Professional Documents

Culture Documents

Researchers Recently Examined The Initial Public Offering (IPO) Multi-Source Reasoning 2

Uploaded by

Jeff LeeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Researchers Recently Examined The Initial Public Offering (IPO) Multi-Source Reasoning 2

Uploaded by

Jeff LeeCopyright:

Available Formats

NEW HERE?

2 LEARN MORE close 3 3

FORUM GMAT TESTS MBA DEALS REVIEWS MARKETPLACE CHAT 4ever760

Forum Home GMAT Data Insights Questions Multi-Source Reasoning Unanswered Active Topics

My Error Log My GMAT Classic Tests My GMAT Focus Tests PM: 5 New Decision Tracker My Rewards New posts My posts New comers' posts

Researchers recently examined the initial public offering (IPO) FOLLOW Hi 4ever760,

Here are updates for you:

14 POSTS Go to First Unread Post Print view

ANNOUNCEMENTS

NEW TOPIC POST REPLY QUESTION BANKS DOWNLOADS MY BOOKMARKS IMPORTANT TOPICS REVIEWS

Admitted to Stanford, Booth,

Search for and Haas | My GRE and MBA

Success

Show Tags

Researchers recently examined the initial public offering (IPO)

Updated on: 04 Oct 2023, 01:09

[#permalink]

15 Bookmarks Expert Reply Build a Quiz

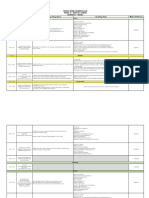

IPO Pricing 1994-2008 IPOs

L

00:00

Sajjad1994 Researchers recently examined the initial public offering (IPO)

-- a private firm's first sale of stock shares to the public -- of DIFFICULTY: QUESTION STATS: Saturday, Feb 24,

IR & RC Forum Moderator

firms listed on Kenya's Nairobi Stock Exchange (NSE) 45% (medium) 68% (02:38) correct 32% (02:31) wrong based on 136 sessions 10am NY; 3pm London, 8:30pm Mumbai

Joined: 02 Nov 2016 between 1994 and 2008. During this time, the number of IPOs

HIDE TIMER STATISTICS

Status:GMAT Club Team listed per year varied from zero to four. The researchers

Member wanted to examine the extent to which four different variables 1. The discussion of the researchers' study of Kenyan IPOs refers

Affiliations: GMAT Club -- investor sentiment, firm size, board prestige, and firm age -- to "board prestige" primarily to

affected the IPO stock share price, which is set by the firm. Subscribe to us on YouTube AND Get FREE

Posts: 14504

They hypothesized that all four variables would show a strong help explain why investor sentiment toward some firms is Access to Premium GMAT Question Bank for 7

Own Kudos [?]: 30873 [15]

sometimes very low Days

positive correlation with this IPO asking price. However, after

Given Kudos: 5696 examing the firms listed, they were surprised to find that none

caution that some variables should not be considered accurate

of the variables showed a strong positive correlation with IPO

predictors of IPO pricing

GPA: 3.62

pricing, and in fact investor sentiment and board prestige both Free GMAT Club Tests,

FOLLOW showed a strong negative correlation. introduce one of the variables whose relationship to IPO pricing Internships at GMAT Club, FT

Send PM

surprised the researchers MBA Rankings, more GMAT &

The researcheres also discovered that nearly all of these IPOs MBA stories

point to one of the attributes firms often used to generate investor

were underprised by an average of 50 percent, which is to say

interest in their IPO

the IPO share prices were about half of what the share prices

were at the close of the first day of trading. Such underpricing demonstrate that some attributes of a firm are often negatively

constitutes a loss to the listed firm because the firm could correlated with the firm's IPO price

have immediately raised more money with a higher price. The

researchers noted that firms should take care to set an IPO Submit

price low enough to capture investor interest but high enough

Click Submit to add this question to your Error log

to generate sufficient capital for the firm.

Show Answer

Subscribe to us on YouTube AND Get FREE

Access to Premium GMAT Question Bank for 7

00:00

Days

DIFFICULTY: QUESTION STATS: Financial Times MBA Rankings 2024

65% (hard) 42% (01:33) correct 58% (01:35) wrong based on 155 sessions

HIDE TIMER STATISTICS

2. For each of the following statements, select Inferable if the

statement is reasonably inferable from the information provided

about the NSE IPOs. Otherwise select Not Inferable.

Yes No

IPOs of firms with prestigious boards were mor likely to be

underpriced than those of other firms.

Firestone East Africa set its IPO price slightly lower than it

should have.

At least one of the firms examined by the researchers did

not have an underpriced IPO.

Submit

Click Submit to add this question to your Error log

Show Answer

M7 & T15 Free Interview Prep

00:00 with Students & Experts

DIFFICULTY: QUESTION STATS:

95% (hard) 29% (02:10) correct 71% (01:51) wrong based on 130 sessions

HIDE TIMER STATISTICS

3. For each of the following statements, select Supported if the

statement is supported by the information provided about NSE

IPOs. Otherwise select Not supported.

Supported Not Supported

AGSM at UNIVERSITY OF CALIFORNIA

The board of Safaricom was likely

RIVERSIDE

considered more prestigious than that of

Co-Operative Bank at the time of their

IPOs.

Kenya Re and Eveready were Tuck at Dartmouth

approximately the same size firms at the

time of their IPOs. Highly Skilled and Ready to Lead, Tuck’s

Latest MBA Graduates Coveted by Top Firms

When their IPO prices were set, investor Tuck graduates remain in high demand at top

sentiment was likely more favorable firms around the world. For the third consecutive

toward Kengen than toward Scangroup year—and ninth out of the last 10—95 percent

or Eveready. or more of the latest Tuck graduates received a

job offer within three months after graduation.

Submit

Read More

Click Submit to add this question to your Error log

Show Answer Goizueta MBA at Emory

Goizueta delivers the only top-25 MBA with small

classes in a dynamic, global city. Become a

Show Spoiler

forward-focused, strategic leader with the Emory

advantage.

Originally posted by Sajjad1994 on 25 Apr 2020, 02:10.

Last edited by BottomJee on 04 Oct 2023, 01:09, edited 8 times in total.

Moved to the new forum

LATEST POSTS

+1 Kudos Build a Quiz Report a Problem Quote

XLRI ExPGDM(earlier known as GMP)

Program 2024 intake Class of 2025

Re: Researchers recently examined the initial public offering (IPO)

25 Apr 2020, 06:46 12 mins RatnaSingh

[#permalink]

Which of the following functions has as its

2 Kudos domain the set of all real

13 mins LamboWalker

1)C,introduce one of the variables whose relationship to IPO pricing surprised the researchers,since it gives a surprise to the researchers

D that why underpricing was there and what are parameters to compelete the study. Calling Simon Rochester MBA Applicants:

2024 Intake Class of 2026

Apt0810 2)a)No,since with prestigious board negative correlation was there and it was not increasing the likelihood 17 mins Acueep

Senior Manager b)No,it set a higher price

In the 1930’s and 1940’s, African American

Joined: 15 Jul 2018 c)Yes,Firststone and Mumias sugar are exceptions industrial workers in the s

Posts: 351 25 mins SnorLax_7

3)a) Supported beacuse safaricom had more underpricing

Own Kudos [?]: 376 [2] b)Not supported since there is nothing mentioned about firm size People who have spent a lot of time in contact

with animals often

Given Kudos: 94 c)Not supported since that might be less supported and effect could be from board prestige

27 mins samagra__

FOLLOW Posted from my mobile device

More Latest posts

Send PM

+1 Kudos Report a Problem Quote

Re: Researchers recently examined the initial public offering (IPO)

26 Apr 2020, 05:57

[#permalink]

L

1 Kudos

bM22

1. The discussion of the researchers' study of Kenyan IPOs refers to "board prestige" primarily to

Retired Moderator

Joined: 05 May 2016 A. help explain why investor sentiment toward some firms is sometimes very low

Posts: 799 B. caution that some variables should not be considered accurate predictors of IPO pricing

C. introduce one of the variables whose relationship to IPO pricing surprised the researchers

Own Kudos [?]: 672 [1]

D. point to one of the attributes firms often used to generate investor interest in their IPO

Given Kudos: 1316

E. demonstrate that some attributes of a firm are often negatively correlated with the firm's IPO price

Location: India

Schools: IIM (A) IIM (A)

IIM-A '24 (A) ISB '24 (A) Correct Answer - C,

Explanation - as mentioned in the para: They hypothesized that all four variables would show a strong positive correlation with this IPO

FOLLOW asking price. However, after examing the firms listed, they were surprised to find that none of the variables showed a strong positive

Send PM correlation with IPO pricing, and in fact investor sentiment and board prestige both showed a strong negative correlation.

2. For each of the following statements, select Inferable if the statement is reasonably inferable from the information provided about the NSE

IPOs. Otherwise select Not Inferable.

1. No - since as we saw, the board prestige had a negative effect on pricing.

2. No - its the opposite as we can infer from the last row of the table.

3. Yes - Firestone, and Mumias Sugar have -1.41 and 0.00% underpricing.

3. For each of the following statements, select Supported if the statement is supported by the information provided about NSE IPOs.

Otherwise select Not supported.

1. Supported, as we can infer from the table row of Safaricom and Co-operative bank and the information in the passage above, that the

mentioned statement is supported by the information.

2. Not Supported, nothing is mentioned in the passage w.r.t firm size and its effect of the pricing of IPO's.

3. Not Supported, as we cannot explicitly infer, if it was actually from the investor sentiment or other factors like board pricing (which is

actually mentioned).

+1 Kudos Report a Problem Quote

Re: Researchers recently examined the initial public offering (IPO)

27 Jun 2020, 07:33

[#permalink]

3 Kudos

Can someone please explain, how the below statements have the opposite answers? Either both should be Yes( and in my opinion Yes

B should be the answer ) or both should be No.

Suryanshi "IPOs of firms with prestigious boards were more likely to be underpriced than those of other firms"

Current Student

Joined: 06 Oct 2019 "The board of Safaricom was likely considered more prestigious than that of Co-Operative Bank at the time of their IPOs"

Posts: 14

Own Kudos [?]: 6 [3]

Given Kudos: 8

Schools: Tepper '23 (A)

FOLLOW

Send PM +1 Kudos Report a Problem Quote

Re: Researchers recently examined the initial public offering (IPO)

27 Jun 2020, 11:07

[#permalink]

L

1 Kudos

bM22

Suryanshi wrote:

Retired Moderator

Joined: 05 May 2016

Can someone please explain, how the below statements have the opposite answers? Either both should be Yes( and in my opinion Yes

Posts: 799 should be the answer ) or both should be No.

Own Kudos [?]: 672 [1]

"IPOs of firms with prestigious boards were more likely to be underpriced than those of other firms"

Given Kudos: 1316

Location: India "The board of Safaricom was likely considered more prestigious than that of Co-Operative Bank at the time of their IPOs"

Schools: IIM (A) IIM (A)

IIM-A '24 (A) ISB '24 (A)

FOLLOW

Hi Suryanshi,

Send PM

1. The answer to :"IPOs of firms with prestigious boards were more likely to be underpriced than those of other firms" would be No, as its

mentioned in the IPO Pricing passage: "However, after examing the firms listed, they were surprised to find that none of the variables

showed a strong positive correlation with IPO pricing, and in fact investor sentiment and board prestige both showed a strong negative

correlation."

=> the board prestige had a negative effect on pricing.

2. The answer to : "The board of Safaricom was likely considered more prestigious than that of Co-Operative Bank at the time of their IPOs"

- this would true, i.e supported as asked in the question, since we can infer from the table row of Safaricom and Co-operative bank and the

information in the passage above, that the mentioned statement is supported by the information.

Hope it helps.

thanks.

+1 Kudos Report a Problem Quote

Re: Researchers recently examined the initial public offering (IPO)

28 Jun 2020, 05:41

[#permalink]

Hi bm2201,

B

Thank you for the explanation. Really appreciate that. But I am still not able to understand and here is the reason.

Suryanshi

Current Student What I deduce from below line ""However, after examing the firms listed, they were surprised to find that none of the variables showed a

Joined: 06 Oct 2019 strong positive correlation with IPO pricing, and in fact investor sentiment and board prestige both showed a strong negative correlation" is

that since board prestige has a negative correlation with IPO pricing, so if board prestige is high, IPO pricing will be low and this is what

Posts: 14

sentence "IPOs of firms with prestigious boards were more likely to be underpriced than those of other firms" says.

Own Kudos [?]: 6 [0]

Given Kudos: 8 Seeing the data of Co-operative bank and Safari bank, we were able to relate the difference in their prices at the day start and day end with

Schools: Tepper '23 (A) board prestige. Safaricom was more undervalued and therefore it was likely that its board had more prestige than co-operative bank's.

That's why the answer for this statement "The board of Safaricom was likely considered more prestigious than that of Co-Operative Bank at

FOLLOW the time of their IPOs" was Yes.

Send PM

Based on above reasoning according to me answer to the first statement should also be Yes. Now, I know there must be big loophole in my

understanding somewhere. Would really appreciate if you can pinpoint the same.

+1 Kudos Report a Problem Quote

Re: Researchers recently examined the initial public offering (IPO)

22 Dec 2020, 16:48

[#permalink]

2 Kudos

Suryanshi wrote:

B

maikikiuu Hi bm2201,

Intern Thank you for the explanation. Really appreciate that. But I am still not able to understand and here is the reason.

Joined: 30 Sep 2018

What I deduce from below line ""However, after examing the firms listed, they were surprised to find that none of the variables

Posts: 23

showed a strong positive correlation with IPO pricing, and in fact investor sentiment and board prestige both showed a strong

Own Kudos [?]: 8 [2] negative correlation" is that since board prestige has a negative correlation with IPO pricing, so if board prestige is high, IPO pricing

Given Kudos: 112 will be low and this is what sentence "IPOs of firms with prestigious boards were more likely to be underpriced than those of other

firms" says.

FOLLOW

Seeing the data of Co-operative bank and Safari bank, we were able to relate the difference in their prices at the day start and day

Send PM end with board prestige. Safaricom was more undervalued and therefore it was likely that its board had more prestige than co-

operative bank's. That's why the answer for this statement "The board of Safaricom was likely considered more prestigious than that

of Co-Operative Bank at the time of their IPOs" was Yes.

Based on above reasoning according to me answer to the first statement should also be Yes. Now, I know there must be big loophole

in my understanding somewhere. Would really appreciate if you can pinpoint the same.

I agree with the OA that the first answer of Q2 should be no; but it is the answer in Q3 that is questionable.

According to the prompt, there are 2 factors that negatively relate to asking price (lower asking price --> more likely underpriced):

1. investor sentiment

2. prestigious board

The board itself will not be able to affect the asking pricing alone - one must consider the investor sentiment. Therefore, the board itself is not

an indicator of the asking price and the answer should be no.

However, the first OA for Q3 contradicts such logic, for it assumes that the board is the only factor affecting asking price (thus the

underpricing). What if the primary reason for Safaricom's underpricing is investor sentiment while the primary reason for Co-Operative

Bank's underpricing is the board?

+1 Kudos Report a Problem Quote

Re: Researchers recently examined the initial public offering (IPO)

02 May 2022, 05:36

[#permalink]

I don't understand question number 2

B

2. For each of the following statements, select Inferable if the statement is reasonably inferable from the information provided about the NSE

Tanchat IPOs. Otherwise select Not Inferable.

Manager

Joined: 31 Jan 2020 "IPOs of firms with prestigious boards were more likely to be underpriced than those of other firms."

According to the passage, it tells that

Posts: 233

However, after examining the

Own Kudos [?]: 13 [0] (15) firms listed, they were surprised to find that

Given Kudos: 139 (16) none of the variables showed a strong positive

(17) correlation with IPO pricing, and in fact investor

FOLLOW (18) sentiment and board prestige both showed a

(19) strong negative correlation.

Send PM

Therefore, prestigious boards do negatively affect to the IPO price and then make the firms underpriced.

Why the answer is no

+1 Kudos Report a Problem Quote

Re: Researchers recently examined the initial public offering (IPO)

16 Jul 2022, 12:45

[#permalink]

1 Kudos

Official Explanations for Q2 and Q3 are inconsistent:

B

Q2(1): IPOs of firms with prestigious boards were more likely to be underpriced than those of other firms.

nisen20 OE: Board prestige is one of the four variables examined by the researchers for any correlation they may have with IPO pricing. The

Manager discussion of underpriced IPOs does not involve these variables, and while board prestige is found by the researchers to be negatively

Joined: 16 Jun 2020 correlated with IPO price, it cannot therefore be inferred that a lower IPO price has any correlation with an IPO being underpriced.

The correct answer is Not inferable.

Posts: 57

Own Kudos [?]: 24 [1] Q3(1): The board of Safaricom was likely considered more prestigious than that of Co-Operative Bank at the time of their IPOs.

Given Kudos: 501 OE: The passage indicates that the researchers found a strong negative correlation between board prestige and IPO price (lines 14-19). In

other words, the lower the IPO price of a firm, the more prestigious that firm's board is likely to be. Looking at the table of Kenyan IPOs for

FOLLOW 2008, Safaricom had an IPO price of 5.00 Kenyan shillings and Co-Operative Bank had an IPO price of 9.50 shillings, suggesting that

Safaricom's board was more prestigious than Co-Operative Bank's.

Send PM

The correct answer is Supported.

Q3(3): When their IPO prices were set, investor sentiment was likely more favorable toward Kengen than toward Scangroup or Eveready.

OE: The passage indicates that the researchers found a strong negative correlation between investor sentiment and IPO price (lines 14-19).

In other words, the higher the IPO price of a firm, the lower investor sentiment toward that firm is likely to be. Looking at the table of Kenyan

IPOs for 2006, Kengen had an IPO price of 11.90 Kenyan shillings, whereas Scangroup (10.45) and Eveready (9.50) had lower IPO prices,

suggesting that investor sentiment was likely less favorable toward Kengen than toward either Scangiroup or Eveready.

The correct answer is Not supported.

Do the GMAC guys have any standard when creating questions?

+1 Kudos Report a Problem Quote

Re: Researchers recently examined the initial public offering (IPO)

23 Nov 2023, 01:51

[#permalink]

I finally understand. The sentiment and broad prestige only affect the set of the IPO price, which do not affect the first day closing price.

B Therefore, the lower the IPO price have nothing relate to the first day closing price, and the under price percentage.

xiafan0521

Intern

Joined: 08 May 2022

Posts: 1

Own Kudos [?]: 0 [0]

Given Kudos: 11

Location: China

FOLLOW

Send PM +1 Kudos Report a Problem Quote

Re: Researchers recently examined the initial public offering (IPO)

06 Jan 2024, 23:23

[#permalink]

1 Kudos

xiafan0521 wrote:

Rita77 I finally understand. The sentiment and broad prestige only affect the set of the IPO price, which do not affect the first day closing

price. Therefore, the lower the IPO price have nothing relate to the first day closing price, and the under price percentage.

Intern

Joined: 06 Jan 2024

Posts: 1

Yes. PRICING and UNDERPRICED are two different concepts. Here PRICING refers to the absolute price number.

Own Kudos [?]: 1 [1]

Given Kudos: 1

FOLLOW

Send PM +1 Kudos Report a Problem Quote

Re: Researchers recently examined the initial public offering (IPO)

14 Jan 2024, 09:43

[#permalink]

Gmat Ninja can you please clear the ambiguity for q2 and q3?

B

Vijaisai44

Intern

Joined: 21 Apr 2019

Posts: 4

Own Kudos [?]: 1 [0]

Given Kudos: 50

FOLLOW

Send PM

+1 Kudos Report a Problem Quote

Re: Researchers recently examined the initial public offering (IPO)

15 Jan 2024, 07:03

[#permalink]

A bit confused by 3 c: since the P0 value is higher, can we infer that the sentiments towards kengen was more favorable?

B

debanjanhalder

Intern

Joined: 08 Aug 2017

Posts: 13

Own Kudos [?]: 6 [0]

Given Kudos: 4

Concentration: General

Management, Operations

WE:Operations

(Manufacturing)

FOLLOW

Send PM

+1 Kudos Report a Problem Quote

Researchers recently examined the initial public offering (IPO)

04 Feb 2024, 12:02

[#permalink]

Hi Sajjad1994

B

Kindly can you post the official explanation for Q2 and Q3 ? Some options in both these questions are creating ambiguity.

SnorLax_7

Manager GMATNinjaTwo, @GMATCoachBen Can you pls help with Q2 and Q3 correct answers with explanations ?

Joined: 19 Nov 2022

Thanks !

Posts: 90

Own Kudos [?]: 16 [0]

Given Kudos: 1807

FOLLOW

Send PM

+1 Kudos Report a Problem Quote

Researchers recently examined the initial public offering (IPO)

04 Feb 2024, 12:02

[#permalink]

gmatclubot

NEW TOPIC

POST REPLY QUESTION BANKS DOWNLOADS MY BOOKMARKS IMPORTANT TOPICS REVIEWS

Quick Reply

B i u Quote URL Mention user

Write something here...

Tip: Click preview to attach a file or use advanced formatting

PREVIEW SUBMIT

Similar topics

AUTHOR 6

2 ER The Securities Trading Commission (STC) recently examined the acquisit

Sajjad1994 Replies

20 Feb 2024, 20:14

AUTHOR 2

2 ER A press release on Facebook's IPO published on May 17, 2012: Facebook

Sajjad1994 Replies

05 Jan 2024, 04:59

AUTHOR 5

3 ER A team of classicists is examining some newly discovered manuscripts

Sajjad1994 Replies

05 Feb 2024, 07:55

AUTHOR 10

2 ER USFS Publications Director to County Commissioners of Western Colorado

Sajjad1994 Replies

06 Oct 2022, 08:30

AUTHOR 3

6 ER News article in a popular business publication - June 7 - If current

Sajjad1994 Replies

20 Feb 2024, 11:39

Moderators:

Bunuel Sajjad1994 BottomJee chetan2u

Math Expert IR & RC Forum Moderator DI Forum Moderator RC & DI Moderator

91646 posts 14504 posts 994 posts 10794 posts

You are here: Forum Home GMAT Data Insights Questions Multi-Source Reasoning

Powered by phpBB © phpBB Group | Emoji artwork provided by EmojiOne

MAIN NAVIGATION GMAT RESOURCES PARTNERS MBA RESOURCES

Home Build Your Study Plan e-GMAT Full Time MBA Rankings

GMAT Forum Best GMAT Books Magoosh Part Time MBA Rankings Copyright © 2024 GMAT Club

GMAT Prep Courses All the GMAT Tests Manhattan Prep Executive MBA Rankings GMAT ® is a registered trademark of the

Graduate Management Admission Council ®

MBA Programs GMAT Club Tests Target Test Prep International MBA Rankings

(GMAC ®). GMAT Club's website has not

Self Prep EA Tests Experts' Global Best App Tips been reviewed or endorsed by GMAC.

GMAT Blog Forum Quiz GMATWhiz Best MBA Books

GMAT Classic Test Test Dates Application Reference

GMAT Focus Test GMAT Math Interviews

GMAT GMAT Verbal Resumes

Chat Error Log Templates Free Profile Evaluation

About GMAT Official Guide Why MBA

Contact

Advertise

Chats

›

www.gmac.com | www.mba.com | | GMAT Club Rules | Terms and Conditions

You might also like

- Value Stream Improvement Plan TemplateDocument4 pagesValue Stream Improvement Plan TemplatemilandivacNo ratings yet

- Day Trading With Heikin Ashi Charts - Tim HaddockDocument54 pagesDay Trading With Heikin Ashi Charts - Tim HaddockARK WOODY89% (9)

- Patterns in CR Questions - VerbalDocument3 pagesPatterns in CR Questions - VerbalsandeepNo ratings yet

- Kinross Mine Planning Best PracticeDocument11 pagesKinross Mine Planning Best Practicealvaroaac4No ratings yet

- Breakeven Analysis: The Definitive Guide To Cost-Volume-Profit AnalysisDocument14 pagesBreakeven Analysis: The Definitive Guide To Cost-Volume-Profit AnalysisBusiness Expert PressNo ratings yet

- CCUS An OpportunityDocument36 pagesCCUS An OpportunityForexliveNo ratings yet

- Course Challenge w5 1 CourseraDocument1 pageCourse Challenge w5 1 CourseraabdullahalmahmoodrakibNo ratings yet

- Planning For Differentiated LearningDocument4 pagesPlanning For Differentiated LearningLoeyNo ratings yet

- $12,000 Favourable Nil $8,000 Favourable $6,000 UnfavourableDocument72 pages$12,000 Favourable Nil $8,000 Favourable $6,000 UnfavourableNavindra JaggernauthNo ratings yet

- Course Challenge w5 3 CourseraDocument1 pageCourse Challenge w5 3 Courseraabdullahalmahmoodrakib0% (1)

- Solved - Return On Investment (ROI) Is Computed in The Following...Document4 pagesSolved - Return On Investment (ROI) Is Computed in The Following...faisal58650100% (3)

- ICC Global Trade and Finance Survey 2014Document144 pagesICC Global Trade and Finance Survey 2014Radu Victor Tapu100% (1)

- Report Benchmarking Construction Resources 24032006Document80 pagesReport Benchmarking Construction Resources 24032006Mohamed ElfawalNo ratings yet

- Economics of Regulation and AntitrustDocument14 pagesEconomics of Regulation and AntitrustPablo Castelar100% (1)

- 12 Weeks To 720, Then 3 Weeks To 750 - My Story of Willing & WinningDocument14 pages12 Weeks To 720, Then 3 Weeks To 750 - My Story of Willing & WinningMani CNo ratings yet

- Prob Solving ExplDocument18 pagesProb Solving ExplArthur WangNo ratings yet

- Advanced Overlapping Sets Problems - GMAT Quantitative SectionDocument12 pagesAdvanced Overlapping Sets Problems - GMAT Quantitative Sectionrawat2583No ratings yet

- Inequalities Made EasyDocument17 pagesInequalities Made EasysamiNo ratings yet

- Events & Promotions: A Long Journey ...... From 520 To 710 (V17 To V40)Document5 pagesEvents & Promotions: A Long Journey ...... From 520 To 710 (V17 To V40)Ethan HuntNo ratings yet

- Calculus: (7th Edition)Document1 pageCalculus: (7th Edition)Abraao Zuza CostaNo ratings yet

- A Long Journey .....Document6 pagesA Long Journey .....Ethan HuntNo ratings yet

- 01-Picking Your Event NameDocument2 pages01-Picking Your Event Nameandrew.sun1348No ratings yet

- Four Dogs Are in A Kennel OverlappingDocument7 pagesFour Dogs Are in A Kennel OverlappingEthan HuntNo ratings yet

- UNITE-Innovation Approach OverviewDocument1 pageUNITE-Innovation Approach OverviewPhoebe WangNo ratings yet

- The Iterative Testing Process: Extract Your Hypotheses (Re) Shape Your IdeasDocument16 pagesThe Iterative Testing Process: Extract Your Hypotheses (Re) Shape Your Ideasjack leanNo ratings yet

- 7 Steps of QC Problem Solving - Detached Brackets Rev 06Document74 pages7 Steps of QC Problem Solving - Detached Brackets Rev 06Enrique Rosales ContrerasNo ratings yet

- 11 Calculus 7th Edition Textbook SolutionsDocument1 page11 Calculus 7th Edition Textbook SolutionsAbraao Zuza CostaNo ratings yet

- Recommended Bolt Torque RequirementsDocument1 pageRecommended Bolt Torque RequirementsKucritKampretNo ratings yet

- The Assessment Platform For Every Stage of The Hiring ProcessDocument2 pagesThe Assessment Platform For Every Stage of The Hiring ProcessAditya JainNo ratings yet

- Calculus: (7th Edition)Document1 pageCalculus: (7th Edition)Abraao Zuza CostaNo ratings yet

- Calculus: (7th Edition)Document1 pageCalculus: (7th Edition)Abraao Zuza CostaNo ratings yet

- 15.1 Todos Os ExercíciosDocument18 pages15.1 Todos Os ExercíciosAbraao Zuza CostaNo ratings yet

- Adapted Trom ROBERT S KAPLAN INCOM Company The Dec...Document6 pagesAdapted Trom ROBERT S KAPLAN INCOM Company The Dec...Swapan Kumar SahaNo ratings yet

- Solusi Introduction of Statistic MathematicDocument86 pagesSolusi Introduction of Statistic MathematichanaNo ratings yet

- Calculus: (7th Edition)Document1 pageCalculus: (7th Edition)Abraao Zuza CostaNo ratings yet

- 7 Calculus 7th Edition Textbook SolutionsDocument1 page7 Calculus 7th Edition Textbook SolutionsAbraao Zuza CostaNo ratings yet

- Calculus: (7th Edition)Document1 pageCalculus: (7th Edition)Abraao Zuza CostaNo ratings yet

- 5 Calculus 7th Edition Textbook SolutionsDocument1 page5 Calculus 7th Edition Textbook SolutionsAbraao Zuza CostaNo ratings yet

- Calculus: (7th Edition)Document1 pageCalculus: (7th Edition)Abraao Zuza CostaNo ratings yet

- Calculus: (7th Edition)Document1 pageCalculus: (7th Edition)Abraao Zuza CostaNo ratings yet

- Question: On September 1, 2020, D&H Corporation Starts The Business. IDocument5 pagesQuestion: On September 1, 2020, D&H Corporation Starts The Business. INgọc BíchNo ratings yet

- Calculus: (7th Edition)Document1 pageCalculus: (7th Edition)Abraao Zuza CostaNo ratings yet

- Calculus: (7th Edition)Document1 pageCalculus: (7th Edition)Abraao Zuza CostaNo ratings yet

- (PDF) DSM-5 and Old Age PsychiatryDocument1 page(PDF) DSM-5 and Old Age PsychiatryMohamed MalfiNo ratings yet

- Calculus: (7th Edition)Document1 pageCalculus: (7th Edition)Abraao Zuza CostaNo ratings yet

- Solved - The MediQuick Lab Has Three Lab Technicians Available T... - Chegg - Comd PDFDocument3 pagesSolved - The MediQuick Lab Has Three Lab Technicians Available T... - Chegg - Comd PDFDiego Castro100% (1)

- Calculus: (7th Edition)Document1 pageCalculus: (7th Edition)Abraao Zuza CostaNo ratings yet

- Calculus: (7th Edition)Document1 pageCalculus: (7th Edition)Abraao Zuza CostaNo ratings yet

- Linux Kernel Crash CourseDocument1 pageLinux Kernel Crash CourseProf SilvaNo ratings yet

- Calculus: (7th Edition)Document1 pageCalculus: (7th Edition)Abraao Zuza CostaNo ratings yet

- 15.10 Todos Os ExerciciosDocument28 pages15.10 Todos Os ExerciciosAbraao Zuza CostaNo ratings yet

- Androgen Receptor Inhibitors For Treating Acne Vulgaris - CCIDDocument1 pageAndrogen Receptor Inhibitors For Treating Acne Vulgaris - CCIDArnold BlackNo ratings yet

- Calculus: (7th Edition)Document1 pageCalculus: (7th Edition)Abraao Zuza CostaNo ratings yet

- Solved - Leonard v. PepsiCo, Inc., 210 F.3d 88 (2d Cir. 2000) (A...Document2 pagesSolved - Leonard v. PepsiCo, Inc., 210 F.3d 88 (2d Cir. 2000) (A...N QuynhNo ratings yet

- 'VFX' USADocument3 pages'VFX' USAKalashNo ratings yet

- Simple & Compound Interest, Growth & Decay AQA GCSE Maths Questions & Answers 2022 (Hard) Save My ExamsDocument1 pageSimple & Compound Interest, Growth & Decay AQA GCSE Maths Questions & Answers 2022 (Hard) Save My Examsjishnu.rajwaniNo ratings yet

- Chapra 25-21Document3 pagesChapra 25-21dikiNo ratings yet

- Calculus: (7th Edition)Document1 pageCalculus: (7th Edition)Abraao Zuza CostaNo ratings yet

- 5s Check SheetDocument3 pages5s Check SheetMohamed Ajas Abdul KarimNo ratings yet

- Week-1-Syllabus Co-Creation - Failure-S&V-2021-2Document18 pagesWeek-1-Syllabus Co-Creation - Failure-S&V-2021-2Mariana HernandezNo ratings yet

- Principles of Geotechnical Engineering 7th Edition Textbook Solutions Chegg - Com 201Document1 pagePrinciples of Geotechnical Engineering 7th Edition Textbook Solutions Chegg - Com 201Cristian A. GarridoNo ratings yet

- 16.8 Parte UnicaDocument20 pages16.8 Parte UnicaAbraao Zuza CostaNo ratings yet

- Calculus: (7th Edition)Document1 pageCalculus: (7th Edition)Abraao Zuza CostaNo ratings yet

- Time Learning Area Learning Competency Learning Task Mode of DeliveryDocument7 pagesTime Learning Area Learning Competency Learning Task Mode of DeliveryMarcusNo ratings yet

- Yields, Swaps, & Corporate Finance: Financing Tactics Teaching With BloombergDocument20 pagesYields, Swaps, & Corporate Finance: Financing Tactics Teaching With BloombergHkn YılmazNo ratings yet

- 38 Calculus 7th Edition Textbook SolutionsDocument1 page38 Calculus 7th Edition Textbook SolutionsAbraao Zuza CostaNo ratings yet

- Burnout, Fatigue and Stress Factors in Solo EntrepreneursDocument39 pagesBurnout, Fatigue and Stress Factors in Solo EntrepreneursPJ PoliranNo ratings yet

- CH 25Document32 pagesCH 25Mohammed Al DhaheriNo ratings yet

- SEC Filings - Microsoft - 0000898430-99-001359Document17 pagesSEC Filings - Microsoft - 0000898430-99-001359highfinanceNo ratings yet

- Price Elasticity of DemandDocument4 pagesPrice Elasticity of DemandMADmanTalksNo ratings yet

- Group Work - Inventory Cost Flow and LCNRVDocument2 pagesGroup Work - Inventory Cost Flow and LCNRVKawhileonard LeonardNo ratings yet

- P1.T3. Financial Markets & Products Robert Mcdonald, Derivatives Markets, 3Rd Edition Bionic Turtle FRM Study Notes Reading 20Document18 pagesP1.T3. Financial Markets & Products Robert Mcdonald, Derivatives Markets, 3Rd Edition Bionic Turtle FRM Study Notes Reading 20Garima GulatiNo ratings yet

- Study Case NIVEADocument2 pagesStudy Case NIVEANazri MokhtarNo ratings yet

- Apple Inc - Research ReportDocument1 pageApple Inc - Research Reportapi-554762479No ratings yet

- Basics Fundamental AnalysisDocument5 pagesBasics Fundamental AnalysispudiwalaNo ratings yet

- Management PrinciplesDocument81 pagesManagement PrinciplesTheo Van Schalkwyk67% (3)

- HSBC - Assesment 1Document16 pagesHSBC - Assesment 1aliNo ratings yet

- Activity-Based Costing: Question IM 10.1 IntermediateDocument6 pagesActivity-Based Costing: Question IM 10.1 IntermediateZohaib AslamNo ratings yet

- Cia4u ch10Document72 pagesCia4u ch10Ghassan AlMahalNo ratings yet

- Transferable LCDocument6 pagesTransferable LCSakaNo ratings yet

- Invoice OD219618879639285000 PDFDocument1 pageInvoice OD219618879639285000 PDFSUBHADIP DASNo ratings yet

- Candlestick Secrets For Profiting in Options Seminar (PDFDrive)Document49 pagesCandlestick Secrets For Profiting in Options Seminar (PDFDrive)RajaNo ratings yet

- Group6 - Land Acquisition Policy For Industrial Use - v2Document14 pagesGroup6 - Land Acquisition Policy For Industrial Use - v2Amit PrasadNo ratings yet

- Seminar Report EditDocument14 pagesSeminar Report EditRavisingh RajputNo ratings yet

- QuestionsDocument5 pagesQuestionsmonster gamerNo ratings yet

- Standing OrderDocument28 pagesStanding Orderf999khanNo ratings yet

- Group3 - M&A - Presentation FinalDocument72 pagesGroup3 - M&A - Presentation FinalUtkarsh SengarNo ratings yet

- PS2 PDFDocument6 pagesPS2 PDFFarid BabayevNo ratings yet

- BIG Rock International Expansion PlanDocument20 pagesBIG Rock International Expansion PlanAly Ihab GoharNo ratings yet