary.

Add: Note collected by bank 25,000 B. Verify that each check is

Outstanding checks 2,500 supported by a prenumbered

Less: Bank service charge 2,000 sales invoice.

Deposit in transit 12,000 C. Prepare a duplicate listing of

Balance per bank, June 30, 2018 P113,500 checks received.

D. Record the checks in the cash

Data per bank , June 30, 2018 follow: receipts journal.

Deposits (including P10,000 note collected by 5. Which of the following sets of

bank)-P115,000 information does an auditor usually

Disbursements (including P3,000 bank service confirm on one form?

charge July)-P88,000 A. Accounts payable and purchase

commitments.

All reconciliation items at June 30,2018, cleared B. Cash in bank and collateral for

the bank and taken up in the books in July. loans.

Outstanding checks at July 31, 2018, C. Inventory on consignment and

amounted to P7,500 and there were P15,100 contingent liabilities.

deposits in transit on the same date. D. Accounts receivable and

accrued interest receivable.

QUESTIONS:

1. Determine the cash balance per book at July

31, 2018?

2. Determine the adjusted cash balance on July “ GOD BLESS AND DON’T FORGET TO

31, 2018? SMILE”

II. Multiple Choice. Encircle the letter of your

answer. (1 point each)

1. A cash shortage may be concealed by

transporting funds from one location to

another or by converting negotiable

assets to cash. Because of this, which of

the following is vital?

A. Simultaneous confirmations

B. Simultaneous verifications

APPLIED AUDITING QUIZ 2-SET B Page 2 of 2

You might also like

- Calculate Cash and Cash EquivalentsDocument54 pagesCalculate Cash and Cash EquivalentsMARJORIE BAMBALAN86% (14)

- AP - Shareholders Equity PDFDocument5 pagesAP - Shareholders Equity PDFJasmin NgNo ratings yet

- Auditing Problems: First PreboardDocument8 pagesAuditing Problems: First PreboardCarlo AgravanteNo ratings yet

- Complete List of Application Identifiers (Aid)Document18 pagesComplete List of Application Identifiers (Aid)JR DeeNo ratings yet

- Understanding key aspects of letters of creditDocument86 pagesUnderstanding key aspects of letters of creditMasud Khan ShakilNo ratings yet

- AP 5902 LiabilitiesDocument11 pagesAP 5902 LiabilitiesAnonymous Cd5GS3GM100% (1)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Cannon Ball Review Part 2 Cash and ReceivablesDocument30 pagesCannon Ball Review Part 2 Cash and ReceivablesLayNo ratings yet

- Audit of Cash - Exercise 1Document4 pagesAudit of Cash - Exercise 1Rolando E. CaserNo ratings yet

- Auditing ProblemsDocument39 pagesAuditing ProblemstinNo ratings yet

- Audit of Cash and Cash EquivalentsDocument9 pagesAudit of Cash and Cash Equivalentspatricia100% (1)

- QUIZ Cash APDocument11 pagesQUIZ Cash APJanelleNo ratings yet

- Audit of Cash and Cash Equivalents 1Document9 pagesAudit of Cash and Cash Equivalents 1nena cabañesNo ratings yet

- CPA Review School Audit ProblemsDocument10 pagesCPA Review School Audit Problemsxxxxxxxxx100% (1)

- Practice SetDocument4 pagesPractice SetXena Natividad100% (1)

- Cash For SeatworkDocument3 pagesCash For SeatworkMika MolinaNo ratings yet

- Hybrid Script 8-8-23Document17 pagesHybrid Script 8-8-23Andrés FlórezNo ratings yet

- Prelim Examination 2018 With Answers PDFDocument6 pagesPrelim Examination 2018 With Answers PDFjudel ArielNo ratings yet

- Audit of liabilities quiz problemsDocument4 pagesAudit of liabilities quiz problemsEarl Donne Cruz100% (4)

- Ap Tip Preweek 2017Document58 pagesAp Tip Preweek 2017Jay-L Tan100% (1)

- Practical Accounting 1 Comprehensive ExamsDocument3 pagesPractical Accounting 1 Comprehensive ExamsCris Tarrazona CasipleNo ratings yet

- ProblemsDocument28 pagesProblemsYou Knock On My DoorNo ratings yet

- Receipt Hotel Borobudur JakartaDocument3 pagesReceipt Hotel Borobudur JakartaRosita Awaludin100% (3)

- 0a1d01080000001709195 ESTATEMENT 012022 0a1d010800000017Document5 pages0a1d01080000001709195 ESTATEMENT 012022 0a1d010800000017Chandan VNo ratings yet

- Total Bills = P 800Coins 10.00 x 50 pieces = P 500 5.00 x 15 pieces = 75 0.25 x 32 pieces = 8Document8 pagesTotal Bills = P 800Coins 10.00 x 50 pieces = P 500 5.00 x 15 pieces = 75 0.25 x 32 pieces = 8Anonymous LC5kFdtcNo ratings yet

- FAR Cash and Cash EquivalentsDocument2 pagesFAR Cash and Cash EquivalentsXander AquinoNo ratings yet

- 2021 Prelim Exam Auditing Concepts and Applications 1Document15 pages2021 Prelim Exam Auditing Concepts and Applications 1moreNo ratings yet

- Auditing Problem........Document7 pagesAuditing Problem........Anonymous 7E97HENo ratings yet

- CPA Review: Cash and Cash Equivalents ProblemsDocument3 pagesCPA Review: Cash and Cash Equivalents ProblemsLui100% (1)

- Bank Recon & Proof-Set ADocument2 pagesBank Recon & Proof-Set AJaypee BignoNo ratings yet

- Applied Auditing Audit of Cash and ReceivablesDocument2 pagesApplied Auditing Audit of Cash and ReceivablesSiulien AbaloNo ratings yet

- Applied Auditing Audit of Cash and ReceivablesDocument2 pagesApplied Auditing Audit of Cash and ReceivablesCar Mae LaNo ratings yet

- CCE Quiz Batasan SetDocument3 pagesCCE Quiz Batasan SetJoovs JoovhoNo ratings yet

- Quizzer 1 Cash and Cash EquivalentsDocument3 pagesQuizzer 1 Cash and Cash EquivalentsMocha FurrerNo ratings yet

- Encode JobDocument12 pagesEncode JobRainNo ratings yet

- Adjust bank reconciliation problems and calculate cash balancesDocument1 pageAdjust bank reconciliation problems and calculate cash balancesFucio, Mark JeroldNo ratings yet

- Prelim-Pr 2a14fb4488c3b5b235Document11 pagesPrelim-Pr 2a14fb4488c3b5b235Romina LopezNo ratings yet

- Cup 6 (Audit) Comprehensive Problem IDocument9 pagesCup 6 (Audit) Comprehensive Problem IHannah AbeloNo ratings yet

- Cash and Cash Equivalents Multiple Choice QuestionsDocument11 pagesCash and Cash Equivalents Multiple Choice Questionsjhela18No ratings yet

- Cash & Cash EquivalentsDocument10 pagesCash & Cash EquivalentsKristine Valerie BonghanoyNo ratings yet

- Problem 1Document4 pagesProblem 1Live LoveNo ratings yet

- Bank Recon QuizDocument1 pageBank Recon QuizJaypee BignoNo ratings yet

- Auditing and Assurance Quiz, Cash and Cash EquivalentsDocument5 pagesAuditing and Assurance Quiz, Cash and Cash EquivalentswesNo ratings yet

- Daily Grind Day 1 With Suggested AnswerDocument2 pagesDaily Grind Day 1 With Suggested AnswerBulandos ChroniclesNo ratings yet

- Accounting Reviewer Part 2Document14 pagesAccounting Reviewer Part 2yhygyugNo ratings yet

- Audit of Cash and Cash Equivalent Problem 1 (Adapted)Document6 pagesAudit of Cash and Cash Equivalent Problem 1 (Adapted)Robelyn Asuna LegaraNo ratings yet

- Assignment - Cash and CEDocument4 pagesAssignment - Cash and CEAleah Jehan AbuatNo ratings yet

- PA QE - CCE HandoutsDocument6 pagesPA QE - CCE HandoutsBenicel Lane M. D. V.No ratings yet

- Iii-Ama: Bornasal Audit of Cash and Cash Equivalents (13 Feb 2021)Document20 pagesIii-Ama: Bornasal Audit of Cash and Cash Equivalents (13 Feb 2021)nena cabañesNo ratings yet

- Exercises For Bank Reconciliation and Proof of CashDocument2 pagesExercises For Bank Reconciliation and Proof of CashAnnie RapanutNo ratings yet

- Auditing 1 AssessmentDocument15 pagesAuditing 1 AssessmentEmilou AustriacoNo ratings yet

- Date Description AmountDocument5 pagesDate Description AmountClaire BarbaNo ratings yet

- Cash and Cash EquivalentDocument5 pagesCash and Cash EquivalentPau SantosNo ratings yet

- Auditing Problems: Final Pre-Board ExaminationDocument2 pagesAuditing Problems: Final Pre-Board ExaminationGerry CarabbacanNo ratings yet

- Ap-5907 CashDocument11 pagesAp-5907 CashSaoxalo ONo ratings yet

- 1 Cash and Cash EquivalentsDocument3 pages1 Cash and Cash EquivalentsJohn Aries Reyes100% (1)

- Handout - Cash and Cash EquivalentsDocument5 pagesHandout - Cash and Cash Equivalentsandrea arapocNo ratings yet

- Quiz 1Document3 pagesQuiz 1Carmi FeceroNo ratings yet

- ASCA301 L1Cash - AdditionalProblemsDocument3 pagesASCA301 L1Cash - AdditionalProblemsJr Reyes PedidaNo ratings yet

- Audit of Cash PDFDocument11 pagesAudit of Cash PDFShaira UntalanNo ratings yet

- Ap9208 Cash 1Document4 pagesAp9208 Cash 1Onids AbayaNo ratings yet

- Mid-Term Exam Review for Intermediate Accounting IDocument9 pagesMid-Term Exam Review for Intermediate Accounting Ijestoni alvezNo ratings yet

- Problem 7 - 16Document2 pagesProblem 7 - 16Jao FloresNo ratings yet

- Assignment On Chapter 5 Cash Ad ReceivablesDocument3 pagesAssignment On Chapter 5 Cash Ad Receivablesdameregasa08No ratings yet

- Auditing Application Special ExamDocument3 pagesAuditing Application Special Examnicole bancoroNo ratings yet

- AUDITING Pre-Board 1 Instructions: Select The Correct Answer For Each of The Following Questions. Mark OnlyDocument12 pagesAUDITING Pre-Board 1 Instructions: Select The Correct Answer For Each of The Following Questions. Mark OnlyKathrine Gayle BautistaNo ratings yet

- 04 Quiz On Topic 03 Auditing Problems With Answer KeyDocument6 pages04 Quiz On Topic 03 Auditing Problems With Answer KeyNye NyeNo ratings yet

- AP - Cash, Bank Recon, M2018Document14 pagesAP - Cash, Bank Recon, M2018Leah Hope CedroNo ratings yet

- Cash and Cash Equivalent LatestDocument54 pagesCash and Cash Equivalent LatestNil Justeen GarciaNo ratings yet

- QUIZ 2Document2 pagesQUIZ 2Jaypee BignoNo ratings yet

- QUIZ 4Document1 pageQUIZ 4Jaypee BignoNo ratings yet

- Bank Recon QuizDocument1 pageBank Recon QuizJaypee BignoNo ratings yet

- NIMHANS Remitance SlipDocument2 pagesNIMHANS Remitance SlipNandu RaviNo ratings yet

- Boosting Rural Development in RajasthanDocument36 pagesBoosting Rural Development in RajasthanSoubhik MondalNo ratings yet

- Bank Credit Growth and Credit Quality ReportDocument34 pagesBank Credit Growth and Credit Quality ReportNgọc Hoàng Thị BảoNo ratings yet

- A Study On Financial Analysis and Performance of Kotak Mahindra BankDocument12 pagesA Study On Financial Analysis and Performance of Kotak Mahindra BankAkash DevNo ratings yet

- Smart Task-1 (VCE)Document3 pagesSmart Task-1 (VCE)Pampana Bala Sai Saroj RamNo ratings yet

- Daily Monitoring TGL 04 Mei 2020Document6 pagesDaily Monitoring TGL 04 Mei 2020nada cintakuNo ratings yet

- GlossaryDocument25 pagesGlossaryBergNo ratings yet

- Problems?: Cambridge IGCSE Business Studies 4th Edition © Hodder & Stoughton LTD 2013Document3 pagesProblems?: Cambridge IGCSE Business Studies 4th Edition © Hodder & Stoughton LTD 2013Aaleen AamirNo ratings yet

- Three Year Estimated Loss History for Years 2010-2012Document7 pagesThree Year Estimated Loss History for Years 2010-2012Mitesh SarodeNo ratings yet

- Project Report On ICICI BankDocument106 pagesProject Report On ICICI BankRohan MishraNo ratings yet

- Tutorial 2Document5 pagesTutorial 2K60 Trần Công KhảiNo ratings yet

- Lao Law On Payment System 2017 PDFDocument18 pagesLao Law On Payment System 2017 PDFfandieconomistNo ratings yet

- What Is An ATM: Automated Teller MachineDocument6 pagesWhat Is An ATM: Automated Teller MachineTilahun GirmaNo ratings yet

- FSD7Document2 pagesFSD7Leo the BulldogNo ratings yet

- ESG Gaining Ground in Banking - The StarDocument7 pagesESG Gaining Ground in Banking - The StarFarhan Ibn AtiqNo ratings yet

- Large Project Financiers: Who Funds Infrastructure ProjectsDocument33 pagesLarge Project Financiers: Who Funds Infrastructure Projectsk bhargavNo ratings yet

- Practice of Banking Lecture Notes 1Document26 pagesPractice of Banking Lecture Notes 1Ganiyu TaslimNo ratings yet

- List of Mushroom Cultures (2021)Document3 pagesList of Mushroom Cultures (2021)Ramakanta Padhan HinduNo ratings yet

- Investment Analysis & Portfolio ManagementDocument22 pagesInvestment Analysis & Portfolio ManagementJyoti YadavNo ratings yet

- Course Material 4 - Accounting For Disbursement and Related TransactionsDocument32 pagesCourse Material 4 - Accounting For Disbursement and Related TransactionsJayvee BernalNo ratings yet

- Daksh Booklet - 02 PDF by Ankush LambaDocument35 pagesDaksh Booklet - 02 PDF by Ankush LambaRam BharoseNo ratings yet

- Unit 5,6 and 7Document24 pagesUnit 5,6 and 7Akshita KambojNo ratings yet

- Chapter SixDocument23 pagesChapter SixHaile GirmaNo ratings yet

- Cash and Cash EquivsDocument7 pagesCash and Cash EquivsVic BalmadridNo ratings yet

- Forensic Audit Presentation Including Case Studies 21122022Document63 pagesForensic Audit Presentation Including Case Studies 21122022mithilesh tabhaneNo ratings yet