Professional Documents

Culture Documents

Sign

Sign

Uploaded by

Aliyana Smolderhalder0 ratings0% found this document useful (0 votes)

10 views1 pageCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views1 pageSign

Sign

Uploaded by

Aliyana SmolderhalderCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 1

20 you and/or your Pi

Someone else?

No[) Go to 52

Yes) 60 tornert question

arin

St share the care of your children

ST Has the c:

18s the care arrange

Since you lat told en! Shen in your car ehangod

Nol>

i i ue pea parinars ‘care arrangements

ou Ge, OU wil need to contact ust upaete

Go to next question

‘You and/or your partner wil need 7]

ooomplete

and return a Details of your child's come

‘arrangement (FAQ12) form.

yeu donot hav ths frm, go to

‘Servicesaustralia.gov.au/forms

Yes >.

60 to next question

Checklist

|

|

|

53. You and your partner need to rea this

Privacy notice

Privcy and your persona infomation

The privacy and security of our personal information

'simportnt ous, ond is prtetes by la We collect

thisintomation so we can process and manage your |

2ppleatons and payments, and provide serves fo you, |

Wr oly share your ration wt ter parts where you

havo aioe, oewhore ha aw allows or requires For more |

iMrmaton, ooo seresaunrala gov au/privacy

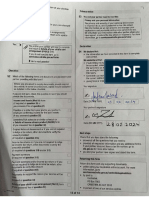

Declaration

54 We declare thet:

‘=the information we have provided inthis form is complete

and corect.

We understand that:

+ if submiting this form as part of a cam, the cleim may not

be accord, unless supporting documents ar lodged at

the same ime asthe claim. The only exception wil be if we

are waiting for medical evidence or oler documents from a

third par ;

‘52 Which ofthe folowing forms and documents are you andr your See a

the rome seon? | | + ing feo misleading Information sa sarious efence,

‘Where you are asked to supply documents, provide original

documents. n some circumstances, copies may be accepted You signature

a detalied inthe below checklist.

ityou are not sure, check the question to see you shoul é

provide the documents ,

j = $ a

Income and Assets (Mod i) form |

(ied at quston 2 G] | sweoowtuvin | 29 |[ oa] ee 24 |

Jou anower Yes el msBon2) Your parinors signature

Payelps ora eter from your and/or your partner's ||

‘employer confirming income for the last 8 weeks

Gt you answered question 25) va

ene DVA steer sina chal Oo

1 Details of income stream product ($4330) form aoe

you answored Yes at question 20) ‘ 9 |2.8102) 2024

Orginal Notice of Assessment ori you are notrequred |)

to lodgo a tax retun other documents to very the ae cee

amount provided EBS eee fe

lt required at question 314) Check that you have done the folowing

; * answered all the question that you need to

patederinedte tee te (| * provided all requested information and any additional forms.

‘amount/s provided Hn pee ‘does not have a tax file number, go to

gov. or more information.

ef reqared at questions 215 Sa 2) ‘you and your partner have signed and dated this form.

Payment summary eee ne ee TE a a

(tf required at question 31D)

Payment summary and/or income tax return or if you

‘ot required to lodge an income tax return, othor

cuments to verify this amount

quired at question 31E)

sments to support the reason your income will be

at question 34)

of yur eis xr aregenet FTE om |)

red Yes at question 51)

Returning this form

Return this form and any supporting documents:

* online using your Centrelink online account. For

Information, go to fo

Servicesaustralia.gov.au/centrelinkuploaddocs.

= by post to

Centreink

PO Box 7802

CANBERRA BC ACT 2610

+ inperson at one of our service centres.

14 0f14

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Woolworth Analysis (9)Document1 pageWoolworth Analysis (9)Aliyana SmolderhalderNo ratings yet

- Woolworth Analysis (3)Document3 pagesWoolworth Analysis (3)Aliyana SmolderhalderNo ratings yet

- Woolworth Analysis (8)Document1 pageWoolworth Analysis (8)Aliyana SmolderhalderNo ratings yet

- Woolworth Analysis (2)Document2 pagesWoolworth Analysis (2)Aliyana SmolderhalderNo ratings yet

- Woolworth Analysis (5)Document1 pageWoolworth Analysis (5)Aliyana SmolderhalderNo ratings yet

- Week 2Document1 pageWeek 2Aliyana SmolderhalderNo ratings yet

- Modp 2303en F MergedDocument17 pagesModp 2303en F MergedAliyana SmolderhalderNo ratings yet

- Woolworth Analysis (4)Document1 pageWoolworth Analysis (4)Aliyana SmolderhalderNo ratings yet

- Week 3 Activity-1Document2 pagesWeek 3 Activity-1Aliyana SmolderhalderNo ratings yet

- Case DetailsDocument1 pageCase DetailsAliyana SmolderhalderNo ratings yet