Professional Documents

Culture Documents

Financial-Assets-at-Fair-Value-Notes

Uploaded by

James R JunioCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial-Assets-at-Fair-Value-Notes

Uploaded by

James R JunioCopyright:

Available Formats

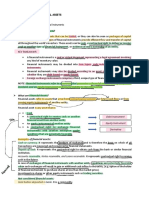

Financial Assets at Fair Value

Felix L. Domingo, CPA, CMA

Investments, definition:

➢ Assets held by an entity for the accretion of wealth through distribution of such interest, royalties,

dividends and rentals, for capital appreciation or for other benefits to the investing entity such as

those obtained through trading relationship.

➢ Statement classification:

• Current investments are by their very nature readily realizable and are intended to hold for

not more than one year.

▪ Examples, trading securities

• Non-current or long-term investments are other than current investments

▪ Intended to be held for more than one year, or

▪ Not expected to be realized within 12 months after the end of reporting period.

Financial instruments

➢ Any contract that gives rise to a financial asset of one entity and financial liability or equity

instruments of another entity.

• Financial asset, is any assets that is:

a) Cash

b) Contractual right to receive cash or another financial asset

c) Contractual right to exchange financial instruments under conditions that are potentially

favourable

d) Equity instruments

• Financial liability, is any liability that is a contractual obligation:

a) To deliver cash or other financial asset to another entity.

b) To exchange financial instruments under conditions that are potentially unfavourable

• Equity securities, is any contract that evidence a residual interest in the assets of an entity

after deducting all its liabilities

Classification of Financial Assets

1. Financial asset at Fair Value

2. Financial asset at Amortized Cost

❖ Financial asset at Fair Value includes both Equity and Debt Securities while financial assets

at Amortized cost include only Debt Securities.

❖ Under PAS 39, the usual categories, such as loans and receivables, available for sale and

held to maturity are now eliminated.

➢ Equity security, any instruments representing ownership shares and right, warrants

or option to acquire or dispose of ownership shares at a fixed or determinable price.

• Includes, ordinary shares, preference shares and other share capital.

• Not include redeemable preference share, treasury shares and convertible debt.

➢ Debt Security, represents a creditor relationship with an entity,

• This security has a maturity date and a maturity value.

Financial asset at Fair Value

The following financial assets shall be measured at “Fair Value through Profit and Loss”:

1. Financial assets held for trading or Trading Securities, these financial assets are measured at

fair value through profit and loss by requirement, meaning, required by the standard.

• A financial asset is held for trading, if:

a) Acquired principally for the purpose of selling or repurchasing it in the near term.

Page 1 of 3

Financial Assets at Fair Value

Felix L. Domingo, CPA, CMA

b) Initial recognition, it is part of a portfolio of identifiable financial assets that are managed

together and for which there is evidence of a recent actual pattern of short-term profit

taking.

c) It is a derivative, except for a derivative that is financial guarantee contract or a

designated and an effective hedging instrument.

2. Financial assets that are irrevocably designated on initial recognition as at fair value through

profit and loss.

3. All other investments in quoted equity instruments.

Initial measurement of financial assets

➢ An entity shall measure a financial asset at fair value (transaction price) plus, in the case of

financial assets not at fair value though profit and loss, transaction costs that are directly

attributable to the acquisition of the financial asset.

• Transaction costs include:

a) fees and commissions paid to agents, advisors, brokers, and dealers,

b) levies by regulatory agencies and securities exchanges, and

c) transfer taxes and duties

• Transaction costs not include:

a) Debt premiums and discounts,

b) Financing costs, and

c) Internal administrative or holding costs

• If the financial assets are held for trading or if the financial assets are measured at fair

value through profit and loss, transaction costs are expensed outright.

Subsequent measurement, after initial recognition:

➢ An entity shall measure a financial asset either at fair value or amortized cost, depending on the

entity’s business model for managing financial assets:

• To hold investments in order to:

a) realize fair value changes

b) collect contractual cash flows

Measurement at Amortized Cost

➢ The following condition should be met:

• The business model is to hold the financial assets in order to collect contractual cash flows

on specific date,

• The contractual cash flows are solely payments of principal and interest on the principal

amount outstanding.

Measurement at Fair Value

➢ Financial assets that do not meet the conditions for amortized costs are measurement hall be

measured at fair value.

• However, in initial recognition, an entity may irrevocably designate a financial asset as

measured at fair value through profit or loss even if the financial asset satisfies the

measurements at amortized cost.

Unrealized Gains and Losses – Trading Securities

➢ Gains and losses on financial assets measured at fair value shall be presented in profit and loss,

unless, Financial asset is:

• Part of a hedging relationship,

• An investment in equity instruments and the entity has irrevocably elected to present the

unrealized gains and losses on other comprehensive income.

Page 2 of 3

Financial Assets at Fair Value

Felix L. Domingo, CPA, CMA

❖ Unrealized Gain if Fair Value is greater than Carrying Amount

❖ Unrealized Loss if Fair Value is less than Carrying Amount

Gains and losses – Financial Assets at Amortized Cost

➢ Unrealized gains and losses on financial assets at amortized cost are not recognized simply

because such investments are not reported at fair value.

➢ Gains and losses on financial assets measured at amortized cost and are not part of hedging

relationship shall be recognized in profit or loss when the financial assets are derecognized, sold,

impaired ore reclassified, and through amortization process.

Reclassification

➢ An entity shall reclassify financial assets only when it changes its business model for managing

the financial assets.

• The entity shall apply the reclassification prospectively from the reclassification date.

• The entity shall not restate any previously recognized gains or losses and interest.

➢ Reclassification date is the first day after of the reporting period following the change in business

model that results in an entity reclassifying financial asset.

➢ The following would not result to a change in business model:

• Change in intention related to a particular financial asset

• Temporary disappearance of a particular market of a financial asset

• Transfer of financial asset between parts of the entity with different business model

Reclassification from Fair Value to Amortized Cost

➢ The fair value at the reclassification date becomes the new carrying amount of the financial asset

at amortized cost.

• The difference between the new carrying amount of the financial asset at amortized cost and

the face value of the financial asset shall be amortized through profit and loss over the

remaining life of the financial asset using effective interest method.

Reclassification from Amortized Cost to Fair Value

➢ The fair value is determined at reclassification date.

• The difference between the previous carrying amount and fair value is recognized in profit or

loss.

Impairment – Financial Asset at Fair Value

➢ There is no impairment loss on financial asset measured at fair value, whether through profit or

loss, or other comprehensive income

• If the decline in value of financial asset measured at fair value through other comprehensive

income is judge to be non-temporary, the unrealized loss will continue to be reported as

component of other comprehensive income rather than as an impairment loss.

Impairment – Financial Asset at Amortized Cost

➢ An entity shall access at the end of each reporting period whether there is any objective evidence

that a financial asset or group of financial assets measured at amortized cost is impaired.

• If there is objective evidence that an impairment loss on financial assets has been incurred,

the amount of the loss is measured as the difference between the carrying amount and

the present value of estimated future cash flows discounted at the original effective

interest rate.

• The carrying amount of the asset shall be reduced either directly or through the use of an

allowance account.

• The amount of the loss shall be recognized in profit or loss

Page 3 of 3

You might also like

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideNo ratings yet

- Ia1 5a Investments 15 FVDocument55 pagesIa1 5a Investments 15 FVJm SevallaNo ratings yet

- Contract of AgencyDocument2 pagesContract of Agencyjonel sembranaNo ratings yet

- Investments at a GlanceDocument55 pagesInvestments at a GlanceJm SevallaNo ratings yet

- Case DigestsDocument48 pagesCase DigestsHazel Reyes-AlcantaraNo ratings yet

- Intoduction To Financial Assets and Financial Assets at Fair ValueDocument11 pagesIntoduction To Financial Assets and Financial Assets at Fair ValueKin Lee100% (2)

- Saic P 3002Document1 pageSaic P 3002aneeshjokay0% (1)

- 2012-Tcot-008-S.o.w-001 Rev.2Document150 pages2012-Tcot-008-S.o.w-001 Rev.2denyNo ratings yet

- Canara HSBC Life Insurance Premium ReceiptDocument1 pageCanara HSBC Life Insurance Premium Receiptyogesh bafnaNo ratings yet

- ITAC 100 Implementation Guide For SAP (V2012)Document154 pagesITAC 100 Implementation Guide For SAP (V2012)Othmane Ferroukhi100% (3)

- Classification of Financial InstrumentsDocument18 pagesClassification of Financial InstrumentsElena Hernandez100% (2)

- Lesson 1 (Week 1) - Financial Assets at Fair Value and Investment in BondsDocument14 pagesLesson 1 (Week 1) - Financial Assets at Fair Value and Investment in BondsMonica MonicaNo ratings yet

- FAR.111 - INVESTMENT IN EQUITY SECURITIES AND DEBT SECURITIES With AnswerDocument12 pagesFAR.111 - INVESTMENT IN EQUITY SECURITIES AND DEBT SECURITIES With AnswerMae100% (1)

- Audit of Receivables ProblemsDocument20 pagesAudit of Receivables ProblemsMa Yra YmataNo ratings yet

- PAS 39 Financial Instruments Recognition and MeasurementsDocument51 pagesPAS 39 Financial Instruments Recognition and MeasurementsSherry Mae Malabago93% (14)

- Test Bank For Human Resource Management 11th Edition Rue Byars and Ibrahim 0078112796 9780078112799Document36 pagesTest Bank For Human Resource Management 11th Edition Rue Byars and Ibrahim 0078112796 9780078112799TerryRandolphdsec100% (24)

- Actrev2 - InvestmentsDocument19 pagesActrev2 - InvestmentsKenneth Bryan Tegerero Tegio100% (1)

- L6a - MFRS 9 Financial InstrumentsDocument55 pagesL6a - MFRS 9 Financial InstrumentsandyNo ratings yet

- Pas 32Document34 pagesPas 32Iris SarigumbaNo ratings yet

- Department of Labor and Employment Vs Kentex Manufacturing Corporation (Case Digest)Document1 pageDepartment of Labor and Employment Vs Kentex Manufacturing Corporation (Case Digest)Ma. Fabiana GarciaNo ratings yet

- FAR-4207 (Investment in Equity Securities)Document3 pagesFAR-4207 (Investment in Equity Securities)Jhonmel Christian AmoNo ratings yet

- InvestmentDocument39 pagesInvestmentJames R JunioNo ratings yet

- IntAcc1.3LN Investments in Debt Equity InstrumentsDocument4 pagesIntAcc1.3LN Investments in Debt Equity InstrumentsJohn AlbateraNo ratings yet

- Module 4Document20 pagesModule 4Althea mary kate MorenoNo ratings yet

- Accounting For InvestmentsDocument7 pagesAccounting For InvestmentsPaolo Immanuel OlanoNo ratings yet

- Intermediate Acc NotesDocument6 pagesIntermediate Acc NotesLuh CheeseNo ratings yet

- Financial Instrument - (NEW)Document11 pagesFinancial Instrument - (NEW)AS Gaming100% (1)

- Exam NotesDocument9 pagesExam NotesEven JayNo ratings yet

- Government Accounting'Document22 pagesGovernment Accounting'Jayvee FelipeNo ratings yet

- Financial InstrumentsDocument3 pagesFinancial InstrumentsSHIENA TECSONNo ratings yet

- Intermediate Acc NotesDocument24 pagesIntermediate Acc Notesyurineo losisNo ratings yet

- Financial Asset at Fair ValueDocument10 pagesFinancial Asset at Fair ValuePgumballNo ratings yet

- Financial Assets and Investments Reporting GuideDocument219 pagesFinancial Assets and Investments Reporting GuideKRISTINA DENISSE SAN JOSENo ratings yet

- IA Downloaded From GoogleDocument5 pagesIA Downloaded From Googlearnold espiniliNo ratings yet

- AC78 Chapter 3 Investment in Debt Securities Other Non Current Financial AssetsDocument78 pagesAC78 Chapter 3 Investment in Debt Securities Other Non Current Financial AssetsmerryNo ratings yet

- Understanding Financial Reporting for Small EntitiesDocument8 pagesUnderstanding Financial Reporting for Small EntitiesMonique VillaNo ratings yet

- Module1 FAR1 MergedDocument53 pagesModule1 FAR1 MergedKin LeeNo ratings yet

- Financial Asset at Fair ValueDocument32 pagesFinancial Asset at Fair ValueJay-L TanNo ratings yet

- InvestmentDocument29 pagesInvestmentjanjuvene EguiaNo ratings yet

- Module 5-InvestmentsDocument27 pagesModule 5-InvestmentsJane Clarisse SantosNo ratings yet

- Summarized Concept Notes On InvestmentsDocument2 pagesSummarized Concept Notes On InvestmentsAlysa dawn CabrestanteNo ratings yet

- Accounting For InvestmentsDocument6 pagesAccounting For InvestmentsBeldineNo ratings yet

- Accounting For Financial InstrumentsDocument40 pagesAccounting For Financial Instrumentssandun chamikaNo ratings yet

- CFAS PAS 32 Financial Instruments and PFRS 9 Measurement of F Asset Topic 5Document3 pagesCFAS PAS 32 Financial Instruments and PFRS 9 Measurement of F Asset Topic 5Erica mae BodosoNo ratings yet

- Reviewer - IntaccDocument36 pagesReviewer - IntaccPixie CanaveralNo ratings yet

- LECTURE I InvestmentDocument5 pagesLECTURE I Investmentrodell pabloNo ratings yet

- Week 05 - 01 - Module 10 - Financial Assets at Fair ValueDocument11 pagesWeek 05 - 01 - Module 10 - Financial Assets at Fair Value지마리No ratings yet

- Financial InstrumentsDocument21 pagesFinancial InstrumentsTommaso SpositoNo ratings yet

- Finals Course ProjectDocument45 pagesFinals Course ProjectEverlyn MontalabaNo ratings yet

- Financial Accounting and Reporting - InvestmentsDocument10 pagesFinancial Accounting and Reporting - InvestmentsLuisitoNo ratings yet

- Ind AS 32, 109 and 107 Financial Instruments Standards SummaryDocument70 pagesInd AS 32, 109 and 107 Financial Instruments Standards SummaryAshish.kaklotar7No ratings yet

- Financial InstrumentsDocument8 pagesFinancial InstrumentsMezbah Uddin AhmedNo ratings yet

- 161 14 PFRS 9 Financial Instrument Investment in Financial AssetDocument5 pages161 14 PFRS 9 Financial Instrument Investment in Financial AssetRegina Gregoria SalasNo ratings yet

- Chapter 15 - Financial Asset at Fair ValueDocument22 pagesChapter 15 - Financial Asset at Fair ValueTurksNo ratings yet

- Unit IV InvestmentsDocument16 pagesUnit IV InvestmentsJonnacel TañadaNo ratings yet

- IFRS 9 Financial Instruments OverviewDocument33 pagesIFRS 9 Financial Instruments OverviewMirzakarimboy AkhmadjonovNo ratings yet

- Intacc Ass 1Document5 pagesIntacc Ass 1Pixie CanaveralNo ratings yet

- LIABILITIESDocument12 pagesLIABILITIESJOHANNANo ratings yet

- Ifrs 9Document42 pagesIfrs 9tariqNo ratings yet

- Financial Instrument v.03Document49 pagesFinancial Instrument v.03ashaheen2704No ratings yet

- Financial Instruments FINALDocument40 pagesFinancial Instruments FINALShaina DwightNo ratings yet

- Financial-Assets-at-Amortized-Cost-Notes (1)Document1 pageFinancial-Assets-at-Amortized-Cost-Notes (1)James R JunioNo ratings yet

- PFRS 9Document6 pagesPFRS 9Beverly UrbaseNo ratings yet

- Pas 32Document15 pagesPas 32Cheska GalvezNo ratings yet

- 14. Statement of Cash FlowsDocument26 pages14. Statement of Cash Flowslascona.christinerheaNo ratings yet

- SECTION 11Document30 pagesSECTION 11Abata BageyuNo ratings yet

- Intacc 1Document12 pagesIntacc 1Mycka Joy HernandezNo ratings yet

- FA II - Chapter 2 & 3 Part IDocument32 pagesFA II - Chapter 2 & 3 Part ISitra AbduNo ratings yet

- Financial InstrumentsDocument40 pagesFinancial InstrumentsArvind KumarNo ratings yet

- ELECTRO-2-PROBLEM-SOLVING-FRONTDocument1 pageELECTRO-2-PROBLEM-SOLVING-FRONTJames R JunioNo ratings yet

- partnership-problemsDocument46 pagespartnership-problemsJames R JunioNo ratings yet

- Module-1.4.2_Computation-of-Gross-Estate-Students-copyDocument13 pagesModule-1.4.2_Computation-of-Gross-Estate-Students-copyJames R JunioNo ratings yet

- AP 200 3 Change in Accounting Estimates Change in Accounting Policy and Correction of Errors StudentsDocument4 pagesAP 200 3 Change in Accounting Estimates Change in Accounting Policy and Correction of Errors StudentsMonica mangobaNo ratings yet

- Investment in Equity Securities ProblemsDocument19 pagesInvestment in Equity Securities ProblemsJames R JunioNo ratings yet

- Quiz in Taxation Answer KeyDocument1 pageQuiz in Taxation Answer KeyJames R JunioNo ratings yet

- Mid Term Exam Answer KeyDocument6 pagesMid Term Exam Answer KeyJames R JunioNo ratings yet

- Chapter1 5importance JRJDocument45 pagesChapter1 5importance JRJJames R JunioNo ratings yet

- Tax.103 2 Corporate Income Taxation StudentsDocument23 pagesTax.103 2 Corporate Income Taxation StudentsJames R JunioNo ratings yet

- Auto and Home Insurance QuotesDocument9 pagesAuto and Home Insurance QuotesBarja FeedsNo ratings yet

- Business FinanceDocument8 pagesBusiness FinanceChristine Marie ViscaynoNo ratings yet

- Fifo, Lifo, Simple and Weighted AverageDocument12 pagesFifo, Lifo, Simple and Weighted AverageSanjay SolankiNo ratings yet

- The Impact of Sustainability Reporting Quality On The Value Relevance of Corporate Sustainability PerformanceDocument21 pagesThe Impact of Sustainability Reporting Quality On The Value Relevance of Corporate Sustainability PerformanceFarwa KhalidNo ratings yet

- (Routledge Research in International Economic Law) Hao Wu - Trade Facilitation in The Multilateral Trading System - Genesis, Course and Accord-Routledge (2018)Document238 pages(Routledge Research in International Economic Law) Hao Wu - Trade Facilitation in The Multilateral Trading System - Genesis, Course and Accord-Routledge (2018)hasannbrNo ratings yet

- CHAPTER THREE - Operations ManagementDocument1 pageCHAPTER THREE - Operations ManagementPattraniteNo ratings yet

- TriaDocument15 pagesTriasadeqNo ratings yet

- Reaction Paper Fostering Competition in The Philippines The Challenge of Restrictive RegulationsDocument3 pagesReaction Paper Fostering Competition in The Philippines The Challenge of Restrictive RegulationsJoey Albert SabuyaNo ratings yet

- Audit ScheduleDocument3 pagesAudit ScheduleQuality ManNo ratings yet

- Health Care Waste ManagementDocument5 pagesHealth Care Waste ManagementJessa YlaganNo ratings yet

- Vic Roads Transfer FormDocument4 pagesVic Roads Transfer Formjikolji0% (1)

- Auditing Problems - 001Document2 pagesAuditing Problems - 001Geoff MacarateNo ratings yet

- Sap MM QuestionsDocument12 pagesSap MM QuestionsBhaskar NagNo ratings yet

- Growing Ampalaya (Bitter Gourd) in The Philippines 2Document29 pagesGrowing Ampalaya (Bitter Gourd) in The Philippines 2kishore_hemlani86% (7)

- Financial AccountingDocument18 pagesFinancial AccountingVibhav RautelaNo ratings yet

- Crisis Management Final Examination: "PT. Freeport Indonesia Big Gossan Collapsed"Document16 pagesCrisis Management Final Examination: "PT. Freeport Indonesia Big Gossan Collapsed"PavelBondarNo ratings yet

- Hair Oil PresentationDocument12 pagesHair Oil Presentationmohan_ved02550% (2)

- TS Grewal Class 11 Accountancy Solutions Chapter 7Document10 pagesTS Grewal Class 11 Accountancy Solutions Chapter 7Vishek kashyap 10 A1 22No ratings yet

- The Human Resources Management and Payroll CycleDocument8 pagesThe Human Resources Management and Payroll Cyclefinny100% (1)

- Company Profile - MNP Multi Niaga Putra V2-1 - CompressedDocument15 pagesCompany Profile - MNP Multi Niaga Putra V2-1 - CompressedIswahyudiNo ratings yet

- Tata Motors Group Corporate Presentation 2023Document46 pagesTata Motors Group Corporate Presentation 2023Vikram KatariaNo ratings yet

- Willaware vs Jesichris unfair competition caseDocument1 pageWillaware vs Jesichris unfair competition caseLawiswisNo ratings yet