Professional Documents

Culture Documents

Equity Invesetmentz

Uploaded by

romamikhaelalouisseCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Equity Invesetmentz

Uploaded by

romamikhaelalouisseCopyright:

Available Formats

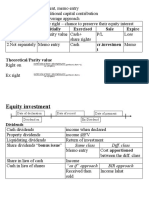

Cash Dividends Shares in lieu of cash dividends [stock rights] Not Accounted for Separately:

- If the equity securities are measured at FVPL - This is Income à at fair value of the shares - Treated as an embedded derivative à so, the

/ FVOCI / cost, dividends earned are received. value is not separated.

considered as income. o If no FV à cash dividends that would - Receipt of right à memo entry

have been received. - If the stock rights are sold à credit the

Dividend on- between date of declaration and the investment sa value sa cash received.

record date. (shares carry with them the right to rcv Cash received in lieu of share dividends

dividends) “as if” approach – dividends are assumed to be

received and subsequently sold at the cash

Ex-dividend – between date of record and date of received. (followed for financial accounting

payment. (original shareholder has the right to rcv purposes) à Gain or Loss

the dividends on payment date)

*TN BIR Approach – the cash received is dividend

When to recognize? DATE OF DECLARATION bcoz income

the right was alrdy acquired.

Share right or stock right

- A legal right granted to shareholders to

Property Dividends / Div in Kind subscribe for new shares issued by a

corporation at a specified price during a

- Recorded at fair value. definite period.

- Inherent in every share (one for ever yshare)

Liquidating Dividends - Goal: to preserve their equity interest in the

- Represent return of invested capital (not an corporation.

income)

- When the corp is dissolved / liquidated but 2 schools of thought:

commonly applied in cases of wasting asset 1. Share rights are accounted for separately

corporations. 2. Share rights are not accounted for separately

- May be designated as partly income and

partly return of capital. [stock rights] Accounted for Separately:

- Measured initially at fair value.

Share Dividends - If fair value is not given, refer to theoretical or

- Issuing entity’s own shares. (if shares of parity value of the share right

another entity, dili na share dividends but o When to use? “no known market

property divends na.) value”

o 2 formulas: [right on] & [ex-right]

2 kinds: same class or diWerent class - Expiration à Loss on share rights.

You might also like

- Trading and non-trading securities accounting under FVPL and FVOCIDocument1 pageTrading and non-trading securities accounting under FVPL and FVOCINicole Allyson AguantaNo ratings yet

- Preference Shares and DividendsDocument3 pagesPreference Shares and DividendsEd ViggayanNo ratings yet

- Actrev2 - InvestmentsDocument19 pagesActrev2 - InvestmentsKenneth Bryan Tegerero Tegio100% (1)

- Chapter 4 Investments in Equity SecuritiesDocument25 pagesChapter 4 Investments in Equity SecuritiesCarylle silveoNo ratings yet

- Investment in Equity SecuritiesDocument3 pagesInvestment in Equity Securitiesmiss independentNo ratings yet

- Shareholders' Equity BreakdownDocument3 pagesShareholders' Equity BreakdownCurtain SoenNo ratings yet

- Earnings Per ShareDocument5 pagesEarnings Per SharePushTheStart GamingNo ratings yet

- CFAS MIDTERM OUTLINE CHAPTER 2-3Document7 pagesCFAS MIDTERM OUTLINE CHAPTER 2-3Mharc PerezNo ratings yet

- Initially Exercised Sale Expire: Market Value of Share Subscription Price No - of Rights Purchase 1 Share+1Document8 pagesInitially Exercised Sale Expire: Market Value of Share Subscription Price No - of Rights Purchase 1 Share+1Bryan NatadNo ratings yet

- PPT-5 Corporate Action-Dividends, Bonus, Splits EtcDocument16 pagesPPT-5 Corporate Action-Dividends, Bonus, Splits EtcAmrita GhartiNo ratings yet

- Earnings Per ShareDocument5 pagesEarnings Per SharePushTheStart GamingNo ratings yet

- Notes Financial Asset ReviewerDocument25 pagesNotes Financial Asset ReviewerStephen Jay RioNo ratings yet

- Financial Instruments ClassDocument2 pagesFinancial Instruments Classchevel dosdosNo ratings yet

- Equity Securities MarketDocument6 pagesEquity Securities MarketAngelica DechosaNo ratings yet

- IA-final NotesDocument5 pagesIA-final NotesRocel B. LigayaNo ratings yet

- FAR17 Dividends - With AnsDocument7 pagesFAR17 Dividends - With AnsAJ CresmundoNo ratings yet

- Accounting For Investment in O/SDocument4 pagesAccounting For Investment in O/SchinchangeNo ratings yet

- InvestmentDocument4 pagesInvestmentTupayb AgosNo ratings yet

- Financial Assets at Fair ValueDocument2 pagesFinancial Assets at Fair ValueNicole Allyson AguantaNo ratings yet

- She 1Document5 pagesShe 1cynthia bansilNo ratings yet

- FAR 2 Discussion Material - Shareholders' Equity PDFDocument4 pagesFAR 2 Discussion Material - Shareholders' Equity PDFAisah ReemNo ratings yet

- Classify and Measure Equity InvestmentsDocument4 pagesClassify and Measure Equity InvestmentsIrah LouiseNo ratings yet

- Investments in Equity Securities: Control May Be Exercised in Some Instances Even If Holding Is Less Than 50%Document4 pagesInvestments in Equity Securities: Control May Be Exercised in Some Instances Even If Holding Is Less Than 50%Irah LouiseNo ratings yet

- Chapt. 11 Investments - Additional ConceptsDocument2 pagesChapt. 11 Investments - Additional ConceptsKearn CercadoNo ratings yet

- Chapter 6 NotesDocument8 pagesChapter 6 NotesCunanan, Malakhai JeuNo ratings yet

- Divided by The Number of Shares OutstandingDocument5 pagesDivided by The Number of Shares OutstandingRia GabsNo ratings yet

- Corporation Lecture NotesDocument3 pagesCorporation Lecture Notespatricia louise montejoNo ratings yet

- Corporate ActionDocument11 pagesCorporate ActionGurkirat SinghNo ratings yet

- Far.118 Sharholders-EquityDocument8 pagesFar.118 Sharholders-EquityMaeNo ratings yet

- 8 Retained Earnings and Quasi-ReorganizationDocument5 pages8 Retained Earnings and Quasi-ReorganizationNasiba M. AbdulcaderNo ratings yet

- Investment in Equity Securities 2Document26 pagesInvestment in Equity Securities 2Mhelka Tiodianco0% (1)

- Retained Earnings Guide: Key Terms and EntriesDocument2 pagesRetained Earnings Guide: Key Terms and Entrieshansel0% (1)

- InvestmentsDocument7 pagesInvestmentsNicole MoralesNo ratings yet

- The Investment EnvironmentDocument2 pagesThe Investment EnvironmentLyka LibreNo ratings yet

- Fa - Investment in Equity Securities - Lecture NotesDocument4 pagesFa - Investment in Equity Securities - Lecture NotesCharlene Jane EspinoNo ratings yet

- Financial Instrument SummaryDocument1 pageFinancial Instrument SummaryAmiel Jay DuraNo ratings yet

- Buscom ReviewerDocument16 pagesBuscom ReviewereysiNo ratings yet

- Equity - The Accounting Equation For Every BusinessDocument5 pagesEquity - The Accounting Equation For Every BusinessSarah Del RosarioNo ratings yet

- MMW Module 9Document3 pagesMMW Module 9Kristine MartinezNo ratings yet

- Chapter 6 ParcorDocument4 pagesChapter 6 ParcorFeona Mae MartinezNo ratings yet

- SHEmbotDocument5 pagesSHEmbotMiles CasidoNo ratings yet

- Philippine Stock Exchange (PSE) :: FinanceDocument3 pagesPhilippine Stock Exchange (PSE) :: FinanceAdrienne Erika MANAIGNo ratings yet

- Financial Asset at Fair Value ModuleDocument5 pagesFinancial Asset at Fair Value ModuleNorfaidah Didato GogoNo ratings yet

- Audit of Stockholder’s Equity, Share Based Payment & Book ValueDocument6 pagesAudit of Stockholder’s Equity, Share Based Payment & Book ValueJessalyn DaneNo ratings yet

- Financial Investment AccountsDocument5 pagesFinancial Investment AccountssmlingwaNo ratings yet

- Stockholders' Equity Part 1Document43 pagesStockholders' Equity Part 1rhaypensoyNo ratings yet

- Intermediate Acc NotesDocument24 pagesIntermediate Acc Notesyurineo losisNo ratings yet

- Understanding Equity Securities Classification and AccountingDocument9 pagesUnderstanding Equity Securities Classification and Accountingwingsenigma 00No ratings yet

- CF Week13 14 STDocument42 pagesCF Week13 14 STPol 馬魄 MattostarNo ratings yet

- Potential Equity Shares - Financial Instruments Entitle Its Holder The Right To Acquire Equity Shares Ex: Convertible Debentures, Convertible Preference Shares, Options, Warrants EtcDocument5 pagesPotential Equity Shares - Financial Instruments Entitle Its Holder The Right To Acquire Equity Shares Ex: Convertible Debentures, Convertible Preference Shares, Options, Warrants EtcD Suresh BabuNo ratings yet

- CHAPTER 22 Theory Financial Assets at Fair ValueDocument3 pagesCHAPTER 22 Theory Financial Assets at Fair ValueRomel BucaloyNo ratings yet

- Module Buscom PDFDocument4 pagesModule Buscom PDFNita Costillas De MattaNo ratings yet

- Mutual Fund Glossary PDFDocument5 pagesMutual Fund Glossary PDFfeb2257No ratings yet

- FABM2 ReviewerDocument7 pagesFABM2 ReviewerMakmak NoblezaNo ratings yet

- Topic 4. Stock MarketDocument7 pagesTopic 4. Stock MarketЕкатерина КидяшеваNo ratings yet

- Valuation of SharesDocument3 pagesValuation of SharesJabez JohnNo ratings yet

- FM ReviewerDocument20 pagesFM ReviewerBSA - Cabangon, MerraquelNo ratings yet

- Chapter 3Document6 pagesChapter 3Prince S'Luu HitiNo ratings yet

- Business Combinations Notes Ch 1-3Document4 pagesBusiness Combinations Notes Ch 1-3Mary Jescho Vidal AmpilNo ratings yet

- K 2 - Investment of Trusts - UpdatedDocument15 pagesK 2 - Investment of Trusts - Updatedstra100% (1)

- Swiss banks influence on Indonesian palm oil and pulp & paperDocument134 pagesSwiss banks influence on Indonesian palm oil and pulp & paperI Made SudanaNo ratings yet

- Portfolio Insurance: Determination of A Dynamic CPPI Multiple As Function of State Variables.Document23 pagesPortfolio Insurance: Determination of A Dynamic CPPI Multiple As Function of State Variables.krityarosNo ratings yet

- Chapter 23 Hedging With Financial DerivativesDocument15 pagesChapter 23 Hedging With Financial DerivativesGiang Dandelion100% (1)

- Introduction to Consumer Credit and Its Advantages & DisadvantagesDocument29 pagesIntroduction to Consumer Credit and Its Advantages & Disadvantagesmana gNo ratings yet

- Careers in Credit and BankingDocument33 pagesCareers in Credit and BankingPrajwal WakhareNo ratings yet

- Full HRM Notes by Ram Chad Ran SirDocument122 pagesFull HRM Notes by Ram Chad Ran SirKrupa PatilNo ratings yet

- Blink Health - Chaiken - ComplaintDocument36 pagesBlink Health - Chaiken - Complainti723087100% (1)

- Social Responsibility of BusinessDocument4 pagesSocial Responsibility of BusinessShubhamNo ratings yet

- Hartigan Nominees and Another V RydgeDocument2 pagesHartigan Nominees and Another V RydgeAngela Au100% (1)

- Chapter 4Document58 pagesChapter 4Anh Võ TừNo ratings yet

- The Viability of Halal Food Industry For Brunei Economic Diversification - Swot Analysis PDFDocument14 pagesThe Viability of Halal Food Industry For Brunei Economic Diversification - Swot Analysis PDFGlobal Research and Development ServicesNo ratings yet

- System Trading Made Easy With John BollingerDocument6 pagesSystem Trading Made Easy With John BollingerkosurugNo ratings yet

- India Business Law DirectoryDocument42 pagesIndia Business Law DirectoryGenesisGenesisNo ratings yet

- Chapter Eleven: Commercial Banks: Industry OverviewDocument26 pagesChapter Eleven: Commercial Banks: Industry OverviewroBinNo ratings yet

- A Project Report On Apollo Tyres Brand Image 1Document62 pagesA Project Report On Apollo Tyres Brand Image 1Cyril ChettiarNo ratings yet

- LendIt PDFDocument4 pagesLendIt PDFLuis GNo ratings yet

- John Ervin Bonilla Bsba Fm2B 1. Admission by Purchase of InterestDocument8 pagesJohn Ervin Bonilla Bsba Fm2B 1. Admission by Purchase of InterestJohn Ervin Bonilla100% (4)

- Technical Analysis of Banking Sector ReportDocument28 pagesTechnical Analysis of Banking Sector ReportShadman TauheedNo ratings yet

- Business FinanceDocument4 pagesBusiness FinanceTrang NgôNo ratings yet

- COA C2022-003 AnnexADocument3 pagesCOA C2022-003 AnnexAJec JekNo ratings yet

- National IncomeDocument5 pagesNational IncomeAziz YasserNo ratings yet

- AFA 100 - Chapter 1 NotesDocument4 pagesAFA 100 - Chapter 1 NotesMichaelNo ratings yet

- Theories of Exchange Rate DeterminationDocument6 pagesTheories of Exchange Rate DeterminationOmisha SinghNo ratings yet

- Acctg3-7 Associates and Joint VentureDocument2 pagesAcctg3-7 Associates and Joint Ventureflammy07No ratings yet

- Wilcon Depot Quarterly Earnings, Revenue, EPS and Forecast SummaryDocument9 pagesWilcon Depot Quarterly Earnings, Revenue, EPS and Forecast SummaryAleli BaluyoNo ratings yet

- Cheat Sheet Exam 1Document1 pageCheat Sheet Exam 1Shashi Gavini Keil100% (2)

- Investment in Equity SecuritiesDocument4 pagesInvestment in Equity Securitiesanna mae orcioNo ratings yet

- Notice: Self-Regulatory Organizations Proposed Rule Changes: SSgA Funds Management, Inc., Et Al.Document7 pagesNotice: Self-Regulatory Organizations Proposed Rule Changes: SSgA Funds Management, Inc., Et Al.Justia.comNo ratings yet

- Woven SacksDocument27 pagesWoven Sacksbig johnNo ratings yet