Professional Documents

Culture Documents

Vendor Verification Form

Uploaded by

Michael L.Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Vendor Verification Form

Uploaded by

Michael L.Copyright:

Available Formats

New Vendor Information Form

Strive Tech Inc

Company Name: _____________________________________________________________________________

82-0812497

Vendor TIN or SSN (Tax ID Number): _____________________________________________________________

Strive Tech Inc

Name as shown on tax return: __________________________________________________________________

Legal Classification:

✔ C Corporation Individual/Sole Proprietor

S Corporation Limited Liability Company

Partnership Other

24000 35th ave SE, Suite 102Bothell WA 98021

Remit to Address: ___________________________________________________________________________

Bothell

City: _________________________________________ State: Washington

_____________ Zip: 98021

_____________________

Accounts Receivable Contact: Strive Tech Inc

__________________________________________________________________

(425) 286-8874 sales@strive.tech

Phone: _________________ Fax: _________________ Email: _______________________________________

Preferred method of receiving Purchase Orders: Fax ✔ Email

Provides accurate and actionable data platform proven to optimize muscle performance.

Brief description of services provided: ___________________________________________________________

*An invoice will be required for each requested payment. Payments will be made by check and will be mailed to

the remitting address above, unless otherwise arranged. All payments will be made within University net 30

payment terms.

Business (Diversity) Classification (choose all that apply):

Large Business Non Profit Business

Small Disadvantaged Business Small Service Disabled Vet Owned Business

✔ Small Business Small Woman-Owned Business

Hubzone Business

REQUIRED DOCUMENTATION:

• W-9 or W-8– Please attach a signed copy of the IRS Form W-9 or W-8 BEN: Request for Taxpayer

Identification Number and Certification. Documentation is required at time of contract signature.

o If you are an individual/sole proprietor, a SSN will be required. Additional information may be

required to determine whether a service provider should be classified for federal, state, and FICA

tax purposes as an Employee of the University of Utah or as an Independent Contractor.

You might also like

- Forklift Credit ApplicationDocument1 pageForklift Credit ApplicationFaizal JamalNo ratings yet

- Merchant Account ChangeDocument1 pageMerchant Account Changeaglenn788934No ratings yet

- HCS Carrier Payment OptionsDocument28 pagesHCS Carrier Payment OptionsFabianNo ratings yet

- Best Buy Business Advantage Account Application: Company InformationDocument5 pagesBest Buy Business Advantage Account Application: Company InformationGlendaNo ratings yet

- Customer Profile Template 15Document1 pageCustomer Profile Template 15Apollo SharmaNo ratings yet

- Autocheque: Electronic Payment ProgramDocument3 pagesAutocheque: Electronic Payment ProgramNicholas GarrisonNo ratings yet

- DBapplicationDocument1 pageDBapplicationGM MainstayNo ratings yet

- Update Your Credit ReportDocument1 pageUpdate Your Credit ReportAndrewNo ratings yet

- App - UsDocument3 pagesApp - Usrob3277No ratings yet

- NoticeDocument2 pagesNoticerajat20101998No ratings yet

- Bankers Standing Order MandateDocument1 pageBankers Standing Order Mandateapi-26427841No ratings yet

- New Company Registration Online Guide: WWW - Cipc.co - ZaDocument25 pagesNew Company Registration Online Guide: WWW - Cipc.co - ZaSasha OhlmsNo ratings yet

- New Client Questionnaire EditableDocument4 pagesNew Client Questionnaire EditableKarabo RasenyaiNo ratings yet

- DRC Supplier Registration FormDocument6 pagesDRC Supplier Registration FormYonas LeulNo ratings yet

- Mobile Service AgreementDocument4 pagesMobile Service AgreementawxcareNo ratings yet

- Installment Payment Plan Request: No PO Box NumberDocument4 pagesInstallment Payment Plan Request: No PO Box NumberjackNo ratings yet

- Microsoft Word - Supplier Registration Form REV 4Document3 pagesMicrosoft Word - Supplier Registration Form REV 4PT Arinda Ananda ArsindoNo ratings yet

- Extra Space Storage Lease NJ Eff. 11-1-21Document5 pagesExtra Space Storage Lease NJ Eff. 11-1-21hutz5000100% (1)

- U ASK Now Listing Form 2010Document1 pageU ASK Now Listing Form 2010Motella BlogNo ratings yet

- Post Production Editing Invoice TemplateDocument1 pagePost Production Editing Invoice TemplateLanre Jazzel AbimbolaNo ratings yet

- Tacoma Capital Application 030719Document2 pagesTacoma Capital Application 030719theodrostadiosNo ratings yet

- Subscription Form Access Account For Seafood Export - Import StatisticsDocument2 pagesSubscription Form Access Account For Seafood Export - Import StatisticsĐặng Thiện ToànNo ratings yet

- USCredit ApplicationDocument5 pagesUSCredit ApplicationFSO COMPRESORESNo ratings yet

- NEXAIRDocument1 pageNEXAIRchalfordslimitedNo ratings yet

- Please Use The Checking and Savings Account Application ToDocument3 pagesPlease Use The Checking and Savings Account Application ToGulrana AlamNo ratings yet

- Borrower Summary SheetDocument2 pagesBorrower Summary SheetheluchienNo ratings yet

- Switching Bank Accounts Made EasyDocument5 pagesSwitching Bank Accounts Made EasyTrish HitNo ratings yet

- Pa - New - Account - Skyrox Form Filled 28-05-2022Document2 pagesPa - New - Account - Skyrox Form Filled 28-05-2022Валера ШаповаловNo ratings yet

- CREDIT CARD AUTHORIZATION Rev 11.12.2019Document2 pagesCREDIT CARD AUTHORIZATION Rev 11.12.2019Cuong TranNo ratings yet

- PNB Request FormDocument1 pagePNB Request FormNagamuthu.SNo ratings yet

- Bacs Form For Payment of BenefitsDocument2 pagesBacs Form For Payment of BenefitsKishore KumarNo ratings yet

- HR Generic Payroll Mergers and Acquisitions Checklist Rev 09 08Document11 pagesHR Generic Payroll Mergers and Acquisitions Checklist Rev 09 08claokerNo ratings yet

- SubstituteW 9formDocument1 pageSubstituteW 9formZhantinique FultonNo ratings yet

- Auto-Offer PSBANKDocument3 pagesAuto-Offer PSBANKAnna KristinaNo ratings yet

- Direct Deposit Election FormDocument2 pagesDirect Deposit Election FormAsha Leigh100% (1)

- Credit Card Authorization Form WoffordDocument1 pageCredit Card Authorization Form WoffordRaúl Enmanuel Capellan PeñaNo ratings yet

- Letter For Activation of Dormant Trading and Demat AccountDocument1 pageLetter For Activation of Dormant Trading and Demat AccountgreatabrahamNo ratings yet

- EFT FormDocument1 pageEFT FormMope SASNo ratings yet

- payroll_client_setup_checklistDocument2 pagespayroll_client_setup_checklistva.amazonsellercentralNo ratings yet

- Fixed / Recurring Deposit Application-Cum-Deposit Slip Date: Deposit Opened in Branch: Branch SOL IDDocument3 pagesFixed / Recurring Deposit Application-Cum-Deposit Slip Date: Deposit Opened in Branch: Branch SOL IDSS56% (16)

- WithdrawDocument1 pageWithdrawblackgatNo ratings yet

- Estimate-Contract: CompanyDocument3 pagesEstimate-Contract: CompanyRonald KahoraNo ratings yet

- Business Visa ApplicationDocument3 pagesBusiness Visa ApplicationBlake WeberNo ratings yet

- Home Loan Form NewDocument6 pagesHome Loan Form Newpatruni sureshkumarNo ratings yet

- Application 1pagerDocument1 pageApplication 1pagerFabian JadueNo ratings yet

- MySoft Software Enquiry Form (190914)Document3 pagesMySoft Software Enquiry Form (190914)Rocky M VNo ratings yet

- Direct Deposit FormDocument1 pageDirect Deposit Forms585cvhc22No ratings yet

- Direct Deposit FormDocument1 pageDirect Deposit FormlordpersonNo ratings yet

- TWI Enrolment Form for NDT Training and ExaminationDocument4 pagesTWI Enrolment Form for NDT Training and ExaminationBraamNo ratings yet

- Residential Only - Name Change / Account Transfer: Instructions / ChecklistDocument3 pagesResidential Only - Name Change / Account Transfer: Instructions / ChecklistAnonymous vypymttdCONo ratings yet

- ZiiplabsDocument2 pagesZiiplabsgaw urNo ratings yet

- Customer Registration Form for Merino IndustriesDocument5 pagesCustomer Registration Form for Merino IndustriesAbhimanyu MahadikNo ratings yet

- Bank Mandate Form PDFDocument1 pageBank Mandate Form PDFtechie_10No ratings yet

- City of University ParkDocument2 pagesCity of University Parkanon ymousNo ratings yet

- Appointment of Agent For Single-Family Residential Property Tax MattersDocument2 pagesAppointment of Agent For Single-Family Residential Property Tax MattersAnonymous kb8CXdqnNo ratings yet

- Supplier Cert InternationalDocument1 pageSupplier Cert Internationalapi-3715055No ratings yet

- Cash Sales InvoiceDocument1 pageCash Sales InvoiceHoscomco HscmcNo ratings yet

- Multipurpose FormDocument1 pageMultipurpose Formcustodian.archiveNo ratings yet

- Cash Receipt Template 03 PDFDocument1 pageCash Receipt Template 03 PDFB. GundayaoNo ratings yet

- 10.udyam Registration Certificate Udyam Gj-22-0004105Document2 pages10.udyam Registration Certificate Udyam Gj-22-0004105Suman jhaNo ratings yet

- McKinsey Problem Solving ApproachDocument46 pagesMcKinsey Problem Solving ApproachJuan Diego Valencia100% (21)

- PT ABC's 20xx Statement of Cash FlowDocument28 pagesPT ABC's 20xx Statement of Cash FlowVincent kuswandiNo ratings yet

- Camarilla EquationDocument4 pagesCamarilla Equationmarcosfa81No ratings yet

- Discussion Acctng For MaterialsDocument3 pagesDiscussion Acctng For MaterialsKim Arvin DalisayNo ratings yet

- Craft Baker Certificate Course ListDocument14 pagesCraft Baker Certificate Course Listanish ashokkumarNo ratings yet

- Monthly Narrative Report Outline TemplateDocument2 pagesMonthly Narrative Report Outline TemplateRozette BautistaNo ratings yet

- Inbound 8143484023258758048Document1 pageInbound 8143484023258758048mgilangfreeNo ratings yet

- Final Exam MGR ECON - MMUT - BATCH2Document5 pagesFinal Exam MGR ECON - MMUT - BATCH2Dani KurniawanNo ratings yet

- Performance Evaluation of Select Paint Companies in IndiaDocument5 pagesPerformance Evaluation of Select Paint Companies in IndiaIAEME PublicationNo ratings yet

- Global Market Integration Module 3Document3 pagesGlobal Market Integration Module 3Erika Joyce RunasNo ratings yet

- Input Data Sheet For SHS E-Class Record: Learners' NamesDocument11 pagesInput Data Sheet For SHS E-Class Record: Learners' NamesMariya BhavesNo ratings yet

- Accounting concepts and principles activityDocument19 pagesAccounting concepts and principles activityLaiza Cristella SarayNo ratings yet

- ZJ5303Document51 pagesZJ5303Andebet AtlawNo ratings yet

- Chapter 4: Option Pricing Models: The Binomial ModelDocument10 pagesChapter 4: Option Pricing Models: The Binomial ModelTami DoanNo ratings yet

- 2.1 Market StructuresDocument38 pages2.1 Market StructuresJean FlordelizNo ratings yet

- Accounting & Marketing Students ListDocument9 pagesAccounting & Marketing Students ListJustine Brylle DomantayNo ratings yet

- Madaraka Express - Travel Kenya - Online Booking 2Document1 pageMadaraka Express - Travel Kenya - Online Booking 2LennyNo ratings yet

- PNJBDocument44 pagesPNJByadavahir0734578No ratings yet

- Cambridge International AS & A Level: EconomicsDocument15 pagesCambridge International AS & A Level: EconomicsDivya SinghNo ratings yet

- Acquired Assets For Lease With Option To Buy - Retail Housing UnitsDocument7 pagesAcquired Assets For Lease With Option To Buy - Retail Housing UnitsJec JekNo ratings yet

- Teori Stewardship Raharjo 2007Document19 pagesTeori Stewardship Raharjo 2007arini ANo ratings yet

- Aa290523030002u RC11052023Document3 pagesAa290523030002u RC11052023DEVRAJU S0% (1)

- Macroeconomics Course Outline - Fall 2020Document10 pagesMacroeconomics Course Outline - Fall 2020Syeda WasqaNo ratings yet

- Forex Trading PsychologyDocument49 pagesForex Trading PsychologyIsrael Akinyemi100% (2)

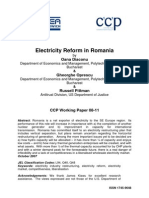

- Electricity Reform in Romania: Restructuring Plans and Key IssuesDocument29 pagesElectricity Reform in Romania: Restructuring Plans and Key IssuesgotcanNo ratings yet

- Economics FM 22Document5 pagesEconomics FM 22Vansh RajaNo ratings yet

- Tata Projects Limited BTRS, SVS Road, Mayor's Bunglow, Shivaji Park, Dadar West Scope Matrix For Secant Piling WorksDocument1 pageTata Projects Limited BTRS, SVS Road, Mayor's Bunglow, Shivaji Park, Dadar West Scope Matrix For Secant Piling WorksSabyasachi BangalNo ratings yet

- Characteristics of Underdevelopment and Approaches to Measuring Poverty in PakistanDocument54 pagesCharacteristics of Underdevelopment and Approaches to Measuring Poverty in PakistanHamid UsmanNo ratings yet

- Master Thesis Uzh EconomicsDocument4 pagesMaster Thesis Uzh Economicsfjgjdhzd100% (1)