Professional Documents

Culture Documents

UB Sir New Questions

UB Sir New Questions

Uploaded by

binu0 ratings0% found this document useful (0 votes)

61 views16 pagesCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

61 views16 pagesUB Sir New Questions

UB Sir New Questions

Uploaded by

binuCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 16

»

2

»

4

8

8)

»

10)

11)

12)

CA Umesh Bhattarai

TIME VALUE MONEY poe

‘Yanstout Autos ofling te ee ona motoryle eating Rs 100.000 fr whieh Re 4,000 should be pad a8 cash

Gown Payment and rest tte endof 2 yeas, Badbas Auto wl giv RS 5000 fh at pie for the sare motorcycle but

<£es no ofr re coat Which company is fering the batter dealt buyers it meet mmretrate is 10%?

EXE Lid borows Ra 4360000 rom EYE Lid at a stnle ret rl of 12% pa. hie opoed tat the loan shal be

payable in two qe sainets which shal be payebia athe end of 6 menhs and year reepecvely. Calculate the

‘amountof instalments,

‘esa thal yu ae offered an anuly that pays Rs, 1,00 athe ond ofeach year for 40 years, You could eam 6% on

Your money in other Investments wth

qual isk. What isthe most you should pay forthe annuity? Ifthe payments began

Immediately, how much would the annuty be worth?

NCC Bank granted a losn of Rs. 6, 34,000 repayable in 4 equal annua instants beginning with the date of sanction of

‘ne oan. Determine the amount of stalinents if otectv rae ofinaestis 18% pa.

‘You plan to make a series of deposits in an interest

bearing account @ 10%. You will deposits Rs. 1000 today, Rs 2000 at

{he end of year 2 and Rs 8000 atthe end of

‘year 5. I you withdraw Rs 2000 atthe end of year 3 and Res 6000 at the end

ofyear 7. 5

Required; a

(Present value

(iTeminal value

‘Abank granted a loan of Rs 1234,800 repayable in 4 annual nstatnents in th rato of 1: 2:3: 4 respectively,

wih fhe ond of tstyear.Detemine the amount of instalments Hf effective rate of terest 18% pa.

‘You borrowed Rs 100,000 @ 9% pa. Ifyou

Pays Rs 10.000 per year, how long tothe nearest year you wil repay the

loan?

beginning

Me. X has made real estate investment for Rs, 12,000 which he expects wi have a mtuty vale equivalents invest t

12% compeunded monty for § years, I mest savings Instutlonscuenty pay 8% compounded quartet on 2's year

‘erm, whats the least amountfor which Mr.X should sel his property to get expected matuty valve?

You are given the folowing information:

@ FutureValue = Rs 2000

Present Value =Rs 1000

b. Nootyears — =7

Interest Rate 0%

‘A doctor i panning to buy an X-Ray machine for his hospital He has two optons. He can either purchase & by making

‘cash payment of Rs 5 lakhs or six equal annual instalments of Rs. 102,000 p.a. Which option do you suggest tothe

doctor assuming the rate of return is 12 percent?

You must take

Payment of Re. 1,492.02 ten yoars fom today. To prepare for his payment, you wil make § equa!

].

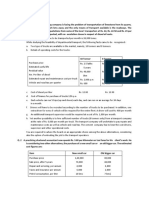

7 500,000 550/000 6,00,000

z 40000 640,000

3 580,000 %,90,000

a 620,000 740,000,

= 660,000 300,000

“The taxrato ie 40 per cent. The company follows straight line method of depreciation, Assume cost of capital to be 15 per cent.

P.VF. of 15%, 5 = 0.870, 0.756, 0.658, 0.572 and 0,497.

‘You are requied to advise the company as to which alternative is to be adopted.

56) A theatre with some surplus accommodation proposes fo extend its catering facilis to provide ight meals to its patrons.

‘The Management Board is prepared to make inital funds availabe to cover capital cost. It requires that these be repaid over @

1% and discounting factors at this interest rate are indicated below:

7 z 3 a 5

Discounting factor Tp 08s | arr uaF ae

“The capital costs are estimated at Rs 60,000 Tor equipment ti ‘of five years and ho residual value. Running

costs of staf, et, will be Rs 20,000 in the year, increasing ich subsequent year. The board proposes to

charge Rs 5,000 per annum for lighting heating and other property expenses and wants a nominal Rs 2,600 per annum to

‘cover any unforeseen contingencies. Apart from this, the Board is not locking for any profit, as such, from the extension of

these facities, because it believes that this wil enable more theatre seats to be sold. It i proposed that costs should be

recovered by setting pices forthe food at double the direct costs,

Its not expected thatthe level wil be reached until year 3, The proportions of the level estimated to be reached in

years 1 and 2 are 35% and 65% respectively

You are requied to: Caleuate the sales that ned to be achieved In each ofthe fve years to meet the Boards targets. Ignore

taxation and inflation,

‘Ans: Full Sales = Rs.128, 449

57) A company is considering the purchase of a new comput

Would cost Re 35 Lakhs. The operation and maintenance cos

‘The estimated Ife of the system i 6 yoars,

‘The system wit result In reduction in design and draughtsman-ship cost to

disposal of used drawing offi equipment and furniture Is antipated

there is no fx on capital pro

m for Its Research and Development Dhision, which

'in9 deprecation) are expected tobe Rs 7 Lakhs pa

OFRS 12 Lakhs annually, Also, the

9,00.000. ts book value is Nit ang

44

. CA Umesh BI

Woe 100% wia-f ne fst Yar or tx pues, The companys orectne

‘of the proposal.

BCD Lid, specializes in production of

sig abl water fr which has dstbutors bot nth Norham and Southern parts

roduc in the East a

1 West parts of Nepal ar clamoring for more branches in each of tese

ject team to study the fe

irement. The team, afer serious

‘of the branch expansion project as well as

submited Is report containing the fotowing infomation ‘lating tothe branch to be opened in the

150,000 with nil serap value

Expected ie span - 10 years

Sales volume - 20,000 uns per annum

Selling price. 20 per

Direct variable cost -R. 18 per unit -

~ Fixed cost excluding dopreciaton - Rs, 25,000 per annum.

IRR -17%. aa Ariaontek

‘The Mansging Oreos concomed about “tity of project sth IRs clos othe company's Missa rte os 15%

estes wanted you to eval th project very wel so att does stoma ee Present value of annuily at

company's hurdle rae or 10 years is 50188

Required: ‘be

Compute the sensitvy ofthe NPV to each ef the folowing variables:

Sales price

Sales volume

Inital outay

Variable cost

Discount rate

Life of project

From your calulaton in () above, determine the two most senskive variables and interpret the result.

‘Ans: Most sensitve-Seling Price and Variable Cost

‘ADJUSTED PRESENT VALUE- APV

59) XYZ Ltd. is pres

Which wil require

Gaul) financed. The drecto ofthe company have been evaluating investment in a Project,

ns capa expenditure on new machinery. Thay expec the capital ivestnent o prove seal

cash fows of 42 lakhs indefiitly, which is nat of al tax adjustments, The discount rte, whieh ‘applies to such

Investment decisions, is 14% net.

‘The directors of the company believe

Propose to finance the new project wi

ecured on the company’s assets, The company intonds

the ater tax costo sue,

corporate undated debt of similar risk is 10%, The ater

1s 20%,

Investment,

£0) A company uses certainly equvalnt approach to evaluates risky projets thas colected the following detais for a

_Pfoject which Is under consideration;

3s

ject to manufacture and sell a new product. The

i. The annual fixed

Wenn conoay i canon wie

year and on the assumption that wit

16

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Service CostingDocument6 pagesService Costingbinu100% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Internal Reco Dec 2020Document12 pagesInternal Reco Dec 2020binuNo ratings yet

- BCDocument6 pagesBCbinuNo ratings yet

- Share Based PaymentDocument65 pagesShare Based PaymentbinuNo ratings yet

- Nas 17Document17 pagesNas 17binuNo ratings yet

- NAS 21 The Effects of Changes in Foreign Exchange RatesDocument14 pagesNAS 21 The Effects of Changes in Foreign Exchange RatesbinuNo ratings yet

- Finance Suggested Short Notes CompilationDocument15 pagesFinance Suggested Short Notes CompilationbinuNo ratings yet

- Deepak Kumar Yadav ProposalDocument15 pagesDeepak Kumar Yadav ProposalbinuNo ratings yet

- 500 Questions - UpdatedDocument53 pages500 Questions - Updatedbinu0% (1)

- AFR Consolidation TrendDocument1 pageAFR Consolidation TrendbinuNo ratings yet

- Ind As 19Document86 pagesInd As 19binuNo ratings yet

- WHT, Advance Tax & Others (CAP II) - Summary NoteDocument10 pagesWHT, Advance Tax & Others (CAP II) - Summary NotebinuNo ratings yet

- 1 Day Revision Note Portfolio ManagementDocument9 pages1 Day Revision Note Portfolio ManagementbinuNo ratings yet

- Interim Reporting Nas 34Document34 pagesInterim Reporting Nas 34binuNo ratings yet

- Income Tax 2074-75 TransDocument9 pagesIncome Tax 2074-75 TransbinuNo ratings yet

- Tax Handwritten NoteDocument230 pagesTax Handwritten NotebinuNo ratings yet

- Advanced Auditing & Assurance Trend AnalysisDocument2 pagesAdvanced Auditing & Assurance Trend AnalysisbinuNo ratings yet

- Man Bahadur KhatriDocument41 pagesMan Bahadur KhatribinuNo ratings yet

- Overhead ControlDocument1 pageOverhead ControlbinuNo ratings yet

- Budget Highlights - Crowe Nepal (78-79)Document72 pagesBudget Highlights - Crowe Nepal (78-79)binuNo ratings yet

- Income Tax 2075-2076Document8 pagesIncome Tax 2075-2076binuNo ratings yet

- IT TrainingDocument139 pagesIT TrainingbinuNo ratings yet

- Nsa 230 Application Material UpdatedDocument12 pagesNsa 230 Application Material UpdatedbinuNo ratings yet

- Dissolutioni of Partnership FirmDocument69 pagesDissolutioni of Partnership FirmbinuNo ratings yet

- Nsa 520 SM UpdatedDocument8 pagesNsa 520 SM UpdatedbinuNo ratings yet

- VAT Compilation CAP IIDocument15 pagesVAT Compilation CAP IIbinuNo ratings yet

- Non Integrated AccountingDocument4 pagesNon Integrated AccountingbinuNo ratings yet

- (14 Files Merged)Document14 pages(14 Files Merged)binuNo ratings yet

- Investment For Cap 11Document8 pagesInvestment For Cap 11binuNo ratings yet