Professional Documents

Culture Documents

Adjusting Entry Review

Adjusting Entry Review

Uploaded by

princesolasco12345Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Adjusting Entry Review

Adjusting Entry Review

Uploaded by

princesolasco12345Copyright:

Available Formats

ADJUSTING JOURNAL ENTRY – Answer the following questions and show your solutions.

1. On December 25, 2023, Aldous Vulcanizing Shop rendered 50,000.00 worth of services to a client. However, the amount has not yet been collected.

It was agreed that the customer will pay the amount on January 9, 2024. The transaction was not recorded in the books of Aldous Vulcanizing Shop.

The accounting period ends on December 31, 2023.

a) What is the Adjusting Journal Entry on December 31, 2023?

b) What is the Journal Entry upon payment on January 9, 2024?

2) Nana Company rented a space at Lianga Market Mall for 80,000.00 per month payable every 8th day of the following month. The rental for the

month of December 2023 will be paid on January 8, 2024. The accounting period ends on December 31, 2023.

a) What is the Adjusting Journal Entry on December 31, 2023?

b) What is the Journal Entry upon payment on January 8, 2024?

3) On May 1, 2023, Vexana Company collected the amount of 300,000.00 representing an advance rental from Franco, a tenant who occupies a space

of the building. The advanced rental will cover the period from May 1, 2023 to May 1, 2024. The accounting period ends on December 31, 2023.

Assuming that Income Method is used:

a) What is the journal entry to record the pre-collection of income on May 1, 2023?

b) What is the adjusting entry on December 31, 2023?

c) In your adjusting entry, are you increasing or decreasing the amount of your Rent Income account?

4) On August 1, 2023, Zilong Corporation insured its property with Ling Insurance Company and pays premium of 60,000.00 for a one-year policy

contract covering the period from August 1, 2023 to August 1, 2024. The accounting period ends on December 31, 2023. Assuming that Expense

Method is used:

a) What is the journal entry to record the pre-payment of expense on August 1, 2023?

b) What is the adjusting entry on December 31, 2023?

c) In your adjusting entry, are you increasing or decreasing the amount of your Insurance Expense account?

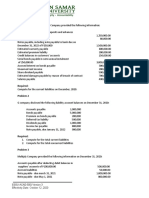

5) The following Accounts Receivable data is taken from Karrie Store for the year December 31, 2023 before adjustment was prepared:

1-60 days 61-120 days

Customer A 25,000.00

Customer B 30,000.00

Customer C 10,000.00

Based on experience, the uncollectibility rate of accounts for 1-60 days is 5% and for 61-120 days is 8%.

a) How much is the Doubtful Accounts Expense as per aging made?

b) What is the Adjusting Journal Entry on December 31, 2023?

c) What is the Net Realizable Value as of December 31, 2023?

6. On March 1, 2023, Balmond Commercial purchased equipment unit for office use costing 200,000.00. The estimated useful life is 6 years with a

residual value of 20,000.00.

a. How much is the annual depreciation?

b. What is the Adjusting Journal Entry on December 31, 2023?

c. What is the Carrying Value as of December 31, 2023?

You might also like

- CA Inter DT Handwritten Notes May 2024Document89 pagesCA Inter DT Handwritten Notes May 2024narayan100% (2)

- Value Chain AnalysisDocument7 pagesValue Chain Analysisprabhu777No ratings yet

- Accounts Receivable Receivable Financing Notes Receivable PROBLEM SOLVING StudentsDocument10 pagesAccounts Receivable Receivable Financing Notes Receivable PROBLEM SOLVING StudentsWoozi Lee0% (1)

- IBISWorld - Car Rental in The US - 2019Document41 pagesIBISWorld - Car Rental in The US - 2019uwybkpeyawxubbhxjyNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- FAR Problem Quiz 1Document6 pagesFAR Problem Quiz 1Ednalyn CruzNo ratings yet

- Chapter 2-Culture and Corporate StrategyDocument16 pagesChapter 2-Culture and Corporate StrategyNor LailyNo ratings yet

- Quiz and Major Exam Accounting For Special Transactions 1Document38 pagesQuiz and Major Exam Accounting For Special Transactions 1CmNo ratings yet

- Receivables ProblemsDocument4 pagesReceivables ProblemsLarpii MonameNo ratings yet

- Carbon Inventory Methods PDFDocument315 pagesCarbon Inventory Methods PDFMohamedNo ratings yet

- Fa4 Prelim Exercises 1 Fa4 Current - LiabilitiesDocument6 pagesFa4 Prelim Exercises 1 Fa4 Current - LiabilitiesatashajaylevelasquezNo ratings yet

- Tutorial 8Document6 pagesTutorial 8Waruna PrabhaswaraNo ratings yet

- Final Requirment (Case Study)Document2 pagesFinal Requirment (Case Study)Gerry SajolNo ratings yet

- Current Liabilities and WarrantiesDocument5 pagesCurrent Liabilities and WarrantiesJames AngklaNo ratings yet

- SM10 EventsAfterBalanceSheetDateDocument2 pagesSM10 EventsAfterBalanceSheetDateHilarie JeanNo ratings yet

- 7104 - InventoryDocument2 pages7104 - InventoryGerardo YadawonNo ratings yet

- Accounts Receivable ExercisesDocument3 pagesAccounts Receivable Exercisesirishcliedbartolome25No ratings yet

- MTP 4 28 Questions 1681997232 PDFDocument6 pagesMTP 4 28 Questions 1681997232 PDFroshanNo ratings yet

- 7169 - Noncurrent Asset Held For Sale and Discountinued OperationDocument2 pages7169 - Noncurrent Asset Held For Sale and Discountinued Operationjsmozol3434qcNo ratings yet

- FARAP - Liabilities - Part 2Document13 pagesFARAP - Liabilities - Part 2vanNo ratings yet

- 7197 - Premium Warrant and ProvisionDocument2 pages7197 - Premium Warrant and ProvisionRevs AsjeiNo ratings yet

- Quiz 2 Current Liabilities and ProvisionsDocument2 pagesQuiz 2 Current Liabilities and ProvisionsJapon, Jenn RossNo ratings yet

- 7103 - Notes Receivable and Loan ImpairmentDocument2 pages7103 - Notes Receivable and Loan ImpairmentGerardo YadawonNo ratings yet

- Intermediate Accounting 3 Share Based PaymentDocument4 pagesIntermediate Accounting 3 Share Based PaymentdmangiginNo ratings yet

- CA Inter Accounting Full Test 1 Nov 2022 Unscheduled Test PaperDocument18 pagesCA Inter Accounting Full Test 1 Nov 2022 Unscheduled Test Papersinku123No ratings yet

- FTME Reviewer Part 2Document7 pagesFTME Reviewer Part 2Mel BoqueNo ratings yet

- Current LiabilitiesDocument6 pagesCurrent LiabilitiesorillosachristoperjohnNo ratings yet

- FA Sample PaperDocument10 pagesFA Sample PaperThe ShiningNo ratings yet

- Audit of Liabilities - Set ADocument5 pagesAudit of Liabilities - Set AZyrah Mae SaezNo ratings yet

- A232 MC 2 Inventories - Questions-1Document3 pagesA232 MC 2 Inventories - Questions-1nur amiraNo ratings yet

- kALBARYONISHERLY 1Document8 pageskALBARYONISHERLY 1De MarcusNo ratings yet

- Chapter 1 Liabilities ExercisesDocument3 pagesChapter 1 Liabilities ExercisesAwish FernNo ratings yet

- E3 Adjusting Entries - QuestionsDocument3 pagesE3 Adjusting Entries - QuestionsHuzaifanadeemNo ratings yet

- Module 8 - THEORIESDocument5 pagesModule 8 - THEORIESFiona MiralpesNo ratings yet

- FINACC1 3rd LQDocument3 pagesFINACC1 3rd LQco230154No ratings yet

- MTP 14 28 Questions 1700718781Document5 pagesMTP 14 28 Questions 1700718781aim.cristiano1210No ratings yet

- CAF Test2 Accounts June23 R2 (Que)Document4 pagesCAF Test2 Accounts June23 R2 (Que)AISHWARYA DESHMUKHNo ratings yet

- Answers R41920 Acctg Varsity Basic Acctg Level 1Document6 pagesAnswers R41920 Acctg Varsity Basic Acctg Level 1John AceNo ratings yet

- Account MOCK Test - 2Document6 pagesAccount MOCK Test - 2CA ASPIRANTNo ratings yet

- 106 1648004706 PDFDocument15 pages106 1648004706 PDFMohd AmanullahNo ratings yet

- B Com 2023 Examination PaperDocument9 pagesB Com 2023 Examination PaperAkshitaNo ratings yet

- QUIZ-current Liability TEACHERDocument3 pagesQUIZ-current Liability TEACHERpadayonmhieNo ratings yet

- Adjusting Entries ProblemsDocument5 pagesAdjusting Entries ProblemsDirck VerraNo ratings yet

- RS ImpDocument2 pagesRS ImpAira Mae MendozaNo ratings yet

- Sir Kahlil Far 1 Batch 4Document6 pagesSir Kahlil Far 1 Batch 4Asim MahmoodNo ratings yet

- Module 2 Dec 2023Document96 pagesModule 2 Dec 2023oraju0330No ratings yet

- 02 FAR02 Accounting-for-ReceivablesDocument3 pages02 FAR02 Accounting-for-ReceivablesBea GarciaNo ratings yet

- 11 Sample Papers Accountancy 2020 English Medium Set 1 PDFDocument13 pages11 Sample Papers Accountancy 2020 English Medium Set 1 PDFpriyaNo ratings yet

- Anskey 1-1Document8 pagesAnskey 1-1De MarcusNo ratings yet

- Intangibles: Problem 1Document7 pagesIntangibles: Problem 1Jeric Lagyaban AstrologioNo ratings yet

- 206B 3rd Preboard ActivityDocument9 pages206B 3rd Preboard ActivityJERROLD EIRVIN PAYOPAYNo ratings yet

- Test Series: May, 2022 Mock Test Paper 2 Foundation Course Paper - 1: Principles and Practice of AccountingDocument5 pagesTest Series: May, 2022 Mock Test Paper 2 Foundation Course Paper - 1: Principles and Practice of AccountingGayathiri RNo ratings yet

- Test Series: March 2023 Mock Test Paper 1 Intermediate: Group - I Paper - 1: AccountingDocument75 pagesTest Series: March 2023 Mock Test Paper 1 Intermediate: Group - I Paper - 1: AccountingKartik GuptaNo ratings yet

- Assets Maam MaconDocument6 pagesAssets Maam Maconchristinemariet.ramirezNo ratings yet

- Class XI Acc SM Arya Annual 2023-24Document5 pagesClass XI Acc SM Arya Annual 2023-24pandeyansh962No ratings yet

- Assignment 1Document1 pageAssignment 1PujaNo ratings yet

- J.K Shah Full Course Practice Question PaperDocument7 pagesJ.K Shah Full Course Practice Question PapermridulNo ratings yet

- RISE ITA Model Paper SolutionDocument15 pagesRISE ITA Model Paper Solutionzaffiii.293No ratings yet

- 7096 - Noncurrent Asset Held For SaleDocument2 pages7096 - Noncurrent Asset Held For SaleAlliah Mae ArbastoNo ratings yet

- Audit of Special Liabilities 1Document4 pagesAudit of Special Liabilities 1kimnicoledelacruz05No ratings yet

- Test Aldine FinalDocument3 pagesTest Aldine FinalAkshay TulshyanNo ratings yet

- RTP Dec 2020 QnsDocument13 pagesRTP Dec 2020 QnsbinuNo ratings yet

- Chartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalDocument81 pagesChartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalPrashant Sagar GautamNo ratings yet

- Inp 2211 Accounts Question Paper PDFDocument8 pagesInp 2211 Accounts Question Paper PDFSachin ChourasiyaNo ratings yet

- ABFA1173Document6 pagesABFA1173yxtan-pb21No ratings yet

- Class12english PreboardDocument4 pagesClass12english PreboardNitin ChaudharyNo ratings yet

- Labor Law Set 4 Case #002 Knitjoy Vs Ferrer - Calleja PDFDocument8 pagesLabor Law Set 4 Case #002 Knitjoy Vs Ferrer - Calleja PDFArnold Christian LozanoNo ratings yet

- MODULE 4 Group 6Document17 pagesMODULE 4 Group 6Denisse Nicole SerutNo ratings yet

- Importance of Effective Communication in BusinessDocument9 pagesImportance of Effective Communication in Businessmathi sivaNo ratings yet

- The Impact Buy Now Pay Later Feature Towards Online Buying Decision in E-Commerce IndonesiaDocument8 pagesThe Impact Buy Now Pay Later Feature Towards Online Buying Decision in E-Commerce Indonesiahuonggiang1412No ratings yet

- Marketing Mix of PatanjaliDocument10 pagesMarketing Mix of PatanjaliDevendra GehlotNo ratings yet

- AKUPREPSLPWDocument1 pageAKUPREPSLPWuzrabaig111No ratings yet

- For Ca Final: Audit BombDocument159 pagesFor Ca Final: Audit Bombsri valliNo ratings yet

- Case Study Asc302Document17 pagesCase Study Asc302Izzah Batrisyia Khairul HadiNo ratings yet

- Creating Agility The Next Agenda For Strategy Organization Leaders and Individuals PDFDocument63 pagesCreating Agility The Next Agenda For Strategy Organization Leaders and Individuals PDFYurika Fauzia WardhaniNo ratings yet

- MS Cambridge O Accounting-P1 Preparation-Of-Financial-Statements 2Document66 pagesMS Cambridge O Accounting-P1 Preparation-Of-Financial-Statements 2Accounts SSTNo ratings yet

- BZAN 505 Quiz 2 - SolutionDocument6 pagesBZAN 505 Quiz 2 - SolutionJahedulHoqNo ratings yet

- Applied Entrepreneurship: Prepared By: Kristine Diane C. Cerdeña, LPTDocument22 pagesApplied Entrepreneurship: Prepared By: Kristine Diane C. Cerdeña, LPTRommel LegaspiNo ratings yet

- Big Data Analytics and Business Process InnovationDocument9 pagesBig Data Analytics and Business Process InnovationAbdulGhaffarNo ratings yet

- Business Plan Part 3Document19 pagesBusiness Plan Part 3Asadulla KhanNo ratings yet

- Pre Test of Bahasa Inggris 21 - 9 - 2020Document5 pagesPre Test of Bahasa Inggris 21 - 9 - 2020magdalena sriNo ratings yet

- Earned Value AnalysisDocument30 pagesEarned Value AnalysiswendyNo ratings yet

- 1 Far East Bank V Phil DepositDocument15 pages1 Far East Bank V Phil DepositGie CortesNo ratings yet

- The 4 Ps of MarketingDocument5 pagesThe 4 Ps of MarketingKj Bush0% (1)

- Oguz Kaya CVDocument3 pagesOguz Kaya CVOguz KayaNo ratings yet

- MBA ProjectDocument32 pagesMBA ProjectHemali RameshNo ratings yet

- TPLF Strategy English TranslationDocument76 pagesTPLF Strategy English TranslationMHEP_DANIELNo ratings yet

- Question Paper Code:: Reg. No.Document11 pagesQuestion Paper Code:: Reg. No.Livin TNo ratings yet

- CM1B - April22 - EXAM - Clean ProofDocument3 pagesCM1B - April22 - EXAM - Clean ProofShivansh ChawlaNo ratings yet