Professional Documents

Culture Documents

INCOTERMS

Uploaded by

Trâm Anh Phạm0 ratings0% found this document useful (0 votes)

4 views3 pagesCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views3 pagesINCOTERMS

Uploaded by

Trâm Anh PhạmCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

INCOTERMS

I. INTERNATIONAL COMMERCIAL TERM

1. Definition

- The Incoterms (International Commercial Terms) are pre-defined commercial terms

published by the International Chamber of Commerce (ICC). The main content of these

terms includes two important points:

o Defining the responsibilities and obligations of the seller and the buyer.

o Allocation of costs and risks.

- Three-letter standard trade terms (e.g. FOB, CFR, CIF) are commonly used in

international commercial transactions for the sale of goods.

2. Role

- The main purpose and role of Incoterms are to explain common commercial terms used

in international trade.

- Clearly define the responsibilities, costs, and risks involved in the process of transferring

goods from the seller to the buyer, thereby helping all parties involved to have a unified

understanding and avoid any potential disputes.

- The Incoterms also deal with the documentation required for global trade; they specify

which parties are responsible for which documents, since requirements vary much

between countries.

3. Classification

The Incoterms are most frequently classified by category:

- The Incoterms beginning with F refer to shipments where the primary cost of shipping is

not paid for by the seller.

- The Incoterms beginning with C deal with shipments where the seller pays for shipping.

- The Incoterms beginning with E deal with the seller’s responsibilities are fulfilled when

goods are ready to depart from their facilities.

- The Incoterms beginning with D refer to the shipper/seller’s responsibility ends when the

goods arrive at some specific point.

4. The legal value of Incoterms

- Incoterms are not mandatory. Buyers and sellers are not obliged to adhere to Incoterms.

- The benefits provided by Incoterms have led many businesses to continue using this set

of rules, and adherence to Incoterms terms is often required.

II. CLASSIFICATION OF INCOTERMS

1. Group E – Departure

EXW – Ex Works: The buyer is responsible for loading the goods on truck or container at the

seller’s premises, and for the subsequent costs and risks.

2. Group F – Main Carriage Unpaid (by the seller)

FCA – Free Carrier: The seller delivers the goods, which are cleared for export, to the carrier

nominated by the buyer at the named place. The buyer’s responsibility for insurance and

transportation begins at the same moment.

FAS – Free alongside Ship: The seller is responsible for the cost of transporting and delivering

goods alongside a vessel in a port in his country.

FOB – Free on Board: The goods are placed on board the ship by the seller at a port of

shipment named in the sales agreement. The risk of loss of or damage to the goods, the cargo

insurance, and other costs is transferred to the buyer, when the goods pass the ship’s rail. The

seller pays the cost of loading the goods.

3. Group C – Main Carriage Paid (by the seller)

CFR – Cost and Freight: The seller must pay the costs and freight necessary to bring the goods

to the named destination, but the risk of loss or damage to the goods are transferred from the

seller to the buyer, when the goods pass the ship’s rail in the port of shipment. Insurance is the

buyer’s responsibility.

CIF – Cost, Insurance and Freight: The seller must pay the cost, freight necessary and

insurance to bring the goods to the named port of destination, but the risk of loss of or damage to

the goods, and additional costs are transferred from the seller to the buyer.

CPT – Carriage Paid To: The seller must pay the freight for the carriage of the merchandise to

the named destination. The risk of loss or damage to the goods are transferred from the seller to

the buyer, at the point where the goods are taken in charge by a carrier.

CIP – Carriage and Insurance Paid To: The seller pays for the insurance against loss or

damage. The buyer undertakes the import customs clearance, payment of customs duties and

taxes, and other costs and risks.

4. Group D – Arrival

DAF – Delivered at Frontier: Seller’s responsibility (import customs clearance, payment of

customs duties and taxes, and other costs) is complete, when the goods have arrived at the

frontier. The buyer is responsible for the cost of the goods to clear customs.

DES – Delivered Ex Ship: The seller’s responsibility is to get the goods to the port of

destination or to engage the forwarder to move cargo to the port of destination.

DEQ – Delivered Ex Quay: The buyer is responsible for duties and charges and the seller is

responsible for delivering the goods to port of destination. The buyer undertakes the cargo

insurance and other costs, risks, and customs clearance.

DDP – Delivered Duty Paid: The seller is responsible (insure the goods and cover all costs and

risks) for dealing with all the tasks involved in moving goods from the manufacturing plant to

the buyer’s door. The buyer pays the duty and any additional costs, which are caused by the

failure to clear the goods for import in time.

DDU – Delivered Duty Unpaid: The buyer is responsible for the duty, fees and taxes. The seller

has to bear the costs and risks involved in bringing the merchandise in the country of destination.

The buyer pays the duty and any additional costs caused by its failure to clear the goods for

import in time.

You might also like

- Incoterms 2010Document3 pagesIncoterms 2010SNo ratings yet

- International Chamber of Commerce: Incoterms 2015Document3 pagesInternational Chamber of Commerce: Incoterms 2015allyshaNo ratings yet

- Incoterms 2010 Why Are They Required?Document8 pagesIncoterms 2010 Why Are They Required?SanktifierNo ratings yet

- A Brief About The INCOTERMS (International Commercial Terms)Document5 pagesA Brief About The INCOTERMS (International Commercial Terms)Shrinivas Meherkar100% (1)

- International Commercial IncotermsDocument6 pagesInternational Commercial IncotermsFaridul AlamNo ratings yet

- Questions:: ST ND STDocument3 pagesQuestions:: ST ND STZeubenChatodkathNo ratings yet

- Incoterms 2000Document6 pagesIncoterms 2000jonh286No ratings yet

- Incoterms - Topic SevenDocument4 pagesIncoterms - Topic SevenMoney CafeNo ratings yet

- IBM431 AssignmentDocument6 pagesIBM431 AssignmentDekar TsheringNo ratings yet

- Paper On IncotermsDocument5 pagesPaper On IncotermsIsagani DionelaNo ratings yet

- Incoterms 2000Document7 pagesIncoterms 2000Siddharth_Sonik_7898No ratings yet

- Incoterms: Group E - DepartureDocument5 pagesIncoterms: Group E - DepartureMaria Victoria MunozNo ratings yet

- Terms Used in Shipping (INCO Terms) : Nitesh Shelly 09MBA095 Kanda Kumar 09MBA Abhijit 09MBADocument38 pagesTerms Used in Shipping (INCO Terms) : Nitesh Shelly 09MBA095 Kanda Kumar 09MBA Abhijit 09MBAMukund BalasubramanianNo ratings yet

- The Use of Incoterms 2020Document8 pagesThe Use of Incoterms 2020david dearingNo ratings yet

- International Trade: Import-Export ProcedureDocument5 pagesInternational Trade: Import-Export ProcedureashrafkaisraniNo ratings yet

- LogisticsDocument1 pageLogisticswalid.shahat.24d491No ratings yet

- INCOTERMSDocument11 pagesINCOTERMSRomero Mary JaneNo ratings yet

- Manda Topic 22Document5 pagesManda Topic 22HOPENo ratings yet

- Exportaid: Incoterms - Definitions ' 2007Document2 pagesExportaid: Incoterms - Definitions ' 2007Marey MorsyNo ratings yet

- IBLaw Weekly Assignment 1Document4 pagesIBLaw Weekly Assignment 1FeiyezNo ratings yet

- Incoterms®: of Commerce (ICC) - ICC Rules For The Use of Domestic and International Trade Terms, p.241.)Document4 pagesIncoterms®: of Commerce (ICC) - ICC Rules For The Use of Domestic and International Trade Terms, p.241.)danikNo ratings yet

- Incoterms: Eneral NformationDocument4 pagesIncoterms: Eneral NformationrooswahyoeNo ratings yet

- INCOTERMSDocument26 pagesINCOTERMSMeenakshi SinghNo ratings yet

- Incoterms and The ExporterDocument4 pagesIncoterms and The ExporterRachma Noviyanti HidayahNo ratings yet

- Incoterms Unit 6 - Trade Terms in International Sale of Goods or International Commercial TermsDocument12 pagesIncoterms Unit 6 - Trade Terms in International Sale of Goods or International Commercial Termsrenatus APOLINARYNo ratings yet

- Fast Facts Incoterms 2010 VirginiaDocument4 pagesFast Facts Incoterms 2010 VirginiaJen Li KohNo ratings yet

- Incoterms 2000Document6 pagesIncoterms 2000Manoj BansalNo ratings yet

- Incoterms 2010: Icc Official Rules For The Interpretation of Trade TermsDocument41 pagesIncoterms 2010: Icc Official Rules For The Interpretation of Trade TermsTsamaraNo ratings yet

- Incoterms 2020Document3 pagesIncoterms 2020Loulica Danielle Gangoue mathosNo ratings yet

- INCOTERMSDocument4 pagesINCOTERMSAviNo ratings yet

- Incoterms 2010Document16 pagesIncoterms 2010dkhana243No ratings yet

- UntitledDocument5 pagesUntitledHIMANSHU PALNo ratings yet

- Incoterms or International Commercial Terms Are A Series of International SalesDocument8 pagesIncoterms or International Commercial Terms Are A Series of International Saleswendypost73No ratings yet

- Group E (Departure) : Understanding IncotermsDocument4 pagesGroup E (Departure) : Understanding IncotermsqualijormanNo ratings yet

- Navigating Global Trade - The Power of IncotermsDocument7 pagesNavigating Global Trade - The Power of IncotermsSiddharthNo ratings yet

- Incoterms For Any Mode of Transport: EXW - Ex WorksDocument4 pagesIncoterms For Any Mode of Transport: EXW - Ex WorksNOSTRANo ratings yet

- Topic 2: Selecting The Suitable Incoterm For Export ActivitiesDocument5 pagesTopic 2: Selecting The Suitable Incoterm For Export ActivitiesNguyễn Thanh ThúyNo ratings yet

- INCOTERMS, Practical GuideDocument12 pagesINCOTERMS, Practical GuideaLESSANALESSAN495No ratings yet

- Break Even Analysi1Document5 pagesBreak Even Analysi1dixits1111No ratings yet

- INCOTERMS 2010: Standard Trade Definitions Used in International Freight TransactionsDocument3 pagesINCOTERMS 2010: Standard Trade Definitions Used in International Freight TransactionsdcdecastrojrNo ratings yet

- IncotermsDocument6 pagesIncotermsHarsimran SinghNo ratings yet

- IncotermsDocument4 pagesIncotermsSK MunafNo ratings yet

- IncotermsDocument4 pagesIncotermsCamille Angelie SoribelloNo ratings yet

- International Commerce TermsDocument4 pagesInternational Commerce TermsYoussef RadiNo ratings yet

- Incoterms DefinitionDocument9 pagesIncoterms DefinitionDishank AgrawalNo ratings yet

- Incoterms - 2020Document5 pagesIncoterms - 2020Alejandro Moreno SalasNo ratings yet

- Incoterms For International TradeDocument4 pagesIncoterms For International TradeMohammad Shahjahan SiddiquiNo ratings yet

- English Inc or Terms.Document3 pagesEnglish Inc or Terms.Victoriya PolshchikovaNo ratings yet

- Incoterms: "Incoterms" Is A Registered Trademark of The International Chamber of Commerce. IncotermsDocument7 pagesIncoterms: "Incoterms" Is A Registered Trademark of The International Chamber of Commerce. IncotermsNagaraj SusurlaNo ratings yet

- Assignment IncotermsDocument6 pagesAssignment IncotermsBaba NasheNo ratings yet

- Incoterms: Group 2 - Banking 59Document27 pagesIncoterms: Group 2 - Banking 59Nhật HạNo ratings yet

- Balmer LawrieDocument18 pagesBalmer LawrieShameem AnwarNo ratings yet

- Incoterms ExplainedDocument4 pagesIncoterms Explainednereafp72No ratings yet

- FF Issues INCO TermsDocument3 pagesFF Issues INCO Termsjigar2uNo ratings yet

- What Are The Most Important Changes in Incoterms 2020Document5 pagesWhat Are The Most Important Changes in Incoterms 2020frNo ratings yet

- Who Uses Incoterms?: What Are They?Document3 pagesWho Uses Incoterms?: What Are They?FueNo ratings yet

- The Shipbroker’s Working Knowledge: Dry Cargo Chartering in PracticeFrom EverandThe Shipbroker’s Working Knowledge: Dry Cargo Chartering in PracticeRating: 5 out of 5 stars5/5 (1)

- The Forwarder´s Concern: An introduction into the marine liability of forwarders, carriers and warehousemen, the claims handling and the related insuranceFrom EverandThe Forwarder´s Concern: An introduction into the marine liability of forwarders, carriers and warehousemen, the claims handling and the related insuranceNo ratings yet

- Basics of Chartering: Negotiation - Compatibility - Decision MakingFrom EverandBasics of Chartering: Negotiation - Compatibility - Decision MakingNo ratings yet

- 8V3) Pins and Bushings ExcavatorsDocument150 pages8V3) Pins and Bushings Excavatorsofm100% (1)

- NL-RTM-RDH: Netherlands, TheDocument3 pagesNL-RTM-RDH: Netherlands, Thecarlos diazNo ratings yet

- Bill of Lading (B/L)Document15 pagesBill of Lading (B/L)RahulNo ratings yet

- WLC Business FlowDocument4 pagesWLC Business FlowHüseyin TeklerNo ratings yet

- Mystics 2020 US Stamp CatalogDocument156 pagesMystics 2020 US Stamp CatalogOrange100% (3)

- Shipping AbbreviationsDocument24 pagesShipping Abbreviationsyw_oulalaNo ratings yet

- CFAY Post Office Zip CodesDocument3 pagesCFAY Post Office Zip CodesRebekah Galloway ReyesNo ratings yet

- SP HR 20220727Document38 pagesSP HR 20220727Gautam VedwalNo ratings yet

- ORB Part II ExamplesDocument5 pagesORB Part II ExamplesRosario SisniegasNo ratings yet

- Incoterms PDFDocument3 pagesIncoterms PDFARIGATONo ratings yet

- MV SSI BRIALLIANT Final Report - November 2023Document23 pagesMV SSI BRIALLIANT Final Report - November 2023DanielNo ratings yet

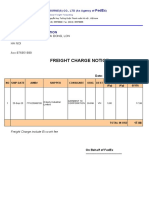

- Freight Charge Notice: To: Garment 10 CorporationDocument4 pagesFreight Charge Notice: To: Garment 10 CorporationThuy HoangNo ratings yet

- All Postal Codes Under FARIDABAD District: Pin Code / Postal Zip Code SearchDocument6 pagesAll Postal Codes Under FARIDABAD District: Pin Code / Postal Zip Code SearchcubadesignstudNo ratings yet

- Bms Template Seaport ManualDocument9 pagesBms Template Seaport ManualPeter PanNo ratings yet

- TMS - Business Analysis Review: Transportation CorridorDocument3 pagesTMS - Business Analysis Review: Transportation CorridorVishal PadharNo ratings yet

- 2017 Club ContactsDocument17 pages2017 Club ContactsAldo CatalanNo ratings yet

- Kr-Sel-Sos: Express WorldwideDocument3 pagesKr-Sel-Sos: Express WorldwideJeremia PattinussaNo ratings yet

- Maritime ContainersDocument216 pagesMaritime ContainersNa NguyễnNo ratings yet

- MS Cargo ContactlistDocument5 pagesMS Cargo ContactlistRadwa RafatNo ratings yet

- General PackingDocument7 pagesGeneral PackingMuhammad Farukh ManzoorNo ratings yet

- Draft BL - RolDocument1 pageDraft BL - RolArnofus DiasNo ratings yet

- Dos ReportDocument917 pagesDos ReportMeena ManivannanNo ratings yet

- List of Incidents For 2022 (Caa 6 Apr 22)Document8 pagesList of Incidents For 2022 (Caa 6 Apr 22)ubaldo abacanNo ratings yet

- Rep 1110110404 PDFDocument1,400 pagesRep 1110110404 PDFTabitha Brownell0% (1)

- Hapag Country Wise Terms About BLDocument13 pagesHapag Country Wise Terms About BLRAAZIQ INTERNATIONALNo ratings yet

- Vanguard North America Cfs Hours of Operation 27mar2020Document16 pagesVanguard North America Cfs Hours of Operation 27mar2020Atlas SNo ratings yet

- Agility Shipping Guide 2018Document14 pagesAgility Shipping Guide 2018taufiqNo ratings yet

- HAWAIIDocument4 pagesHAWAIIallan jay usmanNo ratings yet

- PFFA Membership List2020Document15 pagesPFFA Membership List2020jesscltNo ratings yet

- Copy Verify: Bill OF Lading FOR Ocean Transport or Multimodal TransportDocument1 pageCopy Verify: Bill OF Lading FOR Ocean Transport or Multimodal TransportTino MarcosNo ratings yet