Professional Documents

Culture Documents

PART B - SET A (Odd groups - 1,3,5,7,9)

Uploaded by

ngocanhhlee.11Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PART B - SET A (Odd groups - 1,3,5,7,9)

Uploaded by

ngocanhhlee.11Copyright:

Available Formats

ACC201 PRINCIPLES OF ACCOUNTING

INCLASS TEST 01 – SET A

PART B - 45 Minutes

Question 1 (0.5 mark)

N&H Time2Clean started 2020 with total assets of $18,000 and total liabilities of $12,000. At

the end of 2020, N&H’s total assets stood at $12,000 and total liabilities were $9,000.

Requirements

a. Did the owner’s equity of N&H Time2Clean increase or decrease during 2020? By how

much?

b. Identify the four possible reasons that owner’s equity can change.

Question 2 (0.5 mark)

On September 1, PSO Consulting received an advance payment of $6,000 from a customer for a

service to be performed in the future. During the period, the company completed two-third of

the agreed-on services for the customer. Assume there was no beginning balance in the

Unearned Revenue account for the period. Based on the information provided.

a. Make the December 31 adjusting journal entry to bring the balances to correct.

b. Show the impact that these transactions had.

Question 3 (0.5 mark)

Harvey Norman pays salaries for its employees every Monday with full time of five-working

days $13,000. Assume Harvey Norman’s end of accounting period on Tuesday, June 30, and the

next salaries payment is on Monday, July 6th. The balance for Salaries Expense before

adjustment is $640,000.

a. Prepare adjusting entries to record accrued salaries on June 30.

b. Prepare the journal entries to record the payment made on July 6 for Salaries Expense.

Question 4 (0.5 mark)

After journalizing and posting the transactions, SES Clothing examined the accounts again at the

end of May, it recognized some errors:

a. A customer’s payment on account $950, was debited to Cash $590 and credited to

Service Revenue, $590.

b. A payment for Salaries Expense costing $720 was debited to Utilities Expense, $720 and

credited to Cash $720.

c. A payment on account for $860 for Equipment was debited to Supplies, $680 and

credited to Accounts Payable $680.

Question 5 (0.5 mark)

On November 28, an attorney received $3,000 as an advance payment for legal work to be

performed. On November 28, the $3,000 was recorded with a debit to Cash and a credit to

Unearned Service Revenue.

On November 30, the attorney did not provide any legal services for the client. During

December the attorney provided services costs $1,900. At December 31, no entry had been

made to the revenue earned.

a. Will an adjusting entry be needed at November 30? Why?

b. If there is an adjusting entry to be made at December 31, what will it be?

Question 6 (0.5 mark)

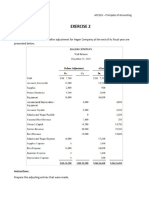

After adjusting the accounts, Bed&Bath Co’s accounts balance are as follows.

Prepare the adjusted trial balance for Bed&Bath Co. at December 31, 2021.

Cash $ ? Salaries Payable $ 310

Equipment 30,000 Accumulated Depreciation-Equipment 2,500

Accounts Payable 2,400 Insurance Expense 580

Service Revenue 25,400 Unearned Revenue 300

Bed&Bath, Capital 15,300 Salaries Expenses 7,310

Supplies Expense 1,700 Office Supplies 300

Prepaid Insurance 20 Depreciation Expense-Equipment 500

Bed&Bath, Withdrawals 5,000

Question 7 (0.5 mark)

When recording adjusting entries, JB Hi-fi did not record the adjusting entries for the following

situations:

a. Unearned revenue still unearned at December 31, $3,600.

b. Prepaid rent still in forcae at December 31, $2,000.

c. Depreciation expense, $400.

d. Acrued Salaries Expense at December 31, $180.

e. Office Supplies used, $600

Determine the effects on the income statement and balance sheet by identifying whether

assets, liabilities, equity, revenue and expenses are either overstated or understated. Use the

following table.

Adjustment Balance Sheet Income Statement

Not recorded Assets Liabilities Equity Revenue Expenses

(Example) Overstated Overstated Understated

Question 8 (0.5 mark)

Prepare an adjusted trial balance from the following account information, considering the

adjustment data provided (assume accounts have normal balances).

Account payable $ 11,700

Accounts receivable 17,100

Administrative expense 54,800

Cash 44,800

Owner’s capital 30,000

Prepaid insurance 16,000

Service revenue 91,000

Adjustments needed:

• Salaries due to administrative employees, but unpaid at period end, $2,000

• Insurance still unexpired at end of the period, $12,000

Question 9 (0.5 mark)

From the following SEEDS FASHION adjusted trial balance, prepare financial statements, as

follows:

a. Income Statement

b. Owner’s Equity Statement

c. Classified Balance Sheet

SEEDS FASHION

Adjusted Trial Balance

December 31,2020

Debit Credit

Cash $ 1,300

Accounts Receivable 1,500

Office Supplies 1,800

Equipment 20,900

Accumulated Depreciation – Equipment $ 2,200

Account Payble 400

Interest Payable 500

Note Payable (due in 11 months) 3,100

Seeds, Capital 16,150

Seeds, Withdrawals 1,400

Service revenue 13,800

Rent Expense 3,900

Supplies Expense 850

Depreciation Expense – Equipment 2,200

Interest Expense 2,300 .

Total $36,150 $36,150

Question 10 (0.5 marks)

Using the information from question 9, prepare the closing entries and prepare the post-closing

trial balance for SEEDS Clothing.

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Adjusting EntriesDocument5 pagesAdjusting EntriesM Hassan BrohiNo ratings yet

- ACCT 1005 - Worksheet - 2Document12 pagesACCT 1005 - Worksheet - 2Rick SimmsNo ratings yet

- ACCT10002 Tutorial 2 Exercises, 2020 SM1Document6 pagesACCT10002 Tutorial 2 Exercises, 2020 SM1JING NIENo ratings yet

- Principles of Accounting (ACC-1101)Document4 pagesPrinciples of Accounting (ACC-1101)hojegaNo ratings yet

- Homework 4題目Document2 pagesHomework 4題目劉百祥No ratings yet

- Accounting Assignment 04A 207Document10 pagesAccounting Assignment 04A 207Aniyah's RanticsNo ratings yet

- Problem Sheet 4 Summer 22Document4 pagesProblem Sheet 4 Summer 22Md Tanvir AhmedNo ratings yet

- Chapter 4 - Complete The Accounting Cycle Practice Set A: Exercise 4.1A - Prepare Correcting EntriesDocument8 pagesChapter 4 - Complete The Accounting Cycle Practice Set A: Exercise 4.1A - Prepare Correcting EntriesBảo GiangNo ratings yet

- Eco & Actg for Engineers Assignment SolutionsDocument6 pagesEco & Actg for Engineers Assignment SolutionsNayeem HossainNo ratings yet

- Chapter 4 4 4 4 4Document7 pagesChapter 4 4 4 4 4Rabie HarounNo ratings yet

- Arab Final 90% Fall2021 (YS)Document8 pagesArab Final 90% Fall2021 (YS)ahmed abuzedNo ratings yet

- Adjusting EntryDocument8 pagesAdjusting EntryRaeha Tul Jannat BuzdarNo ratings yet

- Work Sheet On Financial AccountingDocument3 pagesWork Sheet On Financial AccountingFantayNo ratings yet

- Unit 3 Tutorial Worksheet (Session 1)Document15 pagesUnit 3 Tutorial Worksheet (Session 1)MingxNo ratings yet

- Review Accounting 1Document9 pagesReview Accounting 1jhouvanNo ratings yet

- Unadjusted Trial BalanceDocument10 pagesUnadjusted Trial BalanceMingxNo ratings yet

- Sample Midterm Exam With SolutionDocument17 pagesSample Midterm Exam With Solutionq mNo ratings yet

- Chapter 3 Practice QuestionsDocument3 pagesChapter 3 Practice QuestionsFamily PicturesNo ratings yet

- PA-1 Adjusments and Worksheet (Problems)Document5 pagesPA-1 Adjusments and Worksheet (Problems)Safira ChairunnisaNo ratings yet

- Class ExerciseDocument14 pagesClass ExerciseAbdul Basit MalikNo ratings yet

- Group Assignment - Questions - RevisedDocument6 pagesGroup Assignment - Questions - Revised31231023949No ratings yet

- Homework Chapter 4Document17 pagesHomework Chapter 4Trung Kiên Nguyễn100% (1)

- Chapter 5Document27 pagesChapter 5nadima behzadNo ratings yet

- Accounting Homework AdjustmentsDocument5 pagesAccounting Homework AdjustmentsHasan NajiNo ratings yet

- Accounting ProcessDocument3 pagesAccounting Processabernardino.forschoolNo ratings yet

- Individual Assignment.123Document5 pagesIndividual Assignment.123Tsegaye BubamoNo ratings yet

- CH 3Document10 pagesCH 3Mohammed mostafaNo ratings yet

- 01 - FINC 0200 IP - Assignment Units 1 - 6 Questions - Winter 2022Document6 pages01 - FINC 0200 IP - Assignment Units 1 - 6 Questions - Winter 2022hermitpassiNo ratings yet

- Chapter 2 Problems and Solutions EnglishDocument8 pagesChapter 2 Problems and Solutions EnglishyandaveNo ratings yet

- CHAPTER-3-Bai-tap (1)Document19 pagesCHAPTER-3-Bai-tap (1)Phuong Anh HoangNo ratings yet

- Acc101 - Chapter 2: Accounting For TransactionsDocument16 pagesAcc101 - Chapter 2: Accounting For TransactionsMauricio AceNo ratings yet

- Adjust Financial Statements & Prepare ReportsDocument1 pageAdjust Financial Statements & Prepare ReportsalexandraNo ratings yet

- BX2011 Topic06 Workshop Solutions 2022Document10 pagesBX2011 Topic06 Workshop Solutions 2022yanboliu96No ratings yet

- Exercise Chapter 3Document7 pagesExercise Chapter 3leen attilyNo ratings yet

- Accounting Analysis of TransactionsDocument14 pagesAccounting Analysis of TransactionscamilleNo ratings yet

- FOA ExamDocument3 pagesFOA ExamyeshaNo ratings yet

- FundAcct I @2015 AssignmntDocument6 pagesFundAcct I @2015 AssignmntGedion FeredeNo ratings yet

- (Adjusting Entries) The Ledger of Chopin Rental Agency On March 31 of The Current YearDocument3 pages(Adjusting Entries) The Ledger of Chopin Rental Agency On March 31 of The Current YearFlorencia IrenaNo ratings yet

- Soal Latihan DDADocument1 pageSoal Latihan DDAMutia AzzahraNo ratings yet

- PA-HW Chap3 + 4Document8 pagesPA-HW Chap3 + 4Hà Anh ĐỗNo ratings yet

- Class Exercise Session 5 and 6Document8 pagesClass Exercise Session 5 and 6Sumeet KumarNo ratings yet

- CH03Document3 pagesCH03Fuyiko Kaneshiro HosanaNo ratings yet

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionNo ratings yet

- Make-Up AssignmentDocument5 pagesMake-Up AssignmentRileyNo ratings yet

- Midterms Problem SolvingDocument3 pagesMidterms Problem SolvingTRINA ARUTANo ratings yet

- Kirby Company Financial AnalysisDocument6 pagesKirby Company Financial AnalysisvanessaNo ratings yet

- Chapter 3 exercisesDocument8 pagesChapter 3 exercisesNguyen Khanh Ly K17 HLNo ratings yet

- CH 02Document4 pagesCH 02flrnciairnNo ratings yet

- Exercise 2ADocument3 pagesExercise 2A31231020764No ratings yet

- Exercise Chap 3Document28 pagesExercise Chap 3JF FNo ratings yet

- Tugas Kelompok Ke-1 Week 3/ Sesi 4: EssayDocument5 pagesTugas Kelompok Ke-1 Week 3/ Sesi 4: Essayadelia zahraNo ratings yet

- ADJUSTING ENTRIESDocument4 pagesADJUSTING ENTRIESsinta agnes100% (1)

- BSIT-EVENING FINANCIAL ACCOUNTING Assignment No.7 20-ARID-684 PROBLEMS -BDocument7 pagesBSIT-EVENING FINANCIAL ACCOUNTING Assignment No.7 20-ARID-684 PROBLEMS -Bibrar ghaniNo ratings yet

- Ahsan Saleem 18-Arid-2445 Finn..Document11 pagesAhsan Saleem 18-Arid-2445 Finn..HumnaZaheer muhmmadzaheerNo ratings yet

- Unit 2 WorksheetDocument13 pagesUnit 2 WorksheetHhvvgg BbbbNo ratings yet

- Accounting Unit 4Document3 pagesAccounting Unit 4Swapan Kumar SahaNo ratings yet

- Mr. Sam's new consulting company transactionsDocument7 pagesMr. Sam's new consulting company transactionsMoni TafechNo ratings yet

- Exercise-2BDocument2 pagesExercise-2Bmytu261105No ratings yet

- ĐỀ THI NLKT - ĐỀ 5Document4 pagesĐỀ THI NLKT - ĐỀ 5Hợp BáchNo ratings yet

- Galgotia'S Institute of Management &technology: Summer Training Project ReportDocument82 pagesGalgotia'S Institute of Management &technology: Summer Training Project ReportNeeraj TripathiNo ratings yet

- Revision Questions - Final Exam - 4Document13 pagesRevision Questions - Final Exam - 4Vivian WongNo ratings yet

- Kotak Mahindra StrategyDocument34 pagesKotak Mahindra StrategyShaddab AliNo ratings yet

- Journal Entries and Ledger Accounts - FinalDocument6 pagesJournal Entries and Ledger Accounts - FinalMukul SinhaNo ratings yet

- Deepak Saini: Account Relationship SummaryDocument20 pagesDeepak Saini: Account Relationship SummaryDeepak SainiNo ratings yet

- Exercises On Cash Flow Statement AnalysisDocument3 pagesExercises On Cash Flow Statement AnalysisBoa HancockNo ratings yet

- Uts - Apli Audit - Aurellia - 201870018Document13 pagesUts - Apli Audit - Aurellia - 201870018Aurellia AngelineNo ratings yet

- 001 Government AccountingDocument75 pages001 Government AccountingMark Brian Parantar100% (1)

- PAD Agreement enDocument2 pagesPAD Agreement enGangsta101No ratings yet

- GOVERNMENT FUND PROBLEMSDocument23 pagesGOVERNMENT FUND PROBLEMS20211211017 SKOLASTIKA ANABELNo ratings yet

- Steps in The Accounting Process (Cycle) : Lecture NotesDocument12 pagesSteps in The Accounting Process (Cycle) : Lecture NotesGlen JavellanaNo ratings yet

- Hotel For Sap (General Presentation SS) - Piccola - EngDocument16 pagesHotel For Sap (General Presentation SS) - Piccola - EngHarry NugrahaNo ratings yet

- Fund Flow Statement Changes in FinancialDocument37 pagesFund Flow Statement Changes in FinancialRaju Net CafeNo ratings yet

- Quiz (Dicky Irawan - C1i017051)Document3 pagesQuiz (Dicky Irawan - C1i017051)DICKY IRAWAN 1No ratings yet

- Sharada Mandir ISC 12 Accounts Term1 2017Document3 pagesSharada Mandir ISC 12 Accounts Term1 2017Manish SainiNo ratings yet

- Notes For Students Amalgamation 1Document3 pagesNotes For Students Amalgamation 1vanvunNo ratings yet

- Risk Hedeging Accounting Public LatestDocument17 pagesRisk Hedeging Accounting Public Latesttribhuwan kharkwalNo ratings yet

- Accounting 511 - ConsignmentDocument6 pagesAccounting 511 - ConsignmentLorenz BaguioNo ratings yet

- PDD - Accounts PayableDocument32 pagesPDD - Accounts PayableOana CraciunNo ratings yet

- Accounting For Special TransactionDocument2 pagesAccounting For Special TransactionJoresol AlorroNo ratings yet

- Government Property: Accounting Principles and Business TransactionsDocument20 pagesGovernment Property: Accounting Principles and Business TransactionsRandy Magbudhi100% (4)

- Control Account ExercisesDocument5 pagesControl Account ExercisesAbid Ahmed100% (3)

- Ii Puc Accountancy: Scheme of Valuation 30 (NS)Document12 pagesIi Puc Accountancy: Scheme of Valuation 30 (NS)Shakti S SarvadeNo ratings yet

- PARTNERSHIP2Document13 pagesPARTNERSHIP2Anne Marielle UyNo ratings yet

- Recording Financial Transactions ProjectDocument17 pagesRecording Financial Transactions Projectkevin bhattaraiNo ratings yet

- My ReportDocument57 pagesMy Reportirfan0336100% (1)

- Accounting Learn ModuleDocument28 pagesAccounting Learn ModuleKUHINJANo ratings yet

- Tally PaperDocument3 pagesTally Papergitu219No ratings yet

- Anthony and Anjo-Audit of Stockholders' EquityDocument14 pagesAnthony and Anjo-Audit of Stockholders' EquityCodeSeeker75% (4)

- Oracle Receivables: Technical & Functional OverviewDocument19 pagesOracle Receivables: Technical & Functional OverviewMuhammad Luqman100% (1)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (13)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantFrom EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantRating: 4.5 out of 5 stars4.5/5 (146)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyFrom EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyRating: 5 out of 5 stars5/5 (1)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)

- Ledger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceFrom EverandLedger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceNo ratings yet

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsFrom EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsRating: 5 out of 5 stars5/5 (1)

- Profit First for Therapists: A Simple Framework for Financial FreedomFrom EverandProfit First for Therapists: A Simple Framework for Financial FreedomNo ratings yet

- Financial Accounting For Dummies: 2nd EditionFrom EverandFinancial Accounting For Dummies: 2nd EditionRating: 5 out of 5 stars5/5 (10)

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeFrom EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeRating: 4 out of 5 stars4/5 (21)

- Small Business Startup: How to Start a Business and Go from Idea and Business Plan to Marketing and ScalingFrom EverandSmall Business Startup: How to Start a Business and Go from Idea and Business Plan to Marketing and ScalingRating: 5 out of 5 stars5/5 (1)

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetFrom EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetNo ratings yet

- Bookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesFrom EverandBookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesRating: 5 out of 5 stars5/5 (4)

- The Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyFrom EverandThe Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyRating: 4 out of 5 stars4/5 (4)

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 5 out of 5 stars5/5 (1)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)From EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Rating: 4 out of 5 stars4/5 (33)

- Accounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)From EverandAccounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)Rating: 4.5 out of 5 stars4.5/5 (5)