Professional Documents

Culture Documents

Test - CH 3

Uploaded by

luvkumar3532Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Test - CH 3

Uploaded by

luvkumar3532Copyright:

Available Formats

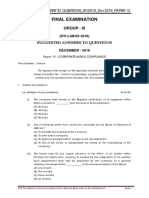

CA Intermediate (Batch Feb 2024)

Test of Chapter 3 - Prospectus

Maximum Time = 1 hour

Maximum Marks = 35 marks

Part A – 10 Marks - MCQs (Attempt All)

Q1: Which of following shall be considered as securities for purpose of section 23 of the Act;

1. Unit linked insurance policy

2. Actionable claim regarding mortgaged debt

3. Securities issued by National Asset Reconstruction Ltd

(a) only

(b) Both (i) and (iii) only

(c) Both (ii) and (iii) only

(d) None of the (i), (ii), and (iii)

Q2: An issue house (share broker) has issued an advertisement in two leading newspapers for selling a big

number of shares allotted to it by a company under a private placement. In which of the following conditions

the advertisement will not be deemed as prospectus?

(a) Advertisement was given within six months from the date of allotment

(b) Advertisement was given after six months from the date of allotment and the issue house paid the entire

consideration to the company

(c) The issue house did not pay entire consideration to the company till the date of allotment

(d) advertisement was given within three months from the date of allotment.

Q3: A prospectus remains valid for a period of ___ days from the date of which a copy thereof is delivered to

the Registrar under the provisions of the Companies Act, 2013

(a) 30

(b) 60

(c) 90

(d) 120

Q4: A shelf prospectus filed with the ROC shall remain valid for a period of:

(a) one year from the date of registration

(b) one year from the date of closing of first issue

(c) one year from the date of opening of first issue

(d) Ninety days from the date on which a copy was delivered to ROC

Q5: Shripad Religious Publishers Limited has received application money of 20,00,000 (2,00,000 equity shares

of 10 each) on 10th October, 2019 from the applicants who applied for allotment of shares in response to

a private placement offer of securities made by the company to them. Select the latest date by which the

company must allot the shares against the application money so received.

(a) 9th November, 2019

(b) 24th November, 2019

(c) 9th December, 2019.

(d) 8th January, 2020

Q6: In case of ‘offer of sale of shares by certain members of the company’, which of the following options is

applicable:

(a) The provisions relating to minimum subscription are not applicable

(b) Entire minimum subscription amount is required to be received within three days of the opening date

(c) 25% of the minimum subscription amount is required to be received on the opening date and the remaining 75%

within three days thereafter

(d) 50% of the minimum subscription is required to be received by the second day of the opening date and the

remaining 50% within next three days after the second day

CA Harsh Gupta CA_Law_HarshGupta

Q7: How much Security Deposit an unlisted public company is required to maintain, at all times, with the

respective depository when it dematerializes its securities.

(a) Equal to not less than one year’s fees payable to the depository

(b) Equal to not less than two years’ fees payable to the depository

(c) Equal to not less than two and a half years’ fees payable to the depository

(d) Equal to not less than three years’ fees payable to the depository

Q8: Criminal liability under section 34 for misstatement in prospectus may be avoided if -

1. the consent to become director was withdrawn

2. prospectus was issued without his knowledge

3. misstatement was immaterial

4. had reasonable ground to believe in truthfulness

5. it was based on statement of expert

(a) 3&4

(b) 1; 2; 3; 4 & 5

(c) 1; 2 & 5

(d) 3; 4 & 5

Q9: Which of the following statement is contrary with the provisions of the Companies Act; 2013?

(a) a private company can make a private placement of its securities

(b) company has to pass a special resolution for private placement

(c) Minimum offer per person should have Market Value of 20,000

(d) a public company can make a private placement of its securities

Q10: The time limit within which a copy of the contract for the payment of underwriting commission is required

to be delivered to the Registrar is:

(a) Three days before the delivery of the prospectus for registration

(b) At the time of delivery of the prospectus for registration

(c) Three days after the delivery of the prospectus for registration

(d) Five days after the delivery of the prospectus for registration

CA Harsh Gupta CA_Law_HarshGupta

Part B – 25 Marks (Subjective)

Question 1 is compulsory

Attempt any 4 out of remaining 5

1. The Board of Directors of 'A Limited' made a private placement offer to a group of 150 persons to subscribe for 100

equity shares @ 100 each on 1st April, 2022 after passing a special resolution in this regard. The company received

application money from the members on 15th April, 2022 but did not make an allotment of shares till 31st July, 2022.

Instead, during this interim period, the company opted to utilize the application money for the payment of dividend that

had been declared by the company. Some of the members raised an objection that as the allotment was not done by

the company within the prescribed time limit, the company is liable to repay the application money with interest @ 15%

p.a. for such non-compliance. Examine the validity of the objection raised by the members with reference to the

Companies Act, 2013, and also decide whether application money can be used for the payment of dividends by the

company.

(5 marks)

2. The Board of Directors of Plum Limited proposes to issue a prospectus inviting offers from the public for subscribing

to the equity shares of the company. State the reports which shall be included in the prospectus for the purposes of

providing financial information under the provisions of the Companies Act, 2013.

(5 marks)

3. An allottee of shares in a company brought action against a Director in respect of false statements in prospectus. The

director contended that the statements were prepared by the promoters and he has relied on them and so director is

not liable. State whether the director will be liable for the misstatements. Also specify the circumstances, if any, in

which the director can escape his liability for the misstatement in the prospectus.

(5 marks)

4. TDL Ltd., a public company is planning to bring a public issue of equity shares in June, 2018. The company has

appointed underwriters for getting its shares subscribed. As a Chartered Accountant of the company appraise the

Board of TDL Ltd. about the provisions of payment of underwriter's commission as per Companies Act, 2013.

(5 marks)

5. Explain the various instances which make the allotment of securities as irregular allotment under the provisions of

Companies Act, 2013.

(5 marks)

6. ABC Limited proposes to issue series of debentures frequently within a period of one year to raise the funds without

undergoing the complicated exercise of issuing the prospectus every time of issuing a new series of debentures.

Examine the feasibility of the proposal of ABC Limited having taken into account the concept of deemed prospectus

dealt with under the provisions of the Companies Act, 2013.

(5 marks)

CA Harsh Gupta CA_Law_HarshGupta

You might also like

- MCQ and DescriptiveDocument24 pagesMCQ and DescriptiveHussain CyclewalaNo ratings yet

- In LW Ut3 QPDocument7 pagesIn LW Ut3 QPFIRST OPINIONNo ratings yet

- CA Inter Law Test 1Document6 pagesCA Inter Law Test 1SwAti KiNiNo ratings yet

- Law T2Document7 pagesLaw T2Badhrinath ShanmugamNo ratings yet

- Company Law New Syllabus Question PaperDocument6 pagesCompany Law New Syllabus Question PaperCma Sankaraiah100% (1)

- CL Test Unit 4Document4 pagesCL Test Unit 4VbNo ratings yet

- Nov 23 MTP-1 (Q)Document8 pagesNov 23 MTP-1 (Q)luciferNo ratings yet

- Company Law PDFDocument8 pagesCompany Law PDFGajanan PanchalNo ratings yet

- Test - CH 4Document5 pagesTest - CH 4luvkumar3532No ratings yet

- Paper Set1Document5 pagesPaper Set1AVS InfraNo ratings yet

- Final Examination: Suggested Answers To QuestionsDocument20 pagesFinal Examination: Suggested Answers To QuestionsidealNo ratings yet

- SOLUTION (Test 2) THEORY Companies Act Part (CHAP 3 Prospectus)Document9 pagesSOLUTION (Test 2) THEORY Companies Act Part (CHAP 3 Prospectus)jj4223062003No ratings yet

- LAW English Question 27.08.2022Document9 pagesLAW English Question 27.08.2022Planet ZoomNo ratings yet

- Test # 11 Co. Act 6 - 7Document4 pagesTest # 11 Co. Act 6 - 7Prachi KarkhanisNo ratings yet

- New Syllabus: NOTE: 1Document32 pagesNew Syllabus: NOTE: 1suresh1No ratings yet

- MTP 3 15 Questions 1680696400Document7 pagesMTP 3 15 Questions 1680696400Umar MalikNo ratings yet

- CL Test Unit 3Document4 pagesCL Test Unit 3VbNo ratings yet

- New Syllabus: Note: 1Document4 pagesNew Syllabus: Note: 1Ankur GuptaNo ratings yet

- In Division B, Question No.1 Is Compulsory Attempt Any Three Questions Out of The Remaining Four QuestionsDocument7 pagesIn Division B, Question No.1 Is Compulsory Attempt Any Three Questions Out of The Remaining Four QuestionsKartik GuptaNo ratings yet

- Examination of Articled Clerks Paper II: Page - 1Document3 pagesExamination of Articled Clerks Paper II: Page - 1legallyindia100% (1)

- CMA Final Corporate Laws & Compliance Solution Dec 2019Document20 pagesCMA Final Corporate Laws & Compliance Solution Dec 2019komalc2026No ratings yet

- Caf 7 CLW Spring 2023Document5 pagesCaf 7 CLW Spring 2023marketcapcoin66No ratings yet

- Corporate and Other Laws: CA Inter Law Test Marathon - Test 3Document4 pagesCorporate and Other Laws: CA Inter Law Test Marathon - Test 3Ca FinalsNo ratings yet

- New Syllabus: Roll NoDocument29 pagesNew Syllabus: Roll Nosuresh1No ratings yet

- Revisionary Test Paper - Final - Syllabus 2012 - Jun2014: Paper 13 - Corporate Law and Compliance Section - ADocument48 pagesRevisionary Test Paper - Final - Syllabus 2012 - Jun2014: Paper 13 - Corporate Law and Compliance Section - Adeep_4uNo ratings yet

- Law Mock Test May 2019Document12 pagesLaw Mock Test May 2019Roshinisai VuppalaNo ratings yet

- New Syllabus: Answer ALL Questions. 2Document11 pagesNew Syllabus: Answer ALL Questions. 2Nitesh MamgainNo ratings yet

- 5 6176943427335225437Document46 pages5 6176943427335225437JINENDRA JAINNo ratings yet

- 52592bos42131 Finalold p7Document13 pages52592bos42131 Finalold p7sourabhNo ratings yet

- CR CS Professional Past PaperDocument6 pagesCR CS Professional Past PaperAkanksha PareekNo ratings yet

- Company Law Live Mock Test PDFDocument4 pagesCompany Law Live Mock Test PDFभगवा समर्थकNo ratings yet

- 2) LawDocument11 pages2) LawKrushna MateNo ratings yet

- Ep Os Module 1 Dec 20Document93 pagesEp Os Module 1 Dec 20Monika SinghNo ratings yet

- CR CS Professional Past PaperDocument7 pagesCR CS Professional Past PaperAkanksha PareekNo ratings yet

- 530 Free MCQs by FinAppDocument116 pages530 Free MCQs by FinAppjanardhan CA,CS100% (1)

- Roll No.....................................Document6 pagesRoll No.....................................black horseNo ratings yet

- CA - Test CH 1, 2 and 3Document4 pagesCA - Test CH 1, 2 and 3adsaNo ratings yet

- MTP 12 15 Answers 1696595420Document8 pagesMTP 12 15 Answers 1696595420harshallahotNo ratings yet

- MTP Law IiDocument11 pagesMTP Law IiAbhishant KapahiNo ratings yet

- MTP 19 48 Questions 1711974286Document12 pagesMTP 19 48 Questions 1711974286Sridhar GuptaNo ratings yet

- Ilovepdf MergedDocument76 pagesIlovepdf MergedNitin KumarNo ratings yet

- Guideline Answers: Professional ProgrammeDocument57 pagesGuideline Answers: Professional ProgrammeLekshminarayanan KrishnanNo ratings yet

- Practice Questions Company LawDocument8 pagesPractice Questions Company LawAditi SinghNo ratings yet

- Roll No. ..................................... : Part-I 1Document8 pagesRoll No. ..................................... : Part-I 1ssNo ratings yet

- 16.06.23 CMA Inter (Law) (Section C&D) (With Ans)Document7 pages16.06.23 CMA Inter (Law) (Section C&D) (With Ans)abhinandnthrukkampattaNo ratings yet

- Roll No. ..................................... : New SyllabusDocument7 pagesRoll No. ..................................... : New Syllabuskevin12345555No ratings yet

- 2) LawDocument13 pages2) LawvgbhNo ratings yet

- MangaDocument12 pagesMangavt7414823No ratings yet

- Law - QuestionsDocument8 pagesLaw - Questionssinglatanmay84No ratings yet

- SP 25-12-2022Document4 pagesSP 25-12-2022Niranjan JadhavNo ratings yet

- P1 Adv Ac MTP2 May24 QP @CAInterLegendsDocument16 pagesP1 Adv Ac MTP2 May24 QP @CAInterLegendsgouravsah2003No ratings yet

- Chap 3 Prospectus & Allotment of SecuritiesDocument75 pagesChap 3 Prospectus & Allotment of SecuritiesAshraf ZishaanNo ratings yet

- Answer PDFDocument7 pagesAnswer PDFManjunath ANo ratings yet

- Paper5 Set2Document4 pagesPaper5 Set2Sa7hkr17h GaurNo ratings yet

- Corporate & Other Laws Question PaperDocument8 pagesCorporate & Other Laws Question Paperpradhiba meenakshisundaramNo ratings yet

- Solved Answer LAW CA PCC June 2009Document10 pagesSolved Answer LAW CA PCC June 2009nikhil92007No ratings yet

- 79 Law TestDocument3 pages79 Law TestKrushna MateNo ratings yet

- LAW 2 New Question PaperDocument9 pagesLAW 2 New Question Paperneha manglaniNo ratings yet

- June 2022 CsexamDocument11 pagesJune 2022 CsexamDiksha AroraNo ratings yet

- An Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersFrom EverandAn Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersNo ratings yet

- MTP 10 17 Answers 1694876511Document11 pagesMTP 10 17 Answers 1694876511luvkumar3532No ratings yet

- Aa RTP M24Document32 pagesAa RTP M24luvkumar3532No ratings yet

- MTP 1N23Document7 pagesMTP 1N23luvkumar3532No ratings yet

- MTP 2N23Document7 pagesMTP 2N23luvkumar3532No ratings yet

- Tutorial 9 PM AnswersDocument6 pagesTutorial 9 PM AnswersKhanh Linh LeNo ratings yet

- Chapter 8 QuizDocument3 pagesChapter 8 QuizTriet Nguyen0% (1)

- C) Technical AnalysisDocument7 pagesC) Technical AnalysisLorrie Mae LicayanNo ratings yet

- Intrinsic Value Calculator. Book Value and Dividend GrowthDocument4 pagesIntrinsic Value Calculator. Book Value and Dividend Growthvr97No ratings yet

- The Declining U.S. Equity PremiumDocument19 pagesThe Declining U.S. Equity PremiumpostscriptNo ratings yet

- Response Letter - LOA - VAT 2021 - RAWDocument2 pagesResponse Letter - LOA - VAT 2021 - RAWGeralyn BulanNo ratings yet

- TRB PG Objective Commerce Study MaterialDocument42 pagesTRB PG Objective Commerce Study Materialfam byteNo ratings yet

- MR KUMARMANGALAM BIRLA REPORTDocument33 pagesMR KUMARMANGALAM BIRLA REPORTUday SethiNo ratings yet

- List of Preference Shares 08.06.19Document1,887 pagesList of Preference Shares 08.06.19gcgary87No ratings yet

- TUGAS 3 - Maquoketa ServicesDocument5 pagesTUGAS 3 - Maquoketa ServicesEunice LylianNo ratings yet

- An Investigation of Auditors Responsibility For Fraud Detection in TaiwanDocument18 pagesAn Investigation of Auditors Responsibility For Fraud Detection in TaiwanmaliNo ratings yet

- Midterm Exam 41-49Document3 pagesMidterm Exam 41-49밀크milkeuNo ratings yet

- Inac Recitation (Book)Document2 pagesInac Recitation (Book)Rovee PagaduanNo ratings yet

- Actg 110aDocument57 pagesActg 110aSittie HafsahNo ratings yet

- HK000000002261493296 HK000000002261493302Document113 pagesHK000000002261493296 HK000000002261493302Sin Publicidad 2016No ratings yet

- Role of Independent DirectorsDocument18 pagesRole of Independent DirectorsSiddhanNo ratings yet

- Cambridge IGCSE: Accounting 0452/12Document12 pagesCambridge IGCSE: Accounting 0452/12afyNo ratings yet

- Test Bank For Intermediate Accounting 7 Edition David Spiceland James F Sepe Mark W NelsonDocument23 pagesTest Bank For Intermediate Accounting 7 Edition David Spiceland James F Sepe Mark W Nelsonthridapricot11e24eNo ratings yet

- TWSE Stocks ListDocument118 pagesTWSE Stocks Listaria smorderNo ratings yet

- 3.2 Business Profit TaxDocument49 pages3.2 Business Profit TaxBizu AtnafuNo ratings yet

- Financial Accounting Chapter 6 QuizDocument7 pagesFinancial Accounting Chapter 6 QuizZenni T Xin100% (1)

- American Depository Receipts (Adrs)Document4 pagesAmerican Depository Receipts (Adrs)rajeshNo ratings yet

- Check List CheckingDocument79 pagesCheck List CheckingAnonymous BgoceGe76No ratings yet

- Crafting and Executing StrategyDocument69 pagesCrafting and Executing Strategykrvij100% (2)

- ACCT1101 Wk7 Tutorial 6 SolutionsDocument9 pagesACCT1101 Wk7 Tutorial 6 SolutionskyleNo ratings yet

- Buenaflor WorksheetDocument10 pagesBuenaflor WorksheetRaff LesiaaNo ratings yet

- Corporate Finance Group ProjectDocument3 pagesCorporate Finance Group ProjectSashalee SwabyNo ratings yet

- Simplywall STDocument10 pagesSimplywall STciprianradu141No ratings yet

- Unidad 3.1Document12 pagesUnidad 3.1Alecia WongNo ratings yet

- Chap 1 Test BankDocument22 pagesChap 1 Test BankMike SerafinoNo ratings yet