Professional Documents

Culture Documents

Banking Laws

Uploaded by

apoorva0 ratings0% found this document useful (0 votes)

4 views2 pagesOriginal Title

banking laws

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views2 pagesBanking Laws

Uploaded by

apoorvaCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

BANKING LAWS

UNIT I:

Evolution of banking law;

Types of Banking institutions in Indian Banking Sector;

Role of World Bank in Indian Banking Sector

Role of International Monetary Fund in Indian Banking Sector

UNIT II:

Kinds and Legal Framework of Banking Instruments;

Banker and customer relationship as borrowers and lien;

Reconstruction and Reorganization of Banking Companies

Suspension and Winding Up of Business Of Banking Companies

UNIT III

Banking Regulation Act, 1949:

Conduct of Banking Business and

Control on Co-Operative Banks;

Reserve Bank of India Act, 1934:

General Provisions and Penalties,

Function of RBI,

Control of RBI over Non-banking Institutions and Financial Institutions,

Regulatory Framework Over The Banks and Frauds,

Forgeries and Vigilance

UNIT IV:

Negotiable Instrument Act, 1881:

Definition and characteristic of Negotiable Instruments,

Types of Negotiable Instruments ---Promissory Note, Bill of Exchange

and Cheque,

Liabilities and Capacity of Parties of Negotiable

Instrument,

Holder and Holder in due course,

Transfer and Negotiation of Negotiable Instrument,

Dishonour of Cheques and Endorsement.

UNIT IV

Banking Ombudsman,

E-Banking Process and Legal Framework and

Recent Trends in Banking: Automatic Teller Machine and Internet Banking,

Smart Credit Cards,

Banking Frauds.

You might also like

- 3rd Sem B, L&o 1.docx 2Document85 pages3rd Sem B, L&o 1.docx 2shree harsha cNo ratings yet

- Law of Banking and Insurance in Nigeria by IsochukwuDocument17 pagesLaw of Banking and Insurance in Nigeria by IsochukwuVite Researchers100% (1)

- Banking Law BookDocument179 pagesBanking Law Bookbhupendra barhatNo ratings yet

- Chapter 2. L2.2 Legal Regime To Control Banking FraudsDocument8 pagesChapter 2. L2.2 Legal Regime To Control Banking FraudsvibhuNo ratings yet

- Course Material Nlsiu MBLDocument6 pagesCourse Material Nlsiu MBLManjunatha GNo ratings yet

- Payment and Settlement SystemsDocument42 pagesPayment and Settlement Systemssm_12m40280% (1)

- Banking & Insurance Law SyllabusDocument3 pagesBanking & Insurance Law Syllabusriko avNo ratings yet

- Banking Law SyllabusDocument5 pagesBanking Law SyllabusVicky DNo ratings yet

- Banking Laws - Updated Syllabus PDFDocument4 pagesBanking Laws - Updated Syllabus PDFjerinNo ratings yet

- 4 Banking LawDocument2 pages4 Banking Lawdb.law1708No ratings yet

- 4 Banking LawDocument2 pages4 Banking LawJohnNo ratings yet

- 4 Banking Law PDFDocument2 pages4 Banking Law PDFJohnNo ratings yet

- BNK211 Banking LawDocument2 pagesBNK211 Banking LawdhitalkhushiNo ratings yet

- 75ad8sem IX Banking and Insurance Law-Pdf - 2Document1 page75ad8sem IX Banking and Insurance Law-Pdf - 2Om H TiwariNo ratings yet

- Syllabus Sem IXDocument6 pagesSyllabus Sem IXAbhimanyuNo ratings yet

- Syllabus AibpDocument21 pagesSyllabus Aibp1233kas75% (4)

- UG - B.B.A - English - 104 42 - Banking Law and Practice-II - English - 9280Document490 pagesUG - B.B.A - English - 104 42 - Banking Law and Practice-II - English - 9280Kathiravan SNo ratings yet

- Paper 3 SyallbusDocument2 pagesPaper 3 SyallbusAditya RajNo ratings yet

- Baking PPPTDocument69 pagesBaking PPPTJøñë ÊphrèmNo ratings yet

- 10 Legal Aspects of BankingDocument7 pages10 Legal Aspects of BankingFalguni SarmalkarNo ratings yet

- Banking Law SyllabusDocument2 pagesBanking Law SyllabusAbhjeet Kumar SinhaNo ratings yet

- Law !VDocument6 pagesLaw !VsachinNo ratings yet

- Banking ProjectDocument9 pagesBanking ProjectYashvardhan sharmaNo ratings yet

- MBA III Sem Finance Unsolved 2022 CompressedDocument36 pagesMBA III Sem Finance Unsolved 2022 CompressedAli ShaikhNo ratings yet

- Law SyllabusDocument3 pagesLaw SyllabusAsad IqbalNo ratings yet

- TN LLB Syllabus Book 3 Yrs-21-25Document5 pagesTN LLB Syllabus Book 3 Yrs-21-25HEMALATHA SNo ratings yet

- Law Syllabus BasicDocument1 pageLaw Syllabus Basicsayan biswasNo ratings yet

- NI Act, Nomination & TDSDocument76 pagesNI Act, Nomination & TDSPreetha ChelladuraiNo ratings yet

- AB Legal Banking For BOB Clerical To Officer Promotion Exam PDFDocument37 pagesAB Legal Banking For BOB Clerical To Officer Promotion Exam PDFNarayanan RajagopalNo ratings yet

- RBI's Circular Was To Choke The Agencies That Sought To Provide A Platform To Facilitate Trading inDocument4 pagesRBI's Circular Was To Choke The Agencies That Sought To Provide A Platform To Facilitate Trading inSingh JagdishNo ratings yet

- Banking and Ins PDFDocument94 pagesBanking and Ins PDFsakshiNo ratings yet

- Course Manual BInsurance LawsDocument5 pagesCourse Manual BInsurance LawsGarima SrivastavaNo ratings yet

- Business Regulatory (Pre-Final)Document11 pagesBusiness Regulatory (Pre-Final)Faith BariasNo ratings yet

- Syllabus For Test On Awareness About Securities Market' of Phase I Securities MarketsDocument5 pagesSyllabus For Test On Awareness About Securities Market' of Phase I Securities MarketsManipal SinghNo ratings yet

- Banking LawDocument78 pagesBanking Lawjerome143No ratings yet

- Syllabus Banking Diploma, IBB 5Document2 pagesSyllabus Banking Diploma, IBB 5sohanantashaNo ratings yet

- Respondet BehalfDocument10 pagesRespondet BehalfMashroor AhmadNo ratings yet

- Criminology: Socioeconomic Offences: Nature and Dimensions Bank Fraud-Types and PreventionDocument19 pagesCriminology: Socioeconomic Offences: Nature and Dimensions Bank Fraud-Types and PreventionSaif ShaikhNo ratings yet

- PCC203Document2 pagesPCC203DushyantNo ratings yet

- BKG Law and Practice - 1,2 & 3 UnitsDocument53 pagesBKG Law and Practice - 1,2 & 3 Unitskheman864No ratings yet

- BANKING - Question BankDocument3 pagesBANKING - Question BankVarunPratapMehtaNo ratings yet

- BLP AssignmentDocument2 pagesBLP AssignmentSekar MuruganNo ratings yet

- B.a.ll.b (Five Year Course) Part-IV (Sem Vii&Viii) - 1Document8 pagesB.a.ll.b (Five Year Course) Part-IV (Sem Vii&Viii) - 1g380No ratings yet

- Banking Law Study MaterialsDocument384 pagesBanking Law Study MaterialsAnjanaNairNo ratings yet

- CHAPTER 2 Banker Customer RelationshipDocument21 pagesCHAPTER 2 Banker Customer RelationshipCarl AbruquahNo ratings yet

- Banking Law Negotiable Instruments Act PDFDocument3 pagesBanking Law Negotiable Instruments Act PDFJohnNo ratings yet

- Credits:3 3: SyllabusDocument2 pagesCredits:3 3: SyllabusAryan RajNo ratings yet

- Syllabus Class: - B.B.A. VI SemesterDocument61 pagesSyllabus Class: - B.B.A. VI SemesterIndhuja MNo ratings yet

- Banking Law Honors PaperDocument4 pagesBanking Law Honors PaperDudheshwar SinghNo ratings yet

- LLBDocument9 pagesLLBuseridnoNo ratings yet

- Banking LawDocument23 pagesBanking LawartiNo ratings yet

- Banking Law Optional Paper I & Ii Course Teacher: Dr. Kiran Kori Objectives of The CourseDocument3 pagesBanking Law Optional Paper I & Ii Course Teacher: Dr. Kiran Kori Objectives of The CourseNaveen SihareNo ratings yet

- Banking TheoryDocument56 pagesBanking TheoryChella KuttyNo ratings yet

- Banking Regulations and Services: Dr.N.Ramesh KumarDocument82 pagesBanking Regulations and Services: Dr.N.Ramesh KumarrameshncmNo ratings yet

- RBI VC CaseDocument10 pagesRBI VC Casearpit kumarNo ratings yet

- Banking LawDocument3 pagesBanking LawRajivCoolNo ratings yet

- Money and Banking2Document2 pagesMoney and Banking2Mohammad Abdullah NabilNo ratings yet

- Loan LendingDocument5 pagesLoan LendingkumbuNo ratings yet

- Paper 1 - Principles & Practices of Banking Module A - Indian Financial SystemDocument4 pagesPaper 1 - Principles & Practices of Banking Module A - Indian Financial Systemakranjan888No ratings yet

- International Trade Law - Class NotesDocument1 pageInternational Trade Law - Class NotesapoorvaNo ratings yet

- Journals Illo 14 1 Article-P284 - PreviewDocument2 pagesJournals Illo 14 1 Article-P284 - PreviewapoorvaNo ratings yet

- Compilation - LLB - VI SemDocument75 pagesCompilation - LLB - VI SemapoorvaNo ratings yet

- International Commercial ArbitrationDocument2 pagesInternational Commercial ArbitrationapoorvaNo ratings yet

- Mergers and Acquisition LawDocument1 pageMergers and Acquisition LawapoorvaNo ratings yet

- Local Self Government Including Panchayat AdministrationDocument1 pageLocal Self Government Including Panchayat AdministrationapoorvaNo ratings yet

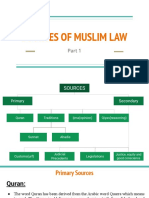

- Muslim Law Lecture 1Document9 pagesMuslim Law Lecture 1apoorvaNo ratings yet

- Science Technology and Human Rights LawDocument2 pagesScience Technology and Human Rights LawapoorvaNo ratings yet

- Muslim Law Lecture 2Document11 pagesMuslim Law Lecture 2apoorvaNo ratings yet

- Muslim Law Lecture 3Document10 pagesMuslim Law Lecture 3apoorvaNo ratings yet