Professional Documents

Culture Documents

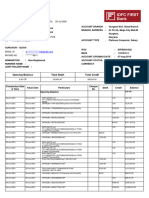

bank-statement-template-25

Uploaded by

skhushbusahniCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

bank-statement-template-25

Uploaded by

skhushbusahniCopyright:

Available Formats

Money Tracker Guide for Direct Payments - Children’s Disability Service

Money Tracker Guide 1

MONITORING - Money Tracker Form

You have to provide an account of how you have used your Direct Payments.

The Money Tracker Form is a simple way to record this information.

The Money Tracker form supports information in your Direct Payments bank

statement by showing all your Direct Payments money transactions, both in

and out.

Money in is also sometimes referred to as income or credits and money out

as payments or debits.

To complete the Money Tracker you will need:

Your most recent bank statements

Your cheque book(s)

Your paying in book, if applicable

Any relevant invoices or receipts

Debit card receipts

A record of any standing orders and direct debits that are set up

A copy of your direct payment support plan and or child in need plan.

They should contain information on what the assessed needs are and

what outcomes are expected to be achieved through the care

purchased with the direct payments

Your timesheets will also be helpful

If you make cash payments from the account you will also need:

Cash point withdrawal receipts.

You should really only use cash transactions in exceptional circumstances

when you can’t pay by cheque or credit card. A clear record must be kept for

all cash payments.

You will need to keep all of these records for at least 6 years plus the current

year to comply with H M Revenue and Custom requirements.

Your Direct Payment Budget runs on an annual allocation basis. This

means that any unused funds remaining in the account at the end of the

budget year over and above the carry forward limit of 8 x weekly direct

payment (4 weeks in advance plus the current 4 week period) must be repaid

to the local authority. A fresh budget year then commences and unused

funds are re-allocated/redistributed. Money Tracker Forms will be issued

Appendix L Money Tracker Guide (Direct Payments Monitoring) 1

annually and may also on occasion be issued in between times. However our

Finance and Audit staff may contact you at any time and ask to see your

records.

How to record your use of Direct Payments

1. Make sure you get invoices or receipts for all Direct Payment services.

Keep all receipts and store them in monthly order. This will make it

easier if you are asked to produce them for an audit. Old shoe boxes,

envelopes or plastic wallets might be hand for this!

2. Keep enough blank Money Tracker forms for future use. Forms are

available on request from your Direct Payments Support Officer.

3. Record the amount of each payment in the money out column.

(Please note that North East Lincolnshire Council will not cover bank

charges incurred as a result of going overdrawn, unless the council is

at fault.)

4. Record who the money was paid to in the column headed ‘Supplier of

Service’

5. Record what you paid for in the column headed ‘Description of

Purchase’

6. Put what agreed outcome(s) from your direct payment support plan or

child in need plan have been met in the final column of the Money

Tracker. Remember you Direct Payment spending should always

match outcomes in your child in need plan and direct payment support

plan.

7. Record all income into your Direct Payments account in the money in

column.

8. Use the numbered columns on the left of the Money Tracker Form to

match the money paid in and out to the entries on your bank statement.

9. Money Tracker forms and supporting bank statements must be sent in

to North East Lincolnshire Council when requested, or your payments

may be suspended or stopped. This is part of your Direct Payments

Agreement.

You can post tracker forms and copies of your bank statements to:

Direct Payments Money Trackers, Children's Disability Services, North

East Lincolnshire Council, The Western Site, Cambridge Road, Grimsby.

DN34 5TD.

For assistance you can telephone: 01472-325607 and ask for the Direct

Payments Officer.

Appendix L Money Tracker Guide (Direct Payments Monitoring) 2

Money Tracker Guide for Direct Payments - Children’s Disability Service

Money Tracker Guide 2

Example Bank Statement

ABC Bank

Monthly Statement Statement 1 of 12

Account Of: Period: DD/MM/YY to DD/MM/YY

Ms A. Nonymous Account No: 11223344

1 Sunny Street Sort Code: 00-00-00

Sunnyville

SU1 1NY

Date Transaction Detail Debit (DR) Credit (CR) Balance

(paid out) (paid in)

01/01/01 Opening Balance 500.00 CR

02/01/01 Cheque 000020 1 25.00 475.00 CR

06/01/01 Cheque 000021 2 15.00 460.00 CR

07/01/01 Transfer from NELC 1 200.00 660.00 CR

07/01/01 Cheque 000022 3 140.00 520.00 CR

10/01/01 Cheque 000023 4 250.00 270.00 CR

10/01/01 Cheque 000024 5 36.00 234.00 CR

16/01/01 Cheque 000025 6 84.00 150.00 CR

31/01/01 Closing Balance 150.00 CR

In the above example 1 2 3 etc in bold italics represent consecutive

item/transaction numbers that you would write in the debit and credit columns

on your bank statement. You would then relate these to the item numbers

that you record on the Money Tracker form. (See page 4 showing an example

of a completed Money Tracker Form for this bank statement)

Appendix L Money Tracker Guide (Direct Payments Monitoring) 3

Money Tracker Guide for Direct Payments - Children’s Disability Service

Money Tracker Guide 3

Example Completed Money Tracker Form

A. Record of money paid out from this account

Item number Money out Supplier of Description of How does this expenditure

(correspond to £ service purchase correspond to the assessed

bank

(Debit) outcomes in the Support

statement)

Plan?

25.00 Mr Ace Carer Carers Carers entrance fee to

1 expenses amusement park paid

15.00 HM Revenue and NationaI Employee/Carer’s National

2 Customs Insurance Insurance paid

140.00 Mr Ace Carer Childcare Child care and social

3 events attended- youth

group, scouts, bowling

250.00 Mr Ace Carer Childcare Childcare inc overnight

4 stays. Parents able to have

unbroken sleep and one to

one time for themselves.

36.00 HM Revenue and National Employee/Carer’s National

5 Customs Insurance Insurance paid

84.00 Mr Ace Carer Childcare, play Holiday activity, caring

6 club break for mum

10

B. Record of money paid in to this account

Item number Money in Any other Description

(correspond to £ money in e.g.

bank interest/other

(Credit)

statement)

200.00 Direct payment from NELC

1

The above gives an example of a complete Money Tracker Form. It shows all money

transactions made in the relevant period. Each item number listed is matched to the

bank statements by writing the item number against the corresponding transaction on

the statement. (See Page 3 Money Tracker Guide 2 – Example bank statement).

Each purchase made has a description of how the money spent has contributed to the

assessed outcomes for your child.

Appendix L Money Tracker Guide (Direct Payments Monitoring) 4

You might also like

- Bank Statement 4Document4 pagesBank Statement 4Jardan Nelli86% (7)

- Business checking statement summaryDocument2 pagesBusiness checking statement summaryKelleyNo ratings yet

- Chase Sep V 2.9Document11 pagesChase Sep V 2.9faxev83733100% (1)

- Chase Bank Statement Template (1) 2Document4 pagesChase Bank Statement Template (1) 2Melissa Douca79% (14)

- Chase Bank Statement BankStatements - Net SepDocument4 pagesChase Bank Statement BankStatements - Net SepJoe SFNo ratings yet

- Bank Statement SummaryDocument11 pagesBank Statement Summaryfaxev8373350% (2)

- December 20, 2013Document4 pagesDecember 20, 2013Ishmon BrownNo ratings yet

- 000 Citibank Client Services 013 PO Box 6201 Sioux Falls, SD 57117-6201 Citibank, N. ADocument4 pages000 Citibank Client Services 013 PO Box 6201 Sioux Falls, SD 57117-6201 Citibank, N. AS RNo ratings yet

- Chase Bank Statement SummaryDocument4 pagesChase Bank Statement Summaryyungler0% (2)

- STMNT 112013 9773Document3 pagesSTMNT 112013 9773redbird77100% (1)

- Citi Bank 2021 StatementsDocument2 pagesCiti Bank 2021 StatementsJohn call67% (3)

- JPMCStatementDocument4 pagesJPMCStatementhealthymassagecs50% (2)

- Your Business Advantage Relationship Banking: Account SummaryDocument4 pagesYour Business Advantage Relationship Banking: Account SummaryJasmine ONeill50% (2)

- Bank Statement Template 19Document4 pagesBank Statement Template 19Thai Chu DinhNo ratings yet

- BRS Full ChapterDocument16 pagesBRS Full ChapterMumtazAhmad100% (1)

- Captial Bank PDFDocument6 pagesCaptial Bank PDFayaNo ratings yet

- Wire Reciept For DaveDocument9 pagesWire Reciept For DaveNicoleNo ratings yet

- Wilkerson Case Study FinalDocument5 pagesWilkerson Case Study Finalmayer_oferNo ratings yet

- BOA 账单 ARMOND - ROBBINS - e - statement PDFDocument5 pagesBOA 账单 ARMOND - ROBBINS - e - statement PDFZheng YangNo ratings yet

- Summary of My Deposit Accounts How To Contact UsDocument2 pagesSummary of My Deposit Accounts How To Contact UsĐào Văn CườngNo ratings yet

- Bank Reconciliation Statement GuideDocument13 pagesBank Reconciliation Statement GuideAli Hassan100% (1)

- Jan 28-Feb 24, 2010: Account ActivityDocument3 pagesJan 28-Feb 24, 2010: Account ActivityAna OdenNo ratings yet

- QUIZ in Government Accounting Disbursements: (Group 3)Document6 pagesQUIZ in Government Accounting Disbursements: (Group 3)TokkiNo ratings yet

- VAT Registration Certificate UAEDocument1 pageVAT Registration Certificate UAEMaaz AzadNo ratings yet

- B 73 C 604 C 20110218Document4 pagesB 73 C 604 C 20110218ALine QueiRozNo ratings yet

- Spark RPG Colour PDFDocument209 pagesSpark RPG Colour PDFMatthew Jackson100% (1)

- Scib RC PipesDocument4 pagesScib RC PipesterrylimNo ratings yet

- Reconciling Bank Statements and Cash BooksDocument12 pagesReconciling Bank Statements and Cash BooksAnita ZerafaNo ratings yet

- ACCOUNTING5Document9 pagesACCOUNTING5Natasha MugoniNo ratings yet

- Shaheed Taylor 2223 Florey LN Apt. E8 ROSLYN PA 19001: Return Service RequestedDocument3 pagesShaheed Taylor 2223 Florey LN Apt. E8 ROSLYN PA 19001: Return Service Requestedshaheed taylorNo ratings yet

- Report On Financial Reporting of Abans RSL To The ManagementDocument15 pagesReport On Financial Reporting of Abans RSL To The ManagementNatala De LemisNo ratings yet

- Cash and Cash Equivalents & Bank ReconciliationDocument20 pagesCash and Cash Equivalents & Bank ReconciliationHesil Jane DAGONDON100% (1)

- Accounting Cash Internal ControlsDocument14 pagesAccounting Cash Internal ControlsDave A ValcarcelNo ratings yet

- Ac3a Qe Oct2014 (TQ)Document15 pagesAc3a Qe Oct2014 (TQ)Julrick Cubio EgbusNo ratings yet

- IFA Chapter 3Document97 pagesIFA Chapter 3kqk07829No ratings yet

- Accounting PPT ReportDocument27 pagesAccounting PPT ReportAbdullah AmjadNo ratings yet

- Acct 2600 Exam 2 Study SheetDocument11 pagesAcct 2600 Exam 2 Study Sheetapi-236442317No ratings yet

- Keac105 PDFDocument31 pagesKeac105 PDFPalashMandalNo ratings yet

- Bank Statement Template 20Document4 pagesBank Statement Template 20衡治洲No ratings yet

- Ignou Solved Assignment Eco - 02 - 2014-15Document11 pagesIgnou Solved Assignment Eco - 02 - 2014-15NandanUpamanyu50% (4)

- Answer to DAF BURERADocument72 pagesAnswer to DAF BURERAbomujykijaNo ratings yet

- Bank Reconciliation NotesDocument25 pagesBank Reconciliation NotesJohn Sue HanNo ratings yet

- Quizzer (Cash To Inventory Valuation) KeyDocument10 pagesQuizzer (Cash To Inventory Valuation) KeyLouie Miguel DulguimeNo ratings yet

- USA Citibank Statement Word and PDF Template.pdf.Pdf_20240403_070654_0000Document2 pagesUSA Citibank Statement Word and PDF Template.pdf.Pdf_20240403_070654_0000abooddeleNo ratings yet

- Petty CashDocument11 pagesPetty CashKim HaejinNo ratings yet

- Brian Smith Account 11990790488 Statement Period - Jan 1 - Jan 31, 2022Document1 pageBrian Smith Account 11990790488 Statement Period - Jan 1 - Jan 31, 2022novelNo ratings yet

- AssignmentDocument8 pagesAssignmentNitesh AgrawalNo ratings yet

- Chapter 5Document5 pagesChapter 5Abrha636No ratings yet

- FA Notes ReviewDocument85 pagesFA Notes ReviewIrina StrizhkovaNo ratings yet

- Ncert AccountancyDocument23 pagesNcert AccountancyArif ShaikhNo ratings yet

- Bank Reconciliation Statement GuideDocument5 pagesBank Reconciliation Statement GuideEng Abdulkadir MahamedNo ratings yet

- Chapter 11 HWDocument5 pagesChapter 11 HWariana rodriguezNo ratings yet

- ACC17-FAR Take Home Activities 1 and 2: Test IDocument19 pagesACC17-FAR Take Home Activities 1 and 2: Test IJustine Cruz67% (3)

- Optimize Cash ControlsDocument18 pagesOptimize Cash ControlsAhmed RawyNo ratings yet

- Double SystemDocument10 pagesDouble SystemNatasha MugoniNo ratings yet

- The Bank ReconciliationDocument3 pagesThe Bank ReconciliationAhmed SroorNo ratings yet

- Bank Reconciliation Statement - Definition, Explanation, Example and Causes of Difference - Accounting For ManagementDocument5 pagesBank Reconciliation Statement - Definition, Explanation, Example and Causes of Difference - Accounting For Managementpeter tichiNo ratings yet

- Bank Reconciliation Statement - Principles of AccountingDocument8 pagesBank Reconciliation Statement - Principles of AccountingAbdulla MaseehNo ratings yet

- Books of Original Entry (Cont)Document16 pagesBooks of Original Entry (Cont)mahmoud abdallahNo ratings yet

- F3FFA Chapter 6 PETTY CASHDocument10 pagesF3FFA Chapter 6 PETTY CASHMd Enayetur RahmanNo ratings yet

- Economic & Budget Forecast Workbook: Economic workbook with worksheetFrom EverandEconomic & Budget Forecast Workbook: Economic workbook with worksheetNo ratings yet

- CBSE-Sample-Paper-2024-Class-10-Maths-Standard-SQPDocument10 pagesCBSE-Sample-Paper-2024-Class-10-Maths-Standard-SQPskhushbusahniNo ratings yet

- MISTERIOUS LIFES] (19)Document598 pagesMISTERIOUS LIFES] (19)skhushbusahniNo ratings yet

- 14Document2 pages14skhushbusahniNo ratings yet

- LOLA LOG MERADocument9 pagesLOLA LOG MERAskhushbusahniNo ratings yet

- Sqbki Behanki ChutDocument5 pagesSqbki Behanki ChutskhushbusahniNo ratings yet

- CBSE-Sample-Paper-2024-Class-10-Maths-Basic-SQPDocument8 pagesCBSE-Sample-Paper-2024-Class-10-Maths-Basic-SQPskhushbusahniNo ratings yet

- Sqbki Behanki ChutDocument5 pagesSqbki Behanki ChutskhushbusahniNo ratings yet

- MISTERIOUS LIFES] (19)Document598 pagesMISTERIOUS LIFES] (19)skhushbusahniNo ratings yet

- way tomakemoney 2024Document2 pagesway tomakemoney 2024skhushbusahniNo ratings yet

- way tomakemoney 2024Document2 pagesway tomakemoney 2024skhushbusahniNo ratings yet

- 15Document1 page15skhushbusahniNo ratings yet

- DisplayLanguageNames SVDocument5 pagesDisplayLanguageNames SVkweevelinNo ratings yet

- maa ka bhosdaDocument1 pagemaa ka bhosdaskhushbusahniNo ratings yet

- 09-SEPTEMBER--2024---TO--09--APRIL--2024-ICICIDocument9 pages09-SEPTEMBER--2024---TO--09--APRIL--2024-ICICIskhushbusahniNo ratings yet

- 521858701-6-Bank-Statement-01 (2)Document12 pages521858701-6-Bank-Statement-01 (2)skhushbusahniNo ratings yet

- New Text DocumentDocument1 pageNew Text DocumentskhushbusahniNo ratings yet

- Prompt for Chatgpt Script WritingDocument2 pagesPrompt for Chatgpt Script WritingskhushbusahniNo ratings yet

- 1627262625675_IDFC FIRST Bank statement 25 000 2021 120000_5432Document10 pages1627262625675_IDFC FIRST Bank statement 25 000 2021 120000_5432skhushbusahniNo ratings yet

- New Text Document (2)Document2 pagesNew Text Document (2)skhushbusahniNo ratings yet

- Daily ReportDocument7 pagesDaily ReportSol IturriagaNo ratings yet

- ICICI STATEDocument1 pageICICI STATEskhushbusahniNo ratings yet

- Database making sheet - ankur CMICDocument87 pagesDatabase making sheet - ankur CMICskhushbusahniNo ratings yet

- bank-statement-template-29Document97 pagesbank-statement-template-29skhushbusahniNo ratings yet

- IFFCO CARRY BAG 14X14.5 hindi punjabiDocument2 pagesIFFCO CARRY BAG 14X14.5 hindi punjabiskhushbusahniNo ratings yet

- ZZZZDocument9 pagesZZZZskhushbusahniNo ratings yet

- RPT_CPSPM_17892336_233332Document3 pagesRPT_CPSPM_17892336_233332skhushbusahniNo ratings yet

- New Text Document (4)Document2 pagesNew Text Document (4)skhushbusahniNo ratings yet

- Prompt for Chatgpt Script WritingDocument2 pagesPrompt for Chatgpt Script WritingskhushbusahniNo ratings yet

- BASANTKUMAR--- PNB (2) (1)Document9 pagesBASANTKUMAR--- PNB (2) (1)skhushbusahniNo ratings yet

- Inkubator TransportDocument8 pagesInkubator TransportYassarNo ratings yet

- Pre-Int Unit 3aDocument2 pagesPre-Int Unit 3aKarla Chong Bejarano0% (1)

- Pseudomonas aeruginosa identificationDocument26 pagesPseudomonas aeruginosa identificationNur AzizahNo ratings yet

- Module 6.1 Plan Training SessionDocument16 pagesModule 6.1 Plan Training Sessioncyrene cayananNo ratings yet

- DX-790-960-65-17.5i-M: Electrical PropertiesDocument2 pagesDX-790-960-65-17.5i-M: Electrical PropertiesАлександрNo ratings yet

- WINTER 2023 Course Outline: ENME 479 Mechanics of Deformable Bodies IIDocument8 pagesWINTER 2023 Course Outline: ENME 479 Mechanics of Deformable Bodies IIKai McDermottNo ratings yet

- Pashchimanchal Campus: Set ADocument1 pagePashchimanchal Campus: Set AAnonymous uTC8baNo ratings yet

- Maintenance of building componentsDocument4 pagesMaintenance of building componentsIZIMBANo ratings yet

- AdinaDocument542 pagesAdinaSafia SoufiNo ratings yet

- NS-3 with ndnSim patch - TutorialDocument8 pagesNS-3 with ndnSim patch - TutorialAli NawazNo ratings yet

- NEBULIZATIONDocument2 pagesNEBULIZATIONMae ValenzuelaNo ratings yet

- Aims and Principles of Foreign Language TeachingDocument3 pagesAims and Principles of Foreign Language TeachingresearchparksNo ratings yet

- Meet Miss Marple, the Famous Amateur SleuthDocument10 pagesMeet Miss Marple, the Famous Amateur SleuthC.Auguste DupinNo ratings yet

- Avila-Flores Etal 2017 - The Use of The DPSIR Framework To Estimate Impacts of Urbanization On Mangroves of La Paz BCSDocument13 pagesAvila-Flores Etal 2017 - The Use of The DPSIR Framework To Estimate Impacts of Urbanization On Mangroves of La Paz BCSKriistian Rene QuintanaNo ratings yet

- Anatomy Book For DoctorsDocument3 pagesAnatomy Book For DoctorsMuhammad JunaidNo ratings yet

- Microtronics Technologies: GSM Based Vehicle Theft Detection SystemDocument3 pagesMicrotronics Technologies: GSM Based Vehicle Theft Detection Systemابراهيم الثوبريNo ratings yet

- Sigma JsDocument42 pagesSigma JslakshmiescribdNo ratings yet

- CH 7b - Shift InstructionsDocument20 pagesCH 7b - Shift Instructionsapi-237335979100% (1)

- Pressure Transducer Davs 311-1-0 Volt - XCMG PartsDocument1 pagePressure Transducer Davs 311-1-0 Volt - XCMG Partsej ejazNo ratings yet

- Ms. Louise Lim Mr. Ivan Cyrus DaldeDocument27 pagesMs. Louise Lim Mr. Ivan Cyrus DaldeJazlyn Andria JarafaNo ratings yet

- Sales Marketing Director in Tampa FL Resume William RoelingDocument2 pagesSales Marketing Director in Tampa FL Resume William RoelingWilliamRoelingNo ratings yet

- QQQQ PDFDocument484 pagesQQQQ PDFSagor Saha100% (1)

- Lesson 12 FastenersDocument9 pagesLesson 12 FastenersEmerson John RoseteNo ratings yet

- Survey-Questionnaire For The Study "Factors Affecting The Level of Comprehension in English of Grade 3 Students School Year 2021-2023"Document13 pagesSurvey-Questionnaire For The Study "Factors Affecting The Level of Comprehension in English of Grade 3 Students School Year 2021-2023"Rosalinda SamongNo ratings yet

- EN Paper-5Document11 pagesEN Paper-5isabellemdelmasNo ratings yet

- Uv Mapping TutorialDocument5 pagesUv Mapping Tutorialbkb193No ratings yet

![MISTERIOUS LIFES] (19)](https://imgv2-1-f.scribdassets.com/img/document/721866628/149x198/7a3dc5bec1/1712776034?v=1)