Professional Documents

Culture Documents

CENG 196 PSET 03 v0.2

CENG 196 PSET 03 v0.2

Uploaded by

rie.mori05Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CENG 196 PSET 03 v0.2

CENG 196 PSET 03 v0.2

Uploaded by

rie.mori05Copyright:

Available Formats

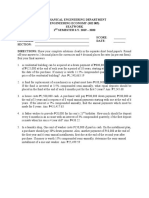

CENG 196 – CE COMPETENCY APPRAISAL 1

Problem Set No. 03

Engineering Economy

Instructions: Answer the following questions on CE paper. Format your paper into two

columns for clarity, ensuring each question is accompanied by its complete

solution. Enclose your final answer for each question within a box. Submission

deadline: March 26, 2024.

1. The tag price of a certain commodity is for 100 days. If paid in 31 days, there is a

3% discount. What is the simple interest paid?

2. A machine having a first cost of P 60,000.00 will be retired at the end of 8 years.

Depreciation cost is computed using a constant percentage of the declining book

value. What is the total cost of depreciation, in pesos, up to the time the machine

is retired if the annual rate of depreciation is 28.72%?

3. One hundred thousand pesos was placed in a time deposit which earned 9%

compounded quarterly, tax free. After how many years would it be able to earn a

total interest of fifty thousand pesos?

4. A debt of x pesos, with interest rate of 7% compounded annually will be retired at

the end of 10 years through the accumulation of deposit in the sinking fund

invested at 6% compounded semi-annually. The deposit in the sinking fund every

end of six months is P 21,962.68. What is the value of x?

5. The present value of an annuity of R pesos, payable annually for 8 years, with the

first payment at the end of 10 years, is P 187,481.25. Find the value of R if money is

worth 5%

6. Determine the break-even point in terms of number of units produced per month

using the following data: (the costs are in pesos per unit)

Selling price per unit = 600 pesos

Total Monthly overhead expenses = 428,000 pesos

Labor cost = 115 pesos

Cost of materials = 76 pesos

Other variable cost = 2.32 pesos

7. What rate (%) compounded quarterly is equivalent to 6% compounded semi-

annually?

8. A new engine will cost P 12,000 with an estimated life of 15 years and a salvage

value of P 800 and guaranteed to have an operating cost of P 3,500 per year. The

new engine is considered as a replacement of the old one. The old engine is

considered as a replacement of the old one. The old engine had a total annual

cost of P 5,200 to operate. Determine the rate of return of the new investment using

6% sinking fund to cover depreciation, if the old engine could be sold now for P

2,000.

9. A time deposit of P 110,000 for 31 days earns P 890.39 on maturity date after

deducting the 20% withholding tax on interest income. Find the rate of interest per

annum.

10. Machine cost = P 15,000; Life = 8 years; Salvage Value = P 3,000. What minimum

cash return would the investor demand annually from the operation of this machine

if he desires interest annually at the rate of 8% in his investment and accumulates a

capital replacement fund by investing annual deposits at 5%?

You might also like

- Rental-Property Profits: A Financial Tool Kit for LandlordsFrom EverandRental-Property Profits: A Financial Tool Kit for LandlordsNo ratings yet

- Eco Notes - Money and BankingDocument8 pagesEco Notes - Money and Bankingutkarsh joshiNo ratings yet

- Annuity, Gradient, PerpetuityDocument2 pagesAnnuity, Gradient, PerpetuityJsbebe jskdbsj100% (3)

- EngineeringeconomyanswerssssDocument13 pagesEngineeringeconomyanswerssssMalik MalikNo ratings yet

- Additional Problems Engineering EconomyDocument4 pagesAdditional Problems Engineering EconomyMark James0% (1)

- Engineering Economy Refresher SetDocument4 pagesEngineering Economy Refresher SetEmmanuel AzuelaNo ratings yet

- CE Board Problems in Engineering EconomyDocument6 pagesCE Board Problems in Engineering EconomyHomer Batalao75% (4)

- Asset - Liability Management System in Banks - Guidelines: 4. ALM Information SystemsDocument12 pagesAsset - Liability Management System in Banks - Guidelines: 4. ALM Information SystemsKevin VazNo ratings yet

- Refresh Module 25 (M19) - Engineering Economy 2Document2 pagesRefresh Module 25 (M19) - Engineering Economy 2Fely Joy RelatoresNo ratings yet

- Hybrid Financing: Preferred Stock, Leasing, Warrants, and ConvertiblesDocument29 pagesHybrid Financing: Preferred Stock, Leasing, Warrants, and ConvertiblesUmer Ali KhanNo ratings yet

- Aci Dealing Certificate Q&aDocument152 pagesAci Dealing Certificate Q&aWesta GeafricaNo ratings yet

- ProblemsDocument28 pagesProblemsYou Knock On My DoorNo ratings yet

- Capital BudgetingDocument4 pagesCapital BudgetingYaj CruzadaNo ratings yet

- 32439287Document18 pages32439287Anjo Vasquez67% (3)

- Engineering EconomicsDocument10 pagesEngineering EconomicsLarah PiencenavesNo ratings yet

- Engineering Economy Problem1Document11 pagesEngineering Economy Problem1frankRACENo ratings yet

- Assignment On Inflation in BangladeshDocument9 pagesAssignment On Inflation in BangladeshSabbir AhamedNo ratings yet

- Looks Fam Econ 4Document24 pagesLooks Fam Econ 4Jayson PagalNo ratings yet

- Engineering Economy Refresher SetDocument4 pagesEngineering Economy Refresher SetMICHAEL JAY ROGANNo ratings yet

- Em 5 Final Term Take Home Quiz Bsee2 1Document3 pagesEm 5 Final Term Take Home Quiz Bsee2 1ParisDelaCruzNo ratings yet

- FinalsDocument7 pagesFinalsPaola Marie CabariosNo ratings yet

- Diag-Economy ADocument3 pagesDiag-Economy APaulo Emmanuele BetitaNo ratings yet

- P5Document7 pagesP5Chris PecasalesNo ratings yet

- PROBLEM SET 1 (Part 1 & 2)Document3 pagesPROBLEM SET 1 (Part 1 & 2)selmareynaldo29No ratings yet

- Deferred AnnuityDocument1 pageDeferred AnnuityChristian MonvilleNo ratings yet

- Engineering Economy Refresher Set PdfbooksforumDocument5 pagesEngineering Economy Refresher Set PdfbooksforumEdmond BautistaNo ratings yet

- Ie151-2x - Eng Eco - PsDocument9 pagesIe151-2x - Eng Eco - Psjac bnvstaNo ratings yet

- Set of Problems (Econ)Document4 pagesSet of Problems (Econ)Ariana Athena V. PanuncioNo ratings yet

- Tolentino Sample Refresher Notes in MathDocument6 pagesTolentino Sample Refresher Notes in MathDindo Mojica100% (2)

- Engineering EconomyDocument4 pagesEngineering EconomyRochelle Louise SampagaNo ratings yet

- Test 2Document2 pagesTest 2raaasaaNo ratings yet

- Statistic Math PDFDocument40 pagesStatistic Math PDFNick GeneseNo ratings yet

- PT 8Document6 pagesPT 8KidlatNo ratings yet

- Engineering Economics - Practice ProblemsDocument5 pagesEngineering Economics - Practice ProblemsSai Krish PotlapalliNo ratings yet

- Exercise 1 FinalDocument4 pagesExercise 1 FinalSlorge dagaldalNo ratings yet

- Assignment 4Document2 pagesAssignment 4Cheung HarveyNo ratings yet

- ENGECODocument3 pagesENGECOmgoldiieeee20% (5)

- BES 221 (PART I - Prefinal Module)Document9 pagesBES 221 (PART I - Prefinal Module)Kristy SalmingoNo ratings yet

- Assignment EcoDocument3 pagesAssignment EcobaterbeeNo ratings yet

- EE Assignments 2016Document8 pagesEE Assignments 2016manojNo ratings yet

- Drill-9 EecoDocument17 pagesDrill-9 EecoTine AbellanosaNo ratings yet

- Engg. EconomicsDocument2 pagesEngg. EconomicsStevenNo ratings yet

- T-MEET310 PS SurnameDocument6 pagesT-MEET310 PS SurnameRochiiNo ratings yet

- Problem Set No. 1Document2 pagesProblem Set No. 1jose friasNo ratings yet

- Ie198 Eeco DrillsDocument6 pagesIe198 Eeco DrillsTintin Tao-onNo ratings yet

- Engineering Economy ExaminationDocument21 pagesEngineering Economy ExaminationElmarc CodenieraNo ratings yet

- Engineering Economics Questions Problem SolvingDocument4 pagesEngineering Economics Questions Problem SolvingLouie Jay LayderosNo ratings yet

- Lesson 16 - Engineering Economics 02Document1 pageLesson 16 - Engineering Economics 02Darvid Wycoco IINo ratings yet

- Institute of Actuaries of India: ExaminationsDocument5 pagesInstitute of Actuaries of India: ExaminationsHemanshu JainNo ratings yet

- Engineering Econ and Financial ManagementDocument10 pagesEngineering Econ and Financial ManagementLoala SMDNo ratings yet

- Money - Time Relationships and Equivalence: Name of Student/s: Dickinson, Sigienel Gabriel, Neil Patrick ADocument12 pagesMoney - Time Relationships and Equivalence: Name of Student/s: Dickinson, Sigienel Gabriel, Neil Patrick ASasuke UchichaNo ratings yet

- Sheet#4 - Time Value of MoneyDocument4 pagesSheet#4 - Time Value of MoneyMuhammad RakibNo ratings yet

- Practice ProblemsDocument4 pagesPractice ProblemsThalia RodriguezNo ratings yet

- Engineering Economics FormularsDocument9 pagesEngineering Economics FormularsFe Ca Jr.No ratings yet

- Practice Problem 3 AnnuityDocument4 pagesPractice Problem 3 Annuityxypat45No ratings yet

- CE A92 Final PlatesDocument2 pagesCE A92 Final PlatesMikaNo ratings yet

- Probset #2 - Engineering EconomicsDocument2 pagesProbset #2 - Engineering EconomicsKshatriya EllaNo ratings yet

- Ecoon PDFDocument9 pagesEcoon PDFJm T. Despabeladero100% (1)

- EconDocument18 pagesEconBenzeneNo ratings yet

- Assignment 1Document21 pagesAssignment 1Mai Abd El-AzizNo ratings yet

- Exrcises and Topics For Discussions DB 2024Document6 pagesExrcises and Topics For Discussions DB 2024Nguyễn Hồng HạnhNo ratings yet

- ECONDocument11 pagesECON22-00248No ratings yet

- Tutorial Sheet 2Document2 pagesTutorial Sheet 2siamesamuel229No ratings yet

- Examinations: Subject 102 - Financial MathematicsDocument5 pagesExaminations: Subject 102 - Financial MathematicsClerry SamuelNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Session 8 and 9 Money, Money Supply, and Money DemandDocument86 pagesSession 8 and 9 Money, Money Supply, and Money DemandhmsbegaleNo ratings yet

- Sources of Finance and Its CostsDocument34 pagesSources of Finance and Its CostsVyakt MehtaNo ratings yet

- Financial Mathematics and Derivatives Chapter 6: LoansDocument23 pagesFinancial Mathematics and Derivatives Chapter 6: LoansFelicia PriskillaNo ratings yet

- Instructors: Beppino PasqualiDocument10 pagesInstructors: Beppino PasqualiAayush AgarwalNo ratings yet

- Fm-Module II Word Document - Anjitha Jyothish Uvais PDFDocument17 pagesFm-Module II Word Document - Anjitha Jyothish Uvais PDFMuhammed HuvaisNo ratings yet

- Review Questions - Chapter 18Document6 pagesReview Questions - Chapter 18Thabiso NgcoboNo ratings yet

- Multiplier and IS-LM ModelDocument49 pagesMultiplier and IS-LM ModelPRATIKSHA KARNo ratings yet

- S N Ne C Las Es L: Quantitative AptitudeDocument33 pagesS N Ne C Las Es L: Quantitative AptitudeanuragNo ratings yet

- Cost of Capital QuestionsDocument18 pagesCost of Capital QuestionsRonmaty VixNo ratings yet

- Auditing Problem 12-18-21Document23 pagesAuditing Problem 12-18-21Joebelle JamosoNo ratings yet

- U2 Revision Notes AQA EconomicsDocument3 pagesU2 Revision Notes AQA EconomicsxiaoniNo ratings yet

- Chapter Twenty-Two: Managing Interest Rate Risk and Insolvency Risk On The Balance SheetDocument23 pagesChapter Twenty-Two: Managing Interest Rate Risk and Insolvency Risk On The Balance SheetSagheer MuhammadNo ratings yet

- Eco 531 - Chapter 1Document8 pagesEco 531 - Chapter 1Nurul Aina IzzatiNo ratings yet

- CA - FOUNDATION LT (APRIL BATCH) NOV'23WE-4 QP-keyDocument4 pagesCA - FOUNDATION LT (APRIL BATCH) NOV'23WE-4 QP-keyDhruv AgarwalNo ratings yet

- CH 14Document6 pagesCH 14Saleh RaoufNo ratings yet

- Earnings Per Share (EPS)Document3 pagesEarnings Per Share (EPS)Gaurav SinhaNo ratings yet

- Unit 1-Financial ManagementDocument66 pagesUnit 1-Financial ManagementAshwini shenolkarNo ratings yet

- Bond ValuationDocument35 pagesBond ValuationCOC AbirNo ratings yet

- Macroeconomics 12th Edition Michael Parkin Solutions ManualDocument11 pagesMacroeconomics 12th Edition Michael Parkin Solutions Manualsarclescaladezk3tc100% (17)

- Measuring The Cost of Living: Powerpoint Slides Prepared By: Andreea Chiritescu Eastern Illinois UniversityDocument56 pagesMeasuring The Cost of Living: Powerpoint Slides Prepared By: Andreea Chiritescu Eastern Illinois UniversityPutri Shery yulianiNo ratings yet

- Cost of Capital ProblemsDocument2 pagesCost of Capital Problemscourse shtsNo ratings yet

- Questions of MTP and RTPDocument144 pagesQuestions of MTP and RTPGaurang ChhanganiNo ratings yet

- JLL - RE DictionaryDocument34 pagesJLL - RE DictionaryHarsh Shah100% (1)

- General Mathematics Q2 Week 1Document18 pagesGeneral Mathematics Q2 Week 1Santos, Mart Czendric Y.No ratings yet