Professional Documents

Culture Documents

8.CMA Alpesh Soni

8.CMA Alpesh Soni

Uploaded by

Manjunath Shetty0 ratings0% found this document useful (0 votes)

13 views426 pagesCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

13 views426 pages8.CMA Alpesh Soni

8.CMA Alpesh Soni

Uploaded by

Manjunath ShettyCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 426

oo &

' Management

Accounting

CGV

Fully Solved Questions of Previous Exams

Topic-wise arrangement of past examination questions

Hints are given for practical MEQs

Chapter-wise Marks Distribution of Past Exams

Updated as per applicable provisions of the Companies Act 2013

vvvvyv

at

Solved

ate)

CSN.S. Zad Paper

For Dec. 2023 Exam (Old Syllabus)

‘Riso Avaliabla?)Self Learning Study Material

8th Edition

Chapter-wise Marks

Distribution

Introduction to Financial Accounting

[Introduction to Corporate Accounting

[Issue of Shares

[Issue of Right & Bonus Shares

[Redemption of Preference Shares

{Issue & Redemption of Debentures

[Underwriting of Shares é& Debentures

2

3

4

5

6 |Buy Back of Shares

7

8

9

[Accounting for Share Based Payments

10 [Financial Statements Interpretation

11 [Consolidation of Accounts

12 |Corporate Financial Reporting

13 |Cash Flow Statement

14 | Overview of Accounting Standards

15 |National & International Accounting Authorities

16 |Adoption, Convergence & Interpretation of IFRS

/& Accounting Standards int India

17 | Overview of Cost

18 |Cost Accounting Records & Cost Audit under the

|Companies Act, 2013

19 | Budgetary Control

20 | Ratio Analysis

Fund Flow Statement

Fz [Management Reporting 2 fal 1a

Fi [Macsinal Costing & Transfer Pricing 3 | = Tee]

Fa [netivity Based Costing & Transfer Pricing 3 piven

35 [Valuation of Goodwill & Shares 4 a1 tas

26 | Valuation, Principles & Framework 4 at Tal

27 | Methods of Valuation 6 = ann

bees a00 100 | 100

Note : J- June; D - December.

Contents

PAGE

Chapter-wise Marks Distribution 15

Chapter-wise Comparison with Study Material z 17

PARTA

CORPORATE ACCOUNTING

© Chapter 2 : ,

___® INTRODUCTION TO FINANCIAL ACCOUNTING _ = 13

Chapter 2

21

@ ACCOUNTING FOR ISSUE

Chapter 4

|_@ ISSUE OF RIGHT & BONUS SHARES 4l

| Chapter 5

|_| REDEMPTION OF PREFERENCE SHARES : : 7 51

* Chapter 6

4 BUY BACK OF SHARES ae oe

| Chapter?

i REDE DEBENTURES

L9

CONTENTS

1-10

japter

Se TING OF SHARES & DEBENTURES

81

Chapter 9 :

@ ACCOUNTING FOR SHARE BASED PAYMENTS (ESOS & ESOP)

2 - Pe

Chapter 10

@ FINANCIAL STATEMENTS INTERPRETATION ik

Id

Chapter 11

@ CONSOLIDATION OF ACCOUNTS 4

Chapter 12

@ CORPORATE FINANCIAL REPORTING. 21

Chapter 13 ’

@ CASH FLOW ‘STATEMENT 131

- Chapter 14

‘© OVERVIEW OF ACCOUNTING STANDARDS iar

Chapter 15

o NATIONAL & INTERNATIONAL ACCOUNTING 3 AUTHORITIES . 151

” Chapter 16

ms

|

!

ADOPTION, CONVERGENCE & INTERPRETATION OF IFRS & ACCOUNTING

__ STANDARDS IN INDIA 161

PARTB _

MANAGEMENT ACCOUNTING

Chapter 17

# OVERVIEW OF cos zag

Chapter 18

° pe ACCOUNTING RECORDS & COST AUDIT UNDER THE COMPANIES 41

chan 19 194

© BUDGETARY CONTROL, ‘

CONTENTS Vit

PAGE,

Chapter 21

+ FUND FLOW STATEMENT 211

Chapter 22

@ MANAGEMENT REPORTING 221

Chapter 23

@ MARGINAL COSTING 231

Chapter 24

24d

Chapter 25 ,

°e VALUATION OF GOODWILL & SHARES 25.1

Chapter 26

@ VALUATION, PRINCIPLES & FRAMEWORK: ‘i * 26.1

Chapter 27

_@ METHODS OF VALUATION 271

Solved Paper : June 2023 (Suggested Answers) PL

PART A

CORPORATE ACCOUNTING

INTRODUCTION TO FINANCIAL

ACCOUNTING

MCQs.ON' THEORY

1, Accounting policies followed by

organizations -

(A), Can be changed every year.

(B) Should be consistently followed

from year to year

(C) Can be changed after 5 years

(D) None of the above

2. When a change 'in accounting policy

is justified?

(A) To comply with accounting stan-

dard

(B) To ensure more appropriate pre-

sentation of the financial state-

ment of the enterprise

(©) ‘To comply with law

(D) All of the above

3. It is essential to standardize the

accounting principles and policies in

order to ensure -

(A) Transparency

(B) Profitability

(C) Reputation

(D)_All of the above

4. A specific accounting policy refers

to-

(A) Principles

(B) Methods of applying those prin-

ciples

13

(C) Both (A) & (B)

(D) None of the above

5. The determination of the amount of

bad debts is an accounting -

(A) Policy

(B) Estimate

(C) Parameter

(D) None of the above

6. Generally, which of the following

measurement bases are usually

accepted in accounting parlance?

(A) Historical Cost

(B) Current Cost

(C) Realizable Value

(D) Any of the:above

7. Book valie & Market value of

machinery 0n31.3.2015 was %1,00,000

& 7 1,10,000 respectively. As on

31.3.2019, if the company values the

machinery at & 1,10,000, which of the

* following valuation principle is being

followed -

(A) Historical Cost

(B) Present Value

(C) Realisable Value

(D) Current Cost

On the basis of following informa-

tion answer next 4 questions.

PART A : CORPORATE: ACCOUNTING 1

14

urchased a machinery

ee ¥ 10,000 on 1.4.2010.

on 31.3.2019, similar machinery

val be purchased for € 20,000 but

the realizable value of the machinery

(purchased on 1.4.2010) was estimated

at ¥ 15,000. The present discounted

value of the future net cash inflows

that the machinery was expected

to generate in the normal course of

business, was calculated as % 12,000,

8. The current cost of the machinery is -

(A) = 10,000

(B) % 20,000

(C) % 15,000

(D) % 12,000

9. The present value of machinery is -

(A) % 10,000 :

(B) % 20,000

(©) % 15,000

(D) 212,000

10. The historical cost ofmachineryis-

(A) % 10,000

(B) % 20,000

(©) % 15,000

) 212,000

11. The realizable value of machinery

is-

(AY % 10,000

“ (B) % 20,000

(C) % 15,000

(D) 212,000

12, Property, plant and €quipment are

convent 2

Shits: ‘onally presented in the balance

(A) Replace

Ment cost Jess 2

lated depreciation See

(B) Historical Cost less Salvage value

(C) Historical cost less

Portion thereof

(D) Original cost adjusted for

Price-level changes

13. All accounts are classifi

(A) Personal

(B) Real

(©) Nominal accounts

(D) Any of the above

14, Accounts recording transactj

with a person or group of perso,

ms

known as - 7

(A) Personal accounts

(B) Real accounts

(C) Nominal accounts

(D), Impersonal accounts

15. Personal accounts are of the

following types:

(A). Natural; Real, Representative

(B) Artificial, Legal, Nominal

(C) Natural, Artificial, Representative

(D) Any of the above

Seprectation

Behera

led into.

. 16. An account recording transactions

with an individual human being is

termed as a'-

(A) Artificial orlegal persons account

(B) Naturalpersons’personal account —

(C) Representative personalaccounts —

(D) Any of the above

17, Accounts relating to properties Of

assets are known as -

(A) Real Accounts

(B) Personal Accounts

(C) Nominal Accounts

(D) None of above

18. An account recording fine!

transactions with an artificial P

CH. 1 : INTRODUCTION TO FINANCIAL ACCOUNTING

created by law or otherwise are termed

as-

(A) Artificial orlegal persons account

(B) Natural persons’ personal account

(C) Representative personal accounts

(D) Any of the above

19. Real accounts can be further

classified into -

(A) Tangible

(B) Intangible

(C) (A) or (B)

(D) None of above

20. Accounts whichrepresenta certain

person or group of persons are termed

as-

(A) Artificial orlegal persons account

(B) Naturalpersonspersonalatcount _

(©) Representative personal accounts

(D) Any of the above

21. The process of balancing of an

account involves equalization of both

sides of thé account. If the debit side

of an account exceeds the credit side,

the difference is put on the credit side.

The said.balance is -

@_ A debit balance

(i) A credit balance

(iii) An expenditure or an asset

(iv) An income or a liability

Sélect the correct answer from, the *

options given below -

(A) Only (i) above

(C) Both (i) and :

(D) Both (ii) and (iii) above

22. Which of the following types

of accounts represent assets and

15

properties which can be seen, touched,

felt, measured, purchased and sold?

(A) Tangible real accounts

(B) Intangible real accounts

(C) Representative personal accounts

(D) Artificial orlegal persons account

23. Accounts relating to income,

revenue, gain expenses and losses are

termed as:

(A) Real Accounts

(B) Personal Accounts

- (C) Nominal Accounts

(D) None of above

24, + accounts represent assets

and properties which cannot be

seen, touched or felt -but they can be

measured in terms of money.

(A) Tangible real accounts

(B) Intangible real accounts

(C) Representative personalaccounts

(D) -Artificial orlegal personsaccount

25. The rule for nominal accounts is -

(A) Debit thereceiver, Credit the giver

(B) Debit what comes in, Credit what

goes out

(C) Debit all expenses and losses,

Credit all incomes and gains

(D) All of the above

26. Current Assets - Current liabilities

=? .

(A) Working capital

(B) Capital

(C) Debtors

(D) Owners equity

27. On 1.1,2019, CS

rent of = 25,000 for

Academy. This can B

PART A: CORPORAT

16

(a) Anevent

cp) A transact

e A transaction as well as an event

fo) Neitheratransactionnoranevent

28. Mt. Bhandari purchased a car for

250,000, making a down payment of

£ 10,000 and signing a © 40,000 bal

payable due in 60 days. As a result of

this transaction:

(A) Totalassetsincreased by 50,000

() Total liabilities increased by

740,000

(C) Total assets increased by % 40,000

(D) Total assets increased by 40,000

with corresponding increase in

liabilities by ¥ 40,000

29. Accounting policy forinventories of

XLtd.states that inventories are valued

at the lower of cost or net realizable

value. Which accounting principle in

followed in adopting the above policy?

(A) Materiality

(B) Prudence

(C) Substance over form

(D) All of the above

30. On 31.3.2019 after sale of goods

£2,000, Neelam is left with the closing

inventory of @ 10,000. This is -

(A) An event

(B) A transaction

tion.

(C) A transaction as well as an event

(D) Neitheratransactionnoranevent

31. Provisions for doubtful debts’ and

‘provision for disco rs’ ar

unt on,

ty debtors’ are

(A) Prudence

(B) Substance over from

(C) Materiality

(D) All of the above

'E ACCOUNTING

32. Purposes of an accounting syste,

include all the following except -

(A) Interpret and record the effects

of business transaction

Classify the effects of transaction, ie

to facilitate the preparation

reports i

(B)

Summarize and communicate

information to,decision makers

Dictate the specific types of busi-

ness enterprise transactions that

the enterprises may engage in,

33. Accounting cycle or accounting

process includes -

(X) Journalizing (Summarizing)

(¥)’ Posting to ledger (Recording)

(Z) Final account (Classifying)

Find the correct match.

(A) (X)

®) @~)

(C) All (X), (Y) & (Z)

(D) None of the above

(C)

@)

- 34, includes identifying, record-

ing, classifying and summarizing the

transactions.

(A) Accounting posting

(B) Accounting cycle

(©) ‘Tally of accounts

(D) All of the above

35. In which order the accounting

transactions and events are recorded

in the books?

(A) Journal, Subsidiary books, Ledger

and Trial Balance

Ledger, Journal, Ledger and Tia! -

Balance.

Subsidiary books, Ledger a4

‘Trial Balance and Journal.

Profit and loss account, Ledge

Balance Sheet, Journal.

B

(C)

(D)

CH, 1: INTRODUCTION TO FINANCIAL ACCOUNTING 1.7

36. Journal is the book of in 41, Ledger is the of account

which every transaction is recorded where similar transactions relating

before being posted into the ledger.

(A) Primary entry

(B) Secondary entry

(©) Third entry

(D) None of above

37. is a book in which all the

business transactions are originally

recorded in chronological order and

fromwhich they are posted to theledger

accounts at any convenient time.

(A) Ledger

(B) Journal

(C) Purchases returns books

(D) Sales book

38. Journal has ____ columns.

() 4

(@) 5

(©) 3

() 6

39. Transactions which are inter-

connected and have taken ‘place

simultaneously are recorded by means

ofa-

(A) Adjustment entry

(B) Combined journal entry

(C) Either (A) or (B)

(D) Closing entry

40. is the principal book of

accounts where similar transactions

relating to a particular person or

property or revenue or expense are

recorded,

(A) Ledger

(B) Journal

(C) Purchases returns books

(D) Sales book

to a particular person or property or

revenue or expense are recorded.

(A) Principal book

(B) Primary entry book

(C) Third entry book

(D) None of above

42, ____ is a book of account; in

which all types of accounts relating to

assets, liabilities, capital, expenses and

revenues are maintained.

(A) Ledger

(B) ‘Journal

(C) Primary entry book

(D) None of above

43. The process of recording transac-

tion in journal is termed as -

(A) Balancing

(B) Posting

(C) Journalizing

(D) None of above

44, Process of recording transaction in

Jedger is known as -

(A) Balancing

(B) Posting

(©) Journalizing

(D) None of above

45. Journal is book of -

(A) Analytical record

(B) Chronological record

(C) Alphabetical record

(D) None of above

46. Ledger is book for -

(A) Analytical record

(B) Chronological record

PART A: CORPORATE ACCOUNTING

18

(©) Aiphabetical record

bove

D) None of al 7

: ‘phe process of equalizing the two

oi fof an account by putting the

oa the side where amount

difference on

is short is known as

(A) Balancing

(B) Posting

(C) Journalizing

(D) None of above

48. Journal and ledger records

transactions in -

(A) Achronological orderandanalyt-

ical order respectively,

(B) An analytical order and chrono-

logical order respectively.

(C) Achronological order only

(D) An analytical order only.

49. Ledgerbookis popularly knownas-

(A) Secondary book of accounts

(B) Principal book of accounts

(C)_ Subsidiary book of accounts

(D) None of the above

50. At the end of the accounting year

all the nominal accounts of the ledger

book are -

(A) Balanced but not transferred to

Profit and loss account

(B) Not balanced andalso the balance

‘snottransferred to the Profitand

loss account

(C) Balancedand the balanceis trans-

ferred to the balance sheet

(D) Not balanced an

transferred to {

account,

d their balance is

he profit and loss

81. An allowance of 8 50 was ‘off

foran early payment of cash of 1 95

It will be recorded in - ,

(A) Sales Book ,

(B) Purchase Book _

(©) Journal Proper (General Journa)y

(D) Cash Book

52. A second hand motor car ‘was

purchased on credit from B & Co, for

% 10,000. If will be recorded in-

(A) Journal Proper (General Journal)

(B) Cash Book

(C) Purchase Book

(D) Sales Book

53. Goods were sold on credit basis

to Mr. Ram for & 10,000. It will be

recorded in -

(A) Journal Proper (General Journal)

(B) Cash Book

(C) Purchase Book

(D): Sales Book

54. Accounting forrecovery from Mr.C

ofan amount of € 2,000 earlier written

off as bad debt will be recorded in -

(A) Sales book

(B) Purchase book

(C) Journal Proper (General Journal)

(D) Cash book

55. Credit purchase ofstationery worth

% 5,000 by a stationery dealer will be

recorded in -

(A) Journal Proper (General Journal)

(B) Cash book

(C) Purchase book

(D) Sales book

56. A bill receivable of € 10,000,

which was received from a debtor in

CH. 1 : INTRODUCTION TO FINANCIAL ACCOUNTING

full settlement for a claim of % 11,0(

cishonoured willbe recanledia on

(A) Bills receivable book

(B) Journal proper (General Journal)

(©) Purchases return Book

(D) Purchase book

57. Outstanding salary % 34,000 to

be provided in the accounts will be

recorded in -

(A) Bills receivable book

(B) Journal proper (General Journal)

(C) Purchases Return Book:

(D) Parchase book

58. A debit note for ¥ 20,000 issued to

Mr. Z for goods returned by us is to be

accounted for in -

(A) Bills receivable book

(B) General journal

(C) Purchases return book

(D) Purchase book

59. Investment was sold in cash for

% 1,00,000 at par will be recorded in -

(A) Cash book

(B) General journal

(C) Purchases return book

(D) Purchase book

60. Investment was sold on credit for

% 1,00,000 at par will be recorded in -

(A) Cash book

(B) General journal

(C) Purchases return book

(D) Purchase book

61. Salary paid in cash - % 50,000 will

be recorded in -

(A) General journal

(B) Cash book

19

(C) Purchases return book

(D) Purchase book”

62. NSZ Ltd. makes payments to its

sundry creditors through cheques and

the cash discount received on these

payments is recorded in the. triple-

coluninar cash book. In the event of —

dishonour of any such cheques, the —

discount so received should be written _

back through:

() A debit to discount column of the

cash book.

(i) Acreditto discount column. ofthe

cash book.

(iii) A credit to bank column of the

cash book.

(iv) A ‘debit to discount account

through journal proper.

(v) A credit to creditor's account

through journal proper.

Select the correct answer from the

options given below -

(A) Only @ above

(B) ‘Only (é) above

(© Both (i) & (éi) above

(D) Both (iv) & (v) above

63. Which of the following statements

> is correct?

(A) The trial balance is prepared af-

ter preparing the profit and loss

account.

The trial balance shows only bal-

ances of assets and liabilities

@)

(©)

The trial balance shows only

nominal account balances.

(D) Thetrial balance has no statutory

importance from the pointof view

of law. :

pART A: CORPO!

1.10 sie

‘ is that expedite et OF

. ———~_cquisiti an

results in acquisition, Feast in the

which results ™ ra business. |

earning capacity of a

@ Capital expenditure

(B) Revenue expenditure .

(©) Deferred revenue expenditure

(D) None of the above

fit expires

65. Expenses whose benefit

within the year of expenditure and

which are incurred to maintain the

earning capacity of existing assets are

termed as -

(A) Capital expenditure

(B) Revenue expenditure

(©) Deferred revenue expenditure

(D) None of the above

66. There are certain expenses which

may be in the nature of revenue but

their benefit may not be consumed-in

the year in which such expenditure

has been incurred; rather the benefit

may extend over a number of years are

termed as -

(A) Capital expenditure

(B) Revenue expenditure

(©) Deferred revenue expenditure

(D) None of the above

67. Which of the following is/are

example of capital expenditure?

(A) Purchases of land & buildings by

the property dealer

(B) Purchases of mat

chinery dealer

(©) Expenses incurred for

Patents

(D) All of the above

68. Which of the

example of capital e:

chinery by ma-

getting

following is/are

‘xpenditure?

RATE, ACCOUNTING

aid to lawyer for drawi

Feearehase deedofland ©

Overhauling expenses of secong

hand machinery

c) Cartagepaid forbringingmachin,

‘ ” ery to the factory from supplier,

premises ig

(D) All of the above

69. Amounts paid for wages, salary

carriage of goods, repairs, rent ang

interest etc., are items of -

(A) Capital expenditure

(B) Revenue expenditure

(©) Deferred revenue expenditure

(D) None of the above

70. Costs incurred to acquire an asset

are but costs incurred to keep

them in working condition orto defend

their ownership.are __

(A) Capital expenditure, Revenue

expenditure

(B) Revenue expenditure, Revenue

expenditure

(a)

(@)

(C) Deferred revenue expenditure,

Revenue expenditure

(D) Revenue expenditure, Capital

expenditure

71. Which of the following is/are not

example of capital expenditure

(A) Money spent to reduce work

ing expenses like conversion 0

hand-driven machinery to pow’

er-driven machinery :

(B) Money paid for goodwill (like th

tight to use the established na™

ofan outgoing firm)

(C) Expenditure which doesnotrest!

Mm an increase in capacity * :

reduction of day-to-day expe™™

() All of the above

CH. 1: INTRODUCTION TO FI

72. Depréciation on fixed assets is -

(A) Capital expenditure

(B) Revenue expenditure

(C) Deferred.revenue expenditure

(D) None of the above

73. All sums spent up to the point an

asset is ready for use should also be

treated as -

(A) Capital expenditure

(B) Revenue expenditure

(C) Deferred revenue expenditure

(D) None of the above

74. Amounts paid for wages, salary,

carriage of goods, repairs, rent and

interest etc. are items of -

"INANCIAL ACCOUNTING 1.11

(A) Capital expenditure

(B) Revenue expenditure

(C) Deferred revenue expenditure

(D) None of the above

715. Fee paid to a lawyer for checking

whether all the papers are in order: ©

beforeland is purchased is ___! -Butif

later asuitis filed against the purchaseh

the legal costs will be

(A) Capital expenditure, Revenue "

expenditure

(B) Revenue expenditure, Revenue

expenditure

(C) Deferred revenue expenditure,

Revenue expenditure

(D) Revenue expenditure, Capital

expenditure

PAST EXAMINATION MCQs

76. Dec. 2019: Mines as asset is an

example of:

(A) Current Asset

(B) Wasting Asset

(C) Fictitious Asset

(D) Intangible Asset

77. Dec. 2019: At the time of prepara-

tion of Balance Sheet, Capital Work-in-

progress is shown in the head of:

(A) Share Capital

(B) Non-current Liabilities

(C) Current Assets

(D) Non-current Assets

78. Dec. 2019: Written down value of

a machine as on 31st March, 2019 is&

6,65,558. Rate of depreciation on the

basis of written down value method

is 15%. What will be the cost of this

- machine purchased on Ist April, 2014?

(A) @15,00,000

(B) = 12,00,000

(C) @10,00,000

(D) %8,00,000

79. Dec. 2019: Following is not an

advantage of Double Entry System:

(A) Itprevents and minimizes frauds.

(B) Helps in decision making

(C) The trial balance doesn’t disclose

certain types of errors

(D) It becomes easy for the Govern-

ment to calculate the tax.

80. Dec. 2020: Financial statements

are used by:

(A) Investors

(B) Creditors

(C) Regulators

(D) All of the above

PART

(a) pebtor

@) Creditor

oO Investor

Promoter :

a ie 2020: The words ‘To Balance

yf’ are recordet

itor By Br olan atthe te

of posting oft :

(a) all compound entries

(B) an opening entry

(©) aclosing entty

(D) an adjusting entry

83. June 2021: Original cost at which

an asset or liability is acquired is

known as —

(A) Carrying cost

(B) Replacement cost

(C) Amortization

(D) Historical cost

84, June 2021: Computers taken on

hire bya business fora period of twelve

months should be classified as:

(A) Current assets

(B) Intangible assets

(©) Deferred revenue expenditure

(D) Not an asset

85. June 2021: The arran;

3 igement of

assets and liabilities in accordance

with a particular order is known as

os of balance sheet.

(A) Tallying

(8) Marking

© Ruling

©) Marshalling

A: CORPORATE

ACCOUNTING

86. June 2021: Provisions arg

“a Nominal accounts

(B) Personal accounts

(C) Real accounts

(D) Representative personal accounts

87. June 2021: As per the provisions

ofthe Companies ‘Act, 2013, companies

must maintain their accounts under

(A) Double account system =”

(B) ‘Single entry system

(C) Double entry system

(D) Duplicate account system

88. Dec. 2021: When complete

sequence of accounting procedure is

done, which happens frequently, and

repeated in same directions during

an accounting period, it is called an

(A) Accounting Cycle

(B) Accounting Period

(C) Accounting Process

(D) Accounting Tools

89. Dec. 2021: While preparing a trial

balance, in which method are totals of

both the sides of the accounts written

in the separate colurnns?

(A) Total Method

(B) Balance Method

(C) Compound Method

(D) Pure Method

90. Dec. 2021: If the owner's equity

~ is 7 5,00,000 and outsiders’ equity is

3,00,000, calculate total equity.

(A) &5,00,000

(B) %2,00,000

(C) %8,00,000

() %3,00,000

CH, 1: INTRODUCTION TO FINANCIAL ACCOUNTING

91. Dec. 2021:

Statement I: It may be prepared ona

loose sheet of paper.

Statement II: The ledger accounts are

balanced at first. They will have either

“debit balance” or “credit balance” or

“nil-balance”.

Statement I: The accounts contain-

ing debit-balance are written on the

debit column, and those with credit-bal-

ance are written on the credit column.

All the above three statements are

relevant for:

(A) Ledger

(B) Cash Book

(C) Trial Balance

(D) Financial Statement

92, Dec. 2021: Purchiase goods of the

list price of = 25,000 from Mohan less

20% trade discount and 2% cash dis-

count. The amount of cash discount is

(A) = 160

(B) 240

(C) = 400

(D) 500

93. June 2022: Who originated the

accounting concept based on double

entry system?

(A) Luco Fernandis

(B) Luca Pacioli

(C) Eric Kohler

(D) Eric Pacioli

94, June 2022: Which of the following

1.13

(A) Provision for taxation

(B) Provision for depreciation

(C) Cash discount to customers

(D) Discount on issue of shares

95. June 2022: What is the nature of

a Cash Book? :

(A) a Journal

(B) a Ledger

(C) both a Journal and a Ledger

(D) neither a Journal nor a Ledger

96. Dec. 2022: Accounting -..

of a business entity.

(A) Measures past performance

(B) Depicts current financial position

(C) Helps in forecasting future per-

formance

(D) All of the above

97. Dec. 2022: Which of the following

statements is correct in relation to

Trade Discount?

(A) Recorded in the books of account

(B) Calculated on invoice price

(©) Encourage prompt payment

(D) All of the above

98. Dec. 2022: Journal Proper contains

vues. that cannot be entered in any

other subsidiary book.

(A) Cash transactions

(B) Cash and Credit transactions

(C) Contra transactions

(D) Rectification entries

is an example of fictitious asset?,

ANSWERS

rlel2 ols [alts [ols | @) 6 ML LO

3. 1) 19 | @) | 10. | @) | (©) | 12. (© | 43. | m) [ 14. [@)

0. | (C)

‘A) | 18. | (A) | 19. | (©) | 2

15. | (© | 16. © ae es 25. | (©) | 26. | (A) zi «

21 (a an 7 31, | (A) | 32. | (D)_| 33. 2) “ 2

sel - (B) | 38. | oa) | 39. | (B) | 40. | (A) ‘ a)

= a 1 (B) | 45. |B) | 46. |) | 47. | @ | 48.

54. | (D) | 55. | (©)

~ | @) | 52. | (a) | 53. | @) :

Sete Let seta es Le La lea ®)

= a 65. | (B) | 66. | © | 67. | (©) | 68. ww). a

7. ©} 72. | @y} 7. | ay | 74. | ®) | 78. (aL [76 oy

78. (A) | 79. | © | 80. | (Dd) | 81. om a * $8. S

85. | D) | 86. | © | 87.| (© | 88. :

bere 93. | (B) | 94. | @) | 95. | © | 96. | () | 97. | @)

1

| Cost on 1.4.2014

x

| ©) Depreciation for 2014-2015 (0.15x)

| 0.85%

| ©) Depreciation for 2015-2016 (0.1275x)

| ; 0.7225

| (2 Depreciation for 2016-2017 (0:108375x)

| 0.614125x

| ©) Depreciation for 2017-2018 (0.09211875x)

| 0.52200625x

| (-) Depreciation for 2018-2019 (0.0783009375x)

L 6,65,558

0.52200625x — 0.0783009375x = 6,65,558

0.4437053125x = 6,65,558

665,558 ne

fe eR

0.4437053125 00,000

90.

Net Equity = 5,00,000 ~ 3,00,000 = 2,00,000

92.

List Price

() Trade discount @ 20%

Cash Discount =

INTRODUCTION TO CORPORATE

ACCOUNTING =

MCQs ON THEORY

1. Anasset shall be classified as current:

(A) Ifitis held primarily for the pur-

pose of being traded.

B

If it is not possible to classify such

asset as non-current asset.

(C) If for the asset normal operating

cycle cannot be identified.

@

If such asset expected to be real-

ized after twelve months after the

reporting date.

2. A copy of the financial statements,

including consolidated financial state-

ment, along with all the documents

attached to financial statements, duly

adopted at the AGM, shall be filed with

the Registrar within __of the date

of AGM in prescribed manner along

with prescribed fees.

(A) 10 days

(B) 30 days

(C) 60 days

(D) 90 days

3. Asper Schedule III ofthe Companies

Act, 2013, where the normal operating

cyclecannot beidentified, itisassumed

to have duration of -

(A) 3 months

(B) 6 months

(C) 9 months

(D) 12 months

4. As per Rule 12 of the Companies

(Accounts) Rules, 2014, a financial

staternent shall be filed in___ which

should be pre-certified by Practicing

CA.

(A) Form AOC-3

(B) Form AOC-4

(©) Form AOC-5

(D) Form AOC-6

5. A liability shall be classified as

current when it satisfies any of the

following criteria: < :

(A) It is expected to be settled in the

company’s normal operating cy-

cle.

(B) Itisduetobesettled within twelve

months after the reporting date

(C) The company does not have an

unconditional right to defer set-

tlement of the liability for at least

twelve months afterthe reporting

date. ~

(D) All of the above

6. OPC shall file a copy of the financial

statements duly adopted by its member,

along with all the documents which are

required to be attached to such finan-

21

2.2 ;

ithi 1c

cial statements, within from the

Closure of the financial year.

(A) 30 days

(B) 60 days

(C) 120 days

(D) 180 days

7, Which of the following is required

to be disclosed in notes to accounts in

respect of ‘Share Capital’?

(A) A reconciliation of the number

of shares outstanding at the

beginning and at the end of the

reporting period :

(B) Aggregate number and class ‘of

shares bought back

(C) Shares in the company held by

each shareholder holding more

than 5%,

(D) All of the above

8, As per Rule 3 of the Companies

(Filing of Documents and Forms in Ex-

tensible Business Reporting Language)

Rules, 2015, all companies having

has to file. their Balance Sheet,

Profit & Loss A/c and other documents

with the Registrar using the Extensible

Business Reporting Language(XBRL).

(A) Issued capital of 5 Croreorabove

(B) Authorized ca:

%10 Crore

(Cc) Paid-up capital of %5 Crore or

above

(D) Subscribed ca

or above

9. Which of the fol]

the heading ‘Rese:

balance sheet?

(A) Share Options Outstanding Ac-

count

(B) Share Applic:

Allotment

pital of more than

pital of 25 Crore

lowing appears under

rves & Surplus’ in the

ation Money Pending

PART A: CORPORATE ACCOUNTING

(C) Long Term Provisions

(D) Secrete Reserves

10. As per Schedule III of the Compa.

nies Act, 2013,a Company shall disclose

byway ofnotes additional information _

(A) 0.5% of the revenue from opera.

tions

(B) % 10,000

(C) 1%ofthe revenue from operations

% 1,00,000, whichever is higher

(D) 0.5% of the revenue from opera-

tions & 10,000, whichever is less,

11. As per Rule 3 of the Companies

(Filing of Documents and Forms in

Extensible Business Reporting Lan-

guage) Rules, 2015, all companies

having turnover of has to file

their Balance Sheet, Profit & Loss Alc

and other documents with the Registrar

using the Extensible Business Report-

ing Language (XBRL)

(A) %50 Crore or above

(B) % 100 Crore or above

(C) % 250 Crore or above

(D) %500 Crore or above

12. As per Section 128 of the Compa-

nies Act, 2013, every company shall

Prepare and keep at its books of

account and other relevant books and

Papersand financial statement forevery

financial year

(A) Corporate Office

(B) Registered Office

(C) Corporate Office or Registered

Ffice

(D) Head Office

13. Which of the following will be

shown in the balance sheet under the

heading ‘cash and cash equivalents”?

CH. 2:

2 -INTRODUCTION TO CORPORATE ACCOUNTING

(A) Earmarked balances with banks

(B) Bank deposits with more than

twelve months maturity

(C) Cheques, drafts on hand

(D) All of the above

14, Which of the following type ofcom-

pany is required to file their accounts

in Extensible Business Reporting Lan-

guage (XBRL) format?

(A) Banking companies

(B) Insurance companies

(C) Non-Banking Financial compa-

nies

(D) None of the above

15. Declared dividend must be paid

within of declaration.

(A) 5 days

(B) 10 days

(C) 30 days

(D) 60 days

16. Retained earnings are -

(A) An indication of a company’s

liquidity. | ~ :

(B) The same as'cash in the bank.

(C) Notimportant when determining

dividends. 7

(D) The cumulative earnings of the

company after dividends.

17.Which of the following type of com-

pany is required to file their accounts

in Extensible Business Reporting Lan-

guage (XBRL) format?

(1) Subsidiary of Indian Listed Com-

pany

(1) Companies

to prepare th

ments in accordanc!

which are required

eir financial state-

e with the

oes

2.3

Companies (Indian Accounting

Standards) Rules, 2015

(111) Private company having turnover

of 99 Crore.

(IV) Publiccompanies. havingpaid-up »

capital of 3 Crore. ,

Select the correct answer from

tions given below - *

@) M&d@ ©

(B) dD & dv)

(C) QD) & a)

(D) ©, i) & GM) 2

18. The primary goal of a public-

ly-owned firm interested in serving its

stockholders should be to -

(A) Maximize expected total corpo-

rate profit

(B) Maximize expected EPS

(C) Maximize thestockprice pershare

(D)’ Maximize expected net income.

19..In the real world, we find that

dividends - ~

(A) Usually exhibit greater stability

than earnings.

(B) Fluctuate more widely than earn-

ings

(C) Tend to be a lower percentage of

earnings for mature firms

(D) Are usually set asa fixed percent-

age of earnings

20. Which of the following statement

is correct?

(A) Acompany may, if so authorized

by its articles, pay dividends in

proportiontothe amount paid-up

on each share.

(B) Dividend cannot be paid on calls-

in-advance.

26. Trial Balance of Complex Ltd., as

at 31.3.2019 shows the following item:

Particulars {De® | Cn @.

Advancé income tax] 55,000] -

Provision for tax for

year ended 31,3.2018 - | 30,000

(1) Advance payment of income tax

includes % 35,000 for 2017-2018.

(2) Actual tax liability for 2017-2018

amounts to % 38,000 and no effect

for the same has so far be given

in accounts.

(3) Provision forincome tax has tobe

made for 2018-2019 for = 40,000.

You are required to calculate: (a) Li-

ability for taxation for last year ie.

2017-2018; (b) Extra provision to be

made in current year for last year.

(A) % 8,000; = 3,000

(B) %5,000; = 12,000

(C) %3,000; = 8,000

(D) = 12,000; = 5,000

27. A company had made provision

for tax = 70,000 for last year. Actual

tax liability for the last financial year

settled at f 68,000. It had paid advance

tax for last year & 65,000. Which of

the following statement is correct in

relation tax treatment in accounts of

the company?

(A) Liability for taxation for the last

year is = 3,000

(B) Provision towrite back for the last

year % 2,000

(C) Adjustment entry isrequired tobe

passed in current year by debiting

Provision for Tax A/cand crediting

Advance Income Tax A/c® 65,000,

(D) All of the above are correct,

28, Yash Ltd. has only one type of

ital, viz. 40,000 equity shares of 100

each, It also has got reserves totalling

% 20,00,000. The company closes its

books on 31st March each year It a

paid dividends @ 15% up to 2015-201

and 20% thereafter: In 2018-2019,

company suffered a loss of & 2,50,009;

therefore, it wishes to draw rea

amount out of the reserves to pay v=

idend at 12%. As the Companies (Dec-

laration of Dividend Out of Reserves.

Rules, 2014 how much man

percentage of dividend can be pat

the company out of reserves.

(A) 12%

(B) 10%

(C) 8.75%

(D) 6.55%

ity of profits, MUSKAT

29. Due to paucity of p: poses 10

LTD. an Indian company P!

declare dividends out of its general

reserves.

z

10% pref, shares (@ 100 each) 10,00,000

Equity shares (~ 100 each) _ 30,00,000

General reserve 8,00,000

Securities premium 2,00,000

Credit balance of P & L A/c 20,000

Net profit for the year (after _1,80,000

tax)

Average dividend for last 3 15%

years

As per the Companies (Declaration of

Dividend Out of Reserves) Rules, 2014

how much-maximum percentage of

dividend can be paid by the company

out of reserves,

(A) 10%

(B) 8%

(C) 12%

(D) 15%

30. i

Sane pene Capital of Apsara Ltd

of 5,00,000 equity shares of

50,000, 8% pret

erence

parr A: CORPO!

if

sh, The statement O

se on ie tthe company i ee

profit and 9°, 21gshowed net Pe

yearended?2"70,00,000. Net Pron.

before ta fom previous Yon

a sheet ‘amounted to © 6,01 nee

balance pakes.a provision of 4076 9°

one Following appropriation’

incom proposed by'the company:

ivi 0 per

final dividend @ € 1.5

yo equity shareholders.

RATE AccoUNTING

aio tra nsfer 5% of net profit to

| reserve.

general 2

orporate dividend tax yay,

s ce

se closing balance of Profit & Log.

Alc will be -

(A) %3,94,500

(B) % 2,94,500

(Cz 4,94,500

(D) %1,94,500

)

PAST EXAMINATION MCQS

31, Dec 2019: As per Companies Act,

2013, the prescribed form of Balance

Sheet of a Company is given in:

(A) Part IL of Schedule IT

(B) Part I of Schedule HT

(©) Part I of Schedule I

(D) Part I of Schedule V

32. Dec 2020: Current Assets are those

assets: 7

(A) Which can be converted into cash

within 12 months

(B) Which can be: converted into cash

within a period normally n

“ ot ex-

ceeding 12 months

Which can be conve

cash within an oper

(C)

erted into

rating cycle

(D,

w 4 (i

mt are held for their conver:

ete “sh withinan operatin

ae °F period of 12 months

- Dec 2029; i i

oe * 2029, he figures a

aS Inancial Stateme,

Founded off tg the n i

Turnover is

PPearing

MS may be

“t Crore, only

(C) more’than % 100 Crore

(D) more than % 500 Crore

34. Dec 2020:A Company shall disclose

by way of notes, additional informa.

tion regarding aggregate expenditure

and income on any item of income or

expenditure which exceeds:

(A) 1%oftherevenue from operations

or 1,00,000, whichever is higher

(B) 1%oftherevenue from operations

or 1,00,000, whichever is lower

(C) 1%0ftherevenue from operations

©r® 10,00,000, whicheveris higher

(D) 1%oftherevenue from operations

9r¥ 10,00,000, whicheveris lower

35. Dec 2020: Loans from banks re-

payable on demand will be classified

n the Balance Sheet of a company as!

(A) Short-term borrowings

(B) Long-term borrowings

= Other Current Liabilities

e eae Long-term Liabilities

comme 2020: In the Balance Sheetof?

Sr aRY Which item shall be sub-cla*

it) 42°: © Secured, considered 2004!

Gi) U; f

Doubreecured, considered good: (i

CH. 2: INTRODUCTION TO CORPORATE ACCOUNTING

(A) Long-term and Short-term Trade

Receivables

(B) Long-term loans and advances

(C) Short-term loans and advances

(D) All of the above

37. June 2021: A corporate balance

sheet is also known a

(A) Statement of changes in assets

and liabilities

(B) Statement of sources and appli-

cation of funds

(C) Statement of financial condition

(@) Statement of object and reason

38, June 2021: A copy of the financial

statements and Board’s report duly

adopted at the AGM shall be filed with

the Registrar within............ of the date

of AGM. .

(A) 60 days

(B) 30 days

(C) 90 days

(D) 21 days

39. June 2021: As per Rule 8 of the

Companies (Accounts) Rules, 2014,

the Report of the Board shall contain

the particulars of contracts or arrange-

ments with related parties under Sec-

tion 188(1) in the

(A) Form AOC-1A.

(B) Form AOC-2

(C) Form AOC-3

(D) Form AOC-4A

40. June 2021: One Person Company

(OPC) shall file a copy of the financial

statements duly adopted by its member,

along with all the documents which

are required to be attached to such

financial statements, within . es

from the closure of the financial year.

2.7

(A) 30 days

(B) 60 days

(C) 120 days

1D) 180 days

a June 2021: Declared dividend

must be paid within of decla-

ration.

(A) 5 days

(B) 10 days

(C) 30 days

(D) 60 days

42. Dec 2021: If the Company's Issued

Capital is more than the Authorized

Capital, and approval of increase in Au-

thorized Capital is pending, the amount

of Share Application Money received

over and above the Authorized Capital

should be shown under the head:

(A). Other Current Liabilities

(B) Other Long-Term Liabilities

(C) Reserve and Surplus

(D) Short-Term Provision

43. Dec 2021: The term “Continuing

Default” is used with respect to:

(A) Short-term borrowing

(B) Medium-term borrowing

(C) Long-term borrowing

(D) None of the above"

44. Dec 2021: For the purposes of

Sub-section (1) of Section 129, the

class of companies as may be notified

by the Central Government from time

to time, shall mandatorily file their

financial statements in:

(A) Extensible Business Reporting

Language (XBRL) format

(B) Extensible Bu:

(XBR) format

(C) Extensible Business Presentation

Language (XBPL) format

(D) Extensible Business P; i

XBP) hee ‘ess Presentation

siness Reporting

2.8

45. June 2022: In the context of filing

of financial statements by a company,

the term “XBRL” means i“

(A) Xavier Business Rules and Law

(B) Extensible Business Reporting

Language

Xavier Business Reporting Lan-

guage ;

Extensible Business Rules and

Law

46, June 2022: According to Section

128(1) of the Companies “Act, 2013

every company shall prepare and keep

its books of account and otherrelevant

books and papers and financial state-

ments for every financial year which

give a true and fair view of the state

of the affairs of the company, at its

©

(D)

(A) Corporate office

(B) Registered office

(©) Every Regional office

(D) Every Branch office

47. Sune 2022: As per Companies Act,

2013, the prescribed form for Statem,

of Profit and Loss is given in: nt

ANSWERS

1. | (A)

8. [©

15. | (©)

22. | (B)

29. | (a)

36. | (D)

43. | ©

PART A; CORPORATE ACCOUNTING

(A) Part I of Schedule IT

(B) Part I of Schedule Ir

(C) Part II of Schedule II

(D) Part lof Schedulev

48. Dec. 2022: The acronym

stands for:

(A) Expandable Business Re

Search,

Language

(B) Expandable Business Reporting

Language

(C) Extensible Busiriess Review Lan,

guage |

(D) Extensible Business Reporting

Language

49. Dec. 2022; For disclosure require-

ment, list of shareholders holding

~. of shares as on the balance

sheet date should be given,

(A) 5% and above

(B) More than 5%

(C) 10% and above

(D) More than 10%

(D) | 7. | o

(D) | 14. | @)

() | 21. | @)

(®) | 28. | (©)

(A) | 35. | @)

(C) | 42.'[ (a)

(D) | 49, (B) |

cH.

: INTRODUCTION TO CORPORATE ACCOUNTING

2.9

HINTS FOR IMPORTANT PRACTICAL MCQs

25. :

Dr.__ Profit and Loss Appropriation A/c for the year ended 31.3.2018 Ce

To General Reserve A/c 1,45,000 | By Balance b/d 95,000

To Preference Dividend 1,37,500 | By Net Profit (current year)

(12,50,000 x 11%)

To Proposed Dividend 9,00,000

(37,50,000 x 24%)

To Corporate Dividend Tax 1,76,375 14,50,000

(1,37,500 + 9,00,000) x 17%

To Balance c/d 1,86,125

15,45,000 15,45,000

26.

| [Adjustment for advance tax

Assessment finalized for last year 38,000

Advance tax paid for last year 35,000

| | Tax to be paid 3,000

Adjustment for pt ion for ne

|_| Assessment finalized for last year 38,000

Provision for tax made for last year 30,000

Extra provision to be made-for last year 8,000

27.

Adjustment for advance tax i = z

Assessment finalized for last year 68,000

Advance tax paid for last year 65,000

Tax to be paid 3,000

Adjustment for provision for tax =

‘Assessment finalized for last year 68,000

Provision for tax made for last year 70,000

| Provision to write back for the last year 2,000

28. Dividends can be declared out of past years profits transferred to reserves.

In this case, the company has to comply with the Companies (Declaration of

Dividend Out of Reserves) Rules, 2014. It lay down the following conditions

subject to which a dividend may. be declared by a company in the event of

inadequacy or absence of profits in any year out of the profits earned by it in

previous years and transferred to reserves.

PART At CORPORATE ACCOUNTING

2.10

he average of the rate.

11 not exceed. the i ai

Jared shal in the 3 years immediately Preceg, 3

(1) The rate of dividend dec!

which dividend was declared by it

that year. ae

~ Dividend Ra

15%

9

2016-2017 20 ie

2017-2018 20%.

55%

Average rate of dividend = 55/3 = 18.33%

So, 18.33% dividend can be paid at first instance. j

Amount required for dividend at 18.33% = 40,00,000 x 1 8.33% = %7,33,200, 3

(2) The total amount to be drawn from such accumulated profits shall not

exceed 1/10th of the sum of its paid-up share capital and free reserves as

appearing in the latest audited financial statement.

1/10th of (Paid up capital + Free Reserve) = (40,00,000 + 20,00,000) x 4

1/10 = 6,00,000. ; :

Thus, above amount in condition (1) will be restricted to % 6,00,000. |

(3) The amount so drawn shall first be-utilized to set off the losses incurred

in the financial year in which dividend is declared before any dividend in _

respect of equity shares is declared. ; i

Total amount to be drawn from such accumulated profits 6,00,000]

©) Losses incurred i

% ),000)

( Preference dividend Cy |

Amount that can be drawn from accumulated profits 3,50,000]

ie

= rate of dividend = 3,50,000/40,00,000 x 100 = 8.75% |

(4) The balance of reserves afte) i cit ‘A |

: S T such withdr;

The balance of reser withdrawal shall not Stok

ie ea are capital as Appearing in the latest audited Ree ite 1

Reserves

20,00,000)

(3,50,000)}

16,50,000|

lated profits

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

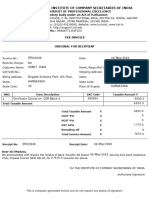

- Invoice Jainam Infotech-1Document1 pageInvoice Jainam Infotech-1Manjunath ShettyNo ratings yet

- HousemateDocument13 pagesHousemateManjunath ShettyNo ratings yet

- MH270024356Document1 pageMH270024356Manjunath ShettyNo ratings yet

- EF027302Document1 pageEF027302Manjunath ShettyNo ratings yet