Professional Documents

Culture Documents

24030400278122_MandateForm

Uploaded by

J. K. MuduliCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

24030400278122_MandateForm

Uploaded by

J. K. MuduliCopyright:

Available Formats

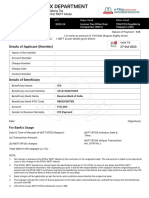

INCOME TAX DEPARTMENT

Mandate Form For Making Tax

Payment Through RTGS/ NEFT Mode

TAN A.Y F.Y Major Head Minor Head

BBND00678G 2024-25 2023-24 Income Tax (Other than TDS/TCS Payable by

Companies) (0021) Taxpayer (200)

ITNS No. : 281 Nature of Payment : 94C

I hereby authorize bank name ( ) to remit an amount of ₹ 750 (Rupees Seven Hundred And Fifty

Only) through ( ) RTGS ( ) NEFT as per details given below:

Valid Till

Details of Applicant (Remitter) 19-Mar-2024

Name of the remitter :

Account Number :

Cheque Number :

Cheque Date :

Contact Number :

Details of Beneficiary

Beneficiary Name : ITD

Beneficiary Account Number : 24030400278122

Beneficiary Bank Name : Reserve Bank of India

Beneficiary Bank IFSC Code : RBIS0CBDTER

Amount : ₹ 750

Sender to Receiver Remarks : ITD Payment

Date : (Signature)

For Bank’s Usage

Date & Time of Receipt of NEFT/RTGS Request : NEFT/RTGS Initiation Date &

Time. :

(a) Transaction Amount :

NEFT/RTGS Unique Transaction

(b) NEFT/RTGS charges : No. (UTR No.) :

Total debit to the taxpayer (a + b) :

NOTE:

1. No change is allowed in the RTGS/ NEFT details by the customer or the originator bank. The transaction is liable to be rejected in case of any change in the RTGS/

NEFT details.

2. This RTGS/ NEFT transaction should reach the destination bank by 19-Mar-2024 .In case of any delay the RTGS/ NEFT transaction would be returned to the originating

account. It will be the responsibility of the taxpayer and the originating bank to ensure that the RTGS/ NEFT remittance reaches the beneficiary account well before the

expiry date and time and neither the ITD authorities nor Reserve Bank of India would be liable for any delay.

3. Bank charges will be applicable as per the terms and conditions prescribed by the respective bank.

4. The taxpayer will get the credit of the tax payment on the date when selected bank has credited the money into the beneficiary account with RBI.

5. CIN will be as per NEFT/RTGS settlement cycle of RBI.

You might also like

- MandateFormDocument1 pageMandateFormuniquerealestate098No ratings yet

- Income Tax Payment Mandate Form RTGS NEFTDocument2 pagesIncome Tax Payment Mandate Form RTGS NEFTNitin RautNo ratings yet

- MandateFormDocument1 pageMandateFormLata BinaniNo ratings yet

- 24030100027916_MandateFormDocument1 page24030100027916_MandateFormmgrudrajayaNo ratings yet

- Mandate FormDocument1 pageMandate FormTechnocrat EnterprisesNo ratings yet

- MandateFormDocument1 pageMandateFormLavanya GoleNo ratings yet

- MandateFormDocument1 pageMandateFormsagarss888No ratings yet

- MandateFormDocument1 pageMandateFormsagarss888No ratings yet

- MandateFormDocument1 pageMandateFormSIDDIQUENo ratings yet

- Income Tax Payment Mandate FormDocument2 pagesIncome Tax Payment Mandate FormMr.Chandrakant SharmaNo ratings yet

- MandateFormDocument1 pageMandateFormAbhishek RoyNo ratings yet

- MandateFormDocument1 pageMandateFormBaid GroupNo ratings yet

- MandateFormDocument1 pageMandateFormsagarss888No ratings yet

- RTGS and NEFT Application FormDocument1 pageRTGS and NEFT Application FormRajesh KumarNo ratings yet

- Rtgs and Neft FormDocument1 pageRtgs and Neft FormAmruta patilNo ratings yet

- Zero Only: Application For Funds Transfer Under Rtgs/NeftDocument1 pageZero Only: Application For Funds Transfer Under Rtgs/NeftHemanth KumarNo ratings yet

- Kotak Mahindra Bank Rtgs Neft FormDocument1 pageKotak Mahindra Bank Rtgs Neft Formlandb1No ratings yet

- Fund Transfer Request - Combined Form: RTGS/NEFT/DD Issuance/RBL Account To Account Transfer (ATAT)Document1 pageFund Transfer Request - Combined Form: RTGS/NEFT/DD Issuance/RBL Account To Account Transfer (ATAT)shri halaNo ratings yet

- Fund Transfer Request Editable FormDocument1 pageFund Transfer Request Editable FormRAJESHNo ratings yet

- GST ChallanDocument2 pagesGST Challandevendrakumarrath_26No ratings yet

- Sbi RtgsDocument1 pageSbi Rtgssiddharthgautam765No ratings yet

- DCB Neft RTGSDocument1 pageDCB Neft RTGSRAGHAVA NAIDU .KNo ratings yet

- Fund Transfer Request Editable FormDocument1 pageFund Transfer Request Editable FormDeepraj NathNo ratings yet

- GST-CHALLAN (64)Document2 pagesGST-CHALLAN (64)vk6541803No ratings yet

- SBI RTGS GaneshDocument1 pageSBI RTGS Ganeshjd27112012No ratings yet

- Neft Rtgs Format SbiDocument1 pageNeft Rtgs Format SbiLalit AdityaNo ratings yet

- GST-CHALLAN (15)Document2 pagesGST-CHALLAN (15)skd9559No ratings yet

- GST NotesDocument2 pagesGST NotesivikramviratNo ratings yet

- Income Tax Payment ChallanDocument1 pageIncome Tax Payment Challangandapur khanNo ratings yet

- Account Statement PDFDocument2 pagesAccount Statement PDFUng NimulNo ratings yet

- NEFT RTGS FormDocument1 pageNEFT RTGS FormSalasar BuilderNo ratings yet

- Indian Overseas Bank Application Form For Funds Transfer Under RtgsDocument2 pagesIndian Overseas Bank Application Form For Funds Transfer Under Rtgsabhishek bakhlaNo ratings yet

- GST ChallanDocument2 pagesGST ChallanSaravanan DevasagayamNo ratings yet

- FBR ITO Assing Contractor 22feb2024Document1 pageFBR ITO Assing Contractor 22feb2024Syed TabishNo ratings yet

- Lampiran Alat Bukti Tergugat - T-4Document12 pagesLampiran Alat Bukti Tergugat - T-4Arya PermanaNo ratings yet

- Amount To Be Remitted Rs. Charges/Commission Rs. Services Tax Rs. Total Amount To Be Debited RsDocument2 pagesAmount To Be Remitted Rs. Charges/Commission Rs. Services Tax Rs. Total Amount To Be Debited Rsabhishek bakhlaNo ratings yet

- 1201 0 0 0 0 1201 SGST (0006)Document2 pages1201 0 0 0 0 1201 SGST (0006)Nitinkumar BharadiaNo ratings yet

- Real Time Gross Settlement/ National Electronic Funds Transfer (Rtgs/Neft) Application FormDocument1 pageReal Time Gross Settlement/ National Electronic Funds Transfer (Rtgs/Neft) Application Formjose smithNo ratings yet

- Real Time Gross Settlement/ National Electronic Funds Transfer (Rtgs/Neft) Application FormDocument1 pageReal Time Gross Settlement/ National Electronic Funds Transfer (Rtgs/Neft) Application FormpoojaNo ratings yet

- Real Time Gross Settlement/ National Electronic Funds Transfer (Rtgs/Neft) Application FormDocument1 pageReal Time Gross Settlement/ National Electronic Funds Transfer (Rtgs/Neft) Application Formsher singh SinghNo ratings yet

- Real Time Gross Settlement/ National Electronic Funds Transfer (Rtgs/Neft) Application FormDocument1 pageReal Time Gross Settlement/ National Electronic Funds Transfer (Rtgs/Neft) Application FormRAJIV SNo ratings yet

- Real Time Gross Settlement/ National Electronic Funds Transfer (Rtgs/Neft) Application FormDocument1 pageReal Time Gross Settlement/ National Electronic Funds Transfer (Rtgs/Neft) Application FormDev Dutt SharmaNo ratings yet

- Real Time Gross Settlement/ National Electronic Funds Transfer (Rtgs/Neft) Application FormDocument1 pageReal Time Gross Settlement/ National Electronic Funds Transfer (Rtgs/Neft) Application FormGurmeet SinghNo ratings yet

- Sbi Rtgs PDFDocument1 pageSbi Rtgs PDFShubhansu AsatiNo ratings yet

- Sbi Rtgs PDFDocument1 pageSbi Rtgs PDFTrilochan SahooNo ratings yet

- Real Time Gross Settlement/ National Electronic Funds Transfer (Rtgs/Neft) Application FormDocument1 pageReal Time Gross Settlement/ National Electronic Funds Transfer (Rtgs/Neft) Application FormMady CoolNo ratings yet

- Real Time Gross Settlement/ National Electronic Funds Transfer (Rtgs/Neft) Application FormDocument1 pageReal Time Gross Settlement/ National Electronic Funds Transfer (Rtgs/Neft) Application FormGurmeet SinghNo ratings yet

- Sbi-Rtgs-Neft Form Word PDFDocument1 pageSbi-Rtgs-Neft Form Word PDFhimanshuextra50% (4)

- SBI NEFT RTGS Form PDFDocument1 pageSBI NEFT RTGS Form PDFCrAzY PuLkiT58% (12)

- Real Time Gross Settlement/ National Electronic Funds Transfer (Rtgs/Neft) Application FormDocument1 pageReal Time Gross Settlement/ National Electronic Funds Transfer (Rtgs/Neft) Application FormAnonymous JgMQJjgDNo ratings yet

- Real Time Gross Settlement/ National Electronic Funds Transfer (Rtgs/Neft) Application FormDocument1 pageReal Time Gross Settlement/ National Electronic Funds Transfer (Rtgs/Neft) Application FormRAJIV SNo ratings yet

- Real Time Gross Settlement/ National Electronic Funds Transfer (Rtgs/Neft) Application FormDocument1 pageReal Time Gross Settlement/ National Electronic Funds Transfer (Rtgs/Neft) Application FormMady CoolNo ratings yet

- RTGS NEFT Form GuideDocument1 pageRTGS NEFT Form GuideRAJIV SNo ratings yet

- Sbi Rtgs Neft Form WordDocument1 pageSbi Rtgs Neft Form Wordhimanshuextra88% (8)

- RTGS NEFT Funds Transfer FormDocument1 pageRTGS NEFT Funds Transfer FormJoydip ChandaNo ratings yet

- Real Time Gross Settlement/ National Electronic Funds Transfer (Rtgs/Neft) Application FormDocument1 pageReal Time Gross Settlement/ National Electronic Funds Transfer (Rtgs/Neft) Application FormM Badal100% (1)

- Real Time Gross Settlement/ National Electronic Funds Transfer (Rtgs/Neft) Application FormDocument1 pageReal Time Gross Settlement/ National Electronic Funds Transfer (Rtgs/Neft) Application Formmacha chandrashekharNo ratings yet

- Real Time Gross Settlement/ National Electronic Funds Transfer (Rtgs/Neft) Application FormDocument1 pageReal Time Gross Settlement/ National Electronic Funds Transfer (Rtgs/Neft) Application FormShubhansu AsatiNo ratings yet

- RTGS NEFT Funds Transfer FormDocument1 pageRTGS NEFT Funds Transfer Formsher singh Singh100% (3)

- AUGUST 1 2023 (2)Document1 pageAUGUST 1 2023 (2)J. K. MuduliNo ratings yet

- OD429351760036126100Document2 pagesOD429351760036126100J. K. MuduliNo ratings yet

- Chabila Madhu Barnobodha (High)Document44 pagesChabila Madhu Barnobodha (High)J. K. MuduliNo ratings yet

- Vedic MathDocument33 pagesVedic MathAbir Dutta100% (1)

- Chase0280 Activity 20190825Document5 pagesChase0280 Activity 20190825Lisette TrujilloNo ratings yet

- Holiday HomesDocument3 pagesHoliday Homessanchit gargNo ratings yet

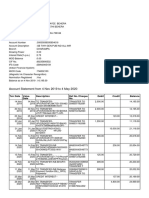

- Account Statement From 4 Nov 2019 To 4 May 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument2 pagesAccount Statement From 4 Nov 2019 To 4 May 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceChiranjibi Behera ChiruNo ratings yet

- Account Statement: Penyata AkaunDocument2 pagesAccount Statement: Penyata AkaunAsyraf SyazwanNo ratings yet

- Af Pension Regs Part Ii PDFDocument217 pagesAf Pension Regs Part Ii PDFTILAK MALIKNo ratings yet

- FC3 (3 Files Merged)Document9 pagesFC3 (3 Files Merged)Jatin SarnaNo ratings yet

- Minicases 5Document3 pagesMinicases 5dini sofiaNo ratings yet

- ACTBAS 2 - Lecture 1 Merchandising Business and Inventory SystemDocument7 pagesACTBAS 2 - Lecture 1 Merchandising Business and Inventory SystemJason Robert MendozaNo ratings yet

- PDFDocument22 pagesPDFKarthik ShimogaNo ratings yet

- Report Monthly 2023 JulDocument2 pagesReport Monthly 2023 JulShuktarai Nil JosnaiNo ratings yet

- Ey 2022 WCTG WebDocument2,010 pagesEy 2022 WCTG WebPedro J Contreras ContrerasNo ratings yet

- Mpesa Transaction HistoryDocument12 pagesMpesa Transaction HistoryMadeleiGOOGYXNo ratings yet

- Terms & Conditions - Airport Transfer Service: Eligible Cards: FAB Credit Card Number of Transfers (Per Annum)Document3 pagesTerms & Conditions - Airport Transfer Service: Eligible Cards: FAB Credit Card Number of Transfers (Per Annum)sbtharanNo ratings yet

- Statement of Account SummaryDocument4 pagesStatement of Account SummaryVirtual ShoppingNo ratings yet

- Obacap Obacap: Ship To: Ship ToDocument4 pagesObacap Obacap: Ship To: Ship Toyoussef slimaniNo ratings yet

- Account No. - 31858342846 Account No. - 31858342846 Account No. - 31858342846Document1 pageAccount No. - 31858342846 Account No. - 31858342846 Account No. - 31858342846DeekshaomarNo ratings yet

- 2017 Fee Booklet DurbanDocument99 pages2017 Fee Booklet DurbanMarshall-tendai Zifa-sire Zuku-chibikaNo ratings yet

- Your AT&T Bill BreakdownDocument2 pagesYour AT&T Bill BreakdownChloeNo ratings yet

- 以下几点教训:1. 合同签订前应详细确认各项条款,避免口头约定产生纠纷。2. 合同应明确交货方式为托收或L/C,不可两者混淆。3. 货物质量问题应在合同中明确检查标准和责任归属。4. 托收时应注明收取利息,并在托收指示书中明确。5. 代收行放单前应检查货物质量,避免买方提出质Document26 pages以下几点教训:1. 合同签订前应详细确认各项条款,避免口头约定产生纠纷。2. 合同应明确交货方式为托收或L/C,不可两者混淆。3. 货物质量问题应在合同中明确检查标准和责任归属。4. 托收时应注明收取利息,并在托收指示书中明确。5. 代收行放单前应检查货物质量,避免买方提出质veroNo ratings yet

- Chapter 3 - Highway Capacity and Level of ServiceDocument74 pagesChapter 3 - Highway Capacity and Level of ServiceTaha Gargoum100% (2)

- Accounting Information System: The Expenditure Cycle Part 1 Walker Inc. Case 4Document7 pagesAccounting Information System: The Expenditure Cycle Part 1 Walker Inc. Case 4Ratu ShaviraNo ratings yet

- Komponen SSH 200415Document4,055 pagesKomponen SSH 200415SDN 215 RancasagatanNo ratings yet

- SCM Inventory Part - IIDocument75 pagesSCM Inventory Part - IIKushal Kapoor100% (1)

- CTP Insurance Green Slip CTN346227145-1Document2 pagesCTP Insurance Green Slip CTN346227145-1AAA GGGNo ratings yet

- Withholding TaxDocument18 pagesWithholding Taxraju aws100% (1)

- Bell Boy Errand Card NEWDocument21 pagesBell Boy Errand Card NEWAgungSandyWarmanNo ratings yet

- Account Usage and Recharge Statement From 12-Jul-2020 To 18-Jul-2020Document1 pageAccount Usage and Recharge Statement From 12-Jul-2020 To 18-Jul-2020MONISH NAYARNo ratings yet

- Indian Income Tax Return Acknowledgement for Assessment Year 2019-20Document1 pageIndian Income Tax Return Acknowledgement for Assessment Year 2019-20vvn HarishNo ratings yet

- Starbucks Supply Chain and Global Procurement StrategyDocument22 pagesStarbucks Supply Chain and Global Procurement StrategyJoysmita SahaNo ratings yet

- URA Shame List As at 31-12-2015Document2 pagesURA Shame List As at 31-12-2015jadwongscribdNo ratings yet