Professional Documents

Culture Documents

Form 4 Accounting Study Pack

Uploaded by

waynejuwakinyu0 ratings0% found this document useful (0 votes)

3 views3 pagesnotes on accounting with formats IGCSE

Original Title

form 4 Accounting study pack -

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentnotes on accounting with formats IGCSE

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views3 pagesForm 4 Accounting Study Pack

Uploaded by

waynejuwakinyunotes on accounting with formats IGCSE

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

CLASS FORM 4

SUBJECT ACCOUNTING STUDY PACK

TOPIC DEPRECIATION OF NON CURRENT ASSETS

INSTRUCTIONS

Read and write the notes in this study pack in your Accounting Notebook.

Answer the questions in your class exercise book.

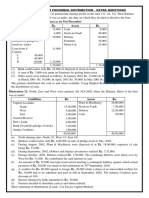

DEPRECIATION PRACTICE QUESTION

Example 1

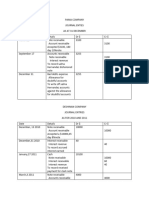

Sasha Limited had the following balances in its ledger accounts on 1 Jan 2010:

Motor Vehicles Account $640 000

Provision for Depreciation Account $ 85 000

On the same date, a new motor vehicle was bought for $50 000 cash. Another vehicle was bought paying

by cheque for $60 000 on 1 July 2010.

A vehicle which was bought on 1 January 2008 for $40 000 was sold for cash $35 000 on 31 December

2010.

It is the company’s policy to depreciate motor vehicles at 10% per annum on cost.

You are required to prepare:

(a) Motor Vehicles Account

(b) Provision for Depreciation Account (c) Motor Vehicles Disposal

Account

SOLUTIONS

Motor Vehicles Account

2010 Balance b/d $ 2010 Disposal Account $

Jan 1 Cash 640 000 Dec 31 40 000

Bank 50 000 Balance c/d

Jul 1 60 000 710 000

750 000 750 000

2011 Balance b/d 2011

Jan 1

710 000

Provision for Depreciation Account

2010 Disposal Account $ 2010 Balance b/d $

Dec31 12 000 Jan 1 Profit & Loss A/c 85 000

Balance c/d Dec31 72 000

145 000

157 000 157 000

2011 2011 Balance b/d

Jan 1 145 000

Motor Vehicles Disposal Account

2010 $ 2010 $

Dec31 Motor vehicle 40 000 7 Dec31 Depreciation 12 000

Profit on disposal 000 Cash 35 000

47 000 47 000

Depreciation in the disposal account was calculated as follows:

10% × $40 000 × 3 years = $12 000

The Profit & Loss depreciation was calculated as follows:

10% × $690 000 + 10% × $60 000 × 0.5 = $72 000

Exercise

Answer the questions below

2

You might also like

- 8-Day Intensive Course TradingDocument83 pages8-Day Intensive Course TradingCutter LstrNo ratings yet

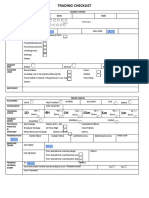

- Trading Checklist BH v2Document2 pagesTrading Checklist BH v2Tong SepamNo ratings yet

- 13 Week Cash Flow ModelDocument16 pages13 Week Cash Flow ModelASChipLeadNo ratings yet

- Liner Shipping OperationsDocument142 pagesLiner Shipping OperationsFeby Sam100% (5)

- Loan Origination PDFDocument59 pagesLoan Origination PDFmohajNo ratings yet

- SKFDDocument27 pagesSKFDRhen Robles100% (1)

- WorldcomDocument5 pagesWorldcomHAN NGUYEN KIM100% (1)

- CH 1Document32 pagesCH 1yechale tafere50% (2)

- E13.2 (LO 1) (Accounts and Notes Payable) The Following Are Selected 2022 Transactions ofDocument4 pagesE13.2 (LO 1) (Accounts and Notes Payable) The Following Are Selected 2022 Transactions ofChupa HesNo ratings yet

- 1 637304139596797833 Stockholders Equity Section AccountingDocument7 pages1 637304139596797833 Stockholders Equity Section AccountingShandaNo ratings yet

- Ak 2Document12 pagesAk 2nikenapNo ratings yet

- KasdanPiutang 4B Kelompok1Document11 pagesKasdanPiutang 4B Kelompok1Estin TasyaNo ratings yet

- Depre Sums 4-1Document6 pagesDepre Sums 4-1Pradeep NairNo ratings yet

- Acc136 Module GuideDocument36 pagesAcc136 Module Guidemcskelta8No ratings yet

- Ch.4 Bad Debts and Allowance For Doubtful Debts: Prudence ConceptDocument3 pagesCh.4 Bad Debts and Allowance For Doubtful Debts: Prudence Concept咚河叔TNo ratings yet

- Midterm 1 991ansDocument12 pagesMidterm 1 991ansNguyên NguyễnNo ratings yet

- Rekon, Depreciation, and FifoDocument3 pagesRekon, Depreciation, and Fifom habiburrahman55No ratings yet

- Null 33Document6 pagesNull 33ranganaitinotenda1No ratings yet

- Book Value Per Share 950,000.00 500,000.00 250,000.00 (Add) 100,000.00 Bvps 17Document9 pagesBook Value Per Share 950,000.00 500,000.00 250,000.00 (Add) 100,000.00 Bvps 17jose.labianoNo ratings yet

- AkkeuDocument6 pagesAkkeuMedlin Yustisia RirringNo ratings yet

- Chapter 8Document6 pagesChapter 8swaroopcharmiNo ratings yet

- Soal ReceivableDocument1 pageSoal ReceivableMutia RiskaNo ratings yet

- AssignmentDocument7 pagesAssignmentangelnayera7No ratings yet

- Midterm 2 (Fall 2020) FMGT 2293Document7 pagesMidterm 2 (Fall 2020) FMGT 2293brendonNo ratings yet

- Solution To Ch14 P13 Build A ModelDocument6 pagesSolution To Ch14 P13 Build A ModelALI HAIDERNo ratings yet

- Practice Question DepreciationDocument100 pagesPractice Question DepreciationTinu Burmi AnandNo ratings yet

- Subsidiary Ledgers and Special JournalsDocument11 pagesSubsidiary Ledgers and Special JournalsMohamed ZakyNo ratings yet

- Credit Sales $10,000,000 Accounts Receivable 3,000,000 Allowance For Doubtful Accounts 50,000Document11 pagesCredit Sales $10,000,000 Accounts Receivable 3,000,000 Allowance For Doubtful Accounts 50,000rahul ambatiNo ratings yet

- Plantilla Tarea 1 1 ACCO 3150 4mjjDocument5 pagesPlantilla Tarea 1 1 ACCO 3150 4mjjcrispyy turonNo ratings yet

- AC114M3 Part 2Document13 pagesAC114M3 Part 2Penny TratiaNo ratings yet

- Branch Accounting Question'sDocument4 pagesBranch Accounting Question'saslamhamza949No ratings yet

- University of Cambridge International Examinations General Certificate of Education Advanced Level Accounting Paper 3 Multiple Choice October/November 2006 1 HourDocument12 pagesUniversity of Cambridge International Examinations General Certificate of Education Advanced Level Accounting Paper 3 Multiple Choice October/November 2006 1 Hourroukaiya_peerkhanNo ratings yet

- FSA - Exercise Session 3Document18 pagesFSA - Exercise Session 3mhmdgholami0939No ratings yet

- BAT Unit 5 AssignmentDocument14 pagesBAT Unit 5 AssignmentTalhah WaleedNo ratings yet

- Acc 3 Revision Questions 18Document6 pagesAcc 3 Revision Questions 18Danielle WatsonNo ratings yet

- MR A ClassworkDocument3 pagesMR A Classworkcoraliemaunick5No ratings yet

- AFA Questions - Students HandoutDocument51 pagesAFA Questions - Students HandoutDusabamahoro JoniveNo ratings yet

- Book Keeping and Accounts Past Paper Series 4 2011Document7 pagesBook Keeping and Accounts Past Paper Series 4 2011i saiNo ratings yet

- Cheat SheetDocument9 pagesCheat SheetKhushi RaiNo ratings yet

- Account 1Document6 pagesAccount 1jean rousselinNo ratings yet

- BA3 Mock Exam 01 - PILOT PAPER Nov 2020Document8 pagesBA3 Mock Exam 01 - PILOT PAPER Nov 2020Sanjeev JayaratnaNo ratings yet

- Home Control Work - Variant 10 - Le Duc Tuan Minh - IFF18-3kDocument15 pagesHome Control Work - Variant 10 - Le Duc Tuan Minh - IFF18-3kMinh LêNo ratings yet

- Exercise Chapter 14Document9 pagesExercise Chapter 14hassah fahadNo ratings yet

- Exercise Chapter 14Document9 pagesExercise Chapter 14hassah fahadNo ratings yet

- Cash BudgetingDocument3 pagesCash BudgetingAngel Kitty Labor67% (3)

- Sem 3Document9 pagesSem 3shioamn100% (1)

- 6001q1specimen PaperDocument12 pages6001q1specimen Paperckjoshua819100% (1)

- Statement of Cash Flow Set-2Document9 pagesStatement of Cash Flow Set-2vdj kumarNo ratings yet

- A. 1a Problem 4Document1 pageA. 1a Problem 4shuzoNo ratings yet

- F7.2 - Mock Test 1Document5 pagesF7.2 - Mock Test 1huusinh2402No ratings yet

- Accounting 2 - Chapter 14 - Notes - MiuDocument4 pagesAccounting 2 - Chapter 14 - Notes - MiuAhmad Osama MashalyNo ratings yet

- TP 1 - Accounting IIDocument11 pagesTP 1 - Accounting IIAbiNo ratings yet

- Chapter 3 Financial Statements, Free Cash FlowDocument2 pagesChapter 3 Financial Statements, Free Cash FlowPik Amornrat SNo ratings yet

- Chapter 15 Review ProblemsDocument4 pagesChapter 15 Review ProblemsMaya HamdyNo ratings yet

- Csec Poa June 2010 p2Document12 pagesCsec Poa June 2010 p2Renelle RampersadNo ratings yet

- Ans: A) Journal Entry On Date of Issue Date Account DR CRDocument4 pagesAns: A) Journal Entry On Date of Issue Date Account DR CRHumera AkbarNo ratings yet

- La Consolacion College-Manila: School of Business and AccountancyDocument20 pagesLa Consolacion College-Manila: School of Business and AccountancyKasey PastorNo ratings yet

- A-Levels Accounting RandalDocument36 pagesA-Levels Accounting RandalchauromweaNo ratings yet

- v1521065 Rafi Rasendria Rabbani Ktm10Document2 pagesv1521065 Rafi Rasendria Rabbani Ktm10rafi rasendriaNo ratings yet

- Depreciation of Non-Current Assets - 11Document3 pagesDepreciation of Non-Current Assets - 11richieco.saichi.studentNo ratings yet

- Depre Sums 1Document11 pagesDepre Sums 1Pradeep NairNo ratings yet

- Piecemeal - Extra QuestionsDocument4 pagesPiecemeal - Extra Questionskushgarg627No ratings yet

- 20.2 - Notes WK 6 - Asset DisposalDocument9 pages20.2 - Notes WK 6 - Asset DisposalDenzel RasodiNo ratings yet

- Cover FadilDocument42 pagesCover FadiltitirNo ratings yet

- What's Cooking: Digital Transformation of the Agrifood SystemFrom EverandWhat's Cooking: Digital Transformation of the Agrifood SystemNo ratings yet

- Economic & Budget Forecast Workbook: Economic workbook with worksheetFrom EverandEconomic & Budget Forecast Workbook: Economic workbook with worksheetNo ratings yet

- Daftar ReferensiDocument4 pagesDaftar ReferensiMarvella GabrielleNo ratings yet

- Chapter 2 in Fundamental of AbmDocument28 pagesChapter 2 in Fundamental of Abmdon genre tibayNo ratings yet

- Acc030 Classification ExerciseDocument2 pagesAcc030 Classification ExerciseAqilahNo ratings yet

- Spotting The Differences Between IFRS For SMEs and Full IFRSDocument5 pagesSpotting The Differences Between IFRS For SMEs and Full IFRSTannaoNo ratings yet

- GC-Case Description-En en MobileDocument8 pagesGC-Case Description-En en Mobilesunil sakriNo ratings yet

- RAM Annual Report 2007Document90 pagesRAM Annual Report 2007Meor Amri100% (7)

- MMQ 18247 - Bina PlasticDocument3 pagesMMQ 18247 - Bina PlasticWAN AHMAD HANISNo ratings yet

- 0 Airbus BrazilDocument6 pages0 Airbus BrazilZohra BoureniNo ratings yet

- Client Code: 01S ICICI BankDocument1 pageClient Code: 01S ICICI BankKushNo ratings yet

- FeeReceipt Dashboard - AspxDocument1 pageFeeReceipt Dashboard - AspxZuberNo ratings yet

- Lecture 8, 9 and 10 - Plant Assets, Natural Resources and Intangible AssetsDocument60 pagesLecture 8, 9 and 10 - Plant Assets, Natural Resources and Intangible AssetsTabassum Sufia MazidNo ratings yet

- Modelo Proof of Claim MaestroDocument8 pagesModelo Proof of Claim MaestroMetro Puerto RicoNo ratings yet

- Mehta-Saket ResumeDocument1 pageMehta-Saket Resumemehtass2No ratings yet

- KANANIIND 29062022112051 KILClosurewindowDocument1 pageKANANIIND 29062022112051 KILClosurewindowBharat MahanNo ratings yet

- MCQ On CostingDocument36 pagesMCQ On CostingSahil AttarNo ratings yet

- Test of Relationship Between Exchange Rate and Inflation in South Sudan: Granger-Causality ApproachDocument7 pagesTest of Relationship Between Exchange Rate and Inflation in South Sudan: Granger-Causality ApproachlukeniaNo ratings yet

- IFRIC 22: Foreign Currency Transactions and Advance ConsiderationDocument2 pagesIFRIC 22: Foreign Currency Transactions and Advance ConsiderationVladimir StanovicNo ratings yet

- Lecture 4 The Four Shipping MarketsDocument40 pagesLecture 4 The Four Shipping MarketsAhmed Saeed SoudyNo ratings yet

- Fund Vintage Commitment Returns ROIDocument4 pagesFund Vintage Commitment Returns ROIJonas BrandonNo ratings yet

- Verdict: Upon Comparing Apex Foods and Olympic Foods' Performance, The Investors Will BeDocument7 pagesVerdict: Upon Comparing Apex Foods and Olympic Foods' Performance, The Investors Will BeZidan ZaifNo ratings yet

- Financial Ratios MCQDocument10 pagesFinancial Ratios MCQJessy NairNo ratings yet

- Premier Estate Management Website Brochure MAY 2021Document24 pagesPremier Estate Management Website Brochure MAY 2021Fagaras BogdanNo ratings yet

- 2011 ACE Limited Annual ReportDocument252 pages2011 ACE Limited Annual ReportACELitigationWatchNo ratings yet